Professional Documents

Culture Documents

SFM MTP - May 2018 Question

SFM MTP - May 2018 Question

Uploaded by

Majid0 ratings0% found this document useful (0 votes)

74 views6 pagesCA-FINAL SFM Mock Test Paper Question- May -2018

Original Title

SFM MTP -May 2018 Question

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCA-FINAL SFM Mock Test Paper Question- May -2018

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

74 views6 pagesSFM MTP - May 2018 Question

SFM MTP - May 2018 Question

Uploaded by

MajidCA-FINAL SFM Mock Test Paper Question- May -2018

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 6

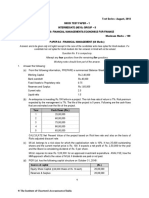

Test Series: April, 2018

MOCK TEST PAPER –2

FINAL (OLD) COURSE: GROUP – I

PAPER – 2 : STRATEGIC FINANCIAL MANAGEMENT

Question No. 1 is compulsory. Attempt any five questions from the remaining six questions.

Working notes should form part of the answer.

Time Allowed – 3 Hours Maximum Marks – 100

1. (a) BSE 5000

Value of portfolio Rs.10,10,000

Risk free interest rate 9% p.a.

Dividend yield on Index 6% p.a.

Beta of portfolio 1.5

We assume that a future contract on the BSE index with four months maturity is

used to hedge the value of portfolio over next three months. One future contract is

for delivery of 50 times the index.

Based on the above information calculate:

(i) Price of future contract.

(ii) The gain on short futures position if index turns out to be 4,500 in three

months. (5 Marks)

(b) ABC Ltd. of UK has exported goods worth Can $ 5,00,000 receivable in 6 months.

The exporter wants to hedge the receipt in the forward market. The following

information is available:

Spot Exchange Rate Can $ 2.5/£

Interest Rate in UK 12%

Interest Rate In Canada 15%

The forward rates truly reflect the interest rates differential. Find out the gain/loss to UK

exporter if Can $ spot rates (i) declines 2%, (ii) gains 4% or (iii) remains unchanged over

next 6 months. (5 Marks)

© The Institute of Chartered Accountants of India

(c) A company is considering Projects X and Y with following information:

Project Expected NPV Standard deviation

(Rs.)

X 1,22,000 90,000

Y 2,25,000 1,20,000

(i) Which project will you recommend based on the above data?

(ii) Explain whether your opinion will change, if you use coefficient of variation as

a measure of risk.

(iii) Which measure is more appropriate in this situation and why? (5 Marks)

(d) M Ltd. has to make a payment on 30th January, 2010 of Rs. 80 lakhs. It has surplus

cash today, i.e. 31st October, 2009; and has decided to invest sufficient cash in a

bank's Certificate of Deposit scheme offering an yield of 8% p.a. on simple interest

basis. What is the amount to be invested now? (5 Marks)

2. (a) DEF Ltd has been regularly paying a dividend of Rs. 19,20,000 per annum for

several years and it is expected that same dividend would continue at this level in

near future. There are 12,00,000 equity shares of Rs. 10 each and the share is

traded at par.

The company has an opportunity to invest Rs. 8,00,000 in one year's time as well

as further Rs. 8,00,000 in two year's time in a project as it is estimated that the

project will generate cash inflow of Rs. 3,00,000 per annum in three year's time and

four year’s time and Rs. 3,60,000 in five year’s time which will continue forever. This

investment is possible if dividend is reduced for next two years.

Whether the company should accept the project? Also analyze the effect on the

market price of the share, if the company decides to accept the project. (8 Marks)

(b) A Mutual Fund Co. has the following assets under it on the close of business as on:

1st February 2012 2nd February 2012

Company No. of Shares Market price per Market price per

share share

Rs. Rs.

L Ltd 20,000 20.00 20.50

M Ltd 30,000 312.40 360.00

N Ltd 20,000 361.20 383.10

P Ltd 60,000 505.10 503.90

© The Institute of Chartered Accountants of India

Total No. of Units 6,00,000

(i) Calculate Net Assets Value (NAV) of the Fund.

(ii) Following information is given:

Assuming one Mr. A, submits a cheque of Rs. 30,00,000 to the Mutual Fund

and the Fund manager of this company purchases 8,000 shares of M Ltd; and

the balance amount is held in Bank. In such a case, what would be the position

of the Fund?

