Professional Documents

Culture Documents

Press Release Pennar Industries Limited: Details of Instruments/facilities in Annexure-1

Press Release Pennar Industries Limited: Details of Instruments/facilities in Annexure-1

Uploaded by

Radha MohanCopyright:

Available Formats

You might also like

- IMC LimitedDocument5 pagesIMC LimitedMayank AgarwalNo ratings yet

- Tutorial 4A Interest and Discount: ST STDocument3 pagesTutorial 4A Interest and Discount: ST STKhairun Nasuha bt Mohamad Tahir100% (1)

- Fin Corp 2021 Exerc MonitoriasDocument13 pagesFin Corp 2021 Exerc MonitoriasFabio Streitemberger FabroNo ratings yet

- Benchmarking Best Practices for Maintenance, Reliability and Asset ManagementFrom EverandBenchmarking Best Practices for Maintenance, Reliability and Asset ManagementNo ratings yet

- Group 2 Analysis of Financial StatementsDocument37 pagesGroup 2 Analysis of Financial StatementsA cNo ratings yet

- Mers, Inc. Membership List of 5,566 Members As of May 22, 2016Document133 pagesMers, Inc. Membership List of 5,566 Members As of May 22, 2016Emanuel McCray100% (1)

- Technico Industries LimitedDocument4 pagesTechnico Industries Limitedshankarravi8975No ratings yet

- Press Release RACL Geartech LTDDocument4 pagesPress Release RACL Geartech LTDSourav DuttaNo ratings yet

- CARE Sunflag 4.01.2024Document9 pagesCARE Sunflag 4.01.2024Swapnil SomkuwarNo ratings yet

- Jay Ushin Limited: Rationale-Press ReleaseDocument4 pagesJay Ushin Limited: Rationale-Press Releaseravi.youNo ratings yet

- Roots Industries India Limited: Facilities/Instruments Amount (Rs. Crore) Rating Rating ActionDocument4 pagesRoots Industries India Limited: Facilities/Instruments Amount (Rs. Crore) Rating Rating ActionKarthikeyan RK SwamyNo ratings yet

- Sunfuel Technologies LLP-01-15-2019Document4 pagesSunfuel Technologies LLP-01-15-2019mansinagpal245286No ratings yet

- Filatex India Limited PDFDocument6 pagesFilatex India Limited PDFfatNo ratings yet

- Press Release Amkette Analytics Limited: Details of Instruments/facilities in Annexure-1Document5 pagesPress Release Amkette Analytics Limited: Details of Instruments/facilities in Annexure-1Data CentrumNo ratings yet

- Press Release MaharajaDocument5 pagesPress Release MaharajaMS SAMIRANNo ratings yet

- Anthem Biosciences-R-21052018Document7 pagesAnthem Biosciences-R-21052018swarnaNo ratings yet

- IOL Chemicals and Pharmaceuticals Limited-07-07-2020Document4 pagesIOL Chemicals and Pharmaceuticals Limited-07-07-2020Jeet SinghNo ratings yet

- Shaily Engineering Plastics Limited-09-25-2019Document4 pagesShaily Engineering Plastics Limited-09-25-2019Ashutosh Gupta100% (1)

- Press Release RACL Geartech LTDDocument4 pagesPress Release RACL Geartech LTDSourav DuttaNo ratings yet

- Arya Steels Rolling (India) LimiteDocument4 pagesArya Steels Rolling (India) LimiteData CentrumNo ratings yet

- Prayag Polymers Private LimitedDocument4 pagesPrayag Polymers Private Limitednandinimishra6168No ratings yet

- Shyam Metalics and Energy Limited-12-17-2020Document7 pagesShyam Metalics and Energy Limited-12-17-2020Parth PatelNo ratings yet

- Hyundai Steel India - R - 08062018Document7 pagesHyundai Steel India - R - 08062018Andrew BruceNo ratings yet

- Ajax Fiori-R-07092017Document7 pagesAjax Fiori-R-07092017parimal.rodeNo ratings yet

- Shri Balaji Rollings Private LimDocument4 pagesShri Balaji Rollings Private LimData CentrumNo ratings yet

- Kellton Tech Solutions R 28092018Document7 pagesKellton Tech Solutions R 28092018Suresh Kumar RaiNo ratings yet

- IOL Chemicals and Pharmaceuticals Limited-07!02!2019Document4 pagesIOL Chemicals and Pharmaceuticals Limited-07!02!2019Technical dostNo ratings yet

- Tarsons Products LimitedDocument5 pagesTarsons Products LimitedujjwalgoldNo ratings yet

- Indotech Transformers LimitedDocument7 pagesIndotech Transformers Limitedpiyush.kundraNo ratings yet

- Press Release Mehul Construction Company Private Limited: Details of Instruments/facilities in Annexure-1Document5 pagesPress Release Mehul Construction Company Private Limited: Details of Instruments/facilities in Annexure-1tejasNo ratings yet

- Press Release Adani Agri Logistics (Harda) LimitedDocument5 pagesPress Release Adani Agri Logistics (Harda) Limitedsurprise MFNo ratings yet

- Radico Khaitan LimitedDocument6 pagesRadico Khaitan LimitedHarminder Singh BajwaNo ratings yet

- Rane Engine Valve Limited: Summary of Rated Instruments Instrument Rated Amount (Rs. Crore) Rating ActionDocument7 pagesRane Engine Valve Limited: Summary of Rated Instruments Instrument Rated Amount (Rs. Crore) Rating ActiontomNo ratings yet

