Professional Documents

Culture Documents

BA 117 Diagnostic Test

BA 117 Diagnostic Test

Uploaded by

alheruelaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BA 117 Diagnostic Test

BA 117 Diagnostic Test

Uploaded by

alheruelaCopyright:

Available Formats

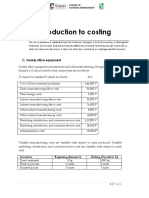

Denver Office Equipment manufactures and sells metal shelving. It began operations on January 1, 2011.

Costs incurred for 2011 are as follows (V stands for variable; F stands for fixed):

Variable manufacturing costs are variable with respect to units produced. Variable marketing,

distribution, and customer-service costs are variable with respect to units sold. Inventory data are as

follows:

Production in 2011 was 123,000 units. Two pounds of direct materials are used to make one unit of

finished product. Revenues in 2011 were $594,000. The selling price per unit and the purchase price per

pound of direct materials were stable throughout the year. The company’s ending inventory of finished

goods is carried at the average unit manufacturing cost for 2011. Finished-goods inventory at December

31, 2011, was $26,000.

REQUIRED

1. Calculate direct materials inventory, total cost, December 31, 2011.

2. Calculate finished-goods inventory, total units, December 31, 2011.

3. Calculate selling price in 2011.

4. Calculate operating income for 2011.

Foxwood Company is a metal- and woodcutting manufacturer, selling products to the home

construction market. Consider the following data for 2011:

REQUIRED

1. Prepare an income statement with a separate supporting schedule of cost of goods manufactured.

For all manufacturing items, classify costs as direct costs or indirect costs and indicate by V or F whether

each is basically a variable cost or a fixed cost (when the cost object is a product unit). If in doubt, decide

on the basis of whether the total cost will change substantially over a wide range of units produced.

2. Suppose that both the direct material costs and the plant-leasing costs are for the production of

900,000 units. What is the direct material cost of each unit produced? What is the plant-leasing cost per

unit? Assume that the plant-leasing cost is a fixed cost.

3. Suppose Foxwood Company manufactures 1,000,000 units next year. Repeat the computation in

requirement 2 for direct materials and plant-leasing costs. Assume the implied cost-behavior patterns

persist.

You might also like

- Cost Accounting QuizDocument2 pagesCost Accounting QuizHussain khawaja75% (4)

- Another Exam IIDocument5 pagesAnother Exam IIzaqmkoNo ratings yet

- PFM CHAP 22 All SolutionsDocument22 pagesPFM CHAP 22 All Solutionsjanay martin100% (1)

- Group 9 - ACCCOB3 - K39 Business CaseDocument4 pagesGroup 9 - ACCCOB3 - K39 Business CaseMelanie GraceNo ratings yet

- Ch2 HW HardDocument3 pagesCh2 HW HardMuhammadShabbirHassaNo ratings yet

- IE 23 LO 5 AssignmentDocument1 pageIE 23 LO 5 AssignmentKent Benedict Cabucos0% (1)

- Math PracticeDocument3 pagesMath Practiceakmal_07No ratings yet

- 20-3 Cotter CompanyDocument3 pages20-3 Cotter CompanyYJ261260% (1)

- BA 121 Case 1 - WhodunitDocument1 pageBA 121 Case 1 - WhodunitalheruelaNo ratings yet

- Denver Office Equipment Manufactures and Sells Metal ShelvingDocument1 pageDenver Office Equipment Manufactures and Sells Metal Shelvingtrilocksp SinghNo ratings yet

- Activity No. 2: Problem 1Document1 pageActivity No. 2: Problem 1Charice Anne VillamarinNo ratings yet

- Topic 2 ExercisesDocument14 pagesTopic 2 ExercisesCLAUDIA RUIZ CUEVAS SAINZNo ratings yet

- 9.23 Standard Costing - Handout.inclass PDFDocument4 pages9.23 Standard Costing - Handout.inclass PDFgadisikaNo ratings yet

