Professional Documents

Culture Documents

100%(1)100% found this document useful (1 vote)

421 viewsCamp John Hay vs. CBAA

Camp John Hay vs. CBAA

Uploaded by

GeorginaThe Camp John Hay Development Corporation appealed tax assessments issued by the City Assessor of Baguio City for various buildings and land that they owned and leased. They claimed exemption from taxes under the Bases Conversion and Development Act. The Board of Tax Appeals dismissed the appeal for failure to comply with Section 252 of the Local Government Code, which requires payment of taxes under protest before a protest can be entertained. The Central Board of Assessment Appeals and the Court of Tax Appeals affirmed this decision. The Supreme Court denied the petition, finding that Section 252 applies even to allegedly tax-exempt entities, in order to allow the uninterrupted collection of taxes that are vital for government services.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- Camp John Hay Development Corp. v. CBAA, 706 SCRA 547 - THE LIFEBLOOD DOCTRINE - DigestDocument2 pagesCamp John Hay Development Corp. v. CBAA, 706 SCRA 547 - THE LIFEBLOOD DOCTRINE - DigestKate Garo100% (1)

- Matalin Coconut Co., Inc. vs. The Municipal Council of MalabangDocument1 pageMatalin Coconut Co., Inc. vs. The Municipal Council of MalabangJeorge Ryan MangubatNo ratings yet

- Matalin v. Municipal CouncilDocument2 pagesMatalin v. Municipal CouncilStradivarium100% (1)

- COMPARISON of SEC 222 and 203 - CABUSOGDocument2 pagesCOMPARISON of SEC 222 and 203 - CABUSOGKristine Jay Perez-CabusogNo ratings yet

- Digest San Juan Vs CastroDocument2 pagesDigest San Juan Vs CastroRyan AcostaNo ratings yet

- Cir v. Bpi, 521 Scra 373 - The Lifeblood Doctrine - DigestDocument1 pageCir v. Bpi, 521 Scra 373 - The Lifeblood Doctrine - DigestKate Garo100% (1)

- Camp John Hay Development Corporation vs. Central Board of Assessment Appeals (Cbaa)Document3 pagesCamp John Hay Development Corporation vs. Central Board of Assessment Appeals (Cbaa)lexxNo ratings yet

- CIR Vs PetronDocument3 pagesCIR Vs PetronChic PabalanNo ratings yet

- Cocacola Vs ToledoDocument2 pagesCocacola Vs ToledoPia SottoNo ratings yet

- Victorias Milling Vs PpaDocument2 pagesVictorias Milling Vs PpaMike LlamasNo ratings yet

- Abello vs. CIR & CA (Case Digest)Document1 pageAbello vs. CIR & CA (Case Digest)Vince Leido100% (7)

- LG Electronics vs. CIR DigestDocument1 pageLG Electronics vs. CIR DigestAnonymous MikI28PkJcNo ratings yet

- Cir v. Cebu HoldingsDocument4 pagesCir v. Cebu HoldingsAudrey50% (2)

- CIR Vs PhilamlifeDocument2 pagesCIR Vs PhilamlifeBreAmberNo ratings yet

- Kepco Vs Cir Case DigestDocument1 pageKepco Vs Cir Case DigestjovifactorNo ratings yet

- Kepco Vs CIRDocument3 pagesKepco Vs CIRLizzette Dela PenaNo ratings yet

- Pilmico-Maurifoodcorp Cir Ctano.6151Document3 pagesPilmico-Maurifoodcorp Cir Ctano.6151Nathallie CabalunaNo ratings yet

- CIR vs. V.Y. Domingo JewellersDocument2 pagesCIR vs. V.Y. Domingo JewellersRob100% (2)

- CIR v. BPIDocument2 pagesCIR v. BPIIshNo ratings yet

- NPC V Provincial Treasurer of Benguet GR No 209303Document3 pagesNPC V Provincial Treasurer of Benguet GR No 209303Trem GallenteNo ratings yet

- Consolidated Cases of City of Manila vs. Colet and Malaysian Airline System 120051Document1 pageConsolidated Cases of City of Manila vs. Colet and Malaysian Airline System 120051magen100% (1)

- Lascona Land Vs CIRDocument2 pagesLascona Land Vs CIRJOHN SPARKSNo ratings yet

- 1 CIR V Hambrecht - QuistDocument2 pages1 CIR V Hambrecht - Quistaspiringlawyer1234No ratings yet

