Professional Documents

Culture Documents

Profile PDF

Profile PDF

Uploaded by

Bilal AhmedCopyright:

Available Formats

You might also like

- Full Download Services Marketing An Asia Pacific and Australian Perspective 6th Edition Lovelock Test BankDocument35 pagesFull Download Services Marketing An Asia Pacific and Australian Perspective 6th Edition Lovelock Test Banklukegordonq4fz100% (26)

- This Is A System Generated Letter and Does Not Require Any SignaturesDocument1 pageThis Is A System Generated Letter and Does Not Require Any SignaturesBISHNU BORAL100% (1)

- Pengantar Akuntansi 2, Warren-Reeve-Duchac 25E Indonesia AdaptationDocument65 pagesPengantar Akuntansi 2, Warren-Reeve-Duchac 25E Indonesia AdaptationJessica ChandraNo ratings yet

- TransportationDocument557 pagesTransportationArmil Busico Puspus100% (2)

- Total Debt of Pakistan-11!02!2019Document1 pageTotal Debt of Pakistan-11!02!2019MeeroButtNo ratings yet

- Pakistan's Debt and Liabilities Profile: FY14 FY15 Q3FY15 Q3FY16Document1 pagePakistan's Debt and Liabilities Profile: FY14 FY15 Q3FY15 Q3FY16Wajahat GhafoorNo ratings yet

- Pakistan's Debt and Liabilities Profile: FY15 FY16 Q3FY16 Q3FY17Document1 pagePakistan's Debt and Liabilities Profile: FY15 FY16 Q3FY16 Q3FY17crkriskyNo ratings yet

- Profile PDFDocument1 pageProfile PDFcrkriskyNo ratings yet

- Pakistan's Debt and Liabilities-Summary: Jun-17 Dec-17 Mar-18 Jun-18 Sep-18 Dec-18 Mar-19Document1 pagePakistan's Debt and Liabilities-Summary: Jun-17 Dec-17 Mar-18 Jun-18 Sep-18 Dec-18 Mar-19coolasim79No ratings yet

- Domestic and External DebtDocument9 pagesDomestic and External DebtYasir MasoodNo ratings yet

- Domestic External Debt of PakistanDocument9 pagesDomestic External Debt of PakistanMeeroButtNo ratings yet

- Pakistan's Debt and Liabilities-Summary: Jun-09 Jun-10 Jun-11 Jun-12 Jun-13 Jun-14 Jun-15 Jun-16Document1 pagePakistan's Debt and Liabilities-Summary: Jun-09 Jun-10 Jun-11 Jun-12 Jun-13 Jun-14 Jun-15 Jun-16nasiralisauNo ratings yet

- Domestic External DebtDocument9 pagesDomestic External DebtMeeroButtNo ratings yet

- Domestic and External Debt: 8.1 OverviewDocument19 pagesDomestic and External Debt: 8.1 OverviewMuhammad Hasnain YousafNo ratings yet

- Pakistan's Debt and Liabilities-Summary: Items Jun-15Document1 pagePakistan's Debt and Liabilities-Summary: Items Jun-15Waqas TayyabNo ratings yet

- SummaryDocument1 pageSummaryfarhanNo ratings yet

- 10.1 Consolidated Fiscal Operations (Federal & Provincial) : FY14 FY15 FY16 FY17 FY18 FY19Document4 pages10.1 Consolidated Fiscal Operations (Federal & Provincial) : FY14 FY15 FY16 FY17 FY18 FY19MeeroButtNo ratings yet

- Key Economic Indicators: DemographyDocument2 pagesKey Economic Indicators: Demographyshifan_amNo ratings yet

- Pakistan's Debt and Liabilities-Summary: Jun-15 Jun-16 Mar-16 Mar-17Document1 pagePakistan's Debt and Liabilities-Summary: Jun-15 Jun-16 Mar-16 Mar-17Zahid Hussain KhokharNo ratings yet

- PFO-July June 2022 23Document10 pagesPFO-July June 2022 23Murtaza HashimNo ratings yet

- 10.1 Consolidated Fiscal Operations (Federal & Provincial)Document4 pages10.1 Consolidated Fiscal Operations (Federal & Provincial)MeeroButtNo ratings yet

- Research Report On Public FinanceDocument4 pagesResearch Report On Public Financemaryamshah63neduetNo ratings yet

