Professional Documents

Culture Documents

Internal and External Analysis of Jio: Rahul Mhabde, Ali Dhamani

Internal and External Analysis of Jio: Rahul Mhabde, Ali Dhamani

Uploaded by

deep gargOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Internal and External Analysis of Jio: Rahul Mhabde, Ali Dhamani

Internal and External Analysis of Jio: Rahul Mhabde, Ali Dhamani

Uploaded by

deep gargCopyright:

Available Formats

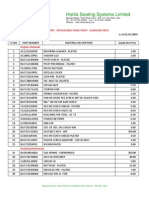

Vol-4 Issue-2 2018 IJARIIE-ISSN(O)-2395-4396

Internal and External Analysis of Jio

1

Rahul Mhabde, Department of BABM Podar World college, India

2

Ali Dhamani , Department of BABM World College, India

ABSTRACT

Internal and External Environmental Analysis was carried out, Industry selected was the Telecom Industry. The

company which got Volte (Voice Over Long Term Evolution) first in India and is currently the market leader with

39% market share with capital investment of 1.50 Lakh Crore; Reliance Jio.

Researcher has compared the data plans along with spectrum bands to know how Jio is retaining its position in the

market by beating its competitors. By the use of Porters Five Forces group has gaged the competitive pressure in

the current market and its results on Jio. To know the full environment of Jio and its impact politically,

environmentally, socially and technologically on the current market as per the Telecom Industry there is PEST

analysis undertaken. There is discussion done on the opportunities for Jio taking into consideration the other tools

also group has mentioned the threats to Jio due to other existing players in market.

To know the entire process of Value Creation and know the internal analysis of Jio tools like Value Chain Analysis

has been used. To know how Jio is segmenting the masses of India along with its targeting and positioning strategy

has been discussed by the group. How Jio overcomes its threats group has mentioned the strengths and weaknesses

of Jio after they have entered the market. To know the source of sustainable competitive advantage there has been

Value, Rarity, Imitability and Non – Substitute (VRIN) analysis carried out. To understand the blue ocean strategy

and red ocean strategy group has used the strategy canvas. Hence on doing an in-depth study of the internal and

external environment of Reliance Jio, suitable and relevant suggestions for Jio have been provided at the end of the

Group Report.

Keyword: - Jio, communication, technology, services, 4G ,porters 5 forces

1. TITLE- Internal and External Analysis of Jio

India having the number of auctions for airwave networks and connections there are maximum number of spectrum

bands currently available in India. As of 2015, India is the only country to have both strong telecom services along

with the lowest spectrum bands (Mint Research, 2015). Reliance being the parent company of Jio which is into

Telecom sector providing 4G network services and 100% VoLTE (Voice Over Long Term Evolution) (Bhawar

2017services. The company has invested Rs. 1,50,000 Crore (Reuters,2017) in the telecom sector. Initially, Jio

provided free 4G internet services and free voice calls for a period of one year (Jio,2017) to its subscribers and

currently they have overpowered the market by providing data and voice call services at low prices as compared to

th

the competitors. Jio was officially introduced on 5 September 2016 (Raghavendra Holla, 2017) in India whereas

th

the company distributed trial packs to its existing employees on 27 December 2015.

2. Objectives:

1)To analyse internal environment of Jio Value Chain Analysis, Segmenting, Targeting and Positioning and

Strengths and Weakness.

2) To analyse external environment of Jio using Industry analysis, Porter’s Five Forces, PESTLE Analysis and

opportunities and threats.

7686 www.ijariie.com 1057

Vol-4 Issue-2 2018 IJARIIE-ISSN(O)-2395-4396

3. Industry Analysis:

The number of mobile phone users in Telecom Industry has been increasing by 5.54 % (IBTimes,2016) every year

along with the number of mobile subscribers since 2005. As a result Jio has gained 39.60% market share

(TRAI,2017) in its first year only while launching its free services despite the impose of GST (Goods & Service

Tax) in India but There are 93% of prepaid subscribers and only 7% of subscribers who are using postpaid network

services (statista,2017) whereas, GST has been imposed only for the postpaid service providers.

Spectrum band playing the most important role in the telecom sector, varying from very low frequency to extremely

high frequency. Jio has the least spectrum (Jio,2017) band when compared to other competitors which is a positive

point for Jio as the network clarity and data strength is the most powerful among its its rivals. The plans of Jio as

compared to other telecom players ranges from Rs.149 per month for 1GB 4G data and highest being of Idea Rs.

