Professional Documents

Culture Documents

Union Tax and Duties

Union Tax and Duties

Uploaded by

ahyaanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Union Tax and Duties

Union Tax and Duties

Uploaded by

ahyaanCopyright:

Available Formats

24

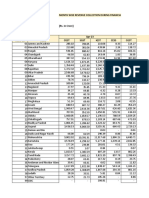

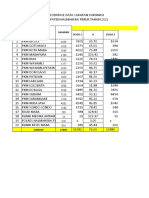

ANNEX-4

STATEMENT SHOWING STATE-WISE DISTRIBUTION OF NET PROCEEDS OF UNION TAXES AND DUTIES FOR BE 2019-20

(in ` crore)

Sl. State Share Corporation Income Wealth Central Customs Union Grand

No. (per cent)* Tax Tax@ Tax GST Excise Total

(0020) (0021) (0032) (0032) (0037) Duty (4 to 9)

(0038)

1 2 3 4 5 6 7 8 9 10

1 Andhra Pradesh 4.305 11775.31 9893.51 -0.32 11004.42 2284.72 1402.62 36360.26

2 Arunachal Pradesh 1.370 3747.31 3148.46 -0.10 3501.99 727.08 446.36 11571.10

3 Assam 3.311 9056.46 7609.15 -0.24 8463.56 1757.19 1078.77 27964.89

4 Bihar 9.665 26436.33 22211.56 -0.71 24705.63 5129.34 3148.98 81631.13

5 Chhattisgarh 3.080 8424.61 7078.28 -0.23 7873.08 1634.60 1003.50 26013.84

6 Goa 0.378 1033.93 868.70 -0.03 966.24 200.61 123.16 3192.61

7 Gujarat 3.084 8435.55 7087.48 -0.23 7883.31 1636.72 1004.81 26047.64

8 Haryana 1.084 2965.03 2491.19 -0.08 2770.91 575.29 353.18 9155.52

9 Himachal Pradesh 0.713 1950.24 1638.58 -0.05 1822.57 378.40 232.30 6022.04

Receipts Budget,

10 Jammu & Kashmir 1.854 5071.18 4260.76 -0.14 4739.19 983.94 604.06 15658.99

11 Jharkhand 3.139 8585.99 7213.87 -0.23 8023.90 1665.91 1022.73 26512.17

12 Karnataka 4.713 12891.30 10831.15 -0.35 12047.35 2501.25 1535.56 39806.26

13 Kerala 2.500 6838.16 5745.36 -0.18 6390.49 1326.78 814.53 21115.14

14 Madhya Pradesh 7.548 20645.77 17346.39 -0.56 19294.16 4005.82 2459.23 63750.81

2019-2020

15 Maharashtra 5.521 15101.39 12688.05 -0.41 14112.75 2930.07 1798.81 46630.66

16 Manipur 0.617 1687.66 1417.95 -0.04 1577.17 327.45 201.03 5211.22

17 Meghalaya 0.642 1756.04 1475.41 -0.05 1641.08 340.72 209.17 5422.37

18 Mizoram 0.460 1258.22 1057.15 -0.03 1175.85 244.13 149.87 3885.19

19 Nagaland 0.498 1362.16 1144.47 -0.04 1272.98 264.29 162.25 4206.11

20 Odisha 4.642 12697.10 10667.98 -0.34 11865.86 2463.57 1512.42 39206.59

21 Punjab 1.577 4313.51 3624.17 -0.12 4031.12 836.93 513.81 13319.42

22 Rajasthan 5.495 15030.28 12628.30 -0.40 14046.29 2916.27 1790.34 46411.08

23 Sikkim 0.367 1003.84 843.42 -0.03 938.12 194.77 119.57 3099.69

24 Tamil Nadu 4.023 11003.97 9245.43 -0.30 10283.57 2135.06 1310.74 33978.47

25 Telangana 2.437 6665.84 5600.58 -0.18 6229.45 1293.35 794.01 20583.05

26 Tripura 0.642 1756.04 1475.41 -0.05 1641.08 340.72 209.17 5422.37

27 Uttar Pradesh 17.959 49122.61 41272.37 -1.33 45906.71 9531.07 5851.27 151682.70

28 Uttarakhand 1.052 2877.50 2417.65 -0.08 2689.12 558.31 342.76 8885.26

29 West Bengal 7.324 20033.07 16831.61 -0.54 18721.57 3886.94 2386.25 61858.90

TOTAL 100.00 273526.40 229814.39 -7.39 255619.52 53071.30 32581.26 844605.48

* As per accepted recommendations of the Fourteenth Finance Commission, the States' share has been fixed at 42% of the net proceeds of shareable Central Taxes.

