Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

18 viewsPaperwise Exemption ForHighQual

Paperwise Exemption ForHighQual

Uploaded by

Ayush Bisht1. Students pursuing a CS course are eligible for paper-wise exemptions based on higher qualifications like an LLB degree or completing the final course of the Institute of Cost Accountants of India.

2. An LLB degree with 50% or more marks provides an exemption for the Industrial, Labour & General Laws paper in the Executive Programme. No exemptions are available for professional programme papers based on an LLB.

3. Completing the ICAI final course provides exemptions for several papers in both the Executive and Professional programmes, including Cost and Management Accounting, Tax Laws and Practice, and Company Accounts and Auditing Practices.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- Solution Manual For Managerial Economics 12th Edition by ThomasDocument6 pagesSolution Manual For Managerial Economics 12th Edition by ThomasAkshat JainNo ratings yet

- Paper Wise Exemption On The Basis of Higher Qualifications: (As Per Revised Guidelines Effective From 1 December 2013)Document1 pagePaper Wise Exemption On The Basis of Higher Qualifications: (As Per Revised Guidelines Effective From 1 December 2013)Shubham MaheshwariNo ratings yet

- Paperwise Exemption Syllabus17-1Document2 pagesPaperwise Exemption Syllabus17-1ShubhamNo ratings yet

- Paperwise Exemption Syllabus17Document2 pagesPaperwise Exemption Syllabus17taufiquerahaman2073No ratings yet

- MA2 Syllabus and Study Guide - Sept 22-Aug 23Document13 pagesMA2 Syllabus and Study Guide - Sept 22-Aug 23amandaNo ratings yet

- BT - FBT Syllabus and Study Guide - Sept 22-Aug 23Document19 pagesBT - FBT Syllabus and Study Guide - Sept 22-Aug 23juliet nnajiNo ratings yet

- Employment Opportunities 05312024Document6 pagesEmployment Opportunities 05312024esmie distorNo ratings yet

- LME301Document8 pagesLME301Karim MohamedNo ratings yet

- LM300Document8 pagesLM300Sharma GokhoolNo ratings yet

- ExamDocument8 pagesExamsasasNo ratings yet

- Symbiosis: Exam HandbookDocument11 pagesSymbiosis: Exam HandbookKirpal rawatNo ratings yet

- LM302Document8 pagesLM302Win GungadinNo ratings yet

- Exam Handbook Ay 2022Document9 pagesExam Handbook Ay 2022Ritik AsatiNo ratings yet

- It Security 1 PDFDocument7 pagesIt Security 1 PDFPravin Bandale0% (1)

- MA2 - Sept 23-Aug 24 Syllabus and Study Guide - Final - V2 DatesDocument14 pagesMA2 - Sept 23-Aug 24 Syllabus and Study Guide - Final - V2 Datesgranbacha1017No ratings yet

- Paper-Wise Exemptions On Reciprocal Basis To Icsi and Icwai StudentsDocument1 pagePaper-Wise Exemptions On Reciprocal Basis To Icsi and Icwai StudentsKarandeep Singh TuliNo ratings yet

- 1357StudentsEnrolment NoticeDocument2 pages1357StudentsEnrolment NoticeSUBRATA GHOSHNo ratings yet

- MA - Fma Syllabus and Study Guide - Sept 22-Aug 23Document15 pagesMA - Fma Syllabus and Study Guide - Sept 22-Aug 23Như NguyễnNo ratings yet

- Exemption in Professional ExaminationsDocument3 pagesExemption in Professional ExaminationsRishabh RaiNo ratings yet

- BT Syllabus and Study Guide 2020-21 FINALDocument19 pagesBT Syllabus and Study Guide 2020-21 FINALarpit soniNo ratings yet

- BT Syllabus and Study Guide 2020-21 FINALDocument19 pagesBT Syllabus and Study Guide 2020-21 FINALBondhu GuptoNo ratings yet

- Revised OJT GuidelinesDocument23 pagesRevised OJT GuidelinesJet-jet JetNo ratings yet

- Certified TreasusuresDocument11 pagesCertified TreasusuresNAVDESH NIRWANNo ratings yet

- MA1 - Sept 23-Aug 24 Syllabus and Study Guide - FinalDocument11 pagesMA1 - Sept 23-Aug 24 Syllabus and Study Guide - Finalmoni123456No ratings yet

- Exam HandbookDocument16 pagesExam HandbookParveshNo ratings yet

- Management Accounting (MA/FMA) : Syllabus and Study GuideDocument15 pagesManagement Accounting (MA/FMA) : Syllabus and Study Guideduong duongNo ratings yet

- Proforma For Transfer of External Credits From ICAI (ICWAI) To MBA, MBAOL, MBAFM, MBAHR, MBAOM, MBAMM, MBFDocument5 pagesProforma For Transfer of External Credits From ICAI (ICWAI) To MBA, MBAOL, MBAFM, MBAHR, MBAOM, MBAMM, MBFwejiga3512No ratings yet

- BFSI COURSES-ASAP KeralaDocument12 pagesBFSI COURSES-ASAP KeralamdkdmdnNo ratings yet

- Ma2 SyllabusDocument14 pagesMa2 Syllabusazizrehman15951No ratings yet

- Diploma in Banking & FinanceDocument10 pagesDiploma in Banking & FinanceJayashree JothivelNo ratings yet