- Maithan Alloys LimitedDocument6 pagesMaithan Alloys Limiteddrkashish1989No ratings yet

- Press Release Om Logistics Limited: Details of Instruments/facilities in Annexure-1Document6 pagesPress Release Om Logistics Limited: Details of Instruments/facilities in Annexure-1Sinius InfracomNo ratings yet

- Ultramarine & Pigments LTD: Summary of Rated InstrumentsDocument7 pagesUltramarine & Pigments LTD: Summary of Rated Instrumentsjanmejay26No ratings yet

- Rockman Industries Limited: Summary of Rated Instruments Instrument Rated Amount (Rs. Crore) Rating ActionDocument7 pagesRockman Industries Limited: Summary of Rated Instruments Instrument Rated Amount (Rs. Crore) Rating ActionVirender RawatNo ratings yet

- Rating Definitions - 19 July 2018Document4 pagesRating Definitions - 19 July 2018SushantNo ratings yet

- Tata Advanced Materials-R-28062019Document7 pagesTata Advanced Materials-R-28062019shoaib merchantNo ratings yet

- Parijat Industries-R-23032018Document7 pagesParijat Industries-R-23032018dear14us1984No ratings yet

- Thriveni Earthmovers Private LimitedDocument9 pagesThriveni Earthmovers Private Limitedarc14consultantNo ratings yet

- Press Release Tab India Granites Private LimitedDocument6 pagesPress Release Tab India Granites Private LimitedRavi BabuNo ratings yet

- T V Sundram Iyengar-R-16022018Document7 pagesT V Sundram Iyengar-R-16022018AGN YaNo ratings yet

- United Breweries Limited: Summary of Rated InstrumentsDocument8 pagesUnited Breweries Limited: Summary of Rated InstrumentsKaushikDasguptaNo ratings yet

- Mega Steel IndustriesDocument4 pagesMega Steel IndustrieshseckalpeshNo ratings yet

- Peekay Steel Castings Private Limited-01!09!2019Document5 pagesPeekay Steel Castings Private Limited-01!09!2019GAYATHRI S.RNo ratings yet

- Press Release Tarsons Products Private Limited: Details of Instruments/facilities in Annexure-1Document4 pagesPress Release Tarsons Products Private Limited: Details of Instruments/facilities in Annexure-1hussainNo ratings yet

- Super Screws Private Limited: Summary of Rated InstrumentsDocument7 pagesSuper Screws Private Limited: Summary of Rated InstrumentsAnonymous bdUhUNm7JNo ratings yet

- Pan Healthcare Private Limited (PHCPL) October 12, 2020Document5 pagesPan Healthcare Private Limited (PHCPL) October 12, 2020Sachin DhorajiyaNo ratings yet

- Happy ForgingsDocument7 pagesHappy ForgingsArshChandraNo ratings yet

- Thyssenkrupp Industries PDFDocument7 pagesThyssenkrupp Industries PDFBinoy MtNo ratings yet

- Ankit Pulps and Boards - R-25102018Document6 pagesAnkit Pulps and Boards - R-25102018HEMANT GURJARNo ratings yet

- Greentech Power Private Limited-01-06-2020 PDFDocument4 pagesGreentech Power Private Limited-01-06-2020 PDFMukesh TodiNo ratings yet

- Aachi Masala Foods-R-28092018 PDFDocument7 pagesAachi Masala Foods-R-28092018 PDFபாரத் அச்சுNo ratings yet

- SMC Power Generation LTD.: Summary of Rated InstrumentsDocument7 pagesSMC Power Generation LTD.: Summary of Rated Instrumentspiyush upadhyayNo ratings yet

- Epicenter Technologies Private - R - 11082020Document7 pagesEpicenter Technologies Private - R - 11082020Shawn BlazeNo ratings yet

- Research Paper - Rashmi Sponge Iron & Power Industries LTDDocument6 pagesResearch Paper - Rashmi Sponge Iron & Power Industries LTDSoumyakanti S. Samanta (Pgdm 09-11, Batch II)No ratings yet

- Oriental Rubber Industries Pvt. LTDDocument7 pagesOriental Rubber Industries Pvt. LTDPriya VijiNo ratings yet

- Press Release Deccan Industries: Positive FactorsDocument4 pagesPress Release Deccan Industries: Positive FactorsHARI HARANNo ratings yet

- STEER Engineering Private Limited: Summary of Rated InstrumentsDocument7 pagesSTEER Engineering Private Limited: Summary of Rated InstrumentsNarendranNo ratings yet

- Maxcure Nutravedics LTDDocument8 pagesMaxcure Nutravedics LTDcurryhome006No ratings yet

- PR ARCL Organics 31jan22Document7 pagesPR ARCL Organics 31jan22anady135344No ratings yet

- Audit Risk Alert: General Accounting and Auditing Developments 2018/19From EverandAudit Risk Alert: General Accounting and Auditing Developments 2018/19No ratings yet

- Question and Answer - 60Document31 pagesQuestion and Answer - 60acc-expertNo ratings yet

- Digital Subscriber Management and Consultancy Services Private Limited: AssignedDocument3 pagesDigital Subscriber Management and Consultancy Services Private Limited: AssignedDEVESH BHOLENo ratings yet

- DocPro-Due Diligence Checklist For Startup-Angel Investor Venture Capital Private EquityDocument13 pagesDocPro-Due Diligence Checklist For Startup-Angel Investor Venture Capital Private EquityLuis SantosNo ratings yet

