Professional Documents

Culture Documents

To Help You Evaluate The Amount That You Would Get Under Each Option We Have Created A Pension Payout Estimate With 100% of Your Existing Maturity Value of '303140.01

To Help You Evaluate The Amount That You Would Get Under Each Option We Have Created A Pension Payout Estimate With 100% of Your Existing Maturity Value of '303140.01

Uploaded by

rangass70Copyright:

Available Formats

You might also like

- LifeInsur E311 2022 10 9EDDocument312 pagesLifeInsur E311 2022 10 9EDEldho GeorgeNo ratings yet

- EPSMDocument2 pagesEPSMDaniya BegNo ratings yet

- Max Life SAILDocument13 pagesMax Life SAILMohit ChaudhariNo ratings yet

- 7.xlsx 0Document144 pages7.xlsx 0KhenissiNo ratings yet

- Download ebook pdf of Основы Оптики Теория Изображения 2Nd Edition Суханов И И full chapterDocument69 pagesDownload ebook pdf of Основы Оптики Теория Изображения 2Nd Edition Суханов И И full chaptertoxxmrko100% (11)

- Inalca Jbs - Slaughtering: Total 34,479 40,815 36,263Document37 pagesInalca Jbs - Slaughtering: Total 34,479 40,815 36,263api-19989194No ratings yet

- Lottery ResultDocument2 pagesLottery ResultARJUNNo ratings yet

- HDFC Life - Click To Wealth: Inthispolicy, Theinvestmentriskininvestmentportfolio Isborneby ThepolicyholderDocument2 pagesHDFC Life - Click To Wealth: Inthispolicy, Theinvestmentriskininvestmentportfolio Isborneby Thepolicyholderpusparaj baraikNo ratings yet

- Squear RootDocument1 pageSquear Rootlakh.mohamed130No ratings yet

- TMP 64855Document2 pagesTMP 64855SaravananSrsChitturNo ratings yet

- Arpu-Mou Report of Kerala Prepaid Numbers For The Month: Total 1321705561Document2 pagesArpu-Mou Report of Kerala Prepaid Numbers For The Month: Total 1321705561Jeena JosephNo ratings yet

- tmp64757 PDFDocument2 pagestmp64757 PDFSaravananSrsChitturNo ratings yet

- Test Data Group - 13Document21 pagesTest Data Group - 13Dilshan JayasuriyaNo ratings yet

- Phone:-Director Office FAX WWW - Kerala.gov - in 0471-2305230 0471-2305193 0471-2301740Document2 pagesPhone:-Director Office FAX WWW - Kerala.gov - in 0471-2305230 0471-2305193 0471-2301740Rabin kennadiNo ratings yet

- Laptop Core I5 Harga 5 Jutaan SSDDocument2 pagesLaptop Core I5 Harga 5 Jutaan SSDdoddy hartadyNo ratings yet

- Acme A349-A360Document7 pagesAcme A349-A360Wim PeetersNo ratings yet

- Total RainfallDocument2 pagesTotal RainfallRaju RahmanNo ratings yet

- Leela Malayalam KDocument2 pagesLeela Malayalam Kvgn techNo ratings yet

- Santosh 5 LakhsDocument1 pageSantosh 5 LakhsCURIOUS MANNo ratings yet

- Phone:-Director Office FAX WWW - Kerala.gov - in 0471-2305230 0471-2305193 0471-2301740Document2 pagesPhone:-Director Office FAX WWW - Kerala.gov - in 0471-2305230 0471-2305193 0471-2301740Abimanyu ShenilNo ratings yet

- Phone:-Director Office FAX WWW - Kerala.gov - in 0471-2305230 0471-2305193 0471-2301740Document2 pagesPhone:-Director Office FAX WWW - Kerala.gov - in 0471-2305230 0471-2305193 0471-2301740Sreepathi DasNo ratings yet

- 31 D Technical Superintendent Civil EngineeringDocument1 page31 D Technical Superintendent Civil EngineeringShailendra Kumar SinghNo ratings yet

