Professional Documents

Culture Documents

Ariel Simple Turtle Robot

Ariel Simple Turtle Robot

Uploaded by

Rodrigo AsthCopyright:

Available Formats

You might also like

- Question 1 (1 Point)Document44 pagesQuestion 1 (1 Point)milanchabhadiya288No ratings yet

- Developed by S.B.T. & Mark Larsen: 0.table of ContentsDocument16 pagesDeveloped by S.B.T. & Mark Larsen: 0.table of ContentsJustine SalimNo ratings yet

- High-Frequency Trading - Reaching The LimitsDocument5 pagesHigh-Frequency Trading - Reaching The LimitsBartoszSowulNo ratings yet

- Backtesting and Trading JournalDocument5 pagesBacktesting and Trading JournalLynnhNo ratings yet

- 952BDocument276 pages952BMohd. Osama100% (1)

- 4X Pip Snager Trading SystemsDocument69 pages4X Pip Snager Trading SystemstonmdnNo ratings yet

- Form To Correct Errors in CGHS CardDocument1 pageForm To Correct Errors in CGHS CardsachinkurhekarNo ratings yet

- NationDocument88 pagesNationJustin Luu0% (1)

- How To Conduct An Effective Trading Session Review: by Lance BeggsDocument13 pagesHow To Conduct An Effective Trading Session Review: by Lance BeggsNishantNo ratings yet

- Trading Systems IndicatorsDocument3 pagesTrading Systems IndicatorsKam MusNo ratings yet

- Eu Rome Strategy Guide PDFDocument2 pagesEu Rome Strategy Guide PDFScottNo ratings yet

- TradeBuilder - Classic Edition MANUALDocument19 pagesTradeBuilder - Classic Edition MANUALGabriel BlakeNo ratings yet

- FibnocciDocument30 pagesFibnoccipraveenrajNo ratings yet

- Larry Connors - Connors On Advanced Trading Strategies PDFDocument111 pagesLarry Connors - Connors On Advanced Trading Strategies PDFDogi DuduNo ratings yet

- Jacko Trading StyleDocument25 pagesJacko Trading StyleMohammed NizamNo ratings yet

- Become A Market Maven Be Picky When Day Trading Dan Zanger Offers AdviceDocument6 pagesBecome A Market Maven Be Picky When Day Trading Dan Zanger Offers Advicequantum70No ratings yet

- Techinical AnalysisDocument14 pagesTechinical AnalysisCamille BagadiongNo ratings yet

- Andromeda About UsDocument2 pagesAndromeda About UsPratik ChhedaNo ratings yet

- Rogue Galaxy Official Strategy Guide PDFDocument5 pagesRogue Galaxy Official Strategy Guide PDFPriant DelongeNo ratings yet

- Et 3528w 3b1w903 PDFDocument2 pagesEt 3528w 3b1w903 PDFMarthaNo ratings yet

- Barbara Star - PresentationDocument51 pagesBarbara Star - PresentationKenneth Anderson100% (1)

- Profitability of Momentum Strategies An Evaluation of Alternative Explanations 2001Document23 pagesProfitability of Momentum Strategies An Evaluation of Alternative Explanations 2001profkaplanNo ratings yet

- Active Trading Online Manual 2012Document42 pagesActive Trading Online Manual 2012artus14No ratings yet

- Bollinger Bands - Using Volatility by Matthew ClaassenDocument5 pagesBollinger Bands - Using Volatility by Matthew ClaassenTradingTheEdgesNo ratings yet

- Live Market Seminar CurriculumDocument33 pagesLive Market Seminar CurriculumRui LopesNo ratings yet

- Bandy NAAIM PaperDocument30 pagesBandy NAAIM Paperkanteron6443No ratings yet

- Woodies CCI PDFDocument29 pagesWoodies CCI PDFRakesh MishraNo ratings yet

- Evidence Based Technical Analysis Download PDFDocument2 pagesEvidence Based Technical Analysis Download PDFTamara0% (1)

- Exit Strategies (Part 1)Document6 pagesExit Strategies (Part 1)pderby1No ratings yet

