Professional Documents

Culture Documents

Federal Securities Laws

Federal Securities Laws

Uploaded by

Julie GonzalezCopyright:

Available Formats

You might also like

- WIlls and Trusts Essay RoadmapDocument18 pagesWIlls and Trusts Essay RoadmapCamille Walker100% (4)

- Fed Securities Laws - Rule OutlineDocument30 pagesFed Securities Laws - Rule OutlineVirginia Crowson100% (12)

- AWESOME ATTACK OUTLINE Securities Regulation - Haft 2005-PreviewDocument4 pagesAWESOME ATTACK OUTLINE Securities Regulation - Haft 2005-Previewscottshear1No ratings yet

- Business Associations OutlineDocument34 pagesBusiness Associations OutlineIsabella L100% (1)

- Securities Regulation-E&E (6th Ed.)Document24 pagesSecurities Regulation-E&E (6th Ed.)Larry Rogers100% (1)

- Secreg - Gun Jumping Exam SheetDocument5 pagesSecreg - Gun Jumping Exam SheetRaj VashiNo ratings yet

- Momotaro Roles Play ScriptDocument3 pagesMomotaro Roles Play Scriptmommymusab100% (1)

- Possessory Estates & Future InterestsDocument1 pagePossessory Estates & Future InterestsAnnaNo ratings yet

- Mini Outline Securities RegulationDocument11 pagesMini Outline Securities RegulationGang GaoNo ratings yet

- BusAss OutlineDocument75 pagesBusAss OutlinejryanandersonNo ratings yet

- Business Associations - ChartDocument9 pagesBusiness Associations - Chartmkelly2109100% (1)

- PRINTED - Sec. Reg. Outline - GW Prof. Gabaldon 2012 - Text Soderquist & GabaldonDocument33 pagesPRINTED - Sec. Reg. Outline - GW Prof. Gabaldon 2012 - Text Soderquist & GabaldonErin Jackson100% (3)

- ST OutlineDocument103 pagesST Outlineam3ze100% (4)

- Gift and Estate Tax OutlineDocument15 pagesGift and Estate Tax OutlineChad DeCoursey100% (1)

- Secured Transactions OutlineDocument148 pagesSecured Transactions Outlineinsane7100% (3)

- Contract Law OutlineDocument8 pagesContract Law OutlineJ0221No ratings yet

- Secured Transactions OutlineDocument27 pagesSecured Transactions OutlineJ M100% (1)

- SERVITUDESDocument5 pagesSERVITUDESmfarooqi21100% (1)

- Secured Transactions, Governing Law: Law Essentials for Law School and Bar Exam PrepFrom EverandSecured Transactions, Governing Law: Law Essentials for Law School and Bar Exam PrepRating: 3 out of 5 stars3/5 (1)

- Keto Mojo Kickstart GuideDocument105 pagesKeto Mojo Kickstart GuideJulie GonzalezNo ratings yet

- Securities Regulation OutlineDocument50 pagesSecurities Regulation OutlineTruth Press Media100% (1)

- Sec Reg ChartDocument17 pagesSec Reg ChartMelissa GoldbergNo ratings yet

- Securities OutlineDocument58 pagesSecurities OutlineJonDoeNo ratings yet

- 2 207 FlowchartDocument1 page2 207 FlowchartMatthew Alan PierceNo ratings yet

- Secured Trans (Good Explanations)Document42 pagesSecured Trans (Good Explanations)JasonGershensonNo ratings yet

- Checklist PrintDocument22 pagesChecklist PrintIkram AliNo ratings yet

- Fiscal Carillo Full Transcript - Crim Law 1Document161 pagesFiscal Carillo Full Transcript - Crim Law 1Ryu Mendoza100% (1)

- Attack Sec. RegDocument5 pagesAttack Sec. RegTroyNo ratings yet

- Securities Regulation Outline - PKDocument119 pagesSecurities Regulation Outline - PKErin Jackson100% (2)

- Securities Outline FinalDocument22 pagesSecurities Outline FinalDaniel Novick100% (1)

- Securities RegulationDocument127 pagesSecurities RegulationErin Jackson100% (1)

- Securities Regulation OutlineDocument67 pagesSecurities Regulation OutlineSean Balkan100% (1)

- Contracts OutlineDocument31 pagesContracts OutlineVasu Goyal100% (12)

- Sec Reg Attack 2021 - NEWDocument28 pagesSec Reg Attack 2021 - NEWmattytang100% (1)

- Securities Regulations Law OutlineDocument32 pagesSecurities Regulations Law Outlinetwbrown1220100% (2)

- Securities Regulation OutlineDocument55 pagesSecurities Regulation OutlineJosh SawyerNo ratings yet

- Acing BA OutlineDocument64 pagesAcing BA OutlineStephanie PayanoNo ratings yet

- Securities Regulation Short Outline: I. BackgroundDocument14 pagesSecurities Regulation Short Outline: I. BackgroundzklvkfdNo ratings yet

- Securities Regulation Outline Bancroft Fall 2011Document33 pagesSecurities Regulation Outline Bancroft Fall 2011Erin JacksonNo ratings yet

- SecReg Outline 1 - Stern DetailedDocument127 pagesSecReg Outline 1 - Stern Detailedsachin_desai_9No ratings yet

- Choi (1) SecuritiesRegulation Spring2006Document124 pagesChoi (1) SecuritiesRegulation Spring2006himanshuNo ratings yet

- Chart OutlineDocument29 pagesChart OutlineKasem AhmedNo ratings yet

- I. Was It Implied in Fact?: 33 SaterialeDocument9 pagesI. Was It Implied in Fact?: 33 SaterialeJFNo ratings yet