@ Income Tax includes Securities Transaction Tax (STT).

You might also like

- Trivedi Rudri Assignement 2Document9 pagesTrivedi Rudri Assignement 2Rudri TrivediNo ratings yet

- River of Stories - A Comic by Orijit SenDocument51 pagesRiver of Stories - A Comic by Orijit Senactionist100% (22)

- Boner, A. (1990) - Principles of Composition in Hindu Sculpture Cave Temple Period. Motilal Banarsidass Publ..Document54 pagesBoner, A. (1990) - Principles of Composition in Hindu Sculpture Cave Temple Period. Motilal Banarsidass Publ..Mohit Singh100% (1)

- SWOT AnalysisDocument4 pagesSWOT Analysissuryasth0% (1)

- Statement Showing State-Wise Distribution of Net Proceeds of Union Taxes and Duties For Be 2021-22Document1 pageStatement Showing State-Wise Distribution of Net Proceeds of Union Taxes and Duties For Be 2021-22Manish RajNo ratings yet

- Annex 4Document1 pageAnnex 4samjaaon1998No ratings yet

- Statement Showing State-Wise Distribution of Net Proceeds of Union Taxes and Duties For Be 2018-19Document1 pageStatement Showing State-Wise Distribution of Net Proceeds of Union Taxes and Duties For Be 2018-19Nivedh VijayakrishnanNo ratings yet

- Annex 1Document1 pageAnnex 1Meet AhujaNo ratings yet

- StateWise Performance 2021-22Document1 pageStateWise Performance 2021-22sgrfgrNo ratings yet

- Tax Collection On GST Portal 2019 2020Document16 pagesTax Collection On GST Portal 2019 2020Disha MohantyNo ratings yet

- Month Wise Revenue Collection During Financial Year 2021-2022Document4 pagesMonth Wise Revenue Collection During Financial Year 2021-2022Ali NadafNo ratings yet

- StateWise Performance 2023-24Document1 pageStateWise Performance 2023-24loanconsultant285No ratings yet

- Tax Collection On GST Portal 2019 2020Document9 pagesTax Collection On GST Portal 2019 2020Atiq PunjabiNo ratings yet

- Tables Chapter 1Document9 pagesTables Chapter 1Akhilesh KushwahaNo ratings yet

- Actual Generation (MU) During December Actual Generation (MU) During April To DecemberDocument2 pagesActual Generation (MU) During December Actual Generation (MU) During April To DecemberHarikrishna MudaNo ratings yet

- Tax Collection On GST Portal 2023 2024Document4 pagesTax Collection On GST Portal 2023 2024akhil4every1No ratings yet

- State Wise Gross Direct Premium Income General InsuranceDocument6 pagesState Wise Gross Direct Premium Income General InsuranceNaveen AlluNo ratings yet

- Allocation 2018-19 RevisedDocument67 pagesAllocation 2018-19 Revisedmahe pitchaiNo ratings yet

- Turmeric: Area, Production and Productivity in IndiaDocument1 pageTurmeric: Area, Production and Productivity in IndiaSweta PriyadarshiniNo ratings yet

- Profit and Loss Summary For ALLDocument4 pagesProfit and Loss Summary For ALLlipikavenkataNo ratings yet

- Milk Availability ProductionDocument3 pagesMilk Availability ProductionBala SampathNo ratings yet

- State Wise Farm Area 5 YearsDocument1 pageState Wise Farm Area 5 YearsVivek VatsNo ratings yet

- April To July 2019 April To July 2018 Name of State/UTDocument3 pagesApril To July 2019 April To July 2018 Name of State/UTrahulggn4_588180004No ratings yet

- Allocation of Funds (Disbursement)Document1 pageAllocation of Funds (Disbursement)Shashikant MeenaNo ratings yet

- Arrivals 2020Document3 pagesArrivals 2020Maria Jonnacis LinsanganNo ratings yet

- May 2019 A 1Document1 pageMay 2019 A 1felix florentinoNo ratings yet

- Eman WalDocument3 pagesEman WalEman waliNo ratings yet

- Pro Reg AdvancesDocument3 pagesPro Reg Advancessm_1234567No ratings yet

- Status Hydro Electri Potentia in IndiaDocument1 pageStatus Hydro Electri Potentia in IndiahydelNo ratings yet

- Interregional Fiscal FlowsDocument49 pagesInterregional Fiscal FlowsAishwarya RaoNo ratings yet

