Professional Documents

Culture Documents

Credit Awareness

Credit Awareness

Uploaded by

Himanshu MishraCopyright:

Available Formats

You might also like

- Handbook of CreditDocument253 pagesHandbook of CreditYashveer ChoudharyNo ratings yet

- Disbursing Officer IPCRF and CashierDocument4 pagesDisbursing Officer IPCRF and CashierDonald Bose Mandac76% (17)

- 2015 - AFS - Steel Asia Manufacturing CorpDocument58 pages2015 - AFS - Steel Asia Manufacturing CorpMarius Angara100% (2)

- Insider TradingDocument1 pageInsider TradingmattNo ratings yet

- Credit Appraisal System of Commercial Vehicle Loans.Document43 pagesCredit Appraisal System of Commercial Vehicle Loans.Pravin Kolpe92% (12)

- General Guidelines On Loans & Advance: Sachin Katiyar-Chief ManagerDocument53 pagesGeneral Guidelines On Loans & Advance: Sachin Katiyar-Chief Managersaurabh_shrutiNo ratings yet

- Introduction To Credit Risk AnalysisDocument39 pagesIntroduction To Credit Risk AnalysisHitesh Kalwani100% (2)

- Credit Monitoring and Follow-Up: MeaningDocument23 pagesCredit Monitoring and Follow-Up: Meaningpuran1234567890100% (2)

- A Case Study On Credit Appraisal For Working Capital Finance To Small and Medium Enterprises in Bank of IndiaDocument34 pagesA Case Study On Credit Appraisal For Working Capital Finance To Small and Medium Enterprises in Bank of Indiaarcherselevators0% (1)

- Bank - Credit Risk ManagementDocument103 pagesBank - Credit Risk ManagementApoorv SrivastavaNo ratings yet

- Case DIgest - CIR vs. Bicolandia Drug Corp. GR 148083, July 21, 2006Document2 pagesCase DIgest - CIR vs. Bicolandia Drug Corp. GR 148083, July 21, 2006Lu CasNo ratings yet

- BLGFs Role and Administrative Governance On Local Treasury OperationsDocument38 pagesBLGFs Role and Administrative Governance On Local Treasury Operationsjrduronio100% (2)

- Credit Appraisal and Risk Rating at PNBDocument87 pagesCredit Appraisal and Risk Rating at PNBVishnu Soni100% (2)

- Credit Appraisal in MuthootDocument30 pagesCredit Appraisal in MuthootNISHI1994100% (1)

- The Basel Ii "Use Test" - a Retail Credit Approach: Developing and Implementing Effective Retail Credit Risk Strategies Using Basel IiFrom EverandThe Basel Ii "Use Test" - a Retail Credit Approach: Developing and Implementing Effective Retail Credit Risk Strategies Using Basel IiNo ratings yet

- Credit Risk Assessment: The New Lending System for Borrowers, Lenders, and InvestorsFrom EverandCredit Risk Assessment: The New Lending System for Borrowers, Lenders, and InvestorsNo ratings yet

- Credit Book PDFDocument157 pagesCredit Book PDFMeghna SheoranNo ratings yet

- Lending Policies of Indian BanksDocument47 pagesLending Policies of Indian BanksProf Dr Chowdari Prasad80% (5)

- Risk Management in BanksDocument32 pagesRisk Management in Banksanon_595315274100% (1)

- Bank Credit-Management NotesDocument32 pagesBank Credit-Management NotesWesley67% (3)

- Loan SyndicationDocument7 pagesLoan SyndicationYasir ArafatNo ratings yet

- Credit Risk ManagementDocument24 pagesCredit Risk ManagementAl-Imran Bin Khodadad100% (2)

- Credit Appraisal ProcessDocument19 pagesCredit Appraisal ProcessVaishnavi khot100% (2)

- Credit Appraisal3Document99 pagesCredit Appraisal3Bharat AhujaNo ratings yet

- Chapters 10 and 12 Credit Analysis and Distress Prediction3223Document45 pagesChapters 10 and 12 Credit Analysis and Distress Prediction3223alfiNo ratings yet

- CreditDocument20 pagesCreditnibedita dashNo ratings yet

- Credit Appraisal System of PUNJAB NATIONAL BANKDocument36 pagesCredit Appraisal System of PUNJAB NATIONAL BANKManish Kanwar78% (9)

- Credit Risk Grading PDFDocument14 pagesCredit Risk Grading PDFaziz100% (1)

- Post-Sanction Monitoring of Industrial Advances in Indian BankDocument127 pagesPost-Sanction Monitoring of Industrial Advances in Indian BankChiranjit Basu100% (4)

- Stress Testing Credit RiskDocument44 pagesStress Testing Credit RiskG117No ratings yet

- Credit Analyst Q&ADocument6 pagesCredit Analyst Q&ASudhir PowerNo ratings yet

- Credit Appraisal PNBDocument48 pagesCredit Appraisal PNBURMI0% (1)

- Asset Liability Management in BanksDocument36 pagesAsset Liability Management in BanksHoàng Trần HữuNo ratings yet

- Credit Policy Version 1.2Document157 pagesCredit Policy Version 1.2Amit SinghNo ratings yet

- CREDIT RISK GRADING MANUAL BangladeshDocument45 pagesCREDIT RISK GRADING MANUAL BangladeshIstiak Ahmed100% (2)

- Working CapitalDocument62 pagesWorking CapitalHrithika AroraNo ratings yet

- Revised Credit HandBookDocument587 pagesRevised Credit HandBookWaqas Ishtiaq100% (1)

- Credit MonitoringDocument15 pagesCredit MonitoringTushar JoshiNo ratings yet

- Product Development: - Loan Pricing Product Development: - Loan PricingDocument55 pagesProduct Development: - Loan Pricing Product Development: - Loan PricingBriju RebiNo ratings yet

- Credit Appraisal - Term LoansDocument92 pagesCredit Appraisal - Term Loanspoppyeolive0% (1)

- Credit Appraisal and Risk Rating at PNBDocument48 pagesCredit Appraisal and Risk Rating at PNBAbhay Thakur100% (2)

- Credit Risk Analysis PDFDocument300 pagesCredit Risk Analysis PDFraj kumarNo ratings yet

- Report On Credit Appraisal in PNBDocument76 pagesReport On Credit Appraisal in PNBSanchit GoyalNo ratings yet

- Basel IiiDocument32 pagesBasel Iiivenkatesh pkNo ratings yet

- BFW3841 Lecture Week 1 Semester 1 2018Document40 pagesBFW3841 Lecture Week 1 Semester 1 2018hi2joeyNo ratings yet

- Credit Risk Management On HDFC BankDocument17 pagesCredit Risk Management On HDFC BankAhemad 12No ratings yet

- Components of A Sound Credit Risk Management ProgramDocument8 pagesComponents of A Sound Credit Risk Management ProgramArslan AshfaqNo ratings yet

- Credit Appraisal in Banking Sector PPT at Bec DomsDocument31 pagesCredit Appraisal in Banking Sector PPT at Bec DomsBabasab Patil (Karrisatte)100% (2)

- Credit MonitoringDocument5 pagesCredit MonitoringAmit GiriNo ratings yet

- Credit Risk Management 1Document61 pagesCredit Risk Management 1Rajeshkumar Varanasi100% (1)

- Credit Appraisal of Term Loans by Financial Institutions Like BanksDocument4 pagesCredit Appraisal of Term Loans by Financial Institutions Like BanksKunal GoldmedalistNo ratings yet

- Basel NormsDocument42 pagesBasel NormsBluehacksNo ratings yet

- 104-Check List For Scrutiny of Credit ProposalsDocument10 pages104-Check List For Scrutiny of Credit ProposalsgayathrihariNo ratings yet

- Credit Worthiness: What Is A Corporate Credit RatingDocument23 pagesCredit Worthiness: What Is A Corporate Credit RatingSudarshan ChitlangiaNo ratings yet

- Credit Pricing - Risk BasedDocument16 pagesCredit Pricing - Risk Basediyervsr100% (1)

- Credit Risk Project PDFDocument104 pagesCredit Risk Project PDFDenish PatelNo ratings yet

- BankingDocument110 pagesBankingNarcity UzumakiNo ratings yet

- Credit Risk SiDocument90 pagesCredit Risk SiSampath SanguNo ratings yet

- Assessment of Working CapitalDocument43 pagesAssessment of Working CapitalAshutosh VermaNo ratings yet

