Professional Documents

Culture Documents

Asset Management: Asset Evaluation and Renewal Implementation Guide

Asset Management: Asset Evaluation and Renewal Implementation Guide

Uploaded by

Genesis Norbert AlconabaCopyright:

Available Formats

You might also like

- Neuman Tool PDFDocument445 pagesNeuman Tool PDFYnaffit Alteza Untal100% (2)

- Summer 2021Document23 pagesSummer 2021Paul BluemnerNo ratings yet

- Standard Operating Procedure: ObjectiveDocument10 pagesStandard Operating Procedure: Objectiveghjtyu100% (1)

- NIAMM Maintenance Management StandardDocument36 pagesNIAMM Maintenance Management StandardSeenivasagam SeenuNo ratings yet

- ClexaneDocument2 pagesClexaneianecunar100% (2)

- Backpod User Guide 2019Document36 pagesBackpod User Guide 2019Sean DrewNo ratings yet

- Stormwater Management For Manchester DOTDocument9 pagesStormwater Management For Manchester DOTIsaac OtiNo ratings yet

- StormWater and AssetManagement ToolDocument9 pagesStormWater and AssetManagement ToolIsaac OtiNo ratings yet

- StormWater and AssetManagement ToolDocument9 pagesStormWater and AssetManagement ToolIsaac OtiNo ratings yet

- BSI ISO 9001 2015 Gap Analysis Tool CANDocument14 pagesBSI ISO 9001 2015 Gap Analysis Tool CANchaouch.najehNo ratings yet

- What Should A Reliability Engineer RE Actually Do and Know Bennie Oosthuizen and Arnold Botha PDFDocument25 pagesWhat Should A Reliability Engineer RE Actually Do and Know Bennie Oosthuizen and Arnold Botha PDFgersonmorais100% (1)

- Asset Strategy Development Procedure A2D SAP - 1496221Document11 pagesAsset Strategy Development Procedure A2D SAP - 1496221Alejandro Bartolo YañezNo ratings yet

- Lecture1 1 IntegrityDocument23 pagesLecture1 1 IntegrityNoon VichitraNo ratings yet

- Element 2 - Analysis and Examination of Strategy ExecutionDocument23 pagesElement 2 - Analysis and Examination of Strategy ExecutionCatherine Joy O. AbingNo ratings yet

- ISO55000 Series Overview Slides NowDocument8 pagesISO55000 Series Overview Slides Nownasrulsalman9883No ratings yet

- Asset Management FrameworkDocument8 pagesAsset Management FrameworkSreekanthMylavarapuNo ratings yet

- 2010 Guidelines For The Application of Asset ManagementDocument16 pages2010 Guidelines For The Application of Asset ManagementAdnanTajuddinBasyair100% (1)

- AMP Training Presentation v2 24.01.03Document83 pagesAMP Training Presentation v2 24.01.03ਸੁਖਦੀਪ ਸਿੰਘNo ratings yet

- Chapter SevenDocument34 pagesChapter SevenzeyneblibenNo ratings yet

- Treasury Review Audit ReportDocument118 pagesTreasury Review Audit ReportAstalapulos ListestosNo ratings yet

- QMS Processes Samples Pages From ISO 9001 - 2015 A Complete Guide To Quality Management SystemsDocument2 pagesQMS Processes Samples Pages From ISO 9001 - 2015 A Complete Guide To Quality Management SystemsSystem DesignerNo ratings yet

- RD&D, Technology February 1999: A Proposed Strategy For Quality in Life-Cycle Asset ManagementDocument31 pagesRD&D, Technology February 1999: A Proposed Strategy For Quality in Life-Cycle Asset ManagementSusanoo12No ratings yet

- Asset Management GuidelinesDocument9 pagesAsset Management GuidelinesAndres RuizNo ratings yet

- IBM AS400 Security ProceduresDocument46 pagesIBM AS400 Security ProcedurescharlesbluesNo ratings yet

- PHYSICAL - ASSETS Procedures PDFDocument25 pagesPHYSICAL - ASSETS Procedures PDFCecilia Baloy IsubalNo ratings yet

- SSM Assetqualityreviewmanual201806 enDocument295 pagesSSM Assetqualityreviewmanual201806 ensubmarinoaguadulceNo ratings yet

- Chapter 5. Measure PhaseDocument111 pagesChapter 5. Measure PhaseLina Margarita Buelvas GutierrezNo ratings yet

- Appendix D - Asset Management PolicyDocument11 pagesAppendix D - Asset Management PolicyAnggoro Antono100% (1)

- M&E USAID NutricionDocument106 pagesM&E USAID NutricionXiomara SanchezNo ratings yet

- Integrity Communication Pack Aug20Document9 pagesIntegrity Communication Pack Aug20Yury FedichkinNo ratings yet

- Inventory Control System PDFDocument2 pagesInventory Control System PDFAalif IbràhimNo ratings yet

- Gantt Chart TableDocument1 pageGantt Chart TableHope DlaminiNo ratings yet

- PMBOK - Estimate ResourcesDocument8 pagesPMBOK - Estimate ResourcesLuciaNo ratings yet

- 08 AUDIT - CISA - Certified Information Systems Auditor Ch2-3Document26 pages08 AUDIT - CISA - Certified Information Systems Auditor Ch2-3korncheeseNo ratings yet

- Xpert QA Guide 2019Document92 pagesXpert QA Guide 2019falberto.gutierrezNo ratings yet

- Maturity Index TemplateDocument16 pagesMaturity Index Templateniteen.krNo ratings yet

- Internal Audit Report - 2022Document2 pagesInternal Audit Report - 2022Camila AlmeidaNo ratings yet

- AUDITING Internal Controls - 2024Document30 pagesAUDITING Internal Controls - 2024lonaarbillyNo ratings yet

- Presentation On ResearchPaperDocument8 pagesPresentation On ResearchPaperKhurshed AlamNo ratings yet

- Confiabilidad Del EquipoDocument47 pagesConfiabilidad Del EquipoAngello Ever Morales ArrietaNo ratings yet

- Airport InfrastructureDocument23 pagesAirport Infrastructurezaheeruddin_mohdNo ratings yet

- Mock 1 Ans Isca Nov 2019Document8 pagesMock 1 Ans Isca Nov 2019Navratan BhatiNo ratings yet

- ISO 9001:2015 Awareness Trainng Program: © ABI ConstructionDocument52 pagesISO 9001:2015 Awareness Trainng Program: © ABI ConstructionJoshuaNo ratings yet

- MethodologyDocument17 pagesMethodologyJack Sparrow100% (1)

- STEP - Basic SHE Training Module - SHE MS AssignmentDocument6 pagesSTEP - Basic SHE Training Module - SHE MS AssignmentFahmi Arief HakimNo ratings yet

- Audit ProcessDocument43 pagesAudit Processpiyush singh100% (2)

- A Strategy For Implementing Asset Management Principles CarlDocument34 pagesA Strategy For Implementing Asset Management Principles CarlCarl KirsteinNo ratings yet

- Mid Term ItsmDocument11 pagesMid Term ItsmRohan TawarNo ratings yet

- OPMAN-Part-2 - Joel Factoriza Misa - ID 21226220 - ETEEAP BSBADocument20 pagesOPMAN-Part-2 - Joel Factoriza Misa - ID 21226220 - ETEEAP BSBAOnice BallelosNo ratings yet

- PMP Mind Map Diagram ITTOsDocument45 pagesPMP Mind Map Diagram ITTOsVenkatraman PoreddyNo ratings yet

- Sistem Manajemen Mutu - 1Document17 pagesSistem Manajemen Mutu - 1VITRIA NOVITA SARI100% (1)

- Asset Policies 301007Document470 pagesAsset Policies 301007Senthil KumarNo ratings yet

- 3-DPA Awareness ProgramDocument27 pages3-DPA Awareness ProgramVishal MaliNo ratings yet

- Asset ManagementDocument25 pagesAsset ManagementmanojkbNo ratings yet

- Project Cost Management: 1 Plan Cost MGMT 2 Estimate CostDocument23 pagesProject Cost Management: 1 Plan Cost MGMT 2 Estimate CostsahilkaushikNo ratings yet

- CDP04 22-1-18 Recapitalisation Planning-Rev181023Document44 pagesCDP04 22-1-18 Recapitalisation Planning-Rev181023Sumesh AroliNo ratings yet

- Chapter 3 - Audit Planning Startegy and Execution - QRDocument9 pagesChapter 3 - Audit Planning Startegy and Execution - QRAnkita SharmaNo ratings yet

- Quality Assurance Plan For The Data Acquisition and Management System For Monitoring The Fuel Oil Spill at The Sandia National Laboratories Installation in Livermore, CaliforniaDocument40 pagesQuality Assurance Plan For The Data Acquisition and Management System For Monitoring The Fuel Oil Spill at The Sandia National Laboratories Installation in Livermore, CaliforniaMuhammad OsamaNo ratings yet

