Professional Documents

Culture Documents

Income Tax Calculation 2018-19

Income Tax Calculation 2018-19

Uploaded by

Aziz Hotelwala0 ratings0% found this document useful (0 votes)

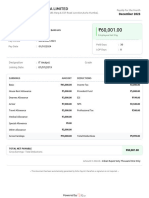

25 views2 pagesThis document is an income calculation sheet for an individual for the year 2018-19. It shows their monthly breakdown of basic pay, allowances, deductions and net pay. The total annual income is calculated as Rs. 846847. Deductions include GPF contributions of Rs. 272832, SLI of Rs. 1080, and income tax payable of Rs. 38495. The net annual income after all deductions is Rs. 488980.

Original Description:

Original Title

Income tax calculation 2018-19.xlsx

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document is an income calculation sheet for an individual for the year 2018-19. It shows their monthly breakdown of basic pay, allowances, deductions and net pay. The total annual income is calculated as Rs. 846847. Deductions include GPF contributions of Rs. 272832, SLI of Rs. 1080, and income tax payable of Rs. 38495. The net annual income after all deductions is Rs. 488980.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

0 ratings0% found this document useful (0 votes)

25 views2 pagesIncome Tax Calculation 2018-19

Income Tax Calculation 2018-19

Uploaded by

Aziz HotelwalaThis document is an income calculation sheet for an individual for the year 2018-19. It shows their monthly breakdown of basic pay, allowances, deductions and net pay. The total annual income is calculated as Rs. 846847. Deductions include GPF contributions of Rs. 272832, SLI of Rs. 1080, and income tax payable of Rs. 38495. The net annual income after all deductions is Rs. 488980.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

You are on page 1of 2

OFFICE OF THE ____________________________________________________________

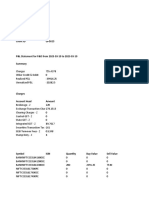

Income calculation sheet of Sh.__________________________________________________________ for the Year 2018-19

Month of the Convy Tax Al

S.No. Pay Basic Pay G. Pay Total PP DA MA HRA CA All G. Total GPF Refund SLI GIS Paid Net

1 Mar-18 13790 4200 17990 0 25006 300 1799 690 0 45785 10000 11000 90 0 500 24195

2 Apr-18 46200 0 46200 0 3234 300 3696 690 0 54120 10000 11000 90 0 500 32530

3 May-18 46200 46200 0 3234 300 3696 690 0 54120 10000 11000 90 0 500 32530

4 Jun-18 46200 46200 0 3234 300 3696 690 0 54120 10000 11000 90 0 500 32530

5 Jul-18 49600 49600 0 3472 300 3968 690 0 58030 10000 11000 90 0 500 36440

6 Aug-18 49600 49600 0 3472 300 3968 690 0 58030 10000 11000 90 0 500 36440

7 Sep-18 49600 49600 0 3472 300 3968 690 0 58030 10000 11000 90 1595 500 34845

8 Oct-18 49600 49600 0 4464 300 3968 690 0 59022 10000 0 90 0 500 48432

9 Nov-19 49600 49600 0 4464 300 3968 690 0 59022 10000 0 90 360 500 48072

10 Dec-19 49600 49600 0 4464 300 3968 690 0 59022 10000 0 90 0 500 48432

11 Jan-19 49600 49600 0 4464 300 3968 690 0 59022 10000 0 90 0 0 48932

12 Feb-19 49600 49600 0 4464 300 3968 690 0 59022 10000 0 90 0 0 48932

13 DA Arrear 0 2976 0 2976 2976 0 0

14 DA Arrear 0 16670 0 16670 0 0 0 0 0 16670

15 7th pay Arrear 0 149856 0 0 149856 149856 0 0

G.Total 549190 4200 703246 0 87090 3600 44631 8280 0 846847 272832 1080 1955 5000 488980