- Risk Management in BanksDocument90 pagesRisk Management in BanksManoj Tarte100% (1)

- Credit Monitoring Module 1 NIBMDocument135 pagesCredit Monitoring Module 1 NIBMMike100% (1)

- Credit Risk Measurement Under Basel IIDocument34 pagesCredit Risk Measurement Under Basel IIcriscincaNo ratings yet

- Assessment of Working Capital LimitDocument4 pagesAssessment of Working Capital LimitKeshav Malpani100% (8)

- Ni Act (Part 1)Document27 pagesNi Act (Part 1)sunnythefactNo ratings yet

- Implications of CDR Sanction TermsDocument4 pagesImplications of CDR Sanction Termsrao_gmailNo ratings yet

- Tata CorusDocument14 pagesTata CorusSameer SunnyNo ratings yet

- CH 04Document76 pagesCH 04Mai LinhNo ratings yet

- VentureCapitalPitchFormula HandoutsDocument49 pagesVentureCapitalPitchFormula HandoutsVladimir UngureanuNo ratings yet

- Memorandum and Articles of Association of Wipro LimitedDocument321 pagesMemorandum and Articles of Association of Wipro LimitedMeghana S BIMSNo ratings yet

- Grade Control in MinesDocument5 pagesGrade Control in Minesa4agarwalNo ratings yet

- Conventions: Convention of DisclosureDocument5 pagesConventions: Convention of DisclosureAiswarya ShanmugamNo ratings yet

- Lista TV Gartis HDDocument362 pagesLista TV Gartis HDEdy Jaulis ENo ratings yet

- Dividend PolicyDocument26 pagesDividend PolicyAnup Verma100% (1)

- JamunaDocument12 pagesJamunaAnamika KhanNo ratings yet

- Tax AssignmentDocument6 pagesTax AssignmentCid Benedict PabalanNo ratings yet

- Quantitative Methods in Finance Msc. in Finance Fall 2020: InstructionsDocument2 pagesQuantitative Methods in Finance Msc. in Finance Fall 2020: InstructionsAlvaro Ramos RiosNo ratings yet

- FIN 3331 Managerial Finance: Time Value of MoneyDocument23 pagesFIN 3331 Managerial Finance: Time Value of MoneyHa NguyenNo ratings yet

- Market Efficiency: T C S B D V .3, PP. 959-970Document13 pagesMarket Efficiency: T C S B D V .3, PP. 959-970Citra Permata YuriNo ratings yet

- Michelle G. Miranda Multiple Choice-Dividends and Dividend PolicyDocument4 pagesMichelle G. Miranda Multiple Choice-Dividends and Dividend PolicyMichelle MirandaNo ratings yet

- HFD Introductory BookletDocument12 pagesHFD Introductory BookletvbardeNo ratings yet

- tb301 PDFDocument60 pagestb301 PDFDarmin Kaye PalayNo ratings yet

- Hle Glass Coat 18 Dec MeetingDocument3 pagesHle Glass Coat 18 Dec MeetingGovindNo ratings yet

- Martin Pring 1 and 2 Bar Price PatternsDocument71 pagesMartin Pring 1 and 2 Bar Price PatternsCynthia Serrao0% (1)

- Module 2 - SumsDocument4 pagesModule 2 - SumsShubakar ReddyNo ratings yet

- Welcome To Wall Street Prep's Financial Modeling Quick Lessons!Document3 pagesWelcome To Wall Street Prep's Financial Modeling Quick Lessons!alexandre1411No ratings yet

- Retirement of A PartnerDocument6 pagesRetirement of A Partnerprksh_451253087No ratings yet

- Financial Reporting - ConsolidationDocument6 pagesFinancial Reporting - ConsolidationHasan JavedNo ratings yet

- Notes On Forward PricingDocument12 pagesNotes On Forward PricingWei Liang Ho100% (1)

Credit Awareness

Credit Awareness

Uploaded by

Himanshu MishraOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Credit Awareness

Credit Awareness

Uploaded by

Himanshu MishraCopyright:

Available Formats

Study Material on

संबंधी अध्ययन-सामग्री

Credit Awareness Prog for

Clerks

लऱपऩकों हे तु ऋण जागरूकोता

कोाययक्रम

IT 1583

STAFF TRAINING COLLEGE

BANGALORE

कोमयचारी प्रलिऺण महापिद्याऱय

बंगऱूर

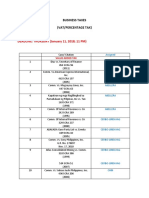

INDEX

SL NO PARTICULARS PAGE NO

1 Lending - an overview 1

2 Time Norms for disposal of Loan applications 5

3 Guidelines on Credit Information Reports 8

4 Internal Credit Risk Rating 10

5 Guidelines on obtention of Financial Statements 13

6 Components of Financial Statements 14

7 Ratio Analysis 20

8 Working Capital - Methods of Assessment 25

9 Micro Small and Medium Enterprises MSMEs 30

10 Term Loan 37

11 Credit Monitoring 42

12 Non Fund Based limits 52

13 Fair Practices code 55

Lending - An overview

Overview :

Lending is one of the major activities of any bank. Over the years, the risks involved in lending

have gone up along with the stringent regulatory norms on Capital Adequacy, Income

Recognition and Asset classification. We need to have a comprehensive approach towards

appraisal of credit and Risk Management. The Credit Risk Management policy of the bank

covers the various aspects of the lending policy of the Bank and contains the guidelines on

identification, measurement, monitoring and control of credit risks.

Principles of lending:

The basic considerations for a Banker for lending will be on the following principles:

1. Safety of funds: It is important because the Banker has to safeguard the stake holders'

money.

2. Identification of the borrower: This includes character, integrity and Business acumen of

the borrower because bank has to be repaid with interest after serving the growth

purpose of the economy.

3. Purpose: Purpose should be clearly spelt out. Usually it will be the source of repayment

(for productive purposes and / or asset creation) or social and economic improvement

in standard of living / lifestyles; for takeover of Borrowal accounts.

4. Liquidity / Repayment: The money should come back as envisaged for effective re-

cycling of funds so the needs are met in time.

5. Security: Any asset to fall back on, if repayment is not forthcoming. Provides an

additional comfort / safety cushion in case of need.

6. Profitability: Bank has to incur expenses, make provisions; pay interest to depositors

and pay dividend to share holders. Bank has to earn a reasonable profit with a

comfortable margin (Interest spread) to meet all the above.

7. Risk Management: Policies are formulated by the Bank as to the extent and areas of

risk appetite.

8. National interest: The advance will be suitable only if it does not counter the national

interest.

Types of credit:

Loans and advances are generally classified into fund - Based and Non - Fund - Based

depending on disbursement of funds is involved or not. Fund - Based limits are further

classified into Working Capital Facilities and Term Loans.

I. Fund based credit:

a. Working Capital Facilities

i. Open Cash Credit (OCC)

CREDIT AWARENESS PROGRAMME FOR CLERKS 1

ii. Advances against Book Debts

iii. Produce Loan

iv. Overdraft

v. Simplified Open Cash Credit for traders and small Enterprises (SOCC)

vi. Packing Credit, Clean Packing Credit

vii. Canara Trade

viii. Bills Limits (SDB, BE, Supply Bills)

ix. Export Bills received for Discount / Negotiation - FDB / FBE

b. Term Loans

i. Short Term Loans - Repayable in a period less than 36 Months

ii. Medium Term Loans - Repayable in 36 Months and above upto 84 Months

iii. Long Term Loans - repayable in over 84 Months upto 120 Months

2. Non - Fund based Facilities

i. Letter of Credit

ii. Bank Guarantees

iii. Stand - by LC

iv. Buyer's Credit

v. Letter Of Commitment

vi. Solvency Certificates

vii. Capability Certificates

Preliminary investigation & Pre - sanction visit:

Before proceeding with the appraisal of a credit proposal, unit visit and preliminary investigation

are to be necessarily conducted by the branch officials and KYC compliance should be

ensured. If the party is having accounts with other banks, OPL from them has to be obtained.

For understanding the business of the party, their management and history, promoter's net

worth outside the business etc, a detailed preliminary interview of the promoter/s has to be

conducted before we take a view on the loan proposal.