- Total Expenditure NHDocument4 pagesTotal Expenditure NHSaikatDebNo ratings yet

- Financial Performance Under NREGA During The Year 2006-2007 Up To The Month of March 2007Document6 pagesFinancial Performance Under NREGA During The Year 2006-2007 Up To The Month of March 2007npbehera143No ratings yet

- Production Estimates of Milk, Egg, Meat and Wool of The Year 2004-05Document10 pagesProduction Estimates of Milk, Egg, Meat and Wool of The Year 2004-05smitasirohiNo ratings yet

- State Revenue EnglishDocument3 pagesState Revenue EnglishDiwakar SinghNo ratings yet

- Areva DLF Limited Bharti Airtel Tata Motors Siemens SBIDocument13 pagesAreva DLF Limited Bharti Airtel Tata Motors Siemens SBIilovetrouble780No ratings yet

- Vn4ul6p 701902312 293E3500XD631X46CBXADC8XDBCD60499F94Document4 pagesVn4ul6p 701902312 293E3500XD631X46CBXADC8XDBCD60499F94Daniel VelaNo ratings yet

- Thermal Energy RASDocument5 pagesThermal Energy RASakanilsingh5No ratings yet

- Beta (Risk), Rsi CalculationDocument228 pagesBeta (Risk), Rsi CalculationNeetika ChawlaNo ratings yet

- Financial Performance Under NREGA During The Year 2006-2007 Up To The Month of March 2007Document6 pagesFinancial Performance Under NREGA During The Year 2006-2007 Up To The Month of March 2007npbehera143No ratings yet

- Dosis 1 % Dosis 2: NO Fasyankes Sasaran Yang DivaksinDocument3 pagesDosis 1 % Dosis 2: NO Fasyankes Sasaran Yang DivaksinIhwanNo ratings yet

- Vn4ul6p 701902632 B34B0F83X6434X4B94X93ACXEA230D9AE1ADDocument4 pagesVn4ul6p 701902632 B34B0F83X6434X4B94X93ACXEA230D9AE1ADDaniel VelaNo ratings yet

- Z ScoreDocument18 pagesZ ScoreAkankshaNo ratings yet

- Status of Large Hydro Electric Potential DevelopmentDocument2 pagesStatus of Large Hydro Electric Potential DevelopmentARUN CHATURVEDINo ratings yet

- Percent To Sales MethodDocument8 pagesPercent To Sales Methodmother25janNo ratings yet

- Coal Reserve 5 Tahun PertamaDocument2 pagesCoal Reserve 5 Tahun Pertamadani bayuNo ratings yet

- Bio Fertilizer IndiaDocument3 pagesBio Fertilizer IndiaveerabahuNo ratings yet

- SAPM Project MidCapDocument80 pagesSAPM Project MidCapAnjali BhatiaNo ratings yet

- 33 - 2022 - Aiboc - Revision in DADocument3 pages33 - 2022 - Aiboc - Revision in DAsengaraaradhanaNo ratings yet

- Central Electricity Authority Go&Dwing Operation Performance Monitoring DivisionDocument2 pagesCentral Electricity Authority Go&Dwing Operation Performance Monitoring DivisionJamjamNo ratings yet

- GSTR 1 2023 2024Document20 pagesGSTR 1 2023 2024S M SHEKAR AND CONo ratings yet

- GROWTH - RATIODocument4 pagesGROWTH - RATIOngbopNo ratings yet

- Hydro Potential Region 9Document2 pagesHydro Potential Region 9Dr Santosh K BeheraNo ratings yet

- Financial Performance Under NREGA During The Year 2006-2007 Up To The Month of March 2007Document8 pagesFinancial Performance Under NREGA During The Year 2006-2007 Up To The Month of March 2007npbehera143No ratings yet

- Maryam Finance Project-1-11Document1 pageMaryam Finance Project-1-11Tutii FarutiNo ratings yet

- Schema TabellaDocument5 pagesSchema TabellaAlessandro CavarrettaNo ratings yet

- 4 5875196789103006596Document1 page4 5875196789103006596Mr GameNo ratings yet

- Self-Help Group-Bank Linkage ProgrammeDocument1 pageSelf-Help Group-Bank Linkage ProgrammeKajal ChaudharyNo ratings yet

- CO Wise Recovery in D4, Loss & Written Off As On 02.08.2022Document1 pageCO Wise Recovery in D4, Loss & Written Off As On 02.08.2022vijay kumarNo ratings yet