249 for 1GB 3G data (Gadgetsnow,2017) (Annexure Number: 16). It is because of speed, lower data plans, and

the first company to come up with VoLTE technology, Jio achieved success in not less than year and has had an

upper hand when compared to its competitors like Vodafone and Idea who are struggling to survive in the market. (

4.External Environmental Analysis

4.1 Porter’s Five Forces:

The bargaining power of customers is high because Number Portability is easily accessible to all consumers and

they have a choice between different telecom service providers. Consumers can choose from a different plans

offered by multiple telecom (Hubmobiles,2016) companies according to their requirements. They can switch to any

service provider as no switching costs are involved

Competitive rivalry is high in this industry as there are established brands in the industry. Airtel, Vodafone, and Idea

have been in the industry for around a decade. The plans offered by Airtel (ETtelecom,2017) and Vodafone were

similar before Jio entered the market. To survive in the market, Airtel has used defensive strategy and reduced its

prices to compete by Jio.

Threat of new entrants and substitutes is low because the telecom industry requires high capital investment. Jio has

already invested around Rs. 1.5 lakh crore for pan – India (Reuters,2017) operations. It will also be fairly difficult for

new companies to survive as there are already established networks. Even though Jio is a new company, there are

high chances for the company to survive as they have more capital to invest (Financialtimes,2017). Jio took

approximately five years to develop VoLTE technology and hence it is a sustained competitive advantage. It will

take new companies years to develop this technology which reduces chances for a new company or a rival to be as

successful as Jio as they have a first mover advantage with VoLTE and 5G.

4.2. PESTLE Analysis:

Politically, Jio is following the Prime Minister’s vision of Digital India. Among many Jio apps, Jio Money facilitates

customers to pay or transfer money digitally. The company is supported by government as it falls in the ‘Make in

India’ scheme that has been encouraged by the government. (Business standards journal,2016) (Annexure

Number: 20). Economically, after the demonetization Jio started giving out free data for a few months. This helped

the company attract more customers and increase GDP growth by 1.38% (Indian Economy,2015) (Annexure

Number: 21). Socially, Reliance Industries spent more than Rs.750 crores in terms of Corporate Social

Responsibility (CSR) (Thehindu,2016). Jio offered free internet services to Indore Traffic Police and are planning

to offer their services to other cities. They are planning to provide free services at government schools, and hospitals

(Ibtimes,2017). Technologically, the VoLTE technology is the most advanced technology in the country. This

technology provides better call quality over its competitors as voice calls are broken up into packets of information

(Business standards,2016).

Environmentally, Jio has installed safe and environment – friendly towers that do not emit electromagnetic radiation.

(Rajat Agarwal,2015)

7686 www.ijariie.com 1058

Vol-4 Issue-2 2018 IJARIIE-ISSN(O)-2395-4396

4.3. Opportunities and Threats:

There has been a drastic increase in the number of Jio subscribers in the recent times. After the first month of launch

there has been an increase in subscribers by 1.13% between January and February 2017. (Ijsrm,2017). Reliance

Industries being the parent company which has widespread business operations (RIL,2017) and more than 50

business operations across the world with good reputation in the market. Even as the telecom industry has seen

monochrome growth in the subscribers, Jio has great opportunity to expand in worldwide networks and to be the

best in the industry with less spectrum band, strong tower connectivity and low tariff plans (Jio,2017) which would

help to sustain their position.

Once these free services of 4G data and voice calls are over, there is a huge threat to Jio and high probability

(ijsrm,2017) of switching costs is involved as the subscribers may switch to other network providers. Also as there

are established players in the market like Vodafone and Idea, they already have a strong customer base. The recent

merger talks between Vodafone and Idea (Business standards,2017) has imposed a threat on Jio. Due to the

merger, Vodafone’s capital investment capacity has increased and the combined customer base will help them to

boost their sales at low tariff plans (Economic times,2017).

5.Internal Environmental Analysis

5.1 Value Chain Analysis:

Jio manufactured and imported around 435,000 SIM cards from China before January 2016 (Economictimes,2016).