- AH4R Metrics3Document3 pagesAH4R Metrics3normanNo ratings yet

- Final Cometitive Analysis Jan-Dec'10Document21 pagesFinal Cometitive Analysis Jan-Dec'10Manu SharmaNo ratings yet

- Phone:-Director Office FAX WWW - Kerala.gov - in 0471-2305230 0471-2305193 0471-2301740Document2 pagesPhone:-Director Office FAX WWW - Kerala.gov - in 0471-2305230 0471-2305193 0471-2301740shinojmkNo ratings yet

- The National Pensions & Social Insurance Fund - Government SectorDocument4 pagesThe National Pensions & Social Insurance Fund - Government Sectorابو السعود محمدNo ratings yet

- Santosh 5jjjDocument1 pageSantosh 5jjjCURIOUS MANNo ratings yet

- Assignment - 1 - Team Alpha4Document24 pagesAssignment - 1 - Team Alpha4ZeusNo ratings yet

- TMP 64847Document2 pagesTMP 64847SaravananSrsChitturNo ratings yet

- Pet Cons 821ker Dcu Nus ADocument4 pagesPet Cons 821ker Dcu Nus AShrekNo ratings yet

- Phone:-Director Office FAX WWW - Kerala.gov - in 0471-2305230 0471-2305193 0471-2301740Document2 pagesPhone:-Director Office FAX WWW - Kerala.gov - in 0471-2305230 0471-2305193 0471-2301740Dominic SavioNo ratings yet

- Phone:-Director Office FAX WWW - Kerala.gov - in 0471-2305230 0471-2305193 0471-2301740Document2 pagesPhone:-Director Office FAX WWW - Kerala.gov - in 0471-2305230 0471-2305193 0471-2301740Rijo RobertNo ratings yet

- RRRTTT PDFDocument2 pagesRRRTTT PDFRijo RobertNo ratings yet

- Torque-Tension Relationship For ASTM A193 B7 Bolts and StudsDocument1 pageTorque-Tension Relationship For ASTM A193 B7 Bolts and StudsSiva Krishna ChaudharyNo ratings yet

- Akshaya LOTTERY NO. AK-394th DRAW Held On 08.05.2019Document2 pagesAkshaya LOTTERY NO. AK-394th DRAW Held On 08.05.2019ANOOP JOSEPHNo ratings yet

- $RZW2890Document1 page$RZW2890Mahesh KumarNo ratings yet

- $RZW2890Document1 page$RZW2890Mahesh KumarNo ratings yet

- Phone:-Director Office FAX WWW - Kerala.gov - in 0471-2305230 0471-2305193 0471-2301740Document2 pagesPhone:-Director Office FAX WWW - Kerala.gov - in 0471-2305230 0471-2305193 0471-2301740SaravananSrsChitturNo ratings yet

- Fsa-Canada-Cc-1999-5star 2003Document87 pagesFsa-Canada-Cc-1999-5star 2003Ivanovich RuizNo ratings yet

- tmp66065 PDFDocument2 pagestmp66065 PDFSaravananSrsChitturNo ratings yet

- tmp66837 PDFDocument2 pagestmp66837 PDFSajith MsivadasNo ratings yet

- Phone:-Director Office FAX WWW - Kerala.gov - in 0471-2305230 0471-2305193 0471-2301740Document2 pagesPhone:-Director Office FAX WWW - Kerala.gov - in 0471-2305230 0471-2305193 0471-2301740Sajith MsivadasNo ratings yet

- InventariosDocument7 pagesInventariosAndres LoperaNo ratings yet

- TMP 71785Document2 pagesTMP 71785ARJUNNo ratings yet

- TMP 64807Document2 pagesTMP 64807SaravananSrsChitturNo ratings yet

- Ahu SizesDocument2 pagesAhu Sizeskgsatish1979No ratings yet

- Abonos NuevosDocument109 pagesAbonos NuevosCamilo GallegoNo ratings yet

- Phone:-Director Office FAX WWW - Kerala.gov - in 0471-2305230 0471-2305193 0471-2301740Document2 pagesPhone:-Director Office FAX WWW - Kerala.gov - in 0471-2305230 0471-2305193 0471-2301740SaravananSrsChitturNo ratings yet

