Professional Documents

Culture Documents

IFRIC 22: Foreign Currency Transactions and Advance Consideration

IFRIC 22: Foreign Currency Transactions and Advance Consideration

Uploaded by

Vladimir StanovicOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

IFRIC 22: Foreign Currency Transactions and Advance Consideration

IFRIC 22: Foreign Currency Transactions and Advance Consideration

Uploaded by

Vladimir StanovicCopyright:

Available Formats

www.mgiworld.

com/globalifrs

IFRIC 22: Foreign Currency Transactions and Advance Consideration

IFRIC 22 clarifies the accounting for transactions that include the receipt or payment of advance

consideration in a foreign currency. IFRS Interpretations Committee (IC) observed some diversity in

practice regarding the exchange rate used when reporting transactions that are denominated in a

foreign currency in accordance with IAS 21 The Effects of Changes in Foreign Exchange Rates in

circumstances in which consideration is received or paid in advance of the recognition of the related

asset, expense or income.

IFRIC 22 is effective for annual reporting periods beginning on or after 1 January 2018 and was adopted

by the EU on 3 April 2018.

Scope of IFRIC 22

The Interpretation addresses foreign currency transactions when an entity recognizes a non-monetary

asset or a non-monetary liability that arises from the prepayment or prepayment received in advance

before the entity recognizes the related asset, income or expense recorded. It is not applicable when an

entity measures the related asset, income or expense on initial recognition at fair value or fair value of

the consideration received or paid at a time other than the initial recognition of the non-monetary asset

or non-monetary liability. Furthermore, the interpretation is not to be applied to income taxes, insurance

contracts and reinsurance contracts.

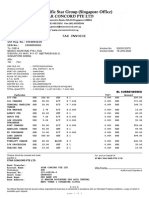

Example 1: Single advance payment for the purchase of a single item of PP&E

On March 20X1, Entity A entered into a contract with a supplier to purchase a machine for use in its

business. Under the terms of the contract, Entity A pays the supplier a fixed purchase price of FC 1,000 on

1 April 20X1. On 15 May 20X1, Entity A takes delivery of the machine.

Date Spot exchange rate FC:LC Entity A’s accounting entries

1 April 20X1 1:1.5 Dr. Prepayment LC1,500

Cr. Bank LC1,500

Entity A initially recognizes a non-monetary asset translating FC1,000 into its functional currency at the

spot exchange rate on 1 April 201X. A does not update the translated amount of the non-monetary

asset.

15 May 20X1 1:1.7 Dr. PP&E LC1,500

Cr. Prepayment LC1,500

On 15 May 20X1, Entity A takes delivery of the machine. Entity A derecognizes the non-monetary asset

and recognizes the machine as PP&E. On initial recognition of the machine, Entity A recognizes the cost

of the machine using the exchange rate at the date of the transaction, which is 1 April 20X1 (i.e. the

date of initial recognition of the non-monetary asset).

Example 2: Multiple receipts of revenue recognized at multiple points in time

On 1 January 20X4, Entity D enters into a contract to sell two products to a customer. Entity D transfers

one product on 1 March 20X4 and the second on 1 June 20X4. As required by the contract, the customer

www.mgiworld.com/globalifrs

pays a fixed purchase price of FC1,000. In applying IFRS 15 Entity D allocates FC 450 of the transaction

price to the first product and FC 550 to the second product. FC200 is due and received in advance on 31

January 20X4. Entity D has determined that these FC 200 relate to the first product transferred on 1 March

20X4. The remaining consideration of FC 800 is due and received on 1 June 20X4. On transfer of the first

product, Entity D has an unconditional right to FC 250 of the remaining consideration.

Date Spot exchange rate FC:LC Entity A’s accounting entries

31 January 20X4 1:1.5 Dr. Cash (FC200) LC300

Cr. Contract liability (FC200) LC300

The advance payment is recorded at functional currency using exchange rate at 31 January 20X4. Entity

D does not update the translated amount of the non-monetary contract liability (IAS 21.23b).

1 March 20X4 1:1.7 Dr. Contract liability (FC200) LC300

Dr. Receivable (FC250) LC425

Cr. Revenue (FC450) LC725

Entity D transfers the first product with a transaction price of FC450 on 1 March 20X4. Entity D

derecognises the contract liability and recognizes revenue of LC300. Entity D recognises the remaining

revenue of FC250 relating to the first product and a corresponding receivable both at the spot exchange

rate as of the date that it recognizes the remaining revenue of FC 250, i.e. 1 March 20X4.