Reliance Jio has signed with GTL Infrastructure Ltd. (Indiainfoline,2016) for tower infrastructure sharing Jio is also

planning to add more 1,00,000 (Economic times,2017) towers for better network. Only Reliance Jio uses VoLTE

technology and hence the company has competitive advantage and first mover advantage in the industry (Jio,2017)

(Annexure Number: 23). With Jio planning to launch 5G soon, it is already far in front of its rivals which will

facilitate in gaining more market share. Jio is planning to expand its operations in the DTH and broadband (Business

standards journal, 2017) services market and have planned to invest Rs. 18,000 crores for its fibre network. Jio has

more than 40,000 employees that are spread across the 1200+ stores (Reliancedigital,2017) across the country and

the 24/7 customer care service centres. Jio has a unique way to market its products and was the only brand to

sponsor (Gadgetsnow,2017) 7 out of the 8 IPL teams during IPL 2017.

5.2. Segmenting, Targeting and Positioning:

Jio has segmented the market based on the masses and have targeted the youth, employees and working class of the

society (Jio,2017) . The offer provided by Jio are more valuable in terms of both, cost and service as seen in the

graph (Annexure Number: 9) due to which there has been increase in Jio subscribers. Moreover, the consumers are

targeted by Jio bundling with LYF phones (Danish Khan,2016) and giving free Jio services. Jio applications, a Jio

SIM card, and a Jio 4G enabled phone is provided in the bundled offer. Jio has positioned themselves in market as a

company which provides regular offers to its customers. Recently after the launch (Moneycontrol, 2017) the Apple

iPhone 8 and iPhone X, Jio has tied up with Apple with a 70% buyback offer (Piyush Pandey,2016) for the

customers. Such offers are not provided by other company and hence Jio has a upper hand and advantage over other

companies.

5.3Strength & Weakness:

The investment cost by Jio in the telecom market is one of the major strengths of Jio in the telecom market.

Approximately, Jio has invested Rs.1,50,000 crore (Livemint,2017) due to which they have the power to bear the

losses that they are making by providing free services to the consumers. Jio also has a wide spread network and

cover all 22 circles (Chaprama,2017) in India. Jio offers a range of applications for movies, shopping, and payment

gateway among others(Jioapps,2017Jio has focused towards the Prime Minister’s vision of Digital India. Reliance

nd

Jio’s success has facilitated Reliance Industries Limited to surpass its competitors and achieve 2 position in the

market for its brand value (Financial Express,2017). Reliance Industries as increased its reputation et after the

launch of Jio and its success in market which has led to a 9% increase in the company’s brand value. Jio covers all

22 network circles across the country, like its competitors Idea and Airtel who also cover 22 network circles. But

7686 www.ijariie.com 1059

Vol-4 Issue-2 2018 IJARIIE-ISSN(O)-2395-4396

Airtel and Idea’s tariff plans are not as cheap when compared to that of Jio. If Jio incurs losses and in the future plan

to hike their prices, there are chances for Jio to loose its customers (Teleeconomictimes,2016). Although consumers

are making optimum utilization of data packages, 60%-70% revenue (Nishit Kumar,2016) is generated by voice

calls. This has been a weakness as Jio has voice call service which is being offered for free which can hamper their

profits in the future. Due to strong financial background and brand value Jio can overcome these weaknesses

(Siliconindia,2017). According to the observation a conclusion has been made in comparison to other companies.

There is rating scale of 1-5 and Jio has been rated the highest. In terms of price, quality, services, network, and plan

options. Jio is doing phenomenally well when compared to its rivals in the industry.

5.4 VRIN Framework:

Similarity between the brand image (Economic Times,2017) and consumer base for JIO which leave it as a very

valuable factor due to the fact that Jio’s parent company Reliance was a major player in the market and has a good

brand image and also merge with Jio for 5G (Gsmarena,2017). Leaving company with a good start even with

customers, further in marketing and sale, despite areas which can be imitated by other companies like hoardings and

adverts (Insidesport,2017). Jio has sponsored 7 out of 8 IPL teams to hold a rare marketing strategy compared to its

competitors. In 2016 alone the telecom industry has spent 4.5 thousand crore (Annexure Number: 26)

(Economictimes,2017) just in advertisements, JIO in the coming years plans to grow this trend efficiently.

5.5 Strategy Canvas:

The Indian Telecom Industry has high competition among them as mentioned in Porter’s Five Forces. All the

companies compete on the basis of prices of the plans offered by the service providers. This is because the

companies want to attract maximum market share to increase their market share in the industry, and hence the prices

of plans offered by the telecom services fall in the Red Ocean Strategy (Hubmobile,2017).