- Encuesta ComercioDocument1,155 pagesEncuesta Comerciomejiajuliana223No ratings yet

- Trade No Date Price Profit Points Total Profit Loss PointsDocument3 pagesTrade No Date Price Profit Points Total Profit Loss Pointsjayeshcsls11No ratings yet

- Sukanya Calculator-Monthly, Quarterly EtcDocument2 pagesSukanya Calculator-Monthly, Quarterly Etcasfdsf shagsdgNo ratings yet

- tmp64320 PDFDocument2 pagestmp64320 PDFSaravananSrsChitturNo ratings yet

- TMP 64320Document2 pagesTMP 64320SaravananSrsChitturNo ratings yet

- Phone:-Director Office FAX WWW - Kerala.gov - in 0471-2305230 0471-2305193 0471-2301740Document2 pagesPhone:-Director Office FAX WWW - Kerala.gov - in 0471-2305230 0471-2305193 0471-2301740SaravananSrsChitturNo ratings yet

- Retirement Facts 8: Credit For Unused Sick Leave Under The Civil Service Retirement SystemDocument14 pagesRetirement Facts 8: Credit For Unused Sick Leave Under The Civil Service Retirement SystemRuro LaudaNo ratings yet

- Phone:-Director Office FAX WWW - Kerala.gov - in 0471-2305230 0471-2305193 0471-2301740Document2 pagesPhone:-Director Office FAX WWW - Kerala.gov - in 0471-2305230 0471-2305193 0471-2301740sweet boy play boyNo ratings yet

- PBI A PA y PC Bolivia - CajacuriDocument13 pagesPBI A PA y PC Bolivia - CajacuriJanina Soriano MachacuayNo ratings yet

- Phone:-Director Office FAX WWW - Kerala.gov - in 0471-2305230 0471-2305193 0471-2301740Document2 pagesPhone:-Director Office FAX WWW - Kerala.gov - in 0471-2305230 0471-2305193 0471-2301740Suja RobertNo ratings yet

- Workbook Contents: U.S. Total Crude Oil and Products ImportsDocument35 pagesWorkbook Contents: U.S. Total Crude Oil and Products ImportspmellaNo ratings yet

- United States Census Figures Back to 1630From EverandUnited States Census Figures Back to 1630No ratings yet

- Match Annual 2013: From the Makers of the UK's Bestselling Football MagazineFrom EverandMatch Annual 2013: From the Makers of the UK's Bestselling Football MagazineNo ratings yet

- Faq Hire Purchase CarloanDocument7 pagesFaq Hire Purchase CarloanIkhwan MohamadNo ratings yet

- "NOW" Downpayment Assistance (DPA) ProgramDocument2 pages"NOW" Downpayment Assistance (DPA) Programapi-26011493No ratings yet

- Net Pay $2,269.21 Pay DetailsDocument1 pageNet Pay $2,269.21 Pay DetailsSimonNo ratings yet

- Problem Exercise #1Document9 pagesProblem Exercise #1Janice DuenesNo ratings yet

- e-StatementBRImo 737601007180538 Sep2023 20231003 140442Document5 pagese-StatementBRImo 737601007180538 Sep2023 20231003 140442jonibinrazwiNo ratings yet

- Grade Sheet - October 2015 GraduatingDocument19 pagesGrade Sheet - October 2015 GraduatingEppie SeverinoNo ratings yet

- PFM15e IM CH05Document33 pagesPFM15e IM CH05Daniel HakimNo ratings yet

- Income Tax Calculator 2023-24 v08 02Document6 pagesIncome Tax Calculator 2023-24 v08 02syedfurkhan41No ratings yet

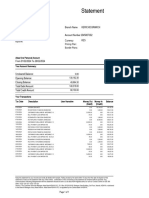

- GBP Statement: Beatriz Manchado FloresDocument2 pagesGBP Statement: Beatriz Manchado Floresmr.laravelNo ratings yet

- Tax Information SlipsDocument5 pagesTax Information SlipsTarynNo ratings yet

- E07h3salary 1Document6 pagesE07h3salary 1api-549665851No ratings yet

- Current Account Statement 12122022Document4 pagesCurrent Account Statement 12122022fq4fnjbhsqNo ratings yet