- Sia Kelompok 10Document16 pagesSia Kelompok 10Desy manurungNo ratings yet

- Internal Quality Assurance: Assesment Process & Practice MethodDocument11 pagesInternal Quality Assurance: Assesment Process & Practice MethodWaiyan Htet AungNo ratings yet

- ACCT2522 Notes Week 1Document8 pagesACCT2522 Notes Week 1Kevin NguyenNo ratings yet

- FIN005 PowerpointDocument43 pagesFIN005 PowerpointvaibhavacademicmantraNo ratings yet

- Establishing A CGMP Laboratory Audit System: A Practical GuideFrom EverandEstablishing A CGMP Laboratory Audit System: A Practical GuideNo ratings yet

- Public Office, Private Interests: Accountability through Income and Asset DisclosureFrom EverandPublic Office, Private Interests: Accountability through Income and Asset DisclosureNo ratings yet

- 11 MIF2nd S1B Ws09.2a Set1 eDocument6 pages11 MIF2nd S1B Ws09.2a Set1 eGenesis Norbert AlconabaNo ratings yet

- 07 MIF2nd S1B ws09.1C Set1 eDocument6 pages07 MIF2nd S1B ws09.1C Set1 eGenesis Norbert AlconabaNo ratings yet

- 03 MIF2nd S1B Ws09.1a Set1 eDocument3 pages03 MIF2nd S1B Ws09.1a Set1 eGenesis Norbert AlconabaNo ratings yet

- 06 MIF2nd S1B ws09.1B Set2 eDocument2 pages06 MIF2nd S1B ws09.1B Set2 eGenesis Norbert AlconabaNo ratings yet

- 05 MIF2nd S1B ws09.1B Set1 eDocument4 pages05 MIF2nd S1B ws09.1B Set1 eGenesis Norbert AlconabaNo ratings yet

- HW 5 - 5.4 Total Surface Areas of Right Prisms - Answers PDFDocument2 pagesHW 5 - 5.4 Total Surface Areas of Right Prisms - Answers PDFGenesis Norbert AlconabaNo ratings yet

- 04 MIF2nd S1B Ws09.1a Set2 eDocument3 pages04 MIF2nd S1B Ws09.1a Set2 eGenesis Norbert AlconabaNo ratings yet

- Analysis and Approaches 1 Page Formula SheetDocument1 pageAnalysis and Approaches 1 Page Formula SheetGenesis Norbert Alconaba100% (1)

- 05 MIF2nd S1B ws09.1B Set1 eDocument4 pages05 MIF2nd S1B ws09.1B Set1 eGenesis Norbert AlconabaNo ratings yet

- Level 3 Checklist - Are You Able To Achieve It? Math Vocab CornerDocument2 pagesLevel 3 Checklist - Are You Able To Achieve It? Math Vocab CornerGenesis Norbert AlconabaNo ratings yet

- Figure 4: Projected Operations and Maintenance Expenditure: 5.3.3 Summary of Future Maintenance ExpendituresDocument4 pagesFigure 4: Projected Operations and Maintenance Expenditure: 5.3.3 Summary of Future Maintenance ExpendituresGenesis Norbert AlconabaNo ratings yet

- FindingsDocument2 pagesFindingsGenesis Norbert AlconabaNo ratings yet

- Lecture 7Document26 pagesLecture 7Genesis Norbert AlconabaNo ratings yet

- MSC Subjects by EEDocument1 pageMSC Subjects by EEGenesis Norbert AlconabaNo ratings yet

- Five Steps For Successful Realization of Asset Value: Case Study: Singapore Rts InfrastructureDocument6 pagesFive Steps For Successful Realization of Asset Value: Case Study: Singapore Rts InfrastructureGenesis Norbert AlconabaNo ratings yet

- MECH3427 Design Project 2017Document8 pagesMECH3427 Design Project 2017Genesis Norbert AlconabaNo ratings yet

- Trip Advisor - Food in JAPANDocument12 pagesTrip Advisor - Food in JAPANGenesis Norbert AlconabaNo ratings yet

- Admission Requirements For The Building Services DisciplineDocument18 pagesAdmission Requirements For The Building Services DisciplineGenesis Norbert AlconabaNo ratings yet

- How The COVID-19 Epidemic Changed Working Conditions in FranceDocument4 pagesHow The COVID-19 Epidemic Changed Working Conditions in FranceRenata JapurNo ratings yet

- HairRevolution! PDFDocument78 pagesHairRevolution! PDFLarisa S.100% (1)

- Childhood EssayDocument3 pagesChildhood EssayAddison CharlletNo ratings yet

- TRIBHUVAN UNIVERSITY Case BookDocument67 pagesTRIBHUVAN UNIVERSITY Case BookSirpa MhrznNo ratings yet

- The Magic of Living Forever 3Document3 pagesThe Magic of Living Forever 3tesladariNo ratings yet

- 53 JMSCRDocument7 pages53 JMSCRAddinul FitryNo ratings yet

- Q3 - M1 Pre - AssessmentDocument2 pagesQ3 - M1 Pre - AssessmentLhen WayasNo ratings yet

- Psychoanalysis and Psychodynamic TherapiesDocument51 pagesPsychoanalysis and Psychodynamic Therapieskuro hanabusaNo ratings yet

- D.2 - Business Continuity Plan DocumentDocument35 pagesD.2 - Business Continuity Plan DocumentNikitasKladakis100% (1)

- Agriculture Under President Gloria Macapagal ArroyoDocument32 pagesAgriculture Under President Gloria Macapagal ArroyoVin Lava60% (10)

- Issue BriefDocument11 pagesIssue Briefapi-609525561No ratings yet

- Patpat Foundations of Special and Inclusive Education ReviewerDocument27 pagesPatpat Foundations of Special and Inclusive Education ReviewerJoseph John Estobaña100% (2)

- Cukb Materi ViiDocument34 pagesCukb Materi Viirandybayu235No ratings yet

- Centennial Vs QuiambaoDocument4 pagesCentennial Vs QuiambaoKornessa ParasNo ratings yet

- Gas Welding Risk AssessmentDocument8 pagesGas Welding Risk AssessmentvictorNo ratings yet

- Alexis - Protector-Retractor PlagaDocument8 pagesAlexis - Protector-Retractor PlagaMarius NenciuNo ratings yet

- Bioprocess Technology: Course Code: BTB 701 Credit Units: 03Document5 pagesBioprocess Technology: Course Code: BTB 701 Credit Units: 03Sahil GuptaNo ratings yet

- 05 PPE Presentation Slides 04062017Document25 pages05 PPE Presentation Slides 04062017Usman DastgirNo ratings yet

- Management of Traumatic HyphemaDocument38 pagesManagement of Traumatic HyphemaKaisun TeoNo ratings yet

- Lynch Et Al (2013)Document17 pagesLynch Et Al (2013)Valerie Walker LagosNo ratings yet

- SPE 86863 Health Risk Assessment in Oil and Gas Exploration: Siesmic WorkDocument6 pagesSPE 86863 Health Risk Assessment in Oil and Gas Exploration: Siesmic WorkWaleed Barakat MariaNo ratings yet

- Labour Second StageDocument8 pagesLabour Second StageakankshaNo ratings yet

- Macro Perspective of Tourism and Hospitality 6Document22 pagesMacro Perspective of Tourism and Hospitality 6Crhystal Joy Reginio100% (3)

- Government Medical College, Badaun-1Document2 pagesGovernment Medical College, Badaun-1Utkarsh VermaNo ratings yet

- Bsiec2019 ResearchDocument28 pagesBsiec2019 ResearchRosendo Dizon NualNo ratings yet

- Soc Di Term Paper K12Document25 pagesSoc Di Term Paper K12Labli Mercado100% (2)

Asset Management: Asset Evaluation and Renewal Implementation Guide

Asset Management: Asset Evaluation and Renewal Implementation Guide

Uploaded by

Genesis Norbert AlconabaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Asset Management: Asset Evaluation and Renewal Implementation Guide

Asset Management: Asset Evaluation and Renewal Implementation Guide

Uploaded by

Genesis Norbert AlconabaCopyright:

Available Formats

Guidelines for

Implementing Total Management Planning

Asset Management

ASSET EVALUATION AND RENEWAL

Implementation Guide

2 Asset Management: Asset Evaluation and Renewal - Implementation Guide

TABLE OF CONTENTS

Page No.

