Professional Documents

Culture Documents

Transocean Ltd. and Subsidiaries Supplemental Effective Tax Rate Analysis

Transocean Ltd. and Subsidiaries Supplemental Effective Tax Rate Analysis

Uploaded by

suhasshinde88Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Transocean Ltd. and Subsidiaries Supplemental Effective Tax Rate Analysis

Transocean Ltd. and Subsidiaries Supplemental Effective Tax Rate Analysis

Uploaded by

suhasshinde88Copyright:

Available Formats

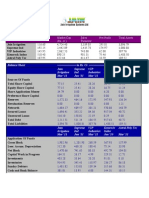

Transocean Ltd.

and subsidiaries

Supplemental Effective Tax Rate Analysis

(In US$ millions, except tax rates)

Three months ended Nine months ended

September 30, June 30, September 30, September 30, September 30,

2016 2016 2015 2016 2015

Income from continuing operations before income taxes $ 235 $ 104 $ 344 $ 669 $ 347

Add back (subtract):

Litigation matters - - - - (788)

Restructuring charges 4 8 3 17 20

Loss on impairment of goodwill and other assets 11 20 13 34 1,839

Gain on disposal of other assets, net (3) (4) (1) (8) (6)

Gain on retirement of debt (110) (38) (7) (148) (7)

Adjusted income from continuing operations before income taxes 137 90 352 564 1,405

Income tax expense (benefit) from continuing operations (9) 17 17 82 140

Add back (subtract):

Litigation matters - - - - (53)

Restructuring charges - 1 1 2 2

Loss on impairment of goodwill and other assets - 2 - 3 155

Gain on disposal of other assets, net - - - - 1

Changes in estimates (1) 38 (5) 9 34 9

Adjusted income tax expense from continuing operations (2) $ 29 $ 15 $ 27 $ 121 $ 254

Effective Tax Rate (3) -3.8% 16.2% 4.9% 12.3% 40.3%

Effective Tax Rate, excluding discrete items (4) 21.2% 16.3% 7.5% 21.5% 18.0%

(1) Our estimates change as we file tax returns, settle disputes with tax authorities or become aware of other events and include changes in (a) deferred taxes, (b)

valuation allowances on deferred taxes and (c) other tax liabilities.

(2) The three months and nine months ended September 30, 2016 includes $4 million of additional tax expense (benefit) reflecting the catch-up effect of an

increase (decrease) in the annual effective tax rate from the previous quarter estimate.

(3) Our effective tax rate is calculated as income tax expense for continuing operations divided by income from continuing operations before income taxes.

(4) Our effective tax rate, excluding discrete items, is calculated as income tax expense for continuing operations, excluding various discrete items (such as

changes in estimates and tax on items excluded from income before income taxes), divided by income from continuing operations before income tax expense,

excluding gains and losses on sales and similar items pursuant to the accounting standards for income taxes and estimating the annual effective tax rate.

You might also like

- BV - Assignement 2Document7 pagesBV - Assignement 2AkshatAgarwal50% (2)

- Working Capital Management: Case: ALAC InternationalDocument55 pagesWorking Capital Management: Case: ALAC Internationaljk kumarNo ratings yet

- Chapter 16 AssignmentDocument4 pagesChapter 16 Assignmentsam broughtonNo ratings yet

- Assignment 3 Lessons From Derivatives MishapsDocument3 pagesAssignment 3 Lessons From Derivatives MishapsSandip Chovatiya100% (2)

- Forecasting Financial StatementsDocument30 pagesForecasting Financial StatementsChris Jays100% (1)

- Transocean Ltd. and Subsidiaries Supplemental Effective Tax Rate AnalysisDocument1 pageTransocean Ltd. and Subsidiaries Supplemental Effective Tax Rate Analysissuhasshinde88No ratings yet

- Baird Presentation - FINALDocument17 pagesBaird Presentation - FINALJames BrianNo ratings yet

- cpr03 Lesechos 16165 964001 Consolidated Financial Statements SE 2020Document66 pagescpr03 Lesechos 16165 964001 Consolidated Financial Statements SE 2020kjbewdjNo ratings yet

- InvestorPresentation-1H2016vFpinang CoalDocument20 pagesInvestorPresentation-1H2016vFpinang CoalHendry ChristiantoNo ratings yet

- Standalone Financial Results For December 31, 2016 (Result)Document1 pageStandalone Financial Results For December 31, 2016 (Result)Shyam SunderNo ratings yet

