Professional Documents

Culture Documents

Blank Effects of Business Transactions in The Accounting Equation

Blank Effects of Business Transactions in The Accounting Equation

Uploaded by

Ronald CatapangCopyright:

Available Formats

You might also like

- OutputDocument19 pagesOutputJohnson WilliamNo ratings yet

- Paper From Advance America Cash AdvanceDocument6 pagesPaper From Advance America Cash AdvanceJoyNo ratings yet

- Japan Land - Case StudyDocument2 pagesJapan Land - Case Studypriyaa0380% (10)

- Chapter 3 Market Opportunity Analysis and Consumer AnalysisDocument2 pagesChapter 3 Market Opportunity Analysis and Consumer AnalysisRonald Catapang88% (8)

- Case 4 Numi TeaDocument1 pageCase 4 Numi TeaRonald Catapang50% (2)

- Bessemer's Top 10 Laws For Being SaaS-yDocument11 pagesBessemer's Top 10 Laws For Being SaaS-yjon.byrum9105100% (4)

- The Accounting Equation (Financial Accounting)Document5 pagesThe Accounting Equation (Financial Accounting)RidwanAbirNo ratings yet

- Week 2-1 SlidesDocument30 pagesWeek 2-1 SlidesLIAW ANN YINo ratings yet

- Acct615 NjitDocument24 pagesAcct615 NjithjnNo ratings yet

- Ch.1: Accounting in Action (Cont'd)Document29 pagesCh.1: Accounting in Action (Cont'd)mariam raafatNo ratings yet

- Revision On Principle of Accounting: by Isb Academic TeamDocument37 pagesRevision On Principle of Accounting: by Isb Academic TeamDoan BùiNo ratings yet

- L2 - Accounting Equation & Transaction Analysis - Edited With AnsswerDocument39 pagesL2 - Accounting Equation & Transaction Analysis - Edited With AnsswerEslam SamyNo ratings yet

- Chapter3+4UsingT-Accounts 2Document37 pagesChapter3+4UsingT-Accounts 2الغيثيNo ratings yet

- Ch.2 - Recording Business Transactions (Pearson 6th Edition) - MHDocument56 pagesCh.2 - Recording Business Transactions (Pearson 6th Edition) - MHSamZhao100% (1)

- Analysis of Business TransactionsDocument21 pagesAnalysis of Business TransactionsDan Gideon Cariaga100% (1)

- Chapter 2 HINM 318Document41 pagesChapter 2 HINM 318MOHAMMAD BORENENo ratings yet

- Accounting Equation & Financial ReportingDocument36 pagesAccounting Equation & Financial ReportingAnelisa IvyNo ratings yet

- 01 PowerpointDocument64 pages01 PowerpointVave IsraelNo ratings yet

- Chapter 1 Notes - StudentDocument6 pagesChapter 1 Notes - StudentMia PerdueNo ratings yet

- Accounting Essentials Chapter 3 SynthesisDocument1 pageAccounting Essentials Chapter 3 SynthesisdaraNo ratings yet

- 5# 4 Accounting Equation (UnSolved) PDFDocument4 pages5# 4 Accounting Equation (UnSolved) PDFZaheer SwatiNo ratings yet

- Finance+Webinar 13.12.2022++updatedDocument42 pagesFinance+Webinar 13.12.2022++updatedJasmine ChoudharyNo ratings yet

- AccountingDocument67 pagesAccountinggunanNo ratings yet

- Accounting Equation 2023Document2 pagesAccounting Equation 2023Nishtha GargNo ratings yet

- Use The Accounting Equation To Analyze Business TransactionsDocument36 pagesUse The Accounting Equation To Analyze Business TransactionsPradeep GuptaNo ratings yet

- Accounting Equation: Fundamentals of ABM 1Document97 pagesAccounting Equation: Fundamentals of ABM 1ediwowNo ratings yet

- Ratio AnalysisDocument1 pageRatio AnalysisMuskan hamdevNo ratings yet

- Topic 2 Accounting Equation and StatementsDocument47 pagesTopic 2 Accounting Equation and StatementsNurul AfiqahNo ratings yet