Preliminary Interview:

Preliminary Interview with the promoter/s is one of the very important areas of credit appraisal,

as many information which may not be otherwise available in the loan application and in the

other related written documents can be obtained only through a personal interview of the

proposed borrower. It is pertinent to note that the enterprise of an entrepreneur can be gauged

effectively through a professional interview of the borrower. The interviewer has to ensure that

open ended intelligent questions are asked to the proposed borrower with an objective to get

CREDIT AWARENESS PROGRAMME FOR CLERKS 2

maximum possible information about the party and his business.

Before we take a view on any loan proposal, we need to have comprehensive information about

the party, the purpose for which the loan is sought, the financial strengths & weaknesses of the

unit to be financed, the party's net worth outside the business etc .We also need to consider the

"four Hs" and "five Cs" to determine whether the applicant qualifies for a loan.

The four Hs are:

• How much money is needed by the party?

• How that money will be used?

• How long do they need it?

• How the money will be repaid?

These questions are referred to as the ' four Hs' in a loan interview.

The five Cs of credit appraisal are Character, Capacity, Capital, Conditions and Collateral.

Each of these items is to be prudently analysed before taking a view on whether to consider the

proposal or not.

• Character

In commercial lending, character refers to the client's willingness and determination to meet a loan

obligation. Business people of good character will make every effort to repay a loan and will work

openly and transparently with their banker if their business experiences financial difficulties.

• Capacity

Management's ability to generate enough excess cash to satisfy all obligations is defined as

Capacity. Capacity also refers to the ability to manage cash. Although a company may generate

sufficient excess cash to pay its debts, it may use it for other purposes, for example, purchasing

fixed assets rather than paying off debts.

• Capital

Capital refers to the funds available to operate a business, of which there are two primary

considerations: the amount of equity capital the owners have invested in the business and how

effectively the total capital, including creditor capital, is employed. Sufficient equity capital is

particularly important in new, closely held business entities, which often fail when the total amount

of equity and debt is too small to finance the company's operations.

• Conditions

Conditions are external variables, such as the state of the economy and the type of industry in

which the client's business is a part. For example, a carpet retailer will be adversely affected when

housing sector starts showing downward trend.

• Collateral

A borrower can pledge collateral to offset weaknesses in the other Cs. Collateral provides the

bank a secondary source of repayment if the primary source of repayment does not materialize. In

CREDIT AWARENESS PROGRAMME FOR CLERKS 3

order to repay a loan, collateral must be liquidated or turned into cash. An attempt by the bank to

sell a company's assets (collateral) often leads the debtor to seek protection by filing for

bankruptcy or by raising legal objections.

Once a view is taken as to whether we may proceed with the processing of the proposal we may

ask the party to submit application form and all other related documents. (The application forms for

various credit facilities are given in Annexure I)

Obtention of CREDIT INFORMATION REPORT from CIBIL and Credit Risk Rating are pre -

sanction exercises which are to be done before proceeding with the appraisal. These are detailed

in chapters ahead.

CREDIT AWARENESS PROGRAMME FOR CLERKS 4

TIME NORMS FOR DISPOSAL OF LOAN APPLICATIONS:

The various time norms for disposal of loan applications are as below

(For MSME loan applications, pl see next page):

Sl. Nature of credit Facilities MODIFIED GUIDELINES

No. Sanctions Sanctions at Sanctions at

at Branch Circle HO

1 Loans upto Rs.25000/- 15 Days NA NA

2 Kisan Credit Card -branch powers 15 Days NA NA

3 Other Priority Sector Advances

1. Loans / Advances upto Rs.25000/- 2 Weeks NA NA

2. Loans / Advances over Rs.25000- 30 Days 45 Days 8 - 9 Wks

4 i) Loans up to Rs.25000/- 2 weeks NA NA

ii) Loans beyond Rs.25000/- and up to 4 weeks 4 weeks 4 weeks

Rs.5 lakhs

iii) Loans over Rs.5 lakhs and upto Rs. 30 days 45 days 45 days

25 lakhs

iv) Loans over Rs.25 lakhs 30 days 45 days Max.8 wks

5 Export Credit

30 days 45 days 45 days

(i) Sanction of fresh / enhanced credit

(25 days) (25 days) (25 days)

limits

30 days 30 days 30 days

(ii) Renewal of existing credit Limits

(15 days) (15 days) (15 days)

(iii) Sanction of adhoc credit facilities

(Days in brackets indicate the 15 days 15 days 15 days

maximum time frame for sanction (7 days) (7 days) (7 days)

under Gold Card Scheme)

6 Advances under Sole Banking, Multiple

Banking Arrangement, Consortium and

other than the above [(1) to (4)] the credit

proposals shall be disposed off within the

time frame as stated

(i) Sanction of fresh/ enhanced credit 30 days 45 days 60 days

limits (30 days) (45 days) (45 days)

(ii) Renewal of existing credit limits 30 days 45 days 45 days

(30 days) (30 days) (30 days)

(iii) Sanction of adhoc credit facilities

(Days in brackets indicate the maximum 30 days 30 days 30 days

time frame for sanction of export credit (15 days) (15 days) (15 days)

limits)

hereunder: PROGRAMME FOR CLERKS

CREDIT AWARENESS 5

TIME NORMS FOR DISPOSAL OF LOAN APPLICATIONS OF MSME

(HO CIR 220/2013):

Sl. Nature of credit Facilities MODIFIED GUIDELINES

No. Enterprises Sanctions Sanctions at Sanctions at

at Branch Circle HO

1 Loans upto Rs.25000/- Micro & Small

2 wks NA NA

Ent.

Medium Ent 2 wks

2 Loans beyond Rs.25,000/- upto Micro & Small 2 wks 2 wks 2 wks

Rs.5 lakhs Ent.

Medium Ent 4 wks 4 wks 4 wks

3 Loans beyond Rs.5 lakhs upto Micro & Small 4 wks 4 wks 4 wks

Rs.25 lakhs Ent.

Medium Ent 30 days 45 days 45 days

4 Loans beyond Rs 25 lakhs Micro & Small 8 wks 8 wks

8 wks

Ent.

Medium Ent 30 days 45 days 8 wks

REJECTION OF CREDIT PROPOSALS:

a) Applications for credit facilities from SC/ST customers shall not be rejected at branch

level and such applications shall be referred to the next higher authority for their

decision/permission.

b) Whenever applications for MSME loans under Govt. Sponsored Schemes are rejected

by the Branch Manager himself/herself for valid reasons, a register is to be maintained

to this effect which shall be examined by the controlling authorities during their branch

visits.

c) Rejection of MSME proposals is subject to concurrence of the next higher authority.

d) MSME proposals once rejected by a higher authority shall be placed before such higher

authority even though the subsequent proposals say, for lesser amount falls within the

powers of a lower authority.

e) Rejection of export credit proposals shall be reported to C & MD, as per extant

guidelines.

f) Rejection of credit proposals by the branch level authorities shall be recorded in a

CREDIT AWARENESS PROGRAMME FOR CLERKS 6

register maintained for this purpose, which shall be reviewed by the controlling

authorities visiting branches.

Web Based Credit Sanction Register for PRR 20A, C, D, and NB179

Bank has introduces web based Credit Sanction Register Package for PRR 20A, C, D and

NB179 to have run time information on sanctions. The system covers proposals relating to

General advances, Government sponsored schemes, Agriculture and Retail lending schemes.

The branches have to key-in only a few fields relating to the credit proposals which enable

Monitoring of sanctions, disbursements, rejections and un-availment on an ongoing basis.

Proposals are to be inwarded invariably in the Web package to effectively monitor the sanctions

/ disbursements / rejections / un-availment.

CREDIT AWARENESS PROGRAMME FOR CLERKS 7

GUIDELINES ON CREDIT INFORMATION REPORTS

Obtaining CIR (Credit Information Report) from CIBIL shall be a pre-sanction exercise and is

not a substitute for verifying default borrower data under RBI's defaulter's list / Willful defaulter's

list / list of undesirable parties at branches or Specific Approval List (SAL) of ECGCI etc.

CIBIL has categorized the credit information under two groups.

*Consumer Accounts - Borrower accounts in the names of individuals

*Commercial Accounts - Borrower accounts other than that of individuals

The data on suit filed accounts in respect of willful defaulters of Rs 25 lacs and above and other

borrower accounts of Rs 1 Cr and above are available in the CIBIL website which can be

accessed freely.

Applicability

*In the case of commercial accounts, obtaining Credit Information Report shall be

manadatory.CIR shall be obtained in consortium accounts where we are leaders.

*The CIR shall be obtained at the time of processing credit proposals from existing clients of the

Bank as well as proposals received from new parties.