- SGXNET FY2016 - 21feb17Document12 pagesSGXNET FY2016 - 21feb17phuawlNo ratings yet

- 2016 LBG q1 Ims Excel DownloadDocument12 pages2016 LBG q1 Ims Excel DownloadsaxobobNo ratings yet

- Standard Chartered PLC Full Year 2022 ReportDocument9 pagesStandard Chartered PLC Full Year 2022 Reporthoneysgh.394No ratings yet

- Ifrs (Usd) (En)Document49 pagesIfrs (Usd) (En)Ameya KulkarniNo ratings yet

- Consolidated Statement of Stockholders'EquityDocument1 pageConsolidated Statement of Stockholders'EquityMs. AngNo ratings yet

- First Quarter Financial Statement and Dividend AnnouncementDocument9 pagesFirst Quarter Financial Statement and Dividend Announcementkelvina_8No ratings yet

- Revised Standalone Financial Results For December 31, 2016 (Result)Document4 pagesRevised Standalone Financial Results For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Nexans 2022 Consolidated Financial StatementsDocument76 pagesNexans 2022 Consolidated Financial StatementsvolgatangaNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Dell - Cash Flow statement-ANALYSIS-FOR DISCUSSIONDocument1 pageDell - Cash Flow statement-ANALYSIS-FOR DISCUSSIONRohitNo ratings yet

- Financial Results Annual 2010 RMWLDocument1 pageFinancial Results Annual 2010 RMWLSanjay GulatiNo ratings yet

- Consolidated Balance Sheet For Hindustan Unilever LTDDocument11 pagesConsolidated Balance Sheet For Hindustan Unilever LTDMohit ChughNo ratings yet

- In Millions of Euros, Except For Per Share DataDocument33 pagesIn Millions of Euros, Except For Per Share DataGrace StylesNo ratings yet

- Estados FinancierosDocument4 pagesEstados FinancierosIvan Eduardo Zalazar MendivilNo ratings yet

- Iluted Arnings Er SDocument2 pagesIluted Arnings Er Ssuhasshinde88No ratings yet

- Quarterlyresults Mar2019Document6 pagesQuarterlyresults Mar2019SuhasNo ratings yet

- TCTB - Quarterly Report Q1 2024Document14 pagesTCTB - Quarterly Report Q1 2024seeme55runNo ratings yet

- Dec09 Inv Presentation GAAPDocument23 pagesDec09 Inv Presentation GAAPOladipupo Mayowa PaulNo ratings yet

- Assignment Briefs (Module 4)Document8 pagesAssignment Briefs (Module 4)aung sanNo ratings yet

- F22 BorgWarner SolutionDocument3 pagesF22 BorgWarner SolutionFalguni ShomeNo ratings yet

- 02 - Assignment Integration Exercise - SolutionDocument4 pages02 - Assignment Integration Exercise - SolutionAgustín RosalesNo ratings yet

- MMFSL Fin Results Q1 F2019 LODR Clause 33 FianlDocument2 pagesMMFSL Fin Results Q1 F2019 LODR Clause 33 FianlIMAM JAVOORNo ratings yet

- Arss Infrastructure Projects Limited: (Rs. in Crores Except For Shares & EPS)Document2 pagesArss Infrastructure Projects Limited: (Rs. in Crores Except For Shares & EPS)Likun sahooNo ratings yet

- The Procter & Gamble Company Consolidated Statements of EarningsDocument5 pagesThe Procter & Gamble Company Consolidated Statements of EarningsJustine Maureen AndalNo ratings yet

- Estado de Resultados Integrales Consolidado: Correspondiente Al Año Finalizado Al 31 de Diciembre de 2020 y 2019Document2 pagesEstado de Resultados Integrales Consolidado: Correspondiente Al Año Finalizado Al 31 de Diciembre de 2020 y 2019frmartinezNo ratings yet

- AR Ali 102Document1 pageAR Ali 102Lieder CLNo ratings yet

- On FaDocument9 pagesOn FaTanushree BhowmickNo ratings yet

- Statement of Profit and Loss: Particulars Notes For The Year Ending On 31st March 2020Document11 pagesStatement of Profit and Loss: Particulars Notes For The Year Ending On 31st March 2020dineshkumar1234No ratings yet

