Professional Documents

Culture Documents

International Tax - British Virgin Islands Highlights 2017

International Tax - British Virgin Islands Highlights 2017

Uploaded by

ruan fangCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

International Tax - British Virgin Islands Highlights 2017

International Tax - British Virgin Islands Highlights 2017

Uploaded by

ruan fangCopyright:

Available Formats

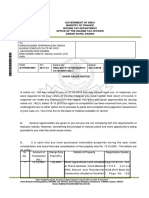

International Tax

British Virgin Islands

Highlights 2017

Investment basics: (agents making interest payments to residents of an EU

member state will automatically exchange information

Currency – US Dollar (USD)

with the relevant member state’s tax authorities with

Foreign exchange control – No respect to the identity of the beneficial owner and the

Accounting principles/financial statements – IFRS, payment). Although the directive has been repealed as

US, UK and Canadian GAAP are accepted. Other from 1 January 2016 and replaced by the common

internationally recognized GAAP also are accepted but reporting standard, the final reporting obligation in the

these must be approved by the local regulators. BVI is the year ending 31 December 2016 (with the

Principal business entities – These are a company, reporting made in 2017).

partnership and trust. Royalties – No

Corporate taxation: Technical service fees – No

Branch remittance tax – No

Residence – There is no concept of residence applicable

to BVI corporate taxation. Other taxes on corporations:

Basis – There is a zero-rated income tax regime for all Capital duty – No

BVI-domiciled corporate entities.

Payroll tax – Payroll tax is levied on both the employer

Taxable income – No and the employee. The employer pays 2% or 6% of the

Taxation of dividends – No gross salary paid, and the employee 8% (the latter is

Capital gains – No deducted at source), in excess of USD 10,000 per annum.

Losses – No Real property tax – Land tax is levied at USD 50 for a

half acre or less. For greater than a half an acre, but less

Rate – No

than one acre, the tax is USD 150 per year. Any

Surtax – No additional acre or part of an acre is taxed at USD 50 per

Alternative minimum tax – No year. Lower fees apply if the land is owned by a

Foreign tax credit – No BVIslander or a BVI company.

Participation exemption – No A building tax is levied at a rate of 1.5% of the assessed

annual rental value.

Holding company regime – No

Social security – The employer must pay 4.5% of the

Incentives – No

employee’s salary, while 4% is paid by the employee

Withholding tax: (both are subject to a cap).

Dividends – No The employer must pay 3.75% of the employee’s salary

Interest – There is no withholding tax on interest, but for national health insurance; the employee also pays the

the BVI has implemented the EU savings tax directive same rate (both are subject to a cap).

British Virgin Islands Highlights 2017

Stamp duty – A 12% stamp duty (4% if the transferee is than a half-acre, but less than one acre, and any

a BVIslander) is levied on property transactions; minimal additional acre or part of an acre is taxed at USD 50 per

duty is levied on other conveyances. year. Lower fees apply if the land is owned by a

Transfer tax – No BVIslander or a BVI company.

A building tax is levied at a rate of 1.5% of the assessed

Anti-avoidance rules:

annual rental value.

Transfer pricing – No Inheritance/estate tax – No

Thin capitalization – No Net wealth/net worth tax – No

Controlled foreign companies – No Social security – The employer must pay 4.5% of the

Disclosure requirements – No employee’s salary (up to a cap), via withholding from the

gross salary.

Compliance for corporations:

The employer must pay 3.75% of the employee’s salary

Tax year – Calendar year for national health insurance; the employee also pays the

Consolidated returns – Consolidated returns are not same rate (both are subject to a cap).

permitted; each company must file a separate return.

Compliance for individuals:

Filing requirements – None for corporate income tax

purposes, but filing requirements apply for payroll tax, Tax year – Calendar year

social security and stamp duty purposes. Filing and payment – There is no income tax filing

Penalties – There are some penalties for failure to obligation, but returns have to be filed for stamp duty.

comply with the law. Penalties – There are some penalties for failure to

Rulings – No comply with the law.

Personal taxation: Value added tax:

Basis – There is a zero-rated income tax regime for all Taxable transactions – The BVI does not levy VAT or

BVI individuals and domiciled unincorporated entities. sales tax.

Residence – An individual that is domiciled in the BVI is Rates – N/A

deemed to be resident. Registration – N/A

Filing status – N/A Filing and payment – N/A

Taxable income – N/A Source of tax law: Land and House Tax Ordinance,

Capital gains – N/A Income Tax Act, Stamp Act, Payroll Taxes Act, Social

Security Ordinance, Mutual Legal Assistance (Tax

Deductions and allowances – N/A

Matters), (Amendment) Act

Rates – N/A

Tax treaties: None, but the BVI has concluded and

Other taxes on individuals: signed 28 tax information exchange agreements.

Capital duty – No Tax authorities: Inland Revenue Department

Stamp duty – A 12% stamp duty (4% if the transferee is

a BVIslander) is levied on property transactions; minimal Contact:

duty is levied on other conveyances. Carlene Romney (cromney@deloitte.com)

Capital acquisitions tax – No

Real property tax – Land tax is levied at USD 50 for a

half acre or less. The tax is USD 150 where there is more

British Virgin Islands Highlights 2017

Deloitte refers to one or more of Deloitte Touche Tohmatsu Limited, a UK private company limited by guarantee

(“DTTL”), its network of member firms, and their related entities. DTTL and each of its member firms are legally

separate and independent entities. DTTL (also referred to as “Deloitte Global”) does not provide services to

clients. Please see https://www.deloitte.com/about to learn more about our global network of member firms.