- Country DataDocument12 pagesCountry DataRakesh DebNo ratings yet

- Data State/Uts Sum - Deaths Sum - Discharged Sum - Active Sum - Total Cases Maharashtra 133038 6103325 78700 6315063Document4 pagesData State/Uts Sum - Deaths Sum - Discharged Sum - Active Sum - Total Cases Maharashtra 133038 6103325 78700 6315063Jayesh PatelNo ratings yet

- Ecm Log NormDocument4 pagesEcm Log NormROMAN RAMIREZNo ratings yet

- Vn4ul6p 701902333 3E6642BDXB939X4323XAAE9X9B5C10779A8EDocument4 pagesVn4ul6p 701902333 3E6642BDXB939X4323XAAE9X9B5C10779A8EDaniel VelaNo ratings yet

- Acj&msr 1Document27 pagesAcj&msr 1davishtaara9No ratings yet

- List of Pupils Selected For Provisional Admission in Science StreamDocument6 pagesList of Pupils Selected For Provisional Admission in Science StreamAhanNo ratings yet

- Becoming Indian The Unfinished Revolution of Culture and Identity Pavan K Varma PDFDocument2 pagesBecoming Indian The Unfinished Revolution of Culture and Identity Pavan K Varma PDFHera Riastiana0% (1)

- Notice Regarding Opening and Closing RankDocument67 pagesNotice Regarding Opening and Closing RankAkshay TandleNo ratings yet

- Dams in India Geography Notes For UPSCDocument2 pagesDams in India Geography Notes For UPSCDhansingh KokareNo ratings yet

- Nse 20141008Document33 pagesNse 20141008Dhawan SandeepNo ratings yet

- DaburDocument2 pagesDaburimchitraNo ratings yet

- IB SA MTS Result 2023Document72 pagesIB SA MTS Result 2023029 Krishna kumar SarkiNo ratings yet

- Recent Development in Indian PoliticsDocument3 pagesRecent Development in Indian PoliticsNikhil YadavNo ratings yet

- Battle of Buxar CorrectedDocument1 pageBattle of Buxar CorrectedHasaan AhmedNo ratings yet

- AllahabadDocument9 pagesAllahabadgrath3895No ratings yet

- History of Spices in India (A Short Article)Document2 pagesHistory of Spices in India (A Short Article)India UnconventionalNo ratings yet

- Pak Affairs MCQsDocument15 pagesPak Affairs MCQsQaiser Fareed JadoonNo ratings yet

- X Civics Important Questions Board (2022-23)Document2 pagesX Civics Important Questions Board (2022-23)Aditya GoelNo ratings yet

- Sino-Pakistan Relations: A Chinese PerspectiveDocument17 pagesSino-Pakistan Relations: A Chinese Perspectivearun1974No ratings yet

- Yuva Bharati, Voice of Youth, October 2011 Issue.Document48 pagesYuva Bharati, Voice of Youth, October 2011 Issue.Vivekananda KendraNo ratings yet

- Indian OfficialsDocument4 pagesIndian Officialsnira365No ratings yet

- Advanced Industrial Relations Model Question PapersDocument4 pagesAdvanced Industrial Relations Model Question PapersViraja Guru100% (1)

- Modern PYQDocument107 pagesModern PYQVIKAS SANGWANNo ratings yet

- Note SecularismDocument7 pagesNote SecularismAnil AvNo ratings yet

- Indian Independence and PartitionDocument17 pagesIndian Independence and PartitionArav Kavan GowdaNo ratings yet

- University Grants Commission (UGC) - NET - IndiaDocument2 pagesUniversity Grants Commission (UGC) - NET - Indiavk9115250No ratings yet

- Political Map PakistanDocument1 pagePolitical Map PakistanRehan ShahwaniNo ratings yet

- UPSC Civil Services Examination: UPSC Notes (GS-I) Topic: Third Anglo-Maratha War (Modern Indian History Notes For Upsc)Document2 pagesUPSC Civil Services Examination: UPSC Notes (GS-I) Topic: Third Anglo-Maratha War (Modern Indian History Notes For Upsc)RATHLOGICNo ratings yet

- Obituary Professor Jean Philippe Vogel PDFDocument2 pagesObituary Professor Jean Philippe Vogel PDFmahiyagiNo ratings yet

- Andhra Pradesh Civil Courts Amendment Act 1989Document12 pagesAndhra Pradesh Civil Courts Amendment Act 1989Latest Laws TeamNo ratings yet

- Domestic Violence Act Misused - Centre - The HinduDocument8 pagesDomestic Violence Act Misused - Centre - The Hinduqtronix1979No ratings yet