Professional Documents

Culture Documents

Download

Download

Uploaded by

Scotti BwoyOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Download

Download

Uploaded by

Scotti BwoyCopyright:

Available Formats

Theory of Cost and Profit

6

Theory of Cost and Profit

The relationships and the interactions of consumers and producers can be easily understood

using the economic model in Chapter 1 showing the Circular flow of Income. Chapter 5 on the

Theory of Consumer Behavior discusses the demand side of the market flow. We had initially

presented the Theory of Production in Chapter 5 focusing on the physical production-inputs and

outputs. In this chapter, we will continue to study the behavior of the firm (producers and

sellers), the supply side of the product market in terms of the relationships between costs and

output.

Objectives:

After studying this chapter, the students should be able to:

• Account for the factors that comprise a firm’s cost

• Explain the relationship among the different economic costs

• Differentiate between economic profit and accounting profit

• Explain how firms decide what and how to produce.

I. The Production and Costs

Production cost is a determinant of supply and exhibits an inverse relationship.

Thus, the objective of producers is to generate products and services at the lowest cost

possible without sacrificing quality. High production cost means higher prices for their

products which could limit the consumer demand while less cost would mean increase

demand for the product resulting to higher sales and chance for higher profit.

To produce a good or a service, a firm needs economic resources or factors of

production referred to as inputs and process them into outputs. The firm has to pay for

these inputs and in the process, generate costs. As discussed in Chapter 1, the inputs or

factors of production are the following with their corresponding factor payments:

Factor of Production Factor Payments

or Input

Land Rent

Labor Salary or Wage

Capital Interest

Entrepreneur Profit

Cost of production is the sum of the costs of all inputs used in production.

Principles of Economics, Taxation and Agrarian Reform 1

Theory of Cost and Profit

Types of Economic Cost

1. Explicit Cost

Payments to the owners of the factors of production like wage, interests, and raw

materials. It is also called the expenditure cost and requires money outlay from

the firm.

2. Implicit Cost

This is the firm’s opportunity cost of using its own factors of production without a

corresponding cash payment like rent for land. In economics, implicit costs are

taken into account in determining the performance of the firm (profit or loss).

3. Opportunity Cost

This refers to the cost of foregone opportunity or alternative benefit. It is the value

of the next-highest-valued alternative use of that resource

4. Fixed Cost (FC)

Fixed cost is the type of cost which remains constant regardless of the volume of

production. It does not change with an increase or decrease in the amount of

goods or services produced. Even at zero production the firm still incurs this cost.

Rent for stalls and offices has to be paid whether you utilize them or not.

5. Average Fixed Cost (AFC)

Average Fixed Cost (AFC) is total fixed cost divided by the quantity of the

output:

AFC = TFC

Q

6. Variable Cost (VC)

Costs that vary or change depending on the volume of production are called

variable costs. They rise as production increases and fall as production decreases

like raw materials, wages and salaries.

7. Average Variable Cost (AVC)

Total variable cost divided by the quantity of the output or AVC = TFC

Q

2 Principles of Economics, Taxation and Agrarian Reform

Theory of Cost and Profit

8. Total Cost (TC)

Total cost is the market value of all the inputs used by the firm in production. It is

the sum of all the fixed and variable costs incurred by the firm in producing its

products.

TC = FC + VC

9. Average Cost (AC)

Average cost is also called the unit cost and is equivalent to the total cost divided

evenly by the quantity of the output.

AC = TC

Q

Average cost can also be expressed as the sum of Average Fixed Cost (AFC) and

Average Variable Cost (AVC), since total cost is just the sum of fixed and

variable cost.

AC = AFC + AVC

10. Marginal Cost (AC)

This cost refers to the increase in total cost from producing one extra unit of

output. It is also known as the slope of the total cost curve. Marginal cost is

obtained by dividing change in total cost by change in quantity of the output.

MC = ∆TC

∆Q

Short Run Cost Curves

Principles of Economics, Taxation and Agrarian Reform 3

Theory of Cost and Profit

A. Total Cost Curves

Graphs are useful to better understand the relationships between production and costs.

The Total Product Curves below are based on Table 6.1: Total Cost and Output Schedule

of LAM Company, on the short run. It can be noted that at least one input is fixed.