- Forex For BeginnersDocument18 pagesForex For Beginnersimzee25No ratings yet

- ForeignDocument5 pagesForeignkumar_eeeNo ratings yet

- Odin ManualDocument37 pagesOdin ManualChathura Jayashan100% (1)

- Bisnews Technical AnalysisDocument33 pagesBisnews Technical AnalysisWings SVNo ratings yet

- Trade BuilderDocument73 pagesTrade BuilderTony JoshNo ratings yet

- Manual - Forex Generator Version 7.x: Main WebsiteDocument116 pagesManual - Forex Generator Version 7.x: Main WebsiteangkiongbohNo ratings yet

- Kims RLCO Trading System DescriptionDocument21 pagesKims RLCO Trading System DescriptionMala DcruzNo ratings yet

- Mark Minervini (@markminervini) - Twitter6Document1 pageMark Minervini (@markminervini) - Twitter6LNo ratings yet

- The Matras Increasing Earnings ApproachDocument4 pagesThe Matras Increasing Earnings ApproachANIL1964No ratings yet

- Volume 29, Issue 3: Profitability of The On-Balance Volume IndicatorDocument8 pagesVolume 29, Issue 3: Profitability of The On-Balance Volume IndicatorRavikumar GandlaNo ratings yet

- Introducing Dinapoli On The Dollar/Yen: Chart 1 Dinapoli Macd PredictorDocument9 pagesIntroducing Dinapoli On The Dollar/Yen: Chart 1 Dinapoli Macd PredictorMohammed Sadhik100% (1)

- Evaluation of Systematic Trading Programs - 14-08-12Document42 pagesEvaluation of Systematic Trading Programs - 14-08-12Marcos MelloNo ratings yet

- DailyFX Top Trading Lessons 2021Document14 pagesDailyFX Top Trading Lessons 2021Fernando SNNo ratings yet

- The Winners and Losers of The Zero-Sum Game: The Origins of Trading Profits, Price Efficiency and Market LiquidityDocument34 pagesThe Winners and Losers of The Zero-Sum Game: The Origins of Trading Profits, Price Efficiency and Market LiquidityChiou Ying Chen100% (1)

- Linear Regression Slope: Sensitivity Test: Oxford Capital Strategies LTD: Trading Strategy: Commission & Slippage: $0Document8 pagesLinear Regression Slope: Sensitivity Test: Oxford Capital Strategies LTD: Trading Strategy: Commission & Slippage: $0Oxford Capital Strategies LtdNo ratings yet

- Powerinvesting: Trading Your Way To Financial FreedomDocument42 pagesPowerinvesting: Trading Your Way To Financial Freedomgold2013No ratings yet

- Bloomberg: C S L M - S G/BLP CDocument20 pagesBloomberg: C S L M - S G/BLP CvaibkalNo ratings yet

- Funded Trader Program 2020Document8 pagesFunded Trader Program 2020JonasDispersynNo ratings yet

- 5 Trading Strategies Using The Relative Vigor IndexDocument9 pages5 Trading Strategies Using The Relative Vigor IndexKouadio guy roger ADOUNo ratings yet

- Opening Bell: What Is Overbought Can Stay Overbought' - This Alternative Approach To The Stochastic Indicator Works!Document8 pagesOpening Bell: What Is Overbought Can Stay Overbought' - This Alternative Approach To The Stochastic Indicator Works!thunderdomeNo ratings yet

- JulianDocument4 pagesJulianBhavesh GelaniNo ratings yet

- Trade PlanDocument14 pagesTrade PlanMr DiNo ratings yet

- How To Setup A Multi-Monitor PC - StocksToTradeDocument11 pagesHow To Setup A Multi-Monitor PC - StocksToTradecsanchezptyNo ratings yet

- Srs Trend Rider Complete CourseDocument75 pagesSrs Trend Rider Complete CourseNilay Gajiwala100% (1)

- Computer Analysis of The Futures MarketDocument34 pagesComputer Analysis of The Futures Marketteclas71No ratings yet