*In the case of consumer accounts, obtaining CIR shall be mandatory as under:

Priority Sector - All borrowal accounts with Credit Limit of Rs 2 lacs and above Others - Rs 1

lac and above

Exemptions:

*All individual accounts below Rs 1 lac under non priority advances *All individual accounts

below Rs 2 lacs under priority sector

*All borrowal accounts where salary of the borrower is credited to the account with the lending

branch

*CANARA pension *Educational loans

*Loans against our own deposits/approved securities

*Gold Loans

*Staff Loans

On receipt of an application for credit facility at the branch level, the concerned advances

section officials shall draw the CIR from CIBIL website before processing the proposal. If the

name/s of any proprietor, director/s, partner/s, etc of an applicant appears in the CIR, then the

branch / sanctioning authority, inter alia, shall examine the aspects affecting the credit quality,

before processing and appraising the proposal.

Procedure for drawing CIR :

1. User shall log in to the CIBIL website:http://www.cibil.com

CREDIT AWARENESS PROGRAMME FOR CLERS 8

2. On opening the site, window will appear for selecting the segment-

consumer/commercial

3. Select the segment and punch the details as under:

*name

*date of birth *address

*any of the following

PAN Number/Voter identity card number/Passport details/telephone number etc

*gender

*PIN Code

If the information displayed is as per the requirement, request can be made for generating the

report. To avoid duplication, the report generated as per the request may be saved in hard disk

before taking a print.

Obtaining OPL from existing banker:

In the case of new parties, if they are already having accounts with other banks, OPL from the

bank concerned has to be obtained before processing the proposal.

CREDIT AWARENESS PROGRAMME FOR CLERS 9

INTERNAL CREDIT RISK RATING

Bank has an appropriate Credit Risk Management and monitoring process. The risk rating of

borrowers is a pre sanction exercise as per Bank's policy. The measurement of risk is through

the credit risk rating and scoring models put in place by the Bank.

Risk rating framework is the foundation on which all the credit risk management systems are

built. Rating exercise at the time of appraising a proposal provides useful inputs to the appraiser

and ensures uniformity in credit selection procedures. Apart from it, it aids in

• Pricing the loan products

• Evolving exposure norms

• Carrying out portfolio-level analysis and assessing credit quality

• Post sanction surveillance, monitoring and internal MIS

• Assessing the aggregate risk profile of the Bank

• Measuring credit risk and estimating the provisioning requirements as also capital charge for

credit risk

• Determining the frequency of review/ renewal

Credit Risk Framework in our bank

The concept of risk rating was first introduced in our Bank in 2000 as a post sanction exercise

for exposures to manufacturing activity with limits of Rs 8 crore and above. The guidance note

of Reserve Bank of India on credit risk management issued in October 2002 prescribed that all

the exposures (credit & investment) should be risk rated at the pre-sanction stage. Besides, for

the Bank to move to Advanced Approaches suggested by Basel II, it is necessary that all the

exposures are risk rated and a history of ratings is built up. Risk rating of all borrowal accounts

through Internal Risk Rating Models is mandatory requirement for moving to adoption of

Internal Rating Based Approach under Basel II. The Bank has established a system to measure

Credit Risk of various borrower clients with greater reliability and satisfaction.

Presently the Bank is using the following modules to Risk rate different levels of exposure and

individual borrowers. Judgemental Rating Modules are used while rating individual exposures.

The Credit Risk Rating is conducted using any of the following 4 models as applicable:

a. Risk Assessment Model (RAM)

This model is applicable for the borrowal accounts with sanctioned limit of over Rs. 2 crore. The

software is uploaded in SERVER located in HO Bangalore. The software is developed by

CRISIL and customized to suit our Bank's requirement. Users in the circles are able to access

the model through intranet.

b. Manual Model

This is applicable for borrowal accounts with sanctioned limit of over Rs.20 lacs and not more

than Rs. 2 crores. The model essentially addresses Business risks, Management risks and

Financial risks. Value statements have been provided under each trait to facilitate the users to

uniformly give the scorings and grade will be allotted as under. The Manual model has

CREDIT AWARENESS PROGRAMME FOR CLERKS 10

separate models for risk rating borrowers pursuing industrial and trading activity. A separate

model has been developed for new accounts i.e., those with less than 2 years dealings with

us.

General Guidelines for Rating under Manual Model

The grading system adopted in the Manual model is on a numeric scale. Lower the credit risk

lower is the calibration on the scale. The scale starts from Grade 'III' representing highest level

of safety and lowest level of credit risk and ends at Grade 'VIII' representing lowest level of

safety and highest level of credit risk.

The various risk grades, their definition and the qualifying overall scores are given below

Overall risk score Risk Grade description

(out of 150) Grade Degree of Risk Degree of safety

> 100 III Low Risk (LR 3) Good

> 85 & up to 100 IV Normal Risk Satisfactory

> 70 & up to 85 V Moderate risk Just adequate & needs close

monitoring

> 55 & up to 70 VI High Risk - HR 1 Inadequate & needs very

close watch & monitoring

> 40 & up to 55 VII High Risk - HR 2 Poor & needs very close

watch & monitoring

< 40 VIII High Risk - HR 3 Poor

To qualify for risk grades III & IV a borrower should secure a minimum score of 29 under

financial risk apart from fulfilling the requirements of overall risk score stipulated for the Grade.

If a borrower is not able to achieve the required score of 29 under Financial risks he should be

assigned a next higher risk grade than the risk grade he qualifies for, as per the overall risk

score upto grade V. However from risk grade V onwards even if minimum score of 29 is not

recorded under financial score the borrower should be awarded respective risk grade based

on the overall score secured by him.

c. Small Value Model

This model is applicable for borrowal accounts with sanctioned limit of Rs.2 lakhs and above

and upto Rs 20 lakhs For the purpose of using the model the limit sanctioned alone is the

criteria. However, loans under Retail lending schemes and Direct agricultural loans and loans to

individuals where financial statements are not available (other than CANARA TRADE, RETAIL

TRADE and DOCTORS' CHOICE and Indirect Agricultural loans as mentioned vide H.O.Cir

150/07 and other loans under Priority Sector) are not covered under this model.

To qualify for risk grades III & IV a borrower should secure a minimum score of 20 under

Financial risk apart from fulfilling the requirements of overall risk score stipulated for the Grade

CREDIT AWARENESS PROGRAMME FOR CLERKS 11

(total marks in this model is 135 and the gradation is done similar to the manual model). If a

borrower is not able to achieve the required score of 20 under Financial risks he should be

assigned a next higher risk grade than the risk grade he qualifies for, as per the overall risk

score upto grade V. However from risk grade V onwards even if minimum score of 20 is not

recorded under financial score the borrower should be awarded respective risk grade based on

the overall score secured by him.

d. Portfolio Model

The borrowal accounts of aggregate limits below Rs. 2 lacs and borrowal accounts where

financial statements are not available are risk rated under portfolio model, duly grouping the

accounts as near homogenous pool based on category of borrowers and loan

schemes/segment. The model covers rating of borrowal accounts classified under Priority and

non priority segments. Exposure within Rs. 2 lakhs and Direct Agriculture Loans, Exposure to

individual under Retail Lending Schemes (other than Canara Trade) , Priority Sector Loans

(Other than Retail Trade, Doctor's Choice, Indirect Agriculture) and Non-Priority Loans where

Financial Statements are not available.

APPLICABILITY OF PORTFOLIO MODEL:

The following exposures are covered under the portfolio model.

• Loans / advances under Retail lending Schemes, educational loans, excluding loans under

'Canara trade' scheme.

• Loans to Individuals.

• All direct and indirect Agriculture. However in case of exposure to corporates, firms, co

operative societies, wherever the financial statements are prepared, the risk rating is to be

conducted as a pre sanction exercise in any of the model as applicable.

• Any other schematic loans under retail lending or priority sector.

• Staff loans. (Loans and Advances against bank deposits and specified collateral, life

insurance policies, NSCs, IVPs and KVPs.)

• Loans / advances against valuable securities such as bank deposits, NSCs, KVPs etc.

Risk rating is a pre-sanction exercise and has to be done based on the balance sheet submitted

by the party.

CREDIT AWARENESS PROGRAMME FOR CLERKS 12

GUIDELINES FOR OBTAINING FINANCIAL STATEMENTS

Provisions regarding Audit of Financial Statements to be Submitted :

1. For credit limits upto Rs.20 lakhs (FB+NFB) audited financial statements need not be

insisted. However unaudited financial statements should be obtained.