- Financial Statements Kodak Q3 2022Document3 pagesFinancial Statements Kodak Q3 2022GARCÍA GUTIERREZ NOEMINo ratings yet

- Profit&Loss 09 10Document1 pageProfit&Loss 09 10Rashmin TomarNo ratings yet

- Enron As 0Document4 pagesEnron As 0Camila PeñaNo ratings yet

- MGI Q3 2010 EarningsDocument5 pagesMGI Q3 2010 EarningsBrian_Markwort_5393No ratings yet

- Unaudited Financial 0608Document3 pagesUnaudited Financial 0608manish_khabarNo ratings yet

- Annual Report 2019 Financial Statements and Notes PDFDocument124 pagesAnnual Report 2019 Financial Statements and Notes PDFArti AtkaleNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- 1272380424153-SEBI - FORMAT March2010Document5 pages1272380424153-SEBI - FORMAT March2010Harshitha UchilNo ratings yet

- Nism Series XV Research Analyst Exam WorkbookDocument53 pagesNism Series XV Research Analyst Exam WorkbookDhyan MothukuriNo ratings yet

- Att-Ar-2012-Financials Cut PDFDocument5 pagesAtt-Ar-2012-Financials Cut PDFDevandro MahendraNo ratings yet

- Financial Statements AnalysisDocument5 pagesFinancial Statements AnalysisSAQIB SAEEDNo ratings yet

- Com Merx Npoint ServletsDocument1 pageCom Merx Npoint Servletssgoswami_1No ratings yet

- 105 10 Amazon Financial StatementsDocument5 pages105 10 Amazon Financial StatementsCharles Vladimir SolvaskyNo ratings yet

- Additional ExcelSpreadsheetsDocument35 pagesAdditional ExcelSpreadsheetsbipin kumarNo ratings yet

- Yanlord Land Third QTR and Nine Months Ended 30 Sep 09 Financial STMT Annc - 101109Document31 pagesYanlord Land Third QTR and Nine Months Ended 30 Sep 09 Financial STMT Annc - 101109WeR1 Consultants Pte LtdNo ratings yet

- SPS Chit Funds Private Limited Profit-Loss Fy2021-22Document1 pageSPS Chit Funds Private Limited Profit-Loss Fy2021-22Basker BillaNo ratings yet

- In Millions of Euros, Except For Per Share DataDocument24 pagesIn Millions of Euros, Except For Per Share DataGrace StylesNo ratings yet

- DCF Model: Consolidated Balance Sheet Consolidated Statement of Profit & Loss Consolidated Statement of Cash FlowsDocument1 pageDCF Model: Consolidated Balance Sheet Consolidated Statement of Profit & Loss Consolidated Statement of Cash FlowsGolamMostafaNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Danone 2020 Full Year Consolidated Financial Statements and Related NotesDocument62 pagesDanone 2020 Full Year Consolidated Financial Statements and Related NotesHager SalahNo ratings yet

- Kering V2Document6 pagesKering V2Pranav HansonNo ratings yet

- Akzonobel Report18 Cons Cash FlowsDocument1 pageAkzonobel Report18 Cons Cash FlowsS A M E E U L L A H S O O M R ONo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Cash Flows Statement - Two ExamplesDocument4 pagesCash Flows Statement - Two Examplesakash srivastavaNo ratings yet

- S8 Probabilistic ModelingDocument48 pagesS8 Probabilistic Modelingsuhasshinde88No ratings yet

- S8 ProbabiliDocument48 pagesS8 Probabilisuhasshinde88No ratings yet

- S11 Introdion Taluatioost Ofital EstimationDocument42 pagesS11 Introdion Taluatioost Ofital Estimationsuhasshinde88No ratings yet

- S6 UnderstandDocument28 pagesS6 Understandsuhasshinde88No ratings yet

- S4 Going Beyond AnptDocument47 pagesS4 Going Beyond Anptsuhasshinde88No ratings yet

- S3 The PTH of A Finaal MoDocument18 pagesS3 The PTH of A Finaal Mosuhasshinde88No ratings yet

- S5 The DepthDocument21 pagesS5 The Depthsuhasshinde88No ratings yet

- Measuring Investment Returns: Stern School of BusinessDocument139 pagesMeasuring Investment Returns: Stern School of Businesssuhasshinde88No ratings yet

- S7xplorie ParameteaceDocument45 pagesS7xplorie Parameteacesuhasshinde88No ratings yet