- Appendix-3: Bangladesh: Some Selected StatisticsDocument28 pagesAppendix-3: Bangladesh: Some Selected StatisticsSHafayat RAfeeNo ratings yet

- Statistical - Appendix Eng-21Document96 pagesStatistical - Appendix Eng-21S M Hasan ShahriarNo ratings yet

- Data Col PDFDocument2 pagesData Col PDFNelson ArturoNo ratings yet

- SummaryDocument1 pageSummaryPicoNo ratings yet

- SummaryDocument1 pageSummarymkhalid1970No ratings yet

- Pakistan's Debt and Liabilities-Summary: Jun-15 Jun-16 Jun-17Document1 pagePakistan's Debt and Liabilities-Summary: Jun-15 Jun-16 Jun-17Khalid HameedNo ratings yet

- Statistical Appendix (English-2023)Document103 pagesStatistical Appendix (English-2023)Fares Faruque HishamNo ratings yet

- Eco IndicatorsDocument12 pagesEco Indicatorscherryalegre83No ratings yet

- Profile DebtDocument1 pageProfile DebtwaqaslamarNo ratings yet

- Pidilite Industries Financial ModelDocument39 pagesPidilite Industries Financial ModelKeval ShahNo ratings yet

- GulastanDocument1 pageGulastanAdeel KhanNo ratings yet

- Domestic External DebtDocument9 pagesDomestic External Debtshab291No ratings yet

- SummaryDocument1 pageSummaryusama khanNo ratings yet

- SefiDocument12 pagesSefirichard emersonNo ratings yet

- SefiDocument12 pagesSefirichard emersonNo ratings yet

- 9-Public DebtDocument19 pages9-Public DebtUsama AdenwalaNo ratings yet

- Debt 3Document16 pagesDebt 3mohsin.usafzai932No ratings yet

- D.statistical - Appendix (English-2020)Document98 pagesD.statistical - Appendix (English-2020)ArthurNo ratings yet

- SWM Annual Report 2016Document66 pagesSWM Annual Report 2016shallynna_mNo ratings yet

- Weekly Economic Update 37 - 2019Document4 pagesWeekly Economic Update 37 - 2019jyl12No ratings yet

- Data UgaDocument2 pagesData UgasheokandgangNo ratings yet

- Chapter IVDocument6 pagesChapter IVmohsin.usafzai932No ratings yet

- Egypt, Arab Rep.: Income and Economic GrowthDocument2 pagesEgypt, Arab Rep.: Income and Economic GrowthPlaystation AccountNo ratings yet

- PortfoiloDocument1 pagePortfoiloHemant ChaudhariNo ratings yet

- ITBA Post Budget Seminar 16-Jun-2009Document39 pagesITBA Post Budget Seminar 16-Jun-2009sanirao100% (2)

- Bop Singapore PotraitDocument2 pagesBop Singapore PotraitLisa Puspa RiniNo ratings yet

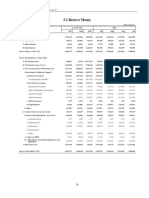

- Statement 1: Reserve Money: (' Billion)Document1 pageStatement 1: Reserve Money: (' Billion)Piyush ChopdaNo ratings yet

- BIL IN - Table 132Document10 pagesBIL IN - Table 132Zikuz SarNo ratings yet

- Money SupplyDocument1 pageMoney SupplyRahul NikamNo ratings yet

- PR1790S30012019 MSDocument1 pagePR1790S30012019 MSRahul NikamNo ratings yet

- LatinFocus Consensus Forecast - November 2023 (Argentina)Document1 pageLatinFocus Consensus Forecast - November 2023 (Argentina)Phileas FoggNo ratings yet

- Gross National Income (Gni) and Gross Domestic Product by Expenditure SharesDocument1 pageGross National Income (Gni) and Gross Domestic Product by Expenditure SharesLerry FernandezNo ratings yet

- Indicatori Sistem BrazilDocument9 pagesIndicatori Sistem BrazilNatalia BesliuNo ratings yet

- Table 30Document2 pagesTable 30Shirwen ClamNo ratings yet

- 18 Statistics Key Economic IndicatorsDocument17 pages18 Statistics Key Economic Indicatorsjohnmarch146No ratings yet

- Management Control CaseDocument9 pagesManagement Control Casera.manriquedNo ratings yet

- 2021 Statistics Bulletin - Public FinanceDocument16 pages2021 Statistics Bulletin - Public FinanceIbeh CosmasNo ratings yet

