Professional Documents

Culture Documents

Industrial Estate: Strong Sales To Drive Sector's Rerating

Industrial Estate: Strong Sales To Drive Sector's Rerating

Uploaded by

Ramdha Dien AzkaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Industrial Estate: Strong Sales To Drive Sector's Rerating

Industrial Estate: Strong Sales To Drive Sector's Rerating

Uploaded by

Ramdha Dien AzkaCopyright:

Available Formats

17 January 2018

Industrial Estate

Sector Update

Sector Index Performance (JAKPROP)

3M 6M 12M

Strong sales to drive sector’s rerating

Absolute (%) 4.4 6.8 -0.6 Industrial estate developers mostly meet FY17 sales target.

Relative to JCI (%) -4.8 -4.4 -22.9

Industry-wide estate sales grew 35% in 9M17, according to Colliers.

52w high/low (Rp) 532-471

Demand still dominated from auto, consumer & logistic sector.

Equity | Indonesia | Property

120

Attractive valuation with steep NAV discount of 72-75%.

110 Strong sales achievement in FY17. BEST records total sales of 42ha (+34%

yoy), exceeding our/company’s FY17 target of 30-40ha, which is company’s best

100

performance since 2014. DMAS booked total industrial sales of 59.1ha (+12% yoy)

in FY17, which accounts for 102% of our/company’s FY17 forecast of 60ha. In the

90

other hand, SSIA booked total 2.1ha (-80% yoy) industrial sales in FY17, which

accounts for 42% of our/company’s target of 5ha. However, SSIA is the only

80

5-Dec 5-Mar 5-Jun 5-Sep 5-Dec industrial estate which record ASP appreciation with ASP growth of 22% yoy. Going

JCI JAKPROP Index

forward we forecast sector conservative ASP appreciation of 5-8% given FY18-FY19

ex Chart

political year (vs. FY12-F17 CAGR: 10%).

Source: Bloomberg

Industry’s sales recovery as of 9M17 (+35% yoy). According to Colliers,

land sales in industrial estates in the Greater Jakarta area, have reached 144ha in

9M17 (+35%), cumulating to 82% of FY16 sales of 175ha. The overall land sales

in 9M17 were mainly came from food-related industries (29%) with 42.4ha,

automotive-related industries (25%) with 36.7ha, and warehouse or logistic

purposes (7%) with 9.4ha. In quarterly basis, the industry booked a total sales of

only 22.7ha (-62% yoy, -64 qoq). However, in 4Q17 companies under our

coverage, namely DMAS and BEST managed to record substantial land sales of

20ha and 19.3ha, which brings industry FY17F sales at least to 183ha, exceeding

FY16 land sales of 175ha by 4%.

Inquiries still originated from Auto, Consumer and Logistic. Based on our

channel check, companies under our coverage have total inquiries of 207-237ha for

FY18F. The inquiries are still dominated by companies from automotive sector,

followed by consumer and logistic sector. Given adequate amount of inquiry, we

forecast modest marketing sales growth of 8-10% for FY18.

Attractive Valuation. We are bullish on the sector with Buy ratings on three

company under our coverage, namely BEST, DMAS and SSIA. We believe the

stocks are attractively valued following its FY17 good performance and stocks

recent de ratings since 9M17 (8-22%), which makes the stocks trade at steep

discount of 72-75% to our NAV estimates. We continue to like DMAS due to its

largest unscattered landbank (986ha), better residential/commercial facilities and

has no debt while BEST (750ha) is located closest to Jakarta and enjoys higher

prices and margins - both have most resilient earnings in the sector. SSIA

(974ha) has strongest recovery outlook from the construction of Subang-

Patimban toll road with total contract worth Rp1-1.5tn. We maintain our Buy

rating for BEST with TP of Rp380, DMAS with TP of Rp270 and SSIA with TP of

Rp825.