- M and ADocument52 pagesM and Aoaijf100% (3)

- Corporations OutlineDocument42 pagesCorporations OutlineElNo ratings yet

- Trust OutlineDocument21 pagesTrust Outlineprentice brown100% (1)

- Sec Reg 2016 OutlineDocument101 pagesSec Reg 2016 OutlineRyan MaloleyNo ratings yet

- The Rule Against PerpetuitiesDocument2 pagesThe Rule Against Perpetuitieselleeklein100% (1)

- UCC OutlineDocument5 pagesUCC Outlinesielynikam50% (2)

- Decedent's Estates and Trusts OutlineDocument29 pagesDecedent's Estates and Trusts OutlineKylee Colwell100% (1)

- Corps Secret WeaponDocument4 pagesCorps Secret WeaponKeith DyerNo ratings yet

- Secured TransactionsDocument28 pagesSecured Transactionspatrick88% (8)

- Contracts UCC SalesDocument89 pagesContracts UCC Salesalbtros100% (7)

- Secured TransactionsDocument3 pagesSecured TransactionsJon Leins100% (2)

- Sales Outline: "The Good Guy Always Wins"Document15 pagesSales Outline: "The Good Guy Always Wins"zachroyusiNo ratings yet

- Secured Transactions OutlineDocument59 pagesSecured Transactions OutlineGabby ViolaNo ratings yet

- Contracts OutlineDocument26 pagesContracts OutlineNader100% (6)

- Estates and Trust OutlineDocument34 pagesEstates and Trust OutlinestaceyNo ratings yet

- Business Associations OutlineDocument59 pagesBusiness Associations OutlineCfurlan02100% (1)

- Covenants, Equitable Servitudes and RestrictionsDocument23 pagesCovenants, Equitable Servitudes and RestrictionsPhillip DoughtieNo ratings yet

- Remedie and Restitution NotesDocument128 pagesRemedie and Restitution NotesShelby MathewsNo ratings yet

- Full Outline - Bar Exam DoctorDocument19 pagesFull Outline - Bar Exam DoctorJulie Gonzalez100% (1)

- The Mariology of Maximillian KolbeDocument18 pagesThe Mariology of Maximillian KolbeJulie GonzalezNo ratings yet

- List N Disinfectant Results Table - ExploreDocument135 pagesList N Disinfectant Results Table - ExploreJulie GonzalezNo ratings yet

- Lemon Herb VinaigretteDocument8 pagesLemon Herb VinaigretteJulie GonzalezNo ratings yet

- Dom Prosper GuérangerDocument22 pagesDom Prosper GuérangerJulie GonzalezNo ratings yet

- The Athanasian CreedDocument3 pagesThe Athanasian CreedJulie GonzalezNo ratings yet

- The Epistles of ST Ignatius Bishop of AntiochDocument139 pagesThe Epistles of ST Ignatius Bishop of AntiochJulie GonzalezNo ratings yet

- Real Property Future Interests PDFDocument1 pageReal Property Future Interests PDFJulie GonzalezNo ratings yet

- Guide To Reading The BibleDocument53 pagesGuide To Reading The BibleJulie GonzalezNo ratings yet

- Real Property: Easements: STEP TWO: What Will The Effect Be? Three QuestionsDocument1 pageReal Property: Easements: STEP TWO: What Will The Effect Be? Three QuestionsJulie GonzalezNo ratings yet

- PSALMSDocument175 pagesPSALMSJulie GonzalezNo ratings yet

- Real Property Future Interests PDFDocument1 pageReal Property Future Interests PDFJulie GonzalezNo ratings yet

- Joinder & Impleader & JurisdictionDocument2 pagesJoinder & Impleader & JurisdictionJulie GonzalezNo ratings yet

- Balunueco Vs CADocument2 pagesBalunueco Vs CAJoshua OuanoNo ratings yet

- Family Report 2019 BDocument13 pagesFamily Report 2019 BalannainsanityNo ratings yet

- Eclipse-Lautapelin Viimeinen Osa, Shadow of The RiftDocument5 pagesEclipse-Lautapelin Viimeinen Osa, Shadow of The RiftPetteri KlenholmNo ratings yet

- Parliamentary ProceduresDocument59 pagesParliamentary ProceduresmarievalencNo ratings yet

- 2017 Puerto Rican Status ReferendumDocument5 pages2017 Puerto Rican Status ReferendumarroyojcNo ratings yet

- Guy FawkesDocument10 pagesGuy FawkesChristopher ServantNo ratings yet

- Pakistan Affairs PPSC 2022Document34 pagesPakistan Affairs PPSC 2022Malik TAHIRNo ratings yet

- APT Case Digest (RMP)Document3 pagesAPT Case Digest (RMP)boorijan0% (1)

- Barfield, MedallionDocument8 pagesBarfield, MedallionTR119No ratings yet

- We Signed A Binding Contract Last Year and It Is Still ValidDocument2 pagesWe Signed A Binding Contract Last Year and It Is Still ValidJosé ArmandoNo ratings yet

- CIR V Ayala Securities CorporationDocument1 pageCIR V Ayala Securities CorporationEmil Bautista100% (1)

- Today's Fallen Heroes Sunday 20 October 1918 (1732)Document35 pagesToday's Fallen Heroes Sunday 20 October 1918 (1732)MickTierneyNo ratings yet

- Cebu Shipyard and Engineering Works, Inc. v. William Lines - IBP Zamboanga Del Norte ChapterDocument4 pagesCebu Shipyard and Engineering Works, Inc. v. William Lines - IBP Zamboanga Del Norte ChapterZainne Sarip BandingNo ratings yet

