Professional Documents

Culture Documents

A

A

Uploaded by

Barsha Maharjan0 ratings0% found this document useful (0 votes)

9 views1 pageOriginal Title

a.txt

Copyright

© © All Rights Reserved

Available Formats

TXT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as TXT, PDF, TXT or read online from Scribd

Download as txt, pdf, or txt

0 ratings0% found this document useful (0 votes)

9 views1 pageA

A

Uploaded by

Barsha MaharjanCopyright:

© All Rights Reserved

Available Formats

Download as TXT, PDF, TXT or read online from Scribd

Download as txt, pdf, or txt

You are on page 1of 1

Hence, risk management focus on the identification of potential unanticipated

events and on their possible impact on the financial performance of the firm and at

the limit on its survival. Risk Management in its current form is different from

what the banks used to practice earlier. Risk environment has changed and according

to the draft Basel II norms the focus is more on the entire risk return equation.

Under Pillar 1 of the specific NRB guidelines, the bank currently follows

Simplified Standardized Approach for

Credit Risk, Basic Indicator Approach for Operational Risk and Net Open Position

approach for Market risk.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5834)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (350)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (824)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Chapter 2597Document19 pagesChapter 2597Barsha MaharjanNo ratings yet

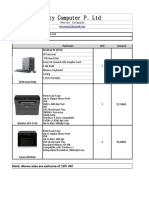

- City Computer P. LTD: Particular Unit Amount Desktop PC (CPU)Document1 pageCity Computer P. LTD: Particular Unit Amount Desktop PC (CPU)Barsha MaharjanNo ratings yet

- Research Methodology in Finance MGMG 522: Session #1: Charn Soranakom, PH.DDocument44 pagesResearch Methodology in Finance MGMG 522: Session #1: Charn Soranakom, PH.DBarsha MaharjanNo ratings yet

- Personal Information: Sustainability & InnovationDocument4 pagesPersonal Information: Sustainability & InnovationBarsha MaharjanNo ratings yet

- Background of The StudyDocument2 pagesBackground of The StudyBarsha MaharjanNo ratings yet

- In - Nepali 2074 75 NewDocument192 pagesIn - Nepali 2074 75 NewBarsha MaharjanNo ratings yet

- Financial Risk Management-OverviewDocument15 pagesFinancial Risk Management-OverviewBarsha MaharjanNo ratings yet

- Full Text 01Document69 pagesFull Text 01Barsha MaharjanNo ratings yet

- 7-Final List of TablesDocument1 page7-Final List of TablesBarsha MaharjanNo ratings yet

- 8 - Final List of FiguresDocument1 page8 - Final List of FiguresBarsha MaharjanNo ratings yet

- 12 Appindix I QuestionairDocument3 pages12 Appindix I QuestionairBarsha MaharjanNo ratings yet

- 1-Front PageDocument2 pages1-Front PageBarsha MaharjanNo ratings yet

- Viva-Voce Sheet: We Have Conducted The Viva-Voce Examination of The Thesis PresentedDocument1 pageViva-Voce Sheet: We Have Conducted The Viva-Voce Examination of The Thesis PresentedBarsha MaharjanNo ratings yet

- A Study On Quality of Work Life in Life Insurance CorporationDocument107 pagesA Study On Quality of Work Life in Life Insurance CorporationBarsha MaharjanNo ratings yet

- "Analysis of Financial Performance of Nepal Bank Limited": Submitted By: Kiran Prasad Pokhrel 7-2-1348-2005Document1 page"Analysis of Financial Performance of Nepal Bank Limited": Submitted By: Kiran Prasad Pokhrel 7-2-1348-2005Barsha MaharjanNo ratings yet

- TMT and Structure of BODDocument4 pagesTMT and Structure of BODBarsha MaharjanNo ratings yet

- Creativity and Innovation in Nepalese Banks - Pushpa MaharjanDocument4 pagesCreativity and Innovation in Nepalese Banks - Pushpa MaharjanBarsha MaharjanNo ratings yet

- Old Stock: Particular Quantity RateDocument2 pagesOld Stock: Particular Quantity RateBarsha MaharjanNo ratings yet