- Current Macroeconomic and Financial Situation Tables Based On Eleven Months Data of 2022.23 4Document84 pagesCurrent Macroeconomic and Financial Situation Tables Based On Eleven Months Data of 2022.23 4shyam karkiNo ratings yet

- Chapter 5Document20 pagesChapter 5bilalNo ratings yet

- Table 1. Macroeconomic Indicators: MoroccoDocument5 pagesTable 1. Macroeconomic Indicators: MoroccoazfatrafNo ratings yet

- Hyundai Construction Equipment (IR 4Q20)Document17 pagesHyundai Construction Equipment (IR 4Q20)girish_patkiNo ratings yet

- To the Moon Investing: Visually Mapping Your Winning Stock Market PortfolioFrom EverandTo the Moon Investing: Visually Mapping Your Winning Stock Market PortfolioNo ratings yet

- C TS410 2020-SampleDocument5 pagesC TS410 2020-Samplerahulg.sapNo ratings yet

- Fringe Program For ALP National ConferenceDocument27 pagesFringe Program For ALP National ConferenceAustralianLaborNo ratings yet

- Template - Tender Management ProcessDocument9 pagesTemplate - Tender Management ProcessGryswolf0% (1)

- Muñoz PDFDocument225 pagesMuñoz PDFCristián OpazoNo ratings yet

- Grammar Handbook Parts of SpeechDocument29 pagesGrammar Handbook Parts of SpeechClayton OgilvyNo ratings yet

- The Fire of Freedom, Volume 1: Satsang With Papaji, Volume 1. Awdhuta FoundationDocument3 pagesThe Fire of Freedom, Volume 1: Satsang With Papaji, Volume 1. Awdhuta FoundationTechnologyNo ratings yet

- Annales School of History: Its Origins, Development and ContributionsDocument8 pagesAnnales School of History: Its Origins, Development and ContributionsKanchi AgarwalNo ratings yet

- Executive Summary: Department of Public Works and HighwaysDocument12 pagesExecutive Summary: Department of Public Works and Highwayssalman arompacNo ratings yet

- MPM-Master Project-Draft Chapter 1-Ammended 07102014Document12 pagesMPM-Master Project-Draft Chapter 1-Ammended 07102014Shalom NagaratnamNo ratings yet

- 15 QuestionsDocument10 pages15 Questionsvirpal-kaur.virpal-kaur100% (1)

- Ab 2015 Law NisheshDocument2 pagesAb 2015 Law NisheshAVANI MalhotraNo ratings yet

- Bayugan National Comprehensive High SchoolDocument3 pagesBayugan National Comprehensive High SchoolVenancia PadonatNo ratings yet

- Code of Conduct at Škoda Auto GroupDocument40 pagesCode of Conduct at Škoda Auto GroupGowri J BabuNo ratings yet

- Family Law - Parsi Marriage and Divorce Act 1936Document7 pagesFamily Law - Parsi Marriage and Divorce Act 1936Sushan Gangadhar ShettyNo ratings yet

- Principles of IHLDocument21 pagesPrinciples of IHLPk RedNo ratings yet

- Principles of Accounting PDFDocument68 pagesPrinciples of Accounting PDFRaza Natiqi50% (2)

- Works of Defence Act 1903 1Document21 pagesWorks of Defence Act 1903 1Eighteenth JulyNo ratings yet

- Negotiable Instruments 1st SessionDocument50 pagesNegotiable Instruments 1st SessionRM Mallorca100% (3)

- Part III: Programmatic Cost Analysis: Assessing Resources: The Third of A Five-Part SeriesDocument38 pagesPart III: Programmatic Cost Analysis: Assessing Resources: The Third of A Five-Part SeriespatriciavfreitasNo ratings yet

- CLACIO, KATHLEEN ANN C. 12 ABM 3 Module 7-8 Reflection and Assessment (AutoRecovered)Document5 pagesCLACIO, KATHLEEN ANN C. 12 ABM 3 Module 7-8 Reflection and Assessment (AutoRecovered)Kathleen AnnNo ratings yet

- FR QB Part 2Document12 pagesFR QB Part 2AkhilNo ratings yet

- Gate Degree & PG College - Tirupati Investment Management Model Paper - I Max. Time: 3 Hrs. Max. Marks: 75 Section - ADocument3 pagesGate Degree & PG College - Tirupati Investment Management Model Paper - I Max. Time: 3 Hrs. Max. Marks: 75 Section - ApsnmurthyNo ratings yet