- Summary of Account Activity Payment Information: Protecting What Matters MostDocument4 pagesSummary of Account Activity Payment Information: Protecting What Matters MostJames BergmanNo ratings yet

- Itr Ack Fy 2022-23Document1 pageItr Ack Fy 2022-23info.acfintaxNo ratings yet

- Statement 21068481 EUR 2023-01-31 2023-03-02Document8 pagesStatement 21068481 EUR 2023-01-31 2023-03-02bradleystephaneNo ratings yet

- Chapter1 SynthesisDocument16 pagesChapter1 SynthesisPrincess Engreso100% (2)

- Provisional Certificate H402HHL0713483Document1 pageProvisional Certificate H402HHL0713483sivavm4No ratings yet

- Customer Perception Towards Home Loan WiDocument18 pagesCustomer Perception Towards Home Loan WiPradeepNo ratings yet

- Deed of Simple Mortgage Deed: Mr. - , Son of Mr. - , Aged About - YearsDocument5 pagesDeed of Simple Mortgage Deed: Mr. - , Son of Mr. - , Aged About - YearsJai GaneshNo ratings yet

- Absa - Statement BwinaDocument1 pageAbsa - Statement BwinaAllan NgetichNo ratings yet

- FT - CCT - (SG9) (AP) (FINAL) (v.2) (PDF) (FM CYip) 18.10.23Document3 pagesFT - CCT - (SG9) (AP) (FINAL) (v.2) (PDF) (FM CYip) 18.10.23jshfjksNo ratings yet

- FullStmt 1673361432885 4230166313357 MUHAMMADRAHIL786Document5 pagesFullStmt 1673361432885 4230166313357 MUHAMMADRAHIL786Nasir AhmedNo ratings yet

- Central Philippine University College of Law Midterm Examinations Atty. Llslgarcia - September 14, 2019Document3 pagesCentral Philippine University College of Law Midterm Examinations Atty. Llslgarcia - September 14, 2019Jean Jamailah TomugdanNo ratings yet

- TractorexcesscreditDocument2 pagesTractorexcesscreditash209606No ratings yet

- Compound Interest TableDocument6 pagesCompound Interest TablespmzNo ratings yet

- Personal Financial Planning: Presented byDocument11 pagesPersonal Financial Planning: Presented byNeha Sathaye100% (1)

- World Savings Bank REMIC 12 PSADocument88 pagesWorld Savings Bank REMIC 12 PSAmtgfixerNo ratings yet

- Products: Product List Updated As On 29-Oct-21Document5 pagesProducts: Product List Updated As On 29-Oct-21KARTHIGEYAN.RNo ratings yet

- Julia King Credit ScoreDocument54 pagesJulia King Credit ScoreGregory SMithNo ratings yet

To Help You Evaluate The Amount That You Would Get Under Each Option We Have Created A Pension Payout Estimate With 100% of Your Existing Maturity Value of '303140.01

To Help You Evaluate The Amount That You Would Get Under Each Option We Have Created A Pension Payout Estimate With 100% of Your Existing Maturity Value of '303140.01

Uploaded by

rangass70Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

To Help You Evaluate The Amount That You Would Get Under Each Option We Have Created A Pension Payout Estimate With 100% of Your Existing Maturity Value of '303140.01

To Help You Evaluate The Amount That You Would Get Under Each Option We Have Created A Pension Payout Estimate With 100% of Your Existing Maturity Value of '303140.01

Uploaded by

rangass70Copyright:

Available Formats

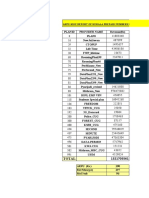

To help you evaluate the amount that you would get under each option we have created a pension

payout estimate

with 100% of your existing maturity value of `303140.01

19823 9748 4834 1602

18269 8984 4455 1477

19045 9366 4644 1540

18656 9175 4550 1508

19580 9630 4776 1583

19795 9737 4828 1601

19735 9707 4814 1596

19648 9666 4794 1589

18009 8835 4376 1449

Less than 12000 pa Less than 12000 pa Less than 12000 pa Less than 12000 pa

18125 8926 4429 1469

18120 8924 4428 1469

17313 8526 4231 1403

*Purchase Price: One time premium payable for availing pension.