- True Ghosts Spooky IncidentsDocument136 pagesTrue Ghosts Spooky IncidentsAliosha BazaesNo ratings yet

- The Coca-Cola Bottling Company of New York, Inc. v. Soft Drink and Brewery Workers Union Local 812, International Brotherhood of Teamsters, 242 F.3d 52, 2d Cir. (2001)Document9 pagesThe Coca-Cola Bottling Company of New York, Inc. v. Soft Drink and Brewery Workers Union Local 812, International Brotherhood of Teamsters, 242 F.3d 52, 2d Cir. (2001)Scribd Government DocsNo ratings yet

- PLDT Vs CADocument2 pagesPLDT Vs CAAissa VelayoNo ratings yet

- Individual Daily Log Accomplishement ReportDocument11 pagesIndividual Daily Log Accomplishement ReportSilvester CardinesNo ratings yet

- NCLEX Study GuideDocument26 pagesNCLEX Study GuideLinda KellyNo ratings yet

- Appendix Notice 138Document2 pagesAppendix Notice 138Mrīgendra Narayan UpadhyayNo ratings yet

- Fake News Essay Outline PDFDocument2 pagesFake News Essay Outline PDFGarry ChiuNo ratings yet

- Phil Pharmawealth V PfizerDocument1 pagePhil Pharmawealth V PfizerKristina B DiamanteNo ratings yet

- Revision For Unit 1,2,3Document9 pagesRevision For Unit 1,2,3Pham ThuhienNo ratings yet

- 'The Woman in The House Across The Street From The Girl in The Window' Ending, ExplainedDocument1 page'The Woman in The House Across The Street From The Girl in The Window' Ending, ExplainedBecca WhoNo ratings yet

- Differential Diagnosis of Genital Ulcer Differential Diagnosis of Genital UlcersDocument3 pagesDifferential Diagnosis of Genital Ulcer Differential Diagnosis of Genital UlcersNurhayati HasanahNo ratings yet

- Kaaba PresentationDocument15 pagesKaaba PresentationmimiNo ratings yet

- Rubi vs. Provincial Board of MindoroDocument2 pagesRubi vs. Provincial Board of MindoroMichaelNo ratings yet

- People vs. BulosDocument1 pagePeople vs. BulosEllaine VirayoNo ratings yet

- Evid ProjectDocument74 pagesEvid ProjectVince Albert TanteNo ratings yet

Federal Securities Laws

Federal Securities Laws

Uploaded by

Julie GonzalezOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Federal Securities Laws

Federal Securities Laws

Uploaded by

Julie GonzalezCopyright:

Available Formats

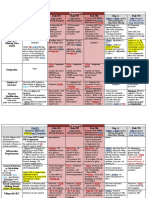

Federal SEC Regulation.

1934 Act Important Provisions.

1933 Act

§ 10 Fraud. § 12 §14 Proxies §16 Insider

Registration Reporting Rules §13 Disclosure

-Purpose was to ensure

No use of Requirements. Regulates the Requirements

complete and truthful

mail/interstate soliciation and Has 'short swing'

information (disclosure 1934 Act commerce Anything falling substance of rules and

theory). Periodic Reporting

involving the under this proxies; including requirments for for §12 Corps.

-Filled gaps purchase/sale section is disclosure disclsoure of

-Prohibits offers and of 1933 -> of security and condsidered requriements. insider trading -10K Audited

sales of securities applies to involvees " public" activities Annual Financial

WHICH AREN'T trades on fraudulent Report

registered with the SEC. market. conduct. §12(a) ->

Anything on a -10Q Unaudited

-20 Day Waiting Period. Centerpiece national Quarterly

Must wait 20 days after of Current SUPER exchage ONLY APPLY TO Reports

filing registration with SEC Regulation FUCKING " PUBLIC" CORPS PER

and selling stock to public; Regime. IMPORTANT; §12(g)1 - THE § 12 REGISTRATION -8k Interim

ensures access to Companies on reports for BIG

Insider trading, REQS.

information. NASDAQ w/ at events (Change in

frauds,

least 2,000 SH control,

breaches, ALL

DOES NOT EFFECT or 500 resignation of

SORTS OF

DAILY TRADING; JUST non-accredited directors, changes

ACtioN investors AND

REGISTRATION AND in accountants,

REPORTING 10 million net and Bankruptcy)

assets.

Trust Indenture Act of 1939 Williams Act of

1968

BOND REGULATION Securities

Investment Investment

Investment 14(e) [not subject to Sarbanes Oxley Act

Company Act of Advisors Act of

- IMposes limitations, disclosure, Protection Act of 12(g), to all publicly of 2002

1940 1940

and structuring requriments for 1970 (SIPA) traded corps]

all companies that issue bonds 14(d) subject to the

publicly reqs.

Trust Indenture: Master

agreement that governs the

terms & conditions of general

obligation corproate bonds

(debentures) that are offered to

the public under the 1933 Act.

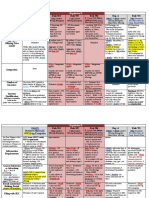

Reporting Companies &

Requirements

§12 §12(g)(1)

AVOIDING THE PROXY RULES. Hint, you can't.

§12(a) Any Company with (1) a -> Limit use of proxies or regular meetings.

class of securities

Companies that sell having more than 2,000 2. In Delaware (some othrs), can act

securities (stocks or regular SH of record or 1. Try to get a quorum w/o soliciting

w/o meeting if there is majority

bonds) on a national 500 people who are not proxies.

consent of SH on action.

securities exchange accredited investors HOWEVER

HOWEVER!!

