Professional Documents

Culture Documents

Company Analysis and Valuation Project PDF

Company Analysis and Valuation Project PDF

Uploaded by

Augusto LopezOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Company Analysis and Valuation Project PDF

Company Analysis and Valuation Project PDF

Uploaded by

Augusto LopezCopyright:

Available Formats

Company Analysis and Valuation Project December 10, 2014

ESTÉE LAUDER

COMPANIES

Stock snapshot Company Overview

The Estee Lauder Companies is a beauty company based in the

Estée Lauder Companies Inc. - United States. It was founded in 1946 by Mrs. Estee Lauder and her

NYSE

husband, Joseph Lauder. It is headquartered in New York City, New

73.45 1.19(1.59%)- Dec.10 York and employed about 42,400 people as of June 30, 2014. Its

Day’s Range 73.42 - 74.44 products are sold in over 150 countries and territories under a

52wk Range 63.63-77.66 number of well known brand names including: Estée Lauder, Aramis,

Market Cap 27.88B Clinique, Origins, MAC, Bobbi Brown, La Mer and Aveda. For fiscal

P/E (ttm) 25.41 2014, net sales were $10.97 billion, an increase of 7.7% percent over

EPS (ttm) 2.89 FY 2013 and net earnings were $1.2 billion.

1y Target Price 85

Opinion Buy

Key Ratios

Estee Lauder’s Business Model

Estee Lauder’s main business is manufacturing and marketing all

2013 2014 their products and licenses. The company's manufacturing

Revenue growth 4.8% 7.7% operations are primarily conducted in the US, Belgium, Switzerland,

the UK and Canada. Estee Lauder utilizes third parties on a global

Net Margin 10.02% 10.98%

basis for finished goods production.

Asset Turnover 1.48 1.46

Leverage Ratio 2..28 2.10

Estee Lauder conducts its operations through a single business

segment of beauty products and operates across the following

ROE 35.10 34.33

product categories: skin care, makeup, fragrance, hair care and

Group member other products.

Jieshan Peng The principal raw materials used in the manufacture of the

company's products are essential oils, alcohols and specialty

jxp133830@utdallas.edu

chemicals. Estee Lauder's centralized global supplier relations

department procures these required raw materials for all its

Jia Heng

manufacturing facilities.

jxh135830@utdallas.edu

Estee Lauder has a well-balanced portfolio geographically. The

Xiaoqing Xu company markets products that they know will sell in each country

xxx132030@utdallas.edu depending on research that has previously been conducted. The

Estée Lauder Companies Inc. (The) 1

Company Analysis and Valuation Project December 10, 2014

Revenue by

Americas (primarily the US) are the

Geography Revenue by Catergory

company's largest market, representing

37% of sales. Europe, the Middle East &

Africa accounts for more than a third. 1%

5%

21%

Estée Lauder has also expanded its

42% 43%

distribution channels to include mass 38%

merchandisers and salons. The company

has been gradually shifting business from 37% Skin Care

13% Fragrance

department stores to its own stores and

Make Up

other outlets. Its online Origins presence A&P

Hair Care

has expanded, too. Clinique, M.A.C, Eur/MEA

Other

Origins, and Bobbi Brown sell products N&S Am

online.

The fiscal year 2014 Skin Care accounted for 43% of net sales, Make Up accounting for 38%, Fragrance

13%, and Hair Care representing 5% of net sales.

Estee Lauder’s strategy

Our analysis reveals that Estee Lauder is a product/service differentiation company. Its ability to stand out

from other competitors is crucial to its financial performance.

Diverse product brand portfolio

Estee Lauder, focusing solely on prestige beauty, is a global company with a global strategy to follow. They

aim to target different market niches in each region. Their business is balanced by product category. Their

strategy of “Bringing the Best to Everyone We Touch and Being the Best in Everything We Do” is quite

easy to achieve with their vast market appeal.

The Skin care brands Clinique and Origins are marketed to appeal to customers that want natural,

organic, and allergen-free products. Makeup lines MAC and Bobbi Brown are targeted for the higher end

fashion savvy customer. These brands appeal to both teen and middle aged market and offer professional-

grade makeup and tools. La Mer and Darphin Paris are targeted at their high-end market and have

substantial brand recognition as the prestigious skin care and makeup brands. In late 2014, Estée Lauder

acquired Le Labo, which specializes in distinctively French high-end fragrance and sensory items that

have earned a loyal consumer following for its exclusivity and personalized service. In offering a product

to nearly every market niche, Estee Lauder has been able to get through the global economic downturn

while still generating profits each year.

Innovation & Creativity

Estee Lauder are focused on creating fewer, but more successful products. They are motivated to be

“creativity-driven and consumer-inspired.” Their muse is the consumer, who is used to create beauty

Estée Lauder Companies Inc. (The) 2

Company Analysis and Valuation Project December 10, 2014

products that they couldn’t have imagined needing. Estee

Lauder’s overall strategy also includes heavily investing in

Research and Development. In order to have the most

advanced products that consumer’s desire they feel that this is

a necessary expense. As of June 30, 2014 Estee Lauder had

approximately 700 employees engaged in R&D costing 157.9

million dollars.

Global distribution channel

Estee Lauder has a well-balanced portfolio geographically. The

Company sells its products principally through distribution

channels to complement the images associated with its

brands. Some of the channels include department stores,

specialty retailers, pharmacies, and salons. As August 14, 2014,

Estee Lauder directly operated approximately 940 retail

stores. Additionally, they also sell their brands through e-

commerce in the United States, Canada, The UK, France,

Germany, Australia, Korea, China, and Japan from selling

products through own and authorized dealer websites, stores

on cruise ships, direct response television, in-flight and duty

free shops, and some self-select outlets. Recently, Estee

Lauder also opened shop on Tmall, which contributed to their

e-commerce business in China more than doubling.

‘High-Touch’ service model

Advertising and promotions are key in the ultra competitive

personal care products market. Estée Lauder advertises on TV, in

magazines and newspapers, on digital and social media sites, and on billboards and via direct mail.