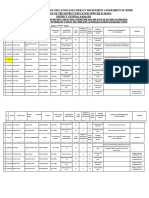

17F 18F 17F 18F 18F 18F

Price TP

Stock Ticker Rating P/E P/E P/B P/B ROA ROE

(Rp) (Rp) (x) (x) (x) (x) (%) (%)

Joey Faustian

Bekasi Fajar BEST IJ BUY 276 380 6.1 4.8 0.7 0.6 9.1 13.7

PT Indo Premier Sekuritas

Puradelta DMAS IJ BUY 165 270 11.4 8.8 1.1 1.0 11.2 11.8

Joey.faustian@ipc.co.id

Surya Semesta SSIA IJ BUY 500 825 2.3* 31.8 0.5 0.5 1.2 2.0

+62 21 5793 1169

*One off due to Cipali toll-road divestment

Source: IndoPremier Note: Share prices as of closing 17 January 2018

Refer to Important disclosures in the last page of this report

Sector Update - Property

Fig. 1 : FY17 sales achievement % of FY17 target Fig. 2 : SSIA’s ASP appreciate by +22% yoy

70 105% 120% 3.00

98.5%

60 100% 2.50

50

80% 2.00

40

Rp Mn

Rp bn

60% 1.50

30 42%

40% 1.00

20

20% 0.50

10

0 0% 0.00

DMAS BEST SSIA 2012 2013 2014 2015 2016 2017

FY17 Sales % FY17 Target BEST DMAS SSIA

Source : Colliers, IndoPremier Source : Company, IndoPremier

Fig. 3 : We forecast 13% yoy growth in FY17F Fig. 4 : BEST & DMAS’ sales in 4Q17F accounts for 39ha

1400 200% 200

1200 180

150%

160

1000

100% 140

hectares

800

120

hectares

50%

600 100

0%

400 80

200 -50% 60

40

0 -100%

20

0

Marketing Sales Growth

Source : Colliers, IndoPremier Source : Source : Colliers, IndoPremier

Fig. 5 : 9M17 sales is still dominated by Auto, F&B and Logistic

sector

Automotive

23.9% 25% F&B

Logistic/Warehouse

Chemical

4% Building Material

3% Metal

5%

Energy

29%

3% 7% Other

Source : Colliers, IndoPremier

Refer to Important disclosures in the last page of this report 2

Head Office

PT INDO PREMIER SEKURITAS

Wisma GKBI 7/F Suite 718

Jl. Jend. Sudirman No.28

Jakarta 10210 - Indonesia

p +62.21.5793.1168

f +62.21.5793.1167

INVESTMENT RATINGS

BUY : Expected total return of 10% or more within a 12-month period

HOLD : Expected total return between -10% and 10% within a 12-month period

SELL : Expected total return of -10% or worse within a 12-month period

ANALYSTS CERTIFICATION.

The views expressed in this research report accurately reflect the analyst;s personal views about any and all of the subject securities or issuers; and no part of the

research analyst's compensation was, is, or will be, directly or indirectly, related to the specific recommendations or views expressed in the report.

DISCLAIMERS

This reserch is based on information obtained from sources believed to be reliable, but we do not make any representation or warraty nor accept any

responsibility or liability as to its accruracy, completeness or correctness. Opinions expressed are subject to change without notice. This document is prepared for

general circulation. Any recommendations contained in this document does not have regard to the specific investment objectives, finacial situation and the

particular needs of any specific addressee. This document is not and should not be construed as an offer or a solicitation of an offer to purchase or subscribe or

sell any securities. PT. Indo Premier Sekuritas or its affiliates may seek or will seek investment banking or other business relationships with the companies in this

report.

You might also like

- Smerdon's ScandinavianDocument672 pagesSmerdon's Scandinavianprimos saNo ratings yet

- 2009 Courier Autumn WinterDocument17 pages2009 Courier Autumn WinterJoriwingNo ratings yet

- Danareksa Equity Research Industrial Estate 24 May 2021 Reiterate-3Document3 pagesDanareksa Equity Research Industrial Estate 24 May 2021 Reiterate-3botoy26No ratings yet

- Paint - Sector Update, Initiating Coverage On AsianPaints Buy, Berger Paints Hold, Kansai Nerolac BUY PDFDocument92 pagesPaint - Sector Update, Initiating Coverage On AsianPaints Buy, Berger Paints Hold, Kansai Nerolac BUY PDFSahil GargNo ratings yet

- IDirect AmaraRaja CoUpdate Feb21Document6 pagesIDirect AmaraRaja CoUpdate Feb21Romelu MartialNo ratings yet

- Goodyear India 19-03-2021 IciciDocument6 pagesGoodyear India 19-03-2021 IcicianjugaduNo ratings yet

- Sun Pharma: Promising Specialty PipelineDocument8 pagesSun Pharma: Promising Specialty PipelineDinesh ChoudharyNo ratings yet

- 28162192019882apex IC Report PDFDocument9 pages28162192019882apex IC Report PDFAshutosh GuptaNo ratings yet