- DT Trend FilterDocument3 pagesDT Trend FilteranudoraNo ratings yet

- Yukitoshi Higashino MftaDocument29 pagesYukitoshi Higashino MftaSeyyed Mohammad Hossein SherafatNo ratings yet

- Trading StrategiesDocument2 pagesTrading StrategiesAmar KukrejaNo ratings yet

- Lifespan Investing: Building the Best Portfolio for Every Stage of Your LifeFrom EverandLifespan Investing: Building the Best Portfolio for Every Stage of Your LifeNo ratings yet

- Inve$t & Grow: Different Forms of Investment Explained - A Beginner's GuideFrom EverandInve$t & Grow: Different Forms of Investment Explained - A Beginner's GuideNo ratings yet

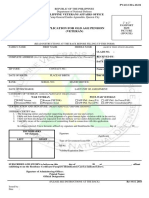

- Old Age Pension VeteranDocument2 pagesOld Age Pension VeteranLADY LYN SANTOSNo ratings yet

- Capital Budgeting Decisions: Solutions To QuestionsDocument61 pagesCapital Budgeting Decisions: Solutions To QuestionsBasanta K SahuNo ratings yet

- F Speaking Shadowing PDFDocument1 pageF Speaking Shadowing PDFGilber LazaroneNo ratings yet

- Deluxe Programmable Thermostat: Climate PerfectDocument12 pagesDeluxe Programmable Thermostat: Climate PerfectBrian TseNo ratings yet

- Investment ProgrammingDocument14 pagesInvestment ProgrammingDILG NagaNo ratings yet

- Hostel RulesDocument15 pagesHostel RulesalogpgNo ratings yet

- Depth-First Search: COMP171 Fall 2005Document27 pagesDepth-First Search: COMP171 Fall 2005Praveen KumarNo ratings yet

- Automotive Radar - MATLAB & SimulinkDocument3 pagesAutomotive Radar - MATLAB & SimulinkAdfgatLjsdcolqwdhjpNo ratings yet

- Windows 10 Activator TXT FileDocument3 pagesWindows 10 Activator TXT FileSahir RegenNo ratings yet

- Piping Material Specification - Tsmto 99fu M 99 Pt0 001 Rev0!3!65Document64 pagesPiping Material Specification - Tsmto 99fu M 99 Pt0 001 Rev0!3!65epbamdad100% (1)

- Honda DAXDocument12 pagesHonda DAXFranco CondeNo ratings yet

- Lexical and Syntax Analysis: TopicsDocument5 pagesLexical and Syntax Analysis: TopicsReshma PiseNo ratings yet

- UnivibeDocument1 pageUnivibePablo EspinosaNo ratings yet

- Methods of Teaching (Handouts)Document3 pagesMethods of Teaching (Handouts)Даша ГалкаNo ratings yet

- CS Dec 2018-Jan 2019 PDFDocument78 pagesCS Dec 2018-Jan 2019 PDFPavanNo ratings yet

- Portfolio Analyer - ConfigDocument23 pagesPortfolio Analyer - Configvikaditya100% (1)

- 2nd Year Past Keys Hafiz BilalDocument33 pages2nd Year Past Keys Hafiz Bilalsibtainm001No ratings yet

- Acs42 Config GuideDocument214 pagesAcs42 Config GuideOtia ObaNo ratings yet

- Creed Corporation Is Considering Manufacturing A New Engine Designated As PDFDocument2 pagesCreed Corporation Is Considering Manufacturing A New Engine Designated As PDFDoreenNo ratings yet

- Nihms 1713249Document13 pagesNihms 1713249Achilles Fkundana18No ratings yet

- Rina Floating Docks Res7-Eng2022Document28 pagesRina Floating Docks Res7-Eng2022Osman ÖzenNo ratings yet

- Peter Wicke - Rock Music Culture Aesthetic and SociologyDocument121 pagesPeter Wicke - Rock Music Culture Aesthetic and SociologyFelipeNo ratings yet