2. For credit limits of over Rs.20 lakhs (FB+NFB), audited financial statements should be

obtained.

3. Where by virtue of existing statute / law in force, the audit of the accounts is

mandatory, like in case of companies & business enterprises with an annual turnover of Rs

100 lacs and above, if the annual gross receipts exceed Rs25 lakhs rupees in case of

professionals etc, audited financial statements, should be obtained irrespective of the

quantum of credit limit.

4. For borrowers under crop loan & other agriculture related loans to whom income tax

provisions are not applicable, ABS need not be obtained for loans up to Rs 100 lacs.

5. Wherever applicable, Form-3 CB and Form-3CD prescribed under IT Rules should be

obtained.

6. Certified copies of statements with declarations such as "as extracted from the books of

accounts maintained by the party" or "found to be in agreement with the books of accounts

maintained by the party" or "verified and certified" or "certified and found correct" and such

other declarations will not amount to audit of accounts.

7. If the financial statements submitted are more than 6 months old at the time of submission

of proposal for fresh limits/renewal, provisional financial statements of the latest date should

be submitted by the parties.

8. All financial statements are to be obtained in triplicate in the case of proposals falling under

the powers of Circle Office and above.

9. Penalty:

Penal interest of 2% on the outstanding liability shall be collected if the Audited financial

statement is not submitted before 31st October of every year (within 7 months from the date of

closing of its accounting year, if the accounting year of the borrower is other than the period

ending 31st March - HO CIR 159/2010) or within a fortnight from the date of Audit of financial

accounts of the company whichever is earlier. (Cir 231 / 2009)

CREDIT AWARENESS PROGRAMME FOR CLERKS 13

COMPONENTS OF FINANCIAL STATEMENTS

Auditors Report: The auditors will audit the accounts of the business entity and give

comments on accounts and on balance sheet and profit and loss account and other documents

attached to the financial statements. They also report whether the books of accounts are in

agreement and whether there is any deviation from generally accepted accounting principles.

This will help the stake holders including bankers to assess the performance of the business

entity and analyze its strengths and weaknesses.

Director's Report / Chairman's statement: Director's report is a report submitted by the

directors of a company to its shareholders, apprising them of the performance of the company

under its direction during the year and during the interim period between the date of the balance

sheet and date of the annual report. It also discusses company's plans for expansion,

diversification or modernization, company's future prospects and plans for investments. It is a

synopsis of the company's activities.

Balance Sheet: Balance sheet reflects the financial position of a business at a given point of

time. Balance Sheet can either be depicted in horizontal form or vertical form. Vertical

form is widely used by companies in their annual reports.

Profit & Loss Account: This is also known as Operating Statement. Profit and Loss account

statement summarizes the transactions which together result in a profit (or loss) for a specific

period of time. This profit or loss is reflected in the Balance sheet as an increase or decrease in

the owner's equity. Like Balance Sheet, P & L account statement also can be depicted in

horizontal or vertical form. Vertical form of P & L account statement is widely used by

companies in their annual reports. In this statement all revenues are shown first and expenses

are accounted later.

Funds flow statement: The major difference between a funds flow statement and a Balance

Sheet is that the funds flow statement captures the movement of funds between two balance

sheets where as the Balance sheet merely represents a static picture of the sources and uses

of funds as on a particular date. Funds Flow statement explains the various sources from which

funds are/were generated /raised and the uses to which these funds are/were put to use. This

statement would enable one to see how the business financed its fixed assets, built up its

inventory, and discharged its liabilities, paid its dividends and taxes and so on

Items appearing in Balance Sheet:

Capital:

In case of proprietorship concern, capital contributed by the promoter will appear on the

liability side of the balance sheet.

In case of partnership firm, two types of capital i.e. fixed capital and capital under their current

account will appear on liability side of balance sheet. The capital appearing under their current

account is floating in nature.

In case of companies there are two types of share capital. One is equity Capital and the other

CREDIT AWARENESS PROGRAMME FOR CLEKRS 14

is preference capital. Equity Capital is the contribution of capital by the owners (share holders)

of the company. Equity capital carries no fixed rate of dividend, where as preference capital,

which is contributed by preference share holders, carries a fixed amount or rate of dividend.

The funds contributed by the share holders/owners constitute the capital of the enterprise.

In respect of a limited company, the structure of the capital is as follows:

• Authorized capital - authorized by share holders of the company within which the Board of

the Directors can issue shares to the prospective shareholders.

• Issued Capital - the capital issued by the Board of Directors to the prospective

shareholders.

• Subscribed Capital - the capital subscribed by the prospective shareholders.

• Paid up capital - the amount paid by the prospective shareholders towards capital.

Reserves & Surplus:

These are surplus which have been generated from the business activities and retained in the

business.

Reserves are classified into two types i.e. Revenue Reserves & Capital Reserves. Further

Revenue Reserves are nothing but accumulated retained earnings from the profits of normal

business operations. Revenue Reserves are held in several forms like General reserve,

investment allowance reserve, capital redemption reserve etc.

Capital Reserves arise out of gains which are not related to the business operations of the

company. Some examples of capital reserves are Fixed Asset Revaluation Reserve, Share

Premium Reserve etc.

It is important to note that the Revenue Reserves are available for distribution of profits; where

as the Capital Reserves are not available for distribution among the share holders.

Surplus is the balance in the P & L Account after effecting all the appropriations. Reserves,

Surplus along with equity are known as Share Holder's funds.

Secured Loans:

These are borrowings made by the company / firm by creating a specific charge on the assets

of the Company / firm. Some examples of the secured loans are Long Term borrowings from

Commercial Banks, State Financial Institutions etc.

Unsecured Loans:

Borrowings made by the company / firm for which no specific security is furnished. Examples

are Fixed Deposits, Loans from Promoters/Directors, Inter Corporate Deposits and unsecured

Loans from Banks etc.

Current Liabilities:

Any liability that is payable in the next 12 months from the date of Balance Sheet shall be

treated as Current Liability. Therefore the installments of Term loans which are due for payment

in the next 12 months shall also be classified as CL.

CREDIT AWARENESS PROGRAMME FOR CLEKRS 15

Some Examples of Current Liabilities are Advance Payments received from Customers,

outstanding expenses, Dividends, Unclaimed Dividends, Sundry Creditors for Goods, Sundry

Creditors for expenses etc

Generally Bank borrowings by way of Long Term Loans or Short Term Working Capital limits

are reported as Secured or Unsecured loans depending upon the charges created. However for

the purpose of analysis of financial statements, one has to classify them as Term Loans or

Current Liabilities according to the definition of CL.

Fixed Assets:

Fixed assets are meant for carrying on the business operation of the company. Fixed assets

are not meant for resale. Examples of fixed assets are Land, Buildings, and Plant & Machinery

etc.

Fixed assets are shown as gross block and net block. The difference between them is

depreciation. Capital works in Progress are fixed assets which are in the process of

creation/construction. E.g.: If a factory building is under construction, the amount spent on such

construction is shown as Capital works in Progress. Soon after completion of construction, the

same is reflected in Fixed assets.

Depreciation:

Depreciation is a charge on the fixed assets. employed in producing revenues. The reason

behind this is, assets other than land deteriorate with use and eventually wear out. Hence cost

of such assets are to be charged against revenues over a period of time

Different methods are used for depreciating assets. They are:

> Straight Line Method

> Written Down Value Method.

> Sum of Digits Method.

Most companies follow either of the first two methods. In India, Income Tax Act 1961

recognizes the WDV method for the purpose of tax exemptions. Companies have freedom to

decide on the method of depreciation.

Investments:

They are financial assets owned by the company. Investments are long term or short term.

Financial assets though short term are to be classified as Investments, but not as Current

assets.

Investments made by an enterprise which are generally not realizable within a span of 12

months are considered as non current assets. Similarly investments or acquisition of assets

which are not required for business whether short term, or long term are also called non current

assets eg. investment in shares, allied concerns etc.

Current Assets:

Any asset that is realizable in next 12 months shall be treated as Current Asset. These assets

get converted into cash during the operating cycle. They are held for a short time. Current

CREDIT AWARENESS PROGRAMME FOR CLEKRS 16

assets consist of Inventories, Cash/Bank Balances, Sundry Debtors, Loans / Advances,

Prepaid Expenses etc.

Inventories can be in the form of raw material, semi finished goods, finished goods and stores &

spares. They are reported in the balance sheet at lower of Cost or Market Price.