Please note:

1. The pension amount mentioned above is calculated based on your current fund value after deduction of Goods & Services tax of 1.8%. It is calculated based on your age and spouse age

(if applicable) as on August 20, 2019. Tax rates are charged as per prevailing tax laws and may change from time to time.

2. After February 04, 2020 you can avail your maturity amount only as pension.

3. The pension amount that you will receive may vary depending on when you have opted for the pension option. If you opt for pension option before maturity of policy, rate applicable on

maturity will apply and after maturity of policy rate applicable in the same month will apply.

4. Pension payouts on your policy will begin after we receive all the requisite documents from you.

5. The pension amount that you will receive may vary depending on the pension rate applicable at the time you apply for pension.

6. You also have an option to purchase pension from another Insurance Company. This is known as the Open Market Option. If you wish to avail of this, please submit a "Open Market" option

form along with the requisite documents at any of our branches. ICICI Prudential Life Insurance will then draw the cheque in favor of the Life Insurance Company from whom you want to take

the pension.

7. As per the IRDAI guidelines, on the maturity of your policy, if your pension amounts to less than `12,000 a year, then your maturity amount will be refunded to your bank account.

*Purchase Price: One time premium payable for availing pension.

ICICI Prudential Life Insurance Company. IRDAI Regn No. 105. CIN:U66010MH2000PLC127837. Registered Address:- 1089 Appasaheb Marathe

Marg, Prabhadevi, Mumbai-400025. UIN: 105L032V01. Comp/doc/Nov/2017/0549.

You might also like

- LifeInsur E311 2022 10 9EDDocument312 pagesLifeInsur E311 2022 10 9EDEldho GeorgeNo ratings yet

- EPSMDocument2 pagesEPSMDaniya BegNo ratings yet

- Max Life SAILDocument13 pagesMax Life SAILMohit ChaudhariNo ratings yet

- 7.xlsx 0Document144 pages7.xlsx 0KhenissiNo ratings yet

- Download ebook pdf of Основы Оптики Теория Изображения 2Nd Edition Суханов И И full chapterDocument69 pagesDownload ebook pdf of Основы Оптики Теория Изображения 2Nd Edition Суханов И И full chaptertoxxmrko100% (11)

- Inalca Jbs - Slaughtering: Total 34,479 40,815 36,263Document37 pagesInalca Jbs - Slaughtering: Total 34,479 40,815 36,263api-19989194No ratings yet

- Lottery ResultDocument2 pagesLottery ResultARJUNNo ratings yet

- HDFC Life - Click To Wealth: Inthispolicy, Theinvestmentriskininvestmentportfolio Isborneby ThepolicyholderDocument2 pagesHDFC Life - Click To Wealth: Inthispolicy, Theinvestmentriskininvestmentportfolio Isborneby Thepolicyholderpusparaj baraikNo ratings yet

- Squear RootDocument1 pageSquear Rootlakh.mohamed130No ratings yet

- TMP 64855Document2 pagesTMP 64855SaravananSrsChitturNo ratings yet

- Arpu-Mou Report of Kerala Prepaid Numbers For The Month: Total 1321705561Document2 pagesArpu-Mou Report of Kerala Prepaid Numbers For The Month: Total 1321705561Jeena JosephNo ratings yet

- tmp64757 PDFDocument2 pagestmp64757 PDFSaravananSrsChitturNo ratings yet

- Test Data Group - 13Document21 pagesTest Data Group - 13Dilshan JayasuriyaNo ratings yet

- Phone:-Director Office FAX WWW - Kerala.gov - in 0471-2305230 0471-2305193 0471-2301740Document2 pagesPhone:-Director Office FAX WWW - Kerala.gov - in 0471-2305230 0471-2305193 0471-2301740Rabin kennadiNo ratings yet