- Alcohols Ethers and Phenol-02 Solved ProblemsDocument13 pagesAlcohols Ethers and Phenol-02 Solved ProblemsRaju SinghNo ratings yet

- Prototype TutorialDocument451 pagesPrototype TutorialMariela DemarkNo ratings yet

- ELEN 3018 - Macro Test - 2013 - ADocument1 pageELEN 3018 - Macro Test - 2013 - AsirlordbookwormNo ratings yet

- Added by Guest, Last Edited by Guest On Jun 12, 2007 Show CommentDocument5 pagesAdded by Guest, Last Edited by Guest On Jun 12, 2007 Show CommentNarendrareddy RamireddyNo ratings yet

- Character Education With A PlusDocument5 pagesCharacter Education With A PlusAzis Eko YuliantoNo ratings yet

Ariel Simple Turtle Robot

Ariel Simple Turtle Robot

Uploaded by

Rodrigo AsthOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ariel Simple Turtle Robot

Ariel Simple Turtle Robot

Uploaded by

Rodrigo AsthCopyright:

Available Formats

Ariel – Simple Turtle Robot

The turtle trading strategy is a famous trend-following strategy by legendary traders Richard Dennis

and William Eckhardt in the 1980s.

Richard felt anyone could learn how to trade if taught properly. His partner, William Eckhardt,

disagreed, and their debate resulted in an experiment with a group of would-be apprentice traders

recruited during 1983 and 1984 for two trading “classes.” That “Turtle” name? It was simply the

nickname Dennis used for his students.

Starting with less than 10million, the group made over 150million in 5 years. (There is no official

figure but this is based on estimates by Michael Covel in his book “The Complete Turtle Trader”.)

Check out the amazing trading experiment: http://turtletrader.com/it/

Check out the trading strategy that was taught:

http://bigpicture.typepad.com/comments/files/turtlerules.pdf

Ariel is a simplified version of the Turtle Strategy. The full Turtle Robot will in included in the later

sections.

Trend Following

The turtle trading strategy is a trend following strategy. This means that the edge comes from

capturing and riding long term trends.

Trading Rules

ARIEL ENTRY RULES:

• Long: When closing price is equal to or crosses Donchian(20) upper bound from the

bottom.

• Short: When closing price is equal to or crosses Donchian(20) lower bound from the top.

ARIEL EXIT RULES:

• Profit-Taking Exit 1: Exit the long trade when closing price is equal to or crosses

Donchian(20) lower bound from the top.

• Profit-Taking Exit 1: Exit the short trade when closing price is equal to or crosses

Donchian(20) upper bound from the bottom.

• Stop Loss Exit: Exit trade when closing price travelled 1 ATR in the adverse direction.

ARIEL POSITION SIZING RULE:

• 1% of Capital risked per trade

NOTE:

• Parameter values are arbitrary.

• Avoid using fixed price values in Entry and Exit rules. We use Donchian and ATR so that

our robot adapts to the volatility of the market.

• You need to download and compile the custom indicator: Donchian Channels.mq4. Place

the indicator in the indicator folder and compile it. Learn more about it here:

http://en.wikipedia.org/wiki/Donchian_channel

• Equity curve has long periods of drawdowns and occasional large upward spikes

Download codes for entire Bonus Chapter: https://github.com/Lucas170/Bonus-Chapter

Works best on:

• Trending and low volatility conditions. High Volatility is extremely detrimental to the

robot. If there exist high volatility, increase the Donchian periods and ATR StopLoss

multiple to allow the robot to absorb the noise.

• Mid-High timeframe - 30m and larger.