(iii) Find new NAV of the Fund as on 2nd February 2012. (8 Marks)

3. (a) XY Limited is engaged in large retail business in India. It is contemplating for

expansion into a country of Africa by acquiring a group of stores having the same

line of operation as that of India.

The exchange rate for the currency of the proposed African country is extremely

volatile. Rate of inflation is presently 40% a year. Inflation in India is currently 10%

a year. Management of XY Limited expects these rates likely to continue for the

foreseeable future.

Estimated projected cash flows, in real terms, in India as well as African

country for the first three years of the project are as follows:

Year – 0 Year – 1 Year – 2 Year - 3

Cash flowsin Indian -50,000 -1,500 -2,000 -2,500

Rs. (000)

Cash flows in African -2,00,000 +50,000 +70,000 +90,000

Rands (000)

XY Ltd. assumes the year 3 nominal cash flows will continue to be earned each

year indefinitely. It evaluates all investments using nominal cash flows and a

nominal discounting rate. The present exchange rate is African Rand 6 to Rs. 1.

You are required to calculate the net present value of the proposed investment

considering the following:

(i) African Rand cash flows are converted into rupees and discounted at a risk

adjusted rate.

(ii) All cash flows for these projects will be discounted at a rate of 20% to reflect

it’s high risk.

(iii) Ignore taxation.

Year - 1 Year - 2 Year - 3

PVIF @ 20% .833 .694 .579 (8 Marks)

© The Institute of Chartered Accountants of India

(b) Given the following information:

Exchange rate – Canadian dollar 0.665 per DM (spot)

Canadian dollar 0.670 per DM (3 months)

Interest rates – DM 7% p.a.

Canadian Dollar – 9% p.a.

What operations would be carried out to take the possible arbitrage gains?

(8 Marks)

4. (a) XYZ Ltd.’s bond (Face Value of Rs. 1000) with 4 years maturity is currently trading

at Rs. 900 carrying a coupon rate of 15%. Assuming that the reinvestment rate is

16%, you are required to calculate Realized Yield to Maturity of the bond. (8 Marks)

(b) Following are the details of a portfolio consisting of three shares:

Share Portfolio weight Beta Expected return in Total variance

%

A 0.20 0.40 14 0.015

B 0.50 0.50 15 0.025

C 0.30 1.10 21 0.100

Standard Deviation of Market Portfolio Returns = 10%

You are given the following additional data:

Covariance (A, B) = 0.030

Covariance (A, C) = 0.020

Covariance (B, C) = 0.040

Calculate the following:

(i) The Portfolio Beta

(ii) Residual variance of each of the three shares

(iii) Portfolio variance using Sharpe Index Model

(iv) Portfolio variance (on the basis of modern portfolio theory given by Markowitz).

(8 Marks)

5. (a) A Ltd. has an export sale of Rs. 50 crore of which 20% is paid by importer in

advance of dispatch and for balance the average collection period is 60 days.

However, it has been observed that these payments have been running late by 18

days. The past experience indicates that bad debt losses are 0.6% on Sales. The

expenditure incurred for efforts in receivable collection are Rs. 60,00,000 p.a.

© The Institute of Chartered Accountants of India

So far A Ltd. had no specific arrangements to deal with export receivables, following

two proposals are under consideration:

(i) A non-recourse export factoring agency is ready to buy A Ltd.’s receivables by

charging 2% commission. The factor will pay an advance to the firm at an

interest rate of MIBOR + 2.00% after withholding 20% as reserve.

(ii) Insu Ltd. an insurance company has offered a comprehensive insurance policy

at a premium of 0.45% of the sum insured covering 85% of risk of non-

payment. A Ltd. can assign its right to a bank in return of an advance of 75%

of the value insured at MIBOR+1.75%.

Assuming that MIBOR is 6% and A Ltd. can borrow from its bank at

MIBOR+2.25% by using existing overdraft facility determine the which of the

two proposal should be accepted by A Ltd. (1 Year = 360 days). (10 Marks)

(b) A company is long on 10 MT of copper @ Rs. 474 per kg (spot) and intends to

remain so for the ensuing quarter. The standard deviation of changes of its spot and

future prices are 4% and 6% respectively, having correlation coefficient of 0.75.