LIST OF ACRONYMS 4

1 PURPOSE 5

2 INTRODUCTION 5

3 THE ASSET EVALUATION AND RENEWAL PROCESS 5

3.1 Capturing asset attribute data 6

3.2 Developing and maintaining asset registers 7

3.3 Undertaking asset valuation 12

3.4 Evaluating asset condition and performance 13

3.5 Developing an asset renewal strategy 18

4 RISK ISSUES 22

5 TMP REQUIREMENTS 22

REFERENCES AND FURTHER READING 22

APPENDIX A: ASSET VALUATION PROCESS 23

APPENDIX B: CONTENT AND DEVELOPMENT LEVEL OF SUB-PLAN 26

Asset Management: Asset Evaluation and Renewal - Implementation Guide 3

LIST OF ACRONYMS

CCTV closed-circuit television

COAG Council of Australian Governments

EPP (Water) Environmental Protection (Water) Policy 1997

GIS geographical information system

GPS geographical positioning system

IBS integrated business system

IF importance factor

KPI key performance indicator

LOS level of service

RDBMS relational database management system

SQL standard query language

SWOT strengths, weaknesses, opportunities, threats

TMP Total Management Plan

WSP Water Service Provider

4 Asset Management: Asset Evaluation and Renewal - Implementation Guide

1 PURPOSE

This guide is intended to provide guidance for water service provider (WSP) practitioners and their

consultants on the processes involved in establishing and implementing effective asset evaluation and

renewal strategies and procedures and developing associated documentation.

2 INTRODUCTION

Outcomes

Effective asset evaluation and renewal will allow a WSP to have an intimate knowledge of:

• assets it has under its control;

• the location of these assets;

• the value of these assets;

• the condition and performance of these assets;

• the approximate residual life of these assets; and

• prioritised projections of asset replacement or rehabilitation costs.

Outputs

Outputs from the asset evaluation and renewal process include:

• an Asset Evaluation and Renewal Plan (TMP sub-plan);

• asset registers which can be presented in text or graphical outputs;

• asset condition/performance reports;

• asset valuation reports;

• specific asset management studies; and

• a prioritised asset replacement/rehabilitation program.

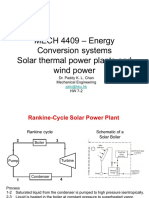

3 THE ASSET EVALUATION AND RENEWAL PROCESS

The asset evaluation process is illustrated in Figure 1.

Capture

asset

attribute

data

Develop and

Develop an maintain

asset asset

renewal

The Asset

registers

strategy Evaluation

Process

Monitor

asset Undertake

condition asset

and valuation

performance

FIGURE 1: The asset evaluation process

Asset Management: Asset Evaluation and Renewal - Implementation Guide 5

3.1 Capturing asset attribute data

The initial data collection requires significant resources (human and financial). In the early and mid-1990s

most Queensland WSPs captured information relevant to their assets. Data was collected from a range of

sources including:

• drawings and contract documents;

• operation & maintenance manuals;

• inspection and measurement of assets;

• geographical positioning systems, for asset location;

• photogrammetric mapping; and

• digitising of existing drawings.

Processes are also well established to capture new and/or modified asset data. Unless updating processes are

rigorously enforced, however, the asset database will gradually deteriorate and become unreliable and

useless. Financial auditors are also keen to ensure integrity of the asset register information.

The data capture process can be extremely expensive, so it is essential that the process is well planned. The

steps are illustrated in Figure 2.

Phase 1 This sets the level of detail, accuracy, completeness of required data.

Determine objectives for Examples:

data capture • meeting accounting requirements

• setting up a maintenance management system

• predictive modelling of asset failure.

Phase 2 This is a highly effective means of understanding the system, how it should and actually

Develop schematic layouts works, and the role of each component in delivering the service. This facilitates the

development of an appropriate hierarchical system for the assets.

Phase 3 Infrastructure should be classified within a hierarchical structure that:

Develop an appropriate • is logical and easily understood

hierarchical system for • consistent with proposed asset register software requirements

assets (asset classification) • facilitates data collection and recording.

Phase 4 Quality management procedures should be developed for:

Document data collection • data collection for different asset groups including detail and accuracy of data

procedures • auditing/verification of data

• presentation of information

• storage of information

• audit trails

Phase 5 This will allow the WSP an opportunity to review and refine:

Undertake trial data • project resources/budgets

collection • level of detail of data to be collected

• data collection methodology

• quality procedures for data capture.

Phase 6 This may take a significant amount of time, particularly for larger WSPs. Management

Undertake data collection support and commitment and staff enthusiasm are essential to ensure quality outputs.

Phase 7 Undertaken to ensure:

Audit data • compliance with agreed quality procedures

• accuracy and completeness of data.

Phase 8 Set up systems for data It is critical that processes are set up to capture information on new or modified assets

updating otherwise the register will rapidly become out of date.

FIGURE 2: The asset data capture process

6 Asset Management: Asset Evaluation and Renewal - Implementation Guide

3.2 Developing and maintaining asset registers

An asset register includes information on asset description, location, condition, residual life and asset current

costs, depreciation and value. Asset registers are useful to a wide range of personnel. These include financial

managers, engineers, maintenance managers and staff. The type of information required by various groups is

shown in Figure 3. The level of detail contained in the registers will vary to suit the required user group.

Extent of assets

Asset valuation

Depreciation

Increasing Asset life

detail

Asset age

Financial

Asset capacity/sizing

System Asset condition

Other technical parameters

modelling

Detailed asset information

Spare parts

Maintenance

Supplier details

management Associated drawings/

catalogues

Asset register application

FIGURE 3: Asset register types

This section outlines key issues to be considered when developing an asset register. The type of register

described can be classified as suitable for financial managers and for system modelling. Asset registers

appropriate for maintenance management will require more detail.

Establishing the asset register

It is all too easy to get caught up in the development and establishment of computer systems rather than the

collection, collation and use of basic information. For most WSPs, therefore, it is much better to purchase a

cheap, readily available commercial database and spend most of the money on collecting and using the data

(i.e. developing an asset renewal plan, undertaking financial planning, etc.).

Cheap, simple databases, spreadsheets or geographical information systems (GIS) can serve as effective,

low-cost entry points for many WSPs establishing a formalised asset management system. Data can be

readily transferred from most simple databases to more sophisticated computer systems at a later stage.

However, larger WSPs with significant resources and management commitment may find it cost-effective to

develop a detailed asset register as part of an integrated asset management package.

Information requirements

Before commencing an asset register (and related data capture), WSPs should critically assess what

information is required from the register, by whom, and to what level of detail — now, in 5 years and in

10 years’ time. The outcome of this assessment will help to determine the degree of integration, now and in

the future, with:

• other registers;

• financial management system;

• maintenance management system; and

• geographic information systems (GIS).

Asset Management: Asset Evaluation and Renewal - Implementation Guide 7

From this information, an implementation plan can be produced for cost-effective development of an asset

register.

An asset register will include:

• a unique asset identification number; • condition rating;

• asset location/description; • residual life;

• basic dimensions; • current cost;

• material; • accumulated depreciation;

• year constructed; • written-down current cost; and

• importance level for asset; • annual depreciation.

• useful life;

Level of asset disaggregation

This will depend on what the register is to be used for. For financial asset registers, asset disaggregation

should be based on the asset having a single useful life and the applicability of cost data.

Screening process

It is important that a sound screening process be applied before data is entered in the asset register, to ensure

that financial reporting provides a true picture of the infrastructure. The screening process can be undertaken

relatively quickly, initially on a macro basis and then at a facility level. The screening process would involve

confirming the asset and applying the deprival test, as described below.

• Confirming the asset:

- Does the WSP control the asset?

- Does the asset have a service potential?

- Can its value be reliably measured?

- Is its value likely to be material?

• Applying the deprival test:

- Would the asset’s service potential be restored following rehabilitation to the deprival value?

Asset numbering systems

A number of asset numbering systems exist, including:

• unintelligent (random sequential numbers);

• semi-intelligent; and

• fully intelligent.

The issue of asset numbering systems becomes less relevant where the system (with or without a GIS):

• incorporates standard query language; or

• is a relational database management system; or

• is a fully integrated business system.

Asset’s level of importance (criticality)

Within a water/sewerage or irrigation scheme, some assets are more important or more critical than others,

on the basis of whether their function is related to level of service and the cost of correcting a preventable

breakdown. Assigning an importance factor (IF) to each asset provides an indication of its relative

importance and the consequence of its failure. This rating will assist in objectively determining and

prioritising maintenance or replacement strategies for that asset. A suggested rating system for the asset

register is a scale of 0 to 5 (where 5 indicates the most critical importance). Examples of these criteria are

shown in Table 1.

8 Asset Management: Asset Evaluation and Renewal - Implementation Guide

TABLE 1: Criteria For asset importance

Importance factor Effect of failure of asset

Immediate and unacceptable impact on the levels of service; or

Highest large number of consumers affected; or

(4–5) results in considerable cost to the WSP; or

affects the safety of WSP staff or the community.

Probably has an adverse effect on the levels of service; or

Middle medium number of consumers affected; or

(2–3) likely to cause long-term problems which are costly to rectify; or

potentially unsafe conditions may result for WSP staff or the community.

Probably will not adversely affect the levels of service; or

Lowest small number of consumers affected; or

(0–1) cause minor cost to the WSP; or

unlikely to affect the safety of WSP staff or the community.