1 June 20X4 1:1.9 Dr. Receivable LC50

Cr. Foreign exchange gain LC50

Dr. Cash (FC800) LC1,520

Cr. Receivable (FC250) LC475

Cr. Revenue (FC550) LC1,045

As the receivable of FC250 is a monetary item, Entity D updates the translated amount until the

receivable is settled (1 June 20X4: 250 x 1.9 – 250 x 1.7 = 50). Entity D transfers the second product

with a transaction price of FC550 on 1 June 20X4. Entity D recognises revenue of FC550 using the

exchange rate at the date of the transaction (1 June 20X4).

Conclusion

IFRIC 22 will has an impact on all entities that enter into foreign currency transactions for which

consideration is paid or received in advance. Applying the interpretation can be challenging for entities

that enter into long-term foreign currency contracts with complex payment schedules and/or significant

upfront payments.

For more information please contact the MGI Worldwide Global IFRS Group:

Dr. Michael Grüne Nigel Fry Dr. Thies Lentfer

BHP GmbH von Diest, Greve und Partner

Stuttgart, Germany Hamburg, Germany

E: michael.gruene@mgi-bhp.de E: thies.lentfer@vondiest.de

F: +49 711 18791 0 F: +49 40 3749 4516

Juan Carlos Guerra Enriques Laura Pritchard Rosie Davis

MGI Guerra & Asociados Seymour Taylor MGI Perth

Quito, Ecuador High Wycombe, UK Perth, Australia

E: jcguerra@mgiecuador.com E: laura.pritchard@stca.co.uk E: rdavis@mgiperth.com.au

F: +593 2 255 0299 F: +44 1494 552136 F: +61 8 9388 9744

MGI Worldwide is a network of independent audit, tax, accounting and consulting firms. MGI Worldwide does not provide any

services and its member firms are not an international partnership. Each member firm is a separate entity and neither MGI

Worldwide nor any member firm accepts responsibility for the activities, work, opinions or services of any other member firm.

For more information visit www.mgiworld.com/legal.

You might also like

- TD Personal Checking: Account # 008-182338743Document1 pageTD Personal Checking: Account # 008-182338743ZTECH71% (7)

- Consignment Sales 2Document22 pagesConsignment Sales 2Mhelka Tiodianco33% (3)

- Learn The ABCs and Get Your CAP Rev 3Document9 pagesLearn The ABCs and Get Your CAP Rev 3sc100% (30)

- Solicitors Accounts Lecture 4 HandoutDocument10 pagesSolicitors Accounts Lecture 4 HandoutJames C. RickerbyNo ratings yet

- Reviewer Financial AccountingDocument21 pagesReviewer Financial Accountingjingyuu kim67% (3)

- AC2101 SemGrp4 Team5 UpdatedDocument42 pagesAC2101 SemGrp4 Team5 UpdatedKwang Yi JuinNo ratings yet

- Buss. Combi PrelimDocument8 pagesBuss. Combi PrelimPhia TeoNo ratings yet

- Chapter 49-Pfrs For SmesDocument6 pagesChapter 49-Pfrs For SmesEmma Mariz Garcia40% (5)

- Quiz 9Document4 pagesQuiz 9Aramina Cabigting BocNo ratings yet

- Foreign Currency Transaction Notes (Ias 21) (2021)Document43 pagesForeign Currency Transaction Notes (Ias 21) (2021)Elago IilongaNo ratings yet

- Forex and DerivativesDocument5 pagesForex and Derivativesmaria claraNo ratings yet

- Philippine Interpretations Committee (Pic) Questions and Answers (Q&As)Document5 pagesPhilippine Interpretations Committee (Pic) Questions and Answers (Q&As)CamilleHernandezNo ratings yet

- Forward ContractDocument6 pagesForward ContractUsama AhmadNo ratings yet

- 2023 16 March Part-4 Final LPBDocument5 pages2023 16 March Part-4 Final LPBjolanevdwaltNo ratings yet

- Elimination RoundDocument11 pagesElimination RoundDeeNo ratings yet

- At 31 May 20X7 RobertaDocument6 pagesAt 31 May 20X7 RobertaTrung Anh NguyenNo ratings yet

- Accountancy Philippines Daily Review For Afar June 04 2020: Q1. AverageDocument7 pagesAccountancy Philippines Daily Review For Afar June 04 2020: Q1. Averagechris layNo ratings yet

- Module 1.2 PFRS 15 Revenue From Customers - Other IssuesDocument16 pagesModule 1.2 PFRS 15 Revenue From Customers - Other IssuesNCTNo ratings yet

- FOREXDocument17 pagesFOREXMaria ChouNo ratings yet

- Far 811S Test 2 2023Document7 pagesFar 811S Test 2 2023Grechen UdigengNo ratings yet