- San Roque Power Corporation Vs CirDocument2 pagesSan Roque Power Corporation Vs Cirleslansangan100% (3)

- Commissioner of Internal Revenue vs. Avon Products Manufacturing, IncDocument3 pagesCommissioner of Internal Revenue vs. Avon Products Manufacturing, IncFrancis PunoNo ratings yet

- (Digest) CIR v. Pineda, 21 SCRA 105Document2 pages(Digest) CIR v. Pineda, 21 SCRA 105Homer SimpsonNo ratings yet

- National Power Corporation vs. Province of AlbayDocument1 pageNational Power Corporation vs. Province of AlbayIsh100% (3)

- Nippon Express V Cir Case No. 5Document2 pagesNippon Express V Cir Case No. 5Brian Jonathan Paraan100% (3)

- Mobil Phil Vs The City Treasurer of MakatiDocument1 pageMobil Phil Vs The City Treasurer of MakatiClaire CulminasNo ratings yet

- CIR Vs Algue Inc Digest OnwardsDocument32 pagesCIR Vs Algue Inc Digest OnwardsMark Jason Crece Ante100% (1)

- TAX-Villanueva vs. City of IloiloDocument2 pagesTAX-Villanueva vs. City of IloiloJoesil Dianne67% (3)

- Systra Philippines vs. Cir G.R. No. 176290 September 21, 2007Document2 pagesSystra Philippines vs. Cir G.R. No. 176290 September 21, 2007Armstrong BosantogNo ratings yet

- CD - 41. CIR v. ReyesDocument2 pagesCD - 41. CIR v. ReyesCzarina CidNo ratings yet

- Accenture, Inc. v. CIR, G.R. No. 190102, July 11, 2012Document2 pagesAccenture, Inc. v. CIR, G.R. No. 190102, July 11, 2012Kelly RoxasNo ratings yet

- China Banking Corporation v. Commissioner of Internal Revenue DigestDocument2 pagesChina Banking Corporation v. Commissioner of Internal Revenue DigestJLNo ratings yet

- Team Energy Corporation V CIR - DigestDocument1 pageTeam Energy Corporation V CIR - DigestKate GaroNo ratings yet

- Philamlife vs. CIRDocument1 pagePhilamlife vs. CIRMona LizaNo ratings yet

- Mangwang - Deutsche Knowledge Services Vs Cir - GR No 197980Document1 pageMangwang - Deutsche Knowledge Services Vs Cir - GR No 197980トレンティーノ アップルNo ratings yet

- (Tax 1) (Phil. Match v. Cebu)Document3 pages(Tax 1) (Phil. Match v. Cebu)Ylmir_1989No ratings yet

- Cir vs. PhilamlifeDocument2 pagesCir vs. PhilamlifeAnny YanongNo ratings yet

- Nestle Philippines, Inc. vs. Court of AppealsDocument2 pagesNestle Philippines, Inc. vs. Court of AppealsCecil MoriNo ratings yet

- BIR Ruling (DA-287-07) May 8, 2007Document3 pagesBIR Ruling (DA-287-07) May 8, 2007Raiya AngelaNo ratings yet

- Cir VS Cta and Petron Corp PDFDocument3 pagesCir VS Cta and Petron Corp PDFMark Joseph LupangoNo ratings yet

- Philippine Health Care Vs CIRDocument1 pagePhilippine Health Care Vs CIRKim Lorenzo CalatravaNo ratings yet

- Pepsi-Cola Vs Municipality of Tanauan DigestDocument3 pagesPepsi-Cola Vs Municipality of Tanauan DigestRyan Acosta100% (1)

- Taxation 2 Case DigestsDocument26 pagesTaxation 2 Case DigestsKatrina GamboaNo ratings yet

- Bantillo - CIR Vs PNBDocument3 pagesBantillo - CIR Vs PNBAto TejaNo ratings yet

- PPA Vs FuentesDocument2 pagesPPA Vs FuentesPia SottoNo ratings yet

- Silicon Philippines V CirDocument2 pagesSilicon Philippines V CirKia BiNo ratings yet

- Ericsson Vs City of PasigDocument3 pagesEricsson Vs City of PasigRaymond RoqueNo ratings yet

- City of Pasig v. RepublicDocument1 pageCity of Pasig v. RepublicAiza OrdoñoNo ratings yet