AND (2) total net assets -> the information statement

SEC rules still require MGMT to issue

of at least $10 million required before ALL meetings must

proxy statement to all SH's if it acts

have essentially same info 14(f)

by consent w/o meeting.

Once above 2,000 persons

or 500 non-instituitonal

investors, status STICKS

until the number falls

If EITHER of these

below 1,200.

requirements are met, the

PUBLIC company is

subject to §13, §14, §16 & Vast maj of companies;

Williams Act. remember -> record

holder and

§10 applies to all, incl. BENEFICIAL owner is

private. different.

The Proxy Rules

Four Main. Enabling statute. Allows the

§ 14(a)(1) - " It shall be unlawful . . . to use

(1) Rule 14(a)(1) when moved to real proxy rules which follow.

mail/ISCI . . . in contravention of such rules as

(2) Rule 14a-7 page, insert this here Important implications on

may be adopted . . . to solicit a proxy of any

(3) Rule 14a-8 security registered per § 12."

scope. NOTHING CAN GO

(4) Rule 14a-9 BEYOND SCOPE.

Main Consequences/Holdings.

Within scope of rules?

1) Must be full & fair

disclosure of all material a1) Is Corp covered? a2) Is the investor covered?

facts on any MGMT-submitted

proposals subject to SH vote If under §12(g)(1) -> can TERMINATE registration Special 10 person rule: Investors may communicate with

with SEC if number of S/H drops below 1,200 one another about voting SO LONG AS THERE ARE 10 or

2) Material misstatements/ OR FEWER communicating.

omissions & fraud in its assets drop below $10 million FOR THREE

connection with soliciation of YEARS IN A ROW AND the number of SH is < ALL OTHERS ARE IN IF CORP IS. NOTE:

proxy prohibited. 2,000 Non-Shareholders ARE INCLUDED IN THIS SCOPE!!!!!

"in connection with"

3) MGMT must not only submit

relevant SH proposals, but a3) What is a solicitation?

must allow proponents short Not limited to 'pure' solicitations a4) Is the type of communication otherwise

space to explain their position Rule 14a-1(L) -> A solicitiation is "any exempted?

in face of MGMT opposition. communication which is reasonably

calcualted to solicit a S/H vote." "A statement made by a person stating how they

4) There must be full will vote is NOT A SOLICITATION if it is a press

disclosure in any non-MGMT "Reasonably calculated" means not direct; release, publication, ad, or broadcast opinion.

proxy materials [significant in therefore something which reasonably COULD (Meant to change result of Long Island Lighting)

proxy wars] HAVE altered SH votes = proxy solication if from

a SH or MGMT.

Must follow:

If all met: AVOIDING THE PROXY RULES.

§ 14(a)(4) (Requirements to Proxy) -> Mandates -> Don't use proxies or regular meetings.

-Proxy solicitations MUST form for Proxy Solicitation

1. Try to get a quorum w/o

be field with SEC or 2. In Delaware (some othrs), can

cannot be voted. See § 14(a)(5) (Proxy Statements Required for soliciting proxies. act w/o meeting if there is

14(a)(2). MGMT) -> Must use specific Schedule 14A (1) HOWEVER majority consent of SH on action.

before every meeting ANDl (2) when soliciting -> the information statement HOWEVER!!

- Need to be concerned proxies. required before ALL meetings SEC rules still require MGMT to

with FRAUD liability. must have essentially same info

MGMT proxy statements MUST include BOTH issue proxy statement to all SH's if

(but would avoid 14a; still may it acts by consent w/o meeting.

deal with 10b-5)

FEDERAL Shareholder Right to Information. (state rights still Rule 14a-9 -> False or Misleading Statements; ANTI-FRAUD Rule.

apply) See 10b-5 for more detalied process of fraud.

14(a)(7) -> IF a S/H wants to communicate with other SHs "No solicitation (under this) shall be made . . . containing any statement which . .

about a matter that is a proper subject in a proxy . is false or misleading w/ respect to any material fact or which omits to state

mat fact necessary to make remainder non-misleading"

solicitation, the SH may demand that MGMT provide him

with access to toher SH's 3) Was

2) NO SCIENTER. Unlike 10b-5, information

1) Public material?

Offer to send out the proxy solicitation there is no requirement for

companies only. -> Rsbl investor

FIRST using corp list, etc. BUT -> AT THE deceptive intent.

Not as expansive would have

SH S/H expense.

Corp as 10b-5. consiered it.->>

Requests. Negligent mistatements COUNT.

has MAG v. PROB.

Choice

Must be S/H

of record. Provide the SH with the SH list. Misstatement or Omission?

- Materially misleading or fraudulent affirmative statements prhobit.

-Material omissions (needed to make accurate) are prohibited.

NOBO List - Non-Objecting Beneficial

-List of ben owns who do not object to disribution of

SECOND.

names.

Two types of Plaintiffs Remedies

- Not all record holders are ben. ownrs.

lists. -SH -Injunction

- Fed Law permits ben ownr. to

-SEC -Recission

-Corporation -Damages

CEDE List - Depository that holds shares for others

A record holder for a large number of beneficial

owners.

BIG CAVEAT for

REASON:

EXCLUSIONS!!

Rule 14a-8

Shareholder MGMT required by Schedule

If SH proposal is excluded,

Proposal Rule Under limited circumstances, certain minority S/H have a right to include AND SH says he will

14A TO INCLUDE all

shareholder proposals on MGMT's own proxy statement. matters which MGMT

appear at meeting and

reasonably believes will be

raise it anyway, MGMT

voted upon ie THIS.

MUST include anyway.