- Illustrating The Accounting Equation: Background Information For LearnersDocument6 pagesIllustrating The Accounting Equation: Background Information For LearnersMarlyn LotivioNo ratings yet

- Professional Accounting PackageDocument72 pagesProfessional Accounting PackageAnmol poudelNo ratings yet

- CFAB Accounting Chap02 Accounting EquationDocument38 pagesCFAB Accounting Chap02 Accounting EquationHoa NguyễnNo ratings yet

- Chapter 7 The Accounting EquationDocument20 pagesChapter 7 The Accounting EquationMylene Salvador100% (1)

- Financial Accounting I: Winter 2020-Lecture "2"Document32 pagesFinancial Accounting I: Winter 2020-Lecture "2"Malak RabieNo ratings yet

- Accounting ProcessDocument13 pagesAccounting ProcessXiavNo ratings yet

- Chapter 2 Accounting ElementsDocument40 pagesChapter 2 Accounting ElementsVivek GargNo ratings yet

- Lecture02-Introduction To AccountingDocument38 pagesLecture02-Introduction To Accounting錢永健No ratings yet

- Work Book XI-CommerceDocument92 pagesWork Book XI-CommerceTariq IqbalNo ratings yet

- CHAPTER 5 The Accounting EquationDocument35 pagesCHAPTER 5 The Accounting EquationKyla BallesterosNo ratings yet

- Training Financial AccountingDocument23 pagesTraining Financial AccountingSara PiccioliNo ratings yet

- Double Entry System & Accounting Equation: by - Mrs. Dilshad D. JalnawallaDocument34 pagesDouble Entry System & Accounting Equation: by - Mrs. Dilshad D. JalnawallaTufail GanaieNo ratings yet

- Accounts, Accountants and AccrualsDocument20 pagesAccounts, Accountants and Accrualsjcmail999446No ratings yet

- 3-THEORY AND APPLICATION OF ACCOUNTING EQUALITY (Morning Shift) (1) - 3Document24 pages3-THEORY AND APPLICATION OF ACCOUNTING EQUALITY (Morning Shift) (1) - 3ScribdTranslationsNo ratings yet

- Lecture Slides - Chapter 1 2Document69 pagesLecture Slides - Chapter 1 2Nhi BuiNo ratings yet

- Chapter Lecture - RemovedDocument43 pagesChapter Lecture - RemovedCJ MacasioNo ratings yet

- Financial Accounting 188 Canva CPT 2-3Document7 pagesFinancial Accounting 188 Canva CPT 2-3marizanne krugerNo ratings yet

- 1.6 Accounting EquationDocument8 pages1.6 Accounting EquationAbijit GudaNo ratings yet

- Chapter Accounting EquationDocument24 pagesChapter Accounting Equationpriyam.200409No ratings yet

- What Is Accounting?: Is A Process of Three Activities: Identifying Recording CommunicatingDocument41 pagesWhat Is Accounting?: Is A Process of Three Activities: Identifying Recording CommunicatingMd. Haseeb KhanNo ratings yet

- Basic Accounting EquationDocument42 pagesBasic Accounting Equationlily smithNo ratings yet

- 1st Assignment - 2023Document15 pages1st Assignment - 2023harmanchahalNo ratings yet

- BBFA1103 Topic 3 Accounting Cycle - NoteDocument13 pagesBBFA1103 Topic 3 Accounting Cycle - Noteknea9999No ratings yet

- Accounting ConceptDocument1 pageAccounting ConceptNISHANTH P CHOYAL 2228512No ratings yet

- AfM 0 - Introduction, Transaction Recognition, AccountsDocument30 pagesAfM 0 - Introduction, Transaction Recognition, AccountsjaymursalieNo ratings yet

- BASIC ACCOUNTING PRACTICE - MISSING AMOUNTS-4Document14 pagesBASIC ACCOUNTING PRACTICE - MISSING AMOUNTS-4randel10caneteNo ratings yet

- Chapter 7 The Accounting Equation RevisedDocument21 pagesChapter 7 The Accounting Equation RevisedJesseca JosafatNo ratings yet