What is its hedge ratio? What is the amount of the copper future it should short to

achieve a perfect hedge? (6 Marks)

6. (a) The following information is provided relating to the acquiring company Efficient Ltd.

and the target Company Healthy Ltd.

Efficient Ltd. Healthy Ltd.

No. of shares (F.V. Rs. 10 each) 10.00 lakhs 7.5 lakhs

Market capitalization 500.00 lakhs 750.00 lakhs

P/E ratio (times) 10.00 5.00

Reserves and Surplus 300.00 lakhs 165.00 lakhs

Promoter’s Holding (No. of shares) 4.75 lakhs 5.00 lakhs

Board of Directors of both the Companies have decided to give a fair deal to the

shareholders and accordingly for swap ratio the weights are decided as 40%, 25%

and 35% respectively for Earning, Book Value and Market Price of share of each

company:

(i) Calculate the swap ratio and also calculate Promoter’s holding % after

acquisition.

(ii) What is the EPS of Efficient Ltd. after acquisition of Healthy Ltd.?

(iii) What is the expected market price per share and market capitalization of

Efficient Ltd. after acquisition, assuming P/E ratio of Firm Efficient Ltd. remains

unchanged.

(iv) Calculate free float market capitalization of the merged firm. (8 Marks)

© The Institute of Chartered Accountants of India

(b) X Limited, just declared a dividend of Rs. 14.00 per share. Mr. B is planning to

purchase the share of X Limited, anticipating increase in growth rate from 8% to

9%, which will continue for three years. He also expects the market price of this

share to be Rs. 360.00 after three years.

You are required to determine:

(i) the maximum amount Mr. B should pay for shares, if he requires a rate of

return of 13% per annum.

(ii) the maximum price Mr. B will be willing to pay for share, if he is of the opinion

that the 9% growth can be maintained indefinitely and require 13% rate of

return per annum.

(iii) the price of share at the end of three years, if 9% growth rate is achieved and

assuming other conditions remaining same as in (ii) above.

Calculate rupee amount up to two decimal points.

Year-1 Year-2 Year-3

FVIF @ 9% 1.090 1.188 1.295

FVIF @ 13% 1.130 1.277 1.443

PVIF @ 13% 0.885 0.783 0.693

(8 Marks)

7. Write short notes on any of four of the following:

(a) Cross Border Leasing

(b) Buy-outs

(c) CAMEL Model in Credit Rating

(d) Random Walk Theory

(e) Practical considerations in dividend policy with regard to desire of shareholders

(4 ×4 = 16 Marks)

© The Institute of Chartered Accountants of India

You might also like

- AP Investments Quizzer QDocument55 pagesAP Investments Quizzer QLordson Ramos75% (4)

- CA Intermediate Mock Test Eco FM 16.10.2018 EM Only QuestionDocument6 pagesCA Intermediate Mock Test Eco FM 16.10.2018 EM Only QuestionTanmayNo ratings yet

- Takaful Companies and Products in MalaysiaDocument52 pagesTakaful Companies and Products in MalaysiaMohammed AlshuaibiNo ratings yet

- SFM QuesDocument5 pagesSFM QuesAstha GoplaniNo ratings yet

- 44956mtpbosicai Final QP p2Document7 pages44956mtpbosicai Final QP p2Shubham SurekaNo ratings yet

- SFM Mixed Compilation QTSDocument25 pagesSFM Mixed Compilation QTSBijay AgrawalNo ratings yet

- Question No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The AnswerDocument5 pagesQuestion No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The AnswercdNo ratings yet

- Question No. 1 Is Compulsory. Attempt Any Five Questions From The Remaining Six Questions. Working Notes Should Form Part of The AnswerDocument5 pagesQuestion No. 1 Is Compulsory. Attempt Any Five Questions From The Remaining Six Questions. Working Notes Should Form Part of The AnswerCA Dipesh JainNo ratings yet

- Question No. 1 Is Compulsory. Attempt Any Five Questions From The Remaining Six Questions. Working Notes Should Form Part of The AnswerDocument17 pagesQuestion No. 1 Is Compulsory. Attempt Any Five Questions From The Remaining Six Questions. Working Notes Should Form Part of The AnswerMajidNo ratings yet