FIrst -> Can S/H get it prima facie in? Note: If 1-4 are not met, MGMT must still notify SH of problem and give opprotunity to correct. 14a-8(f)(1).

1) Is the Does the MBCA or Del. C. 5) Submitted soon

submission for 2) Is the shareholder

NEED or ALLOW 3) Is this the enough?

a PROPER ELIGIBLE? 4) Is the

shareholder input on this? ONLY proposal

MATTER for proposal TOO

for the Must be submitted in

SH Must hold at least $2,000 LONG?

-> Can't influence regular meeting? "sufficient advance of

consideration of shares in MKT value the meeting for the

business decisions left to

under state OR at least 1% of No more than

MGMT w/o shareholder Rule 14a-8(a)(4) company to respond as

law? securities FOR AT LEAST 500 words in

say. says only one to whether they are

ONE YEAR before the proposal.

per meeting. going to accept

BIG!!!! submission of proposal.

-> No votes for protest in proposal.

YUGE!!!! this sense.

Second -> Can MGMT keep it out? 14a-8(

Improper Under Would Cause Violation of SEC Personal Claim Proposal Is NOT Relates to ORDINARY BUSINESS

State Law Corp to violate Proxy Rules or Greivance RELEVANT OPERATION of mgmt

14a-8(i)(1) state, federal, or 14a-8(i)(3) (i)(4) (i)(5) (i)(7)

foreign law. Rule: Look at what proposal is really about.

Wording -> "may 14a-8(i)(2) MOST COMMON eg -> "I love ANTHR BIG ONE.

or shall" SOURCE OF rockets. I propose Test has Objctv & Ask: Does the proposal go beyond ordinary

Shall = BAD. Eg. DENIAL!!!!!. that BOD interview Subjective Cmpts. business operation?

May = GOOD. Recommendation me b/c they turned Is it national in scope or global in policy?

that BoD commit If the statement is me down. NOT "A subject of Does it speak to heart of business?

If proposal is not arson or fraud. materially COOL. proposal is

proper subject for misleading OR irrelevant if it (1)

Even discriminatory practices were ordinary

action by SH; !!! too vauge (or eg -> complaints relates to

business decisions. -> Crackerbarrel

omitts mat fact that company's operations that

case.But new SEC opinion says SIGNIFICANT

-If proposal is req.); it triggers product prices are account for <5%

SOCIAL ISSUES go beyond mere business

binding on liability under. too high and want of corporation's

decision

corporation, is to pay less. NOT business (objctv)

NOT PROPER. Usually something COOL. AND (2) is not

Need to distinguish: Show it goes beyond

SH may not such as "to make "significantly

ordinary business. If broader general or

mandate actions; corp better" Better related to" the

overriding statement on who the company is

only recommend is VAGUE, so corp's business.

and how percieved/ principles -> GOES

and approve. IMPROPER. (subjct)

BEYOND OBO and is non-excludable.

-THUS, big diff Usually given Must meet BOTH to be excluded. NOTE:

b/w may and some chance to " signif related" INCLUDES SOCIAL ie "Hiring practices ie "Hiring practices

Corp would not

shall. amend and SIGNIFICANCE. could be more could be less racist"

Have

remedy. ie) social extremists use these to watch out/ efficient" so we so we aren't

Power/Authority to

advocate for animal treatment make more $$ -> ASSHOLES -> NOT

Contradicts a Effectuate Proposal

EXCLUDABLE. EXCLUDABLE.

MGMT (i)(6)

MOOTNESS

Proposal Relates to Election of

(i)(10) Resubmission of

(i)(9) Highly related to Office (i)(8)

(i)(2). Coverse -> Dividends (Law gen Proposal from <

MGMT has leaves to BoD) 12 months w/ <

B/c matter is lacks legal auth EXTREMELY

instead of prohibited. substantially Duplication (i)(13) 3%.

already before CONTROVERSIAl.

implemented of another (i)(12)

SH, would be

the Proposal Particular Dividend?

waste of ex) "I propose Is seen as directly

General Motors proposal (i)(11) (ie we should have $8) IF the SH proposal

resources to adversarial to MGMT, if this

already. EXCLUDABLE was submitted

have converse should end war in is the case, SH should have

vote. Iraq" to do it at own expense Duplicate of recently but "failed"

(like state law provides). prop from General Question? to get 3% or >.

CURRENT (ie should we dividend

Corp not responsible for YEAR. at all?) Applies to most

BIG NOTE: Schd 14A Item 20. Even if MGMT can

providing forum for BoD NOT EXCLUDABLE repeats.

keep the proposal out, if it has reason to know

that something will be voted on at the next challenges.

meeting it must include a mention in their proxy [Proposal for new seat is

statement that it will be voted on. HOwever, okay though.]

they do NOT need to include it AS a proposal, it

just must be noted.

Six Elements

Basic Securities Fraud. 1) Mat mis/omit

10b-5. 2) in connection

with

ANY PRCHS/SALE BY OF ANY SECURITY 3) Scienter

§ 10(b)

ANY PERSON 4) Deception

Prohibits the use of any manipulative or deceptive

Applies to ALL corporate securities, 5) Reliance

device or contrivance in contravention of SEC rules in

Includes corporations and including those of Private-Held 6) Causation

connection with the purchase or sale of securities.

natural persons. Corps and Closely Held Corps.

Not self-enforcing; merely gives the SEC the

ability to make rules criminally & civily

outlawing certain acts in the purchase/sale

secs. Who Can Enforce?