Within each rating level, the following factors may influence the importance of an asset:

building damage

effect on business and essential service;

damage to other utilities; and

traffic disruption.

An alternative and more refined rating system is illustrated in Table 2.

TABLE 2: Alternative rating system for importance of a pipeline

Score Weighting Score

Importance criteria Severity

(S) 1 to10 (W) 1 to 5 (S x W)

1a Number of customers serviced <10 2

by pipeline >10 <50 5

>50 <200 8

>200 10

1b Type of customers serviced by Mainly industrial area 3

pipeline Mainly residential area 5

Mainly commercial area 8

High safety risk, e.g. hospitals 10

2 Public health and safety No effect 0

Minor — single illness or injury 4

Major — multiple illnesses or

10

injury

3 Environmental impact No effect (flows contained) 0

Minor impact 4

Major impact 10

4 Cost of repair <$5000 2

>$5000 <$10 000 4

>$10 000 <$15 000 6

>$15 000<$20 000 8

>$20 000 10

Asset Management: Asset Evaluation and Renewal - Implementation Guide 9

Score Weighting Score

Importance criteria Severity

(S) 1 to10 (W) 1 to 5 (S x W)

5 Time to repair <1 day 2

1–3 days 4

>3 days 10

6 Disruption to traffic No access or road disruption 0

Minor access disruption 2

Important access disruption 4

Minor road disruption 5

Major road disruption 10

TOTAL

From draft NSW Renewals Guidelines 1998.

Pipelines would be assigned importance ratings A, B and C based on the total weighted score determined

using Table 2.

Useful life

The useful life of an asset is the lowest of:

• the period where the asset will provide the designated level of service at an economic cost; or

• the period by which time the asset will be technologically obsolescent; or

• the period by which time the asset’s service potential is no longer required.

An asset’s useful life will depend on a number of factors that include material, construction methods, design

criteria, location, loading, pressure, environmental conditions and level of maintenance. Table 3 provides

indicative asset useful lives that may be suitable as an initial estimate of asset life. This estimate can be

refined during the development of the initial asset register by:

• calculating the estimated replacement year. If this calculation produces an unrealistic result, then the

useful life should be modified to reflect a more realistic value;

• using information already being collected on asset condition or performance (e.g. record of main

breaks, sewer inspection records); and/or

• discussion with field staff on asset performance.

A formal asset management system should provide information on asset condition or performance so that

realistic asset life estimates can be developed and refined on an ongoing basis. This is discussed in

Section 2.4. The refining of asset life estimation is illustrated in Figure 4.

TABLE 3: Indicative useful lives

Asset Indicative useful life (years)

Dams 150–200

Weirs 50–125

Bores 50–80

Irrigation channels (earthworks) 150

10 Asset Management: Asset Evaluation and Renewal - Implementation Guide

Asset Indicative useful life (years)

Irrigation channels (concrete lining) 50

Irrigation channels (clay lining) 50

Water-retaining structures 80

Steel structures 60

Buildings and other structures 60

Pumps, compressors, process plant and other mechanical equipment 15–25

Electrical equipment 15–25

Telemetry and instrumentation 10

Meters 15

Fences/ladders/rails 25

Water pipelines 50–80

Services 50

Hydrants 30–50

Valves 25–50

Control valves 15

Sewers (gravity and pressure) 50–80

House connections 50

Manholes 40–60

FIGURE 4: Refining asset life estimation

Asset Management: Asset Evaluation and Renewal - Implementation Guide 11

Asset condition scale

An asset register should provide a quick guide to the condition of the assets by means of an appropriate

condition scale. Examples of simple condition scales are shown in Tables 4 and 5. Some scales (e.g. Table 4)

give 5 as the best condition, whereas others nominate 1 as the best condition. Obviously the WSP will need

to have a consistent system.

The assessment method illustrated in Table 5 can be refined for different asset groups, with comments

relevant to specific groups (e.g. electrical or mechanical).

Table 6 outlines a sample qualitative condition rating for civil irrigation assets. This rating has a scale of 1–6.

TABLE 4: Example of an asset condition scale

Condition rating Asset condition (taking into account asset age)

1 Excellent

2 Good

3 Average

4 Fair

5 Poor

6 Unserviceable

TABLE 5: An alternative condition scale

Alternative description

Condition rating Asset condition Description

(e.g. for a pipeline)

Only normal maintenance Expected residual life >50

1 Perfect/excellent

required. years

Minor maintenance required Expected residual life 20–50

2 Minor defects only

(5%) years

Backlog maintenance Significant maintenance Expected residual life 6–20

3

required required. years

Significant renewal/ upgrade Expected residual life 2–5

4 Requires major renewal

required. years

Over 50% of the asset requires Expected residual life <1 year

5 Imminent failure

replacement.

6 Asset failed Total replacement required Zero residual life

3.3 Undertaking asset valuation

Publicly owned WSPs are required, through relevant account standards, to value their assets at current value.

Effective asset valuations are critical to the management of a WSP for the following reasons:

• to ensure compliance with regulatory requirements;

• to reflect the value of assets to stakeholders;

• to measure the financial performance of the WSP; and

• to enable consistent benchmarking of the financial performance of the WSP with similar agencies.

12 Asset Management: Asset Evaluation and Renewal - Implementation Guide

The valuation process can be separated into three major parts:

• preliminary work;

• determining asset values; and

• presentation of results.

The process is illustrated in Figure 5 and fully explained in Appendix A. While all four Phases are critical for

successful valuation, the first phase is the most crucial. If the valuation process is well thought out and

planned, and information effectively communicated to relevant staff, the process can be implemented

correctly, cost-effectively and at the first attempt.

Phase 1: Preliminary Step 1: Establish communication lines

Step 2: Develop an asset valuation policy

Step 3: Allocation resources

Phase 2: Valuation Step 4: Collect cost information

Step 5: Determine asset values

Phase 3: Presentation Step 6: Present Valuation Results

Phase 4: Refinement Step 7: Refine initial valuations

Step 8: Evaluate alternative valuation methodologies

FIGURE 5: The asset valuation process

3.4 Evaluating asset condition and performance

The purpose of asset condition and performance evaluation is to:

• trigger asset maintenance (condition-based or predictive maintenance);

• identify assets requiring rehabilitation and replacement in the short and medium term; and

• provide raw data for developing and/or calibrating asset deterioration/failure models.

Figure 6 illustrates a typical condition decay curve for infrastructure assets. In many instances condition

assessment may only identify assets that are well into their useful life and in need of replacement or

rehabilitation.

Asset Management: Asset Evaluation and Renewal - Implementation Guide 13

Decay curve after

rehabilitation

1 Do nothing

EXCELLENT

2 GOOD

Maintain

Condition

Nominated minimum

service standard

3 FAIR

Rehabilitate

4 POOR

Replace

5 VERY POOR

FAILURE

0% 100%

% Useful life

FIGURE 6: Typical condition decay curve for infrastructure assets

Any condition/performance evaluation process should possess the following characteristics:

• repeatability — the same condition rating will be determined if a different person performs the

rating;

• objectivity — the rating can be measured on the basis of some physical characteristics such as

cracking;

• simplicity — simple systems are easier to use and generally lead to more consistent results.

Table 6 illustrates a structured qualitative condition assessment for civil irrigation assets which was

developed in the Victorian rural water industry in the early 1990s. The method allows a large number of

assets to be assessed in a relatively short period of time.

14 Asset Management: Asset Evaluation and Renewal - Implementation Guide

TABLE 6: Sample qualitative condition rating

Condition 1 2 3 4 5 6

Type

Channel embankments Recently constructed, Some wear and tear Reduced bank cross Significantly reduced Severely reduced Bank in state of

remodelled, replaced, but no operational section causing bank cross section bank cross section collapse with

or rehabilitated problem or likely operational problems and loss of freeboard. causing intermittent continuous breaching,

leakage or breaks or leaks Operational breaching or overtopping and/or

difficulties and overtopping and/or extreme leakage or

potential for collapse severe leakage or seepage through bank

and/or significant seepage through bank

seepage loss.

Channel waterway Recently constructed, Routine weed Occasional desilting Frequent desilting or Major desilting or Effectively blocked

remodelled, replaced, removal required or or mechanical weekly mechanical week mechanical week required remodelling

or rehabilitated lining or with minor removal required or removal required or removal required or or lining effectively

cracking lining with sufficient lining moderately lining extensively collapsed and losses

cracking to require cracked and some cracked and missing unacceptably high

minor patching patches missing.