- Business and Technology (BT/FBT) : Syllabus and Study GuideDocument18 pagesBusiness and Technology (BT/FBT) : Syllabus and Study GuideMeril JahanNo ratings yet

- Stages To Become A Company Secretary: Icsi - EduDocument6 pagesStages To Become A Company Secretary: Icsi - EduRoshan SinghNo ratings yet

- WorkoutDocument3 pagesWorkoutayan.mishraxxxNo ratings yet

- ExamDocument12 pagesExamAvi SiNo ratings yet

- ADMISSION TO THE CS COURSE Is Open Throughout The Year. Examinations Are Held Twice A Year in June & DecemberDocument10 pagesADMISSION TO THE CS COURSE Is Open Throughout The Year. Examinations Are Held Twice A Year in June & DecemberSomprasad PoudelNo ratings yet

- Indian Institute of Banking & Finance: Diploma in Banking TechnologyDocument10 pagesIndian Institute of Banking & Finance: Diploma in Banking TechnologySahil SaabNo ratings yet

- MA2 Syllabus and Study Guide 2020-21 FINAL V2Document14 pagesMA2 Syllabus and Study Guide 2020-21 FINAL V2Mokoena RalesupiNo ratings yet

- 7087Students Enrolment Notice Session Dec 23-Feb 24Document2 pages7087Students Enrolment Notice Session Dec 23-Feb 24Md. REzwan RezwanNo ratings yet

- Guidelines and Policies For The School of I.T. and I.S. Ojt/Internship CoursesDocument18 pagesGuidelines and Policies For The School of I.T. and I.S. Ojt/Internship Coursesedwardgarcia333No ratings yet

- FAU Syllabus and Study Guide Dec 22-Jun 23Document12 pagesFAU Syllabus and Study Guide Dec 22-Jun 23Sai PhaniNo ratings yet

- 164 - 1008 - CAAP-Final - 20200718Document10 pages164 - 1008 - CAAP-Final - 20200718Anand FCANo ratings yet

- FA2 - Sept 23-Aug 24 Syllabus and Study Guide - Final - V2 DatesDocument19 pagesFA2 - Sept 23-Aug 24 Syllabus and Study Guide - Final - V2 Datesmyselftaha7No ratings yet

- 42 - DBF-Final - 18-01-23 - Final - WebsiteDocument19 pages42 - DBF-Final - 18-01-23 - Final - WebsiteDarshit ShrishrimalNo ratings yet

- Internship 1 Syllabus CCG502Document12 pagesInternship 1 Syllabus CCG502Mohseen InamdarNo ratings yet

- Utpras Primer TVET ProvidersDocument25 pagesUtpras Primer TVET ProvidersK-phrenCandariNo ratings yet

- Handbook - Curtin University MC COMMDocument11 pagesHandbook - Curtin University MC COMMJuni KasthakarNo ratings yet

- Data Entry Operator CTS2.0 NSQF 3 NewDocument26 pagesData Entry Operator CTS2.0 NSQF 3 Newsanjit singhNo ratings yet

- MA2 Syllabus and Study Guide 2020-21 FINALDocument14 pagesMA2 Syllabus and Study Guide 2020-21 FINALRumaisha BatoolNo ratings yet

- 4330001Document7 pages4330001JEET PARMARNo ratings yet

- Pamantasan NG Lungsod NG Muntinlupa College of Information Technology and Computer StudiesDocument9 pagesPamantasan NG Lungsod NG Muntinlupa College of Information Technology and Computer StudiesMat Perater MacoteNo ratings yet

- Risk in Financial ServicesDocument302 pagesRisk in Financial Servicessguru09No ratings yet

- Indian Institute of Banking & Finance: Certified Credit ProfessionalDocument10 pagesIndian Institute of Banking & Finance: Certified Credit ProfessionalsvijayswarupNo ratings yet

- BT - FBT Syllabusandstudyguide Sept23 Aug24Document21 pagesBT - FBT Syllabusandstudyguide Sept23 Aug24Sialkot CamNo ratings yet

- 74932bos Transition Scheme NsetDocument47 pages74932bos Transition Scheme NsetShubhamNo ratings yet

- Ma1 Syllabusandstudyguide Sept23 Aug24Document11 pagesMa1 Syllabusandstudyguide Sept23 Aug24Lulu BubuNo ratings yet

- Management Accounting (MA/FMA) : Syllabus and Study GuideDocument16 pagesManagement Accounting (MA/FMA) : Syllabus and Study GuideEnkhbold Damdinsuren100% (1)

- Indian Institute of Banking & Finance: Certified Banking Compliance Professional CourseDocument12 pagesIndian Institute of Banking & Finance: Certified Banking Compliance Professional CourseABHIJITH G KUMARNo ratings yet

- Advertisement For WebsiteDocument4 pagesAdvertisement For WebsiteKumar AnkitNo ratings yet

- TOGAF® 9.2 Level 2 Scenario Strategies Wonder Guide Volume 2 – 2023 Enhanced Edition: TOGAF® 9.2 Wonder Guide Series, #5From EverandTOGAF® 9.2 Level 2 Scenario Strategies Wonder Guide Volume 2 – 2023 Enhanced Edition: TOGAF® 9.2 Wonder Guide Series, #5No ratings yet