- Bumi Serpong Damai: Solid Marketing Sales AchievementDocument5 pagesBumi Serpong Damai: Solid Marketing Sales Achievementowen.rijantoNo ratings yet

- Unaudited Financial Results Half-Year Ended September 30, 2017Document14 pagesUnaudited Financial Results Half-Year Ended September 30, 2017Puja BhallaNo ratings yet

- 1pil4 PDFDocument14 pages1pil4 PDFPuja BhallaNo ratings yet

- AIA Engineering LTD: Q3FY18 Result UpdateDocument6 pagesAIA Engineering LTD: Q3FY18 Result Updatesaran21No ratings yet

- Action Construction EquipmentDocument8 pagesAction Construction EquipmentP.B VeeraraghavuluNo ratings yet

- CD Equisearchpv PVT LTD: Quarterly HighlightsDocument12 pagesCD Equisearchpv PVT LTD: Quarterly HighlightsanjugaduNo ratings yet

- 354466122018909bharat Forge LTD Q4FY18 Result Updates - SignedDocument5 pages354466122018909bharat Forge LTD Q4FY18 Result Updates - Signedakshara pradeepNo ratings yet

- Marico (MARLIM) : Soft Copra Prices To Drive Earnings GrowthDocument10 pagesMarico (MARLIM) : Soft Copra Prices To Drive Earnings GrowthAshokNo ratings yet

- Escorts: All-Round Optimism Bolsters Constructive ViewDocument10 pagesEscorts: All-Round Optimism Bolsters Constructive ViewasdhahdahsdjhNo ratings yet

- Motherson Sumi: Impressive Margin Profile, Sustenance Holds KeyDocument8 pagesMotherson Sumi: Impressive Margin Profile, Sustenance Holds KeyAnurag MishraNo ratings yet

- NITI-RMI India Report Web-V2Document7 pagesNITI-RMI India Report Web-V2sgarg79No ratings yet

- Initiating Coverage: Rvind TDDocument19 pagesInitiating Coverage: Rvind TDV KeshavdevNo ratings yet

- Consumer Durables - Sector Update - 171121 - OthersDocument12 pagesConsumer Durables - Sector Update - 171121 - OthersHardik ShahNo ratings yet

- Berger Paints India: Colourful Growth StoryDocument21 pagesBerger Paints India: Colourful Growth StoryVishnu KanthNo ratings yet

- Blue Dart Express (NOT RATED) - BOBCAPS SecDocument3 pagesBlue Dart Express (NOT RATED) - BOBCAPS SecdarshanmaldeNo ratings yet

- Aegis Logistics: Volumes Inching Up Capacity Expansion Augurs Well BuyDocument6 pagesAegis Logistics: Volumes Inching Up Capacity Expansion Augurs Well BuynnsriniNo ratings yet

- Pidilite Industries (PIDIND) : High Raw Material Prices Hit MarginDocument10 pagesPidilite Industries (PIDIND) : High Raw Material Prices Hit MarginSiddhant SinghNo ratings yet

- Sadbhav Engineering: Driving in The Right LaneDocument5 pagesSadbhav Engineering: Driving in The Right LanesuprabhattNo ratings yet

- Aarti Industries - 1QFY19 RU - KR ChokseyDocument7 pagesAarti Industries - 1QFY19 RU - KR ChokseydarshanmaldeNo ratings yet

- Amara Raja Batteries: Telecoms Business Still Weak Maintaining A SellDocument6 pagesAmara Raja Batteries: Telecoms Business Still Weak Maintaining A Sellrishab agarwalNo ratings yet

- IDirect IEX Q4FY21Document5 pagesIDirect IEX Q4FY21SushilNo ratings yet

- Genus Power IIFL ICDocument17 pagesGenus Power IIFL ICarif420_999No ratings yet

- Telecommunication Services - Etihad Etisalat - 7020Document2 pagesTelecommunication Services - Etihad Etisalat - 7020AliNo ratings yet

- Spark Pidilite Industries - Update - Mar2021Document28 pagesSpark Pidilite Industries - Update - Mar2021Akshaya SrihariNo ratings yet

- IDirect RallisInd CoUpdate Apr17Document4 pagesIDirect RallisInd CoUpdate Apr17saran21No ratings yet

- Research Report Maruti Suzuki Ltd.Document8 pagesResearch Report Maruti Suzuki Ltd.Harshavardhan pasupuletiNo ratings yet