Source: Asirikuy.com

You might also like

- Question 1 (1 Point)Document44 pagesQuestion 1 (1 Point)milanchabhadiya288No ratings yet

- Developed by S.B.T. & Mark Larsen: 0.table of ContentsDocument16 pagesDeveloped by S.B.T. & Mark Larsen: 0.table of ContentsJustine SalimNo ratings yet

- High-Frequency Trading - Reaching The LimitsDocument5 pagesHigh-Frequency Trading - Reaching The LimitsBartoszSowulNo ratings yet

- Backtesting and Trading JournalDocument5 pagesBacktesting and Trading JournalLynnhNo ratings yet

- 952BDocument276 pages952BMohd. Osama100% (1)

- 4X Pip Snager Trading SystemsDocument69 pages4X Pip Snager Trading SystemstonmdnNo ratings yet

- Form To Correct Errors in CGHS CardDocument1 pageForm To Correct Errors in CGHS CardsachinkurhekarNo ratings yet

- NationDocument88 pagesNationJustin Luu0% (1)

- How To Conduct An Effective Trading Session Review: by Lance BeggsDocument13 pagesHow To Conduct An Effective Trading Session Review: by Lance BeggsNishantNo ratings yet

- Trading Systems IndicatorsDocument3 pagesTrading Systems IndicatorsKam MusNo ratings yet

- Eu Rome Strategy Guide PDFDocument2 pagesEu Rome Strategy Guide PDFScottNo ratings yet

- TradeBuilder - Classic Edition MANUALDocument19 pagesTradeBuilder - Classic Edition MANUALGabriel BlakeNo ratings yet

- FibnocciDocument30 pagesFibnoccipraveenrajNo ratings yet

- Larry Connors - Connors On Advanced Trading Strategies PDFDocument111 pagesLarry Connors - Connors On Advanced Trading Strategies PDFDogi DuduNo ratings yet

- Jacko Trading StyleDocument25 pagesJacko Trading StyleMohammed NizamNo ratings yet

- Become A Market Maven Be Picky When Day Trading Dan Zanger Offers AdviceDocument6 pagesBecome A Market Maven Be Picky When Day Trading Dan Zanger Offers Advicequantum70No ratings yet

- Techinical AnalysisDocument14 pagesTechinical AnalysisCamille BagadiongNo ratings yet

- Andromeda About UsDocument2 pagesAndromeda About UsPratik ChhedaNo ratings yet

- Rogue Galaxy Official Strategy Guide PDFDocument5 pagesRogue Galaxy Official Strategy Guide PDFPriant DelongeNo ratings yet

- Et 3528w 3b1w903 PDFDocument2 pagesEt 3528w 3b1w903 PDFMarthaNo ratings yet

- Barbara Star - PresentationDocument51 pagesBarbara Star - PresentationKenneth Anderson100% (1)

- Profitability of Momentum Strategies An Evaluation of Alternative Explanations 2001Document23 pagesProfitability of Momentum Strategies An Evaluation of Alternative Explanations 2001profkaplanNo ratings yet

- Active Trading Online Manual 2012Document42 pagesActive Trading Online Manual 2012artus14No ratings yet

- Bollinger Bands - Using Volatility by Matthew ClaassenDocument5 pagesBollinger Bands - Using Volatility by Matthew ClaassenTradingTheEdgesNo ratings yet

- Live Market Seminar CurriculumDocument33 pagesLive Market Seminar CurriculumRui LopesNo ratings yet

- Bandy NAAIM PaperDocument30 pagesBandy NAAIM Paperkanteron6443No ratings yet

- Woodies CCI PDFDocument29 pagesWoodies CCI PDFRakesh MishraNo ratings yet

- Evidence Based Technical Analysis Download PDFDocument2 pagesEvidence Based Technical Analysis Download PDFTamara0% (1)

- Exit Strategies (Part 1)Document6 pagesExit Strategies (Part 1)pderby1No ratings yet

- Forex For BeginnersDocument18 pagesForex For Beginnersimzee25No ratings yet

- ForeignDocument5 pagesForeignkumar_eeeNo ratings yet

- Odin ManualDocument37 pagesOdin ManualChathura Jayashan100% (1)

- Bisnews Technical AnalysisDocument33 pagesBisnews Technical AnalysisWings SVNo ratings yet

- Trade BuilderDocument73 pagesTrade BuilderTony JoshNo ratings yet

- Manual - Forex Generator Version 7.x: Main WebsiteDocument116 pagesManual - Forex Generator Version 7.x: Main WebsiteangkiongbohNo ratings yet