- Accounting Equation and Transaction AnalysisDocument6 pagesAccounting Equation and Transaction AnalysisRR SarkarNo ratings yet

- Clase 14 ITAM Financial Statements & Models Otoño 2017Document25 pagesClase 14 ITAM Financial Statements & Models Otoño 2017Gabriel Ruiz HerreraNo ratings yet

- Accounting C2 Lesson 2 PDFDocument6 pagesAccounting C2 Lesson 2 PDFJake ShimNo ratings yet

- Chapter 2 FinalDocument60 pagesChapter 2 FinalAna María Del CerroNo ratings yet

- Principle of Accounting 1Document25 pagesPrinciple of Accounting 1Quỳnh Trang NguyễnNo ratings yet

- Accounting Part 1Document2 pagesAccounting Part 1Nabeel SiddiquiNo ratings yet

- Bsoa 3 2 Fundamental of AccountingDocument15 pagesBsoa 3 2 Fundamental of AccountingAzalea CruzNo ratings yet

- 4ACCN002W Lecture 2 - TaggedDocument47 pages4ACCN002W Lecture 2 - Taggedredwaanmo19No ratings yet

- Accounting Grade 10 - 12 How To Teach Acc EquationDocument11 pagesAccounting Grade 10 - 12 How To Teach Acc Equationnkambulentokozo55No ratings yet

- Podar International School: 1. Introduction To AccountingDocument3 pagesPodar International School: 1. Introduction To AccountingDhairya AilaniNo ratings yet

- MarketingDocument2 pagesMarketingRonald CatapangNo ratings yet

- Case 5.1 China's Me GenerationDocument1 pageCase 5.1 China's Me GenerationRonald Catapang100% (1)

- Case 8 Why Social Media Advertising Is Set To Explode in The Next 3 YearsDocument2 pagesCase 8 Why Social Media Advertising Is Set To Explode in The Next 3 YearsRonald CatapangNo ratings yet

- Case 2Document1 pageCase 2Ronald CatapangNo ratings yet

- Case 6 Green As A Status SymbolDocument2 pagesCase 6 Green As A Status SymbolRonald CatapangNo ratings yet

- Nature and Concept of ManagementDocument28 pagesNature and Concept of ManagementRonald Catapang100% (1)

- Latihan Soal Pertemuan Ke-6Document15 pagesLatihan Soal Pertemuan Ke-6gloria rachelNo ratings yet

- Rural Godown SchemeDocument5 pagesRural Godown SchemeBhaskaran VenkatesanNo ratings yet

- DBA 5005 Strategic Investment and Financing DecisionsDocument263 pagesDBA 5005 Strategic Investment and Financing DecisionsShrividhyaNo ratings yet

- Trade Finance Letter of Credit (Buy & Sell) in SAP Treasury: BackgroundDocument15 pagesTrade Finance Letter of Credit (Buy & Sell) in SAP Treasury: BackgroundDillip Kumar mallickNo ratings yet

- Industry ProfileDocument26 pagesIndustry ProfileVish SolankiNo ratings yet

- BioMass Business Match-Making CatalogueDocument58 pagesBioMass Business Match-Making Catalogueknizam13No ratings yet

- SITXFIN003Document2 pagesSITXFIN003ozdiploma assignmentsNo ratings yet

- Futurpreneur Cash Flow Template EN 09.08.2022 1Document10 pagesFuturpreneur Cash Flow Template EN 09.08.2022 1Alex VelascoNo ratings yet

- Government of Telangana: PAYSLIP:-MAR-2021Document3 pagesGovernment of Telangana: PAYSLIP:-MAR-2021siva sankar ReddyNo ratings yet

- This Time: Q & A Woods SquareDocument19 pagesThis Time: Q & A Woods SquareChen YishengNo ratings yet

- Chapter 4 Lecture NotesDocument30 pagesChapter 4 Lecture NotesStacy SMNo ratings yet

- Capital Investment Factors - UST2021Document19 pagesCapital Investment Factors - UST2021Ey B0ssNo ratings yet