- Pidilite 3R Aug11 2022Document8 pagesPidilite 3R Aug11 2022Arka MitraNo ratings yet

- BEML - Elara Securities - 3 October 2019Document10 pagesBEML - Elara Securities - 3 October 2019darshanmadeNo ratings yet

- Supreme Industries: Margin Surprises PositivelyDocument12 pagesSupreme Industries: Margin Surprises Positivelysaran21No ratings yet

- Arvind LTDDocument10 pagesArvind LTDNitesh KumarNo ratings yet

- SMI OCBC Report (May17)Document4 pagesSMI OCBC Report (May17)Douglas LimNo ratings yet

- IDirect UnitedSpirits Q4FY21Document6 pagesIDirect UnitedSpirits Q4FY21Ranjith ChackoNo ratings yet

- Neuland Labs - Initiating CoverageDocument31 pagesNeuland Labs - Initiating CoveragedarshanmadeNo ratings yet

- IDirect AartiInds Q4FY21Document9 pagesIDirect AartiInds Q4FY21AkchikaNo ratings yet

- ICICI Direct - Astec Lifesciences - Q3FY22Document7 pagesICICI Direct - Astec Lifesciences - Q3FY22Puneet367No ratings yet

- Cox & Kings (CNKLIM) : Weak Performance Debt Concerns AddressedDocument9 pagesCox & Kings (CNKLIM) : Weak Performance Debt Concerns Addressedsaran21No ratings yet

- ICICI Securities Godrej PropertiesDocument14 pagesICICI Securities Godrej PropertiessaurabhNo ratings yet

- Mahindra & Mahindra LTD.: Key Result Highlights - Q4FY17Document6 pagesMahindra & Mahindra LTD.: Key Result Highlights - Q4FY17anjugaduNo ratings yet

- Amber Enterprises (India) Ltd. (Aeil) : Aeil'S Rac Sales Volumes Rose by A Robust 127% Yoy To 0.4 MN UnitsDocument4 pagesAmber Enterprises (India) Ltd. (Aeil) : Aeil'S Rac Sales Volumes Rose by A Robust 127% Yoy To 0.4 MN UnitsdarshanmadeNo ratings yet

- Jyothy Laboratories LTD Accumulate: Retail Equity ResearchDocument5 pagesJyothy Laboratories LTD Accumulate: Retail Equity Researchkishor_warthi85No ratings yet

- Bharat Forge Geojit Research May 17Document5 pagesBharat Forge Geojit Research May 17veguruprasadNo ratings yet

- Ciptadana Sekuritas ASRI - Growing Recurring IncomeDocument6 pagesCiptadana Sekuritas ASRI - Growing Recurring Incomebudi handokoNo ratings yet

- IDirect MahindraLog ICDocument28 pagesIDirect MahindraLog ICAshutosh GuptaNo ratings yet

- AR Equity PDFDocument6 pagesAR Equity PDFnani reddyNo ratings yet

- India Infoline Limited (INDINF) : Next Delta Missing For Steep GrowthDocument24 pagesIndia Infoline Limited (INDINF) : Next Delta Missing For Steep Growthanu nitiNo ratings yet

- ECM+Report Q3 +2023Document8 pagesECM+Report Q3 +2023Jeffery AlvarezNo ratings yet

- IEA Report 13th FebruaryDocument26 pagesIEA Report 13th FebruarynarnoliaNo ratings yet

- Arvind LTD - Initiating Coverage - Dalal and Broacha - BUYDocument19 pagesArvind LTD - Initiating Coverage - Dalal and Broacha - BUYManoj KumarNo ratings yet

- Sector Updates: Air Conditioner Sector Institutional Research Report - HDFC SecuritiesDocument6 pagesSector Updates: Air Conditioner Sector Institutional Research Report - HDFC SecuritiesHDFC SecuritiesNo ratings yet

- Allcargo Global Logistics Motilal Oswal Religare PLDocument27 pagesAllcargo Global Logistics Motilal Oswal Religare PLarif420_999No ratings yet

- Jyothy Laboratories LTDDocument5 pagesJyothy Laboratories LTDViju K GNo ratings yet

- Cement Sector Report - 201204Document44 pagesCement Sector Report - 201204Chayan JainNo ratings yet

- EIB Group Survey on Investment and Investment Finance 2020: EU overviewFrom EverandEIB Group Survey on Investment and Investment Finance 2020: EU overviewNo ratings yet