- DTM4420Document9 pagesDTM4420Cube7 GeronimoNo ratings yet

- Introduction To World Religions and Belief SystemsDocument23 pagesIntroduction To World Religions and Belief SystemsADONIS ARANILLONo ratings yet

- Keyboard Shortcuts in TallyPrime - 1Document15 pagesKeyboard Shortcuts in TallyPrime - 1perfect printNo ratings yet

- El 01Document1 pageEl 01Faheem ShahzadNo ratings yet

Profile PDF

Profile PDF

Uploaded by

Bilal AhmedOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Profile PDF

Profile PDF

Uploaded by

Bilal AhmedCopyright:

Available Formats

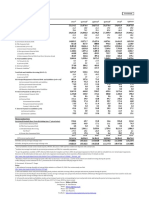

Pakistan's Debt and Liabilities Profile Provisional

(In Billion Rupees)

R R R R R R

FY17 Q2FY18 Q3FY18 Q4FY18 FY18 Q1FY19 Q2FY19 Q3FY19

Pakistan's Total Debt and Liabilities (I +II) 25,114.2 26,861.7 28,358.3 29,879.2 29,879.2 30,846.2 33,235.7 35,094.5

YoY Growth (in %) 11.2 15.0 17.3 19.0 19.0 19.2 23.7 23.8

As percent of GDP 78.6 78.1 82.4 86.9 86.9 80.2 86.4 91.2

I. Pakistan's Total Debt (A+B+C) 24,053.8 25,786.5 27,297.9 28,437.2 28,437.2 29,416.6 31,531.5 33,026.6

YoY Growth (in %) 11.5 14.9 17.1 18.2 18.2 18.4 22.3 21.0

As percent of GDP 75.3 75.0 79.4 82.7 82.7 76.5 82.0 85.8

A. Government Domestic Debt 14,849.2 15,437.4 16,074.1 16,416.3 16,416.3 16,919.8 17,535.7 18,170.6

B. PSEs Domestic Debt 822.8 888.8 996.4 1,068.2 1,068.2 1,128.9 1,213.3 1,378.4

C. External Debt (a+b+c+d) 8,381.8 9,460.2 10,227.3 10,952.7 10,952.7 11,367.8 12,782.4 13,477.6

a) Government External Debt 5,918.7 6,692.5 7,269.6 7,795.8 7,795.8 8,122.9 9,101.1 9,625.7

b) Non-government External Debt 1,468.4 1,702.5 1,827.2 1,979.0 1,979.0 2,052.6 2,432.3 2,597.4

c) Country's Debt from IMF 640.8 690.9 732.7 740.8 740.8 740.7 819.0 811.2

d) Intercompany External Debt from Direct Investor abroad 353.9 374.4 397.9 437.2 437.2 451.6 429.9 443.3

II. Total Liabilities (D+E) 1,060.4 1,075.2 1,060.5 1,442.0 1,442.0 1,429.6 1,704.3 2,067.9

YoY Growth (in %) 4.6 17.0 22.3 36.0 36.0 38.7 58.5 95.0

As percent of GDP 3.3 3.1 3.1 4.2 4.2 3.7 4.4 5.4

D. External Liabilities1 373.8 403.3 432.4 622.3 622.3 620.7 970.0 1,414.3

E. Domestic Liabilities

2

686.5 671.9 628.1 819.7 819.7 808.9 734.3 653.6

Total Debt and Liabilities Servicing (III+IV+V) 1,874.9 424.5 529.7 477.9 1,996.8 611.9 517.9 824.3

YoY Growth (in %) 16.4 44.6 -13.2 3.3 6.5 8.4 22.0 55.6

As percent of GDP 5.9 1.2 1.5 1.4 5.8 1.6 1.3 2.1

III. Principal Repayment of External Debt and Liabilities (a+b+c+d) 3 465.4 75.5 85.7 96.4 365.3 124.8 109.2 202.5

(a) Government External debt and Liabilities 391.4 61.0 63.2 67.0 286.5 96.7 75.9 162.5

(b) Non-government External debt 74.0 14.6 17.6 24.5 69.0 17.7 27.8 22.6

(c) Country's Debt from IMF 0.0 0.0 4.8 4.9 9.8 10.4 5.6 17.4

(d) Monetary Authorities external Liabilities 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0