- Uncertainty, Data & Judgement: Extra ExercisesDocument53 pagesUncertainty, Data & Judgement: Extra ExercisesSergio GoldinNo ratings yet

- Gat Sample Test 01 PDFDocument23 pagesGat Sample Test 01 PDFAamir Ali SeelroNo ratings yet

- CH-1 Advanced FADocument54 pagesCH-1 Advanced FAamogneNo ratings yet

- o CQWyh NZa PVQK 8 WDocument4 pageso CQWyh NZa PVQK 8 WHimanshuNo ratings yet

- Billing of Revenue or Income: Name: Jean Rose T. Bustamante Bsma - 3Document4 pagesBilling of Revenue or Income: Name: Jean Rose T. Bustamante Bsma - 3Jean Rose Tabagay BustamanteNo ratings yet

- Leland Blank, Anthony Tarquin-Engineering Economy-McGraw-Hill Science - Engineering - Math (2011) - 107-114Document8 pagesLeland Blank, Anthony Tarquin-Engineering Economy-McGraw-Hill Science - Engineering - Math (2011) - 107-114ATEH ARMSTRONG AKOTEHNo ratings yet

- Annexure To Trading & Demat Account Opening Form: Power of Attorney (This Document Is Voluntary)Document3 pagesAnnexure To Trading & Demat Account Opening Form: Power of Attorney (This Document Is Voluntary)Consultant NowFoundationNo ratings yet

- Brochure Infodev Incubation Training Nov13 PDFDocument34 pagesBrochure Infodev Incubation Training Nov13 PDFSusiraniNo ratings yet

- Law of EquityDocument17 pagesLaw of EquityAnkitaSharma100% (2)

- RHB CapitalDocument93 pagesRHB CapitalJames WarrenNo ratings yet

- New Government Accounting System NGASDocument20 pagesNew Government Accounting System NGASIsiah Jarrett Trinidad Abille100% (1)

- 582912020511776rpos PDFDocument3 pages582912020511776rpos PDFKarthik sankarNo ratings yet

- Mixed Log Normal Volatility Model OpenGammaDocument9 pagesMixed Log Normal Volatility Model OpenGammamshchetkNo ratings yet

- 1.isidore EkpeDocument27 pages1.isidore Ekpe9415351296No ratings yet

Blank Effects of Business Transactions in The Accounting Equation

Blank Effects of Business Transactions in The Accounting Equation

Uploaded by

Ronald CatapangOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Blank Effects of Business Transactions in The Accounting Equation

Blank Effects of Business Transactions in The Accounting Equation

Uploaded by

Ronald CatapangCopyright:

Available Formats

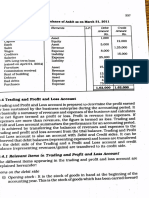

ACCOUNTING EQUATION

All businesses have three parts to their financial makeup:

• The things or property that the company owns.

We call these things ASSETS.

• The money that the company owes to other people.

We call these obligations LIABILTIES.

• The claim of the owner of the business to the Assets after the Liabilities are paid.

We call this claim OWNER’S EQUITY (or just EQUITY).

ACCOUNTING EQUATION

ASSETS = LIABILITIES + OWNER’S EQUITY

ASSETS are the RESOURCES OWNED BY A LIABILITIES are the CREDITOR’S CLAIMS ON

BUSINESS . ASSETS.

Here are some types of assets that might be • Creditors are the people or companies to whom

owned by a business company: a business owes something (like money).

• Here are some types of liabilities that a

company might owe:

EQUITY is the OWNER’S CLAIM ON ASSETS

In a business EQUITY is composed of four parts that either increase or decrease equity:

Sometimes we expand the Accounting Equation to show all the Equity components. This is called the

EXPANDED ACCOUNTING EQUATION.