- QS12 - Midterm 2 ReviewDocument5 pagesQS12 - Midterm 2 Reviewlyk0texNo ratings yet

- An Introduction To Cost Terms and Purposes Problems 1 11Document3 pagesAn Introduction To Cost Terms and Purposes Problems 1 11b894qr949tNo ratings yet

- Class Question Cost SheetDocument3 pagesClass Question Cost SheetRachit SrivastavaNo ratings yet

- Chapter 4 Fa1Document6 pagesChapter 4 Fa1Zebib DestaNo ratings yet

- 10-11 - Introduction To Cost ConceptsDocument2 pages10-11 - Introduction To Cost ConceptsArchiNo ratings yet

- Job Order Costing QuestionsDocument2 pagesJob Order Costing QuestionsPASCHAL IBELENo ratings yet

- (Odd) Acc 101 LT#2B PDFDocument5 pages(Odd) Acc 101 LT#2B PDF有福No ratings yet

- Chapter Four Accounting Cycle For Manufacturing BusinessDocument5 pagesChapter Four Accounting Cycle For Manufacturing BusinessAbrha636No ratings yet

- Cost AssignmentDocument3 pagesCost AssignmentAbrha GidayNo ratings yet

- 8 Altprob 6eDocument5 pages8 Altprob 6eAshish BhallaNo ratings yet

- Studets Class Exercise (1-2)Document7 pagesStudets Class Exercise (1-2)pgp39266No ratings yet

- Chapter 1. Introduction To Cost TermsDocument17 pagesChapter 1. Introduction To Cost TermsfekadeNo ratings yet

- Huc Acc201-Revision Questions May Intake, 2022Document4 pagesHuc Acc201-Revision Questions May Intake, 2022Sritel Boutique HotelNo ratings yet

- 2.1 Materials: Ompiled by Mengistu N., Acfn, Cobe, BduDocument12 pages2.1 Materials: Ompiled by Mengistu N., Acfn, Cobe, BduMAHLET TUBENo ratings yet

- 10 Questions Inventories 2Document2 pages10 Questions Inventories 2bernadeth.lorzanoNo ratings yet

- Job Order CostingDocument20 pagesJob Order CostingNemeraNo ratings yet

- Exercise: Absorption Costing and Marginal CostingDocument14 pagesExercise: Absorption Costing and Marginal CostingKelvinNo ratings yet

- Chapter 4 In-Class ExercisesDocument9 pagesChapter 4 In-Class ExercisesNguyễn Thị Thanh ThúyNo ratings yet

- Various Inventory Issues The Following Independent Situations Re PDFDocument1 pageVarious Inventory Issues The Following Independent Situations Re PDFAnbu jaromiaNo ratings yet

- Acctba 3 Ind CaseDocument3 pagesAcctba 3 Ind Caseloyd aradaNo ratings yet

- 02 Aga Bagoes Ardiansyah 7fkhususDocument4 pages02 Aga Bagoes Ardiansyah 7fkhususAga Bagoes ArdiansyahNo ratings yet

- Cost Accounting Tutorial 2 Session Problem 1Document2 pagesCost Accounting Tutorial 2 Session Problem 1BagoesadhiNo ratings yet

- Tutor 1 (Inventory Costing - Capacity Analysis)Document2 pagesTutor 1 (Inventory Costing - Capacity Analysis)auliaNo ratings yet

- Class Practice Questions (Standard and Variance Analysis)Document4 pagesClass Practice Questions (Standard and Variance Analysis)Ambreen Muhammad ImranNo ratings yet

- EECA-Question BankDocument13 pagesEECA-Question BankS. P DARSHAN S. PNo ratings yet

- Akb 2Document9 pagesAkb 2Dani m DarmawanNo ratings yet

- END3972 Week3 v2Document25 pagesEND3972 Week3 v2Enes TürksalNo ratings yet

- Capital Budgeting DecisionsDocument11 pagesCapital Budgeting DecisionsMohamed DiabNo ratings yet