- TAXATION LAW NAPOCOR v. PROVINCIAL TREASURER OF BENGUETDocument2 pagesTAXATION LAW NAPOCOR v. PROVINCIAL TREASURER OF BENGUETFatima PascuaNo ratings yet

- 05 - Dison vs. PosadasDocument2 pages05 - Dison vs. Posadascool_peach100% (1)

- Philippine Ports Authority v. The City of DavaoDocument2 pagesPhilippine Ports Authority v. The City of DavaoAlyk Tumayan Calion100% (2)

- CIR Vs Next MobileDocument2 pagesCIR Vs Next Mobilegeorge almeda100% (1)

- 10.d ACCRA Investment Corporation vs. CA (G.R. No. 96322 December 20, 1991) - H DigestDocument2 pages10.d ACCRA Investment Corporation vs. CA (G.R. No. 96322 December 20, 1991) - H DigestHarleneNo ratings yet

- Diaz Vs Secretary of FinanceDocument3 pagesDiaz Vs Secretary of FinanceJoshua Shin100% (5)

- Tax 1 - Dean's Circle 2019 15Document1 pageTax 1 - Dean's Circle 2019 15Romeo G. Labador Jr.No ratings yet

- Case Digests Chapter 3Document3 pagesCase Digests Chapter 3Jay GeeNo ratings yet

- Tax Case DigestDocument5 pagesTax Case DigestRay Marvin Anor Palma100% (1)

- When Goods Are Delivered To The Buyer On Approval or On Trial or On SatisfactionDocument5 pagesWhen Goods Are Delivered To The Buyer On Approval or On Trial or On SatisfactionGeorginaNo ratings yet

- Macaria FranciscoDocument1 pageMacaria FranciscoGeorginaNo ratings yet

- Civil LawDocument3 pagesCivil LawGeorginaNo ratings yet

- Civil LawDocument167 pagesCivil LawGeorginaNo ratings yet

- Pena V Paterno PDFDocument13 pagesPena V Paterno PDFGeorginaNo ratings yet

- 1 10 Case Digest Sales PDFDocument5 pages1 10 Case Digest Sales PDFGeorginaNo ratings yet

- Best Practices On Thank You Letters For DonationsDocument8 pagesBest Practices On Thank You Letters For Donationsapi-252129626100% (1)

- Doctrine of Revelation (Transcrição Das Aulas 1 À 10)Document91 pagesDoctrine of Revelation (Transcrição Das Aulas 1 À 10)Leandro ÁlissonNo ratings yet

- TTSB Company Profile (Full Set - 1 of 3)Document18 pagesTTSB Company Profile (Full Set - 1 of 3)zaihasren0% (1)

- Презентація StarlinkDocument15 pagesПрезентація StarlinkatlantidovishNo ratings yet

- Maix BitDocument2 pagesMaix BitloborisNo ratings yet

- To Canadian Horse Defence Coalition Releases DraftDocument52 pagesTo Canadian Horse Defence Coalition Releases DraftHeather Clemenceau100% (1)

- UNIT 8 Types of Punishment For Crimes RedactataDocument17 pagesUNIT 8 Types of Punishment For Crimes Redactataanna825020No ratings yet

- B.A (English) Dec 2015Document32 pagesB.A (English) Dec 2015Bala SVDNo ratings yet

- How To Stop Foreclosure PDFDocument391 pagesHow To Stop Foreclosure PDFSinphonic Recs100% (4)

- RA No. 9514 - Revised Fire Code of The Philippines (2008)Document586 pagesRA No. 9514 - Revised Fire Code of The Philippines (2008)Xyzer Corpuz Lalunio88% (33)

- Tesla Supercharger Pasadena ApprovedDocument5 pagesTesla Supercharger Pasadena ApprovedJoey KlenderNo ratings yet

- Annotated Bibliography1 1Document11 pagesAnnotated Bibliography1 1api-541544834No ratings yet

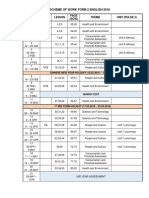

- Scheme of Work Form 2 English 2018: Week Types Lesson (SOW) Theme Unit (Pulse 2)Document2 pagesScheme of Work Form 2 English 2018: Week Types Lesson (SOW) Theme Unit (Pulse 2)Subramaniam Periannan100% (2)

- National Artist in Philippine Cinema (Report)Document30 pagesNational Artist in Philippine Cinema (Report)selwynNo ratings yet