- 8) FM EcoDocument19 pages8) FM EcoKrushna MateNo ratings yet

- Bangalore University Previous Year Question Paper AFM 2020Document3 pagesBangalore University Previous Year Question Paper AFM 2020Ramakrishna NagarajaNo ratings yet

- MTP Oct. 2018 FM and Eco QuestionDocument6 pagesMTP Oct. 2018 FM and Eco QuestionAisha MalhotraNo ratings yet

- MTP 1 May 18 QDocument4 pagesMTP 1 May 18 QSampath KumarNo ratings yet

- Mock Test Q1 PDFDocument4 pagesMock Test Q1 PDFManasa SureshNo ratings yet

- SFM Q 2Document5 pagesSFM Q 2riyaNo ratings yet

- 0432 Fourth Semester 5 Years B.B.A. LL.B. Examination, December 2012 Financial ManagementDocument4 pages0432 Fourth Semester 5 Years B.B.A. LL.B. Examination, December 2012 Financial ManagementsimranNo ratings yet

- MTP 1 May 21 QDocument4 pagesMTP 1 May 21 QSampath KumarNo ratings yet

- Question No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The AnswerDocument15 pagesQuestion No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The Answerritz meshNo ratings yet

- Question No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The AnswerDocument5 pagesQuestion No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The AnswerAyushi GuptaNo ratings yet

- AL Financial Management Nov Dec 2016Document4 pagesAL Financial Management Nov Dec 2016hyp siinNo ratings yet

- SFM New Sums AddedDocument78 pagesSFM New Sums AddedRohit KhatriNo ratings yet

- Question No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The AnswerDocument5 pagesQuestion No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The AnswerKuperajahNo ratings yet

- SFM N RTP, MTP, EXAMDocument204 pagesSFM N RTP, MTP, EXAMKuperajahNo ratings yet

- Cainterseries 2 CompleteDocument70 pagesCainterseries 2 CompleteNishanthNo ratings yet

- Adv Accounts MTP M19 S2Document22 pagesAdv Accounts MTP M19 S2Harshwardhan PatilNo ratings yet

- Mock Test Q2 PDFDocument5 pagesMock Test Q2 PDFManasa SureshNo ratings yet

- Oct19 Ques-1Document5 pagesOct19 Ques-1absankey770No ratings yet

- Question No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The AnswerDocument7 pagesQuestion No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The AnswerHarsh KumarNo ratings yet

- 6th Sem-FM - Model QP by Srijita Datta and Arunangsu Das Sarma-26Apr2020Document15 pages6th Sem-FM - Model QP by Srijita Datta and Arunangsu Das Sarma-26Apr2020Kashish GroverNo ratings yet

- FMECO M.test HM Question 17.03.2022Document5 pagesFMECO M.test HM Question 17.03.2022sahroshan891No ratings yet

- Unit - I: Section - ADocument22 pagesUnit - I: Section - AskirubaarunNo ratings yet

- Maf5102 Accounting and Finance Virt MainDocument4 pagesMaf5102 Accounting and Finance Virt Mainshobasabria187No ratings yet

- Model Paper Financial ManagementDocument6 pagesModel Paper Financial ManagementSandumin JayasingheNo ratings yet

- Question No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The AnswerDocument5 pagesQuestion No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The AnswerItikaa TiwariNo ratings yet

- Mba Summer 2019Document4 pagesMba Summer 2019Dhruvi PatelNo ratings yet

- GTU PaperscjsgjsvjbvksnkbsggjvsvbbsibDocument23 pagesGTU Paperscjsgjsvjbvksnkbsggjvsvbbsibizhseabt2fNo ratings yet

- FMECO M.test EM 30.03.2021 QuestionDocument6 pagesFMECO M.test EM 30.03.2021 Questionsujalrathi04No ratings yet

- CRV - Valuation - ExerciseDocument15 pagesCRV - Valuation - ExerciseVrutika ShahNo ratings yet

