Professional Documents

Culture Documents

T Shadow Capitalism: Thursday, November 11, 2010

T Shadow Capitalism: Thursday, November 11, 2010

Uploaded by

Naufal SanaullahOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

T Shadow Capitalism: Thursday, November 11, 2010

T Shadow Capitalism: Thursday, November 11, 2010

Uploaded by

Naufal SanaullahCopyright:

Available Formats

t Shadow Capitalism

USD strength once again was the theme of the day in FX, as

DXY rallied back to the 78.35 level marking recent cycle highs.

Above this level it will be in range of challenging its 55d and

MARKET COMMENTARY BY NAUFAL SANAULLAH

potentially beginning a new uptrend. A dip in the near-term

from current levels would probably be constructive, and set

Thursday, November 11, 2010

up the potential for a head & shoulders breakout. EURUSD

was a big driver behind USD strength today, as it sold off yet

Fireworks out of Ireland and Cisco drown G20 non-progress

another big fig on continued periphery concerns. As

Quiet day in dataflow today due to the Veteran’s Day holiday mentioned previously, the big difference about today was the

in the US, but tech bellwether Cisco gave the market quite contagion risk that is spiking up, as Portuguese, Spanish, and

the bomb to digest with its earnings conference call last Italian bond yields spiked along with Ireland’s, while NOK HUF

night, forecasting 3-5% YoY sales growth vs the 13% and PLN sold off with EUR. A 700 pip selloff in a week does

consensus projections. The largest US provider of networking not bode well for the euro going forward, and unless QE II

solutions attributed the poor outlook on stifled government liquidity manages to keep USD depressed, interbank liquidity

spending, on both state and federal levels, introducing the could start tightening around the world (USD TWI and foreign

post-stimulus hangover effects into techspace. Across the financial commercial paper outstanding have high inverse

Pacific, Chinese data last night provided the other main driver correlations), exacerbating the concerns in Ireland. It is

for today’s trading session, with misses in IP and retail sales important to point out that the acute risks out of Ireland are

but strong beats in CPI and PPI. Risk sold off, however, on the not really pertaining to the sovereign sector—although there

back of the Cisco numbers, although most selloffs were pared are clearly sizable imbalances that need to be addressed, the

by session close. Eurozone concerns continue to persist, with government is fully funded through next summer, unlike

10yr Irish yields now eyeing 9%, and the spillover into Spain, Greece’s situation last spring; however, there is significant

Portugal, and Italy bond markets gaining traction. Contagion acute risk in Irish banks, and their funding capacities are

risk is rising, as is acute credit event risk from Ireland, going to be driving near-term fluctuations in the euro and

particularly if overnight funding becomes tight or nonexistent Eurozone yields.

for Irish banks. Merkel’s proposed crisis resolution

mechanism involving haircuts for private bondholders on

debt issued in 2013 and beyond is providing some selling

pressure, but considering the timeframe, it appears likelier

that the real liquidations are resulting from solvency theses.

The S&P sold off four-tenths of a percent today, after gapping

down on the CSCO news and paring losses most of the day.

The 1200 level was once again tested and that level will

provide significant context for future direction. I will be

comfortable getting short equity on a break below 1200, due

to the extended nature of the current rally. However, POMOs

start again tomorrow, as per QE II, so it will be important to

see how far QE liquidity has been discounted.

AUDUSD sold off on the risk-off, USD-bid market today,

breaking back below the recent breakout through October

highs, trading south of parity again. Copper prices declining a

percent are not helping matters, but the unexpected rise in prices falling, the addition of the Chinese factor will

Australia’s unemployment rate to 5.4% vs 5.0% expected exacerbate the issue, perhaps causing a real free-fall.

announced today added the real selling pressure. This comes

after a 5.3% MoM decline in the Westpac Consumer

Confidence Index, showing growth risks from hawkish policy

may finally be rising. Obviously the most significant

implication is in housing, where a 1.7x household

debt/disposable income and 1.4x mortgage debt/disposable

income characterize the housing bubble in Australia, where

the First Home Vendors Boost program has sent mortgage

debt/GDP to 0.87x, now higher than USA’s 2007 high of 0.83x

(also note that this is a GDP-adjusted ratio, discounting the

structural economic advantages Australia has over the US,

and still signifying blatant bubble risk). However, home loans

in September grew another 1.3%, above 1.0% estimates, Aside from the more sensationalist theses involving bubbles