- Information Systems Auditing: The IS Audit Follow-up ProcessFrom EverandInformation Systems Auditing: The IS Audit Follow-up ProcessRating: 2 out of 5 stars2/5 (1)

- Assignment ON: SUB Mitted To: Submitted byDocument8 pagesAssignment ON: SUB Mitted To: Submitted byAyush BishtNo ratings yet

- Dr. Anil MishraDocument1 pageDr. Anil MishraAyush BishtNo ratings yet

- Ayush WCM AssignmentDocument14 pagesAyush WCM AssignmentAyush BishtNo ratings yet

- Petroleum Planning & Analysis CellDocument1 pagePetroleum Planning & Analysis CellAyush BishtNo ratings yet

- Projected Annual Expenses: Sr. NO ParticularsDocument3 pagesProjected Annual Expenses: Sr. NO ParticularsAyush BishtNo ratings yet

- Initial PagesDocument2 pagesInitial PagesAyush BishtNo ratings yet

- Code of Conduct For Board Members & SMPDocument10 pagesCode of Conduct For Board Members & SMPAyush BishtNo ratings yet

- Marketing Management by Kotler and Keller (12Th Ed.) Lecture Notes Chapter17. Designing and Managing Integrated Marketing CommunicationsDocument6 pagesMarketing Management by Kotler and Keller (12Th Ed.) Lecture Notes Chapter17. Designing and Managing Integrated Marketing CommunicationsAyush BishtNo ratings yet

- Date Axis Closing Price Daily Return Date NIFTY 50 Daily Return DateDocument4 pagesDate Axis Closing Price Daily Return Date NIFTY 50 Daily Return DateAyush BishtNo ratings yet

- Assignment ON: Acknowledgement I Would Like To Express My Special Thanks of Gratitude To My Professor Dr. SanjayDocument7 pagesAssignment ON: Acknowledgement I Would Like To Express My Special Thanks of Gratitude To My Professor Dr. SanjayAyush BishtNo ratings yet

- Assignment ON: Acknowledgement I Would Like To Express My Special Thanks of Gratitude To My Professor Dr. SanjayDocument7 pagesAssignment ON: Acknowledgement I Would Like To Express My Special Thanks of Gratitude To My Professor Dr. SanjayAyush BishtNo ratings yet

- Curriculum Vitae: Ayush BishtDocument3 pagesCurriculum Vitae: Ayush BishtAyush BishtNo ratings yet

- Department of Business AdministrationDocument31 pagesDepartment of Business AdministrationAyush BishtNo ratings yet

- Business Plan SynopsisDocument5 pagesBusiness Plan SynopsisAyush Bisht100% (1)

- Corporate Evaluation and Strategic ManagementDocument10 pagesCorporate Evaluation and Strategic ManagementAyush BishtNo ratings yet

- Assignment ON: SUB Mitted To: Submitted byDocument12 pagesAssignment ON: SUB Mitted To: Submitted byAyush BishtNo ratings yet

- Steps To Download and Print E-AadhaarDocument1 pageSteps To Download and Print E-AadhaarAyush BishtNo ratings yet

- Financial Plan: Sales ForecastDocument8 pagesFinancial Plan: Sales ForecastAyush BishtNo ratings yet

- 14 Investment Vehicles PDFDocument27 pages14 Investment Vehicles PDFAyush BishtNo ratings yet

- Certificate For Ayush Bisht For "Quiz On Conservation of Env... "Document1 pageCertificate For Ayush Bisht For "Quiz On Conservation of Env... "Ayush BishtNo ratings yet

- Partnership CompleteDocument6 pagesPartnership CompleteJoshua TorillaNo ratings yet

- LCCI L3 Accounting ASE20104 Dec 2016Document24 pagesLCCI L3 Accounting ASE20104 Dec 2016chee pin wong50% (2)

- Final APA Format - EditedDocument44 pagesFinal APA Format - EditedJasmin NgNo ratings yet

- 7 Document Flowchart - From RomneyDocument31 pages7 Document Flowchart - From RomneySefi RifkianaNo ratings yet

- College of Accountancy Final Examination - Accounting For Business Combination I. Theories. Write The Letter of The Correct AnswerDocument11 pagesCollege of Accountancy Final Examination - Accounting For Business Combination I. Theories. Write The Letter of The Correct AnswerLouisse OrtigozaNo ratings yet

- Mercury Athletic Footwear Answer Key FinalDocument41 pagesMercury Athletic Footwear Answer Key FinalFatima ToapantaNo ratings yet

- PAS 8 - Accounting Policies, Changes in Accounting Estimates and ErrorsDocument11 pagesPAS 8 - Accounting Policies, Changes in Accounting Estimates and ErrorsKrizzia DizonNo ratings yet

- Basic Financial Accounting HND NigeriaDocument190 pagesBasic Financial Accounting HND NigeriaWaqar AhmadNo ratings yet

- UG 3rdsem FnlScdl27032019Document8 pagesUG 3rdsem FnlScdl27032019KAZI RAHATNo ratings yet