Pipelines Recently constructed, Very occasional Burst frequency still Some water quality Major water quality Bursts frequently

remodelled, replaced, bursts or blockages. acceptable, moderate problems. Bursts problem due to pipe significant above

rehabilitated Scouring de-weeding, fitting maintenance or frequently approach condition. Frequent maximum acceptable

minor fittings some minor maximum acceptable bursts, major fittings level and fittings

maintenance required blockages, collapses, and moderate fittings maintenance or effectively

joint movement maintenance or some blockages, collapses unserviceable or fully

major blockages, and severe joint blocked, collapsed or

collapses or joint movement joints failed

movement

Access tracks (earth or gravel) Recently constructed, Some wear and tear Minor deterioration Significant Severe deterioration Access effectively

remodelled, replaced, but no access of track formation deterioration of track of track formation unusable

rehabilitated difficulty and structure. formation and and structures. Deep

Potentially difficult structure. Access ruts, access slow and

and unsafe use difficult and unsafe unsafe

Asset Management: Asset Evaluation and Renewal - Implementation Guide 15

Condition 1 2 3 4 5 6

Type

Fencing Recently constructed, Some wear and tear Minor deterioration Significant Severe deterioration Collapsed or

remodelled, replaced, but still provides of post and wire deterioration of post of post and wire. unserviceable

rehabilitated good security reducing security and wire reducing Collapse imminent

security

Bridges, culverts, siphons, Recently constructed, Some wear and tear Some structural Significant structural Severe structural Collapsed,

flumes, weirs (minor), remodelled, replaced, but load capacity or cracking or cracking, cracking or undermined or

offtakes, regulators rehabilitated operational significant wear and undermining or undermining structure damaged preventing

performance not tear potentially repairs needed. collapse or non correct wheel rotation

affected causing loss of load Possible difficult operation of all or or allowing

capacity for bridges operation and reduced component parts significant leakage or

and culverts and load capacity for imminent bypass of water either

operational bridges and culverts internally or

difficulties for all externally

structures

Meter outlet emplacements Recently constructed, Some minor visual Some structure Significant cracking Severe cracking, Structure in total or

remodelled, replaced, deterioration but no cracking or or deterioration with undermining or component

rehabilitated operational problem deterioration but potential undermining damage allowing effectively collapsed

and measurement undermining and and leakage or some leakage or or so damaged to be

accuracy not affected leakage unlikely. bypassing of water bypass of water. unserviceable

Operation and either externally or Imminent interference

measurement internally to wheel rotation

accuracy not affected

From Burns and Godkin 1991.

16 Asset Management: Asset Evaluation and Renewal - Implementation Guide

A WSP will use a number of condition and performance monitoring techniques, a summary of which is

included in Table 7. Many of these activities will be incorporated into a WSP’s planned maintenance

program or operational data analysis, monitoring and reporting. WSPs will define criteria for establishing a

consistent condition rating for each asset group. In some instances, for example a closed-circuit television

(CCTV) evaluation of sewers, standard approaches and specialist software are available to determine

condition of assets.

TABLE 7: Typical methods for evaluating the condition and performance of assets

Asset Typical asset condition/performance evaluation method

Dam Visual inspection

Instrumentation monitoring

Weir Visual inspection

Structures/buildings Visual inspection

Non-destructive testing

Pumps/meters Number of breakdowns

Condition monitoring (e.g. vibration analysis)

Efficiency (e.g. kW.h/ML, amperage)

Electrical switchgear/control panels Number of breakdowns

Visual inspection

Condition monitoring (e.g. thermography)

Proving operation

Water mains Number of breakdowns

Opportunistic inspection (in-ground)

Visual inspection (above-ground) and internally for larger diameter mains

Efficiency friction factor ‘C’ value or kW.h/ML

Leakage level

Intelligent pigging

Water quality complaints

Flow/pressure complaints

Services Number of service breaks

Meters Calibration

Number of breakdowns

Number of consumer billing complaints

Irrigation channels Visual inspection

Sewer mains Number of structural failures

Number of blockages

Number of overflows

Number of odour complaints

Visual inspection (CCTV)

Void detection (wave impedance)

Manholes Visual inspections

Vacuum testing

Due to the extensive nature of assets and the resources required to monitor their condition and performance,

a risk-based approach may need to be developed to prioritise their assessment, particularly where the

assessment is relatively expensive (e.g. CCTV inspections of sewers).

Asset Management: Asset Evaluation and Renewal - Implementation Guide 17

Table 8 illustrates a decision matrix to assist the prioritisation process. As a WSP develops greater

knowledge of its infrastructure, the methodology can be further refined.

TABLE 8: Sample decision matrix for prioritising sewer inspection

Asset importance level

Preliminary

condition rating A B C

Assessment within 12

5 (poor) Immediate assessment Immediate assessment

months

Assessment within 12

4 Immediate assessment Assessment within 3 years

months

Assessment within 12

3 Assessment within 3 years

months

2 Assessment within 3 years

1 (excellent)

Derived from NSW Renewals Guidelines 1998.

The preliminary condition rating may be based on such factors as age of the asset, material type or asset

performance history (formally and informally recorded).

3.5 Developing an asset renewal strategy

In many instances, the identification of future asset renewal costs and addressing the prioritisation and

funding of these liabilities are among the greatest challenges facing WSPs, particularly where a large part of

the infrastructure is nearing the end of its useful life. Questions that arise include the following:

• Are residual life estimates correct?

• Are the replacement costs reasonable?

• How will we fund this expenditure?

• What will be the impacts (particularly on our customers) if we defer asset

replacement/rehabilitation?

• What would happen if we spent more on planned/predictive maintenance practices?

It is therefore essential that each WSP has an asset renewal strategy to:

• optimise expenditure on asset rehabilitation and maintenance;

• plan ahead, particularly for funding asset replacement or rehabilitation; and

• review the existing stock of infrastructure to determine whether existing infrastructure as it

approaches the end of its useful life should be:

- replaced with a similar asset;

- replaced with larger capacity infrastructure as part of an augmentation program;

- replaced with smaller capacity infrastructure as customer demands have reduced; or

- disposed of.

The renewal strategy should be developed in two stages:

• macro (strategic) level; and

• micro (detailed) level.

Strategic level

The macro level (strategic) approach to developing an asset renewal strategy is illustrated in Figure 7 and

explained below. The purpose of this stage is to develop:

18 Asset Management: Asset Evaluation and Renewal - Implementation Guide

• short-, medium- and long-term cost estimates; and

• funding strategies for asset replacement/rehabilitation.

Refine asset register, useful/residual

lives through condition/performance

assessment 1.

Develop replacement cost profile(s) 2.

Input replacement costs into 10 - 20

year infrastructure investment Macro level predictive

(capital works) program 3. modelling and

optimisation of asset

replacement/

rehabilitation/

maintenance

Optimise infrastructure investment

strategies and impacts

and maintenance cost through use of

on levels of service 4.

10 - 20 year financial model

FIGURE 7: Development of a macro level asset renewal strategy

Explanatory Notes for Figure 7

1. At the strategic level, cost estimates are derived for asset replacement/rehabilitation over the next 30-50

years. Over time useful/residual life estimates used for asset registers will be refined through condition

and performance assessment.

2. It may also be desirable to develop a range of profiles based on various asset life scenarios. A further

refinement is to develop a normal distribution (bell curve) of asset useful life around an assumed asset

life. (Refer Figure 8).

3. Rolling 5-10 year average replacement costs derived from the replacement cost profile may be input into

a 10-20 year infrastructure investment program linked into the 10-20 year financial model. Financial

modelling will allow the WSP to determine financial impacts of the proposed asset renewal costs and

allow the WSP to either:

determine financial strategies to fund the renewal; or

based on financial constraints set upper limit targets for asset renewal budgets.

4. Spreadsheet based models based on calibrated asset degradation curves can be a useful tool to allow a

WSP to estimate anticipated infrastructure failure (and hence service standards) based on a range of

maintenance and rehabilitation scenarios/budgets. The models can then be used to develop an optimum

maintenance/asset rehabilitation budget for an asset group (e.g. water mains). These budgets can form

an input into the 10-20 year financial model.

Asset Management: Asset Evaluation and Renewal - Implementation Guide 19

Water Supply

50 Year Replacement Profile

10,000

8,000 5 year rolling average

Value ($,000)

6,000

4,000

2,000

0

99

04

09

14

19

24

29

34

39

44

49

19

20

20

20

20

20

20

20

20

20

20

FIGURE 8: Asset replacement cost profile

Detailed level

The micro level (detailed) approach to developing an asset renewal strategy is illustrated in Figure 9. The

purpose of this stage is to clearly identify and prioritise asset renewal projects.

Determine assets scheduled for replacement/

rehabilitation over the next 5 years 1.

Critically review assets scheduled for

replacement/ rehabilitation 2.

Prioritise asset replacement/ rehabilitation 3.

Determine renewal strategy 4.

Package asset replacement/ rehabilitation

works into projects 5.

Input projects into project prioritisation

worksheet 6.

FIGURE 9: Development of a micro level asset renewal strategy

Explanatory Notes for Figure 9

1. If the asset register is well maintained with asset residual lives that reflect asset condition and

performance evaluation results, then assets requiring replacement or rehabilitation over the next 5-10

years can be readily determined.