Promotional activities include in-store displays. The company's largest customer is department store

operator Macy's, representing about 10% of consolidated net sales for fiscal 2014. The company's

marketing creed is to provide "high-touch" service to build customer loyalty. Estee Lauder connects with

consumers online through e-commerce, social networking and interactive tools. They implement a

customized educational approach that comes from beauty advisors and makeup artists. They have also

Estée Lauder Companies Inc. (The) 3

Company Analysis and Valuation Project December 10, 2014

adapted it for online use, using direct response television and self-assisted formats as well. For example,

on the Estée Lauder brand’s website, visitors can upload a photo and use a “makeup widget” to

experiment with the latest colors and get a virtual makeover, on their time and in the comfort of their

home.

SWOT Analysis

Estee Lauder is a globally recognized manufacturer and marketer of makeup, skin care, fragrances and

hair care products. The company's wide geographical presence reduces the business risk due to diversified

revenue stream and enables participation in fast growing developing markets. However, intense

competition in the beauty market may adversely affect the company's market share.

The Estee Lauder Companies, Inc., SWOT Analysis

Strength Weakness

Strong Brand and Product Portfolio Legal Issues

Geographic Lanscape Limited distribution strategy increases

In-house research and development facilitates dependency on specific channels

high consumer acceptance and quick market

penetration

Opportunities Threats

Growth Prospects: E-Commerce Highly Competitive Market

Positive outlook for the market in China Increase in counterfeit Goods Market may hurt

Consumer Demand Fueling Cosmetic Trends Changing Consumer Preferences

Retail environment in emerging economies Increasing labor cost in the US and Europe

provides strong growth potential

Competition:

Estée lauder’s brands face severe competition in the cosmetics industry. The company faces strong

competition from established international as well as regional and local players. The competitors of the

company include L'Oreal, Shiseido Company, Coty, Procter & Gamble, and Avon Products. Estee Lauder

also faces competition from independent brands and some retailers that have developed their own beauty

brands. Some of these competitors have greater resources than Estee Lauder and may be able to respond

quickly to the changing economic environmental needs. Brand recognition, quality, performance and price

are factors on basis of which the companies compete. Other factors such as advertising, promotion,

merchandising, the pace and timing of new product introductions, and line extensions also impact

Estée Lauder Companies Inc. (The) 4

Company Analysis and Valuation Project December 10, 2014

consumers' buying decisions. In particular, the fragrance product line in the US has been influenced by

the high volume of new product launches by diverse companies across different distribution channels.

Furthermore, the trend toward consolidation in the retail trade in developed markets such as the US and

Western Europe, has made the company increasingly dependent on key retailers, including large-format

retailers. This affects the company's bargaining power and has added to its risk related to the

concentration of customers. Therefore, increasing competition could adversely affect the company's

market share.

Main competitors are displayed:

L'Oreal S.A.

Coty Inc

Procter & Gamble

Elizabeth Arden,

Unilever

Johnson & Johnson

Shiseido Company,

P&G is the global leader in prestige fragrances due to the success of its highly lucrative Dolce &

Gabbana, Gucci and Hugo Boss fragrance brands. Additionally, the company owns Olay, the top facial

skin care brand in the world.

L'Oreal is known for its mass-market cosmetics and hair color products sold under a variety of other well-

known industry brands, such as Garnier, Maybelline, Lancome, Kiehl's and The Body Shop. In June 2014,

L'Oreal announced its intention to acquire Los Angeles-based NYX Cosmetics for an undisclosed sum. In

addition to directly competing with Estee Lauder's MAC Cosmetics line. So M.A.C. and Bobbi Brown

face significantly more competition because both of the companies target same specialized clientele.

Unilever is in the process of expanding its previously male-oriented Axe deodorant brand into hair care

and women's products. The company is also entering the natural and organic segment of the industry. So

Estée Lauder’s all-natural products will face competition . Moreover, its mid-end products compete

against Revlon, Avon, and Elizabeth Arden. We believe the rivalry level between existing firms and

substitute product is quite high.

Due to the diverse product brand portfolio, we believe that threat from new entries is moderate.

Although industry has moderate barriers to entry, only undifferentiated products with low price can lead

downstream buyers to choose one brand over another. For high-quality, niche products, price is less of a

competitive factor as consumers purchase the product based on its promised performance. Besides,

quality is another important basis of competition for industry participants. High-quality items (or those

perceived as such) carry a price premium, which boosts company revenue and profit. So during the past

five years, middle-tier product manufacturers have invested money in appearance to attract consumers on

the basis of perceived high quality.

Estée Lauder Companies Inc. (The) 5

Company Analysis and Valuation Project December 10, 2014

Financial Analysis

DuPond Analysis

By decomposing return on equity ratio into its component parts (DuPond Analysis), we can get

a rough idea of Estée Lauder’s financial performance. Each of the component ratios shown

below is an indicator of a distinct aspect of a company’s performance. DuPond Analysis can be

more helpful when taking target company’s competitors into consideration. In this case,

Procter & Gamble Co., Coty Inc., and Elizabeth Arden Inc. are Estée Lauder’s important

peers.

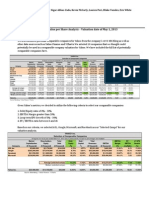

DuPont Analysis EL PG COTY RDEN At first glance, Estée

12 Months Ending 2014-06-30 2014-06-30 2014-06-30 2014-06-30 Lauder had relatively

high net profit margin,

Net Profit Margin 10.98 14.02 -2.14 -12.52

and low leverage ratio.

Asset Turnover 1.46 0.59 0.70 1.08 Also, it outperformed all

Leverage Ratio 2.10 2.10 5.59 2.44 its three competitors in

Return on Equity 33.68 17.25 -8.33 -32.89 management efficiency.