- Adjusting EntriesDocument27 pagesAdjusting EntrieskaiginNo ratings yet

- UNIT 06 (Part 01) Financial Statements For Sole TradersDocument8 pagesUNIT 06 (Part 01) Financial Statements For Sole TradersSandunika DevasingheNo ratings yet

- Fundamentals of Accountancy, Business and Management 1: Module 2"Document68 pagesFundamentals of Accountancy, Business and Management 1: Module 2"Erica AlbaoNo ratings yet

- Nyman 2005Document17 pagesNyman 2005Jarrar TadNo ratings yet

- Account Based COPA - Simplification With Simple FinanceDocument18 pagesAccount Based COPA - Simplification With Simple Financebrcrao100% (1)

- Audit Procedure ReceivablesDocument3 pagesAudit Procedure ReceivablesayyazmNo ratings yet

- Pronto Xi 740 Solutions Overview 3 FinancialsDocument70 pagesPronto Xi 740 Solutions Overview 3 FinancialsAngarEnkhzayaNo ratings yet

- Audit Report: International Standards On Auditing (ISA) 700Document5 pagesAudit Report: International Standards On Auditing (ISA) 700FarhanChowdhuryMehdiNo ratings yet

- LCFChap 2Document80 pagesLCFChap 2Vân Anh Lê PhạmNo ratings yet

- Chapter 8 Materiality Decisions and Performing Analytical ProceduresDocument19 pagesChapter 8 Materiality Decisions and Performing Analytical ProcedureshidaNo ratings yet

- The Conscious Investor Approach: John Price, PHDDocument80 pagesThe Conscious Investor Approach: John Price, PHDPaulo SouzaNo ratings yet

- Case StudyDocument12 pagesCase StudyT. MuhammadNo ratings yet

- Exercises On Trade Receivables and Sales PDFDocument8 pagesExercises On Trade Receivables and Sales PDFShaira MaguddayaoNo ratings yet

- Icaew Assurance QB 2022Document205 pagesIcaew Assurance QB 2022nguyenngocnhuhuyen1824No ratings yet

- Manage Petty Cash and Expenses: ElearningDocument44 pagesManage Petty Cash and Expenses: ElearningfghyurNo ratings yet

- Mgt402 Cost and Management Accounting Short Questions VuabidDocument22 pagesMgt402 Cost and Management Accounting Short Questions Vuabidsaeedsjaan100% (4)

- Bertieindia 45Document8 pagesBertieindia 45thestorydotieNo ratings yet

- Notes For Merchandising Business - 1Document2 pagesNotes For Merchandising Business - 1Ruab PlosNo ratings yet

- BAV Lecture 4Document25 pagesBAV Lecture 4Fluid TrapsNo ratings yet

- Audit and AssuranceFinal AssignmentDocument15 pagesAudit and AssuranceFinal AssignmentMamunur RashidNo ratings yet

Paperwise Exemption ForHighQual

Paperwise Exemption ForHighQual

Uploaded by

Ayush Bisht0 ratings0% found this document useful (0 votes)

18 views1 page1. Students pursuing a CS course are eligible for paper-wise exemptions based on higher qualifications like an LLB degree or completing the final course of the Institute of Cost Accountants of India.

2. An LLB degree with 50% or more marks provides an exemption for the Industrial, Labour & General Laws paper in the Executive Programme. No exemptions are available for professional programme papers based on an LLB.

3. Completing the ICAI final course provides exemptions for several papers in both the Executive and Professional programmes, including Cost and Management Accounting, Tax Laws and Practice, and Company Accounts and Auditing Practices.

Original Description:

IMP

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document1. Students pursuing a CS course are eligible for paper-wise exemptions based on higher qualifications like an LLB degree or completing the final course of the Institute of Cost Accountants of India.

2. An LLB degree with 50% or more marks provides an exemption for the Industrial, Labour & General Laws paper in the Executive Programme. No exemptions are available for professional programme papers based on an LLB.

3. Completing the ICAI final course provides exemptions for several papers in both the Executive and Professional programmes, including Cost and Management Accounting, Tax Laws and Practice, and Company Accounts and Auditing Practices.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

18 views1 pagePaperwise Exemption ForHighQual

Paperwise Exemption ForHighQual

Uploaded by

Ayush Bisht1. Students pursuing a CS course are eligible for paper-wise exemptions based on higher qualifications like an LLB degree or completing the final course of the Institute of Cost Accountants of India.

2. An LLB degree with 50% or more marks provides an exemption for the Industrial, Labour & General Laws paper in the Executive Programme. No exemptions are available for professional programme papers based on an LLB.

3. Completing the ICAI final course provides exemptions for several papers in both the Executive and Professional programmes, including Cost and Management Accounting, Tax Laws and Practice, and Company Accounts and Auditing Practices.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

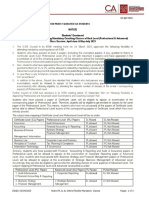

ATTENTION STUDENTS !

PAPER-WISE EXEMPTION ON THE BASIS OF HIGHER QUALIFICATIONS

As per the present guidelines, students pursuing CS Course are eligible for paper-wise exemptions based on

the following higher qualifications acquired by them : -

1. Passed LL.B. (with 50% of more marks in the aggregate)

2. Passed the Final Course of The Institute of Cost Accountants of India [ICAI(Cost)]

Further details pertaining to these exemptions are as under : -

Basis of Exemption Exemption available in paper(s) Exemption available in paper(s)

Qualification covered under Executive covered under Professional

Programme Stage Programme Stage

Passed LL.B. (Three Years No paper-wise exemptions

Degree Course / or Five Years 1. Industrial, Labour & General available for this qualification in

integrated Law Course) Laws any paper covered under

from a recognized (Paper Code – 327 of Module - 2) Professional Programme Stage.