2. It will be necessary to critically review the assets listed for replacement/rehabilitation, particularly in the

early stages of formalised asset management. Operational staff who have intimate but informal

knowledge of asset performance should be consulted during this stage.

20 Asset Management: Asset Evaluation and Renewal - Implementation Guide

3. A sample process for a water or sewer main renewal priotisation is illustrated in Table 9. Different

prioritisation matrices should be developed for different asset groups (eg electrical/mechanical assets).

This simple process can be refined as WSPs asset management processes develop. The prioritised list of

assets should be reviewed by operational staff to confirm/refine the results.

4. Options including:

replacement with an asset of similar capacity;

replace with a larger capacity asset as part of an augmentation program;

replace with a smaller capacity asset because customer demands have reduced and are unlikely

to increase substantially in the future;

rehabilitate the existing asset (e.g. lining of an existing sewer);

increase level of maintenance; or

dispose of the asset.

Asset disposal may be an option where:

the asset is surplus to requirements;

the service could be more cost-effectively delivered by other means (eg tankering of water); or

there are potential risks associated with the asset (e.g. vandalism, financial, environmental,

legal).

5. These modules should be an appropriate size for contracting work to internal or external contractors.

6. These project modules would need to be prioritised against other infrastructure projects as outlined in the

Infrastructure Planning Implementation Guide. Alternatively a WSP may have already determined an

appropriate asset renewal budget (as outlined earlier in this section). In this case the prioritised project

modules whose aggregate total comes within the budget will be funded.

TABLE 9: Sample asset renewal prioritisation matrix

Asset Importance Level

Preliminary condition

rating A B C

5 Replace/rehabilitate Replace/rehabilitate Replace/rehabilitate

(poor) within 1 year within 1 year within 5 years

Replace/rehabilitate Replace/rehabilitate Replace/rehabilitate

4

within 3 years within 5 years within 10 years

1

(excellent)

Derived from NSW Renewals Guidelines 1998.

Asset Management: Asset Evaluation and Renewal - Implementation Guide 21

4 RISK ISSUES

Potential risks associated with asset evaluation and renewal include:

• inappropriate level of data capture (too coarse/too detailed);

• inaccurate data;

• registers becoming outdated due to lack of maintenance;

• inappropriate useful life estimates (over- or underestimate);

• over- or underestimation of asset values;

• inappropriate or sub-optimal asset renewal/rehabilitation investment;

• non-compliance with financial audit requirements;

• unreliable outputs; and

• selection of inappropriate software for information management.

5 TMP REQUIREMENTS

Each WSP’s Total Management Plan (TMP) should include an outline of key issues and identified strategies

addressing these issues for the WSP’s services in respect of asset evaluation and renewal. Appendix B

provides indicative content and appropriate TMP development level for this sub-plan.

A hierarchy has been established to define the level to which a WSP should develop its plan under total

management planning. This is discussed in more detail in the TMP Development Guide. The development

level depends on the size of the WSP (in terms of the replacement cost of its assets).

REFERENCES AND FURTHER READING

Burns M. and Godkin, B., Rural water commission methodology for collection and use of asset information,

ANCID Conference, September 1991.

International Infrastructure Management Manual, National Asset Management Steering Group, Association

of Local Government Engineers New Zealand, Wellington, 2000.

Renewals Guidelines, NSW Department of Land and Water Conservation, 1998 (Draft).

Strategic Asset Management Guidelines, Department of Public Works, Queensland, 2000.

Total Asset Management Manual, New South Wales Government, 2001.

22 Asset Management: Asset Evaluation and Renewal - Implementation Guide

APPENDIX A: Asset Valuation Process

Phase 1: Preliminary Work

Step 1: Establish communication lines

Except for very small organisations, a steering committee is essential to ensure that key players are

involved and committed to the process. Regular consultation with the internal/external auditor also is

highly desirable to ensure that expensive mistakes are avoided.

Step 2: Develop an asset valuation policy

This is a prerequisite for asset valuation because:

• it focuses a WSP’s requirements and expectations. The valuation policy demonstrates that WSP

officers will have thought through the valuation process and documented their requirements. It

also demonstrates agreement of the process by senior management;

• a well developed policy can be used as a basis for briefing external consultants and internal staff;

• a well developed policy will assist the audit process.

Step 3: Allocation Resources

Could be undertaken by internal and/or external resources. WSPs should also consider the relative level of

resources allocated to various asset groups. For instance it would be more cost-effective for a WSP with

water mains (usually accounting for 60 – 80% of total asset value) to devote more valuation resources to

these network assets rather than to an asset group which may account for less than 5% of total asset value.

Personnel involved should:

• have a working knowledge of the engineering and financial aspects and audit requirements;

• understand and support the need for the asset valuation; and

• be properly briefed, in writing.

The valuation brief should clearly specify the outputs required, for example:

• valuation report;

• spreadsheet summaries;

• detailed calculations to be retained/controlled.

Phase 2: Determine Asset Values

Step 4: Collect current cost information

Information sources include:

• recent contracts in the WSP area (or adjacent area) with indexing of contract prices less than 5

years old;

• day labour costs (provided they reflect the true cost of service);

• unit rates from consultants (these should have been calibrated against local costs and

accompanied by a valuation report that explains how the unit rates were derived); or

• full valuation by an external consultant (with supporting information).

Appropriate construction on costs (eg construction contingencies, design, supervision, administration)

should also be included.

Generic cost graphs and rates should only be used as a check that the calculated current cost is in the right

‘ball park’. Old contract sums (say last 20 years) can also be indexed to check the order of costs.

The valuer may need to take a range of approaches to valuation depending on availability of raw data, cost

information, etc. (Refer to Note 1.)

Asset Management: Asset Evaluation and Renewal - Implementation Guide 23

Step 5: Determine asset values

To obtain the asset value (written down current cost) it will be necessary to subtract depreciation over the

asset life to date from the current cost. Usually straight line depreciation is applied with the residual value

of infrastructure being zero. A critical component of the valuation process is therefore useful life. Generic

useful life information should be reviewed and refined to suit local conditions and experience by WSP

officers. Reasons for deviations from generic useful lives should be documented.

Phase 3: Presentation of Results

Step 6: Present valuation results

This report is an essential conclusion to the valuation process as it:

• summary valuation information;

• provides elements of an audit trail; and

• documentation for the next valuation in 5 years time.

Phase 4: Refinement

Step 7: Refine initial valuations

Initial valuations can be improved through:

• developing systems for capturing construction costs for assets;

• ensuring registers are adequately maintained with information on WSP-constructed and donated

assets;

• developing asset management systems for monitoring asset condition and performance to enable

a better estimate of residual asset life.

Step 8: Evaluate alternative valuation methodologies

Alternatives include:

• renewal accounting; and;

• optimised deprival valuation.

Refer to Note 2.)

EXPLANATORY NOTES

Note 1

The current cost should be taken as the lower of reproduction and replacement costs,

where both these are applicable.

Reproduction cost would apply where:

• no cheaper modern equivalent exists; and

• the service capacity is appropriate.

Replacement cost would apply where:

• the asset is not reproducible; or

• the asset is reproducible but a cheaper modern equivalent exists; or

• the asset is reproducible but replaced at a different service capacity.

24 Asset Management: Asset Evaluation and Renewal - Implementation Guide

Note 2: Refinement — evaluate alternative valuation methodologies

Renewal accounting

While current cost accounting (and current cost depreciation) has significant advantages, particularly in

performance comparisons and making asset renewal, it has some disadvantages. The major disadvantage of

current cost accounting for setting water and sewerage prices is the difficulty in convincing customers

(particularly irrigators) that long-lived assets such as dams and irrigation channels would not have an

indefinite life if the assets were effectively maintained.

Renewal accounting requires estimating the timing and cost of replacing essential infrastructure, with regard

to risk of failure and the hazard should failure occur. The cash flow required to fund the necessary renewal of

infrastructure over an extended period is built up from a study of all the infrastructure assets in turn. An

annuity is calculated to smooth out fluctuations in cash flow over the annuity period. Depreciation is then

defined in terms of the renewal annuity.

Optimised deprival valuation (ODV)

The optimised deprival valuation approach has been applied by corporatised electricity authorities in

Australia (including Queensland) and New Zealand, and by some Australian and New Zealand water

authorities, for determining the market value of a utility as a starting basis for commercial operations, and for

rationalising performance comparison. In respect of the water industry, no Council of Australian

Governments (COAG) guidelines related to the ODV methodology have as yet been published.

The ODV of an asset is the lower of optimised depreciated replacement cost (ODRC) and economic value

(EV). Generally the latter will be based on the present value (PV) of future free cash flows (FCF), using the

maximum long-term level of sustainable bulk supply charges.