- Nov 10Document7 pagesNov 10chandreshNo ratings yet

- SFM RTP Nov 22Document16 pagesSFM RTP Nov 22Accounts PrimesoftNo ratings yet

- Question PaperDocument3 pagesQuestion PaperAmbrishNo ratings yet

- Mittal Commerce Classes Intermediate - Mock Test (GI-1, GI-2, GI-3, VI-1, SI-1, VDI-1)Document6 pagesMittal Commerce Classes Intermediate - Mock Test (GI-1, GI-2, GI-3, VI-1, SI-1, VDI-1)Shubham KuberkarNo ratings yet

- 4201 (Previous Year Questions)Document13 pages4201 (Previous Year Questions)Tanjid MahadyNo ratings yet

- FM-July Aug 2022 QPDocument3 pagesFM-July Aug 2022 QPJasmine Placy DaisNo ratings yet

- Capital Budgeting Sums - 16-17 (2018 - 05 - 19 12 - 01 - 33 UTC) (2019 - 01 - 22 04 - 17 - 23 UTC) (2019 - 07 - 02 05 - 43 - 05 UTC) PDFDocument7 pagesCapital Budgeting Sums - 16-17 (2018 - 05 - 19 12 - 01 - 33 UTC) (2019 - 01 - 22 04 - 17 - 23 UTC) (2019 - 07 - 02 05 - 43 - 05 UTC) PDFutsavNo ratings yet

- Financial ManagementDocument4 pagesFinancial ManagementsimranNo ratings yet

- ICAI - Question BankDocument6 pagesICAI - Question Bankkunal mittalNo ratings yet

- FFTFMDocument5 pagesFFTFMKaran NewatiaNo ratings yet

- 05 s601 SFM - 3 PDFDocument4 pages05 s601 SFM - 3 PDFMuhammad Zahid FaridNo ratings yet

- FM QB New NewDocument22 pagesFM QB New NewskirubaarunNo ratings yet

- sFikv8tLO3DuTOB3I8bY 4762Document2 pagessFikv8tLO3DuTOB3I8bY 4762dipusharma4200No ratings yet

- MBA 5109 - Financial Management (MBA 2020-2022)Document6 pagesMBA 5109 - Financial Management (MBA 2020-2022)sreekavi19970120No ratings yet

- 4 Financial Management Questions Nov Dec 2019 PL PDFDocument5 pages4 Financial Management Questions Nov Dec 2019 PL PDFShahriar ShihabNo ratings yet

- 202 - FM Question PaperDocument5 pages202 - FM Question Papersumedh narwadeNo ratings yet

- Model Questions BBS 3rd Year Fundamental of Financial Management PDFDocument9 pagesModel Questions BBS 3rd Year Fundamental of Financial Management PDFShah SujitNo ratings yet

- Assignment MF0001: (2 Credits) Set 1Document9 pagesAssignment MF0001: (2 Credits) Set 1470*No ratings yet

- Test Series: March, 2019 Mock Test Paper - 1 Intermediate (Ipc) : Group - Ii Paper - 5: Advanced AccountingDocument7 pagesTest Series: March, 2019 Mock Test Paper - 1 Intermediate (Ipc) : Group - Ii Paper - 5: Advanced AccountingPiyush AmbastaNo ratings yet

- Ca Final SFM Test Paper QuestionDocument8 pagesCa Final SFM Test Paper Question1620tanyaNo ratings yet

- FM & Eco - Test 1Document3 pagesFM & Eco - Test 1Ritam chaturvediNo ratings yet

- Financial Markets and Institutions248 ut9g7tDEPEDocument2 pagesFinancial Markets and Institutions248 ut9g7tDEPEKhushi SangoiNo ratings yet

- Super 60 Questions CA Final AFM For MAy 24 ExamsDocument42 pagesSuper 60 Questions CA Final AFM For MAy 24 ExamsHenry HundersonNo ratings yet

- Securitization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsFrom EverandSecuritization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsNo ratings yet

- Factory OverheadDocument21 pagesFactory OverheadJuvi CruzNo ratings yet

- Mobile Services: Your Account Summary This Month'S ChargesDocument11 pagesMobile Services: Your Account Summary This Month'S ChargesgeniluniNo ratings yet

- Archivos Televisa-EPN Documentos de Los Contratos The GuardianDocument198 pagesArchivos Televisa-EPN Documentos de Los Contratos The GuardianJag RoNo ratings yet