University / Institute either

constituted under an Act of

Parliament or approved by

AICTE/AIU and having

secured 50% or more

marks in the aggregate.

(Qualification code-047)

Passed Final Course of The

Institute of Cost Accountants 1. Cost and Management 1. Advanced Company Law and

of India Accounting Practice

(Qualification code-044) (Paper Code – 322 of Module - 1) (Paper Code – 331 of Module -

1)

2. Tax Laws and Practice

(Paper Code – 324 of Module - 1) 2. Financial, Treasury and

Forex Management

3. Company Accounts and Auditing (Paper Code – 335 of Module -

Practices 2)

(Paper Code – 325 of Module - 2)

3. Advanced Tax Laws and

Practice

(Paper Code – 337 of Module -

3)

No exemption shall be given on the basis of any other higher qualification effective from 1st December,

2013. However, Paper-wise exemptions granted on the basis of other higher qualifications prior to 1st

December, 2013 will remain valid.

IMPORTANT INSTRUCTIONS FOR STUDENTS FOR CLAIMING PAPER-WISE EXEMPTION :

1. Students are required to apply for paper wise exemption in desired subject through ‘Online Services’ on website

http://smash.icsi.in and for procedure please follow the link

https://smash.icsi.in/Documents/Qualification_Based_Subject_ExemptionandCancellation_Student.pdf

2. Fee for paper wise exemption is Rs.1000/- (per subject) and is to be paid through ‘Online Services’ using Credit/Debit cards

or Net banking.

3. Students who have been granted exemption in Executive Programme Stage on the basis of having passed Final Course of

The Institute of Cost Accountants of India are required to submit their request for exemptions afresh for papers covered

under the Professional Programme Stage & the same are not granted automatically.

4. Students need to upload scanned attested copies of mark sheets of all parts/semesters of LLB degree or scanned attested

copies of final pass certificate of ICAI(cost)

5. Last date of for submission of requests for exemption, complete in all respects, is 9thApril for June Session of examinations and

10th October for December session of Examinations. Requests, if any, received after the said cut-off dates will be considered

for the purpose of subsequent sessions of examinations only. For example, if a student requests for exemption(s) after

10th October, 2017, even if he/she is eligible for such exemption(s), the same will NOT be considered for the purpose of

December, 2017 Session of Examinations.

6. Students may request for cancellation of paper-wise exemption(s), granted to them on the basis of higher qualifications

and/ or the 60% Marks Criteria, through the on-line facility available at https://smash.icsi.in after logging into their

respective online account 15 days before commencement of examination.

7. Since the grant / cancellation of exemption(s) have a bearing on the computation of examination results, the students are

strictly advised to follow the guidelines in letter and spirit to avoid complications at the time of appearing in the examinations

and/or declaration of results.

14.07.2017

****X****

You might also like

- Solution Manual For Managerial Economics 12th Edition by ThomasDocument6 pagesSolution Manual For Managerial Economics 12th Edition by ThomasAkshat JainNo ratings yet

- Paper Wise Exemption On The Basis of Higher Qualifications: (As Per Revised Guidelines Effective From 1 December 2013)Document1 pagePaper Wise Exemption On The Basis of Higher Qualifications: (As Per Revised Guidelines Effective From 1 December 2013)Shubham MaheshwariNo ratings yet

- Paperwise Exemption Syllabus17-1Document2 pagesPaperwise Exemption Syllabus17-1ShubhamNo ratings yet

- Paperwise Exemption Syllabus17Document2 pagesPaperwise Exemption Syllabus17taufiquerahaman2073No ratings yet

- MA2 Syllabus and Study Guide - Sept 22-Aug 23Document13 pagesMA2 Syllabus and Study Guide - Sept 22-Aug 23amandaNo ratings yet

- BT - FBT Syllabus and Study Guide - Sept 22-Aug 23Document19 pagesBT - FBT Syllabus and Study Guide - Sept 22-Aug 23juliet nnajiNo ratings yet

- Employment Opportunities 05312024Document6 pagesEmployment Opportunities 05312024esmie distorNo ratings yet

- LME301Document8 pagesLME301Karim MohamedNo ratings yet

- LM300Document8 pagesLM300Sharma GokhoolNo ratings yet

- ExamDocument8 pagesExamsasasNo ratings yet

- Symbiosis: Exam HandbookDocument11 pagesSymbiosis: Exam HandbookKirpal rawatNo ratings yet

- LM302Document8 pagesLM302Win GungadinNo ratings yet

- Exam Handbook Ay 2022Document9 pagesExam Handbook Ay 2022Ritik AsatiNo ratings yet

- It Security 1 PDFDocument7 pagesIt Security 1 PDFPravin Bandale0% (1)

- MA2 - Sept 23-Aug 24 Syllabus and Study Guide - Final - V2 DatesDocument14 pagesMA2 - Sept 23-Aug 24 Syllabus and Study Guide - Final - V2 Datesgranbacha1017No ratings yet