As mentioned in strengths, Jio offers a number of axpplications from JioTV to Jio Money for its users and is the

only telecom provider to do so. Jio has also launched a 4G phone recently which only costs Rs.1500 (Jio,2017).

Hence, Value Added Services falls in the Blue Ocean Strategy (Gadgetsndtv,2016

6 Suggestions:

After researching about Reliance Jio, we would like to give few suggestions to Jio.

It is the only company to provide VoLTE (Voice Over Long Term Evolution) technology in India along with 4G

services. As mentioned in the VRIN Framework, Jio has an 18-month head start over its competitors wherein they

can start planning for a strong 5G network and launch 5G services in India. As mentioned in PEST analysis, Jio can

gear up and take permissions from the government as the act is supported by the Prime Minister’s vision of Digital

India.

Jio can set up international towers and networks worldwide along with its already existing networks Pan - India.

Nowadays, frequent flyers from India travel abroad and they have to change their SIM cards while travelling. A

solution to this can be that, Jio can either set up international towers worldwide or have a strategic alliance with one

of the international companies. For example: Jio can tie up with British Telecom in the United Kingdom or with

AT&T in the United States of America.

7 References:

1. Arun Prabhudesai. 2014. Growth in Indian telecom industry in 10 years. (Available:

http://trak.in/tags/business/2007/06/19/indian-telecommunication-story-from-10-million-to-150-million-

th

mobile-subscribers-in-5-years/) (Accessed Date: 15 October 2017)

2. Arun Prabhudesai. 2014. Spectrum circles of Jio. (Available: http://trak.in/tags/business/2014/02/03/2g-

nd

spectrum-auction-india/) (Accessed Date: 22 October 2017)

7686 www.ijariie.com 1060

Vol-4 Issue-2 2018 IJARIIE-ISSN(O)-2395-4396

3. Chakri Kudikala. 2016. Advantages and Disadvantages of Jio sim card. (Available:

https://www.gizbot.com/telecom/features/here-are-5-advantages-5-disadvantages-reliance-jio-4g-

rd

sim/articlecontent-pf62675-034857.html) (Accessed Date: 3 October 2017)

4. Danish Khan. 2016. Vodafone spectrum band. (Available:

http://telecom.economictimes.indiatimes.com/news/vodafone-acquires-4g-spectrum-for-rs-20280-crore-

th

in-1800-2100-and-2500-mhz-bands/54730843) (Accessed Date: 4 October 2017)

5. Danish Khan. ET Telecom. 2017. Increasing subscribers and Jio adding new towers. (Available:

http://telecom.economictimes.indiatimes.com/news/reliance-jio-user-base-crosses-108-million-to-add-

th

1-lakh-new-towers/58353578) (Accessed Date: 10 October 2017)

6. Delshad Irani. 2017. Marketing by Jio. (Available:

https://economictimes.indiatimes.com/news/company/corporate-trends/cut-throat-competition-form-jio-

rd

forces-airtel-voda-idea-to-up-spending-on-ads/articleshow/57564661.cms) (Accessed Date: 23

October 2017)

7. Economic Times. 2017. 4g speed test. (Available:

http://economictimes.indiatimes.com/tech/internet/reliance-jio-ahead-in-network-coverage-but-trails-in-

rd

4g-speeds-report/articleshow/56937035.cms) (Accessed Date: 3 October 2017)

8. Economic Times. 2017. VoLTE technology. (Available:

https://economictimes.indiatimes.com/tech/internet/airtel-set-to-start-volte-services-from-next-week-

th

jios-free-run-to-end/articleshow/60415280.cms) (Accessed Date: 17 October 2017)

9. ET Telecom. 2016. Jio imports sim cards. (Available:

http://telecom.economictimes.indiatimes.com/news/reliance-jio-imports-over-4-lakh-sim-cards-from-

th

china-report/50477518) (Accessed Date: 10 October 2017)

10. ET Telecom. 2017. Data plans comparison. (Available:

https://telecom.economictimes.indiatimes.com/news/comparison-data-voice-offers-from-reliance-jio-

st

airtel-vodafone-idea-and-bsnl/57955606) (Accessed date: 21 October 2017)

11. FE Bureau. 2017. Merger of Vodafone and Idea. (Available:

http://www.financialexpress.com/industry/idea-cellular-vodafone-india-may-merge-set-to-create-indias-

st

largest-telco-beat-bharti-airtel/530102/) (Accessed date: 21 October 2017)