Profitability

For year 2014, Estée Lauder experienced a 19.76% surge in sales income, maintained a favorable

level of gross margin at around 80% for recent three years and succeeded in a slight increase in

net profit margin. Although Estée Lauder earned less percentage of net profit than Procter &

Gamble Co., it did outperform the industry average.

Profitability EL EL EL PG COTY RDEN

12 Months Ending 2012-06-30 2013-06-30 2014-06-30 2014-06-30 2014-06-30 2014-06-30

Gross Margin 79.45 80.10 80.32 48.88 59.01 40.34

Operating Margin 13.50 14.99 16.66 18.41 0.56 -5.54

Net Income Margin 8.82 10.02 10.98 14.02 -2.14 -12.52

Income Growth 20.41 16.34 19.76 6.69 Negative Negative

Estée Lauder Companies Inc. (The) 6

Company Analysis and Valuation Project December 10, 2014

Solvency

Solvency EL EL EL PG COTY RDEN

12 Months Ending 2012-06-30 2013-06-30 2014-06-30 2014-06-30 2014-06-30 2014-06-30

EBITDA/Interest Paid 21.43 21.81 33.52 26.86 4.34 -0.29

EBIT/Interest Paid 17.49 17.87 27.69 22.29 0.40 -2.79

Long-Term Debt/Equity 38.91 40.16 34.24 28.31 339.38 94.66

Total Debt/Equity 46.88 40.71 34.71 50.61 342.86 116.02

Solvency refers to the ability to meet company’s financial obligations over long term. The year

2014 witnessed both increase in interest coverage and decrease in financial leverage, which

also beat most competitors.

Liquidity

Liquidity EL EL EL PG COTY RDEN

12 Months Ending 2012-06-30 2013-06-30 2014-06-30 2014-06-30 2014-06-30 2014-06-30

Cash Ratio 0.63 0.77 0.79 0.32 0.78 0.21

Current Ratio 1.81 2.22 2.35 0.94 1.74 2.22

Quick Ratio 1.13 1.38 1.46 0.51 1.19 0.79

Liquidity refers to the ability to meet short-term financial commitments, focusing the

company’s ability to convert assets to cash and to pay for operating needs. All these ratios

above shows that Estée Lauder had an adequate liquidity level, which is also more healthier

than its peers.

Efficiency

ROA measures how well a company's management uses its assets

to generate profits. It is a better measure of operating efficiency

than ROE, which only measures how much profit is generated

on the shareholders equity but ignores debt funding. Estée

Lauder had much higher ROA and ROE than other companies

in the same sector, indicating its efficiency and superior ability to

operate profitably.

Estée Lauder Companies Inc. (The) 7

Company Analysis and Valuation Project December 10, 2014

Efficiency EL EL EL PG COTY RDEN

12 Months Ending 2012-06-30 2013-06-30 2014-06-30 2014-06-30 2014-06-30 2014-06-30

Return on Assets 13.32 14.85 16.04 8.21 -1.49 -13.46

Return on Equity 31.96 33.88 33.72 17.24 -8.33 -32.89

Working Capital Management

Compared to other companies in the same sector (refer table below), we find that Estée Lauder

had average level of receivables turnover and payables turnover. However, it had a much lower

level of inventory turnover, i.e, a much longer days for inventories, which resulted into a long

period of cash conversion cycle. Long cash conversion cycle implies that the company must

finance its inventory and accounts receivable for a longer period of time, possibly indicating a

need for a higher level of capital to fund current assets. Therefore we believe plans to reduce

inventory could be particularly meaningful.

Working Capital Mgt EL EL EL PG COTY RDEN

12 Months Ending 2012-06-30 2013-06-30 2014-06-30 2014-06-30 2014-06-30 2014-06-30

Receivable Turnover 9.69 9.12 8.60 12.88 7.07 6.25

Days Sales Outstanding 37.79 40.01 42.44 28.33 51.62 58.40

Inventory Turnover 2.02 1.93 1.79 6.21 3.04 2.14

Days Inventory Outstanding 181.48 188.95 203.61 58.75 119.89 170.71

Payable Turnover 4.22 4.42 4.65 4.91 2.46 3.65

Days Payables Outstanding 86.76 82.57 78.53 74.35 148.14 100.14

Cash Conversion Cycle 132.51 146.39 167.53 12.72 23.37 128.97

Fortunately, EL said that it has long-term plans to de-stock

and practice tighter working capital management. One of

these important plans is Strategic Modernization Initiative

program (refer Appendix), which will enable the company to

improve service levels, enhance operating efficiencies,

improve inventory management, as well as provides a leaner

supply chain.

Estée Lauder Companies Inc. (The) 7

8

Company Analysis and Valuation Project December 10, 2014

Income Statement Chart

Companies like Estée Lauder have quite low level of cost of goods sold but high level of selling

expenses. They spent a lot on advertising and promotion in order to enhance their market share

and differentiate themselves from other brands. (Refer Appendix for peers’ charts.)

Balance Sheet Chart

It is straightforward to take a look at this chart and learn more about Estée Lauder. For

example, We can see the company financed mainly by shareholder equity (49.17%) and long-

term debt (16.83%). It also hold an adequate level of cash, etc.

Estée Lauder Companies Inc. (The) 9

Company Analysis and Valuation Project December 10, 2014

Company Valuation

Been public since 1995, Estée Lauder’s share price went from $7.27 to $73.45 on Dec.9.2104, showing a

strong growth compare to market in past 5 years. The excellent performance of EL’s share price reflects its

long history of identifying where the best growth opportunities exist, creating desire and excitement

through the power of the outstanding prestige brands, and managing resources with the focus and agility

required to achieve success in a dynamic global marketplace.