- Garcia Unit3 AssessmentTopic1Document5 pagesGarcia Unit3 AssessmentTopic1jaychristiangarcia18No ratings yet

- Zaragosa V Marigold Financial LLC ComplaintDocument11 pagesZaragosa V Marigold Financial LLC ComplaintghostgripNo ratings yet

- Credit Management - ProjectDocument32 pagesCredit Management - ProjectWaqas TariqNo ratings yet

- Bank of AmericaDocument3 pagesBank of AmericaVinayak Arun SahiNo ratings yet

- Issuance Process of Commercial Paper CPsDocument3 pagesIssuance Process of Commercial Paper CPsmohakbhutaNo ratings yet

- DraftingDocument18 pagesDraftingpoonam sharma100% (1)

- Financial ManagementDocument16 pagesFinancial ManagementDell Delos SantosNo ratings yet

- Form A2 PDFDocument2 pagesForm A2 PDFkiran_nyusNo ratings yet

- Topic Outline For Public Accounting and BudgetingDocument8 pagesTopic Outline For Public Accounting and Budgetingsabel sardilla100% (1)

- Bank of PI v. de Coster - 47 Phil. 594Document12 pagesBank of PI v. de Coster - 47 Phil. 594Krista YntigNo ratings yet

- Analisis Industry PT Sentul City, TBKDocument19 pagesAnalisis Industry PT Sentul City, TBKRizky SaragihNo ratings yet

- 1stMT - 1styr - Law On Obligations and Contracts - VerifiedDocument27 pages1stMT - 1styr - Law On Obligations and Contracts - VerifiedKlaire SwswswsNo ratings yet

- Flat CargoDocument26 pagesFlat CargoSherry Yong PkTianNo ratings yet

- My Car Loan PDF WorksheetDocument5 pagesMy Car Loan PDF Worksheetapi-62785081No ratings yet

- Crop LoanDocument3 pagesCrop LoanRamana GNo ratings yet

- BA7026 Banking Financial Services ManagementDocument120 pagesBA7026 Banking Financial Services ManagementchandrasekharNo ratings yet

- Questions - RatiosDocument35 pagesQuestions - Ratios7rtqzp2fj8No ratings yet

- Economics of Money Banking and Financial Markets The Business School 5th Edition Mishkin Test BankDocument25 pagesEconomics of Money Banking and Financial Markets The Business School 5th Edition Mishkin Test Bankfreyahypatias7j100% (39)

- Assessment Cash Management Practices of Cooperative Bank of Oromia, Jimma BranchDocument19 pagesAssessment Cash Management Practices of Cooperative Bank of Oromia, Jimma BranchAshebirNo ratings yet

- Gillette Pakistan Limited: Analysis of Financial StatementDocument19 pagesGillette Pakistan Limited: Analysis of Financial StatementElhemJavedNo ratings yet

- Module 6 - Other Percentage TaxDocument7 pagesModule 6 - Other Percentage TaxPATATASNo ratings yet

- Time Value of MoneyDocument61 pagesTime Value of Moneyfatin atiqahNo ratings yet

- Narrative: by William Thomas ShermanDocument76 pagesNarrative: by William Thomas ShermanWm. Thomas ShermanNo ratings yet

Press Release Pennar Industries Limited: Details of Instruments/facilities in Annexure-1

Press Release Pennar Industries Limited: Details of Instruments/facilities in Annexure-1

Uploaded by

Radha MohanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Press Release Pennar Industries Limited: Details of Instruments/facilities in Annexure-1

Press Release Pennar Industries Limited: Details of Instruments/facilities in Annexure-1

Uploaded by

Radha MohanCopyright:

Available Formats

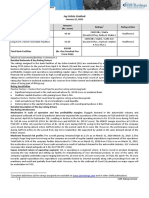

Press Release

Pennar Industries Limited

January 08, 2018

Ratings

Amount 1

Facilities Ratings Rating Action

(Rs. crore)

CARE A; Positive

230.00

Long term Bank Facilities (Single A; Reaffirmed

(enhanced from 191.18)

Outlook: Positive)

175.00 CARE A1

Short term Bank Facilities Reaffirmed

(enhanced from 150.00) (A One)

405.00

Total (Rupees Four Hundred Five

crore only)

Details of instruments/facilities in Annexure-1

Detailed Rationale & Key Rating Drivers

The ratings assigned to the bank facilities of Pennar Industries Limited (PIL) continue to draw strength from experienced

promoter group and management team, long track record of operations, wide product range with presence across

diversified business segments, reputed and diversified client base, comfortable capital structure and liquidity position.

The ratings also take into account growth in revenue and cash accruals during FY17 (refers to the period April 1 to March

31) & H1FY18. The ratings are, however, constrained by flat growth in profit level with decline in profit margin during

FY17, increased dependence on working capital borrowings (at a consolidated level) which along with persistent debt

funded capex has resulted in weakening of debt coverage parameters and return ratios, risks associated with volatility in

raw material price, limited pricing flexibility and competition from other players. The ability of the company to continue

to increase the contribution of the value-added segments while improving the profitability and financial position and

manage raw material price volatility are the key rating sensitivities.

Outlook: Positive

The ‘Positive’ outlook reflects the PIL’s continuous endeavor to diversify its product portfolio with investments in high

margin segments and expected introduction of new range of products resulting in expected growth in scale, financial

position and other key financial parameters.