This equation must ALWAYS BE IN BALANCE

Effects of Business Transactions in the Accounting Equation

Business Transactions

1. The owner invested cash to an internet business for P 200,000.

2. The business purchased internet equipment in cash for P 50,000.

3. The business purchased computer printers on account/ credit for P 10,000.

4. The business purchased supplies in cash for P 2,000

5. The business collected cash from the internet games and users for P 50,000

6. The business paid salaries to employees for P 10,000

7. The business paid communication expense for P 20,000

8. The business paid electricity bill worth P 2,000

9. The owner withdraws cash for P 5,000

10. The business partially paid the payable incurred in the purchase of computer printers for P 5,000

11. The owner invested additional cash to the business for P 100,000

12. At the end of the month, physical count of supplies shows consumption of supplies amount to P 1,500

Effects of Business Transactions in the Accounting Equation

Accounting Equation:

ASSETS = LIABILITIES + OWNER’S EQUITY (CAPITAL)

(left side of the equation) = (right side of the equation)

Transaction 1 Transaction 7

Assets = Assets =

Liabilities = Liabilities =

Capital = Capital =

Transaction 2 Transaction 8

Assets = Assets =

Liabilities = Liabilities =

Capital = Capital =

Transaction 3 Transaction 9

Assets = Assets =

Liabilities = Liabilities =

Capital = Capital =

Transaction 4 Transaction 10

Assets = Assets =

Liabilities = Liabilities =

Capital = Capital =

Transaction 5 Transaction 11

Assets = Assets =

Liabilities = Liabilities =

Capital = Capital =

Transaction 6 Transaction 12

Assets = Assets =

Liabilities = Liabilities =

Capital = Capital =

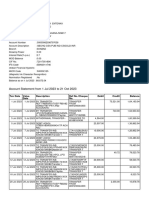

Business Transactions:

1. The owner invested P 97,000 in cash to begin the business. 6. Performed services for P 8,200 in cash.

2. Paid P 19,750 in cash for the purchase of equipment. 7. Performed services for P 6,300 on account.

3. Purchased additional equipment for P 14,400 on credit. 8. Paid P 4,000 for rent expense.

4. Paid P 11,800 in cash to creditors. 9. Received P 3,500 in cash from credit clients.

5. The owner made an additional investment of P 30,000 in 10. Paid P 6,460 in cash for office supplies.

cash. 11. The owner withdrew P 9,000 in cash for personal expenses.

You might also like

- OutputDocument19 pagesOutputJohnson WilliamNo ratings yet

- Paper From Advance America Cash AdvanceDocument6 pagesPaper From Advance America Cash AdvanceJoyNo ratings yet

- Japan Land - Case StudyDocument2 pagesJapan Land - Case Studypriyaa0380% (10)

- Chapter 3 Market Opportunity Analysis and Consumer AnalysisDocument2 pagesChapter 3 Market Opportunity Analysis and Consumer AnalysisRonald Catapang88% (8)

- Case 4 Numi TeaDocument1 pageCase 4 Numi TeaRonald Catapang50% (2)

- Bessemer's Top 10 Laws For Being SaaS-yDocument11 pagesBessemer's Top 10 Laws For Being SaaS-yjon.byrum9105100% (4)

- The Accounting Equation (Financial Accounting)Document5 pagesThe Accounting Equation (Financial Accounting)RidwanAbirNo ratings yet

- Week 2-1 SlidesDocument30 pagesWeek 2-1 SlidesLIAW ANN YINo ratings yet

- Acct615 NjitDocument24 pagesAcct615 NjithjnNo ratings yet

- Ch.1: Accounting in Action (Cont'd)Document29 pagesCh.1: Accounting in Action (Cont'd)mariam raafatNo ratings yet

- Revision On Principle of Accounting: by Isb Academic TeamDocument37 pagesRevision On Principle of Accounting: by Isb Academic TeamDoan BùiNo ratings yet

- L2 - Accounting Equation & Transaction Analysis - Edited With AnsswerDocument39 pagesL2 - Accounting Equation & Transaction Analysis - Edited With AnsswerEslam SamyNo ratings yet

- Chapter3+4UsingT-Accounts 2Document37 pagesChapter3+4UsingT-Accounts 2الغيثيNo ratings yet

- Ch.2 - Recording Business Transactions (Pearson 6th Edition) - MHDocument56 pagesCh.2 - Recording Business Transactions (Pearson 6th Edition) - MHSamZhao100% (1)