Gross Amount 846847 Rebate

Less CA/HRA/Gis 10235 GPF 272832

Less Deduction U/S 16 40000 SLI 1080

Less HBA Interest 0 LIC 0

Total Amount 796612 Tution Fee 0

Savings 150000 Met Life 0

Tax able Income 646612 NSC 0

Non Taxable Amt 250000 INCOMETAX 0

Total Taxable 396612 G. Total 273912

Tax 250001 to 500000 @ 5% 12500

Tax 500000 to 1000000 @ 20% 146612 29322

Education Cess @ 4% 1673

Tax Payable 43495

Taxfee (income Less than 3.50 lac 0

Tax Already Paid 5000

Net Tax Payable 38495

You might also like

- Accounting For Income TaxesDocument17 pagesAccounting For Income TaxesKenn Adam Johan Gajudo70% (10)

- AICTE Tentetive 2017-18Document9 pagesAICTE Tentetive 2017-18jacs127No ratings yet

- Balkrishna Navnath Andhale-4Document2 pagesBalkrishna Navnath Andhale-4andhalebn9448No ratings yet

- Meil Tractable & Adani FY 20-21/AY 21-22 FY 21-22 Month Credited ITR Month Credited Amount As Per F-16Document3 pagesMeil Tractable & Adani FY 20-21/AY 21-22 FY 21-22 Month Credited ITR Month Credited Amount As Per F-16vijay bolisettyNo ratings yet

- Tax Cal - 2020 - 21 MalayDocument8 pagesTax Cal - 2020 - 21 MalayGaming PlazaNo ratings yet

- Brijesh Hisab Finel 13-09-2022Document10 pagesBrijesh Hisab Finel 13-09-2022Maulik PatelNo ratings yet

- Enter Data in Yellow Fields Workings: 723,658 Slab Amount (Old)Document9 pagesEnter Data in Yellow Fields Workings: 723,658 Slab Amount (Old)HarryNo ratings yet

- HTTP Myhr - Bsnl.co - in Portal Pay IncomeTaxDetailsDocument1 pageHTTP Myhr - Bsnl.co - in Portal Pay IncomeTaxDetailssudhakar9v2807No ratings yet

- Basic % DA Ihra Rent R Ohra Cperks Dperks Eperks PRPDocument21 pagesBasic % DA Ihra Rent R Ohra Cperks Dperks Eperks PRPSooperAktifNo ratings yet

- Agent Wise Summary For BC Supervisor Including Round Tripping TransactionsDocument24 pagesAgent Wise Summary For BC Supervisor Including Round Tripping TransactionsraghaveshideaNo ratings yet

- Sales Per Brand-2024-01-05 00 - 00 - 00 To 2024-01-12 23 - 59 - 59Document1 pageSales Per Brand-2024-01-05 00 - 00 - 00 To 2024-01-12 23 - 59 - 59feri ysNo ratings yet

- Vatavruksha Apartment: Ravishankar Marg, Vidhate Nagar, Behind INOX, Nasik Pune Road, Nasik - 422006Document3 pagesVatavruksha Apartment: Ravishankar Marg, Vidhate Nagar, Behind INOX, Nasik Pune Road, Nasik - 422006dineshsirasatNo ratings yet

- San 6 PC Arrear CalcuDocument9 pagesSan 6 PC Arrear Calcusandip2929No ratings yet

- 6 PayDocument2 pages6 Payanon-48393No ratings yet

- Integrated E-Governance PortalDocument2 pagesIntegrated E-Governance Portalayush.11098No ratings yet

- UntitledDocument3 pagesUntitledsamir royNo ratings yet

- Si - No. Invoice Date Invoice No. Cleint NameDocument8 pagesSi - No. Invoice Date Invoice No. Cleint NameKishnsNo ratings yet

- 2016 2017 Annual IncomeDocument1 page2016 2017 Annual Incomevaniyeruva2No ratings yet

- BukuDocument2 pagesBukuRickyNo ratings yet

- Simulasi Bertanam SingkonhDocument2 pagesSimulasi Bertanam SingkonhRickyNo ratings yet