Detailed description of the key rating drivers

Key Rating Strengths

Long track record of the group: Incorporated in 1975 as a cold rolled steel strips manufacturer, PIL has expanded its

business profile with acquisition of related companies, setting up new plants, expansion of existing units and diversifying

into value-added products in the engineering & infrastructure segment. Furthermore, it has significantly increased its

presence in the pre-engineered business segment, water & environment infrastructure business and solar power

generation through its subsidiaries; Pennar Engineered Building Systems Limited (PEBSL), Pennar Enviro Limited (PEL) and

Pennar Renewables Private Limited (PRPL), respectively.

Experienced promoter group with strong management team: The promoters of Pennar group have been in the

engineered steel products business for more than four decades. The company is headed by Mr Nrupender Rao

(Chairman), who has more than 35 years of experience in the industry. Furthermore, PIL is managed by a professional

board comprising 12 directors with all the directors having long-standing industry experience of more than two decades.

Diversified product range and revenue profile: PIL has a diversified product portfolio having wide industrial use ranging

from automobile, white goods, general engineering, domestic appliances, buildings and construction and railways. The

revenue profile of PIL is thus diversified with contributions from four major business units viz. Steel Products, Systems &

Projects, Tubes and Industrial Components. During H1FY18, the company also set up a new manufacturing unit at Velchal,

Telangana, to primarily focus on forward integration in the Steel products business vertical.

Growth in revenue and cash accrual during FY17 and H1FY18: PIL has been reporting a satisfactory operational

performance over the last three years. The company reported a y-o-y revenue growth of 18.2% in total operating income

during FY17 over FY16 at consolidated level. This was backed by increased orders from systems & projects business

vertical and high rise buildings business segment during the year. The improvement in revenue continued during H1FY18

wherein the company registered a total operating income and PAT growth of about 18% and 14% respectively on y-o-y

basis.

Comfortable financial and liquidity position: The capital structure remained comfortable as on March 31, 2017 with both

debt-equity and overall gearing ratio below unity as on the said date. The total debt, however, has been continuously

increasing over the years on account of regular debt funded capex being undertaken by the company as well as higher

dependence on working capital borrowings at a consolidated level.

1 CARE Ratings Limited

Press Release

The liquidity profile has also been comfortable backed by adequate cash generation and free cash/liquid funds

maintained. The said funds, however, are not expected to be continued at the same level given the investment plans

envisaged.

Key Rating Weaknesses

Moderation in profitability and coverage indicators: PIL, although witnessed a strong revenue growth, the same could

not percolate down to the profit level in FY17. The profit level remained flat and the margins witnessed a marginal

deterioration. The PBILDT margin declined by 37 basis points (to 11.04%) in FY17 on account of higher input prices (by

about 18%) mainly at its major subsidiary, PEBSL level, which the company could not pass on to maintain the market

share. Subsequently, PAT margin declined by 67 basis points (to 3.78%) during the year. This apart, the the total debt has

witnessed an increasing trend which in turn has resulted in moderation in debt coverage parameters and return ratios in

FY17. Thus, the ability of the company to optimize the debt levels remains important from credit perspective.

Risk associated with volatility in raw material prices: The raw material cost is the major cost component and accounted

for 75-80% of the total cost of sales in the last three years ended FY17. The input prices being highly volatile which

subjects the profitability to risk associated with adverse movement of prices.

High competition from major players: The engineering segment is a highly competitive and low margin business with

competition from large integrated steel manufacturers.

Analytical approach: Consolidated financials

CARE in its analysis has considered the consolidated business and financial risk profiles of Pennar Industries Ltd. and its

subsidiaries; Pennar Engineered Building Systems Ltd. (PEBSL), Pennar Enviro Limited (PEL) and Pennar Renewables

Private Ltd. (PRPL), together referred to as Pennar group, as the entities are linked through a parent-subsidiary

relationship and collectively have management, business & financial linkages.

Applicable Criteria

Criteria on assigning Outlook to Credit Ratings

CARE’s Policy on Default Recognition

Rating Methodology: Factoring Linkages in Ratings

Criteria for Short Term Instruments

CARE's methodology for Manufacturing Companies

Financial ratios – Non-Financial Sector

About the Company

Pennar Industries Limited (PIL), incorporated in 1975, is engaged in manufacturing of cold rolled steel strips (installed

capacity of 110,000 MT) and engineered steel products, majorly cold rolled formed sections (installed capacity of 144,200

MT) at its manufacturing facilities spread across six places in South India. PIL is particularly focused on the value-added

engineered products segment and the business is divided into four major verticals; Steel Products (cold rolled steel strips,

building products and formed sections), Systems and Projects (Railways and Solar module mounting systems (MMS)

components), Industrial Components (general Engineering and Automotive components) and Tubes (Electric Resistant

Welded, and Cold Drawn Tubes).

The company has announced merger of its subsidiary; PEBSL with itself and the same is under process. Further, the

company has entered into agreement with Hyderabad based Greenko group to sell its entire stake in other subsidiary;

PRPL. The transaction is expected to be completed by end of fiscal FY18. Hence, in the interim period, the company

continues to extend corporate guarantee to the bank facilities of the said subsidiaries.

Brief Financials (Rs. crore) – PIL Consolidated FY16 (A) FY17 (A)

Total operating income 1308.98 1547.36

PBILDT 149.34 170.82

PAT 58.24 58.54

Overall gearing (times) 0.91 0.93

Interest coverage (times) 4.01 2.87

Status of non-cooperation with previous CRA: Not Applicable

Any other information: Not Applicable

Rating History for last three years: Please refer Annexure-2

Note on complexity levels of the rated instrument: CARE has classified instruments rated by it on the basis of complexity. This

classification is available at www.careratings.com. Investors/market intermediaries/regulators or others are welcome to write to

care@careratings.com for any clarifications.