Enables Three Species of Law Private

DoJ SEC Investors

10b-5(a) - Outlaws fraud AGAINST -> Anybody who

(implied)

10b-5(b) - Outlaws making a material mistatment of fact makes a statement

Criminal Civil Must have been

or omission of material fact necessary to not mislead reasonably calcualted to

Sanctions Sanctions actual

10b-5(c) - Outlaws conduct which would "operate as a

purcahser/seller affect another person's

fraud"

purchase or sale of

Then, 10b5-1 for insider trading clarifications of securities (and has the

all 3.. requisite scienter)

Can sue/charge

primary violators Can ONLY sue the

ELEMENT 1 AND primary violators

Materiality & Mistatement/ Omission. aiders/abettors

a) Is there a misstatement or

omission? NOTE: " No comment" Misstatement b) OF A FACT c) Materiality

is perfectly fine way to avoid this.

Omission. a) Would the fact have been of actual

Hard facts included. significance to a reasonable

a2) Is it culpable omission? shareholder?

(1) Duty to Correct. Necessary to

correct earlier, innocent Opinions: MGMT's opinions must be

->>> TSC Ind. Magnitude x Probability

misstatement? true b/c of duty to be informed. (VA

Refined Meanings.

(2) Duty to Not Mislead. Bankshares) ->

i. Little chance, Little thing = NOT

Necessary to make an Opinions will be a misstatement

ii. Really big chance, small thing = jury call

accompanying statement NOT of fact if NOT MADE WITH

iii. Slight chance, Huge thing = jury call

misleading REASONABLE BASIS OF FACT.

iv. Big chance of big thing = MATERIAL.

(3) SEC Req. If an omission was

required by an SEC filing reg. Forward-Looking Statments: Must MORAL of Story: Decline to comment.

--------------------------------------

be supported by reasonable basis of

Silence is usually fine. No comment fact. Even if INCORRECT, two

fine.

overlapping rules may save.

1. "Bespeaks Caution" Doctrine.

No liability for fwd-lking stmt IF "adequate cautionary

stmt"

FRAUD (1) Identify factual basis of statement; AND

ELEMENT 2

(2) identify why it may not come true. Trump case.

" In connection with" Req. SAFE

HARBORS

Qualification & Standing Rule. 2. "Safe Harbor" Provision. If fwd-lking stmt is made

(1) on a reasonable basis; AND

(2) in good faith, COMPANY/MGMT SAFE.

[17a - Sale of security.]

10b-5: IN " In connection with" Can

STANDING.G. DEFENDANTS

connection Sue

REQUIRES

with the Requires "significant nexus

an actual purchase

purchase b/w fraud and transaction (or Govt:

or sale

or sale of solicitation). ie broker wrtiing SEC & DoJ

security" himself check from client Private:

stock fund. 10b-5: ANYONE (ie need not be

10b-5: Actual purchaser.

Fraud need only TOUCH the DIRECT OR DERIVATIVE!!! actual purcahser or seller; but

purchase/sale. often is) who makes a statement

14a-9: IN Options, etc ARE SALES> reasonably calculated to affect

14a-9: Holder of share who

connection recieved proxy. DIRECT OR another person's purchases/sales.

with the NO actual

DERIVATIVE!!!

solicitation purpose required; 14a-9's req is

of a proxy. only a solicitation. self-explainatory.

ELEMENT 3

SCIENTER [10b-5 ONLY, not 14a-9 - SL] NOTE: 17(a)

These are directly in the statute; were

model for 14a. NO PRIVATE RIGHT.

10b-5 Intent to Decieve Required. Ernst & Ernst v. Hocfelder.

or Negligence is NOT enough. Derry v. Peak CL Fraud. SEC Enforces These; Does not Always

17a (1) Knowing misstatement; BOTH need Scienter.

Intent to (2) making statemetn with NO BELIEF in its truth or falsity; OR private

deceive (3) Statement made in reckless disregard for the truth. parties (a)(1): Fraud SELLING securities

AND the Scienter Req.

SEC must

prove (a)(2)-(3): Misstatment/Omission OR

Negligence is sufficeint. scienter.

14a-9 operates as fraud.

Negligence NO scienter req. (Negligence)

Test; Was the misstatemetn/omission UNREASONABLE?

ELEMENT 4 ELEMENT 5

ACTUAL DECEPTION. [Not Sec, PP only] Reliance. [Not SEc, Private Parties ONLY]

Deception: Did the information CAUSE THE PLAINTIFF TO 10b-5? 14a-9?

ACT IN SOME WAY WHICH HE otherwise would not? Reliance Req. NO RELIANCE.

Deceptive Deprival of Action: Denial of a state court

remedy sufficient to constitute deception. Ie if the info 2 Elements P Must (technically, see below) Show

would have permitted to get injunction for merger but

now cannot -> deceptive. (precluded P from acting

in way which he would)

(1) Actual Reliance on D's (2) Reasonable reliance (objct)

misrep. (sub)

Manipulation: Did the information cause the market price to

fluctiuate somehow? TERM OF ART>

FRAUD ON THE MARKET THEORY

Substitutes insufficeint. (presumptivey establishes ACTUAL & REASONABLE)

B/c mkt price is reflection of all avaliable information, on which

CANNOT BE EQUITABLE FRAUD. shareholders are entitled to rely, RELIANCE IS PRESUMED IF P can

show false information was injected into the market.

2 Elements.

(2) Material Misstatment or

(1) Stock is publicly traded.

Omission (elemnt 1 re)

NOTE: Fraud on the Market is the ONLY way to prove reliance in class action

suits.