- Laptop Core I5 Harga 5 Jutaan SSDDocument2 pagesLaptop Core I5 Harga 5 Jutaan SSDdoddy hartadyNo ratings yet

- Acme A349-A360Document7 pagesAcme A349-A360Wim PeetersNo ratings yet

- Total RainfallDocument2 pagesTotal RainfallRaju RahmanNo ratings yet

- Leela Malayalam KDocument2 pagesLeela Malayalam Kvgn techNo ratings yet

- Santosh 5 LakhsDocument1 pageSantosh 5 LakhsCURIOUS MANNo ratings yet

- Phone:-Director Office FAX WWW - Kerala.gov - in 0471-2305230 0471-2305193 0471-2301740Document2 pagesPhone:-Director Office FAX WWW - Kerala.gov - in 0471-2305230 0471-2305193 0471-2301740Abimanyu ShenilNo ratings yet

- Phone:-Director Office FAX WWW - Kerala.gov - in 0471-2305230 0471-2305193 0471-2301740Document2 pagesPhone:-Director Office FAX WWW - Kerala.gov - in 0471-2305230 0471-2305193 0471-2301740Sreepathi DasNo ratings yet

- 31 D Technical Superintendent Civil EngineeringDocument1 page31 D Technical Superintendent Civil EngineeringShailendra Kumar SinghNo ratings yet

- AH4R Metrics3Document3 pagesAH4R Metrics3normanNo ratings yet

- Final Cometitive Analysis Jan-Dec'10Document21 pagesFinal Cometitive Analysis Jan-Dec'10Manu SharmaNo ratings yet

- Phone:-Director Office FAX WWW - Kerala.gov - in 0471-2305230 0471-2305193 0471-2301740Document2 pagesPhone:-Director Office FAX WWW - Kerala.gov - in 0471-2305230 0471-2305193 0471-2301740shinojmkNo ratings yet

- The National Pensions & Social Insurance Fund - Government SectorDocument4 pagesThe National Pensions & Social Insurance Fund - Government Sectorابو السعود محمدNo ratings yet

- Santosh 5jjjDocument1 pageSantosh 5jjjCURIOUS MANNo ratings yet

- Assignment - 1 - Team Alpha4Document24 pagesAssignment - 1 - Team Alpha4ZeusNo ratings yet

- TMP 64847Document2 pagesTMP 64847SaravananSrsChitturNo ratings yet

- Pet Cons 821ker Dcu Nus ADocument4 pagesPet Cons 821ker Dcu Nus AShrekNo ratings yet

- Phone:-Director Office FAX WWW - Kerala.gov - in 0471-2305230 0471-2305193 0471-2301740Document2 pagesPhone:-Director Office FAX WWW - Kerala.gov - in 0471-2305230 0471-2305193 0471-2301740Dominic SavioNo ratings yet

- Phone:-Director Office FAX WWW - Kerala.gov - in 0471-2305230 0471-2305193 0471-2301740Document2 pagesPhone:-Director Office FAX WWW - Kerala.gov - in 0471-2305230 0471-2305193 0471-2301740Rijo RobertNo ratings yet

- RRRTTT PDFDocument2 pagesRRRTTT PDFRijo RobertNo ratings yet

- Torque-Tension Relationship For ASTM A193 B7 Bolts and StudsDocument1 pageTorque-Tension Relationship For ASTM A193 B7 Bolts and StudsSiva Krishna ChaudharyNo ratings yet

- Akshaya LOTTERY NO. AK-394th DRAW Held On 08.05.2019Document2 pagesAkshaya LOTTERY NO. AK-394th DRAW Held On 08.05.2019ANOOP JOSEPHNo ratings yet

- $RZW2890Document1 page$RZW2890Mahesh KumarNo ratings yet

- $RZW2890Document1 page$RZW2890Mahesh KumarNo ratings yet

- Phone:-Director Office FAX WWW - Kerala.gov - in 0471-2305230 0471-2305193 0471-2301740Document2 pagesPhone:-Director Office FAX WWW - Kerala.gov - in 0471-2305230 0471-2305193 0471-2301740SaravananSrsChitturNo ratings yet