- World-Wide Volkswagen Corp. v. WoodsonDocument2 pagesWorld-Wide Volkswagen Corp. v. WoodsonRonnie Barcena Jr.No ratings yet

- Liber XXXVI - The Star SapphireDocument4 pagesLiber XXXVI - The Star SapphireCelephaïs Press / Unspeakable Press (Leng)100% (1)

- APUSH Civil Rights Movement NotesDocument6 pagesAPUSH Civil Rights Movement NotesphthysyllysmNo ratings yet

- Episode 1Document13 pagesEpisode 1CataaaaaaaaaNo ratings yet

- Narayana Sadhana For VashikaranDocument1 pageNarayana Sadhana For Vashikarandivyayoga1235No ratings yet

- Last 6 Months RBI in News Part 2 NiharDocument6 pagesLast 6 Months RBI in News Part 2 NiharbuhhbubuhgNo ratings yet

- How Tax Reform Changed The Hedging of NQDC PlansDocument3 pagesHow Tax Reform Changed The Hedging of NQDC PlansBen EislerNo ratings yet

- Edgerton, R. (1984) Anthropology and Mental Retardation. Research Approaches and OpportunitiesDocument24 pagesEdgerton, R. (1984) Anthropology and Mental Retardation. Research Approaches and OpportunitiesjuanitoendaraNo ratings yet

- Check My TripDocument3 pagesCheck My TripBabar WaheedNo ratings yet

- Illiashenko and Strielkowski 2018 Innovative Management LibroDocument296 pagesIlliashenko and Strielkowski 2018 Innovative Management LibroYaydikNo ratings yet

- BCA - 17UBC4A4 Computer Based Optimization TechniquesDocument16 pagesBCA - 17UBC4A4 Computer Based Optimization Techniquesabhijeetbhojak1No ratings yet

- Forever KnowledgeDocument2 pagesForever KnowledgeminariiNo ratings yet

- Organization and Management - Week - 1Document5 pagesOrganization and Management - Week - 1ღNightmare RadioღNo ratings yet

- Report of Monument and PatternsDocument23 pagesReport of Monument and PatternsMAHEEN FATIMANo ratings yet

- China and Africa - BibliographyDocument357 pagesChina and Africa - BibliographyDavid ShinnNo ratings yet

- Internship Report of Boss Home AppliancesDocument43 pagesInternship Report of Boss Home ApplianceshhaiderNo ratings yet

Camp John Hay vs. CBAA

Camp John Hay vs. CBAA

Uploaded by

Georgina100%(1)100% found this document useful (1 vote)

421 views2 pagesThe Camp John Hay Development Corporation appealed tax assessments issued by the City Assessor of Baguio City for various buildings and land that they owned and leased. They claimed exemption from taxes under the Bases Conversion and Development Act. The Board of Tax Appeals dismissed the appeal for failure to comply with Section 252 of the Local Government Code, which requires payment of taxes under protest before a protest can be entertained. The Central Board of Assessment Appeals and the Court of Tax Appeals affirmed this decision. The Supreme Court denied the petition, finding that Section 252 applies even to allegedly tax-exempt entities, in order to allow the uninterrupted collection of taxes that are vital for government services.

Original Description:

n

Original Title

5. Camp John Hay vs. CBAA

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe Camp John Hay Development Corporation appealed tax assessments issued by the City Assessor of Baguio City for various buildings and land that they owned and leased. They claimed exemption from taxes under the Bases Conversion and Development Act. The Board of Tax Appeals dismissed the appeal for failure to comply with Section 252 of the Local Government Code, which requires payment of taxes under protest before a protest can be entertained. The Central Board of Assessment Appeals and the Court of Tax Appeals affirmed this decision. The Supreme Court denied the petition, finding that Section 252 applies even to allegedly tax-exempt entities, in order to allow the uninterrupted collection of taxes that are vital for government services.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

100%(1)100% found this document useful (1 vote)

421 views2 pagesCamp John Hay vs. CBAA

Camp John Hay vs. CBAA

Uploaded by

GeorginaThe Camp John Hay Development Corporation appealed tax assessments issued by the City Assessor of Baguio City for various buildings and land that they owned and leased. They claimed exemption from taxes under the Bases Conversion and Development Act. The Board of Tax Appeals dismissed the appeal for failure to comply with Section 252 of the Local Government Code, which requires payment of taxes under protest before a protest can be entertained. The Central Board of Assessment Appeals and the Court of Tax Appeals affirmed this decision. The Supreme Court denied the petition, finding that Section 252 applies even to allegedly tax-exempt entities, in order to allow the uninterrupted collection of taxes that are vital for government services.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 2

Camp John Hay Development Corporation (CJHDC) vs.