Table 6.1: Total Costs and Output Schedule

OUTPUT TFC TVC TC

0 40 0 40

2 40 70 110

3 40 130 170

4 40 180 220

5 40 240 280

6 40 310 350

7 40 380 420

8 40 460 500

9 40 550 590

10 40 650 690

Total Cost Curves

COST

800

700

600

500

TFC

400

TVC

300 TC

200

100

OUTPUT

0

0 2 3 4 5 6 7 8 9 10

The cost curves show the relationship between the quantity of production and the costs

involved in production. The total cost curve gets steeper as the production increases

because of the diminishing marginal product. The graph above clearly shows the

behavior of the fixed and variable costs, the components of the total cost. Fixed cost is

constant at all level of production, while the variable cost increases with more

production.

4 Principles of Economics, Taxation and Agrarian Reform

Theory of Cost and Profit

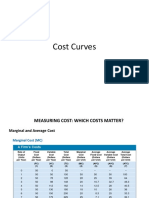

B. Average and Marginal Costs Curves

Table 6.2 on the average cost schedule was based on Table 6.1: Total Cost and Output

Schedule.

Table 6.2: AVERAGE COSTS SCHEDULE

OUTPUT AFC AVC ATC MC

0 0 0 0

2 20 35 55 35

3 13 44 57 60

4 10 45 55 50

5 8 48 56 60

6 7 51 58 70

7 6 54 60 70

8 5 57 62 80

9 5 61 66 90

10 4 65 69 100

Looking more closely, both at the schedule and the graph, reveal that the marginal cost

generally rises as the output increases. When the MC is lower than the average total cost

(ATC), the average total cost is falling. On the other hand, when the MC is higher than

the ATC, the ATC is rising. It crosses the average cost curve at its minimum.

Average Cost Curves

COST

120

100

80

AFC

60 AVC

AC

40

MC

20

0 OUTPUT

0 2 3 4 5 6 7 8 9 10

Principles of Economics, Taxation and Agrarian Reform 5

Theory of Cost and Profit

III. REVENUE AND PROFIT

A. Total Revenue and Marginal Revenue

Total revenue (TR) refers to the total receipts from sales of a given quantity of goods or

services. It is the total income of a firm and is calculated by multiplying the quantity of

goods (Q) sold by the price (P) of the goods.

TR = P x Q

Other concepts related to total revenue are the average revenue (AR) and marginal

revenue (MR).

Average revenue refers to the revenue per unit of output sold and is computed by

dividing the total revenue by the number of units sold.

Marginal revenue (MR) is the additional income generated from the sale of an

additional unit of output. It is the change in total revenue from the sale of one more unit

of a good. MR = ∆TR

∆Q

Table 6.3: Profit and Loss Schedule

OUTPUT TC MC TR MR Profit/(Loss)

0 40 0 20

2 110 35 120 60 10

3 170 60 180 60 10

4 220 50 240 60 20

5 280 60 300 60 20

6 350 70 360 60 10

7 420 70 420 60 0

8 500 80 480 60 -20

9 590 90 540 60 -40

10 690 100 600 60 -80

LAM Company sells its product at P60.00/unit and Table 6.3 shows the company’s

performance at various levels of production. The level that would give the company the

highest profit based on output and pricing is the profit maximization point.

Profit maximization can be determined through the Marginal Cost – Marginal Revenue

Method and the Total Cost-Total Revenue Method. The Marginal Cost – Marginal

Revenue Method is based on the fact that total profit reaches its maximum point where

marginal revenue equals marginal cost. On the other hand, the total revenue–total cost

focuses on maximizing the difference between revenue and costs which is equal to the

company’s profit.

6 Principles of Economics, Taxation and Agrarian Reform

Theory of Cost and Profit

TOTAL REVENUE AND TOTAL COST CURVES

C IV. ..

O

V. ..

S

VI.

T

B. Break-even Point

The break-even point (BEP) is the point at which total cost and total revenue are equal:

there is no net loss or gain. A profit or a loss has not been made, but all costs that need to

be paid were fully settled. The level of output at which total revenue equals total cost and

can be determined using 3 approaches:

1. Based on the total cost and total revenue schedule. Analyze the entries. The break-even

point is when total revenue = total cost. In Table 6.3, LAM Company’s break-even

point is at Output 7, where the total cost and total revenue were both at P 420.00.

2. Graphing - the point of intersection between the total cost and total revenue curves

Principles of Economics, Taxation and Agrarian Reform 7

Theory of Cost and Profit

3. Mathematical computation using the following basic equation:

where:

TFC is Total Fixed Costs,

P is Unit Sale Price, and

V is Unit Variable Cost.