- Paper-Wise Exemptions On Reciprocal Basis To Icsi and Icwai StudentsDocument1 pagePaper-Wise Exemptions On Reciprocal Basis To Icsi and Icwai StudentsKarandeep Singh TuliNo ratings yet

- 1357StudentsEnrolment NoticeDocument2 pages1357StudentsEnrolment NoticeSUBRATA GHOSHNo ratings yet

- MA - Fma Syllabus and Study Guide - Sept 22-Aug 23Document15 pagesMA - Fma Syllabus and Study Guide - Sept 22-Aug 23Như NguyễnNo ratings yet

- Exemption in Professional ExaminationsDocument3 pagesExemption in Professional ExaminationsRishabh RaiNo ratings yet

- BT Syllabus and Study Guide 2020-21 FINALDocument19 pagesBT Syllabus and Study Guide 2020-21 FINALarpit soniNo ratings yet

- BT Syllabus and Study Guide 2020-21 FINALDocument19 pagesBT Syllabus and Study Guide 2020-21 FINALBondhu GuptoNo ratings yet

- Revised OJT GuidelinesDocument23 pagesRevised OJT GuidelinesJet-jet JetNo ratings yet

- Certified TreasusuresDocument11 pagesCertified TreasusuresNAVDESH NIRWANNo ratings yet

- MA1 - Sept 23-Aug 24 Syllabus and Study Guide - FinalDocument11 pagesMA1 - Sept 23-Aug 24 Syllabus and Study Guide - Finalmoni123456No ratings yet

- Exam HandbookDocument16 pagesExam HandbookParveshNo ratings yet

- Management Accounting (MA/FMA) : Syllabus and Study GuideDocument15 pagesManagement Accounting (MA/FMA) : Syllabus and Study Guideduong duongNo ratings yet

- Proforma For Transfer of External Credits From ICAI (ICWAI) To MBA, MBAOL, MBAFM, MBAHR, MBAOM, MBAMM, MBFDocument5 pagesProforma For Transfer of External Credits From ICAI (ICWAI) To MBA, MBAOL, MBAFM, MBAHR, MBAOM, MBAMM, MBFwejiga3512No ratings yet

- BFSI COURSES-ASAP KeralaDocument12 pagesBFSI COURSES-ASAP KeralamdkdmdnNo ratings yet

- Ma2 SyllabusDocument14 pagesMa2 Syllabusazizrehman15951No ratings yet

- Diploma in Banking & FinanceDocument10 pagesDiploma in Banking & FinanceJayashree JothivelNo ratings yet

- Business and Technology (BT/FBT) : Syllabus and Study GuideDocument18 pagesBusiness and Technology (BT/FBT) : Syllabus and Study GuideMeril JahanNo ratings yet

- Stages To Become A Company Secretary: Icsi - EduDocument6 pagesStages To Become A Company Secretary: Icsi - EduRoshan SinghNo ratings yet

- WorkoutDocument3 pagesWorkoutayan.mishraxxxNo ratings yet

- ExamDocument12 pagesExamAvi SiNo ratings yet

- ADMISSION TO THE CS COURSE Is Open Throughout The Year. Examinations Are Held Twice A Year in June & DecemberDocument10 pagesADMISSION TO THE CS COURSE Is Open Throughout The Year. Examinations Are Held Twice A Year in June & DecemberSomprasad PoudelNo ratings yet

- Indian Institute of Banking & Finance: Diploma in Banking TechnologyDocument10 pagesIndian Institute of Banking & Finance: Diploma in Banking TechnologySahil SaabNo ratings yet

- MA2 Syllabus and Study Guide 2020-21 FINAL V2Document14 pagesMA2 Syllabus and Study Guide 2020-21 FINAL V2Mokoena RalesupiNo ratings yet

- 7087Students Enrolment Notice Session Dec 23-Feb 24Document2 pages7087Students Enrolment Notice Session Dec 23-Feb 24Md. REzwan RezwanNo ratings yet

- Guidelines and Policies For The School of I.T. and I.S. Ojt/Internship CoursesDocument18 pagesGuidelines and Policies For The School of I.T. and I.S. Ojt/Internship Coursesedwardgarcia333No ratings yet

- FAU Syllabus and Study Guide Dec 22-Jun 23Document12 pagesFAU Syllabus and Study Guide Dec 22-Jun 23Sai PhaniNo ratings yet

- 164 - 1008 - CAAP-Final - 20200718Document10 pages164 - 1008 - CAAP-Final - 20200718Anand FCANo ratings yet

- FA2 - Sept 23-Aug 24 Syllabus and Study Guide - Final - V2 DatesDocument19 pagesFA2 - Sept 23-Aug 24 Syllabus and Study Guide - Final - V2 Datesmyselftaha7No ratings yet

- 42 - DBF-Final - 18-01-23 - Final - WebsiteDocument19 pages42 - DBF-Final - 18-01-23 - Final - WebsiteDarshit ShrishrimalNo ratings yet

- Internship 1 Syllabus CCG502Document12 pagesInternship 1 Syllabus CCG502Mohseen InamdarNo ratings yet