Central Board of Assessment

Appeals (CBAA)

G.R. No. 169234 October 2, 2013

Perez, J.

Facts:

The City Assessor of Baguio City, respondent, notified petitioner Camp John Hay

Development Corporation about the issuance of 36 Owner’s Copy of Assessment of Real Property

(ARP) covering various buildings and 2 parcels of land which were owned and leased by the

petitioner.

Petitioner questioned the assessments for lack of legal basis due to the City Assessor’s

failure to identify the specific properties and its corresponding values. Petitioner filed with Board

of Tax Assessments Appeals (BTAA) an appeal challenging the validity and propriety of the

issuances of City Assessor. They claimed that there was no legal basis for the issuance of the

assessments because it was allegedly exempted from paying taxes, national and local, pursuant to

Bases Conversion and Development Act.

In a resolution, BTAA enjoined petitioner to first comply with the Rules of Procedure

before the LBAA, particularly to the payment under protest of the subject property taxes before

the hearing of its appeal. Subsequently, Petitioner elevated the case before the Central Board of

Assessment Appeals (CBAA) which denied petitioner’s appeal and remanded the case to LBAA

for further proceedings.

Petitioner appealed to the CTA en banc however, CTA found that the petitioner has indeed

failed to comply with Section 252 of the LGC of 1991 hence it dismissed the petition and affirmed

the resolution of CBAA.

Hence, petitioner elevated its cause to the SC arguing that section 252 of LGC does not

apply when the person assessed is tax-exempt entity.

Issue:

Whether or not CTA en banc erred in dismissing for lack of merit and accordingly affirmed

the order of the CBAA to remand the case to the LBAA for further proceedings subject to a full

and up-to-date payment of realty taxes.

Ruling:

The petition is denied for lack of merit.

Section 252 of LGC of 1991 provides that “ xxx No protest shall be entertained unless the

taxpayer first pays the tax xxx”

Section 252 emphatically directs that the taxpayer questioning the assessment should first

pay the tax due before his protest can be entertained. Payment of the tax assessed under protest, is

an essential condition before a protest or an appeal questioning the correctness of an assessment

of real property tax may be entertained.

This restriction upon the power of the courts to impeach tax assessment without prior

payment, under protest, of the taxes assessed is consistent with the doctrine that taxes are lifeblood

of the nation and as such their collection cannot be curtailed by injunction or any like action;

otherwise, the state, or in this case the LGU, shall be crippled in dispensing the needed services to

the people.

You might also like

- Camp John Hay Development Corp. v. CBAA, 706 SCRA 547 - THE LIFEBLOOD DOCTRINE - DigestDocument2 pagesCamp John Hay Development Corp. v. CBAA, 706 SCRA 547 - THE LIFEBLOOD DOCTRINE - DigestKate Garo100% (1)

- Matalin Coconut Co., Inc. vs. The Municipal Council of MalabangDocument1 pageMatalin Coconut Co., Inc. vs. The Municipal Council of MalabangJeorge Ryan MangubatNo ratings yet

- Matalin v. Municipal CouncilDocument2 pagesMatalin v. Municipal CouncilStradivarium100% (1)

- COMPARISON of SEC 222 and 203 - CABUSOGDocument2 pagesCOMPARISON of SEC 222 and 203 - CABUSOGKristine Jay Perez-CabusogNo ratings yet

- Digest San Juan Vs CastroDocument2 pagesDigest San Juan Vs CastroRyan AcostaNo ratings yet

- Cir v. Bpi, 521 Scra 373 - The Lifeblood Doctrine - DigestDocument1 pageCir v. Bpi, 521 Scra 373 - The Lifeblood Doctrine - DigestKate Garo100% (1)

- Camp John Hay Development Corporation vs. Central Board of Assessment Appeals (Cbaa)Document3 pagesCamp John Hay Development Corporation vs. Central Board of Assessment Appeals (Cbaa)lexxNo ratings yet