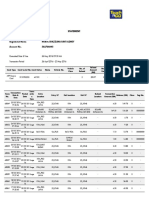

although this doesn’t take into account the 40-45bps hikes in and crashes galore, an interesting bit of data to note is the

mortgage rates executed by Aussie banks in their quests to recent surge in commercials positioning in cotton. Astute

remain competitive and keep margins high in response to the readers may have noticed I went short cotton futures

RBA hike to 475bps earlier this month. Trough inflation has yesterday and this was a big reason behind it. As presented in

clearly been hit in Australia and the hike cycle has a ways to the graphic below, merchant long-positioning in cotton

go, although perhaps not in the immediate future, and this is futures is now above 2008 highs, at the height of a

going to put pressure on already-strained Australian speculative-fueled boom that resulted in a crash. Unlike other

households. I went short AUDUSD on the technical commodities I’ve been bullish on, like soybeans and wheat,

breakdown back through parity as well as on the selloff in copper is an industrial (not food) commodity and much of the

copper from the resistance level I pointed out in last night’s price rise is due to the same Australian-Chinese industrial

piece. Though the property bubble will most likely begin its complex driving copper prices so high. The Pakistani floods

decline in Q2 or Q3 2011, I see near-term pressure building in also helped drive the move higher in the second half of 2010,

AUD and if this translates into reflecting (or catalyzing) but obviously that was a nonrecurring non-trend event. As

longer-term imbalance liquidation, I will hold my short and Indian export shipments finish in December, the panic buying

ride the wave down. Australia’s economy will probably not from end-users hedging against surging prices may prove to

enter acute crisis even if any of these scenarios play out, due be the demand at the margin, in which case a sizable

to its very strong structural properties, but its currency and correction would result. I’m not suggesting there is crash risk

asset values could see drastic selloffs due to overvaluation. in cotton, and in fact believe that it is in a strong bull market,

Unlike the US, such a crisis most likely would not additionally but a sharp correction along the way is what I’m playing and

expose structural imbalances, considering Australia does not current technicals are allowing me to dip my foot in the water

seem to have many. The Australia-China relationship is also with a short, which has already generated an 11% mark-to-

pertinent to this discussion, on both sides of the causal market profit thus far.

relation structure. China has also hit trough growth and

inflation and the PBoC will likely be hiking by next year, if not

Cotton Futures - Commercials Long Position

this December, ending the strong infrastructure spending-

80000

fueled boom in copper demand (and consequently prices),

much of which was satiated by Australian miners, whose 70000

astronomical earnings provided ample liquidity inflows into 60000

Australia. The shift in China’s political dynamics going forward 50000

Contracts

will put pressure on its own overvalued property sector, in 40000

which apartments are typically sold unfurnished without even

30000

basic electrical outputs as a result of being little more than a

20000

speculative marketplace, which further dampens copper

10000

demand and puts pressure on Australian exports. Although

inherently domestic catalysts may send Australian property 0

2006 2007 2008 2009 2010

On a side note, readers will notice that I went long EURUSD Short X | 47.30 | stop 49.25 | -1.05%

today, though I’m short the same pair as well as several other Short AKS | 13.90 | stop 14.25 | +2.66%

euro crosses. After the multiple 400+ pip in-the-blacks in the Short ACOR | 28.00 | stop 28.70 | +1.00%

PnL, and after EURXXX crosses falling sharply to near-term Short AAPL | 321.00 | stop 330.00 | +1.36%

support levels concurrent to USD perhaps approaching a Long PTR | 130.35 | stop 124.20 | +4.60%

near-term correction, I wanted to hedge a bit of downside (in Short /HG | 4.06 | stop 4.15 | +1.97%

this case upside) risk and lock in some gains by going long a Long /CL | 87.33 | stop 85.40 | -0.84%

bit of EURUSD and reassessing in the next week or two Short /CT | 151.50 | stop 160.35 | +10.96%

whether to sell the hedge and hold my core positions or take

profits on the core positions and have a great entry on the CLOSED TRADES

near-term reversal in euro, as the Eurozone debt concerns

play out and QE II begins. I’m putting my EURUSD long stop Long ELP | 24.26 | close 24.22 | -0.16%

level at the 55d (extrapolated using current dP/dt to 21 days Long /NG | 4.05 | sell 3.83 | -5.43%

and subsequently subtracting a buffer level for intrasession

volatility) and consider it a discrete, separate position from NEW TRADES

my short in the same pair.