IV. Interest Payment on debt (a+b+c) 1,367.0 338.2 433.5 358.2 1,575.7 469.9 391.1 605.3

(a) Government Domestic Debt 1,205.8 274.4 383.8 265.9 1,330.0 405.3 282.5 521.2

(b) PSE Debt NA NA NA NA 0.0 NA NA NA

(c) External Debt 161.1 63.8 49.7 92.3 245.7 64.5 108.6 84.1

Government External debt 128.6 49.2 30.7 65.1 172.4 44.8 78.6 57.8

Non-government External debt 23.5 11.4 15.3 23.2 59.2 15.3 25.2 21.2

Country's Debt from IMF 9.0 3.2 3.8 3.9 14.1 4.4 4.8 5.1

V. Interest Payment on Liabilities (a+b) 42.6 10.8 10.5 23.3 55.8 17.2 17.6 16.5

(a) External Liabilities 9.1 0.2 0.6 10.1 11.9 4.1 5.3 5.5

(b) Domestic Liabilities 33.5 10.6 9.9 13.2 43.9 13.1 12.3 10.9

Memorandum Item

Servicing (Principal) Short Term (Excluding item "c" given below) 218.4 22.8 15.7 97.7 205.8 111.8 103.2 33.9

a) Government External Debt 146.0 17.1 11.1 91.1 166.3 74.3 82.3 23.1

b) PSEs Non-Guaranteed Debt 4.5 0.1 0.1 0.0 3.6 0.0 0.0 0.0

c) Scheduled Banks Borrowing 8,666.3 3,033.4 1,758.8 1,268.5 8,121.8 1,089.4 1,457.3 1,039.1

Net Flows 4 177.3 -33.8 -9.3 -48.5 -41.9 5.6 49.0 -12.9

d) Private Non-Guaranteed Debt 67.9 5.5 4.4 6.5 35.9 37.5 20.9 10.7

T T T

FY17R FY18P FY18P FY18P FY18P FY19 FY19 FY19

GDP (current market price)5 31,962.6 34,396.5 34,396.5 34,396.5 34,396.5 38,474.0 38,474.0 38,474.0

US Dollar, last day average exchange rates 104.8861 110.4328 115.5052 121.5405 121.5405 124.2374 138.7921 140.7008

US Dollar, during the period average exchange rates 104.8120 106.5318 111.1973 116.7950 109.9734 124.4085 134.3221 138.9353

1

External liabilities include Central bank deposits, SWAPS, Allocation of SDR and Non resident LCY deposits with central bank.

2

Includes borrowings from banks by provincial governments and PSEs for commodity operations.

3

As per the guidelines available in IMF's External Debt Guide for Compilers and Users 2003, the principal repayment of short term debt is excluded from over all principal repayments. However, for the information of

data users, short term repayment of principal has been reported as Memorandum Items. For details see link:

http://www.sbp.org.pk/departments/stats/Notice/Press%20Release-external%20debt-_Revised_.pdf

4

Net flows of short term borrowings by banks reflect the net increase (+) or decrease (-) in the stock of short term bank borrowings during the period.

5 PBS, GDP(mp) revised estimate for FY17, provisional for FY18 and Annual Plan GDP(mp) target for FY19.

P: Provisional , R: Revised, T: Target

Notes:

1. SBP enhanced coverage & quality of external debt statistics w.e.f March 31, 2010. For revision study see link:

http://www.sbp.org.pk/ecodata/Revision-EDS.pdf

2. Debt and liabilities show end-period outstanding stock positions and debt servicing reflects principal and interest payments during the period.

3. For conversion into Pak Rupees from US Dollars, last day average exchange rates prepared by Domestic Markets & Monetary Management Department have been used for stocks and during the period average

exchange rates for debt servicing.

4. YoY growth external debt and liabilities stocks and servicing is based on the corresponding last year end period stocks and during the period servicing, respectively.

5: As part of annual revision of IIP 2017, data from Dec 31, 2017 to Dec 31, 2018 has been revised.