12. Flipgap. 2017. Offers by Jio (Available: https://www.fillgap.news/might-get-new-surprise-reliance-jio-

st

new-offer) (Accessed date: 21 October 2017)

13. Gaurav. Laghate. 2017. Jio sponsoring IPL teams. (Available: https://www.gadgetsnow.com/tech-news/ipl-

2017-heres-how-reliance-jio-has-beaten-the-title-sponsor-vivo/articleshow/58510083.cms) (Accessed

th

Date: 12 October 2017)

14. Gulveen Aulakh. 2016. Bundling with LYF phones. (Available:

http://economictimes.indiatimes.com/tech/hardware/reliance-jio-begins-sale-of-4g-enabled-lyf-phones-

th

offers-free-unlimited-data-for-3-months/articleshow/52562462.cms) (Accessed Date: 13 October

2017)

15. India Infoline News Service. 2016. Tower sharing deals by Jio. (Available :

http://www.indiainfoline.com/article/news-top-story/reliance-jio-and-gtl-infra-sign-tower-infrastructure-

th

sharing-deal-gtl-infra-116092000305_1.html) (Accessed Date: 10 October 2017)

16. Kshitij Salgunan, 2016. Plans and offers by Jio (Available:

http://gadgets.ndtv.com/telecom/opinion/reliance-jio-business-model-how-can-it-make-money-

th

1454531) (Accessed Date: 24 October 2017)

17. Kukil Bora. 2017. Increase in Jio subscribers. (Available: http://www.ibtimes.co.in/how-reliance-jio-ended-

th

incumbents-unchallenged-reign-reshape-indias-telecom-sector-728980) (Accessed Date: 25 October

2017)

18. Livemint. 2016. Market share of Jio. (Available:

http://www.livemint.com/Industry/LWiXBAqtr0TQMSq6F5G6WJ/Reliance-Jio-ate-into-market-share-

th

of-large-telecoms-in-2016.html) (Accessed Date: 9 October 2017)

19. Livemint. 2017. Investment by Jio. (Available:

http://www.livemint.com/Companies/ncT04NLRTtEMDEHAWdMPGN/Reliance-Jio-initial-

th

investment-at-Rs150000-crore-Mukesh-A.html) (Accessed Date: 15 October 2017)

M.K. Venu. 2016. Politics and dominance of Jio. (Available: https://thewire.in/65555/full-spectrum-dominance-the-

th

politics-and-economics-of-reliance-jio/) (Accessed Date: 9

7686 www.ijariie.com 1061

You might also like

- Reliance Jio - Strategic Analysis Using VRIO MethodDocument17 pagesReliance Jio - Strategic Analysis Using VRIO MethodBatch 2020-22100% (1)

- Reliance Jio Case Study NewDocument8 pagesReliance Jio Case Study Newjatish0% (1)

- Internal and External Analysis of Jio: Rahul Mhabde, Ali DhamaniDocument5 pagesInternal and External Analysis of Jio: Rahul Mhabde, Ali DhamaniDebanjan MukherjeeNo ratings yet

- Industry Analysis:: 1. Porter's Five ForcesDocument2 pagesIndustry Analysis:: 1. Porter's Five ForcesRitu MehraNo ratings yet

- SM Group AssignmentDocument11 pagesSM Group AssignmentSachin SbishtNo ratings yet

- Analysis of The Impact of Reliance Jio Infocomm LTD On Indian Economy: A Case StudyDocument10 pagesAnalysis of The Impact of Reliance Jio Infocomm LTD On Indian Economy: A Case StudyManasvi N ANo ratings yet

- Change in Market and Consumer Mindset in Telecommunication Industry Because of Jio Revolution Using BCG MatrixDocument6 pagesChange in Market and Consumer Mindset in Telecommunication Industry Because of Jio Revolution Using BCG Matrixapoorv agarwalNo ratings yet

- IAMOT 2020 Paper 2701Document25 pagesIAMOT 2020 Paper 2701P Krishna ChaitanyaNo ratings yet

- Jio Case StudyDocument7 pagesJio Case StudyTanya VarshneyNo ratings yet

- Vol11 1 03Document9 pagesVol11 1 03Sourav Bikash SatapathyNo ratings yet

- Disruption by Reliance Jio in Telecom IndustryDocument8 pagesDisruption by Reliance Jio in Telecom IndustryNishant ParasharNo ratings yet