- Analysis of Business TransactionsDocument21 pagesAnalysis of Business TransactionsDan Gideon Cariaga100% (1)

- Chapter 2 HINM 318Document41 pagesChapter 2 HINM 318MOHAMMAD BORENENo ratings yet

- Accounting Equation & Financial ReportingDocument36 pagesAccounting Equation & Financial ReportingAnelisa IvyNo ratings yet

- 01 PowerpointDocument64 pages01 PowerpointVave IsraelNo ratings yet

- Chapter 1 Notes - StudentDocument6 pagesChapter 1 Notes - StudentMia PerdueNo ratings yet

- Accounting Essentials Chapter 3 SynthesisDocument1 pageAccounting Essentials Chapter 3 SynthesisdaraNo ratings yet

- 5# 4 Accounting Equation (UnSolved) PDFDocument4 pages5# 4 Accounting Equation (UnSolved) PDFZaheer SwatiNo ratings yet

- Finance+Webinar 13.12.2022++updatedDocument42 pagesFinance+Webinar 13.12.2022++updatedJasmine ChoudharyNo ratings yet

- AccountingDocument67 pagesAccountinggunanNo ratings yet

- Accounting Equation 2023Document2 pagesAccounting Equation 2023Nishtha GargNo ratings yet

- Use The Accounting Equation To Analyze Business TransactionsDocument36 pagesUse The Accounting Equation To Analyze Business TransactionsPradeep GuptaNo ratings yet

- Accounting Equation: Fundamentals of ABM 1Document97 pagesAccounting Equation: Fundamentals of ABM 1ediwowNo ratings yet

- Ratio AnalysisDocument1 pageRatio AnalysisMuskan hamdevNo ratings yet

- Topic 2 Accounting Equation and StatementsDocument47 pagesTopic 2 Accounting Equation and StatementsNurul AfiqahNo ratings yet

- Illustrating The Accounting Equation: Background Information For LearnersDocument6 pagesIllustrating The Accounting Equation: Background Information For LearnersMarlyn LotivioNo ratings yet

- Professional Accounting PackageDocument72 pagesProfessional Accounting PackageAnmol poudelNo ratings yet

- CFAB Accounting Chap02 Accounting EquationDocument38 pagesCFAB Accounting Chap02 Accounting EquationHoa NguyễnNo ratings yet

- Chapter 7 The Accounting EquationDocument20 pagesChapter 7 The Accounting EquationMylene Salvador100% (1)

- Financial Accounting I: Winter 2020-Lecture "2"Document32 pagesFinancial Accounting I: Winter 2020-Lecture "2"Malak RabieNo ratings yet

- Accounting ProcessDocument13 pagesAccounting ProcessXiavNo ratings yet

- Chapter 2 Accounting ElementsDocument40 pagesChapter 2 Accounting ElementsVivek GargNo ratings yet

- Lecture02-Introduction To AccountingDocument38 pagesLecture02-Introduction To Accounting錢永健No ratings yet

- Work Book XI-CommerceDocument92 pagesWork Book XI-CommerceTariq IqbalNo ratings yet

- CHAPTER 5 The Accounting EquationDocument35 pagesCHAPTER 5 The Accounting EquationKyla BallesterosNo ratings yet

- Training Financial AccountingDocument23 pagesTraining Financial AccountingSara PiccioliNo ratings yet

- Double Entry System & Accounting Equation: by - Mrs. Dilshad D. JalnawallaDocument34 pagesDouble Entry System & Accounting Equation: by - Mrs. Dilshad D. JalnawallaTufail GanaieNo ratings yet

- Accounts, Accountants and AccrualsDocument20 pagesAccounts, Accountants and Accrualsjcmail999446No ratings yet

- 3-THEORY AND APPLICATION OF ACCOUNTING EQUALITY (Morning Shift) (1) - 3Document24 pages3-THEORY AND APPLICATION OF ACCOUNTING EQUALITY (Morning Shift) (1) - 3ScribdTranslationsNo ratings yet

- Lecture Slides - Chapter 1 2Document69 pagesLecture Slides - Chapter 1 2Nhi BuiNo ratings yet