- Utpras Primer TVET ProvidersDocument25 pagesUtpras Primer TVET ProvidersK-phrenCandariNo ratings yet

- Handbook - Curtin University MC COMMDocument11 pagesHandbook - Curtin University MC COMMJuni KasthakarNo ratings yet

- Data Entry Operator CTS2.0 NSQF 3 NewDocument26 pagesData Entry Operator CTS2.0 NSQF 3 Newsanjit singhNo ratings yet

- MA2 Syllabus and Study Guide 2020-21 FINALDocument14 pagesMA2 Syllabus and Study Guide 2020-21 FINALRumaisha BatoolNo ratings yet

- 4330001Document7 pages4330001JEET PARMARNo ratings yet

- Pamantasan NG Lungsod NG Muntinlupa College of Information Technology and Computer StudiesDocument9 pagesPamantasan NG Lungsod NG Muntinlupa College of Information Technology and Computer StudiesMat Perater MacoteNo ratings yet

- Risk in Financial ServicesDocument302 pagesRisk in Financial Servicessguru09No ratings yet

- Indian Institute of Banking & Finance: Certified Credit ProfessionalDocument10 pagesIndian Institute of Banking & Finance: Certified Credit ProfessionalsvijayswarupNo ratings yet

- BT - FBT Syllabusandstudyguide Sept23 Aug24Document21 pagesBT - FBT Syllabusandstudyguide Sept23 Aug24Sialkot CamNo ratings yet

- 74932bos Transition Scheme NsetDocument47 pages74932bos Transition Scheme NsetShubhamNo ratings yet

- Ma1 Syllabusandstudyguide Sept23 Aug24Document11 pagesMa1 Syllabusandstudyguide Sept23 Aug24Lulu BubuNo ratings yet

- Management Accounting (MA/FMA) : Syllabus and Study GuideDocument16 pagesManagement Accounting (MA/FMA) : Syllabus and Study GuideEnkhbold Damdinsuren100% (1)

- Indian Institute of Banking & Finance: Certified Banking Compliance Professional CourseDocument12 pagesIndian Institute of Banking & Finance: Certified Banking Compliance Professional CourseABHIJITH G KUMARNo ratings yet

- Advertisement For WebsiteDocument4 pagesAdvertisement For WebsiteKumar AnkitNo ratings yet

- TOGAF® 9.2 Level 2 Scenario Strategies Wonder Guide Volume 2 – 2023 Enhanced Edition: TOGAF® 9.2 Wonder Guide Series, #5From EverandTOGAF® 9.2 Level 2 Scenario Strategies Wonder Guide Volume 2 – 2023 Enhanced Edition: TOGAF® 9.2 Wonder Guide Series, #5No ratings yet

- Information Systems Auditing: The IS Audit Follow-up ProcessFrom EverandInformation Systems Auditing: The IS Audit Follow-up ProcessRating: 2 out of 5 stars2/5 (1)

- Assignment ON: SUB Mitted To: Submitted byDocument8 pagesAssignment ON: SUB Mitted To: Submitted byAyush BishtNo ratings yet

- Dr. Anil MishraDocument1 pageDr. Anil MishraAyush BishtNo ratings yet

- Ayush WCM AssignmentDocument14 pagesAyush WCM AssignmentAyush BishtNo ratings yet

- Petroleum Planning & Analysis CellDocument1 pagePetroleum Planning & Analysis CellAyush BishtNo ratings yet

- Projected Annual Expenses: Sr. NO ParticularsDocument3 pagesProjected Annual Expenses: Sr. NO ParticularsAyush BishtNo ratings yet

- Initial PagesDocument2 pagesInitial PagesAyush BishtNo ratings yet

- Code of Conduct For Board Members & SMPDocument10 pagesCode of Conduct For Board Members & SMPAyush BishtNo ratings yet

- Marketing Management by Kotler and Keller (12Th Ed.) Lecture Notes Chapter17. Designing and Managing Integrated Marketing CommunicationsDocument6 pagesMarketing Management by Kotler and Keller (12Th Ed.) Lecture Notes Chapter17. Designing and Managing Integrated Marketing CommunicationsAyush BishtNo ratings yet

- Date Axis Closing Price Daily Return Date NIFTY 50 Daily Return DateDocument4 pagesDate Axis Closing Price Daily Return Date NIFTY 50 Daily Return DateAyush BishtNo ratings yet

- Assignment ON: Acknowledgement I Would Like To Express My Special Thanks of Gratitude To My Professor Dr. SanjayDocument7 pagesAssignment ON: Acknowledgement I Would Like To Express My Special Thanks of Gratitude To My Professor Dr. SanjayAyush BishtNo ratings yet

- Assignment ON: Acknowledgement I Would Like To Express My Special Thanks of Gratitude To My Professor Dr. SanjayDocument7 pagesAssignment ON: Acknowledgement I Would Like To Express My Special Thanks of Gratitude To My Professor Dr. SanjayAyush BishtNo ratings yet

- Curriculum Vitae: Ayush BishtDocument3 pagesCurriculum Vitae: Ayush BishtAyush BishtNo ratings yet

- Department of Business AdministrationDocument31 pagesDepartment of Business AdministrationAyush BishtNo ratings yet

- Business Plan SynopsisDocument5 pagesBusiness Plan SynopsisAyush Bisht100% (1)