- Isbnnew 195 198Document5 pagesIsbnnew 195 198singhdivya47264No ratings yet

- TOPIC: Analysis On Marketing Strategies: Word Count: 3972Document31 pagesTOPIC: Analysis On Marketing Strategies: Word Count: 3972DineshNo ratings yet

- Reliance Jio - Group4Document22 pagesReliance Jio - Group4Pratik DhakeNo ratings yet

- FFFFFFFFFFFFFDocument54 pagesFFFFFFFFFFFFFsoundwaves5500No ratings yet

- Impact of Reliance Jio On Financial Performance of Key Players of Telecom IndustryDocument7 pagesImpact of Reliance Jio On Financial Performance of Key Players of Telecom IndustryPawan SinghNo ratings yet

- The Effect On The Telecom Industry and Consumers After The Introduction of Reliance JioDocument20 pagesThe Effect On The Telecom Industry and Consumers After The Introduction of Reliance JioIJEMR JournalNo ratings yet

- Reliance JioDocument11 pagesReliance Jioavinash kNo ratings yet

- Isbnnew 195 198Document5 pagesIsbnnew 195 198manoj_1382No ratings yet

- Post Jio Impact - Research Project PDFDocument12 pagesPost Jio Impact - Research Project PDFVeera JainNo ratings yet

- PESTLE Analysis of Reliance Jio Analyses The Brand On Its Business TacticsDocument3 pagesPESTLE Analysis of Reliance Jio Analyses The Brand On Its Business TacticsHashmi SutariyaNo ratings yet

- Research On Consumer Preference On India's Best Network AIRTEL & JIODocument33 pagesResearch On Consumer Preference On India's Best Network AIRTEL & JIOmirajNo ratings yet

- Case Study of JioDocument5 pagesCase Study of JioAaronNo ratings yet

- Introduction of Jio 4GDocument18 pagesIntroduction of Jio 4GABHISEKH SARKARNo ratings yet

- Jio 2Document5 pagesJio 2Apoorva PattnaikNo ratings yet

- Jio..... 1111Document6 pagesJio..... 1111JagdishNo ratings yet

- CIA - 1 Fundamentals of Business Analytics (MBA 235)Document5 pagesCIA - 1 Fundamentals of Business Analytics (MBA 235)Abin Som 2028121No ratings yet

- Update - Reliance Jio - The Game Changer - December 2018Document5 pagesUpdate - Reliance Jio - The Game Changer - December 2018NLDFNANo ratings yet

- JioDocument16 pagesJioSridharjagann100% (1)

- Customer SatisfactionDocument36 pagesCustomer SatisfactionRajkumar VishwakarmaNo ratings yet

- Name: Nandini Jadhav Class: Ty Bms B ROLL NO: 7587 Specialisation: Marketing Topic: Reliance Jio-Marketing StrategyDocument20 pagesName: Nandini Jadhav Class: Ty Bms B ROLL NO: 7587 Specialisation: Marketing Topic: Reliance Jio-Marketing StrategySHANTA TARADENo ratings yet

- Study of Consumer Behaviour Towards Reliance Jio: Executive SummaryDocument41 pagesStudy of Consumer Behaviour Towards Reliance Jio: Executive Summarysaminathan sNo ratings yet

- 2502 3567 2 PBDocument2 pages2502 3567 2 PBANubhavNo ratings yet

- Reliance Jio InfocommDocument46 pagesReliance Jio Infocommnarayani singhNo ratings yet

- Reliance Jio: Weekly OCTOBER 8, 2016 Vol Li No 41. Jio Came Up With A Vision To Generate Huge Revenue by ProvidingDocument4 pagesReliance Jio: Weekly OCTOBER 8, 2016 Vol Li No 41. Jio Came Up With A Vision To Generate Huge Revenue by ProvidingShubhamNo ratings yet

- The Effect On The Telecom Industry and CDocument20 pagesThe Effect On The Telecom Industry and CuoiuoidaNo ratings yet

- Jio Company (1) - RemovedDocument53 pagesJio Company (1) - RemovedLucky SrivastavaNo ratings yet

- Name and LocationDocument10 pagesName and LocationSolanki SolankiNo ratings yet