8 Principles of Economics, Taxation and Agrarian Reform

Theory of Cost and Profit

References:

Mankiw, G.N., (2012). Essentials of Economics 6th Edition. Harvard University: South-Western,

Cengage Learning

Mastrianna, F.V., (2013). Basic Economics 16th Edition. South-Western Cengage Learning

McConnel, C., et.al (2012). Economics: Principles, Problems, and Policies (Global Edition).

McGraw Hill Co., Inc.

Paraiso, O.C., et.al (2011). Introduction to Microeconomics, Mutya Publishing House, Inc.

Stock, W.A., (2013) Introduction to Economics: Social Issues and Economic Thinking

http://ph.images.search.yahoo.com

http://www.intelligenteconomist.com

http://www.investopedia.com

Principles of Economics, Taxation and Agrarian Reform 9

You might also like

- Product Development and InnovationDocument25 pagesProduct Development and InnovationKimber Palada71% (7)

- 3.7 Firms' Cost, Revenue and ObjectivesDocument40 pages3.7 Firms' Cost, Revenue and ObjectivesThilagavathivijay100% (3)

- Chapter 6Document10 pagesChapter 6Ronah SabanalNo ratings yet

- Theory Cost and ProfitDocument21 pagesTheory Cost and ProfitRonah SabanalNo ratings yet

- Business Economics I 4Document121 pagesBusiness Economics I 4GrenvilNo ratings yet

- Not For Quotation: Theory of Cost and ProfitDocument8 pagesNot For Quotation: Theory of Cost and ProfitFrancis Thomas LimNo ratings yet

- Unit Vi: The Theory and Estimation of CostDocument69 pagesUnit Vi: The Theory and Estimation of CostIshan PalNo ratings yet

- Unit 7 Revenue and Cost and Break EvenDocument13 pagesUnit 7 Revenue and Cost and Break Evenafreen khanNo ratings yet

- Presented By-Trilok, Jaswant, Girish, Lalit, MohitDocument36 pagesPresented By-Trilok, Jaswant, Girish, Lalit, MohitŤŕiļöķ BákøļįâNo ratings yet

- Case & Fair: Chapter 8: Short-Run Costs and Output DecisionsDocument31 pagesCase & Fair: Chapter 8: Short-Run Costs and Output DecisionsManepalli YashwinNo ratings yet

- Chapter Four: Theory of Costs Cost AnalysisDocument14 pagesChapter Four: Theory of Costs Cost AnalysisAkkamaNo ratings yet

- Cost of The Construction Firm: Prof. (DR) Vandana BhavsarDocument40 pagesCost of The Construction Firm: Prof. (DR) Vandana BhavsarAkhil JosephNo ratings yet

- 16793theory of CostDocument55 pages16793theory of CostAnonymous 1ClGHbiT0JNo ratings yet

- Basic Econ 7 PDFDocument5 pagesBasic Econ 7 PDFCarl Jefferson LumabanNo ratings yet

- Unit-3 Cost AnaylsisDocument18 pagesUnit-3 Cost AnaylsisSapan Sagar JatavjiNo ratings yet

- Costs of Production 1Document23 pagesCosts of Production 1Daksh AnejaNo ratings yet

- Cost Analysis PresentationDocument43 pagesCost Analysis Presentationabhishekanshul100% (1)

- 1 Lecture 6 - Short-Run Costs and Output DecisionsDocument14 pages1 Lecture 6 - Short-Run Costs and Output DecisionsyasirNo ratings yet

- Module 3Document21 pagesModule 3sujal sikariyaNo ratings yet

- Costs of Production 1Document31 pagesCosts of Production 1chandel08No ratings yet

- Chapter 5 Costs and ProductionDocument27 pagesChapter 5 Costs and ProductionChen Yee KhooNo ratings yet

- Cost Theory and Cost FunctionDocument30 pagesCost Theory and Cost Functiontanvirahmed122123No ratings yet

- Theory of Production CostDocument17 pagesTheory of Production CostDherya AgarwalNo ratings yet

- Total Cost StudyDocument36 pagesTotal Cost StudyUb UsoroNo ratings yet

- Theory of Firm - CostDocument22 pagesTheory of Firm - CostHARSHALI KATKARNo ratings yet

- Cost CurvesDocument40 pagesCost CurvesNRK Ravi Shankar CCBMDO - 16 BatchNo ratings yet