2 CARE Ratings Limited

Press Release

Analyst Contact:

Name: Ms. Puja Jalan

Tel: 040 40102030

Mobile: +91 9160001511

Email: puja.jalan@careratings.com

**For detailed Rationale Report and subscription information, please contact us at www.careratings.com

About CARE Ratings:

CARE Ratings commenced operations in April 1993 and over two decades, it has established itself as one of the leading credit rating

agencies in India. CARE is registered with the Securities and Exchange Board of India (SEBI) and also recognized as an External Credit

Assessment Institution (ECAI) by the Reserve Bank of India (RBI). CARE Ratings is proud of its rightful place in the Indian capital market

built around investor confidence. CARE Ratings provides the entire spectrum of credit rating that helps the corporates to raise capital

for their various requirements and assists the investors to form an informed investment decision based on the credit risk and their own

risk-return expectations. Our rating and grading service offerings leverage our domain and analytical expertise backed by the

methodologies congruent with the international best practices.

Disclaimer

CARE’s ratings are opinions on credit quality and are not recommendations to sanction, renew, disburse or recall the concerned bank

facilities or to buy, sell or hold any security. CARE has based its ratings/outlooks on information obtained from sources believed by it to

be accurate and reliable. CARE does not, however, guarantee the accuracy, adequacy or completeness of any information and is not

responsible for any errors or omissions or for the results obtained from the use of such information. Most entities whose bank

facilities/instruments are rated by CARE have paid a credit rating fee, based on the amount and type of bank facilities/instruments.

In case of partnership/proprietary concerns, the rating /outlook assigned by CARE is based on the capital deployed by the

partners/proprietor and the financial strength of the firm at present. The rating/outlook may undergo change in case of withdrawal of

capital or the unsecured loans brought in by the partners/proprietor in addition to the financial performance and other relevant

factors.

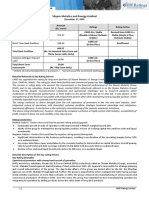

Annexure-1: Details of Instruments/Facilities

Name of the Date of Coupon Maturity Size of the Issue Rating assigned along

Instrument Issuance Rate Date (Rs. crore) with Rating Outlook

Fund-based - LT-Cash - - - 140.00 CARE A; Positive

Credit

Fund-based - LT-Term Loan - - March 2023 90.00 CARE A; Positive

Non-fund-based - ST-BG/LC - - - 95.00 CARE A1

Non-fund-based - ST-BG/LC - - - 80.00 CARE A1

Annexure-2: Rating History of last three years

Sr. Name of the Current Ratings Rating history

No. Instrument/Bank Type Amount Rating Date(s) & Date(s) & Date(s) & Date(s) &

Facilities Outstanding Rating(s) Rating(s) Rating(s) Rating(s)

(Rs. crore) assigned in assigned in assigned in assigned in

2017-2018 2016-2017 2015-2016 2014-2015

1. Fund-based - LT-Cash LT 140.00 CARE A; - 1)CARE A; 1)CARE A 1)CARE A

Credit Positive Positive (08-Dec-15) (29-Jan-15)

(21-Feb-17)

2)CARE A;

Positive

(11-Jan-17)

2. Fund-based - LT-Term LT 90.00 CARE A; - 1)CARE A; 1)CARE A 1)CARE A

Loan Positive Positive (08-Dec-15) (29-Jan-15)

(21-Feb-17)

2)CARE A;

Positive

(11-Jan-17)

3. Non-fund-based - ST- ST 95.00 CARE A1 - 1)CARE A1 1)CARE A1 1)CARE A1

BG/LC (21-Feb-17) (08-Dec-15) (29-Jan-15)

2)CARE A1

(11-Jan-17)

4. Non-fund-based - ST- ST 80.00 CARE A1 - 1)CARE A1 1)CARE A1 1)CARE A1

BG/LC (21-Feb-17) (08-Dec-15) (29-Jan-15)

2)CARE A1

(11-Jan-17)

3 CARE Ratings Limited

Press Release

CONTACT

Head Office Mumbai

Ms. Meenal Sikchi Mr. Ankur Sachdeva

Cell: + 91 98190 09839 Cell: + 91 98196 98985

E-mail: meenal.sikchi@careratings.com E-mail: ankur.sachdeva@careratings.com

Ms. Rashmi Narvankar Mr. Saikat Roy

Cell: + 91 99675 70636 Cell: + 91 98209 98779

E-mail: rashmi.narvankar@careratings.com E-mail: saikat.roy@careratings.com

CARE Ratings Limited

(Formerly known as Credit Analysis & Research Ltd.)

Corporate Office: 4th Floor, Godrej Coliseum, Somaiya Hospital Road, Off Eastern Express Highway, Sion (East), Mumbai - 400 022

Tel: +91-22-6754 3456 | Fax: +91-22-6754 3457 | E-mail: care@careratings.com

AHMEDABAD E-mail: ramesh.bob@careratings.com

Mr. Deepak Prajapati

32, Titanium, Prahaladnagar Corporate Road, JAIPUR

Satellite, Ahmedabad - 380 015 Mr. Nikhil Soni

Cell: +91-9099028864 304, Pashupati Akshat Heights, Plot No. D-91,

Tel: +91-79-4026 5656 Madho Singh Road, Near Collectorate Circle,

E-mail: deepak.prajapati@careratings.com Bani Park, Jaipur - 302 016.