- Exercises For The Course Cost and Management Accounting IIDocument8 pagesExercises For The Course Cost and Management Accounting IIDawit AmahaNo ratings yet

- Soal - 1 Inventory Costing - Revised1Document2 pagesSoal - 1 Inventory Costing - Revised1antonitambaNo ratings yet

- Macroeconomics 21st Edition Mcconnell Solutions ManualDocument19 pagesMacroeconomics 21st Edition Mcconnell Solutions Manualmouldywolves086ez100% (30)

- Macroeconomics 21st Edition Mcconnell Solutions Manual Full Chapter PDFDocument23 pagesMacroeconomics 21st Edition Mcconnell Solutions Manual Full Chapter PDFdeanwheeler24031987dtp100% (14)

- Activity No. 2 (Moredo) : Problem 1Document3 pagesActivity No. 2 (Moredo) : Problem 1Eloisa Joy MoredoNo ratings yet

- Chapter3 Variance AnalysisDocument11 pagesChapter3 Variance AnalysisMohamed DiabNo ratings yet

- Cost II Chapter ThreeDocument11 pagesCost II Chapter ThreeSemira100% (1)

- Measuring A Nation's Production and IncomeDocument32 pagesMeasuring A Nation's Production and IncomeAna OjedaNo ratings yet

- Unit 1Document5 pagesUnit 1Baba Baby NathNo ratings yet

- Macroeconomics 20th Edition Mcconnell Solutions ManualDocument18 pagesMacroeconomics 20th Edition Mcconnell Solutions ManualMichelleBrayqwetn100% (19)

- Management Accounting 21.1.11 QuestionsDocument5 pagesManagement Accounting 21.1.11 QuestionsAmeya TalankiNo ratings yet

- Exercises - Chapter 4Document3 pagesExercises - Chapter 4yen saubiNo ratings yet

- Direct and Indirect Materials: BM1805 Key Elements of Costing Part 1Document8 pagesDirect and Indirect Materials: BM1805 Key Elements of Costing Part 1levix hyuniNo ratings yet

- ACDC Probs FsDocument2 pagesACDC Probs FsMae Ann AvenidoNo ratings yet

- Chapter # 4 Exercise & Problems - NewDocument5 pagesChapter # 4 Exercise & Problems - NewZia UddinNo ratings yet

- Assignment On CH 3 and 4 Cost 2Document4 pagesAssignment On CH 3 and 4 Cost 2sadiya AbrahimNo ratings yet

- Budgeting Quiz 2: Multiple Choice Identify The Choice That Best Completes The Statement or Answers The QuestionDocument17 pagesBudgeting Quiz 2: Multiple Choice Identify The Choice That Best Completes The Statement or Answers The Questionaldrin elsisuraNo ratings yet

- Property Boom and Banking Bust: The Role of Commercial Lending in the Bankruptcy of BanksFrom EverandProperty Boom and Banking Bust: The Role of Commercial Lending in the Bankruptcy of BanksNo ratings yet

- Management Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageFrom EverandManagement Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageRating: 5 out of 5 stars5/5 (1)

- Economic and Business Forecasting: Analyzing and Interpreting Econometric ResultsFrom EverandEconomic and Business Forecasting: Analyzing and Interpreting Econometric ResultsNo ratings yet

- Song ListDocument29 pagesSong ListalheruelaNo ratings yet

- What Is The Problem That I Want To Solve?Document2 pagesWhat Is The Problem That I Want To Solve?alheruelaNo ratings yet

- BA 117 Case 5 and 6Document5 pagesBA 117 Case 5 and 6alheruelaNo ratings yet

- The Budgeting Process: Hat Is Government Budgeting?Document10 pagesThe Budgeting Process: Hat Is Government Budgeting?alheruelaNo ratings yet