- Preference Shares - August 5 2019Document1 pagePreference Shares - August 5 2019Tiso Blackstar GroupNo ratings yet

- 10 Millones 10 MillonesDocument1 page10 Millones 10 MillonesDenis GarciaNo ratings yet

- Khilji Bhai 23-24Document3 pagesKhilji Bhai 23-24Div-IX Ankleshwar Vad-IINo ratings yet

- AttachmentDocument6 pagesAttachmentLion Parcel ArcadiaNo ratings yet

- Profit or Loss1 PDFDocument7 pagesProfit or Loss1 PDFdanishahmed2126No ratings yet

- Sample Auditing Problems Proof of Cash and Correction of Error With Solution - CompressDocument16 pagesSample Auditing Problems Proof of Cash and Correction of Error With Solution - CompressXNo ratings yet

- F. Compras JulioDocument4 pagesF. Compras JulioMaria Belen Vallejos OrtizNo ratings yet

- Jumlah CN Total Bayar (RP) Jumlah PIBK: Rekap Jumlah Barang KirimanDocument1 pageJumlah CN Total Bayar (RP) Jumlah PIBK: Rekap Jumlah Barang KirimanAra PanegarNo ratings yet

- PreferenceSharesDocument1 pagePreferenceSharesTiso Blackstar GroupNo ratings yet

- 7thpc Alw Arr DIFF EMPWISE PDFDocument4 pages7thpc Alw Arr DIFF EMPWISE PDFDarvesh mishraNo ratings yet

- Balram Morla AcpArrDocument1 pageBalram Morla AcpArrvibu613No ratings yet

- My CPC Arrear Calculator Ver 2Document17 pagesMy CPC Arrear Calculator Ver 2rahulbrooNo ratings yet

- Assignment 4 Abraam Fahmy & Amany FayekDocument9 pagesAssignment 4 Abraam Fahmy & Amany FayekabraamNo ratings yet

- Client ID GP5613Document8 pagesClient ID GP5613Balakrishna VadlamudiNo ratings yet

- Salary Statement of Snigdha Panda, Assistant Teacher, Govt. High School IRC Village Bhubaneswar For The Assessment Year 2020-21, PAN-AKSPP6871G TAN - BBNO01162ADocument2 pagesSalary Statement of Snigdha Panda, Assistant Teacher, Govt. High School IRC Village Bhubaneswar For The Assessment Year 2020-21, PAN-AKSPP6871G TAN - BBNO01162ASpNo ratings yet

- GA55 - 2022-11-09T150257.736Document2 pagesGA55 - 2022-11-09T150257.736jailbaran04No ratings yet

- Preference Shares - October 18 2018Document1 pagePreference Shares - October 18 2018Tiso Blackstar GroupNo ratings yet

- I Tax Calculator 09 10Document9 pagesI Tax Calculator 09 10Rajesh NageNo ratings yet

- Pay BillDocument20 pagesPay BillShaloom TVNo ratings yet

- GPF Calculation Sample 20200731224047Document1 pageGPF Calculation Sample 20200731224047SandeepNo ratings yet

- Name: Gopal Krishna Chembeti Month Year Bpay Da Hra Cca Ir Gross Oth - All OwDocument5 pagesName: Gopal Krishna Chembeti Month Year Bpay Da Hra Cca Ir Gross Oth - All OwChembeti GopinathNo ratings yet

- Preference Shares - October 24 2018Document1 pagePreference Shares - October 24 2018Tiso Blackstar GroupNo ratings yet

- Salary Dept - Body Shop - June 2019: S.NO. NameDocument1 pageSalary Dept - Body Shop - June 2019: S.NO. Namerana singhNo ratings yet

- PreferenceSharesDocument1 pagePreferenceSharesTiso Blackstar GroupNo ratings yet

- C$8 Millones Chinandega: Premio MayorDocument1 pageC$8 Millones Chinandega: Premio MayorOscar Danilo Flores OlivasNo ratings yet