- BVFM Assignment 2Document15 pagesBVFM Assignment 2Sandeep GurjarNo ratings yet

- Jio SM ReportDocument9 pagesJio SM ReportANUSHKANo ratings yet

- DD Research Paper 1 FinalDocument25 pagesDD Research Paper 1 Finalmohiyuddinsakhib3260No ratings yet

- MM Research Paper 1 FinalDocument26 pagesMM Research Paper 1 Finalmohiyuddinsakhib3260No ratings yet

- JIO PDFDocument68 pagesJIO PDFVeekeshGuptaNo ratings yet

- RG Case StudyDocument14 pagesRG Case StudySagar MistryNo ratings yet

- A Study On Impact of Jio On The Telecom Industry in IndiaDocument16 pagesA Study On Impact of Jio On The Telecom Industry in IndiaAmisha PrakashNo ratings yet

- SHRM PPT AishikDocument5 pagesSHRM PPT AishikAishik BanerjeeNo ratings yet

- Project Report: ON Comparative Analysis of Marketing Strategies of Reliance Jio & Bharti AirtelDocument23 pagesProject Report: ON Comparative Analysis of Marketing Strategies of Reliance Jio & Bharti AirtelSwapnil MohiteNo ratings yet

- 1009-Article Text-1731-1-10-20171225 PDFDocument6 pages1009-Article Text-1731-1-10-20171225 PDFPursottam SarafNo ratings yet

- 1009-Article Text-1731-1-10-20171225 PDFDocument6 pages1009-Article Text-1731-1-10-20171225 PDFAerum FaheemNo ratings yet

- ReviewDocument26 pagesReviewakshaya akshayaNo ratings yet

- Consumer Satisfaction About JIO: Submitted ToDocument53 pagesConsumer Satisfaction About JIO: Submitted ToHpNo ratings yet

- The Impact of Jio On Indian Telecom Indu PDFDocument5 pagesThe Impact of Jio On Indian Telecom Indu PDFN.PNo ratings yet

- The Impact of Jio On Indian Telecom Indu PDFDocument5 pagesThe Impact of Jio On Indian Telecom Indu PDFAshis Kumar MuduliNo ratings yet

- Jio Marketing StrategyDocument14 pagesJio Marketing StrategyShrey Jain100% (1)

- BRM1Document12 pagesBRM1Dhruv YadavNo ratings yet

- IoT Machine Learning Applications in Telecom, Energy, and Agriculture: With Raspberry Pi and Arduino Using PythonFrom EverandIoT Machine Learning Applications in Telecom, Energy, and Agriculture: With Raspberry Pi and Arduino Using PythonNo ratings yet

- Economic Indicators for Southeastern Asia and the Pacific: Input–Output TablesFrom EverandEconomic Indicators for Southeastern Asia and the Pacific: Input–Output TablesNo ratings yet

- Innovate Indonesia: Unlocking Growth Through Technological TransformationFrom EverandInnovate Indonesia: Unlocking Growth Through Technological TransformationNo ratings yet

- IoT Standards with Blockchain: Enterprise Methodology for Internet of ThingsFrom EverandIoT Standards with Blockchain: Enterprise Methodology for Internet of ThingsNo ratings yet

- Moving up the Value Chain: The Road Ahead for Indian It ExportersFrom EverandMoving up the Value Chain: The Road Ahead for Indian It ExportersNo ratings yet

- Global Business Environment Unit 1Document18 pagesGlobal Business Environment Unit 1deep gargNo ratings yet

- Global Business Environment Unit IiDocument36 pagesGlobal Business Environment Unit Iideep gargNo ratings yet

- European Union: Presented By:-Mansi Hardik Mendhiratta Gaurav Deepanshu Garg Chandan Maheshwari Manish Mansi GuptaDocument49 pagesEuropean Union: Presented By:-Mansi Hardik Mendhiratta Gaurav Deepanshu Garg Chandan Maheshwari Manish Mansi Guptadeep gargNo ratings yet

- Global Business Environment Unit IiDocument36 pagesGlobal Business Environment Unit Iideep gargNo ratings yet

- Global Business Environment Unit 1Document18 pagesGlobal Business Environment Unit 1deep gargNo ratings yet

- Project Report Assignment GBEDocument2 pagesProject Report Assignment GBEdeep gargNo ratings yet