- CIR Vs PetronDocument3 pagesCIR Vs PetronChic PabalanNo ratings yet

- Cocacola Vs ToledoDocument2 pagesCocacola Vs ToledoPia SottoNo ratings yet

- Victorias Milling Vs PpaDocument2 pagesVictorias Milling Vs PpaMike LlamasNo ratings yet

- Abello vs. CIR & CA (Case Digest)Document1 pageAbello vs. CIR & CA (Case Digest)Vince Leido100% (7)

- LG Electronics vs. CIR DigestDocument1 pageLG Electronics vs. CIR DigestAnonymous MikI28PkJcNo ratings yet

- Cir v. Cebu HoldingsDocument4 pagesCir v. Cebu HoldingsAudrey50% (2)

- CIR Vs PhilamlifeDocument2 pagesCIR Vs PhilamlifeBreAmberNo ratings yet

- Kepco Vs Cir Case DigestDocument1 pageKepco Vs Cir Case DigestjovifactorNo ratings yet

- Kepco Vs CIRDocument3 pagesKepco Vs CIRLizzette Dela PenaNo ratings yet

- Pilmico-Maurifoodcorp Cir Ctano.6151Document3 pagesPilmico-Maurifoodcorp Cir Ctano.6151Nathallie CabalunaNo ratings yet

- CIR vs. V.Y. Domingo JewellersDocument2 pagesCIR vs. V.Y. Domingo JewellersRob100% (2)

- CIR v. BPIDocument2 pagesCIR v. BPIIshNo ratings yet

- NPC V Provincial Treasurer of Benguet GR No 209303Document3 pagesNPC V Provincial Treasurer of Benguet GR No 209303Trem GallenteNo ratings yet

- Consolidated Cases of City of Manila vs. Colet and Malaysian Airline System 120051Document1 pageConsolidated Cases of City of Manila vs. Colet and Malaysian Airline System 120051magen100% (1)

- Lascona Land Vs CIRDocument2 pagesLascona Land Vs CIRJOHN SPARKSNo ratings yet

- 1 CIR V Hambrecht - QuistDocument2 pages1 CIR V Hambrecht - Quistaspiringlawyer1234No ratings yet

- San Roque Power Corporation Vs CirDocument2 pagesSan Roque Power Corporation Vs Cirleslansangan100% (3)

- Commissioner of Internal Revenue vs. Avon Products Manufacturing, IncDocument3 pagesCommissioner of Internal Revenue vs. Avon Products Manufacturing, IncFrancis PunoNo ratings yet

- (Digest) CIR v. Pineda, 21 SCRA 105Document2 pages(Digest) CIR v. Pineda, 21 SCRA 105Homer SimpsonNo ratings yet

- National Power Corporation vs. Province of AlbayDocument1 pageNational Power Corporation vs. Province of AlbayIsh100% (3)

- Nippon Express V Cir Case No. 5Document2 pagesNippon Express V Cir Case No. 5Brian Jonathan Paraan100% (3)

- Mobil Phil Vs The City Treasurer of MakatiDocument1 pageMobil Phil Vs The City Treasurer of MakatiClaire CulminasNo ratings yet

- CIR Vs Algue Inc Digest OnwardsDocument32 pagesCIR Vs Algue Inc Digest OnwardsMark Jason Crece Ante100% (1)

- TAX-Villanueva vs. City of IloiloDocument2 pagesTAX-Villanueva vs. City of IloiloJoesil Dianne67% (3)

- Systra Philippines vs. Cir G.R. No. 176290 September 21, 2007Document2 pagesSystra Philippines vs. Cir G.R. No. 176290 September 21, 2007Armstrong BosantogNo ratings yet

- CD - 41. CIR v. ReyesDocument2 pagesCD - 41. CIR v. ReyesCzarina CidNo ratings yet

- Accenture, Inc. v. CIR, G.R. No. 190102, July 11, 2012Document2 pagesAccenture, Inc. v. CIR, G.R. No. 190102, July 11, 2012Kelly RoxasNo ratings yet

- China Banking Corporation v. Commissioner of Internal Revenue DigestDocument2 pagesChina Banking Corporation v. Commissioner of Internal Revenue DigestJLNo ratings yet

- Team Energy Corporation V CIR - DigestDocument1 pageTeam Energy Corporation V CIR - DigestKate GaroNo ratings yet