- Managua: CórdobasDocument1 pageManagua: CórdobasJuan EspinozaNo ratings yet

- VC Purchase RegisterDocument13 pagesVC Purchase RegisterAnonymous 5tiNQtNo ratings yet

- 7 TH PC Arrear WC 1Document7 pages7 TH PC Arrear WC 1Kishan GopalNo ratings yet

- Gain & Loss EQUITY Report As On 28.02.2023 FNR352P102Document3 pagesGain & Loss EQUITY Report As On 28.02.2023 FNR352P102PALLAVI SHARMANo ratings yet

- Promo Flayer 01-15 Juni 2023Document2 pagesPromo Flayer 01-15 Juni 2023Rizwan HerlambangNo ratings yet

- Classic Industries-PARTNERSHIP FIRM: Sales Register - Partywise Without Item DetailDocument1 pageClassic Industries-PARTNERSHIP FIRM: Sales Register - Partywise Without Item DetailCBKS IMETNo ratings yet

- PreferenceSharesDocument1 pagePreferenceSharesTiso Blackstar GroupNo ratings yet

- 7th Pay Commission Charge AllowanceDocument4 pages7th Pay Commission Charge AllowanceAkash SaggiNo ratings yet

- Due DrawnDocument5 pagesDue DrawndpdohisarNo ratings yet

- AttachmentDocument6 pagesAttachmentLion Parcel ArcadiaNo ratings yet

- Preference Shares - May 28 2019Document1 pagePreference Shares - May 28 2019Tiso Blackstar GroupNo ratings yet

- 9 - Sample - Income TaxDocument2 pages9 - Sample - Income TaxShreyash MoharirNo ratings yet

- Wage Arrear Prog 2021 Final1Document9 pagesWage Arrear Prog 2021 Final1MADHUR KULSHRESTHANo ratings yet

- United States Census Figures Back to 1630From EverandUnited States Census Figures Back to 1630No ratings yet

- E-Accounts Course DetailsDocument9 pagesE-Accounts Course DetailsAziz HotelwalaNo ratings yet

- Acknowledgement: Chandresh Suprit SharanDocument67 pagesAcknowledgement: Chandresh Suprit SharanAziz HotelwalaNo ratings yet

- Section I: Success Story of Parle-GDocument69 pagesSection I: Success Story of Parle-GAziz HotelwalaNo ratings yet

- The Relationship Between Women'S Education and Human DevelopmentDocument8 pagesThe Relationship Between Women'S Education and Human DevelopmentAziz HotelwalaNo ratings yet

- Lukhi Sandipkumar.B: - :prepared ByDocument52 pagesLukhi Sandipkumar.B: - :prepared ByAziz HotelwalaNo ratings yet

- Nehru Jawaharlal, (1958) - Speeches: 1946-49. New Delhi Government of India Vol.1, 333Document42 pagesNehru Jawaharlal, (1958) - Speeches: 1946-49. New Delhi Government of India Vol.1, 333Aziz HotelwalaNo ratings yet

- Nehru Jawaharlal, (1958) - Speeches: 1946-49. New Delhi Government of India Vol.1, 333Document42 pagesNehru Jawaharlal, (1958) - Speeches: 1946-49. New Delhi Government of India Vol.1, 333Aziz HotelwalaNo ratings yet

- Hosp Audit GuideDocument97 pagesHosp Audit GuideAziz HotelwalaNo ratings yet

- Financial Planning and Forecasting Financial StatementsDocument70 pagesFinancial Planning and Forecasting Financial StatementsAziz Hotelwala100% (1)

- Sr. No. Topic Page NoDocument2 pagesSr. No. Topic Page NoAziz HotelwalaNo ratings yet

- Taxation Reviewer UP Sigma RhoDocument271 pagesTaxation Reviewer UP Sigma RhoEL Janus GarnetNo ratings yet