- Kims RLCO Trading System DescriptionDocument21 pagesKims RLCO Trading System DescriptionMala DcruzNo ratings yet

- Mark Minervini (@markminervini) - Twitter6Document1 pageMark Minervini (@markminervini) - Twitter6LNo ratings yet

- The Matras Increasing Earnings ApproachDocument4 pagesThe Matras Increasing Earnings ApproachANIL1964No ratings yet

- Volume 29, Issue 3: Profitability of The On-Balance Volume IndicatorDocument8 pagesVolume 29, Issue 3: Profitability of The On-Balance Volume IndicatorRavikumar GandlaNo ratings yet

- Introducing Dinapoli On The Dollar/Yen: Chart 1 Dinapoli Macd PredictorDocument9 pagesIntroducing Dinapoli On The Dollar/Yen: Chart 1 Dinapoli Macd PredictorMohammed Sadhik100% (1)

- Evaluation of Systematic Trading Programs - 14-08-12Document42 pagesEvaluation of Systematic Trading Programs - 14-08-12Marcos MelloNo ratings yet

- DailyFX Top Trading Lessons 2021Document14 pagesDailyFX Top Trading Lessons 2021Fernando SNNo ratings yet

- The Winners and Losers of The Zero-Sum Game: The Origins of Trading Profits, Price Efficiency and Market LiquidityDocument34 pagesThe Winners and Losers of The Zero-Sum Game: The Origins of Trading Profits, Price Efficiency and Market LiquidityChiou Ying Chen100% (1)

- Linear Regression Slope: Sensitivity Test: Oxford Capital Strategies LTD: Trading Strategy: Commission & Slippage: $0Document8 pagesLinear Regression Slope: Sensitivity Test: Oxford Capital Strategies LTD: Trading Strategy: Commission & Slippage: $0Oxford Capital Strategies LtdNo ratings yet

- Powerinvesting: Trading Your Way To Financial FreedomDocument42 pagesPowerinvesting: Trading Your Way To Financial Freedomgold2013No ratings yet

- Bloomberg: C S L M - S G/BLP CDocument20 pagesBloomberg: C S L M - S G/BLP CvaibkalNo ratings yet

- Funded Trader Program 2020Document8 pagesFunded Trader Program 2020JonasDispersynNo ratings yet

- 5 Trading Strategies Using The Relative Vigor IndexDocument9 pages5 Trading Strategies Using The Relative Vigor IndexKouadio guy roger ADOUNo ratings yet

- Opening Bell: What Is Overbought Can Stay Overbought' - This Alternative Approach To The Stochastic Indicator Works!Document8 pagesOpening Bell: What Is Overbought Can Stay Overbought' - This Alternative Approach To The Stochastic Indicator Works!thunderdomeNo ratings yet

- JulianDocument4 pagesJulianBhavesh GelaniNo ratings yet

- Trade PlanDocument14 pagesTrade PlanMr DiNo ratings yet

- How To Setup A Multi-Monitor PC - StocksToTradeDocument11 pagesHow To Setup A Multi-Monitor PC - StocksToTradecsanchezptyNo ratings yet

- Srs Trend Rider Complete CourseDocument75 pagesSrs Trend Rider Complete CourseNilay Gajiwala100% (1)

- Computer Analysis of The Futures MarketDocument34 pagesComputer Analysis of The Futures Marketteclas71No ratings yet

- DT Trend FilterDocument3 pagesDT Trend FilteranudoraNo ratings yet

- Yukitoshi Higashino MftaDocument29 pagesYukitoshi Higashino MftaSeyyed Mohammad Hossein SherafatNo ratings yet

- Trading StrategiesDocument2 pagesTrading StrategiesAmar KukrejaNo ratings yet

- Lifespan Investing: Building the Best Portfolio for Every Stage of Your LifeFrom EverandLifespan Investing: Building the Best Portfolio for Every Stage of Your LifeNo ratings yet