- Fsa-Canada-Cc-1999-5star 2003Document87 pagesFsa-Canada-Cc-1999-5star 2003Ivanovich RuizNo ratings yet

- tmp66065 PDFDocument2 pagestmp66065 PDFSaravananSrsChitturNo ratings yet

- tmp66837 PDFDocument2 pagestmp66837 PDFSajith MsivadasNo ratings yet

- Phone:-Director Office FAX WWW - Kerala.gov - in 0471-2305230 0471-2305193 0471-2301740Document2 pagesPhone:-Director Office FAX WWW - Kerala.gov - in 0471-2305230 0471-2305193 0471-2301740Sajith MsivadasNo ratings yet

- InventariosDocument7 pagesInventariosAndres LoperaNo ratings yet

- TMP 71785Document2 pagesTMP 71785ARJUNNo ratings yet

- TMP 64807Document2 pagesTMP 64807SaravananSrsChitturNo ratings yet

- Ahu SizesDocument2 pagesAhu Sizeskgsatish1979No ratings yet

- Abonos NuevosDocument109 pagesAbonos NuevosCamilo GallegoNo ratings yet

- Phone:-Director Office FAX WWW - Kerala.gov - in 0471-2305230 0471-2305193 0471-2301740Document2 pagesPhone:-Director Office FAX WWW - Kerala.gov - in 0471-2305230 0471-2305193 0471-2301740SaravananSrsChitturNo ratings yet

- Encuesta ComercioDocument1,155 pagesEncuesta Comerciomejiajuliana223No ratings yet

- Trade No Date Price Profit Points Total Profit Loss PointsDocument3 pagesTrade No Date Price Profit Points Total Profit Loss Pointsjayeshcsls11No ratings yet

- Sukanya Calculator-Monthly, Quarterly EtcDocument2 pagesSukanya Calculator-Monthly, Quarterly Etcasfdsf shagsdgNo ratings yet

- tmp64320 PDFDocument2 pagestmp64320 PDFSaravananSrsChitturNo ratings yet

- TMP 64320Document2 pagesTMP 64320SaravananSrsChitturNo ratings yet

- Phone:-Director Office FAX WWW - Kerala.gov - in 0471-2305230 0471-2305193 0471-2301740Document2 pagesPhone:-Director Office FAX WWW - Kerala.gov - in 0471-2305230 0471-2305193 0471-2301740SaravananSrsChitturNo ratings yet

- Retirement Facts 8: Credit For Unused Sick Leave Under The Civil Service Retirement SystemDocument14 pagesRetirement Facts 8: Credit For Unused Sick Leave Under The Civil Service Retirement SystemRuro LaudaNo ratings yet

- Phone:-Director Office FAX WWW - Kerala.gov - in 0471-2305230 0471-2305193 0471-2301740Document2 pagesPhone:-Director Office FAX WWW - Kerala.gov - in 0471-2305230 0471-2305193 0471-2301740sweet boy play boyNo ratings yet

- PBI A PA y PC Bolivia - CajacuriDocument13 pagesPBI A PA y PC Bolivia - CajacuriJanina Soriano MachacuayNo ratings yet

- Phone:-Director Office FAX WWW - Kerala.gov - in 0471-2305230 0471-2305193 0471-2301740Document2 pagesPhone:-Director Office FAX WWW - Kerala.gov - in 0471-2305230 0471-2305193 0471-2301740Suja RobertNo ratings yet

- Workbook Contents: U.S. Total Crude Oil and Products ImportsDocument35 pagesWorkbook Contents: U.S. Total Crude Oil and Products ImportspmellaNo ratings yet

- United States Census Figures Back to 1630From EverandUnited States Census Figures Back to 1630No ratings yet

- Match Annual 2013: From the Makers of the UK's Bestselling Football MagazineFrom EverandMatch Annual 2013: From the Makers of the UK's Bestselling Football MagazineNo ratings yet

- Faq Hire Purchase CarloanDocument7 pagesFaq Hire Purchase CarloanIkhwan MohamadNo ratings yet

- "NOW" Downpayment Assistance (DPA) ProgramDocument2 pages"NOW" Downpayment Assistance (DPA) Programapi-26011493No ratings yet

