Professional Documents

Culture Documents

Tax Quiz Questions Compiled

Tax Quiz Questions Compiled

Uploaded by

Shanelle Napoles0 ratings0% found this document useful (0 votes)

9 views2 pagesOriginal Title

TAX-QUIZ-QUESTIONS-COMPILED.docx

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

9 views2 pagesTax Quiz Questions Compiled

Tax Quiz Questions Compiled

Uploaded by

Shanelle NapolesCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 2

positions espoused by your boss.

How will you handle this

assignment?

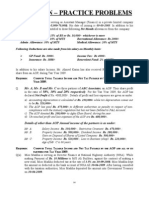

TAX QUIZ QUESTIONS COMPILED 6. Flexible Tariff Clause

TAX QUIZ QUESTIONS 7. Reinvestigation. 2010 nagfile ng return. Motion for Reinvestigation

1. Abusayaf Tax Code nagimpose ng business tax sa sang city sa granted nung 2011. Natapos investigation ng 2014. Prescribed na ba

Mindanao. Other than Abusayaf Tax Code, the same is already yung assessment?

subject to NIRC and local government tax law. Dr, Pachero paid 8. Electric Company subject sa franchise tax. Then, may law na

P125,000 for that business tax. As a result, there was overpayment nagiimpose ng income tax sa companies na may franchise. Required

of taxes. In Abusayaf tax Code, no period was provided in filing the ba magpay yung mga electric company?

tax refund. Can he now claim for the tax refund? If yes, in what 9. Contract entered into by LBC and DOH. Nagagree na exempted sa

period? vat yung transactions nila from 2010 to 2014. Nung 2013, nagkaroon

2. Bill in the Congress for imposition of tax in the amount of 20 centavo ng law na nagrrevoke ng tax exemptions sa mga carriers. Valid ba

upon plastic bags for environmental protection. Is the bill valid? law?

(Suggested answer: YES, Gomez vs Palomar case) 10. 4000sqm na lupa ng church. 300sqm lang ginagamit sa church

3. Ocampo is a businessman in Laguna. There was a Revenue mismo, then nagdecide yung mga priests na magtayo ng veggie

Regulation stating that all those paying 25% higher than the previous garden for personal consumption. Sabi ng tax assessor, liable yun sa

taxable year shall enjoy last priority investigation. Congressman realty tax. Decide.

question saying that it is a form of tax amnesty which the secretary of 11. PLDT was granted a tax privilege of 3% by the government "in lieu of

finance cannot do. What do you think is the basis of the taxes". LGu of laguna passed an ordinance imposing a tax in all

Congressman. If you were the Secretary of Finance. how would you businesses enjoying a franchise privilege.. Is PLDT exempted or

defend it? not..

1. (Suggested answer: Constitutional provision that tax 12. Corporation was penalized for tax evasion. Corporation moved for

exemption must be approved by the absolute majority of the dismissal because of prematurity for the absence of tax deficiency

Congress, Article 6) assessment. DOJ insist that tax deficiency assessment is not a pre-

2. Secretary of Finance may content that the last priority condition. IS DOJ correct?

investigation is not a form of tax exemption because all 13. A corporation was granted a tax exemption on the issuance of bonds

return are still subject to investigation. It is just that those and operation of public utilities. Congress revoked the exemptions

who filed 25% higher has to be preferred last. before expiry. Is the revocation constitutional?

4. Ramon Uy has an agricultural land. May VAT Revenue Regulation, 14. City of manila imposed occupation tax on all persons exercising

hindi alam kung VAT taxpayer sya or hindi. Mr. Uy asked a Bedan various professions. Atty batas paid his taxes with protest saying that

lawyer. Sabi nya VAT taxpayer sya. Pero kayong dalawa (Mr. Uy the ordinance is discriminatory. Discuss with reasons

and Bedal lawyer) hindi mo sure. if you file a return, you will suffer 15. Mr reyes real estate businessman filed his 1994 income tax return on

onerous consequences. Decide. (medyo malabo ung pagkaconstruct march 25, 1995. On december 10, 1995 he left for canada as an

nung tanning) immigrant.After investigation on the said return, bir sent notice of