Short AUDUSD | 0.9980 | stop 1.0075

OPEN TRADES Long EURUSD | 1.3625 | stop 1.3530

Short APOL | 51.90 | stop 54.00 | +29.42%

Long TBT | 32.65 | stop 31.80 | +11.66% If you would like to subscribe to Shadow Capitalism Daily Market

Short /ZB | 133’24 | stop 135’15 | +5’00 Commentary, please email me at naufalsanaullah@gmail.com to be added to

Long AMZN | 159.10 | stop 152.00 | +7.08% the mailing list.

Long VECO | 39.00 | stop 36.30 | +12.27%

DISCLAIMER: Nothing contained anywhere in this commentary, including

Long YHOO | 15.65 | stop 15.35 | +7.38% analysis and trade ideas, constitutes or should be construed as investing or

Long USD/JPY | 80.75 | stop 79.85 | +165 pips financial advice, suggestion, or recommendation. Please consult a financial

Long ACAS | 6.67 | stop 6.25 | +10.05% professional and do due diligence before engaging in any purchase or sale of

Long MSFT | 25.20 | stop 24.85 | +5.55% securities.

Long GRA | 30.04 | stop 29.80 | +13.15%

Long F | 14.25 | stop 13.85 | +16.55%

Short EUR/NZD | 1.8370 | stop 1.8650 | +900 pips

Short GBP/NZD | 2.0885 | stop 2.1900 | +235 pips

Long CAD/JPY | 79.60 | stop 78.55 | +240 pips

Short PWER | 10.58 | stop 11.40 | +15.50%

Short EUR/CHF | 1.3725 | stop 1.3910 | +405 pips

Long BRKR | 14.80 | stop 14.45 | +3.92%

Long AIG | 43.49 | stop 41.00 | -2.25%

Short BP | 42.40 | stop 44.80 | -1.91%

Long MUR | 66.01 | stop 62.90 | +3.71%

Long CEO | 226.96 | stop 210.55 | +2.03%

Long MXN/JPY | 6.600 | stop 6.450 | +110 pips

Short EUR/USD | 1.4170 | stop 1.4275 | +570 pips

Short EUR/CAD | 1.4145 | stop 1.4205 | +445pips

Short EUR/AUD | 1.3995 | stop 1.4105 | +325 pips

Short EUR/NOK | 8.120 | stop 8.180 | +20 pips

Short QQQQ | 53.60 | stop 54.40 | +0.41%

Long USD/HUF | 195.45 | stop 192.70 | +80 pips

Short SPG | 106.45 | stop 110.10 | +4.69%

Long NTES | 41.40 | stop 39.40 | -1.96%

Short NZD/USD | 0.7820 | stop 0.8005 | +40 pips

Long /ZS | 1286.55 | stop 1267.00 | +1.20%

You might also like

- Joint Venture Agreement: STEVEN CONSTRUCTION AND SUPPLY, A Registered CorporationDocument7 pagesJoint Venture Agreement: STEVEN CONSTRUCTION AND SUPPLY, A Registered CorporationGhee Morales100% (1)

- Econ SelfieDocument12 pagesEcon SelfieHarneet SinghNo ratings yet

- Studies in The Macedonian Coinage of Alexander The Great - Hyla A. TroxellDocument204 pagesStudies in The Macedonian Coinage of Alexander The Great - Hyla A. TroxellSonjce Marceva100% (3)

- TESLA International Business Strategy ID Ab5a5569 04ba 42da d249 D8a44b04c634Document23 pagesTESLA International Business Strategy ID Ab5a5569 04ba 42da d249 D8a44b04c634Laia FLNo ratings yet

- Tax Invoice: Louis Philippe 3 Piece Self Design Men SuitDocument1 pageTax Invoice: Louis Philippe 3 Piece Self Design Men SuitSusil Kumar MisraNo ratings yet