Contact Person: Iftikhar Ali Khan

Designation: Sr. Joint Director

Email: iftikhar.ali@sbp.org.pk

Phone: 021-32453682

Fax# 021-99221572

Feedback: http://www.sbp.org.pk/stats/survey/index.asp

You might also like

- Full Download Services Marketing An Asia Pacific and Australian Perspective 6th Edition Lovelock Test BankDocument35 pagesFull Download Services Marketing An Asia Pacific and Australian Perspective 6th Edition Lovelock Test Banklukegordonq4fz100% (26)

- This Is A System Generated Letter and Does Not Require Any SignaturesDocument1 pageThis Is A System Generated Letter and Does Not Require Any SignaturesBISHNU BORAL100% (1)

- Pengantar Akuntansi 2, Warren-Reeve-Duchac 25E Indonesia AdaptationDocument65 pagesPengantar Akuntansi 2, Warren-Reeve-Duchac 25E Indonesia AdaptationJessica ChandraNo ratings yet

- TransportationDocument557 pagesTransportationArmil Busico Puspus100% (2)

- Total Debt of Pakistan-11!02!2019Document1 pageTotal Debt of Pakistan-11!02!2019MeeroButtNo ratings yet

- Pakistan's Debt and Liabilities Profile: FY14 FY15 Q3FY15 Q3FY16Document1 pagePakistan's Debt and Liabilities Profile: FY14 FY15 Q3FY15 Q3FY16Wajahat GhafoorNo ratings yet

- Pakistan's Debt and Liabilities Profile: FY15 FY16 Q3FY16 Q3FY17Document1 pagePakistan's Debt and Liabilities Profile: FY15 FY16 Q3FY16 Q3FY17crkriskyNo ratings yet

- Profile PDFDocument1 pageProfile PDFcrkriskyNo ratings yet

- Pakistan's Debt and Liabilities-Summary: Jun-17 Dec-17 Mar-18 Jun-18 Sep-18 Dec-18 Mar-19Document1 pagePakistan's Debt and Liabilities-Summary: Jun-17 Dec-17 Mar-18 Jun-18 Sep-18 Dec-18 Mar-19coolasim79No ratings yet

- Domestic and External DebtDocument9 pagesDomestic and External DebtYasir MasoodNo ratings yet

- Domestic External Debt of PakistanDocument9 pagesDomestic External Debt of PakistanMeeroButtNo ratings yet

- Pakistan's Debt and Liabilities-Summary: Jun-09 Jun-10 Jun-11 Jun-12 Jun-13 Jun-14 Jun-15 Jun-16Document1 pagePakistan's Debt and Liabilities-Summary: Jun-09 Jun-10 Jun-11 Jun-12 Jun-13 Jun-14 Jun-15 Jun-16nasiralisauNo ratings yet

- Domestic External DebtDocument9 pagesDomestic External DebtMeeroButtNo ratings yet

- Domestic and External Debt: 8.1 OverviewDocument19 pagesDomestic and External Debt: 8.1 OverviewMuhammad Hasnain YousafNo ratings yet

- Pakistan's Debt and Liabilities-Summary: Items Jun-15Document1 pagePakistan's Debt and Liabilities-Summary: Items Jun-15Waqas TayyabNo ratings yet

- SummaryDocument1 pageSummaryfarhanNo ratings yet

- 10.1 Consolidated Fiscal Operations (Federal & Provincial) : FY14 FY15 FY16 FY17 FY18 FY19Document4 pages10.1 Consolidated Fiscal Operations (Federal & Provincial) : FY14 FY15 FY16 FY17 FY18 FY19MeeroButtNo ratings yet

- Key Economic Indicators: DemographyDocument2 pagesKey Economic Indicators: Demographyshifan_amNo ratings yet

- Pakistan's Debt and Liabilities-Summary: Jun-15 Jun-16 Mar-16 Mar-17Document1 pagePakistan's Debt and Liabilities-Summary: Jun-15 Jun-16 Mar-16 Mar-17Zahid Hussain KhokharNo ratings yet

- PFO-July June 2022 23Document10 pagesPFO-July June 2022 23Murtaza HashimNo ratings yet

- 10.1 Consolidated Fiscal Operations (Federal & Provincial)Document4 pages10.1 Consolidated Fiscal Operations (Federal & Provincial)MeeroButtNo ratings yet

- Research Report On Public FinanceDocument4 pagesResearch Report On Public Financemaryamshah63neduetNo ratings yet

- Appendix-3: Bangladesh: Some Selected StatisticsDocument28 pagesAppendix-3: Bangladesh: Some Selected StatisticsSHafayat RAfeeNo ratings yet

- Statistical - Appendix Eng-21Document96 pagesStatistical - Appendix Eng-21S M Hasan ShahriarNo ratings yet