- Chapter Lecture - RemovedDocument43 pagesChapter Lecture - RemovedCJ MacasioNo ratings yet

- Financial Accounting 188 Canva CPT 2-3Document7 pagesFinancial Accounting 188 Canva CPT 2-3marizanne krugerNo ratings yet

- 1.6 Accounting EquationDocument8 pages1.6 Accounting EquationAbijit GudaNo ratings yet

- Chapter Accounting EquationDocument24 pagesChapter Accounting Equationpriyam.200409No ratings yet

- What Is Accounting?: Is A Process of Three Activities: Identifying Recording CommunicatingDocument41 pagesWhat Is Accounting?: Is A Process of Three Activities: Identifying Recording CommunicatingMd. Haseeb KhanNo ratings yet

- Basic Accounting EquationDocument42 pagesBasic Accounting Equationlily smithNo ratings yet

- 1st Assignment - 2023Document15 pages1st Assignment - 2023harmanchahalNo ratings yet

- BBFA1103 Topic 3 Accounting Cycle - NoteDocument13 pagesBBFA1103 Topic 3 Accounting Cycle - Noteknea9999No ratings yet

- Accounting ConceptDocument1 pageAccounting ConceptNISHANTH P CHOYAL 2228512No ratings yet

- AfM 0 - Introduction, Transaction Recognition, AccountsDocument30 pagesAfM 0 - Introduction, Transaction Recognition, AccountsjaymursalieNo ratings yet

- BASIC ACCOUNTING PRACTICE - MISSING AMOUNTS-4Document14 pagesBASIC ACCOUNTING PRACTICE - MISSING AMOUNTS-4randel10caneteNo ratings yet

- Chapter 7 The Accounting Equation RevisedDocument21 pagesChapter 7 The Accounting Equation RevisedJesseca JosafatNo ratings yet

- Accounting Equation and Transaction AnalysisDocument6 pagesAccounting Equation and Transaction AnalysisRR SarkarNo ratings yet

- Clase 14 ITAM Financial Statements & Models Otoño 2017Document25 pagesClase 14 ITAM Financial Statements & Models Otoño 2017Gabriel Ruiz HerreraNo ratings yet

- Accounting C2 Lesson 2 PDFDocument6 pagesAccounting C2 Lesson 2 PDFJake ShimNo ratings yet

- Chapter 2 FinalDocument60 pagesChapter 2 FinalAna María Del CerroNo ratings yet

- Principle of Accounting 1Document25 pagesPrinciple of Accounting 1Quỳnh Trang NguyễnNo ratings yet

- Accounting Part 1Document2 pagesAccounting Part 1Nabeel SiddiquiNo ratings yet

- Bsoa 3 2 Fundamental of AccountingDocument15 pagesBsoa 3 2 Fundamental of AccountingAzalea CruzNo ratings yet

- 4ACCN002W Lecture 2 - TaggedDocument47 pages4ACCN002W Lecture 2 - Taggedredwaanmo19No ratings yet

- Accounting Grade 10 - 12 How To Teach Acc EquationDocument11 pagesAccounting Grade 10 - 12 How To Teach Acc Equationnkambulentokozo55No ratings yet

- Podar International School: 1. Introduction To AccountingDocument3 pagesPodar International School: 1. Introduction To AccountingDhairya AilaniNo ratings yet

- MarketingDocument2 pagesMarketingRonald CatapangNo ratings yet

- Case 5.1 China's Me GenerationDocument1 pageCase 5.1 China's Me GenerationRonald Catapang100% (1)

- Case 8 Why Social Media Advertising Is Set To Explode in The Next 3 YearsDocument2 pagesCase 8 Why Social Media Advertising Is Set To Explode in The Next 3 YearsRonald CatapangNo ratings yet

- Case 2Document1 pageCase 2Ronald CatapangNo ratings yet

- Case 6 Green As A Status SymbolDocument2 pagesCase 6 Green As A Status SymbolRonald CatapangNo ratings yet

- Nature and Concept of ManagementDocument28 pagesNature and Concept of ManagementRonald Catapang100% (1)