The ODRC in valuing assets is a variation on the deprival value, in which the asset network is subjected to a

technical evaluation as to how it would be reconfigured under current service demand forecasts and

employing modern technology. As a result of the evaluation, certain assets might be concluded as being, for

example, superfluous or oversized. The hypothetical reconfigured network is then revalued in terms of its

written-down current cost to yield the ODRC.

The ODRC method involves the identification of modern equivalent assets where appropriate, and in this

respect is no different from the normal deprival value approach. Where it differs is in requiring a

comprehensive engineering review of the asset base, something that is normally neither required nor feasible

in valuing infrastructure assets for financial reporting purposes.

Asset Management: Asset Evaluation and Renewal - Implementation Guide 25

APPENDIX B: Content and development level of sub-plan

TABLE B1: Indicative sub-plan content

Sub-plan features Asset Evaluation and Renewal Plan content

Issues covered in sub-plan Asset data capture.

Registration.

Valuation.

Asset condition and performance assessment.

Asset replacement cost profile.

Purpose of plan To provide summary information on:

the assets controlled by the WSP (extent, location, value, condition and

performance);

asset register outputs; and

future asset evaluation strategies and actions for updating asset registers and refining

useful life estimation.

Policies that may be Asset valuation policy.

required

Other Total Management Financial Management Plan: this requires asset register outputs such as current cost,

Plan elements that are value and depreciation; replacement cost profiles, and renewals annuity calculations.

intimately linked to this sub- Infrastructure Plan: replacement cost profiles will be input into the rehabilitation

plan capital works program.

External issues contributing Relevant accounting standards.

to the current operating Developments in renewals annuity accounting.

environment that need to be

Developments in optimised deprival valuation.

considered

Developments in predictive modelling for asset failure.

Issues that need to be An overview (including commentary) of the WSP’s infrastructure should be provided,

considered in summarising either as a summary table or graphic output. This might include:

the status of current scheme name;

operations

component (e.g. weirs, treatment plants, mains);

quantity (e.g. length, number);

current cost;

written-down current cost; and

annual depreciation.

A discussion on the current status of asset evaluation should include:

a description of the asset data captured, its accuracy and data capture methodology;

information on the extent of knowledge of asset location;

storage of asset register information (GIS, databases) and the linkage between these

databases and other databases (e.g. financial). A flow chart (with accompanying

explanatory notes) would be necessary;

a summary of asset condition and/or performance evaluation methodologies applied

to different assets (e.g. mains, pump stations);

a summary of current asset condition/performance by asset type;

asset performance statistics (e.g. main breaks/100 km, sewer blockages/100 km, and

comparison with average Queensland or Australian performance);

a 50-year asset replacement cost profile (with a commentary) that incorporates a 5-

year rolling average and 20-year renewals annuity;

a description of any initiatives in predictive modelling of asset failure; and

Broad SWOT analysis of relevant operations.

NOTE: This discussion could be presented in 5–10 pages maximum.

26 Asset Management: Asset Evaluation and Renewal - Implementation Guide

Sub-plan features Asset Evaluation and Renewal Plan content

Strategic basis of the plan The strategic elements forming the basis of the plan should include:

goal for asset management;

objective(s) for asset evaluation and renewal;

adopted KPIs; and

management strategies and performance targets.

The management strategies developed will be based on the identified key strategic issues

and SWOT findings, including risk assessment, in respect of asset evaluation and

renewal, and on the required TMP development level.

Many WSPs are likely to require strategies for refining asset residual life estimation.

The strategies should be supported by detailed action plans that would cover a period of

up to 3 years.

Suggested performance Outcome:

measures average asset age by category.

Output:

% length mains replaced or rehabilitated;

% length of trunk mains/channels at condition level 4 or worse;

% length sewers inspected with CCTV.

Supporting documentation This will depend on the WSP, but would typically include:

asset registers;

asset valuation report; and

specific asset management studies.

TABLE B2: Required sub-plan development level

Development level1 Target management mechanisms of Asset Evaluation and Renewal Plan

Asset registers integrated/linked with financial and maintenance management systems.

Assets valued to meet relevant accounting standards.

3 Registers regularly updated.

50-year asset replacement cost profiles refined and optimised on basis of asset

condition/performance assessment, predictive modelling and risk management.

Asset registers available, with assets disaggregated into civil, electrical and mechanical

components.

Assets valued to meet relevant accounting standards,

2

Registers regularly updated,

50-year asset replacement cost profiles refined and optimised on basis of asset

condition/performance assessment.

Basic asset registers available, with assets disaggregated into civil, electrical and

mechanical components.

1 Assets valued to meet relevant accounting standards;

50-year asset replacement cost profiles developed, with some refinement, on basis of asset

condition/performance assessment.

1

Defined in Section 4.2 of TMP Development Guide.

Asset Management: Asset Evaluation and Renewal - Implementation Guide 27

You might also like

- Neuman Tool PDFDocument445 pagesNeuman Tool PDFYnaffit Alteza Untal100% (2)

- Summer 2021Document23 pagesSummer 2021Paul BluemnerNo ratings yet

- Standard Operating Procedure: ObjectiveDocument10 pagesStandard Operating Procedure: Objectiveghjtyu100% (1)

- NIAMM Maintenance Management StandardDocument36 pagesNIAMM Maintenance Management StandardSeenivasagam SeenuNo ratings yet

- ClexaneDocument2 pagesClexaneianecunar100% (2)

- Backpod User Guide 2019Document36 pagesBackpod User Guide 2019Sean DrewNo ratings yet

- Stormwater Management For Manchester DOTDocument9 pagesStormwater Management For Manchester DOTIsaac OtiNo ratings yet

- StormWater and AssetManagement ToolDocument9 pagesStormWater and AssetManagement ToolIsaac OtiNo ratings yet

- StormWater and AssetManagement ToolDocument9 pagesStormWater and AssetManagement ToolIsaac OtiNo ratings yet

- BSI ISO 9001 2015 Gap Analysis Tool CANDocument14 pagesBSI ISO 9001 2015 Gap Analysis Tool CANchaouch.najehNo ratings yet

- What Should A Reliability Engineer RE Actually Do and Know Bennie Oosthuizen and Arnold Botha PDFDocument25 pagesWhat Should A Reliability Engineer RE Actually Do and Know Bennie Oosthuizen and Arnold Botha PDFgersonmorais100% (1)

- Asset Strategy Development Procedure A2D SAP - 1496221Document11 pagesAsset Strategy Development Procedure A2D SAP - 1496221Alejandro Bartolo YañezNo ratings yet

- Lecture1 1 IntegrityDocument23 pagesLecture1 1 IntegrityNoon VichitraNo ratings yet

- Element 2 - Analysis and Examination of Strategy ExecutionDocument23 pagesElement 2 - Analysis and Examination of Strategy ExecutionCatherine Joy O. AbingNo ratings yet

- ISO55000 Series Overview Slides NowDocument8 pagesISO55000 Series Overview Slides Nownasrulsalman9883No ratings yet

- Asset Management FrameworkDocument8 pagesAsset Management FrameworkSreekanthMylavarapuNo ratings yet

- 2010 Guidelines For The Application of Asset ManagementDocument16 pages2010 Guidelines For The Application of Asset ManagementAdnanTajuddinBasyair100% (1)

- AMP Training Presentation v2 24.01.03Document83 pagesAMP Training Presentation v2 24.01.03ਸੁਖਦੀਪ ਸਿੰਘNo ratings yet

- Chapter SevenDocument34 pagesChapter SevenzeyneblibenNo ratings yet

- Treasury Review Audit ReportDocument118 pagesTreasury Review Audit ReportAstalapulos ListestosNo ratings yet

- QMS Processes Samples Pages From ISO 9001 - 2015 A Complete Guide To Quality Management SystemsDocument2 pagesQMS Processes Samples Pages From ISO 9001 - 2015 A Complete Guide To Quality Management SystemsSystem DesignerNo ratings yet

- RD&D, Technology February 1999: A Proposed Strategy For Quality in Life-Cycle Asset ManagementDocument31 pagesRD&D, Technology February 1999: A Proposed Strategy For Quality in Life-Cycle Asset ManagementSusanoo12No ratings yet

- Asset Management GuidelinesDocument9 pagesAsset Management GuidelinesAndres RuizNo ratings yet

- IBM AS400 Security ProceduresDocument46 pagesIBM AS400 Security ProcedurescharlesbluesNo ratings yet

- PHYSICAL - ASSETS Procedures PDFDocument25 pagesPHYSICAL - ASSETS Procedures PDFCecilia Baloy IsubalNo ratings yet

- SSM Assetqualityreviewmanual201806 enDocument295 pagesSSM Assetqualityreviewmanual201806 ensubmarinoaguadulceNo ratings yet

- Chapter 5. Measure PhaseDocument111 pagesChapter 5. Measure PhaseLina Margarita Buelvas GutierrezNo ratings yet