- Philamlife vs. CIRDocument1 pagePhilamlife vs. CIRMona LizaNo ratings yet

- Mangwang - Deutsche Knowledge Services Vs Cir - GR No 197980Document1 pageMangwang - Deutsche Knowledge Services Vs Cir - GR No 197980トレンティーノ アップルNo ratings yet

- (Tax 1) (Phil. Match v. Cebu)Document3 pages(Tax 1) (Phil. Match v. Cebu)Ylmir_1989No ratings yet

- Cir vs. PhilamlifeDocument2 pagesCir vs. PhilamlifeAnny YanongNo ratings yet

- Nestle Philippines, Inc. vs. Court of AppealsDocument2 pagesNestle Philippines, Inc. vs. Court of AppealsCecil MoriNo ratings yet

- BIR Ruling (DA-287-07) May 8, 2007Document3 pagesBIR Ruling (DA-287-07) May 8, 2007Raiya AngelaNo ratings yet

- Cir VS Cta and Petron Corp PDFDocument3 pagesCir VS Cta and Petron Corp PDFMark Joseph LupangoNo ratings yet

- Philippine Health Care Vs CIRDocument1 pagePhilippine Health Care Vs CIRKim Lorenzo CalatravaNo ratings yet

- Pepsi-Cola Vs Municipality of Tanauan DigestDocument3 pagesPepsi-Cola Vs Municipality of Tanauan DigestRyan Acosta100% (1)

- Taxation 2 Case DigestsDocument26 pagesTaxation 2 Case DigestsKatrina GamboaNo ratings yet

- Bantillo - CIR Vs PNBDocument3 pagesBantillo - CIR Vs PNBAto TejaNo ratings yet

- PPA Vs FuentesDocument2 pagesPPA Vs FuentesPia SottoNo ratings yet

- Silicon Philippines V CirDocument2 pagesSilicon Philippines V CirKia BiNo ratings yet

- Ericsson Vs City of PasigDocument3 pagesEricsson Vs City of PasigRaymond RoqueNo ratings yet

- City of Pasig v. RepublicDocument1 pageCity of Pasig v. RepublicAiza OrdoñoNo ratings yet

- TAXATION LAW NAPOCOR v. PROVINCIAL TREASURER OF BENGUETDocument2 pagesTAXATION LAW NAPOCOR v. PROVINCIAL TREASURER OF BENGUETFatima PascuaNo ratings yet

- 05 - Dison vs. PosadasDocument2 pages05 - Dison vs. Posadascool_peach100% (1)

- Philippine Ports Authority v. The City of DavaoDocument2 pagesPhilippine Ports Authority v. The City of DavaoAlyk Tumayan Calion100% (2)

- CIR Vs Next MobileDocument2 pagesCIR Vs Next Mobilegeorge almeda100% (1)

- 10.d ACCRA Investment Corporation vs. CA (G.R. No. 96322 December 20, 1991) - H DigestDocument2 pages10.d ACCRA Investment Corporation vs. CA (G.R. No. 96322 December 20, 1991) - H DigestHarleneNo ratings yet

- Diaz Vs Secretary of FinanceDocument3 pagesDiaz Vs Secretary of FinanceJoshua Shin100% (5)

- Tax 1 - Dean's Circle 2019 15Document1 pageTax 1 - Dean's Circle 2019 15Romeo G. Labador Jr.No ratings yet

- Case Digests Chapter 3Document3 pagesCase Digests Chapter 3Jay GeeNo ratings yet

- Tax Case DigestDocument5 pagesTax Case DigestRay Marvin Anor Palma100% (1)

- When Goods Are Delivered To The Buyer On Approval or On Trial or On SatisfactionDocument5 pagesWhen Goods Are Delivered To The Buyer On Approval or On Trial or On SatisfactionGeorginaNo ratings yet

- Macaria FranciscoDocument1 pageMacaria FranciscoGeorginaNo ratings yet

- Civil LawDocument3 pagesCivil LawGeorginaNo ratings yet

- Civil LawDocument167 pagesCivil LawGeorginaNo ratings yet

- Pena V Paterno PDFDocument13 pagesPena V Paterno PDFGeorginaNo ratings yet

- 1 10 Case Digest Sales PDFDocument5 pages1 10 Case Digest Sales PDFGeorginaNo ratings yet

- Best Practices On Thank You Letters For DonationsDocument8 pagesBest Practices On Thank You Letters For Donationsapi-252129626100% (1)