- Data Col PDFDocument2 pagesData Col PDFNelson ArturoNo ratings yet

- SummaryDocument1 pageSummaryPicoNo ratings yet

- SummaryDocument1 pageSummarymkhalid1970No ratings yet

- Pakistan's Debt and Liabilities-Summary: Jun-15 Jun-16 Jun-17Document1 pagePakistan's Debt and Liabilities-Summary: Jun-15 Jun-16 Jun-17Khalid HameedNo ratings yet

- Statistical Appendix (English-2023)Document103 pagesStatistical Appendix (English-2023)Fares Faruque HishamNo ratings yet

- Eco IndicatorsDocument12 pagesEco Indicatorscherryalegre83No ratings yet

- Profile DebtDocument1 pageProfile DebtwaqaslamarNo ratings yet

- Pidilite Industries Financial ModelDocument39 pagesPidilite Industries Financial ModelKeval ShahNo ratings yet

- GulastanDocument1 pageGulastanAdeel KhanNo ratings yet

- Domestic External DebtDocument9 pagesDomestic External Debtshab291No ratings yet

- SummaryDocument1 pageSummaryusama khanNo ratings yet

- SefiDocument12 pagesSefirichard emersonNo ratings yet

- SefiDocument12 pagesSefirichard emersonNo ratings yet

- 9-Public DebtDocument19 pages9-Public DebtUsama AdenwalaNo ratings yet

- Debt 3Document16 pagesDebt 3mohsin.usafzai932No ratings yet

- D.statistical - Appendix (English-2020)Document98 pagesD.statistical - Appendix (English-2020)ArthurNo ratings yet

- SWM Annual Report 2016Document66 pagesSWM Annual Report 2016shallynna_mNo ratings yet

- Weekly Economic Update 37 - 2019Document4 pagesWeekly Economic Update 37 - 2019jyl12No ratings yet

- Data UgaDocument2 pagesData UgasheokandgangNo ratings yet

- Chapter IVDocument6 pagesChapter IVmohsin.usafzai932No ratings yet

- Egypt, Arab Rep.: Income and Economic GrowthDocument2 pagesEgypt, Arab Rep.: Income and Economic GrowthPlaystation AccountNo ratings yet

- PortfoiloDocument1 pagePortfoiloHemant ChaudhariNo ratings yet

- ITBA Post Budget Seminar 16-Jun-2009Document39 pagesITBA Post Budget Seminar 16-Jun-2009sanirao100% (2)

- Bop Singapore PotraitDocument2 pagesBop Singapore PotraitLisa Puspa RiniNo ratings yet

- Statement 1: Reserve Money: (' Billion)Document1 pageStatement 1: Reserve Money: (' Billion)Piyush ChopdaNo ratings yet

- BIL IN - Table 132Document10 pagesBIL IN - Table 132Zikuz SarNo ratings yet

- Money SupplyDocument1 pageMoney SupplyRahul NikamNo ratings yet

- PR1790S30012019 MSDocument1 pagePR1790S30012019 MSRahul NikamNo ratings yet

- LatinFocus Consensus Forecast - November 2023 (Argentina)Document1 pageLatinFocus Consensus Forecast - November 2023 (Argentina)Phileas FoggNo ratings yet

- Gross National Income (Gni) and Gross Domestic Product by Expenditure SharesDocument1 pageGross National Income (Gni) and Gross Domestic Product by Expenditure SharesLerry FernandezNo ratings yet

- Indicatori Sistem BrazilDocument9 pagesIndicatori Sistem BrazilNatalia BesliuNo ratings yet

- Table 30Document2 pagesTable 30Shirwen ClamNo ratings yet

- 18 Statistics Key Economic IndicatorsDocument17 pages18 Statistics Key Economic Indicatorsjohnmarch146No ratings yet

- Management Control CaseDocument9 pagesManagement Control Casera.manriquedNo ratings yet

- 2021 Statistics Bulletin - Public FinanceDocument16 pages2021 Statistics Bulletin - Public FinanceIbeh CosmasNo ratings yet

- Current Macroeconomic and Financial Situation Tables Based On Eleven Months Data of 2022.23 4Document84 pagesCurrent Macroeconomic and Financial Situation Tables Based On Eleven Months Data of 2022.23 4shyam karkiNo ratings yet

- Chapter 5Document20 pagesChapter 5bilalNo ratings yet

- Table 1. Macroeconomic Indicators: MoroccoDocument5 pagesTable 1. Macroeconomic Indicators: MoroccoazfatrafNo ratings yet