- T Shadow Capitalism: Tuesday, November 23, 2010Document5 pagesT Shadow Capitalism: Tuesday, November 23, 2010Naufal SanaullahNo ratings yet

- Shadow Capitalism: Market Commentary by Naufal SanaullahDocument6 pagesShadow Capitalism: Market Commentary by Naufal SanaullahNaufal SanaullahNo ratings yet

- Sweet Spot Fading enDocument4 pagesSweet Spot Fading enwindson_sgNo ratings yet

- Weekly CommentaryDocument4 pagesWeekly Commentaryapi-150779697No ratings yet

- Shadow Capitalism: Wednesday, November 24, 2010Document4 pagesShadow Capitalism: Wednesday, November 24, 2010Naufal SanaullahNo ratings yet

- Shadow Capitalism: Monday, November 29, 2010Document5 pagesShadow Capitalism: Monday, November 29, 2010Naufal SanaullahNo ratings yet

- Shadow Capitalism: Friday, November 26, 2010Document5 pagesShadow Capitalism: Friday, November 26, 2010Naufal SanaullahNo ratings yet

- Aust House Prices OI 21 2012Document2 pagesAust House Prices OI 21 2012TihoNo ratings yet

- 2010 Aug 09 Olivers Insights Inflation Deflation or Just Low Flat IonDocument2 pages2010 Aug 09 Olivers Insights Inflation Deflation or Just Low Flat IonPranjayNo ratings yet

- Gold Forecast 2010Document12 pagesGold Forecast 2010Mohamed Said Al-QabbaniNo ratings yet

- GMCPTechnicalWeekly26 09 2023Document19 pagesGMCPTechnicalWeekly26 09 2023DineshM78100% (1)

- T Shadow Capitalism: Friday, November 5, 2010Document4 pagesT Shadow Capitalism: Friday, November 5, 2010Naufal SanaullahNo ratings yet

- T Shadow Capitalism: Wednesday, November 10, 2010Document3 pagesT Shadow Capitalism: Wednesday, November 10, 2010Naufal SanaullahNo ratings yet

- Economic and Market Outlook 2023 Down But Not OutDocument30 pagesEconomic and Market Outlook 2023 Down But Not OutKien NguyenNo ratings yet

- 01-31-11 Breakfast With DaveDocument8 pages01-31-11 Breakfast With DavetngarrettNo ratings yet

- T Shadow Capitalism: Tuesday, September 28, 2010Document4 pagesT Shadow Capitalism: Tuesday, September 28, 2010Naufal SanaullahNo ratings yet

- The Years 1999/2000 Were A Time of ExtremesDocument9 pagesThe Years 1999/2000 Were A Time of ExtremesAlbert L. PeiaNo ratings yet

- Global Economic Forecast: October 11th 2010Document12 pagesGlobal Economic Forecast: October 11th 2010kritika_09084799No ratings yet

- Volume 1.10 The Fed's Dilemma Sept 16 2009Document12 pagesVolume 1.10 The Fed's Dilemma Sept 16 2009Denis OuelletNo ratings yet

- Asset Allocation: Fall 2010: Olume CtoberDocument30 pagesAsset Allocation: Fall 2010: Olume Ctoberrichardck50No ratings yet

- Weekly OverviewDocument4 pagesWeekly Overviewapi-150779697No ratings yet

- Breakfast With Dave: David A. RosenbergDocument8 pagesBreakfast With Dave: David A. RosenbergeconomicburnNo ratings yet

- Australia To Benefit From China Ties For Some Time Yet: Economic Research NoteDocument2 pagesAustralia To Benefit From China Ties For Some Time Yet: Economic Research Notealan_s1No ratings yet

- Breakfast With Dave 112210Document15 pagesBreakfast With Dave 112210richardck50No ratings yet

- Ocbc Treasury Research: Key ThemesDocument12 pagesOcbc Treasury Research: Key ThemesenzoNo ratings yet

- 06-10-10 Breakfast With DaveDocument8 pages06-10-10 Breakfast With DavefcamargoeNo ratings yet

- Olivers Insights - Share CorrectionDocument2 pagesOlivers Insights - Share CorrectionAnthony WrightNo ratings yet