The Estée Lauder Companies Inc. (EL) -NYSE 80

73.45 1.19(1.59%)- Dec.10, 2104

60

Prev Close 73.45

Open 74.23

40

Day’s Range 73.42 - 74.44

52wk Range 63.63-77.66 20

Market Cap 27.88B

EL P/E EL Adj Close Price S&P

0

P/E (ttm) 25.41

12/11/09 12/10/10 12/9/11 12/7/12 12/6/13 12/5/14

Source: Yahoo Finance

Prospect: Many Engines of Growth

Estée Lauder’s share is currently trading at 25x NTM vs HPC at 18x, which is justified by its attractive

growing compare with competitors. In fiscal 2014, EL achieved record sales of $10.97 billion, an increase

of 8% over the prior year, outpacing global prestige beauty once again. By maintaining its financial

discipline, EL’s operating margin rose 170 basis points, and diluted earnings per share increased 19%.

12 20 3.5

3

10 15

2.5

2

8 10

1.5

Net Sale (In Billions) Operating Margin (%) Diluted EPS

6 5 1

'10 '11 '12 '13 '14 '10 '11 '12 '13 '14 '10 '11 '12 '13 '14

Source: Estée Lauder’s 2014 Anual Report

Estée Lauder Companies Inc. (The) 9

Company Analysis and Valuation Project December 10, 2014

Many parts of the company contributed to Estée Lauder’s

success in fiscal 2014, highlighted by some standout categories,

brands, products and distribution channels:

• Makeup & luxury fragrances were especially strong.

• Emerging markets, such as China and Brazil, also contributed,

as did important heritage markets, like the United States and

the United Kingdom.

• Strong growth showed in e-commerce, m-commerce and Travel

Retail, and continued focus on creativity and innovation

resulted in successful new products and reformulations across

brand portfolio.

• In addition, A breaking barriers movement by signing 19-year-old model Kendall Jenner, who shows

strength of character & authenticity that resonates with Millennials and could help transform the

brand, especially in the U.S., where it’s lagged.

Thus, based on historical date, our forecasted revenues of EL in next 4 years are as follow:

Revenue Forcast

Jun-10 Jun-11 Jun-12 Jun-13 Jun-14 Jun-15 Jun-16 Jun-17 Jun-18

$millions FY10A FY11A FY12A FY13A FY14A FY15E FY16E FY16E FY16E

Revenue Build-Up

Net revenues $7,812 $8,815 $9,716 $10,183 $10,969 $10,759 $11,479 $12,171 $12,910

% reported 6.50% 12.80% 10.20% 4.80% 7.70% -1.90% 6.70% 6.00% 6.10%

Revenue Breakout

Americas $3,442 $3,796 $4,101 $4,303 $4,572 $4,525 $4,802 $5,045 $5,293

Europe, ME & Africa 2,859 3,258 3,603 3,759 4,164 4,044 4,354 4,631 4,937

Asia Pacific 1,510 1,761 2,011 2,122 2,233 2,190 2,323 2,495 2,680

Skin care 3,227 3,719 4,225 4,465 4,770

Makeup 2,978 3,371 3,697 3,877 4,210

Fragrance 1,137 1,236 1,271 1,311 1425

Hair care 414 432 462 489 516

Multiple-Based Valuation

As the cosmetic and beauty industry is relatively diversified, and there are only several companies listed

on North American stock markets, so it is hard for us to find a comparable company with similar scale.

Thus, we choose P&G, who is the flagship of the industry, and date from Bloomberg Peers, which include

more than 20 competitors listed globally, as the market multiples.

Estée Lauder Companies Inc. (The) 10

Company Analysis and Valuation Project December 10, 2014

Meanwhile, to rule out any exception, we use Revenue (ttm), EPS (ttm), and EBIT (ttm) as performance

measures which are easy to access and commonly used to measure a mature manufacture company.And

the Valuation outcome shows as below:

Multiple-Based Valuation Model

Estée Lauder P&G Bloomberg Peers Average

# of share (million) 379.61

Revenue (ttm): 10,920 83,020

P/S (ttm): 2.59 2.94 2.28

Vluation 1 74.50 84.57 65.59 74.89

EPS (ttm): 2.89 3.66

P/E (ttm): 25.68 24.78 24.91

Vluation 2 74.22 71.61 71.99 72.61

EBITDA (ttm): 2,120 19,180

EV/EBIT 13.26 14.03 13.80

Vluation 3 74.05 78.35 77.07 76.49

Average 74.26 78.18 71.55 74.66

source: Bloomberg

From the valuation results, we can see that the average estimated stock price is $74.66, which is almost

the same as Estée Lauder’s current stock price. It is because the average estimated stock price comes

from Bloomberg Peers is $71.55, which is relatively low for EL. Even using P&G’s data as market multiple,

a price of $78.18 isn’t high for EL, as EL is doing much better than P&G in the perspective of growth

potential according to our financial analysis above. Since EL outperforms most of its competitors on the

market, it maybe inappropriate to value its equity by using industry average data. Also, those trailing

twelve months (ttm) performance measures don’t take future growth in to consideration. So, we have to

change to other valuation method.

Operating-Income-Based Valuation

In order to better estimate Estée Lauder’s share price, we

Weight Cost Multiple

use the residual operating income (ROPI) model to give EL

a new valuation. ROPI model focuses on net operating

95.50% 9.30% 8.88%

profit after tax (NOPAT) and net operating assets (NOA). Equity

This means it uses key measures from both the income Debt 4.50% 1.80% 0.08%

statement and balance sheet in determining firm value, and 0.00% 0.00% 0.00%

Preferred Equity

also consider future growth by discounting forecast future

ROPI at company’s WACC.

WACC 8.96%

According to the revenue forecast above, we start ROPI source: Bloomberg

Estée Lauder Companies Inc. (The) 11

Company Analysis and Valuation Project December 10, 2014

model from revenue. We give EL’s a 6% revenue growth rate for the first 5 years considering EL’s

successful performance recently, and a 4% terminal growth rate which is subtracted from Equity Research

Report issued by BITG on Dec 5 2014. And then compute NOPBT as a percentage of revenue at around

19% for terminal. Also we get effective tax rate from EL’s annual report and WACC at 8.96% from

Blommberg. Combine with our forecast balance sheet, we get the estimated NOA and then calculate

ROPI =NOPAT - (NOAbeginning * Rw). As the calculation shows below, we finally narrow the target share

price for EL at $84.63, which is more reliable than what we get from multiple-based valuation.