Sundry Debtors:

These are amounts owed by customers. Sundry Debtors are reported less of allowance for bad

debts.

Pre paid Expenses:

They are expenses incurred for which services are yet to be received.

Loans & Advances:

They are amounts advanced to staff/employees of the company, customers or deposits with

Government departments etc.

Miscellaneous Expenditure & Losses:

Miscellaneous expenditure such as preoperative expenses and preliminary expenses are

included under intangible assets. In case of companies same are to be adjusted against

Statement of P and L / Reserves and Surplus and not to be shown under asset side,.

Losses on account of operations, if viewed from accounting, are a decrease in owner's equity.

But Company Law requires that share capital cannot be reduced to off set the losses. This is to

protect the interests of the shareholders. Therefore, losses are shown under reserves and

surplus and net it off against other surplus. Otherwise, negative figure will continue under

reserve and surplus.

Profit & Loss Account:

This is also known as Operating Statement. Like Balance Sheet. Profit and Loss account

statement summarizes the transactions which together result in a profit (or loss) for a specific

period of time. This profit or loss is reflected in the Balance sheet as an increase or decrease in

owner's equity.

Technically, the P&L account statement assumes secondary importance in relation to a

Balance sheet. Nevertheless, the P&L account statement furnishes information indicating the

results of operations over a period of time which is highly crucial to decide about the

performance of an enterprise.

Any format of income statement or Profit & Loss Account should include the following:

> Net Sales

> Cost of Goods Sold.

> Gross Profit.

> Operating Expenses.

> Operating Profit.

> Other income & Other expenses

> Profit before T ax

CREDIT AWARENESS PROGRAMME FOR CLEKRS 17

> Tax

> Profit after Tax.

Net Sales:

Not all sales result in full payment. Discounts, allowances and returns are all deducted along

with excise duty from gross sales to arrive at the Net Sales

Cost of Goods Sold:

Cost of goods sold, is different for manufacturers, wholesalers, and retailers. A manufacturer

deals with three types of inventory; raw materials, work in process, and finished goods. To

calculate the cost of goods sold for a manufacturer, the first step is to determine all direct

manufacturing costs over the course of the year; materials costs, labour expense, factory

overhead, and taxes. The calculation for a manufacturer is:

1. Raw materials (including stores & other items used in the process of

2. manufacture)

Power & Fuel

3. Direct labour (factory wages & salaries)

4. Repairs & maintenance

5. Other Manufacturing Expenses

6. Depreciation

7. Add: Opening stocks in process

8. Deduct: Closing stocks in process

9. Equal to Cost of production

10. Add: Opening stock of finished goods

11. Deduct: Closing stock of finished goods

12. Equal to Cost of sales or cost of goods sold

A wholesaler or retailer buys products from one party and sells to another. The cost of goods

sold for a wholesaler or retailer is calculated as follows:

Opening stock of inventory

+ Purchases

- closing stock of inventory

= Cost of goods sold

Because a service company does not produce or sell a tangible product, there is no cost of

goods sold to calculate.

Gross Profit:

When the cost of goods sold is deducted from net sales, the resulting amount is the gross

profit, which is the amount of money available to cover all other operating expenses. Gross

CREDIT AWARENESS PROGRAMME FOR CLEKRS 18

profit usually reflects the type of industry in which the company operates.

Gross Margin Trends:

Deteriorating margins indicate purchasing difficulties, manufacturing inefficiencies, or inventory

accumulation. Acceptable gross margin levels vary among industries, so to assess the

sufficiency of margins, make a comparison with others in the particular market or industry.

Gross margin trends usually are best compared as percentage trends and not Rupee trends.

Operating Expense Analysis:

Operating expense represents costs not directly related to the production of goods and

services. Operating expenses include officer salaries, selling expenses, and general and

administrative expenses. Operating expenses are a reflection of management decisions,

because the owner has more control over operating expenses than cost of goods sold.

Operating income (loss) is calculated by subtracting total operating expenses from the gross

profit. An operating loss occurs if the total operating expenses exceed the gross profit.

CREDIT AWARENESS PROGRAMME FOR CLEKRS 19

RATIO ANALYSIS

A ratio is an expression of linear direct relationship between two indicators. Ratio may also be

expressed as an integer or as a percentage.

Financial ratios

Financial Ratios are used to compare the risk and return of a firm (or of different firms) over a

period of time and in order to enable bankers, creditors and equity investors to formulate proper

credit and investment decisions.

Purpose and use

Ratios present a profile of a firm, its economic characteristics, competitive approach, and its

unique operative, financial, and investment characteristics.

The ratios are classified into four categories - Liquidity ratios, Leverage or Solvency ratios,

Activity ratios and Profitability ratios

Liquidity ratios:- Current Ratio:

Current Assets

Current liabilities

The current ratio offers an approximate measure of a company's ability to pay its current

maturing obligations on time. Generally, the higher the current ratio, the greater the cushion a

company has for meeting its current obligations.

Net working capital

Current Assets - Current Liabilities = Net Working Capital

Although net working capital is not stated as a ratio, it is a measure of liquidity and will be

covered here. As the name suggests, net working capital is money readily available for a

business's use.

Quick ratio is obtained by comparing current assets excluding inventory with current

liability.

This gives a better picture of the firm's ability to liquidate its current liabilities from the current

assets excluding stock

Leverage /Solvency ratios

Leverage is a measure of degree of risk shouldered by the firm versus its financiers. The assets

are financed by TNW (Tangible Net worth= Capital +Reserves-Intangible Assets) of the firm and

financers. Higher the proportion of borrowed funds greater is the degree of risk to the financers.

Highly leveraged business is less equipped to deal with the business cycle fluctuations and are,

therefore, more prone to failure. In the absence of TNW as a source of funds, the firm may be

unable to sustain its operations during economic downturn unless it can procure additional debt

financing. Such a proposal certainly possesses more risk for the bank. And if the default triggers

it is the bank which loses more than the promoters.

CREDIT AWARENESS PROGRAMME FOR CLERKS 20

1. Debt – Equity Ratio:

Long Term Debt

Tangible Net Worth

DER represents stake of promoter vis - a - vis long term lenders. Lender will decide the same

based on risk perception.

2. TOL: TNW

Total Liabilities

TNW

This is a measure of the share of assets belonging to financers and the assets belonging to a

business's owners. As liabilities grow in comparison to equity, so does the risk to financers.

Eventually, a point is reached where financers have greater risk than the owners of the business

– certainly an undesirable situation.

3. Debt Service Coverage Ratio (DSCR):

Profit after Tax + Depreciation + Interest on TL

--------------------------------------------------------------

Interest on TL + TL Installments

DSCR denotes the debt servicing capacity of the business and the cushion available thereof.

The debt service coverage ratio shows the proportion of a company's net profit and non-cash

expenses needed to pay the principal due on long-term debt in the coming year. This ratio is a

fairly reliable indicator of a company's future performance, provided profitability and noncash

expenses are expected to remain the same or move upwards.

Activity Ratios:

Turnover ratios or activity ratios or asset management ratios, measures how efficiently the

assets are employed by a firm. These ratios are based on the relationship between the level of

activity represented by sales, etc, and the levels of various assets. The important turnover

ratios are:

• Inventory turnover

• Receivables turnover

The efficiency with which the firm converts raw materials into work in process and work in

process into finished goods can be analyzed from the following:

Material consumed

Raw Material Turnover = -----------------------------------------------

Closing RM or Average RM

Cost of production

Work in progress Turnover = -----------------------------------------------

Closing WIP or Average WIP

CREDIT AWARENESS PROGRAMME FOR CLERKS 21

Cost of sales

Finished goods Turnover = --------------------------------------------------

Closing FG or Average FG

The inventory turnover reflects the efficiency of inventory management. A high inventory

turnover is indicative of good inventory management. A low inventory turnover implies

excessive inventory levels than warranted by production and sales activities, or a slow moving

or obsolete inventory.

Net Sales

Accounts receivable turnover: ----------------------------------------------------------

Average accounts receivable

This ratio shows how many times accounts receivables (debtors) turn over during the year.

Higher is the accounts receivable turnover the greater the efficiency of credit management

Holding levels

The inventory holding levels measure the average length of time required to sell inventory. Its

usefulness lies in its comparison to past years or to similar companies. The credit analyst

should remember that the valuation of inventory may differ among companies, especially when

making comparisons.