- Net Pay $2,269.21 Pay DetailsDocument1 pageNet Pay $2,269.21 Pay DetailsSimonNo ratings yet

- Problem Exercise #1Document9 pagesProblem Exercise #1Janice DuenesNo ratings yet

- e-StatementBRImo 737601007180538 Sep2023 20231003 140442Document5 pagese-StatementBRImo 737601007180538 Sep2023 20231003 140442jonibinrazwiNo ratings yet

- Grade Sheet - October 2015 GraduatingDocument19 pagesGrade Sheet - October 2015 GraduatingEppie SeverinoNo ratings yet

- PFM15e IM CH05Document33 pagesPFM15e IM CH05Daniel HakimNo ratings yet

- Income Tax Calculator 2023-24 v08 02Document6 pagesIncome Tax Calculator 2023-24 v08 02syedfurkhan41No ratings yet

- GBP Statement: Beatriz Manchado FloresDocument2 pagesGBP Statement: Beatriz Manchado Floresmr.laravelNo ratings yet

- Tax Information SlipsDocument5 pagesTax Information SlipsTarynNo ratings yet

- E07h3salary 1Document6 pagesE07h3salary 1api-549665851No ratings yet

- Current Account Statement 12122022Document4 pagesCurrent Account Statement 12122022fq4fnjbhsqNo ratings yet

- Summary of Account Activity Payment Information: Protecting What Matters MostDocument4 pagesSummary of Account Activity Payment Information: Protecting What Matters MostJames BergmanNo ratings yet

- Itr Ack Fy 2022-23Document1 pageItr Ack Fy 2022-23info.acfintaxNo ratings yet

- Statement 21068481 EUR 2023-01-31 2023-03-02Document8 pagesStatement 21068481 EUR 2023-01-31 2023-03-02bradleystephaneNo ratings yet

- Chapter1 SynthesisDocument16 pagesChapter1 SynthesisPrincess Engreso100% (2)

- Provisional Certificate H402HHL0713483Document1 pageProvisional Certificate H402HHL0713483sivavm4No ratings yet

- Customer Perception Towards Home Loan WiDocument18 pagesCustomer Perception Towards Home Loan WiPradeepNo ratings yet

- Deed of Simple Mortgage Deed: Mr. - , Son of Mr. - , Aged About - YearsDocument5 pagesDeed of Simple Mortgage Deed: Mr. - , Son of Mr. - , Aged About - YearsJai GaneshNo ratings yet

- Absa - Statement BwinaDocument1 pageAbsa - Statement BwinaAllan NgetichNo ratings yet

- FT - CCT - (SG9) (AP) (FINAL) (v.2) (PDF) (FM CYip) 18.10.23Document3 pagesFT - CCT - (SG9) (AP) (FINAL) (v.2) (PDF) (FM CYip) 18.10.23jshfjksNo ratings yet

- FullStmt 1673361432885 4230166313357 MUHAMMADRAHIL786Document5 pagesFullStmt 1673361432885 4230166313357 MUHAMMADRAHIL786Nasir AhmedNo ratings yet

- Central Philippine University College of Law Midterm Examinations Atty. Llslgarcia - September 14, 2019Document3 pagesCentral Philippine University College of Law Midterm Examinations Atty. Llslgarcia - September 14, 2019Jean Jamailah TomugdanNo ratings yet

- TractorexcesscreditDocument2 pagesTractorexcesscreditash209606No ratings yet

- Compound Interest TableDocument6 pagesCompound Interest TablespmzNo ratings yet

- Personal Financial Planning: Presented byDocument11 pagesPersonal Financial Planning: Presented byNeha Sathaye100% (1)

- World Savings Bank REMIC 12 PSADocument88 pagesWorld Savings Bank REMIC 12 PSAmtgfixerNo ratings yet

- Products: Product List Updated As On 29-Oct-21Document5 pagesProducts: Product List Updated As On 29-Oct-21KARTHIGEYAN.RNo ratings yet

- Julia King Credit ScoreDocument54 pagesJulia King Credit ScoreGregory SMithNo ratings yet