- Doctrine of Revelation (Transcrição Das Aulas 1 À 10)Document91 pagesDoctrine of Revelation (Transcrição Das Aulas 1 À 10)Leandro ÁlissonNo ratings yet

- TTSB Company Profile (Full Set - 1 of 3)Document18 pagesTTSB Company Profile (Full Set - 1 of 3)zaihasren0% (1)

- Презентація StarlinkDocument15 pagesПрезентація StarlinkatlantidovishNo ratings yet

- Maix BitDocument2 pagesMaix BitloborisNo ratings yet

- To Canadian Horse Defence Coalition Releases DraftDocument52 pagesTo Canadian Horse Defence Coalition Releases DraftHeather Clemenceau100% (1)

- UNIT 8 Types of Punishment For Crimes RedactataDocument17 pagesUNIT 8 Types of Punishment For Crimes Redactataanna825020No ratings yet

- B.A (English) Dec 2015Document32 pagesB.A (English) Dec 2015Bala SVDNo ratings yet

- How To Stop Foreclosure PDFDocument391 pagesHow To Stop Foreclosure PDFSinphonic Recs100% (4)

- RA No. 9514 - Revised Fire Code of The Philippines (2008)Document586 pagesRA No. 9514 - Revised Fire Code of The Philippines (2008)Xyzer Corpuz Lalunio88% (33)

- Tesla Supercharger Pasadena ApprovedDocument5 pagesTesla Supercharger Pasadena ApprovedJoey KlenderNo ratings yet

- Annotated Bibliography1 1Document11 pagesAnnotated Bibliography1 1api-541544834No ratings yet

- Scheme of Work Form 2 English 2018: Week Types Lesson (SOW) Theme Unit (Pulse 2)Document2 pagesScheme of Work Form 2 English 2018: Week Types Lesson (SOW) Theme Unit (Pulse 2)Subramaniam Periannan100% (2)

- National Artist in Philippine Cinema (Report)Document30 pagesNational Artist in Philippine Cinema (Report)selwynNo ratings yet

- World-Wide Volkswagen Corp. v. WoodsonDocument2 pagesWorld-Wide Volkswagen Corp. v. WoodsonRonnie Barcena Jr.No ratings yet

- Liber XXXVI - The Star SapphireDocument4 pagesLiber XXXVI - The Star SapphireCelephaïs Press / Unspeakable Press (Leng)100% (1)

- APUSH Civil Rights Movement NotesDocument6 pagesAPUSH Civil Rights Movement NotesphthysyllysmNo ratings yet

- Episode 1Document13 pagesEpisode 1CataaaaaaaaaNo ratings yet

- Narayana Sadhana For VashikaranDocument1 pageNarayana Sadhana For Vashikarandivyayoga1235No ratings yet

- Last 6 Months RBI in News Part 2 NiharDocument6 pagesLast 6 Months RBI in News Part 2 NiharbuhhbubuhgNo ratings yet

- How Tax Reform Changed The Hedging of NQDC PlansDocument3 pagesHow Tax Reform Changed The Hedging of NQDC PlansBen EislerNo ratings yet

- Edgerton, R. (1984) Anthropology and Mental Retardation. Research Approaches and OpportunitiesDocument24 pagesEdgerton, R. (1984) Anthropology and Mental Retardation. Research Approaches and OpportunitiesjuanitoendaraNo ratings yet

- Check My TripDocument3 pagesCheck My TripBabar WaheedNo ratings yet

- Illiashenko and Strielkowski 2018 Innovative Management LibroDocument296 pagesIlliashenko and Strielkowski 2018 Innovative Management LibroYaydikNo ratings yet

- BCA - 17UBC4A4 Computer Based Optimization TechniquesDocument16 pagesBCA - 17UBC4A4 Computer Based Optimization Techniquesabhijeetbhojak1No ratings yet

- Forever KnowledgeDocument2 pagesForever KnowledgeminariiNo ratings yet

- Organization and Management - Week - 1Document5 pagesOrganization and Management - Week - 1ღNightmare RadioღNo ratings yet

- Report of Monument and PatternsDocument23 pagesReport of Monument and PatternsMAHEEN FATIMANo ratings yet

- China and Africa - BibliographyDocument357 pagesChina and Africa - BibliographyDavid ShinnNo ratings yet

- Internship Report of Boss Home AppliancesDocument43 pagesInternship Report of Boss Home ApplianceshhaiderNo ratings yet