Residual Operating Income Valuation Model

Jun-14 Jun-15 Jun-16 Jun-17 Jun-18 Jun-19 Terminal

Revenue $10,969 $10,759 $11,479 $12,171 $12,910 $13,685 $14,232

NOPBT 1,828 1,649 1,930 2,146 2,353 2600 $2,704

Tex expense 568 505 597 668 736 806 838

Effective tax rate 31.10% 31.50% 31.50% 31.50% 31.50% 31.50% 31.50%

Pretaxed nonoperating exp. 51 47 37 29 19 15 10

Tax on operating profit 584 520 609 677 742 811 841

NOPAT 1,244 1,129 1,321 1,469 1,611 1,789 1,863

NOA 1,139 1,023 1,057 1,047 1,111 1,177 1,224

ROPI 1,027 1,230 1,374 1,517 1,690 1,757

Rw 8.96%

Discount Factor 1.0000 0.9177 0.8423 0.7730 0.7094 0.6511

PV of ROPI 943 1,036 1,062 1,076 1,100

Horixon $5,216.87

Terminal 23,053.23

NOA 1,139.40

Total firm value 29,409.50

Less NNO -2,715.50

Firm equity value $32,125.00

share outstanding 379.61

Share Price $84.63

Estée Lauder Companies Inc. (The) 12

Company Analysis and Valuation Project December 10, 2014

Compare With Market Estimates

Compare with other analyst estimates, our target price $85 is Price Target Summary

more prudent as it is below the average target. But we think

Mean Target: 91.3

although Estée Lauder has enjoyed a long and glorious history in

cosmetic and beauty industry, the market is becoming more and Median Target: 91.5

more diversified and competitive. New brand and new trends come High Target: 105

and go, and reputation building and safety issue are always crucial to Low Target: 73

company like Estée Lauder. Thus, we can’t be too optimistic about No. of Brokers: 20

the long-term prosperous, and we think $85 is a more realistic price

Our 1 Year Target 85

for EL in the foreseeable future.

Conclusion

In our view, EL has been executing well on its strategy, and we think its

brands' prestige positioning will serve it well in international markets as well as

in the U.S. We see the combination of a mix shift favoring higher-margin skin

care, led by the Asia-Pacific region, which is disproportionately skin-care driven,

and continued operational improvements boosting margins long term. In near

term, we think strong new product momentum and market share gains will drive

results, despite slowing growth in China and sluggish demand in Europe.

Risks to our recommendation and target price include a slowdown in the economies of EL's major

country markets, slow consumer acceptance of new products, and unfavorable foreign exchange

translation. We also have concerns about corporate governance practices given the majority voting power

of insiders.

Our 12-month target price of $85 reflects a P/E multiple of 26.5X applied to our FY 15 EPS estimate.

Our P/E multiple represents a 10% premium to its ten-year average, which we believe is warranted as

benefits from market share gains, despite near term shifts in sales and EPS caused by technology

upgrades. So comparing with the current share price of $73.45, we give EL’s share a BUY opinion.