ELEMENT 6

Causation [Not Sec, private only] Miscellaneous Litigation Reform Statutes

A. Private Securities Litigation Reform Act of 1995 (PSLRA):

Procedural reforms supposed to make it harder to bring securities class

TRANSACTION CAUSATION: Showing of reliance elm 5. actions

Why I entered ESTABLISHES causation. 1. Presumption that the P with the largest economic interest will be named as

P must show that "but for" the the plaintiff, thus ensuring that institutional investors have control over

misrepresentation, the transaction 10b-5 counsel, settlement, etc.

would not have gone through (or 2. Court review of counsel appointments

would have gone through 3. Heightened pleading requirements for scienter

differently) 4. Mandatory review for Rule 11 violations when a suit is dismissed for

Causation: failure to state a claim

5. Automatic stay of discovery pending a 12(b)(6) motion

AND "Essential Link 6. Effect of PSLRA ? P?s started bringing claims in state court to bypass

to Transaction" PSLRA

LOSS CAUSATION

Why I lost. B. Securities Litigation Uniform Standards Act (SLUSA):

P must show that "but for" the 14a-9 Requires all securities fraud class actions involving 50 or more individuals to

misrepresentation, P would not be brought under federal law; state law is preempted

have suffered a loss. 1. Legislative response to the effect of PSLRA

2. Applies regardless of whether the claim is based on federal or state law

Must show that there was MATHEMATICAL POSSIBILITY that the C. Sarbanes Oxley Act of 2002:

transaction WOULD NOT PASS without the proxy vote. Heightens standards for corporate managers/directors

1. Now that Congress has nationalized some aspects of corporate

(1) Sh vote required + (2) Maj couldn't do it without mismanagement, there is some support to mandate a federal law of

(no need to show that vote would have stopped it; only that it legally could.) corporate mismanagement

Section 16 Insider Trading Requirements.

Concerned with potential abuses; penalizes some innocent conudct.

16(a) Reporting Requirements.

a) What must be reported? b) Who is subejct to requirements? 16(a)(1)

(1) Do the duties/functions the person perfomred those

Becoming Insider - Immediate

Officers & Directors -> Objective test based that OFFICER TYPICAL performs? Do they have

Within TEN days of becoming a " covered

on FUNCTION. (a lower-level could be an discretion in those functions;

person." -> MUST file Form 5 declaration.

officer and a VP could be an employee). Two AND

[10% beneficial owner, director, officer,

part test. (2) Did they have access to inside information?

insider}

-> " More likely than not" had inside. No need to prove

actual possession/use.

Familial Attribution Principle -> Shares owned by

10% Beneficial Owners

insider husband may be attributed to shareholder wife.

Any Trades - Supplemental Non-voting shares EXCLUDED from

Rebuttable preesumption that the insider is the

Montly Reports; 2nd calculation.

beneficial owner when a member of the immediate family,

Any month in which busniess day after who shares the indiser's residence, is the record owner of

an insider's holdings trade. (Req by CAN BE A GROUP OF S/Hs.

the shares.

change (he makes Sarbanes-Oxley)

trades), he must file -Insider must indicate Deputized 'Corporations'

what was bought The insider's access to knowledge will be ATTRIBUTED

a report within the

and/or sold Deputized = person put on ANOTHER board to the corporation that placed him on the board of the

10th day of the last

business day of the -Insider faces charges by a corp/parnership. Corp which owns the insider information

month. if report is not filed

Sec 16(b) - Disgorgment of Short Swing Private right of action. LAW

Profits OR EQUITY.

Strict liability Procedure Standing Recovery The Swing.

provision meant to

discourage NO Recovery

Quasi-Derivative.

directors from CONTEMPORANEOUS goes to the

Any PURCHASE and SALE

benefitting off the OWNERSHIP. CORPORATION.

Plaintiff must FIRST ask the within a SIX MONTH

short-term PERIOD.

Corporation to sue.

situation of a corp A person can scour Lawyers are

UNLESS doing so would be futile;

at the expense of SEC fiilings, find a the winners.

in which case no requirement. If you wait six months plus

its long term. short-swing, buy a (yay)

one day -> FINE. " Don't

Law or Equity. stock, and SUE THE mean a thing if it ain't got

NO PROFITABLE Depends on whether P asks for a SHIT out of them. that swing."

TRADING W/N jury trial.

SIX MONTHS OF If YES -> at law.

STOCK If NO -> at equity. [D can't ask for

PURCHASE. jury].

Profit Calculation. Harsh. Trnsctn: Purchase or Sale? Who CANNOT swing? What stocks does it apply to?

Highest sale price MINUS Traditional Transaction Director/Officer -> Liable if in position

lowest purchase price. -Cash (covered) FOR ONE of the transactions. [On

front end; not on back end] - Common & Preferred Stock

This means you can LOSE. Unorthodox Transaction - Anything convertible to stock

-Options & Mergers: 10% Beneficial Owner -> Must be > ie (conv. bond)

Should go back and make pragmatic approachi 10% insider FOR BOTH transactions. -Options?

sure we have right means of -> Look at trasnaction Spouse attribution. Exercise of option NOT 16(b)

calculation; do we give the pragmattically to see if it has Purchase of option SWING!!!.

highest price to all shares potential to spawn the sort Deputized -> If the deputized person

bought/sold? Or only on basis of abuse the statute was has " firewall" around them at

of the ones bought/sold t the meant to prohibit. 'basecamp' then NO LIABILITY. No

price extremes? firewall = liability.

Sec 16(c) Short Sales Prohibition

A corporate insider MUST OWN the shares s/he

trades.

" Covered persons" under 16(a) MAY

NOT participate in " short sales"

CANNOT trade in borrowed or loaned stocks or

convertible bonds.