- Weekly CommentaryDocument4 pagesWeekly Commentaryapi-150779697No ratings yet

- Duomo Capital Market Update November 2013Document1 pageDuomo Capital Market Update November 2013Duomo CapitalNo ratings yet

- Week 10 - Tutorial QuestionsDocument8 pagesWeek 10 - Tutorial Questionsqueeen of the kingdomNo ratings yet

- Tessellatum FFFDocument41 pagesTessellatum FFFadarshNo ratings yet

- The Great Vega ShortDocument10 pagesThe Great Vega ShortgousnavyNo ratings yet

- Shadow Capitalism: Market Commentary by Naufal SanaullahDocument6 pagesShadow Capitalism: Market Commentary by Naufal SanaullahNaufal SanaullahNo ratings yet

- Breakfast With Dave 010511Document15 pagesBreakfast With Dave 010511richardck50No ratings yet

- Global Forecast: UpdateDocument6 pagesGlobal Forecast: Updatebkginting6300No ratings yet

- Breakfast With Dave: While You Were SleepingDocument12 pagesBreakfast With Dave: While You Were Sleepingrichardck61No ratings yet

- Weekly OverviewDocument4 pagesWeekly Overviewapi-150779697No ratings yet

- T Shadow Capitalism: Tuesday, October 19, 2010Document4 pagesT Shadow Capitalism: Tuesday, October 19, 2010Naufal SanaullahNo ratings yet

- Artemis Capital Q12012 Volatility at Worlds End1Document18 pagesArtemis Capital Q12012 Volatility at Worlds End1Sean GreelyNo ratings yet

- Weekly CommentaryDocument4 pagesWeekly Commentaryapi-150779697No ratings yet

- Cross-Currents in The Global Economy - 25 October 2010Document10 pagesCross-Currents in The Global Economy - 25 October 2010peter_martin9335No ratings yet

- ACM The Great Vega ShortDocument10 pagesACM The Great Vega ShortwarrenprosserNo ratings yet

- Australian Interest Rate SwaptionsDocument4 pagesAustralian Interest Rate SwaptionsOMiNYCNo ratings yet

- General Market Update - July 2019Document7 pagesGeneral Market Update - July 2019Anonymous kOLTDa6No ratings yet

- Weekly OverviewDocument4 pagesWeekly Overviewapi-150779697No ratings yet

- S G & Cad & Aud: Tock Markets OLD CommoditiesDocument8 pagesS G & Cad & Aud: Tock Markets OLD Commoditiesderailedcapitalism.comNo ratings yet

- G10 Focus - Why The Market Underestimates Risk For AUDUSD 1.20Document8 pagesG10 Focus - Why The Market Underestimates Risk For AUDUSD 1.20MrHedgeFundNo ratings yet

- Weekly CommentaryDocument3 pagesWeekly Commentaryapi-150779697No ratings yet

- WEEK 46 - November 15 To 19, 2010Document1 pageWEEK 46 - November 15 To 19, 2010JC CalaycayNo ratings yet

- Quarterly: Third QuarterDocument19 pagesQuarterly: Third QuarterTomNo ratings yet

- AMM - Q1 2010 LetterDocument4 pagesAMM - Q1 2010 LetterGlenn BuschNo ratings yet

- Breakfast With Dave 20100928Document8 pagesBreakfast With Dave 20100928marketpanicNo ratings yet

- Hadrian BriefDocument11 pagesHadrian Briefspace238No ratings yet

- The Bigger 'Bigger Picture'Document6 pagesThe Bigger 'Bigger Picture'tanase.octavian2561No ratings yet

- Property Report MelbourneDocument0 pagesProperty Report MelbourneMichael JordanNo ratings yet

- Effect of Euro Debt Crisis On IndiaDocument2 pagesEffect of Euro Debt Crisis On IndiaBrajesh PandeyNo ratings yet

- Wall ST Rises On Reports of Help For GreeceDocument11 pagesWall ST Rises On Reports of Help For GreeceAlbert L. PeiaNo ratings yet

- Summary of Lawrence G. McDonald's How to Listen When Markets SpeakFrom EverandSummary of Lawrence G. McDonald's How to Listen When Markets SpeakNo ratings yet