- Corporate Evaluation and Strategic ManagementDocument10 pagesCorporate Evaluation and Strategic ManagementAyush BishtNo ratings yet

- Assignment ON: SUB Mitted To: Submitted byDocument12 pagesAssignment ON: SUB Mitted To: Submitted byAyush BishtNo ratings yet

- Steps To Download and Print E-AadhaarDocument1 pageSteps To Download and Print E-AadhaarAyush BishtNo ratings yet

- Financial Plan: Sales ForecastDocument8 pagesFinancial Plan: Sales ForecastAyush BishtNo ratings yet

- 14 Investment Vehicles PDFDocument27 pages14 Investment Vehicles PDFAyush BishtNo ratings yet

- Certificate For Ayush Bisht For "Quiz On Conservation of Env... "Document1 pageCertificate For Ayush Bisht For "Quiz On Conservation of Env... "Ayush BishtNo ratings yet

- Partnership CompleteDocument6 pagesPartnership CompleteJoshua TorillaNo ratings yet

- LCCI L3 Accounting ASE20104 Dec 2016Document24 pagesLCCI L3 Accounting ASE20104 Dec 2016chee pin wong50% (2)

- Final APA Format - EditedDocument44 pagesFinal APA Format - EditedJasmin NgNo ratings yet

- 7 Document Flowchart - From RomneyDocument31 pages7 Document Flowchart - From RomneySefi RifkianaNo ratings yet

- College of Accountancy Final Examination - Accounting For Business Combination I. Theories. Write The Letter of The Correct AnswerDocument11 pagesCollege of Accountancy Final Examination - Accounting For Business Combination I. Theories. Write The Letter of The Correct AnswerLouisse OrtigozaNo ratings yet

- Mercury Athletic Footwear Answer Key FinalDocument41 pagesMercury Athletic Footwear Answer Key FinalFatima ToapantaNo ratings yet

- PAS 8 - Accounting Policies, Changes in Accounting Estimates and ErrorsDocument11 pagesPAS 8 - Accounting Policies, Changes in Accounting Estimates and ErrorsKrizzia DizonNo ratings yet

- Basic Financial Accounting HND NigeriaDocument190 pagesBasic Financial Accounting HND NigeriaWaqar AhmadNo ratings yet

- UG 3rdsem FnlScdl27032019Document8 pagesUG 3rdsem FnlScdl27032019KAZI RAHATNo ratings yet

- Adjusting EntriesDocument27 pagesAdjusting EntrieskaiginNo ratings yet

- UNIT 06 (Part 01) Financial Statements For Sole TradersDocument8 pagesUNIT 06 (Part 01) Financial Statements For Sole TradersSandunika DevasingheNo ratings yet

- Fundamentals of Accountancy, Business and Management 1: Module 2"Document68 pagesFundamentals of Accountancy, Business and Management 1: Module 2"Erica AlbaoNo ratings yet

- Nyman 2005Document17 pagesNyman 2005Jarrar TadNo ratings yet

- Account Based COPA - Simplification With Simple FinanceDocument18 pagesAccount Based COPA - Simplification With Simple Financebrcrao100% (1)

- Audit Procedure ReceivablesDocument3 pagesAudit Procedure ReceivablesayyazmNo ratings yet

- Pronto Xi 740 Solutions Overview 3 FinancialsDocument70 pagesPronto Xi 740 Solutions Overview 3 FinancialsAngarEnkhzayaNo ratings yet

- Audit Report: International Standards On Auditing (ISA) 700Document5 pagesAudit Report: International Standards On Auditing (ISA) 700FarhanChowdhuryMehdiNo ratings yet

- LCFChap 2Document80 pagesLCFChap 2Vân Anh Lê PhạmNo ratings yet

- Chapter 8 Materiality Decisions and Performing Analytical ProceduresDocument19 pagesChapter 8 Materiality Decisions and Performing Analytical ProcedureshidaNo ratings yet

- The Conscious Investor Approach: John Price, PHDDocument80 pagesThe Conscious Investor Approach: John Price, PHDPaulo SouzaNo ratings yet

- Case StudyDocument12 pagesCase StudyT. MuhammadNo ratings yet

- Exercises On Trade Receivables and Sales PDFDocument8 pagesExercises On Trade Receivables and Sales PDFShaira MaguddayaoNo ratings yet

- Icaew Assurance QB 2022Document205 pagesIcaew Assurance QB 2022nguyenngocnhuhuyen1824No ratings yet

- Manage Petty Cash and Expenses: ElearningDocument44 pagesManage Petty Cash and Expenses: ElearningfghyurNo ratings yet

- Mgt402 Cost and Management Accounting Short Questions VuabidDocument22 pagesMgt402 Cost and Management Accounting Short Questions Vuabidsaeedsjaan100% (4)

- Bertieindia 45Document8 pagesBertieindia 45thestorydotieNo ratings yet

- Notes For Merchandising Business - 1Document2 pagesNotes For Merchandising Business - 1Ruab PlosNo ratings yet

- BAV Lecture 4Document25 pagesBAV Lecture 4Fluid TrapsNo ratings yet

- Audit and AssuranceFinal AssignmentDocument15 pagesAudit and AssuranceFinal AssignmentMamunur RashidNo ratings yet