- ME Assignment IIDocument12 pagesME Assignment IIJaya BharneNo ratings yet

- Cost Analysis HandoutsDocument18 pagesCost Analysis HandoutsAndrea ValdezNo ratings yet

- Cost AnalysisDocument28 pagesCost AnalysisAnkurNo ratings yet

- (MICROECO) Lesson 4 CostDocument26 pages(MICROECO) Lesson 4 CostCollege Sophomore 2301No ratings yet

- Adigrat University Department of Economics Microeconomics: Chapter Three Theory of Cost of ProductionDocument14 pagesAdigrat University Department of Economics Microeconomics: Chapter Three Theory of Cost of Productionabadi gebruNo ratings yet

- Unit - Iii Cost Analysis: FunctionDocument9 pagesUnit - Iii Cost Analysis: FunctionnikitaNo ratings yet

- Eco 101 8Document4 pagesEco 101 8danielhunton91No ratings yet

- Lesson 6 bm5Document9 pagesLesson 6 bm5Ira OrenciaNo ratings yet

- Theory of Cost of Production6Document91 pagesTheory of Cost of Production6Bhathika GimhanNo ratings yet

- CPC Ec 01Document34 pagesCPC Ec 01Arslan RammayNo ratings yet

- Production Choices & Cost: Supply Decisions Costs Firm TheoryDocument44 pagesProduction Choices & Cost: Supply Decisions Costs Firm TheoryCM MukukNo ratings yet

- The Cost of ProductionDocument64 pagesThe Cost of ProductionSHOBANA96No ratings yet

- Costs CalculationsDocument3 pagesCosts CalculationssylveyNo ratings yet

- MB 112 Cost OutputDocument12 pagesMB 112 Cost OutputVeniNo ratings yet

- Unit - 3 Cost Output RelationshipDocument11 pagesUnit - 3 Cost Output RelationshipKshitiz BhardwajNo ratings yet

- Untitled 3Document22 pagesUntitled 3Khalid AbdulkarimNo ratings yet

- CostDocument9 pagesCostmotlisharmaNo ratings yet

- Managerial Economics: Production Process and Cost AnalysisDocument44 pagesManagerial Economics: Production Process and Cost AnalysisNicole Anne Villanueva PacificoNo ratings yet

- Cost of ProductionDocument61 pagesCost of ProductionPankit KediaNo ratings yet

- Module 5Document13 pagesModule 5Somod BadmusNo ratings yet

- Module-6 Cost and Revenue AnalysisDocument46 pagesModule-6 Cost and Revenue Analysiskarthik21488No ratings yet

- Theory of Cost: Sonuchowdhur YDocument21 pagesTheory of Cost: Sonuchowdhur Yzahra naheedNo ratings yet

- CFO POE12 PPT 08Document41 pagesCFO POE12 PPT 08Batuhan GyulerNo ratings yet

- Theory of Cost - Revenue, Market Structure and Equilibrium of FirmsDocument16 pagesTheory of Cost - Revenue, Market Structure and Equilibrium of Firmscader saib aaishahNo ratings yet

- Perfect Competition and Efficiency AssignmentDocument12 pagesPerfect Competition and Efficiency AssignmentRileyNo ratings yet

- Chapter 6 Theory of Cost and Profit 2Document52 pagesChapter 6 Theory of Cost and Profit 2Jo MalaluanNo ratings yet

- Theory of Cost: Sonu ChowdhuryDocument21 pagesTheory of Cost: Sonu Chowdhuryzahra naheedNo ratings yet

- Tutorial 6 - SchemeDocument5 pagesTutorial 6 - SchemeTeo ShengNo ratings yet

- Manecon Assignment #5Document3 pagesManecon Assignment #5tygurNo ratings yet

- Economics NotesDocument16 pagesEconomics NotesPNo ratings yet

- Costs of ProductionDocument15 pagesCosts of Productionchaudhary samavaNo ratings yet

- A Quick Review On Chapter-5: ProductionDocument32 pagesA Quick Review On Chapter-5: ProductionKhaled Bin Shahabuddin ShagarNo ratings yet

- Lesson 6 Theories of Production and CostDocument10 pagesLesson 6 Theories of Production and CostDaniela CaguioaNo ratings yet

- Intro Econ Chap 4 KANENUSDocument42 pagesIntro Econ Chap 4 KANENUSReshid JewarNo ratings yet