- Global Banking Glut and Loan Risk PremiumDocument46 pagesGlobal Banking Glut and Loan Risk PremiumNaufal SanaullahNo ratings yet

- Shadow Capitalism: Market Commentary by Naufal SanaullahDocument7 pagesShadow Capitalism: Market Commentary by Naufal SanaullahNaufal SanaullahNo ratings yet

- Shadow Capitalism: Market Commentary by Naufal SanaullahDocument8 pagesShadow Capitalism: Market Commentary by Naufal SanaullahNaufal SanaullahNo ratings yet

- Shadow Capitalism: Market Commentary by Naufal SanaullahDocument7 pagesShadow Capitalism: Market Commentary by Naufal SanaullahNaufal SanaullahNo ratings yet

- Shadow Capitalism: Market Commentary by Naufal SanaullahDocument5 pagesShadow Capitalism: Market Commentary by Naufal SanaullahNaufal SanaullahNo ratings yet

- Shadow Capitalism: Market Commentary by Naufal SanaullahDocument6 pagesShadow Capitalism: Market Commentary by Naufal SanaullahNaufal SanaullahNo ratings yet

- Shadow Capitalism: Market Commentary by Naufal SanaullahDocument7 pagesShadow Capitalism: Market Commentary by Naufal SanaullahNaufal SanaullahNo ratings yet

- T Shadow Capitalism: Tuesday, November 23, 2010Document5 pagesT Shadow Capitalism: Tuesday, November 23, 2010Naufal SanaullahNo ratings yet

- Shadow Capitalism: Market Commentary by Naufal SanaullahDocument7 pagesShadow Capitalism: Market Commentary by Naufal SanaullahNaufal SanaullahNo ratings yet

- Calendar 12 05 2010Document5 pagesCalendar 12 05 2010Naufal SanaullahNo ratings yet

- Shadow Capitalism: Market Commentary by Naufal SanaullahDocument5 pagesShadow Capitalism: Market Commentary by Naufal SanaullahNaufal SanaullahNo ratings yet

- Shadow Capitalism: Market Commentary by Naufal SanaullahDocument5 pagesShadow Capitalism: Market Commentary by Naufal SanaullahNaufal SanaullahNo ratings yet

- Shadow Capitalism: Market Commentary by Naufal SanaullahDocument4 pagesShadow Capitalism: Market Commentary by Naufal SanaullahNaufal SanaullahNo ratings yet

- Shadow Capitalism: Market Commentary by Naufal SanaullahDocument6 pagesShadow Capitalism: Market Commentary by Naufal SanaullahNaufal SanaullahNo ratings yet

- Shadow Capitalism: Market Commentary by Naufal SanaullahDocument5 pagesShadow Capitalism: Market Commentary by Naufal SanaullahNaufal SanaullahNo ratings yet

- Shadow Capitalism: Market Commentary by Naufal SanaullahDocument6 pagesShadow Capitalism: Market Commentary by Naufal SanaullahNaufal SanaullahNo ratings yet

- Shadow Capitalism: Wednesday, November 24, 2010Document4 pagesShadow Capitalism: Wednesday, November 24, 2010Naufal SanaullahNo ratings yet

- Shadow Capitalism: Monday, November 29, 2010Document5 pagesShadow Capitalism: Monday, November 29, 2010Naufal SanaullahNo ratings yet

- Shadow Capitalism: Friday, November 26, 2010Document5 pagesShadow Capitalism: Friday, November 26, 2010Naufal SanaullahNo ratings yet

- T Shadow Capitalism: Wednesday, November 10, 2010Document3 pagesT Shadow Capitalism: Wednesday, November 10, 2010Naufal SanaullahNo ratings yet

- T Shadow Capitalism: Tuesday, October 19, 2010Document4 pagesT Shadow Capitalism: Tuesday, October 19, 2010Naufal SanaullahNo ratings yet

- T Shadow Capitalism: Friday, November 5, 2010Document4 pagesT Shadow Capitalism: Friday, November 5, 2010Naufal SanaullahNo ratings yet

- T Shadow Capitalism: Wednesday, October 20, 2010Document3 pagesT Shadow Capitalism: Wednesday, October 20, 2010Naufal SanaullahNo ratings yet