Cell: +91 – 95490 33222

BENGALURU Tel: +91-141-402 0213 / 14

Mr. V Pradeep Kumar E-mail: nikhil.soni@careratings.com

Unit No. 1101-1102, 11th Floor, Prestige Meridian II,

No. 30, M.G. Road, Bangalore - 560 001. KOLKATA

Cell: +91 98407 54521 Ms. Priti Agarwal

Tel: +91-80-4115 0445, 4165 4529 3rd Floor, Prasad Chambers, (Shagun Mall Bldg.)

Email: pradeep.kumar@careratings.com 10A, Shakespeare Sarani, Kolkata - 700 071.

Cell: +91-98319 67110

CHANDIGARH Tel: +91-33- 4018 1600

Mr. Anand Jha E-mail: priti.agarwal@careratings.com

SCF No. 54-55,

First Floor, Phase 11, NEW DELHI

Sector 65, Mohali - 160062 Ms. Swati Agrawal

Chandigarh 13th Floor, E-1 Block, Videocon Tower,

Cell: +91 85111-53511/99251-42264 Jhandewalan Extension, New Delhi - 110 055.

Tel: +91- 0172-490-4000/01 Cell: +91-98117 45677

Email: anand.jha@careratings.com Tel: +91-11-4533 3200

E-mail: swati.agrawal@careratings.com

CHENNAI

Mr. V Pradeep Kumar

Unit No. O-509/C, Spencer Plaza, 5th Floor, PUNE

No. 769, Anna Salai, Chennai - 600 002. Mr.Pratim Banerjee

Cell: +91 98407 54521 9th Floor, Pride Kumar Senate,

Tel: +91-44-2849 7812 / 0811 Plot No. 970, Bhamburda, Senapati Bapat Road,

Email: pradeep.kumar@careratings.com Shivaji Nagar, Pune - 411 015.

Cell: +91-98361 07331

COIMBATORE Tel: +91-20- 4000 9000

Mr. V Pradeep Kumar E-mail: pratim.banerjee@careratings.com

T-3, 3rd Floor, Manchester Square

Puliakulam Road, Coimbatore - 641 037. CIN - L67190MH1993PLC071691

Tel: +91-422-4332399 / 4502399

Email: pradeep.kumar@careratings.com

HYDERABAD

Mr. Ramesh Bob

401, Ashoka Scintilla, 3-6-502, Himayat Nagar,

Hyderabad - 500 029.

Cell : + 91 90520 00521

Tel: +91-40-4010 2030

4 CARE Ratings Limited

You might also like

- IMC LimitedDocument5 pagesIMC LimitedMayank AgarwalNo ratings yet

- Tutorial 4A Interest and Discount: ST STDocument3 pagesTutorial 4A Interest and Discount: ST STKhairun Nasuha bt Mohamad Tahir100% (1)

- Fin Corp 2021 Exerc MonitoriasDocument13 pagesFin Corp 2021 Exerc MonitoriasFabio Streitemberger FabroNo ratings yet

- Benchmarking Best Practices for Maintenance, Reliability and Asset ManagementFrom EverandBenchmarking Best Practices for Maintenance, Reliability and Asset ManagementNo ratings yet

- Group 2 Analysis of Financial StatementsDocument37 pagesGroup 2 Analysis of Financial StatementsA cNo ratings yet

- Mers, Inc. Membership List of 5,566 Members As of May 22, 2016Document133 pagesMers, Inc. Membership List of 5,566 Members As of May 22, 2016Emanuel McCray100% (1)

- Technico Industries LimitedDocument4 pagesTechnico Industries Limitedshankarravi8975No ratings yet

- Press Release RACL Geartech LTDDocument4 pagesPress Release RACL Geartech LTDSourav DuttaNo ratings yet

- CARE Sunflag 4.01.2024Document9 pagesCARE Sunflag 4.01.2024Swapnil SomkuwarNo ratings yet

- Jay Ushin Limited: Rationale-Press ReleaseDocument4 pagesJay Ushin Limited: Rationale-Press Releaseravi.youNo ratings yet

- Roots Industries India Limited: Facilities/Instruments Amount (Rs. Crore) Rating Rating ActionDocument4 pagesRoots Industries India Limited: Facilities/Instruments Amount (Rs. Crore) Rating Rating ActionKarthikeyan RK SwamyNo ratings yet

- Sunfuel Technologies LLP-01-15-2019Document4 pagesSunfuel Technologies LLP-01-15-2019mansinagpal245286No ratings yet

- Filatex India Limited PDFDocument6 pagesFilatex India Limited PDFfatNo ratings yet

- Press Release Amkette Analytics Limited: Details of Instruments/facilities in Annexure-1Document5 pagesPress Release Amkette Analytics Limited: Details of Instruments/facilities in Annexure-1Data CentrumNo ratings yet

- Press Release MaharajaDocument5 pagesPress Release MaharajaMS SAMIRANNo ratings yet

- Anthem Biosciences-R-21052018Document7 pagesAnthem Biosciences-R-21052018swarnaNo ratings yet

- IOL Chemicals and Pharmaceuticals Limited-07-07-2020Document4 pagesIOL Chemicals and Pharmaceuticals Limited-07-07-2020Jeet SinghNo ratings yet

- Shaily Engineering Plastics Limited-09-25-2019Document4 pagesShaily Engineering Plastics Limited-09-25-2019Ashutosh Gupta100% (1)