- Company Law Difference Based Questions & Answers& Some Short Notes & Simplified Notes On Sec 237 Etc Uploaded On 30th Oct 2017 636449743334374193Document2 pagesCompany Law Difference Based Questions & Answers& Some Short Notes & Simplified Notes On Sec 237 Etc Uploaded On 30th Oct 2017 636449743334374193ZoyaKhanNo ratings yet

- Tarea Taller 1 FINA 503Document4 pagesTarea Taller 1 FINA 503Hugo LombardiNo ratings yet

- DAC 100 - Fundamental of Accounting NotesDocument146 pagesDAC 100 - Fundamental of Accounting NotesAlistahr AmoloNo ratings yet

- Microsoft Word - Nigerian Bottling Company PLC FinalDocument20 pagesMicrosoft Word - Nigerian Bottling Company PLC FinalAkindeyi AnuNo ratings yet

- Current Issues in AuditingDocument19 pagesCurrent Issues in AuditingMeng Zong100% (1)

- Request For Bonding And/Or Cancellation of Bond of Accountable Officials and Employees of The Republic of The PhilippinesDocument4 pagesRequest For Bonding And/Or Cancellation of Bond of Accountable Officials and Employees of The Republic of The PhilippinesTimn AndradaNo ratings yet

- Review SR: of AccountancyDocument17 pagesReview SR: of AccountancyJyasmine Aura V. AgustinNo ratings yet

- Score Financial Spreadsheet TemplateDocument29 pagesScore Financial Spreadsheet TemplateMohamed Shaffaf Ali RasheedNo ratings yet

- Test Bank For Money Banking and Financial Markets 3rd Edition CecchettiDocument36 pagesTest Bank For Money Banking and Financial Markets 3rd Edition Cecchettibullfrog.cayman.z05o100% (45)

- Salient Features of GSTDocument9 pagesSalient Features of GSTKunal MalhotraNo ratings yet

- Business Intelligence in Banking IndustryDocument11 pagesBusiness Intelligence in Banking IndustryKrishna Bhaskar100% (1)

- Fa 203902 2020-12-29 SC Drum Bamal SRLDocument1 pageFa 203902 2020-12-29 SC Drum Bamal SRLBarbulescu CiprianNo ratings yet

- Engineering EconomicsDocument161 pagesEngineering EconomicsggrNo ratings yet

- Universityof St. La Salle: REPORT: Quarrying and Mining Waste Management / Sanitation / Pollution ControlDocument40 pagesUniversityof St. La Salle: REPORT: Quarrying and Mining Waste Management / Sanitation / Pollution ControlXirkul TupasNo ratings yet

- Amara Raja - Q1FY22 - MOStDocument10 pagesAmara Raja - Q1FY22 - MOStRahul JakhariaNo ratings yet

- BCG Matrix, Ansoff Matrix & GE Matrix: Marketing ManagementDocument26 pagesBCG Matrix, Ansoff Matrix & GE Matrix: Marketing ManagementTerjani Khanna GoyalNo ratings yet

- Rujukan Kerja Kursus Pengajian Perniagaan STPM 2018Document2 pagesRujukan Kerja Kursus Pengajian Perniagaan STPM 2018Anonymous DIX7SUANo ratings yet

- IFRS For SMEs Update May 2014Document3 pagesIFRS For SMEs Update May 2014DarrelNo ratings yet

- Mutual Funds-WPS OfficeDocument10 pagesMutual Funds-WPS OfficeY KNo ratings yet

- SADC RMS English BookletDocument32 pagesSADC RMS English BookletpalNo ratings yet

- Institute of Bankers Pakistan: MicrofinanceDocument4 pagesInstitute of Bankers Pakistan: MicrofinanceMuhammad KashifNo ratings yet

- ACC 8211 Oil and Gas Accounting PDFDocument93 pagesACC 8211 Oil and Gas Accounting PDFNikhil AnandNo ratings yet

- Pay Monetization ExerciseDocument1 pagePay Monetization ExerciseMalik Osama ShahabNo ratings yet

- Ansoff's Matrix: Analytical ToolDocument5 pagesAnsoff's Matrix: Analytical ToolvrijNo ratings yet

- Mehta Group of Companies (Case Study)Document8 pagesMehta Group of Companies (Case Study)Helary ShahNo ratings yet