- Management Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageFrom EverandManagement Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageRating: 5 out of 5 stars5/5 (1)

- Freitas, Kripa. 2006. The Indian Caste SystemDocument62 pagesFreitas, Kripa. 2006. The Indian Caste SystemImdad HussainNo ratings yet

- Introduction, Example, Types, Provisions, Causes, Impact, Current Situation & ConclusionDocument14 pagesIntroduction, Example, Types, Provisions, Causes, Impact, Current Situation & ConclusionNimesh ShahNo ratings yet

- 01 Chap 14 RosenDocument64 pages01 Chap 14 RosenSagar ChowdhuryNo ratings yet

- ACC1511 MT Sem2 1516 AnswerDocument8 pagesACC1511 MT Sem2 1516 AnswerBeni ZakariaNo ratings yet

- Crony Capitalism IndiaDocument56 pagesCrony Capitalism IndiamalayachechiNo ratings yet

- Proutist Economics As If People Matter: "Increase The Purchasing Capacity of The Common People Above All."Document29 pagesProutist Economics As If People Matter: "Increase The Purchasing Capacity of The Common People Above All."Ml PlayerNo ratings yet

- History of Commodity Futures in IndiaDocument24 pagesHistory of Commodity Futures in Indiahsaurav06No ratings yet

- Chapter 6Document21 pagesChapter 6Pupudt Purnamasary NovalNo ratings yet

- دور الاساليب الكمية في فحص القوائم المرحليةDocument20 pagesدور الاساليب الكمية في فحص القوائم المرحليةد. محمد منصورNo ratings yet

- Matching Principle and Accrual Basis of AccountingDocument2 pagesMatching Principle and Accrual Basis of AccountingNazish KhalidNo ratings yet

- Luxury Sharing, Meet High FashionDocument16 pagesLuxury Sharing, Meet High FashionnemonNo ratings yet

- Global Prospects and Policies: Global Economy Climbing Out of The Depths, Prone To SetbacksDocument64 pagesGlobal Prospects and Policies: Global Economy Climbing Out of The Depths, Prone To SetbacksOrestis VelmachosNo ratings yet

- Time Cost OptimisationDocument36 pagesTime Cost OptimisationellenNo ratings yet

- International EconomicsDocument30 pagesInternational EconomicsNOOR CHNo ratings yet

- Fundamentals of Economics and Business ManagementDocument3 pagesFundamentals of Economics and Business ManagementvijayhmakwanaNo ratings yet

- Entrep ReviewerDocument1 pageEntrep ReviewerWAEL, Kyle Angelo A.No ratings yet

- AEC 213 Course OutlineDocument2 pagesAEC 213 Course Outlinechie syNo ratings yet

- Chapter 12. Land Rents and Land Use PatternsDocument20 pagesChapter 12. Land Rents and Land Use PatternsMega Novetrishka PutriNo ratings yet

- Common Misunderstandings About The WtoDocument11 pagesCommon Misunderstandings About The WtoMithila PatelNo ratings yet

- Wall Street Crash CausesDocument10 pagesWall Street Crash CausesQBroadzillaNo ratings yet

- Swing Trading TemplateDocument2 pagesSwing Trading Templatesangram24No ratings yet

- Test Bank For Fundamentals of Economics 6th Edition by BoyesDocument24 pagesTest Bank For Fundamentals of Economics 6th Edition by Boyesa540281538No ratings yet

- Marketing Strategy ProcessDocument70 pagesMarketing Strategy ProcessDaman AroraNo ratings yet

- CHAPTER I - Financial Management - An OverviewDocument20 pagesCHAPTER I - Financial Management - An OverviewTamiratNo ratings yet

- Spontaneous FundsDocument5 pagesSpontaneous FundsTobelaNcube100% (2)

- Dragun - Et Al - The Uppsala Model vs. The Network Approach in The Process of InternationalizationDocument14 pagesDragun - Et Al - The Uppsala Model vs. The Network Approach in The Process of InternationalizationEr Bishwa KcNo ratings yet

- Fleurbaey - Optimal Taxation Theory and Principles of FairnessDocument56 pagesFleurbaey - Optimal Taxation Theory and Principles of Fairnessandri heryantoNo ratings yet

- Good OneDocument58 pagesGood OneSandy TerpopeNo ratings yet

- Fama French PDFDocument8 pagesFama French PDFMonzer ShkeirNo ratings yet