Wall Street Opinion

Current 1 Month 1 Months 3 Months

Month Ago Ago Ago

Strong Buy 6 7 7 7

Buy 5 5 5 5

Hold 13 12 13 13

Underperform 1 1 1 1

Sell 0 0 0 0

Mean Rating 2.3

Source: Yahoo Finance

Estée Lauder Companies Inc. (The) 13

Company Analysis and Valuation Project December 10, 2014

Appendix

Estee Lauder Cos Inc/The (EL US) - Multiples

12 Months Ending 2010-06-30 2011-06-30 2012-06-30 2013-06-30 2014-06-30

P/E 19.17 27.62 23.63 24.60 23.84

Average 30.69 27.42 28.76 27.19 26.46

High 43.29 36.16 34.32 31.35 28.72

Low 18.72 19.16 22.11 22.08 23.84

P/Book 5.66 7.89 7.70 7.76 7.38

Average 5.96 8.09 8.22 8.86 8.35

High 8.39 10.67 9.81 10.22 9.06

Low 3.63 5.65 6.32 7.19 7.38

P/Free Cash Flow 16.06 30.65 29.80 33.31 27.98

Average 23.41 23.00 31.93 34.29 35.81

High 33.01 30.65 38.09 39.53 38.88

Low 14.28 16.05 24.54 27.84 27.98

EV/Sales 1.43 2.35 2.16 2.49 2.57

Average 1.42 2.04 2.42 2.49 2.67

High 1.96 2.68 2.88 2.87 2.87

Low 0.89 1.43 1.87 2.02 2.45

EV/EBITDA 10.58 14.98 13.06 13.63 12.73

Average 15.43 15.06 15.38 15.04 14.61

High 21.37 19.82 18.31 17.35 15.70

Low 9.72 10.58 11.92 12.20 12.73

Dividend Yield 0.99 0.71 0.97 1.64 1.05

Average 1.17 0.72 0.69 0.85 1.53

High 1.82 0.99 0.97 1.64 1.67

Low 0.79 0.52 0.57 0.73 1.05

Price/Share 27.87 52.60 54.12 65.77 74.26

High 35.65 53.29 65.60 72.70 77.34

Low 15.00 27.31 40.76 49.81 63.63

Enterprise Value 11,143.8 20,734.7 21,001.8 25,382.0 28,161.5

Average 10,390.7 15,891.3 21,300.9 24,189.7 27,238.3

High 14,366.1 20,880.0 25,330.4 27,894.4 29,251.0

Low 6,534.7 11,145.2 16,491.4 19,618.4 24,962.4

Estée Lauder Companies Inc. (The) 1

Company Analysis and Valuation Project December 10, 2014

Estee Lauder Cos Inc/The (EL US) - Contractual Obligations

In Millions of USD except Per Share FY 2010 FY 2011 FY 2012 FY 2013 FY 2014

12 Months Ending 2010-06-30 2011-06-30 2012-06-30 2013-06-30 2014-06-30

Debt Schedule

Debt Schedule - Total Debt 1,228.4 1,218.1 1,288.1 1,344.3 1,343.1

Capital Leases Schedule

Total Future Value of Capital Leases 0.0 0.0 0.0 0.0 0.0

Present Value of ST Capital Leases 0.0 0.0 0.0 0.0 0.0

Present Value of LT Capital Leases 0.0 0.0 0.0 0.0 0.0

Total Present Value of Capital Leases 0.0 0.0 0.0 0.0 0.0

Operating Leases Schedule

Rental Expense - Year 1 200.2 247.7 266.6 280.2 291.7

Rental Expense - Year 2 175.7 218.7 243.5 241.0 274.0

Rental Expense - Year 3 152.3 182.6 209.3 210.9 240.5

Rental Expense - Year 4 131.9 153.1 182.8 176.5 215.9

Rental Expense - Year 5 115.8 129.3 153.5 146.1 190.6

Rental Expense - Years 2 - 3 328.0 401.3 452.8 451.9 514.5

Rental Expense - Years 4 - 5 247.7 282.4 336.3 322.6 406.5

Rental Expense - Years 2 - 5 575.7 683.7 789.1 774.5 921.0

Rental Expense Beyond Year 5 427.4 433.0 482.2 480.0 797.9

Future Min Oper Lease Obligations 1,203.3 1,364.4 1,537.9 1,534.7 2,010.6

Contractual Obligations Schedule

Contractual Obligations - Year 1 1,627.9 1,273.6 1,683.7 1,802.3 1,464.1

Contractual Obligations- Years 2-3 1,002.6 1,198.8 1,201.6 1,283.7 1,815.1

Contractual Obligations- Years 4-5 751.3 645.2 1,028.5 1,011.5 777.3

Contractual Obligations - Years 2 - 5 1,753.9 1,844.0 2,230.1 2,295.2 2,592.4

Contractual Obligations - Beyond Year 5 2,148.3 2,184.6 1,870.3 2,506.1 2,565.9

Total Contractual Obligations 5,530.1 5,302.2 5,784.1 6,603.6 6,622.4

Purchase Obligations 2,212.9 1,881.5 2,178.6 2,681.7 2,280.1

Estée Lauder Companies Inc. (The) 2

Company Analysis and Valuation Project December 10, 2014

Income Statement Chart

Procter & Gamble Co.

Coty Inc.

Elizabeth Arden Inc.

Estée Lauder Companies Inc. (The) 3

Company Analysis and Valuation Project December 10, 2014

Balance Sheet Chart

Procter & Gamble Co.

Coty Inc.

Elizabeth Arden Inc.

Estée Lauder Companies Inc. (The) 4

Company Analysis and Valuation Project December 10, 2014

Strategic modernization initiative program

As part of long-term efforts to enhance information systems and increase productivity, Estee

Lauder is implementing Strategic Modernization Initiative (SMI). This initiative includes an

enterprise-wide global program that will deliver a single set of integrated data, processes and

technologies, which, in turn, would be scalable and used to standardize business processes

across brands, operating units and sales locations. The objective of this initiative is to

streamline Estee Lauder’s operations, create transparency, and renew all facets of the company’s

business. This initiative was first deployed in the company’s North American and UK

manufacturing facilities and created the North American financial foundation. During 2010–12,

this initiative was deployed globally, adding affiliates and brands to existing facilities. Currently,

more than 60% of the company’s sales are SMI-enabled, this includes majority of the

company’s global brands and more than half of its affiliate sales volume. As a result of this SMI

program, Estee Lauder improved its productivity in Korea; customer ordering improved by

four times; labeling is now nearly 30% more efficient; and picking accuracy improved from 97%

to 98.6%. At Smashbox, the time it takes from receiving retail order until delivery decreased

from 10 days or more to six days.

The multiyear investment in SMI includes installing new systems and software. Estee Lauder

focuses on three significant areas under SMI program. These include people, who are expected

to adapt to new ways of working; processes, leading to new systems and capabilities that focus

on speed and agility; and technology, including new SAP software to automate processes,

improve transparency and gain efficiencies. The areas of business using SMI processes and SAP

technology include the company’s manufacturing facilities in North America and the UK, as

well as 15 affiliates including Italy, Spain, Germany, Singapore, Korea, Australia and Thailand.

Further in January 2012, 13 sites began using SMI processes and SAP technology, including eight

affiliates, two global brands, Bumble and bumble and Smashbox, some third-party

manufacturing, as well as key account planning for North America. Further, as part of SMI, the

company intends to migrate majority of its operations to SAP through FY2013.

Therefore, SMI program will enable the company to improve service levels, enhance operating

efficiencies, improve inventory management, as well as provides a leaner supply chain.

Estée Lauder Companies Inc. (The) 5

You might also like

- Case1 4 TrueReligionDocument15 pagesCase1 4 TrueReligionAhmad100% (4)

- Brand Audit Dove SoapDocument25 pagesBrand Audit Dove Soapnimra khanNo ratings yet

- CIO Leads - DelDocument41 pagesCIO Leads - DelNithin N Nayak38% (8)

- Discussions On L'OrealDocument3 pagesDiscussions On L'OrealAsim Dasgupta100% (1)

- Case Study Report On L'Oreal and The Globalization of American Beauty'Document5 pagesCase Study Report On L'Oreal and The Globalization of American Beauty'Анди А. Саэз100% (1)

- GucciDocument3 pagesGuccijstjaved50% (2)

- WSDWQDocument17 pagesWSDWQAnuj HandaNo ratings yet

- Case-Study - Laura Ashley.Document16 pagesCase-Study - Laura Ashley.inesvilafanhaNo ratings yet