5. A member of the Congress acting on the informations from assessment to mr reyes on april 10, 1998 and posted the tax

unimpeachable sources that religious institutions and churches has delinquents (including him). On december 8, 1995 when he came

so much income emanating from religious activities and other back as a balikbayan, upon knowing the same, filed a protest stating

sources proposed to impose taxes on the said income and also to that the assessment has already presribed and that he did not

collect realty taxes on their real properties. The proposal is intended receive the notice of assessment. Will the protest prosper?

to raise more revenues for the government which is in dire need of 16. Premature filing DOJ tax evasion

the revenues to address the fiscal aqequacy needs of the country. It 17. City of quezon city promulgated ordinance imposing a garbage fee

was also argued that these religious institutions have the financial on all household within the city due to the recent trend in waste

capacity to pay and requiring them to share in the burdens of the mgmt and the increase in waste production by 0.66 kilogram. Is the

govenrment conforms with the theoretical justice rule which i one of ordinance violative of equal protection clause and due process

the basic principles of a sound tax system. As counsel working in the clause guaranteed by the constitution? Discuss

office of this member of Congress, you are required to reinforce the

18. Davao city imposed 0.5 percent of the assessed value of urban land representing he const of the paper, ink and related printing expenses

which exceeds 100k as socialized housing tax. does it violate due but there is no profit realised from such activities. It was just a plain

process because it is discriminatory or oppressive thus cost recovery. The LGU of Sorsogon passed an ordinance requiring

unconstitutional? Explain. the sale of all commodities within the town which includes bible to

19. Someone asked a tax related law to the doj. Upon meticulous and 3% sales tax based on gross receipts. The pastor refused to pay the

deep research the doj produced a formal legal opinion upon the tax since accdng, to him he is not engaged in business when he

matter. What is the probative effect of the legal opinion to BIR. distributes bible and collects Php100 per bible. Should a sales tax be

Explain. imposed on his distribution of bible, the tax will diminish the proceeds

20. The church has 2-hectars of land. In the middle and in the south is necessary to print another bible and will affect his evangelization

the church and the convent. Southeastern commercial activity. Decide whether the Local Govt is correct in enforcing the

establishments. Northeastern idle and unoccupied. Could the entire collection of the sales tax pursuant to the ordinance. Explain

parcel of land be tax exempt? Explain. 26. Mr, Butchoy, a leading investor filed his ITR on 4/15/2013 for taxable

21. The president of the philippines imposed additional 8% tax to tariff yr 2012. on 11/5/2013 he received a letter notice from BIR RDO,

pursuant to the flexible tariff clause. It immediately became effective. Muntinlupa requiring him to submit his books of accounts and all

Kenny contended that the law is void because there was no other documentary evidences which were used in preparing his tax

recommendation from th NEDA as provided in section 401 of the return. While evaluating his documents for submission to the BIR he

tariff code. Is Kenny's contention valid? Explain. noticed that he committed an error in the return he filed on 4/15/2013

22. Macheco Corporation was the recipient in 2005 of 2 tax exemptions for having deducted as transportation expense a personal expense

both from Congree, one law exemptiong the company’s bond issues representing airfares of his family incurred during their pilgrimage to

from taxes and other exempting the company from taxes in the Our Lady of Akita in Japan. He decided to correct said error by filing

operation of its public utilities. The two laws extending the tax an amended ITR with the BIR attaching therewith the tax return

exemptions were revoked by the Congress before their expiry dates. earlier filed on 4/15/2013. BIR refused to accept the filing of the

Were the revocations constitutional? Amended ITR. Was the BIR correct? Explain

23. Joey Guilas, who is engaged in the trading business, entrusted to his 27. Taal Savings and Loan Assoc (TSLA) is a thrift bank duly licensed by

accountant Melencio Caunan the preparation of his income tax the BSP and is enjoying a tax incentive whereby for a pd of 5 yrs

return and the payment of the tax due. The accountant filed a starting from the commencement of its operations on 4/15/2012. It is

falsified tax return by underdeclating the sales and overstating the exempted from all taxes except income tax and local tax. TSLA

expense deductions of Joey. Is Joey liable for the deficiency tax and bought computer units from Octagon for which the latter added

penalties thereon? What is the liability, if any, of the accountant? 12%VAT in addition to the selling price of the units. TSLA refused to