Closing stock of RM

Raw material Holding = ............................................... x 365 or 12 months

RM consumed

Closing stock of stores & spares

Stores & Spares Holding = ......................................................... x 365 or 12

Stores & spares consumed

Closing stock of WIP

WIP Holding = .................................. x 365 or 12 months

Cost of production

Closing stock of FG

FG Holding = .................................... x 365 or 12 months

Cost of sales / COGS

Sundry debtors & receivables

Debtors Holding = ............................................... x 365 or 12 months

Net Sales

This ratio gives the average number of days / months it takes for a company to collect credit

sales made to its customers.

CREDIT AWARENESS PROGRAMME FOR CLERKS 22

Sundry creditors for goods

Creditors Holding = ----------------------------------- x 365 or 12

Purchases

This ratio measures how quickly a company pays its trade creditors. Credit terms vary

considerably from industry to industry. A significant increase in this ratio over a period of time

may indicate a cash flow problem, or it may merely signify an easing of credit terms

Profitability ratios:

1. Gross profit Ratio, Operating Profit ratio, Net Profit Ratio

In the income statement, there are four levels of profits or profit margins - gross profit, operating

profit, pretax profit and net profit. The term "margin" can apply to the absolute number for a

given profit level and/or the number as a percentage of net sales/revenues. Profit margin

analysis uses the percentage calculation to provide a comprehensive measure of a company's

profitability on a historical basis (3-5 years) and in comparison to peer companies and industry

benchmarks.

Basically, it is the amount of profit (at the gross, operating, pretax or net income level)

generated by the company as a percentage of the sales generated. The objective of margin

analysis is to detect consistency or positive/negative trends in a company's earnings.

Gross Profit

Gross profit Margin = -------------------------------------

Net Sales (Revenue)

Operating Profit

Operating Profit Margin = ------------------------------------

Net Sales (Revenue)

Net Profit

Net Profit Margin = ----------------------------------

Net Sales (Revenue)

Operating Cycle or Working Capital Cycle:

The process involved in the utilisation of working capital is cyclic. The cycle starts from getting/

RM either on cash basis or on credit and ends with realization of sale proceeds and make

payment to creditors. In respect of trading concerns, operating cycle represents the period from

the time the goods and services are purchased and the same are sold and realised. In the case

of manufacturing concerns, it is the time involved in the purchasing of raw materials, converting

them into finished goods and the same are finally sold and proceeds are realised. The working

capital cycle is illustrated as follows:

CREDIT AWARENESS PROGRAMME FOR CLERKS 23

25

Working Capital Gap

This represents excess of current assets over current liabilities excluding bank borrowings. A

part of the Current Assets are financed by Current Liabilities (other than bank borrowings). The

remaining portion of current assets which requires financing is called as working capital gap.

Banks do not grant advance to the full extent of working capital gap. It is a well established rule

that the borrower has to finance a part of working capital gap out of either capital or long term

sources.

Net Working Capital:

Net Working Capital is the net surplus of long term sources over long term uses. This also

represents excess of current assets over current liabilities (including bank finance). It indicates the

margin or long term sources provided by the borrower for financing a part of the current assets

1. General

Working capital is basically the investment in current assets like raw materials, stores, semi-

finished/finished goods, sundry debtors etc. The amount locked up in the operating cycle is

called the working capital. The quantum of working capital varies from activity to activity.

Broadly, the norms for working capital assessment are made based on:

(i) The quantum of finance required

(ii) Segment of the borrower

(iii) Prevailing mandatory instructions of RBI,

(iv) The trade and industry practices prevailing and other objective factors.

The assessment shall be based on:

a. A total study of the borrower's business operations

b. The processing and production cycle of the industry

Financial and managerial capability of the borrower and the various parameters relating to the

unit and the industry.

CREDIT AWARENESS PROGRAMME FOR CLERKS 24

WORKING CAPITAL - METHODS OF ASSESSMENT

Liquidity & Current ratio norms

Applicability

The guidelines on liquidity norms shall be applicable to borrowers provided with working capital

limits assessed under any of the three methods viz., Turnover method / MPBF system / Cash

Budget system.

(i) In respect of contractors undertaking construction contract and / or those who either

enjoy only NFB limits or predominantly NFB limits for the working capital purposes,

these norms may be relaxed by the respective sanctioning authority.

(ii) Term Loans and NFB limits for acquisition of fixed assets and for other purposes (other

than for working capital), are excluded from the current ratio norms as stated herein.

(iii) These norms are also not applicable in respect of working capital finance to schools /

colleges, hospitals and nursing homes, Hotels and restaurants, service providers,

infrastructure projects and plantation.

Norms and other related stipulation:

1. The benchmark current ratio is a minimum of 1.33 or 1.25 for borrowers whose working

capital limits are assessed under any of the accepted methods of assessment, except in

respect of finance to educational institutions, hospitals / nursing homes, service

providers, infrastructure projects and plantation, where the same may be fixed to each

borrower based on the specific nature of financing approved.

2. The benchmark current ratio is also not applicable to industries / activities for which

relaxations are provided by RBI. (E.g.: Sugar Industry)

3. Bank shall not encourage utilisation of working capital for purposes other than meeting

the requirement of the borrower's own business activity. Even within the business

activity, the Bank shall not, encourage diversion of short-term funds for long term uses

by the borrower.

4. Where prior permission is not obtained for the investment of surplus funds, branches

shall collect the full details of the related investments and study the impact thereof on

the financials / working capital management of the concern and report the same to the

sanctioning authority.

5. In respect of existing borrowers where CR is lower than the benchmarks the same has to

be monitored closely. In exceptional circumstances, if CR is less than 1, the guidelines

as prescribed by the Bank shall be adhered for sanction of credit proposals.

The current ratio norms for BIFR / SIC / Sick Small Enterprises (Manufacturing) / CDR

accounts and accounts under rehabilitation / restructuring shall be as per the rehabilitation /

restructuring package accepted/approved by the appropriate authority

CREDIT AWARENESS PROGRAMME FOR CLERKS 25

Borrower's with LOWER CURRENT RATIO - (CURRENT RATIO LESS THAN 1)

The Credit proposals, among others, are subject to a thorough appraisal of financials and

hence in the normal prudence and as prescribed in the policy guidelines of the Bank; the

Current Ratio shall be not less than 1.25 to 1.33 depending on the quantum of loan and the

segment of financing. However, in exceptional circumstances, if CR is less than 1, the following

guidelines shall be adhered to for delegated powers to sanction.

Existing borrowal accounts:

If the accounts fall under the sanctioning powers of authorities up to Head of Circle, the

respective sanctioning authority can permit renewal / enhancement / additional limits.

However, additional exposure can be permitted subject to clearance from the next higher

authority prior to conveying the sanction. In case of accounts falling under the sanctioning

power of GM (H.O), ED / C&MD, the respective authorities can permit renewal / enhancement /

additional limits.

New borrower clients:

If the CR is less than 1, such proposals generally will not be entertained by the Bank and Head

of Circle and below authorities are not empowered to sanction credit facilities to such clients. In

exceptional circumstances, such proposals falling within the delegated powers of GM (C.O) can

be placed to GM (H.O) for decision.

Current Methods for Assessment of Working Capital

The assessment of working capital requirement of a borrower shall generally be made under

any one of the following 3 methods:

(i) Turnover method

(ii) MPBF System

(iii) Cash Budget System

Turnover Method

The genesis of the turnover method is traced to the P R Nayak Committee Recommendations

which were again reviewed by the Vaz Committee. Under this method, the working capital limit

shall be computed at 20% of the projected gross sales turnover accepted by the Bank.

In the case of MSMEs engaged in Manufacturing as well as rendering / providing services and

seeking / enjoying fund based working capital facilities upto Rs.500 lacs shall be assessed on

the basis of turnover method.

The turnover method shall be applied for sanction of fund based working capital limits to the

non MSME borrowers requiring working capital facilities upto Rs.200 lacs from the banking

system.

This system shall be made applicable to traders, merchants, exporters who are not having a

predetermined manufacturing/trading cycle.

CREDIT AWARENESS PROGRAMME FOR CLERKS 26

Under the turnover method, maintenance of a minimum margin on the projected annual sales

turnover should be ensured. In other words, 25% of the projected / estimated gross sales

turnover value shall be computed as working capital requirement, of which, at least 4/5th

(20%) shall be provided by the Bank and the balance 1/5th (5%) shall be by way of promoter's

contribution towards margin money. If the available Net Working Capital is more than 5%, then

bank finance should be restricted to the balance amount within 25% of the projected / estimated

accepted gross sales turnover.