- Aguinaldo Industries v. CIRDocument1 pageAguinaldo Industries v. CIRTon Ton CananeaNo ratings yet

- Gross IncomeDocument54 pagesGross IncomeErneylou RanayNo ratings yet

- الفروقات المؤقتة ومحاسبة الضريبة المؤجلة في الشركات الفردية وفق النظام المحاسبي الماليDocument18 pagesالفروقات المؤقتة ومحاسبة الضريبة المؤجلة في الشركات الفردية وفق النظام المحاسبي الماليRime KessiraNo ratings yet

- 3.5 BHKDocument1 page3.5 BHKKASATSANo ratings yet

- Commission Structure & Earning Potential - GST Suvidha Kendra PDFDocument4 pagesCommission Structure & Earning Potential - GST Suvidha Kendra PDFvikasNo ratings yet

- Audit of PPEDocument2 pagesAudit of PPEChi VirayNo ratings yet

- Twitter P &L StatementsDocument12 pagesTwitter P &L StatementsDeepika PadukoneNo ratings yet

- 86 City of Davao vs. AP Holdings, IncDocument2 pages86 City of Davao vs. AP Holdings, IncChoco Maphison100% (1)

- South Western Federal Taxation 2017 Individual Income Taxes 40th Edition Hoffman Solutions ManualDocument38 pagesSouth Western Federal Taxation 2017 Individual Income Taxes 40th Edition Hoffman Solutions Manualriaozgas3023100% (18)

- Kartu KeluargaDocument1 pageKartu KeluargaUlvia Q. A. PutriNo ratings yet

- Income From Other SourcesDocument7 pagesIncome From Other SourcessristiNo ratings yet

- OD428171951588322100Document2 pagesOD428171951588322100ramnonaNo ratings yet

- Report Report 23Document9 pagesReport Report 23Pran piyaNo ratings yet

- Group Project - Impact of GST On Supply Chain ManagementDocument20 pagesGroup Project - Impact of GST On Supply Chain ManagementArpit Shah83% (6)

- Ifrs at A Glance: IAS 12 Income TaxesDocument4 pagesIfrs at A Glance: IAS 12 Income Taxeslina_siscanu6356No ratings yet

- Donor's Tax - 1Document3 pagesDonor's Tax - 1Crayon LloydNo ratings yet

- Income Tax Payment Challan: PSID #: 43239093Document1 pageIncome Tax Payment Challan: PSID #: 43239093Rizwan Akram RizwanNo ratings yet

- Ganraj ConstructionDocument2 pagesGanraj ConstructionSUNIL GAIKWADNo ratings yet

- PDFDocument3 pagesPDFMontu DalalNo ratings yet

- Gross Income: Valencia CH 6 Answer KeyDocument46 pagesGross Income: Valencia CH 6 Answer KeyShane TorrieNo ratings yet

- Taxation Chapter 2Document17 pagesTaxation Chapter 2KathleenAlfaroDelosoNo ratings yet

- RMC No. 42-03Document8 pagesRMC No. 42-03Rachel Ann CastroNo ratings yet

- Billing Summary Customer Details: Total Amount Due (PKR) : 2,774Document1 pageBilling Summary Customer Details: Total Amount Due (PKR) : 2,774faisal benisonNo ratings yet

- Minor Project BcomDocument1 pageMinor Project BcomYash DadheechNo ratings yet

- MTP 2 TaxDocument10 pagesMTP 2 TaxPrathmesh JambhulkarNo ratings yet

- June 2023 PayslipDocument2 pagesJune 2023 Payslipgomathi7777_33351404100% (1)

- Compact Maynov - 4 Copy Single Side PrintDocument7 pagesCompact Maynov - 4 Copy Single Side PrintRitikNo ratings yet

- Payslip PIL11250 Jan 2024 4221054843624738094 1706890631521Document1 pagePayslip PIL11250 Jan 2024 4221054843624738094 1706890631521Dipankar BarmanNo ratings yet