Discuss. pay the VAT and argued that it is liable to pay only under its charter

24. In view of the unfavorable balance of payment condition and the income tax and local tax. Was the refusal of TSLA tenable? Discuss

increasing budget deficit, the Pres. of the PH upon recommendation 28. Batangas West High School (BSWH) is a non-profit, non-stock edu

of the NEDA issues during a recess of Congress an Executive Order institution. During enrollment time, the school has big amount of

imposing an additional duty on all imports at the rate of 10% ad funds which are considered idle since there are no projects yet being

valorem. The EO also provides that the same shall take effect initiated by the school for which funds are needed. The treasurer of

immediately. Carlito Viniegra, an importer, questions that legality of BWHS decided to invest the idle funds in the money market with BPI

the EO on the gowned that only Congress has the authority to fix the Capital Corp. withheld the 20% final withholding tax on the interest

rates of import taxes and in any event such an EO can take effect income pursuant to Section 24 of the Tax Code. BWHS questioned

only 30 days after promulgation and the Pres has no authority to the withholding of the tax on the interest income on the ground that

shorten the sad period. Are the objections of Carlito tenable? as a non-profit, non-stock educational institution, it is exempted

Explain. under the Constitution from income tax. Decide.

25. Mr Benny Ancheta is a pastor of a Protestant Church in Sorsogon

whose way of evangelisation was to distribute bibles to people whom

he is evangelizing telling them the importance of reading the bible to

deepen their faith in God. However, when he gives bible to the

people whom he evangelizes, he collect the amount of Php100

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5825)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- RR 2-98Document21 pagesRR 2-98Joshua HorneNo ratings yet

- Internal Revenue Regulations, 2001 (LI 1675)Document48 pagesInternal Revenue Regulations, 2001 (LI 1675)TIMOREGHNo ratings yet

- Principles of Taxation Question Bank by ICAEW 2013 PDF (SPirate)Document216 pagesPrinciples of Taxation Question Bank by ICAEW 2013 PDF (SPirate)Juan Frivaldo75% (4)

- 2017 Beda Taxation Law Pre Week ClearerDocument49 pages2017 Beda Taxation Law Pre Week ClearerShanelle NapolesNo ratings yet

- Tax Planning and ManagementDocument23 pagesTax Planning and ManagementMinisha Gupta100% (19)

- CIVPRO Provisional Remedies PDFDocument21 pagesCIVPRO Provisional Remedies PDFShanelle NapolesNo ratings yet

- Jara Master Notes SCA & SpecProDocument21 pagesJara Master Notes SCA & SpecProShanelle NapolesNo ratings yet

- Civil Procedure Case Doctrines Mendoza 1Document81 pagesCivil Procedure Case Doctrines Mendoza 1Shanelle Napoles0% (1)

- Juicy Notes 2011compiled PDFDocument93 pagesJuicy Notes 2011compiled PDFShanelle Napoles100% (1)

- Credit Samplex For Finals SerranoDocument1 pageCredit Samplex For Finals SerranoShanelle NapolesNo ratings yet

- Other Percentage Taxes: Three Percent (3%) Percentage TaxDocument9 pagesOther Percentage Taxes: Three Percent (3%) Percentage TaxShanelle NapolesNo ratings yet

- Wills and Succession Syllabus Bedan PrayerDocument5 pagesWills and Succession Syllabus Bedan PrayerShanelle NapolesNo ratings yet

- Overview: Enactment: June 6, 1977 Purpose: To Protect The Right of The People To A Healthy Environment Through ADocument30 pagesOverview: Enactment: June 6, 1977 Purpose: To Protect The Right of The People To A Healthy Environment Through AShanelle NapolesNo ratings yet