The working capital requirements are linked to projected turnover. Hence It should ensured that

the party has projected reasonably and branches should satisfy themselves about the level of

projection.

The projected turnover/output value is the 'gross sales' which will include excise duty also. In

the case of traders, while bank finance could be assessed at 20% of the projected turnover, the

actual drawals should be allowed on the basis of drawing power determined after deducting

unpaid stocks.

However, borrowers can opt for MPBF / Cash budget system and Bank can employ it if the

same is more suitable and appropriate for assessing their working capital needs. Actual

drawings will be based on drawing power computed as per Bank's guidelines

MPBF system

Under this method, the assessment of Working Capital Finance requirement is based on the

overall study of the borrower's business operation, the production / processing cycle of the

industry which shall result in estimation of a reasonable buildup of current assets supported by

Bank Finance. Here, proper classification of current assets and current liabilities shall be made

on the lines given in the CMA data format and Method II of MPBF (Maximum Permissible Bank

Finance) lending will be applied. A normal current ratio of 1.33 may be insisted subject to

specific deviations / relaxations.

Working Capital limits (Fund based) over Rs 2 Crore for non -MSME borrowers and over Rs 5

Crore for MSME borrowers as the case may be ,but upto Rs 25 Crore shall be assessed based

on the MPBF system. Limits over Rs 25 Crores can be assessed on the basis of MPBF system

or Cash Budget system at the option of the borrower.

Traders, Merchants, Exporters, others etc., requiring working capital limits (Fund based) over

Rs 2 Crores who are not having a pre-determined manufacturing / trading cycle, may opt for

Cash budget system if the same is more suitable and appropriate for assessing their Working

Capital needs.

Based on Kannan Committee recommendations, RBI has allowed freedom to the banks to

decide the holding levels of various components of current assets for financial support to

ensure efficient functioning of the unit.

The tolerance level of 10% is permissible on the assessed MPBF.

CREDIT AWARENESS PROGRAMME FOR CLERKS 27

ARRIVING AT MPBF:

The following is the method of arriving at Maximum Permissible Bank Finance (MPBF) as per

Method II of lending:

TOTAL CURRENT ASSETS (CA)

LESS: TOTAL CURRENT LIABILITIES OTHER THAN BANK BORROWINGS

WORKING CAPITAL GAP

LESS: 25% OF CA OR ACTUAL / PROJECTED NWC WHICH EVER IS HIGHER

MAXIMUM PERMISSIBLE BANK FINANCE

(*) AFTER PROPER CLASSIFICATION

Cash Budget System:

The competitive banking environment calls for adopting methods of assessment appropriate to

meet the needs of borrowers. Under this method, the Working Capital needs of the borrowers

are assessed on the basis of projected cash flow and the estimate of cash deficit

In the case of borrowers enjoying / seeking Fund based credit facilities of over Rs.25 crores, the

same can be assessed on the basis of Cash Budget system or MPBF system, at the option of

the borrowers.

However, in the case of specific industries / seasonal activities such as software development,

construction activity, tea and sugar, normally, the system of assessment based on the cash

budget may be adopted. Further, in the case of specific industries like tea, wherever for valid

reasons, the borrower opts to avail the Working Capital facility under MPBF system, the same

may be acceded to.

The projected cash budget statement as per Appendix-2 and Projected Balance Sheet and

Profitability statement as per Appendix-3 as per Manual of Instruction on Working Capital

Finance shall be obtained in triplicate along with the application of the borrower and the MPBF

shall be fixed taking into account the peak level cash deficit.

Monitoring the cash budget through cash flow statement:

• The branches shall obtain the quarterly cash flow projections one month in advance before

the commencement of the quarter for stipulating the operative limit. The statement should

be obtained in triplicate.

• The branches shall obtain on a quarterly basis, the actuals of cash flow within a fortnight of

the completion of the quarter and scrutinise the variations with reference to the projected

cash flow obtained earlier, in the same format.

• A copy of the projected / actual cash flow statement shall be endorsed to the reviewing

authority at Circle Office with the specific comments / observations of the branch. In case of

HO power accounts, a copy of the cash flow statement along with the comments of the

CREDIT AWARENESS PROGRAMME FOR CLERKS 28

branch should also be endorsed to the concerned processing Section at HO.

Apart from the above, the branches should also obtain half yearly balance sheet and funds

flow statement as per QOS/HOS from the borrower

DURATION OF WORKING CAPITAL LIMITS:

Normally, the duration of limits will not exceed 12 months from he date of sanction except in the

following cases:

Borrower Category Duration of limits that can be specifically permitted by the

respective sanctioning authority

Employees of the Bank 2 years

OD against Term Deposits

Upto the date of maturity of the Term Deposit

with our Bank

Exporters including those

Two years subject to the other specific operative guidelines

under Gold card category

H.O power accounts/Circle

power accounts rated as

below :

- Low risk - Grade I and 2 Maximum period of 18 months

- Low risk - Grade 3. Maximum period of 15 months

- Normal risk/ Moderate Maximum period of 12 months

risk/High Risk

LUCC 3 years

Canara trade 2 years

MSME In respect of MSME accounts (Industries and Services sectors)

which are categorized under LR1 and LR2 or rated as Low Risk

by SMERA or equivalent SME ratings from ECAIs approved

by RBI - Working Capital limits may be permitted for a period of

2 years. However, annual review of accounts to be conducted to

step up / step down the limits as is prevailing in the case of

Exporters under Gold Card Export scheme.

MSME - LR 3 - 15 months

KCCS - Canara Kisan OD 3 years

Kisan Suvidha 5 years

Krishi Mitra Card 3 years

GL OD 2 years

CREDIT AWARENESS PROGRAMME FOR CLERKS 29

MICRO, SMALL AND MEDIUM ENTERPRISES (MSMEs)

DEFINITION

With the enactment of Micro, Small and Medium Enterprises Development (MSMED) Act, 2006

on June 16, 2006 and notified on October 2, 2006, the definition of Micro, Small and Medium

enterprises has undergone change. With the enactment of MSMED Act 2006, Services sector

has become a part of Micro, Small and Medium Enterprises. Thus for the purpose of bank

credit, MSMEs would include both enterprises engaged in manufacturing or production and

providing or rendering of services.

A. Direct Finance:

1. Enterprises engaged in the manufacture or production, processing or preservation of

goods and whose investment in plant and machinery is the original cost excluding land

building and the items specified by the Ministry of MSME vide its notification no.

S.O.1722(E) dt 5.10.2006 as specified below:

2. Enterprises engaged in providing or rendering of services and whose investment in

equipment (original cost) excluding land building and further, fitting and other items not

directly related to the service rendered or as may be notified under the MSMED Act

2006) as specified below. These will include small road and water transport operators,

small business, retail trade, professional and self employed persons and all other

service enterprises).

Manufacturing Servicing

Enterprises : Enterprises :

engaged in the manufacture or engaged in providing or rendering of

production, processing or services and

preservation of goods and whose investment in equipment

whose investment in P&M is the (original cost excluding land &

original cost excluding land and building and further, fitting and other

building and the items specified by items not directly related to the service

the Ministry of MSME vide its rendered or as may be notified under

notification No. S.O.1722 (E) dated the MSMED Act, 2006) as specified

05.10.2006, as specified below: below:

(These will include small road & water

transport operators, small business,

retail trade, professional & self

employed persons and all other service

enterprises).

Micro Investment in P&M does not exceed Investment in equipment does not

Rs. 25 lacs. exceed Rs. 10 lacs.

Small Investment in P&M is more than Investment in equipment is more than

Rs.25 lacs but does not exceed Rs.5 Rs. 10 lacs but does not exceed Rs. 2

crore. crore.

CREDIT AWARENESS PROGRAMME FOR CLERKS 30

Medium Investment in P&M is more than Rs. 5 Investment in equipment is more than

crore but does not exceed Rs. 10 Rs. 2 crore but does not exceed Rs. 5

crore. crore

*Note: All advances granted to units in the Khadi and Village Industries Sector (KVI),

irrespective of their size of operations, location and amount of original investment in Plant &

Machinery / equipments will be covered under the priority sector advances and will be eligible

for consideration under the sub targets of the micro enterprise segment within the MSE ( Micro

and Small Enterprises ) sector to be considered as advances extended to Micro Enterprises

sector