- Inve$t & Grow: Different Forms of Investment Explained - A Beginner's GuideFrom EverandInve$t & Grow: Different Forms of Investment Explained - A Beginner's GuideNo ratings yet

- Old Age Pension VeteranDocument2 pagesOld Age Pension VeteranLADY LYN SANTOSNo ratings yet

- Capital Budgeting Decisions: Solutions To QuestionsDocument61 pagesCapital Budgeting Decisions: Solutions To QuestionsBasanta K SahuNo ratings yet

- F Speaking Shadowing PDFDocument1 pageF Speaking Shadowing PDFGilber LazaroneNo ratings yet

- Deluxe Programmable Thermostat: Climate PerfectDocument12 pagesDeluxe Programmable Thermostat: Climate PerfectBrian TseNo ratings yet

- Investment ProgrammingDocument14 pagesInvestment ProgrammingDILG NagaNo ratings yet

- Hostel RulesDocument15 pagesHostel RulesalogpgNo ratings yet

- Depth-First Search: COMP171 Fall 2005Document27 pagesDepth-First Search: COMP171 Fall 2005Praveen KumarNo ratings yet

- Automotive Radar - MATLAB & SimulinkDocument3 pagesAutomotive Radar - MATLAB & SimulinkAdfgatLjsdcolqwdhjpNo ratings yet

- Windows 10 Activator TXT FileDocument3 pagesWindows 10 Activator TXT FileSahir RegenNo ratings yet

- Piping Material Specification - Tsmto 99fu M 99 Pt0 001 Rev0!3!65Document64 pagesPiping Material Specification - Tsmto 99fu M 99 Pt0 001 Rev0!3!65epbamdad100% (1)

- Honda DAXDocument12 pagesHonda DAXFranco CondeNo ratings yet

- Lexical and Syntax Analysis: TopicsDocument5 pagesLexical and Syntax Analysis: TopicsReshma PiseNo ratings yet

- UnivibeDocument1 pageUnivibePablo EspinosaNo ratings yet

- Methods of Teaching (Handouts)Document3 pagesMethods of Teaching (Handouts)Даша ГалкаNo ratings yet

- CS Dec 2018-Jan 2019 PDFDocument78 pagesCS Dec 2018-Jan 2019 PDFPavanNo ratings yet

- Portfolio Analyer - ConfigDocument23 pagesPortfolio Analyer - Configvikaditya100% (1)

- 2nd Year Past Keys Hafiz BilalDocument33 pages2nd Year Past Keys Hafiz Bilalsibtainm001No ratings yet

- Acs42 Config GuideDocument214 pagesAcs42 Config GuideOtia ObaNo ratings yet

- Creed Corporation Is Considering Manufacturing A New Engine Designated As PDFDocument2 pagesCreed Corporation Is Considering Manufacturing A New Engine Designated As PDFDoreenNo ratings yet

- Nihms 1713249Document13 pagesNihms 1713249Achilles Fkundana18No ratings yet

- Rina Floating Docks Res7-Eng2022Document28 pagesRina Floating Docks Res7-Eng2022Osman ÖzenNo ratings yet

- Peter Wicke - Rock Music Culture Aesthetic and SociologyDocument121 pagesPeter Wicke - Rock Music Culture Aesthetic and SociologyFelipeNo ratings yet

- Alcohols Ethers and Phenol-02 Solved ProblemsDocument13 pagesAlcohols Ethers and Phenol-02 Solved ProblemsRaju SinghNo ratings yet

- Prototype TutorialDocument451 pagesPrototype TutorialMariela DemarkNo ratings yet

- ELEN 3018 - Macro Test - 2013 - ADocument1 pageELEN 3018 - Macro Test - 2013 - AsirlordbookwormNo ratings yet

- Added by Guest, Last Edited by Guest On Jun 12, 2007 Show CommentDocument5 pagesAdded by Guest, Last Edited by Guest On Jun 12, 2007 Show CommentNarendrareddy RamireddyNo ratings yet

- Character Education With A PlusDocument5 pagesCharacter Education With A PlusAzis Eko YuliantoNo ratings yet