- "That in All Things God May Be Glorified": James Bryan Deang 1Document38 pages"That in All Things God May Be Glorified": James Bryan Deang 1Shanelle NapolesNo ratings yet

- Justo vs. GalingDocument2 pagesJusto vs. GalingShanelle NapolesNo ratings yet

- Campos vs. CamposDocument2 pagesCampos vs. CamposShanelle Napoles100% (1)

- Module 1 - General Principles in TaxationDocument15 pagesModule 1 - General Principles in TaxationMaryrose SumulongNo ratings yet

- As-22 Accounting For Taxes On Income - Brief Note PDFDocument5 pagesAs-22 Accounting For Taxes On Income - Brief Note PDFKaran KhatriNo ratings yet

- Wealth Tax ActDocument10 pagesWealth Tax ActnallurisNo ratings yet

- Tax 301 INCOME TAXATION Module 1 8 PDFDocument162 pagesTax 301 INCOME TAXATION Module 1 8 PDFMaryane AngelaNo ratings yet

- Basic Principles LectureDocument7 pagesBasic Principles LectureevaNo ratings yet

- LAB211 Assignment: Title BackgroundDocument2 pagesLAB211 Assignment: Title Backgroundhieunuy12No ratings yet

- TAXATION Ver 2Document3 pagesTAXATION Ver 2coleenllb_usaNo ratings yet

- IFC Capitalization (Equity) Fund V CIRDocument8 pagesIFC Capitalization (Equity) Fund V CIRLino MomonganNo ratings yet

- Income Statement Report Form 11Document5 pagesIncome Statement Report Form 11mesfin eshete100% (13)

- Income Tax AY 2020-21 Sem III B.comh - Naveen MittalDocument99 pagesIncome Tax AY 2020-21 Sem III B.comh - Naveen MittalNisha PatelNo ratings yet

- Written Task 2 Answer UpdatedDocument12 pagesWritten Task 2 Answer UpdatedelenaNo ratings yet

- Income Taxation NotesDocument3 pagesIncome Taxation NotesMa. Valerie LabareñoNo ratings yet

- Revenue Memorandum Circular No. 075-16Document3 pagesRevenue Memorandum Circular No. 075-16Dominique ShoreNo ratings yet

- Tax DigestDocument6 pagesTax DigestJo-Al GealonNo ratings yet

- V. South African Airways vs. CIRDocument8 pagesV. South African Airways vs. CIRStef OcsalevNo ratings yet

- Special Lecture Handouts in TaxationDocument24 pagesSpecial Lecture Handouts in TaxationTep DomingoNo ratings yet

- R2 NotesDocument15 pagesR2 NotesAmar Guli100% (2)

- Ed Practice Problems For TaxationDocument6 pagesEd Practice Problems For TaxationKIYYA QAYYUM BALOCH100% (1)

- Tax 1 Activity (Soriano Book)Document18 pagesTax 1 Activity (Soriano Book)Sara Andrea SantiagoNo ratings yet

- De La Cuesta, de Las Alas and Callanta Law Offices For Petitioners. The Solicitor General For RespondentsDocument27 pagesDe La Cuesta, de Las Alas and Callanta Law Offices For Petitioners. The Solicitor General For RespondentsAmber QuiñonesNo ratings yet

- Tax Saving Guide - 2022-23Document28 pagesTax Saving Guide - 2022-23Padmapriya SrinivasanNo ratings yet

- 2012 Feb - Personal Income Tax Act 2011Document3 pages2012 Feb - Personal Income Tax Act 2011ProshareNo ratings yet

- Income TaxDocument27 pagesIncome Taxvit vickeyNo ratings yet

- Form No. 15H: (IT Dept. Copy)Document9 pagesForm No. 15H: (IT Dept. Copy)jpsmu09No ratings yet

- Chapter 3 IncometaxDocument20 pagesChapter 3 IncometaxLouella CunananNo ratings yet

- Module 8.1Document21 pagesModule 8.1Yen AllejeNo ratings yet