- Hyundai Construction Equipment (IR 4Q20)Document17 pagesHyundai Construction Equipment (IR 4Q20)girish_patkiNo ratings yet

- To the Moon Investing: Visually Mapping Your Winning Stock Market PortfolioFrom EverandTo the Moon Investing: Visually Mapping Your Winning Stock Market PortfolioNo ratings yet

- C TS410 2020-SampleDocument5 pagesC TS410 2020-Samplerahulg.sapNo ratings yet

- Fringe Program For ALP National ConferenceDocument27 pagesFringe Program For ALP National ConferenceAustralianLaborNo ratings yet

- Template - Tender Management ProcessDocument9 pagesTemplate - Tender Management ProcessGryswolf0% (1)

- Muñoz PDFDocument225 pagesMuñoz PDFCristián OpazoNo ratings yet

- Grammar Handbook Parts of SpeechDocument29 pagesGrammar Handbook Parts of SpeechClayton OgilvyNo ratings yet

- The Fire of Freedom, Volume 1: Satsang With Papaji, Volume 1. Awdhuta FoundationDocument3 pagesThe Fire of Freedom, Volume 1: Satsang With Papaji, Volume 1. Awdhuta FoundationTechnologyNo ratings yet

- Annales School of History: Its Origins, Development and ContributionsDocument8 pagesAnnales School of History: Its Origins, Development and ContributionsKanchi AgarwalNo ratings yet

- Executive Summary: Department of Public Works and HighwaysDocument12 pagesExecutive Summary: Department of Public Works and Highwayssalman arompacNo ratings yet

- MPM-Master Project-Draft Chapter 1-Ammended 07102014Document12 pagesMPM-Master Project-Draft Chapter 1-Ammended 07102014Shalom NagaratnamNo ratings yet

- 15 QuestionsDocument10 pages15 Questionsvirpal-kaur.virpal-kaur100% (1)

- Ab 2015 Law NisheshDocument2 pagesAb 2015 Law NisheshAVANI MalhotraNo ratings yet

- Bayugan National Comprehensive High SchoolDocument3 pagesBayugan National Comprehensive High SchoolVenancia PadonatNo ratings yet

- Code of Conduct at Škoda Auto GroupDocument40 pagesCode of Conduct at Škoda Auto GroupGowri J BabuNo ratings yet

- Family Law - Parsi Marriage and Divorce Act 1936Document7 pagesFamily Law - Parsi Marriage and Divorce Act 1936Sushan Gangadhar ShettyNo ratings yet

- Principles of IHLDocument21 pagesPrinciples of IHLPk RedNo ratings yet

- Principles of Accounting PDFDocument68 pagesPrinciples of Accounting PDFRaza Natiqi50% (2)

- Works of Defence Act 1903 1Document21 pagesWorks of Defence Act 1903 1Eighteenth JulyNo ratings yet

- Negotiable Instruments 1st SessionDocument50 pagesNegotiable Instruments 1st SessionRM Mallorca100% (3)

- Part III: Programmatic Cost Analysis: Assessing Resources: The Third of A Five-Part SeriesDocument38 pagesPart III: Programmatic Cost Analysis: Assessing Resources: The Third of A Five-Part SeriespatriciavfreitasNo ratings yet

- CLACIO, KATHLEEN ANN C. 12 ABM 3 Module 7-8 Reflection and Assessment (AutoRecovered)Document5 pagesCLACIO, KATHLEEN ANN C. 12 ABM 3 Module 7-8 Reflection and Assessment (AutoRecovered)Kathleen AnnNo ratings yet

- FR QB Part 2Document12 pagesFR QB Part 2AkhilNo ratings yet

- Gate Degree & PG College - Tirupati Investment Management Model Paper - I Max. Time: 3 Hrs. Max. Marks: 75 Section - ADocument3 pagesGate Degree & PG College - Tirupati Investment Management Model Paper - I Max. Time: 3 Hrs. Max. Marks: 75 Section - ApsnmurthyNo ratings yet

- DTM4420Document9 pagesDTM4420Cube7 GeronimoNo ratings yet

- Introduction To World Religions and Belief SystemsDocument23 pagesIntroduction To World Religions and Belief SystemsADONIS ARANILLONo ratings yet

- Keyboard Shortcuts in TallyPrime - 1Document15 pagesKeyboard Shortcuts in TallyPrime - 1perfect printNo ratings yet

- El 01Document1 pageEl 01Faheem ShahzadNo ratings yet