- 067Document28 pages067Nouman AsgharNo ratings yet

- Motives For Adult Participation in Physical Activity: Type of Activity, Age, and GenderDocument12 pagesMotives For Adult Participation in Physical Activity: Type of Activity, Age, and GenderHafizAceNo ratings yet

- Phylogeny of The NymphalidaeDocument21 pagesPhylogeny of The NymphalidaeDaniela Agudelo VelasquezNo ratings yet

- Veterinary MicrobiologyDocument53 pagesVeterinary MicrobiologyLicinio Rocha100% (1)

- Certificate of Recognition - 2nd QuarterDocument3 pagesCertificate of Recognition - 2nd QuarterJessy EbitNo ratings yet

- MCQ Surgery 1Document6 pagesMCQ Surgery 1Abdallah GamalNo ratings yet

- Service Manual FSHTV-Z60Document30 pagesService Manual FSHTV-Z60Armamndo RamirezNo ratings yet

- Unwto Tourism Highlights: 2011 EditionDocument12 pagesUnwto Tourism Highlights: 2011 EditionTheBlackD StelsNo ratings yet

- Avance Reciente en El Recubrimiento Comestible y Su Efecto en La Calidad de Las Frutas Frescas - Recién CortadasDocument15 pagesAvance Reciente en El Recubrimiento Comestible y Su Efecto en La Calidad de Las Frutas Frescas - Recién CortadasJHON FABER FORERO BARCONo ratings yet

- Fluke 123 User ManualDocument86 pagesFluke 123 User ManualRobNo ratings yet

- Defining Engagement Success - Architecture AlignedDocument28 pagesDefining Engagement Success - Architecture AlignedAshish TiwariNo ratings yet

- Zero Variance-Problem StatementDocument4 pagesZero Variance-Problem StatementR N Guru50% (2)

- Valerie Rosa Resume 3Document2 pagesValerie Rosa Resume 3api-715391361No ratings yet

- NIV Fs 9108147 e 1911 1 PDFDocument4 pagesNIV Fs 9108147 e 1911 1 PDFliuchenshitaoNo ratings yet

- The Way of Chanting and Knowing KrsnaDocument16 pagesThe Way of Chanting and Knowing Krsnamaggie_cbdNo ratings yet

- Physics Exam ss2 2nd TermDocument14 pagesPhysics Exam ss2 2nd TermchrizyboyziNo ratings yet

- DC ReskiDocument27 pagesDC ReskiHardiyanti HermanNo ratings yet

- School Education and Literacy Department Government of Sindh Office of The District Education Officer (E, S&H.S) District Central KarachiDocument15 pagesSchool Education and Literacy Department Government of Sindh Office of The District Education Officer (E, S&H.S) District Central KarachiNaya PakistanNo ratings yet

- Neurotransmitters: Intellectual FunctionDocument3 pagesNeurotransmitters: Intellectual FunctionMarissa AsimNo ratings yet

- Nalpeiron Software Licensing Models GuideDocument24 pagesNalpeiron Software Licensing Models GuideAyman FawzyNo ratings yet

- 111 Veterinary Gross Anatomy - I (Osteology, Arthrology & Biomechanics)Document161 pages111 Veterinary Gross Anatomy - I (Osteology, Arthrology & Biomechanics)Vaidika YadavNo ratings yet

- Prosec Ii+ ManualDocument1 pageProsec Ii+ ManualBachtiar WidyantoroNo ratings yet

- 13500-0004 BiladylTriladyl Es 120814Document2 pages13500-0004 BiladylTriladyl Es 120814Fabio FerreiraNo ratings yet

- Linde Truck Expert Service and Operational Manuals Wiring Diagrams EtcDocument627 pagesLinde Truck Expert Service and Operational Manuals Wiring Diagrams EtcSoftall Nelu79% (14)

- Smart Cabin For Educational Complex: Prerana More, Vaishnavi Chaudhari & Guided By: Prof. Aarti PawarDocument4 pagesSmart Cabin For Educational Complex: Prerana More, Vaishnavi Chaudhari & Guided By: Prof. Aarti PawarPreranaNo ratings yet

- Course - Design - Policy - 2018 - TrainingDocument23 pagesCourse - Design - Policy - 2018 - TraininggarimagaurNo ratings yet

- DN Diametre Nominal-NPS Size ChartDocument5 pagesDN Diametre Nominal-NPS Size ChartSankar CdmNo ratings yet