- Merger of Wella - P - G1Document44 pagesMerger of Wella - P - G1Avi JhaveriNo ratings yet

- Estee LauderDocument5 pagesEstee LauderMhegan ManarangNo ratings yet

- Amore PacificDocument12 pagesAmore PacificFelix TcNo ratings yet

- Brand and Strategic Management of P&GDocument21 pagesBrand and Strategic Management of P&Gxuni34No ratings yet

- Chinese Immigrants & Angel Island - Irish Immigrants & Ellis IslandDocument5 pagesChinese Immigrants & Angel Island - Irish Immigrants & Ellis Islandapi-283669836No ratings yet

- Strategic Management: Department of Management StudiesDocument17 pagesStrategic Management: Department of Management Studiessri lekhaNo ratings yet

- Estee Lauder: Case AnalysisDocument36 pagesEstee Lauder: Case AnalysisYusmin Jaffar100% (1)

- The Estee Lauder - Company Research Report - Academic Assignment - Top Grade PapersDocument12 pagesThe Estee Lauder - Company Research Report - Academic Assignment - Top Grade PapersTop Grade Papers100% (1)

- Swot Analysis LorealDocument8 pagesSwot Analysis LorealAvinash BalgobinNo ratings yet

- A Case StudyDocument29 pagesA Case StudyAaron John Dela Cruz100% (1)

- MKT 503Document24 pagesMKT 503Prateek SehgalNo ratings yet

- MHM1523-Ind Assignment-Estee Lauder Companies, Inc-Wong Yean Chong-1Document26 pagesMHM1523-Ind Assignment-Estee Lauder Companies, Inc-Wong Yean Chong-1wisely100% (1)

- Estee Lauder Chapter 2Document16 pagesEstee Lauder Chapter 2Berry ChocoNo ratings yet

- Monthly Sales Closing in Indian Pharmaceutical CompaniesDocument2 pagesMonthly Sales Closing in Indian Pharmaceutical CompaniesRamniranjan ShahNo ratings yet

- Sephora in USADocument16 pagesSephora in USABending ExistenceNo ratings yet

- Loreal ParisDocument18 pagesLoreal Parisasish moharanaNo ratings yet

- 2 Brand IdentityDocument61 pages2 Brand IdentityPankaj Tiwaskar0% (2)

- India - Cosmetics Imports & Regulatory AspectsDocument6 pagesIndia - Cosmetics Imports & Regulatory AspectsSuruchi ChopraNo ratings yet

- Distinctive Features of The Beauty Business - 13 01 21Document53 pagesDistinctive Features of The Beauty Business - 13 01 21Akshit AgarwalNo ratings yet

- Singapore Personal Care and Cosmetics Country Guide FINALDocument10 pagesSingapore Personal Care and Cosmetics Country Guide FINALLisa Ray100% (1)

- Bringing "Class To Mass" With PlénitudeDocument36 pagesBringing "Class To Mass" With PlénitudeLeejat Kumar PradhanNo ratings yet

- Swot in Estee Lauder Inc 2011Document2 pagesSwot in Estee Lauder Inc 2011Noor Syamila HashimNo ratings yet

- Proctor and Gamble: Karl Wezmar Williamjeet Singh Jhamb Gaurav Gurpreet SinghDocument51 pagesProctor and Gamble: Karl Wezmar Williamjeet Singh Jhamb Gaurav Gurpreet SinghSingh GurminderNo ratings yet

- RevlonDocument16 pagesRevlonPriya PalNo ratings yet

- Marketing Management Project: By: Group 3Document12 pagesMarketing Management Project: By: Group 3Kirti SainiNo ratings yet

- Loreal 4psDocument2 pagesLoreal 4psMohit NavalkhaNo ratings yet

- Strategic Brand AnalysisDocument22 pagesStrategic Brand AnalysisHaider QaziNo ratings yet

- Case Analysis On PURIteen - Group No. 3Document2 pagesCase Analysis On PURIteen - Group No. 3PravendraSingh100% (1)

- Loreal in ChinaDocument15 pagesLoreal in ChinaDavid Andrei JapsonNo ratings yet

- The Gillette Company: Dry Idea Advertising Case Analysis: Integrated Marketing CommunicationDocument5 pagesThe Gillette Company: Dry Idea Advertising Case Analysis: Integrated Marketing CommunicationShachin ShibiNo ratings yet

- SearsDocument1 pageSearsMohamed GhalwashNo ratings yet

- DoveDocument2 pagesDoveShivamKhareNo ratings yet

- L'Oreal Project: 11.04.2017, Canakkale, Turkey Student, Maria Adelina BoloagăDocument12 pagesL'Oreal Project: 11.04.2017, Canakkale, Turkey Student, Maria Adelina BoloagăMăriuca MăryNo ratings yet

- Lindt's Expansion Plan in India - Group 1 MM PresentationDocument24 pagesLindt's Expansion Plan in India - Group 1 MM Presentationpmal91100% (1)

- BRL Hardy: Globalizing An Australian Wine CompanyDocument6 pagesBRL Hardy: Globalizing An Australian Wine CompanyTusharNo ratings yet

- Each of LilypadDocument3 pagesEach of LilypadJerry ToledoNo ratings yet

- MKT Brand AuditDocument35 pagesMKT Brand Auditapi-312659543No ratings yet

- Got2b Digital CampaignDocument29 pagesGot2b Digital Campaignpratik_singla8437No ratings yet

- Marketing EnvironmentDocument9 pagesMarketing EnvironmentMega Pop Locker0% (1)

- Issue17 CosmeticsDocument32 pagesIssue17 CosmeticsVikas SarangalNo ratings yet

- Brand Audit of CadburyDocument38 pagesBrand Audit of CadburyBhinitha ChandrasagaranNo ratings yet

- Study - Id41589 - Estee Lauder Statista DossierDocument76 pagesStudy - Id41589 - Estee Lauder Statista Dossierkk1116100% (1)