- Press Release RACL Geartech LTDDocument4 pagesPress Release RACL Geartech LTDSourav DuttaNo ratings yet

- Arya Steels Rolling (India) LimiteDocument4 pagesArya Steels Rolling (India) LimiteData CentrumNo ratings yet

- Prayag Polymers Private LimitedDocument4 pagesPrayag Polymers Private Limitednandinimishra6168No ratings yet

- Shyam Metalics and Energy Limited-12-17-2020Document7 pagesShyam Metalics and Energy Limited-12-17-2020Parth PatelNo ratings yet

- Hyundai Steel India - R - 08062018Document7 pagesHyundai Steel India - R - 08062018Andrew BruceNo ratings yet

- Ajax Fiori-R-07092017Document7 pagesAjax Fiori-R-07092017parimal.rodeNo ratings yet

- Shri Balaji Rollings Private LimDocument4 pagesShri Balaji Rollings Private LimData CentrumNo ratings yet

- Kellton Tech Solutions R 28092018Document7 pagesKellton Tech Solutions R 28092018Suresh Kumar RaiNo ratings yet

- IOL Chemicals and Pharmaceuticals Limited-07!02!2019Document4 pagesIOL Chemicals and Pharmaceuticals Limited-07!02!2019Technical dostNo ratings yet

- Tarsons Products LimitedDocument5 pagesTarsons Products LimitedujjwalgoldNo ratings yet

- Indotech Transformers LimitedDocument7 pagesIndotech Transformers Limitedpiyush.kundraNo ratings yet

- Press Release Mehul Construction Company Private Limited: Details of Instruments/facilities in Annexure-1Document5 pagesPress Release Mehul Construction Company Private Limited: Details of Instruments/facilities in Annexure-1tejasNo ratings yet

- Press Release Adani Agri Logistics (Harda) LimitedDocument5 pagesPress Release Adani Agri Logistics (Harda) Limitedsurprise MFNo ratings yet

- Radico Khaitan LimitedDocument6 pagesRadico Khaitan LimitedHarminder Singh BajwaNo ratings yet

- Rane Engine Valve Limited: Summary of Rated Instruments Instrument Rated Amount (Rs. Crore) Rating ActionDocument7 pagesRane Engine Valve Limited: Summary of Rated Instruments Instrument Rated Amount (Rs. Crore) Rating ActiontomNo ratings yet

- Maithan Alloys LimitedDocument6 pagesMaithan Alloys Limiteddrkashish1989No ratings yet

- Press Release Om Logistics Limited: Details of Instruments/facilities in Annexure-1Document6 pagesPress Release Om Logistics Limited: Details of Instruments/facilities in Annexure-1Sinius InfracomNo ratings yet

- Ultramarine & Pigments LTD: Summary of Rated InstrumentsDocument7 pagesUltramarine & Pigments LTD: Summary of Rated Instrumentsjanmejay26No ratings yet

- Rockman Industries Limited: Summary of Rated Instruments Instrument Rated Amount (Rs. Crore) Rating ActionDocument7 pagesRockman Industries Limited: Summary of Rated Instruments Instrument Rated Amount (Rs. Crore) Rating ActionVirender RawatNo ratings yet

- Rating Definitions - 19 July 2018Document4 pagesRating Definitions - 19 July 2018SushantNo ratings yet

- Tata Advanced Materials-R-28062019Document7 pagesTata Advanced Materials-R-28062019shoaib merchantNo ratings yet

- Parijat Industries-R-23032018Document7 pagesParijat Industries-R-23032018dear14us1984No ratings yet

- Thriveni Earthmovers Private LimitedDocument9 pagesThriveni Earthmovers Private Limitedarc14consultantNo ratings yet

- Press Release Tab India Granites Private LimitedDocument6 pagesPress Release Tab India Granites Private LimitedRavi BabuNo ratings yet

- T V Sundram Iyengar-R-16022018Document7 pagesT V Sundram Iyengar-R-16022018AGN YaNo ratings yet

- United Breweries Limited: Summary of Rated InstrumentsDocument8 pagesUnited Breweries Limited: Summary of Rated InstrumentsKaushikDasguptaNo ratings yet

- Mega Steel IndustriesDocument4 pagesMega Steel IndustrieshseckalpeshNo ratings yet

- Peekay Steel Castings Private Limited-01!09!2019Document5 pagesPeekay Steel Castings Private Limited-01!09!2019GAYATHRI S.RNo ratings yet

- Press Release Tarsons Products Private Limited: Details of Instruments/facilities in Annexure-1Document4 pagesPress Release Tarsons Products Private Limited: Details of Instruments/facilities in Annexure-1hussainNo ratings yet

- Super Screws Private Limited: Summary of Rated InstrumentsDocument7 pagesSuper Screws Private Limited: Summary of Rated InstrumentsAnonymous bdUhUNm7JNo ratings yet

- Pan Healthcare Private Limited (PHCPL) October 12, 2020Document5 pagesPan Healthcare Private Limited (PHCPL) October 12, 2020Sachin DhorajiyaNo ratings yet

- Happy ForgingsDocument7 pagesHappy ForgingsArshChandraNo ratings yet

- Thyssenkrupp Industries PDFDocument7 pagesThyssenkrupp Industries PDFBinoy MtNo ratings yet

- Ankit Pulps and Boards - R-25102018Document6 pagesAnkit Pulps and Boards - R-25102018HEMANT GURJARNo ratings yet