- Unit III MNCDocument32 pagesUnit III MNCdeep gargNo ratings yet

- Internal and External Analysis of Jio: Rahul Mhabde, Ali DhamaniDocument5 pagesInternal and External Analysis of Jio: Rahul Mhabde, Ali Dhamanideep gargNo ratings yet

- 3is FORMATDocument10 pages3is FORMATAMACIO, MARIAN JOY A.No ratings yet

- UntitledDocument23 pagesUntitledPravinNo ratings yet

- 0650-EDW-00009-02 - Seaking DST Parts List - Customer Parts ListDocument11 pages0650-EDW-00009-02 - Seaking DST Parts List - Customer Parts ListJosianeMacielNo ratings yet

- Coa MyobDocument4 pagesCoa Myobalthaf alfadliNo ratings yet

- Polyflex 201 EnglishDocument2 pagesPolyflex 201 EnglishcesarNo ratings yet

- Backplane Designer's Guide 4Document11 pagesBackplane Designer's Guide 4terryschNo ratings yet

- Extended Abstract Comparison of Effectiveness of The Various Species of Citrus' Peels As Styrofoam DecomposerDocument3 pagesExtended Abstract Comparison of Effectiveness of The Various Species of Citrus' Peels As Styrofoam DecomposerKen EzekielNo ratings yet

- Song Kiat Chocolate FactoryDocument1 pageSong Kiat Chocolate FactoryKim CuarteroNo ratings yet

- Tectonic Evolution of Mogok Metamorphic BeltDocument21 pagesTectonic Evolution of Mogok Metamorphic BeltOak KarNo ratings yet

- Ip 15Document42 pagesIp 15owenh796100% (4)

- Data Structures in CDocument47 pagesData Structures in CRaghavendiran J M94% (16)

- Intraoral Pressures Produced by Thirteen Semi-Occluded Vocal Tract GesturesDocument7 pagesIntraoral Pressures Produced by Thirteen Semi-Occluded Vocal Tract GesturesCarlosAdiel_No ratings yet

- VELNET-SOLNET Eliminador en AerosolDocument11 pagesVELNET-SOLNET Eliminador en AerosolantonioNo ratings yet

- Ravi LE ROCHUS - ResumeDocument1 pageRavi LE ROCHUS - ResumeRavi Le RochusNo ratings yet

- Instrukcja Obsługi TC-6 Felicia - AngielskiDocument24 pagesInstrukcja Obsługi TC-6 Felicia - Angielskiadrianadik100% (2)

- Step 5 and 6Document6 pagesStep 5 and 6Diana Rose MitoNo ratings yet

- Vendor: Design Information: Gas BootDocument2 pagesVendor: Design Information: Gas Boot124swadeshiNo ratings yet

- Formulating Tips For Creams and LotionDocument3 pagesFormulating Tips For Creams and LotionDewi Sekar AyuNo ratings yet

- Power System Protection - Part 07Document10 pagesPower System Protection - Part 07shashikant yadavNo ratings yet

- Optimisation of Supply Chain of Smart ColoursDocument29 pagesOptimisation of Supply Chain of Smart ColoursPooja ShahNo ratings yet

- Eecs166 267 Syllabus15Document3 pagesEecs166 267 Syllabus15Bhanu Pratap ReddyNo ratings yet

- Assignment 4 Inplant TrainingDocument14 pagesAssignment 4 Inplant TrainingRajas BiliyeNo ratings yet

- Skill Development Sector - Achievement ReportDocument10 pagesSkill Development Sector - Achievement ReportShivangi AgrawalNo ratings yet

- Sso Test 20 Questions EnglishDocument2 pagesSso Test 20 Questions EnglishPanagiwtis M.No ratings yet

- 7040 02 Que 20100511Document28 pages7040 02 Que 20100511Mohammad Mohasin SarderNo ratings yet

- Spare Parts Price List - DeluxeDocument13 pagesSpare Parts Price List - Deluxesrikanthsri4uNo ratings yet

- Permutation & Combination Theory - EDocument9 pagesPermutation & Combination Theory - Ethinkiit100% (1)

- PDF File 5Th Class Math Lesson PlanFor 8 WeeksDocument8 pagesPDF File 5Th Class Math Lesson PlanFor 8 WeeksGB SportsNo ratings yet

- ST 3Document2 pagesST 3JESSA SUMAYANGNo ratings yet

- Chapter One 1.0 History of Herbs: ST THDocument48 pagesChapter One 1.0 History of Herbs: ST THAbu Solomon100% (1)