- Questionnaire ActDocument6 pagesQuestionnaire ActLorainne AjocNo ratings yet

- FOREX Part3Document2 pagesFOREX Part3misonim.eNo ratings yet

- Sem 11 HedgeAccounting - Part II (NTUL)Document62 pagesSem 11 HedgeAccounting - Part II (NTUL)Gordon Ong JinjieNo ratings yet

- NCR Cup JR Basic Accounting FinalDocument6 pagesNCR Cup JR Basic Accounting FinalNicolaus CopernicusNo ratings yet

- Ifrs 15Document9 pagesIfrs 15Nguyễn Thị Mỹ HòaNo ratings yet

- kttc1 IcaewDocument10 pageskttc1 Icaewthành trầnNo ratings yet

- EvalsDocument11 pagesEvalsPaul Adriel Balmes50% (2)

- P2 Question 2012Document18 pagesP2 Question 2012Jake ManansalaNo ratings yet

- Consignments: Customers in Accounting For Revenues FromDocument22 pagesConsignments: Customers in Accounting For Revenues FromVine AlparitoNo ratings yet

- Acctg34 Franchise Pret. Remaining Items AkeyDocument6 pagesAcctg34 Franchise Pret. Remaining Items AkeyDonna Mae SingsonNo ratings yet

- Accounting For Foreign Currency Transactions Advanced Financial Accounting & Reporting Online Lecture byDocument72 pagesAccounting For Foreign Currency Transactions Advanced Financial Accounting & Reporting Online Lecture byTrisha RafalloNo ratings yet

- Class Test 1 - Q+SolutionDocument4 pagesClass Test 1 - Q+Solutionmindofakira756No ratings yet

- 2023 COALA1 Week 5 Transfer Procedures & Correspondent AccountsDocument44 pages2023 COALA1 Week 5 Transfer Procedures & Correspondent Accountsnandinhlapo96No ratings yet

- Buss. Combi PrelimDocument8 pagesBuss. Combi PrelimPhia TeoNo ratings yet

- National College of Business and Arts: Name: Date: Professor: SubjectDocument8 pagesNational College of Business and Arts: Name: Date: Professor: SubjectAngelica CerioNo ratings yet

- Eos CupFinal RoundDocument7 pagesEos CupFinal RoundMJ YaconNo ratings yet

- Chapter 1 None CompressDocument9 pagesChapter 1 None CompressiadcNo ratings yet

- Note Payable Practice Exercise FDocument9 pagesNote Payable Practice Exercise Flana del reyNo ratings yet

- AFAR FinalMockBoard ADocument11 pagesAFAR FinalMockBoard ACattleyaNo ratings yet

- Acctg106 Derivatives Sample QuestionsDocument13 pagesAcctg106 Derivatives Sample QuestionsfunkpopsicleNo ratings yet

- FOREX Part2Document9 pagesFOREX Part2misonim.eNo ratings yet

- ADVANCED ACCOUNTING 1 - Chapter 8: Accounting For Franchise Operations - Franchisor James B. Cantorne Problem 1. T/FDocument2 pagesADVANCED ACCOUNTING 1 - Chapter 8: Accounting For Franchise Operations - Franchisor James B. Cantorne Problem 1. T/FJames CantorneNo ratings yet

- AST Final Examination: RequiredDocument21 pagesAST Final Examination: RequiredCristel TannaganNo ratings yet

- Ias 10 Events After The Reporting PeriodDocument9 pagesIas 10 Events After The Reporting PeriodTawanda Tatenda HerbertNo ratings yet

- bài tập về nhà chapter 1Document7 pagesbài tập về nhà chapter 1Nguyễn Linh NhiNo ratings yet

- Paper - 1: Financial Reporting Questions Ind AS 103Document30 pagesPaper - 1: Financial Reporting Questions Ind AS 103sam kapoorNo ratings yet

- Aidcom Financial Accounting AnalysisDocument17 pagesAidcom Financial Accounting AnalysisAjmal K HussainNo ratings yet

- Quiz - Chapter 8 - Accounting For Franchise Operations - Franchisor - 2021 EditionDocument4 pagesQuiz - Chapter 8 - Accounting For Franchise Operations - Franchisor - 2021 EditionYam SondayNo ratings yet

- Notes ReceivableDocument24 pagesNotes Receivablemariajessalen.azulNo ratings yet

- Eos Cupfinal RoundDocument7 pagesEos Cupfinal RoundSheena Pearl AlinsanganNo ratings yet

- Basic Accounting Final - QuestionDocument6 pagesBasic Accounting Final - QuestionEdaNo ratings yet

- Advanced Corporate AccountingDocument6 pagesAdvanced Corporate Accountingamensinkai3133No ratings yet