- Greentech Power Private Limited-01-06-2020 PDFDocument4 pagesGreentech Power Private Limited-01-06-2020 PDFMukesh TodiNo ratings yet

- Aachi Masala Foods-R-28092018 PDFDocument7 pagesAachi Masala Foods-R-28092018 PDFபாரத் அச்சுNo ratings yet

- SMC Power Generation LTD.: Summary of Rated InstrumentsDocument7 pagesSMC Power Generation LTD.: Summary of Rated Instrumentspiyush upadhyayNo ratings yet

- Epicenter Technologies Private - R - 11082020Document7 pagesEpicenter Technologies Private - R - 11082020Shawn BlazeNo ratings yet

- Research Paper - Rashmi Sponge Iron & Power Industries LTDDocument6 pagesResearch Paper - Rashmi Sponge Iron & Power Industries LTDSoumyakanti S. Samanta (Pgdm 09-11, Batch II)No ratings yet

- Oriental Rubber Industries Pvt. LTDDocument7 pagesOriental Rubber Industries Pvt. LTDPriya VijiNo ratings yet

- Press Release Deccan Industries: Positive FactorsDocument4 pagesPress Release Deccan Industries: Positive FactorsHARI HARANNo ratings yet

- STEER Engineering Private Limited: Summary of Rated InstrumentsDocument7 pagesSTEER Engineering Private Limited: Summary of Rated InstrumentsNarendranNo ratings yet

- Maxcure Nutravedics LTDDocument8 pagesMaxcure Nutravedics LTDcurryhome006No ratings yet

- PR ARCL Organics 31jan22Document7 pagesPR ARCL Organics 31jan22anady135344No ratings yet

- Audit Risk Alert: General Accounting and Auditing Developments 2018/19From EverandAudit Risk Alert: General Accounting and Auditing Developments 2018/19No ratings yet

- Question and Answer - 60Document31 pagesQuestion and Answer - 60acc-expertNo ratings yet

- Digital Subscriber Management and Consultancy Services Private Limited: AssignedDocument3 pagesDigital Subscriber Management and Consultancy Services Private Limited: AssignedDEVESH BHOLENo ratings yet

- DocPro-Due Diligence Checklist For Startup-Angel Investor Venture Capital Private EquityDocument13 pagesDocPro-Due Diligence Checklist For Startup-Angel Investor Venture Capital Private EquityLuis SantosNo ratings yet

- Garcia Unit3 AssessmentTopic1Document5 pagesGarcia Unit3 AssessmentTopic1jaychristiangarcia18No ratings yet

- Zaragosa V Marigold Financial LLC ComplaintDocument11 pagesZaragosa V Marigold Financial LLC ComplaintghostgripNo ratings yet

- Credit Management - ProjectDocument32 pagesCredit Management - ProjectWaqas TariqNo ratings yet

- Bank of AmericaDocument3 pagesBank of AmericaVinayak Arun SahiNo ratings yet

- Issuance Process of Commercial Paper CPsDocument3 pagesIssuance Process of Commercial Paper CPsmohakbhutaNo ratings yet

- DraftingDocument18 pagesDraftingpoonam sharma100% (1)

- Financial ManagementDocument16 pagesFinancial ManagementDell Delos SantosNo ratings yet

- Form A2 PDFDocument2 pagesForm A2 PDFkiran_nyusNo ratings yet

- Topic Outline For Public Accounting and BudgetingDocument8 pagesTopic Outline For Public Accounting and Budgetingsabel sardilla100% (1)

- Bank of PI v. de Coster - 47 Phil. 594Document12 pagesBank of PI v. de Coster - 47 Phil. 594Krista YntigNo ratings yet

- Analisis Industry PT Sentul City, TBKDocument19 pagesAnalisis Industry PT Sentul City, TBKRizky SaragihNo ratings yet

- 1stMT - 1styr - Law On Obligations and Contracts - VerifiedDocument27 pages1stMT - 1styr - Law On Obligations and Contracts - VerifiedKlaire SwswswsNo ratings yet

- Flat CargoDocument26 pagesFlat CargoSherry Yong PkTianNo ratings yet

- My Car Loan PDF WorksheetDocument5 pagesMy Car Loan PDF Worksheetapi-62785081No ratings yet

- Crop LoanDocument3 pagesCrop LoanRamana GNo ratings yet

- BA7026 Banking Financial Services ManagementDocument120 pagesBA7026 Banking Financial Services ManagementchandrasekharNo ratings yet

- Questions - RatiosDocument35 pagesQuestions - Ratios7rtqzp2fj8No ratings yet

- Economics of Money Banking and Financial Markets The Business School 5th Edition Mishkin Test BankDocument25 pagesEconomics of Money Banking and Financial Markets The Business School 5th Edition Mishkin Test Bankfreyahypatias7j100% (39)

- Assessment Cash Management Practices of Cooperative Bank of Oromia, Jimma BranchDocument19 pagesAssessment Cash Management Practices of Cooperative Bank of Oromia, Jimma BranchAshebirNo ratings yet

- Gillette Pakistan Limited: Analysis of Financial StatementDocument19 pagesGillette Pakistan Limited: Analysis of Financial StatementElhemJavedNo ratings yet

- Module 6 - Other Percentage TaxDocument7 pagesModule 6 - Other Percentage TaxPATATASNo ratings yet

- Time Value of MoneyDocument61 pagesTime Value of Moneyfatin atiqahNo ratings yet

- Narrative: by William Thomas ShermanDocument76 pagesNarrative: by William Thomas ShermanWm. Thomas ShermanNo ratings yet