- Product (RED)Document9 pagesProduct (RED)Madison SheenaNo ratings yet

- Yahoo! Inc. Valuation ProjectDocument8 pagesYahoo! Inc. Valuation ProjectNigar_AbbasNo ratings yet

- Nada - Notes From LHIDocument223 pagesNada - Notes From LHIeatbigfishNo ratings yet

- Estee Lauder Companies IncDocument11 pagesEstee Lauder Companies IncMuhammad Bin Kamarulazizi0% (1)

- Lessons Learned at MethodDocument4 pagesLessons Learned at MethodSufian Tan100% (1)

- How Kraft Foods Made Oreo A Global BrandDocument4 pagesHow Kraft Foods Made Oreo A Global BrandvsrajeshvsNo ratings yet

- UntitledDocument14 pagesUntitledMaheen NawazNo ratings yet

- Estee Lauder Strategic AuditDocument17 pagesEstee Lauder Strategic Auditamit29birth100% (1)

- Case Study.02-19-14Document26 pagesCase Study.02-19-14Febie CarmonaNo ratings yet

- The Analysis of Estee Lauder Group's Dominant Position FactorsDocument8 pagesThe Analysis of Estee Lauder Group's Dominant Position FactorsLeman UlaştırıcıNo ratings yet

- Estée Lauder Companies, I N C - 2 0 0 8: Sharynntomlin Angelo State UniversityDocument11 pagesEstée Lauder Companies, I N C - 2 0 0 8: Sharynntomlin Angelo State Universityhitler_burnNo ratings yet

- Estee LauderDocument11 pagesEstee LauderKathrine Anne YapNo ratings yet

- NE20E-S V800R022C00SPC600 Configuration Guide 01 Basic ConfigurationDocument422 pagesNE20E-S V800R022C00SPC600 Configuration Guide 01 Basic ConfigurationMoises HenriqueNo ratings yet

- How To Impress Someone at First MeetingDocument1 pageHow To Impress Someone at First MeetingMohammad Fahim HossainNo ratings yet

- Centers For Disease Control and Prevention's Sexually Transmitted Diseases Infection GuidelinesDocument6 pagesCenters For Disease Control and Prevention's Sexually Transmitted Diseases Infection GuidelinesabhinavrautNo ratings yet

- Chevron Australia Project Overview - PPTDocument15 pagesChevron Australia Project Overview - PPTzawamaNo ratings yet

- Steam Air Ejector Performance and Its Dimensional ParametersDocument296 pagesSteam Air Ejector Performance and Its Dimensional ParametersGuru Raja Ragavendran NagarajanNo ratings yet

- MobilityDocument46 pagesMobilityDipen SoniNo ratings yet

- NIV Excerpt PDFDocument57 pagesNIV Excerpt PDFAnonymous tSYkkHToBPNo ratings yet

- 3544 Im 21455-30Document58 pages3544 Im 21455-30grosselloNo ratings yet

- EZ-212 ManualDocument32 pagesEZ-212 ManualapiadmbrNo ratings yet

- Troubleshooting For Rb433R3, Rb433Ur2: No Power, Blue Led Isn'T LitDocument7 pagesTroubleshooting For Rb433R3, Rb433Ur2: No Power, Blue Led Isn'T LitJoseAugustoOsteicoechea100% (1)

- Level 6 Advanced - A Room With A ViewDocument117 pagesLevel 6 Advanced - A Room With A View01.wawiwawi100% (1)

- T650/T650M Treadmill Repair Manual: Sports Art Industrial Co., LTDDocument112 pagesT650/T650M Treadmill Repair Manual: Sports Art Industrial Co., LTDTiago SantosNo ratings yet

- Acc Area-03Document5 pagesAcc Area-03Zj FerrerNo ratings yet

- Wizard S AideDocument58 pagesWizard S AideKnightsbridge~No ratings yet

- Lived Experiences of Muslim High SchoolDocument12 pagesLived Experiences of Muslim High SchoolJustine ReveloNo ratings yet

- List of SOC Related DocumentsDocument1 pageList of SOC Related DocumentsRavi Yadav0% (1)

- Appendix E-Baseline Design StandardsDocument26 pagesAppendix E-Baseline Design StandardsReshad AtmarNo ratings yet

- The Jet Volume 5 Number 7Document40 pagesThe Jet Volume 5 Number 7THE JETNo ratings yet

- Design of Sequential Circuits - Example 1.3Document3 pagesDesign of Sequential Circuits - Example 1.3MD Saifuzzaman SohanNo ratings yet

- 03 - Information PackagesDocument13 pages03 - Information Packagesyusi cantikNo ratings yet

- Appendix G Elastic and Inelastic Response SpectraDocument11 pagesAppendix G Elastic and Inelastic Response SpectracedaserdnaNo ratings yet

- CPAR LessonDocument2 pagesCPAR LessonAnabelle MoyamoyNo ratings yet

- Pioneer of Mud Architecture: Bhubaneswar Bangalore Mahanadi RiverDocument13 pagesPioneer of Mud Architecture: Bhubaneswar Bangalore Mahanadi RiverDIKSHA ARORA100% (1)

- Checklist Atm Checking: Description Availability Function RemarksDocument6 pagesChecklist Atm Checking: Description Availability Function RemarksDiyas AnggaNo ratings yet

- Chapter 8 Supplemental Questions: E8-1 (Inventoriable Costs)Document7 pagesChapter 8 Supplemental Questions: E8-1 (Inventoriable Costs)Dyan NoviaNo ratings yet

- DB2 V9 Application Programming&SQL Guide Dsnapk13Document1,157 pagesDB2 V9 Application Programming&SQL Guide Dsnapk13Sergio MolinaNo ratings yet

- Effect of Asperity Location On Sliding Stability of Concrete DamsDocument12 pagesEffect of Asperity Location On Sliding Stability of Concrete DamsDipenNo ratings yet

- Deep LearningUNIT-IVDocument16 pagesDeep LearningUNIT-IVnikhilsinha0099No ratings yet