Deloitte provides audit, consulting, financial advisory, risk management, tax and related services to public and

private clients spanning multiple industries. Deloitte serves four out of five Fortune Global 500® companies

through a globally connected network of member firms in more than 150 countries and territories bringing

world-class capabilities, insights, and high-quality service to address clients’ most complex business challenges.

To learn more about how Deloitte’s approximately 225,000 professionals make an impact that matters, please

connect with us on Facebook, LinkedIn, or Twitter.

This communication contains general information only, and none of Deloitte Touche Tohmatsu Limited, its

member firms, or their related entities (collectively, the “Deloitte Network”) is, by means of this communication,

rendering professional advice or services. Before making any decision or taking any action that may affect your

finances or your business, you should consult a qualified professional adviser. No entity in the Deloitte Network

shall be responsible for any loss whatsoever sustained by any person who relies on this communication.

© 2017. For information, contact Deloitte Touche Tohmatsu Limited.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5820)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Extra Judicial Settlement of Estate With Special Power of AttorneyDocument4 pagesExtra Judicial Settlement of Estate With Special Power of AttorneyJayveelyn Magsino Alviar100% (2)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- BIR Rulings On Nominee SharesDocument8 pagesBIR Rulings On Nominee SharesJenny Pasic LomibaoNo ratings yet

- Value Added Subscription PlansDocument1 pageValue Added Subscription PlansChetna SharmaNo ratings yet

- ARK Price List Feb 3000Document4 pagesARK Price List Feb 3000ud1pri1990No ratings yet

- Brigade Oasis Phase 2 Agreement To SellDocument41 pagesBrigade Oasis Phase 2 Agreement To SellsrikhereNo ratings yet

- How To Buy Property in The Philippines: A Complete GuideDocument7 pagesHow To Buy Property in The Philippines: A Complete GuidecammilleNo ratings yet

- Scrip Symbol Company Name Quantity Avg Buy Price TotalDocument9 pagesScrip Symbol Company Name Quantity Avg Buy Price Totalmyhouse482005No ratings yet

- Fiveaoneed Ndia India Non Judicial ARDocument18 pagesFiveaoneed Ndia India Non Judicial ARVIJAY PAREEKNo ratings yet

- Co-Operative Housing SocietyDocument29 pagesCo-Operative Housing SocietyVish Patilvs67% (3)

- Bank Tariff Guide For Hang Seng Wealth and Personal Banking CustomersDocument45 pagesBank Tariff Guide For Hang Seng Wealth and Personal Banking CustomersIsaacNo ratings yet

- Land TransactionsDocument39 pagesLand TransactionsBaguma Patrick RobertNo ratings yet

- Sale DeedDocument33 pagesSale DeedSofia KaushalNo ratings yet

- Stamp Duty and Registration Charges in Madhya Pradesh 2023Document1 pageStamp Duty and Registration Charges in Madhya Pradesh 2023kedar.kale1504No ratings yet

- 2000 June 2006 (Back)Document1 page2000 June 2006 (Back)Rica Santos-vallesteroNo ratings yet

- Schedule I and II To The Maharashtra Stamp Act (BOM. ACT LX OF 1958)Document32 pagesSchedule I and II To The Maharashtra Stamp Act (BOM. ACT LX OF 1958)nikita karwaNo ratings yet

- Bir Ruling 197-93 (May 7, 1993)Document5 pagesBir Ruling 197-93 (May 7, 1993)matinikkiNo ratings yet

- Tax 3 Chapter 14 Documentary Stamp Tax EditedDocument10 pagesTax 3 Chapter 14 Documentary Stamp Tax Editedokay alexNo ratings yet

- Hotel Diwanki Building, Daman, INCOME TAX OFFICE, Hotel Diwanji Building, Devkanand, DAMAN, Gujarat, 396210 Email: Daman - Ito@Incometax - Gov.InDocument2 pagesHotel Diwanki Building, Daman, INCOME TAX OFFICE, Hotel Diwanji Building, Devkanand, DAMAN, Gujarat, 396210 Email: Daman - Ito@Incometax - Gov.Insanjiv kumarNo ratings yet

- ELSS Mutual Fund InvestmentDocument6 pagesELSS Mutual Fund InvestmentAshish ShuklaNo ratings yet

- Agreement To Sell and PurchaseDocument2 pagesAgreement To Sell and PurchaseMuhammad DarwishNo ratings yet

- Idbi Bank Office Premises RequiredDocument16 pagesIdbi Bank Office Premises RequiredJashanNo ratings yet

- Cliffton Valley Price ListDocument2 pagesCliffton Valley Price Listsishir mandalNo ratings yet

- Checklist For Landlord or Property Agent of Landlord For Rental of HDB FlatDocument2 pagesChecklist For Landlord or Property Agent of Landlord For Rental of HDB FlatandrewhwNo ratings yet

- Housing Co-Operative Act, 1960Document6 pagesHousing Co-Operative Act, 1960Payal AhujaNo ratings yet

- 6.schedule of PropertyDocument2 pages6.schedule of PropertyArshad HussainNo ratings yet

- Income From Other SourcesDocument12 pagesIncome From Other Sourcesyatin rajputNo ratings yet

- Karnataka Industrial PolicyDocument47 pagesKarnataka Industrial PolicyRajat SudNo ratings yet

- Industries in TelanganaDocument19 pagesIndustries in TelanganaPriyanka RaiNo ratings yet

- Assignment of An Agreement For Sale: Form No. 7Document2 pagesAssignment of An Agreement For Sale: Form No. 7Sudeep Sharma100% (1)

- BIR Ruling 274-1987 September 9, 1987Document4 pagesBIR Ruling 274-1987 September 9, 1987Raiya Angela100% (1)