- Appendix D - Asset Management PolicyDocument11 pagesAppendix D - Asset Management PolicyAnggoro Antono100% (1)

- M&E USAID NutricionDocument106 pagesM&E USAID NutricionXiomara SanchezNo ratings yet

- Integrity Communication Pack Aug20Document9 pagesIntegrity Communication Pack Aug20Yury FedichkinNo ratings yet

- Inventory Control System PDFDocument2 pagesInventory Control System PDFAalif IbràhimNo ratings yet

- Gantt Chart TableDocument1 pageGantt Chart TableHope DlaminiNo ratings yet

- PMBOK - Estimate ResourcesDocument8 pagesPMBOK - Estimate ResourcesLuciaNo ratings yet

- 08 AUDIT - CISA - Certified Information Systems Auditor Ch2-3Document26 pages08 AUDIT - CISA - Certified Information Systems Auditor Ch2-3korncheeseNo ratings yet

- Xpert QA Guide 2019Document92 pagesXpert QA Guide 2019falberto.gutierrezNo ratings yet

- Maturity Index TemplateDocument16 pagesMaturity Index Templateniteen.krNo ratings yet

- Internal Audit Report - 2022Document2 pagesInternal Audit Report - 2022Camila AlmeidaNo ratings yet

- AUDITING Internal Controls - 2024Document30 pagesAUDITING Internal Controls - 2024lonaarbillyNo ratings yet

- Presentation On ResearchPaperDocument8 pagesPresentation On ResearchPaperKhurshed AlamNo ratings yet

- Confiabilidad Del EquipoDocument47 pagesConfiabilidad Del EquipoAngello Ever Morales ArrietaNo ratings yet

- Airport InfrastructureDocument23 pagesAirport Infrastructurezaheeruddin_mohdNo ratings yet

- Mock 1 Ans Isca Nov 2019Document8 pagesMock 1 Ans Isca Nov 2019Navratan BhatiNo ratings yet

- ISO 9001:2015 Awareness Trainng Program: © ABI ConstructionDocument52 pagesISO 9001:2015 Awareness Trainng Program: © ABI ConstructionJoshuaNo ratings yet

- MethodologyDocument17 pagesMethodologyJack Sparrow100% (1)

- STEP - Basic SHE Training Module - SHE MS AssignmentDocument6 pagesSTEP - Basic SHE Training Module - SHE MS AssignmentFahmi Arief HakimNo ratings yet

- Audit ProcessDocument43 pagesAudit Processpiyush singh100% (2)

- A Strategy For Implementing Asset Management Principles CarlDocument34 pagesA Strategy For Implementing Asset Management Principles CarlCarl KirsteinNo ratings yet

- Mid Term ItsmDocument11 pagesMid Term ItsmRohan TawarNo ratings yet

- OPMAN-Part-2 - Joel Factoriza Misa - ID 21226220 - ETEEAP BSBADocument20 pagesOPMAN-Part-2 - Joel Factoriza Misa - ID 21226220 - ETEEAP BSBAOnice BallelosNo ratings yet

- PMP Mind Map Diagram ITTOsDocument45 pagesPMP Mind Map Diagram ITTOsVenkatraman PoreddyNo ratings yet

- Sistem Manajemen Mutu - 1Document17 pagesSistem Manajemen Mutu - 1VITRIA NOVITA SARI100% (1)

- Asset Policies 301007Document470 pagesAsset Policies 301007Senthil KumarNo ratings yet

- 3-DPA Awareness ProgramDocument27 pages3-DPA Awareness ProgramVishal MaliNo ratings yet

- Asset ManagementDocument25 pagesAsset ManagementmanojkbNo ratings yet

- Project Cost Management: 1 Plan Cost MGMT 2 Estimate CostDocument23 pagesProject Cost Management: 1 Plan Cost MGMT 2 Estimate CostsahilkaushikNo ratings yet

- CDP04 22-1-18 Recapitalisation Planning-Rev181023Document44 pagesCDP04 22-1-18 Recapitalisation Planning-Rev181023Sumesh AroliNo ratings yet

- Chapter 3 - Audit Planning Startegy and Execution - QRDocument9 pagesChapter 3 - Audit Planning Startegy and Execution - QRAnkita SharmaNo ratings yet

- Quality Assurance Plan For The Data Acquisition and Management System For Monitoring The Fuel Oil Spill at The Sandia National Laboratories Installation in Livermore, CaliforniaDocument40 pagesQuality Assurance Plan For The Data Acquisition and Management System For Monitoring The Fuel Oil Spill at The Sandia National Laboratories Installation in Livermore, CaliforniaMuhammad OsamaNo ratings yet

- Sia Kelompok 10Document16 pagesSia Kelompok 10Desy manurungNo ratings yet

- Internal Quality Assurance: Assesment Process & Practice MethodDocument11 pagesInternal Quality Assurance: Assesment Process & Practice MethodWaiyan Htet AungNo ratings yet

- ACCT2522 Notes Week 1Document8 pagesACCT2522 Notes Week 1Kevin NguyenNo ratings yet

- FIN005 PowerpointDocument43 pagesFIN005 PowerpointvaibhavacademicmantraNo ratings yet

- Establishing A CGMP Laboratory Audit System: A Practical GuideFrom EverandEstablishing A CGMP Laboratory Audit System: A Practical GuideNo ratings yet

- Public Office, Private Interests: Accountability through Income and Asset DisclosureFrom EverandPublic Office, Private Interests: Accountability through Income and Asset DisclosureNo ratings yet

- 11 MIF2nd S1B Ws09.2a Set1 eDocument6 pages11 MIF2nd S1B Ws09.2a Set1 eGenesis Norbert AlconabaNo ratings yet

- 07 MIF2nd S1B ws09.1C Set1 eDocument6 pages07 MIF2nd S1B ws09.1C Set1 eGenesis Norbert AlconabaNo ratings yet

- 03 MIF2nd S1B Ws09.1a Set1 eDocument3 pages03 MIF2nd S1B Ws09.1a Set1 eGenesis Norbert AlconabaNo ratings yet

- 06 MIF2nd S1B ws09.1B Set2 eDocument2 pages06 MIF2nd S1B ws09.1B Set2 eGenesis Norbert AlconabaNo ratings yet

- 05 MIF2nd S1B ws09.1B Set1 eDocument4 pages05 MIF2nd S1B ws09.1B Set1 eGenesis Norbert AlconabaNo ratings yet

- HW 5 - 5.4 Total Surface Areas of Right Prisms - Answers PDFDocument2 pagesHW 5 - 5.4 Total Surface Areas of Right Prisms - Answers PDFGenesis Norbert AlconabaNo ratings yet

- 04 MIF2nd S1B Ws09.1a Set2 eDocument3 pages04 MIF2nd S1B Ws09.1a Set2 eGenesis Norbert AlconabaNo ratings yet

- Analysis and Approaches 1 Page Formula SheetDocument1 pageAnalysis and Approaches 1 Page Formula SheetGenesis Norbert Alconaba100% (1)

- 05 MIF2nd S1B ws09.1B Set1 eDocument4 pages05 MIF2nd S1B ws09.1B Set1 eGenesis Norbert AlconabaNo ratings yet

- Level 3 Checklist - Are You Able To Achieve It? Math Vocab CornerDocument2 pagesLevel 3 Checklist - Are You Able To Achieve It? Math Vocab CornerGenesis Norbert AlconabaNo ratings yet

- Figure 4: Projected Operations and Maintenance Expenditure: 5.3.3 Summary of Future Maintenance ExpendituresDocument4 pagesFigure 4: Projected Operations and Maintenance Expenditure: 5.3.3 Summary of Future Maintenance ExpendituresGenesis Norbert AlconabaNo ratings yet

- FindingsDocument2 pagesFindingsGenesis Norbert AlconabaNo ratings yet

- Lecture 7Document26 pagesLecture 7Genesis Norbert AlconabaNo ratings yet

- MSC Subjects by EEDocument1 pageMSC Subjects by EEGenesis Norbert AlconabaNo ratings yet

- Five Steps For Successful Realization of Asset Value: Case Study: Singapore Rts InfrastructureDocument6 pagesFive Steps For Successful Realization of Asset Value: Case Study: Singapore Rts InfrastructureGenesis Norbert AlconabaNo ratings yet

- MECH3427 Design Project 2017Document8 pagesMECH3427 Design Project 2017Genesis Norbert AlconabaNo ratings yet

- Trip Advisor - Food in JAPANDocument12 pagesTrip Advisor - Food in JAPANGenesis Norbert AlconabaNo ratings yet

- Admission Requirements For The Building Services DisciplineDocument18 pagesAdmission Requirements For The Building Services DisciplineGenesis Norbert AlconabaNo ratings yet

- How The COVID-19 Epidemic Changed Working Conditions in FranceDocument4 pagesHow The COVID-19 Epidemic Changed Working Conditions in FranceRenata JapurNo ratings yet