- Iluted Arnings Er SDocument2 pagesIluted Arnings Er Ssuhasshinde88No ratings yet

- Transocean Ltd. and Subsidiaries Supplemental Effective Tax Rate AnalysisDocument1 pageTransocean Ltd. and Subsidiaries Supplemental Effective Tax Rate Analysissuhasshinde88No ratings yet

- NHPSP 19 Reg 602 AdmissionDocument2 pagesNHPSP 19 Reg 602 Admissionsuhasshinde88No ratings yet

- New Horizon Public School & Penguin Kids: ADMISSION FORM (2019-20)Document2 pagesNew Horizon Public School & Penguin Kids: ADMISSION FORM (2019-20)suhasshinde88No ratings yet

- Ncs Cpur 2016Document81 pagesNcs Cpur 2016suhasshinde88No ratings yet

- HSBC Repacks Issuer ServicesDocument5 pagesHSBC Repacks Issuer ServicesDavid CartellaNo ratings yet

- Company - Jain Irrigation System LTDDocument31 pagesCompany - Jain Irrigation System LTDNoor_DawoodaniNo ratings yet

- Money Credit & BankingDocument23 pagesMoney Credit & Bankingenrico menesesNo ratings yet

- Euro07 Jeremy DuplessisDocument81 pagesEuro07 Jeremy Duplessis2010rhs100% (1)

- Finance at NSUDocument31 pagesFinance at NSUDuDuWarNo ratings yet

- PI Industries AcquisitionDocument14 pagesPI Industries AcquisitionravuvenNo ratings yet

- HSBC - Finding Optimal Value in Real Yield 2013-12-13Document16 pagesHSBC - Finding Optimal Value in Real Yield 2013-12-13Ji YanbinNo ratings yet

- The 3 Secrets To Trading Momentum Indicators Pt6Document34 pagesThe 3 Secrets To Trading Momentum Indicators Pt6JasgeoNo ratings yet

- Dissertation FinalDocument83 pagesDissertation FinalSaurabh YadavNo ratings yet

- BIPPDocument2 pagesBIPPPrince Hadhey VaganzaNo ratings yet

- Adjudication Order in Respect of M/s Sitapur Plywood Manufacturers LTDDocument6 pagesAdjudication Order in Respect of M/s Sitapur Plywood Manufacturers LTDShyam SunderNo ratings yet

- Namibia Wildlife Resorts Company Act 3 of 1998Document7 pagesNamibia Wildlife Resorts Company Act 3 of 1998André Le RouxNo ratings yet

- 9 Major Effects of Inflation - Explained!Document13 pages9 Major Effects of Inflation - Explained!Ameer KhanNo ratings yet

- Ratios Finiancial ManagementDocument32 pagesRatios Finiancial ManagementSuman GillNo ratings yet

- Felix Zulauf: Developing EuphoriaDocument9 pagesFelix Zulauf: Developing EuphoriaFriedrich HayekNo ratings yet

- Candlestick Flashcards 101Document10 pagesCandlestick Flashcards 101Viet Nguyen DuyNo ratings yet

- Lecture 03 Bond Price VolatilityDocument45 pagesLecture 03 Bond Price Volatilityandrewchen336No ratings yet

- CMUSHI Cost Engineer Resume Word Doc Rev PDFDocument4 pagesCMUSHI Cost Engineer Resume Word Doc Rev PDFCookie Brown BrownNo ratings yet

- Valuing High-Tech CompaniesDocument7 pagesValuing High-Tech CompaniessharatjuturNo ratings yet

- 10 Commandments of Trading PDFDocument13 pages10 Commandments of Trading PDFSets BotNo ratings yet

- Networth Statement of GuarantorDocument2 pagesNetworth Statement of GuarantorSharif MahmudNo ratings yet

- L J Institute of Management Studies Summer Internship Report 2013 Part III FinanceDocument29 pagesL J Institute of Management Studies Summer Internship Report 2013 Part III FinancesatishgwNo ratings yet

- Stock AnalysisDocument5 pagesStock AnalysisArun Kumar GoyalNo ratings yet

- 11.ong vs. Court of AppealsDocument8 pages11.ong vs. Court of AppealsRocelle LAQUINo ratings yet

- Us Cons Disruptors in Wealth MGMT FinalDocument20 pagesUs Cons Disruptors in Wealth MGMT FinalKshitij SinghNo ratings yet