- Latihan Soal Pertemuan Ke-6Document15 pagesLatihan Soal Pertemuan Ke-6gloria rachelNo ratings yet

- Rural Godown SchemeDocument5 pagesRural Godown SchemeBhaskaran VenkatesanNo ratings yet

- DBA 5005 Strategic Investment and Financing DecisionsDocument263 pagesDBA 5005 Strategic Investment and Financing DecisionsShrividhyaNo ratings yet

- Trade Finance Letter of Credit (Buy & Sell) in SAP Treasury: BackgroundDocument15 pagesTrade Finance Letter of Credit (Buy & Sell) in SAP Treasury: BackgroundDillip Kumar mallickNo ratings yet

- Industry ProfileDocument26 pagesIndustry ProfileVish SolankiNo ratings yet

- BioMass Business Match-Making CatalogueDocument58 pagesBioMass Business Match-Making Catalogueknizam13No ratings yet

- SITXFIN003Document2 pagesSITXFIN003ozdiploma assignmentsNo ratings yet

- Futurpreneur Cash Flow Template EN 09.08.2022 1Document10 pagesFuturpreneur Cash Flow Template EN 09.08.2022 1Alex VelascoNo ratings yet

- Government of Telangana: PAYSLIP:-MAR-2021Document3 pagesGovernment of Telangana: PAYSLIP:-MAR-2021siva sankar ReddyNo ratings yet

- This Time: Q & A Woods SquareDocument19 pagesThis Time: Q & A Woods SquareChen YishengNo ratings yet

- Chapter 4 Lecture NotesDocument30 pagesChapter 4 Lecture NotesStacy SMNo ratings yet

- Capital Investment Factors - UST2021Document19 pagesCapital Investment Factors - UST2021Ey B0ssNo ratings yet

- Uncertainty, Data & Judgement: Extra ExercisesDocument53 pagesUncertainty, Data & Judgement: Extra ExercisesSergio GoldinNo ratings yet

- Gat Sample Test 01 PDFDocument23 pagesGat Sample Test 01 PDFAamir Ali SeelroNo ratings yet

- CH-1 Advanced FADocument54 pagesCH-1 Advanced FAamogneNo ratings yet

- o CQWyh NZa PVQK 8 WDocument4 pageso CQWyh NZa PVQK 8 WHimanshuNo ratings yet

- Billing of Revenue or Income: Name: Jean Rose T. Bustamante Bsma - 3Document4 pagesBilling of Revenue or Income: Name: Jean Rose T. Bustamante Bsma - 3Jean Rose Tabagay BustamanteNo ratings yet

- Leland Blank, Anthony Tarquin-Engineering Economy-McGraw-Hill Science - Engineering - Math (2011) - 107-114Document8 pagesLeland Blank, Anthony Tarquin-Engineering Economy-McGraw-Hill Science - Engineering - Math (2011) - 107-114ATEH ARMSTRONG AKOTEHNo ratings yet

- Annexure To Trading & Demat Account Opening Form: Power of Attorney (This Document Is Voluntary)Document3 pagesAnnexure To Trading & Demat Account Opening Form: Power of Attorney (This Document Is Voluntary)Consultant NowFoundationNo ratings yet

- Brochure Infodev Incubation Training Nov13 PDFDocument34 pagesBrochure Infodev Incubation Training Nov13 PDFSusiraniNo ratings yet

- Law of EquityDocument17 pagesLaw of EquityAnkitaSharma100% (2)

- RHB CapitalDocument93 pagesRHB CapitalJames WarrenNo ratings yet

- New Government Accounting System NGASDocument20 pagesNew Government Accounting System NGASIsiah Jarrett Trinidad Abille100% (1)

- 582912020511776rpos PDFDocument3 pages582912020511776rpos PDFKarthik sankarNo ratings yet

- Mixed Log Normal Volatility Model OpenGammaDocument9 pagesMixed Log Normal Volatility Model OpenGammamshchetkNo ratings yet

- 1.isidore EkpeDocument27 pages1.isidore Ekpe9415351296No ratings yet