- Question11 JohnDocument10 pagesQuestion11 JohnremmymariethaNo ratings yet

- Quiz 1Document8 pagesQuiz 1angelovilladoresNo ratings yet

- Week 4 tut solutions wholly owned entities 28Document9 pagesWeek 4 tut solutions wholly owned entities 28joehe2625No ratings yet

- Power Point Slides - Lesson 9Document23 pagesPower Point Slides - Lesson 9Phelisa Lisa LamaniNo ratings yet

- Chapter 11. RevenueDocument62 pagesChapter 11. RevenueАйбар КарабековNo ratings yet

- Chapter 12 - Accounting For Revenue - 2020 LMSDocument38 pagesChapter 12 - Accounting For Revenue - 2020 LMSMenaka KulathungaNo ratings yet

- Private Client Practice: An Expert Guide, 2nd editionFrom EverandPrivate Client Practice: An Expert Guide, 2nd editionNo ratings yet

- CHALLAN FORM No.32 ADocument3 pagesCHALLAN FORM No.32 AMIan Muzamil0% (1)

- Thomas 05.31.23Document32 pagesThomas 05.31.23Deuntae ThomasNo ratings yet

- The Basics of 1099 ReportingDocument18 pagesThe Basics of 1099 ReportingJagomohan100% (5)

- TBL Major Shareholders' DividendDocument3 pagesTBL Major Shareholders' Dividendrukiaa100% (3)

- Assignment On Secure Electronic TransactionDocument10 pagesAssignment On Secure Electronic TransactionSubhash SagarNo ratings yet

- UP Bar Reviewer 2013 - TaxationDocument210 pagesUP Bar Reviewer 2013 - TaxationPJGalera89% (28)

- Gasbill 4978636878 202007 20200714214937Document1 pageGasbill 4978636878 202007 20200714214937salmansaleemNo ratings yet

- 80C - Children Tuition FeesDocument1 page80C - Children Tuition FeesSekh Hosne MobarakNo ratings yet

- 2nd Installment Academic Fee Demand Notice 2023-2024Document3 pages2nd Installment Academic Fee Demand Notice 2023-2024mamtakanwar.mech26No ratings yet

- Section 80EEB of Income Tax Act - Electric Vehicle Tax Exemption, Benefits and DeductionDocument10 pagesSection 80EEB of Income Tax Act - Electric Vehicle Tax Exemption, Benefits and DeductionnavdeepdecentNo ratings yet

- Define TaxesDocument154 pagesDefine TaxesLeandro Wandekoken Cavalheiro100% (1)

- G.R. No. 197117. April 10, 2013.: Somera, Penano & Associates Office of The Solicitor GeneralDocument7 pagesG.R. No. 197117. April 10, 2013.: Somera, Penano & Associates Office of The Solicitor GeneralJuris FormaranNo ratings yet

- Tax Ii NotesDocument40 pagesTax Ii NotesMARFENo ratings yet

- Account Statement Greendot PDFDocument4 pagesAccount Statement Greendot PDFBaris MironNo ratings yet

- Allowable Dedcutions - Estate TaxDocument1 pageAllowable Dedcutions - Estate TaxJorel DiocolanoNo ratings yet

- Invoice SII22012979Document2 pagesInvoice SII22012979Summersky9333No ratings yet

- W216 InvDocument2 pagesW216 InvKanchanNo ratings yet

- Generic ATM Interface User GuideDocument90 pagesGeneric ATM Interface User Guidegustavrusso888989% (9)

- Fatima Hassan PDFDocument1 pageFatima Hassan PDFHassan ImranNo ratings yet

- Tax Invoice: Advance Receipt Voucher NoDocument2 pagesTax Invoice: Advance Receipt Voucher NoRajeev PuppalaNo ratings yet

- Module 09 - Inclusions in Gross IncomeDocument15 pagesModule 09 - Inclusions in Gross IncomeRoligen Rose PachicoyNo ratings yet

- True False False True True True False True True True True True True True True True True False False True True True False True TrueDocument5 pagesTrue False False True True True False True True True True True True True True True True False False True True True False True TrueDong RoselloNo ratings yet

- Chapter 12 v2Document18 pagesChapter 12 v2Sheilamae Sernadilla GregorioNo ratings yet

- Basic Principles of Taxation-1Document82 pagesBasic Principles of Taxation-1Abby Gail Tiongson83% (6)

- Oct SlipDocument1 pageOct SlipAkshay MehtaNo ratings yet

- Lesson 9 - Payment GatewaysDocument28 pagesLesson 9 - Payment GatewaysZulaika AliNo ratings yet

- Task 4 - Earn-Out Regime ExampleDocument3 pagesTask 4 - Earn-Out Regime ExampleVikasNo ratings yet

- Tax ReviewerDocument3 pagesTax ReviewerGlendaMendozaNo ratings yet