- Maize & Blue Fund - Economist Group - Sector Pitch - Underweight EnergyDocument19 pagesMaize & Blue Fund - Economist Group - Sector Pitch - Underweight EnergyNaufal SanaullahNo ratings yet

- T Shadow Capitalism: Thursday, October 7, 2010Document4 pagesT Shadow Capitalism: Thursday, October 7, 2010Naufal SanaullahNo ratings yet

- T Shadow Capitalism: Sunday, October 17, 2010Document4 pagesT Shadow Capitalism: Sunday, October 17, 2010Naufal SanaullahNo ratings yet

- T Shadow Capitalism: Thursday, October 7, 2010Document4 pagesT Shadow Capitalism: Thursday, October 7, 2010Naufal SanaullahNo ratings yet

- T Shadow Capitalism: Tuesday, September 28, 2010Document4 pagesT Shadow Capitalism: Tuesday, September 28, 2010Naufal SanaullahNo ratings yet

- (Alfred D. Chandler JR, Peter Hagstrom, Orjan Solv (B-Ok - CC)Document488 pages(Alfred D. Chandler JR, Peter Hagstrom, Orjan Solv (B-Ok - CC)anon_49849885No ratings yet

- A Case Study On Pension FundDocument4 pagesA Case Study On Pension FundJalalur RahmanNo ratings yet

- PudhuvazhvuDocument3 pagesPudhuvazhvuRakesh KumarNo ratings yet

- 40 Acta-Moldaviae-Meridionalis XXXIX-I 2019 190Document19 pages40 Acta-Moldaviae-Meridionalis XXXIX-I 2019 190Bogdan CozmaNo ratings yet

- Aisling Winston CVDocument2 pagesAisling Winston CVvenom_ftwNo ratings yet

- Public Sector Marketing Tony ProctorDocument8 pagesPublic Sector Marketing Tony ProctorPère elie AssaadNo ratings yet

- Marketing Contacts PDFDocument4 pagesMarketing Contacts PDFOmprakaash0% (1)

- Factor-Factor RelationshipDocument28 pagesFactor-Factor RelationshipMohammad RizwanNo ratings yet

- Real Estate SectorDocument98 pagesReal Estate SectorIzzah CurlNo ratings yet

- ProgressDocument83 pagesProgressJohn Timothy VillacorteNo ratings yet

- Be It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledDocument4 pagesBe It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledMarc Vergel FuentesNo ratings yet

- Jai BabaDocument1 pageJai BabaShivam KumarNo ratings yet

- EAManufacturersDirectorySSudan - 2020 - 副本Document16 pagesEAManufacturersDirectorySSudan - 2020 - 副本Leo SuNo ratings yet

- Ch11 - Parkin - Econ - Lecture PresentationDocument63 pagesCh11 - Parkin - Econ - Lecture PresentationSu Sint Sint HtwayNo ratings yet

- MBA Energy Management System Report PDFDocument15 pagesMBA Energy Management System Report PDFAnshul BhutaniNo ratings yet

- Pil Abstract and SynopsisDocument7 pagesPil Abstract and SynopsisKartik BhargavaNo ratings yet

- Dependency Theory: Concepts, Classifications, and CriticismsDocument30 pagesDependency Theory: Concepts, Classifications, and Criticismsmostafa abdo100% (1)

- Excel Demo Diving Into PBIDocument135 pagesExcel Demo Diving Into PBIRahul ChauhanNo ratings yet

- Kodi DoganorDocument84 pagesKodi DoganorErald QordjaNo ratings yet

- TNG PDFDocument2 pagesTNG PDFnurulNo ratings yet

- Large Dia CT Sites FInal List - 27-Sep-2021 DPRDocument12 pagesLarge Dia CT Sites FInal List - 27-Sep-2021 DPRMuhammad AsadNo ratings yet

- Letcor Property ManagersDocument4 pagesLetcor Property ManagersshermanNo ratings yet

- Part 1 Social ScienceDocument109 pagesPart 1 Social ScienceRowena CastillanoNo ratings yet

- State of Microfinance in NepalDocument95 pagesState of Microfinance in NepalAbhishek AcharyaNo ratings yet

- Credit-Led Micro Finance in TamaleDocument15 pagesCredit-Led Micro Finance in Tamaledawuda72100% (1)