Two Species of Insider Trades

Common Law Insider Trading

Buying on Good News (fid duty ONLY to current SH)

Breaches fiduciary duty b/c insider is buying from current S/Hs to whom he owes a fiducirary duty

Generally, a person has NO common

law duty to disclose trading Selling on Bad News (breaches limited to current SH)

information. Breaches fiduciary duty b/c insider is personally profiting from the principal

EXCEPTION: When a person has a

fiduciary duty via agency law; OWES

Did Transaction Invoke Duty? Recovery to?

PROFITS FROM USE OF

INFORMATION TO THE PRINCIPAL Face-to-Face Trasaction

If contacting SH directy and insider Creates a duty to Defrauded Shareholder.

hides identity AND induces the disclose identity; Privity of contract substantiates

Agency/Privity Relationship?

trade, there is ACTIONABLE cl because it is a material duty to SH. [Del. C. says insiders

fraud. (can't use corp info against fact. Common law have direct duty to SH by

SH) fraud. extension of Corp]

YES. Privity of K, purchase.

CL insider trading FRAUD

based on failure to disclose Open Market Transaction?

material fact. Therefore other If SH who buys/sells does not know None. Not

party MUST be a shareholder, he is working with insider, then there actionable @

to whom a duty is roughly is no duty invoked. C/L.

owed. NO DUTY.

No direct harm to plaintiff? Selling on BAD NEWS. Minor problem; Corporate Coffers.

Agency Thoery - Diamond buyer must be SH to asser Deriv. some states req. Unjust enrichment theory; Profits

Must depend on Usurpation of corporate opportunity P to show an injury belong to corporation instead.

CORPORATION's fiducary to make profit off of bad news therefore this doesn't

duty. Recovery to corp. belonging to the corproation. work there.

CAVEAT! Because duty is Corps' the BoD or

DERIVATIVE SUIT (would it work for buying on good?) S/H can vote to ratify the agent's improper

action. Poof. Cleansed.

10b-5 Insider Trading Differences from §16 Differences from Com Law

- 10b-5 WIDER RANGE of possible defendants. - Federal actions. (SEC & DoJ standing)

-Insiders trading on info - 10b-5 only concerned with actual abuse - Broader scope of actions

-Tippees trading on info - No 6-month safe haven. -Applies to ALL purchases and sales of securities.

-Tippees, no trade, but

PASS ALONG to trader

(Dirks).

Framework. MISSAPP/ DUTY THEORY TIPPEE THEORY

OR

a) What type of info does bi) Does the person have a duty? bii) Was person a tippee (recipient of info)?

person have? if yes, 2 elements can still trigger

Corporate Insider?

Is it MATERIAL? (c)(1) Was info tainted?

Fiduciary duty to the corporation and S/Hs. (1) Did the insider have a direct or indirect motive or gain

-Would a reasonable investor Can't use this information for their own use w/o

find it of actual signficance? to offer the info?

the approval OF BOTH BoD & SH. Won't [2nd Cir -> Friendship NOT culpable motive]

-Magnitude x Probability Test.

happen; would prob violate other rules by early [9th Cir -> Friendship IS culpable motive]

& disclosure.

REVERSE MATERIALITY RULE AND

The date on which insiders (2) Did insider ACTUALLY gain (even if no motive)?

Outsider Duty. Missapropriation Theory.

began to trade on info is second provision protects disclosures BY

STRONG EV of materiality. Must have fiduciary duty to the SOURCE of WHISTLEBLOWERS

AND

information.

Duty NOT TO APPROPRIATE info obtained w/ (c)(2) Did tippee knowingly trade on inside info?

"confidence of trust" -If the tippee knew the trading was impermissible.

Materiality/ Timing safe harbor: IF

insiders trade b/w 3rd & 10th (1) confidentialy agreement

day after quarterly report, NO Rev. Mat. d) Covered Info + Duty/Tippee = Disclose or Abstain.

(2) Conf. Matter of Law Disclose or Abstain Rule

-Doc/Pateint, Atty/client, When person has inside info and a duty; he must either disclose the

Is it NONPUBLIC @ trade? Emply/EMpler information to the other party or abstain from USING IT for trading.

(Timing Crucial) But ->No duty MoL

No duty if the information is -Broker/Clinet w/o history; physical

public. theif non-approprating. RELIANCE STILL AN ELEMENT; Fraud on Market works.

YES

(3) History of exchanging

Avaliability Rule: Even if confidences (rsbn expect; CLUB of

e) Litigating the Matter.

released, has the MRKT/ young prfsnls)

investing public had time to Use v. Possession. Safe harbor Rights of Action

10b-5 ONLY applies Insiders can 20(a) - Private class action

DIGEST the information?

ANY PERSON with information on a TENDER uses 3rd pty 10b-5 trading violations;

Note: Corp may call EXGE and if the information

OFFER has a duty under 14(e)(3) to not trade.

ask for trading to be halted USED. Possesion of trading plan; disgorgment pro-rata. (5 year

info is almost give up all of st of limits)

temproarily when news

Public AND private corpriatons (10b action) PRESUMPTION OF own discretion, 21(D) - SEC sues for disgorg

announced to allow MKT to react

USE. to continue to & 3x dmgs. 10% bounty to

in queue.

IF one of these three duties exists; go to trade whsitle. (no stat of limits)

Disclose-Abstain; if NOT, go to TIPPEE. Sf Hrbr

If BOTH, continue.

You might also like

- WIlls and Trusts Essay RoadmapDocument18 pagesWIlls and Trusts Essay RoadmapCamille Walker100% (4)

- Fed Securities Laws - Rule OutlineDocument30 pagesFed Securities Laws - Rule OutlineVirginia Crowson100% (12)

- AWESOME ATTACK OUTLINE Securities Regulation - Haft 2005-PreviewDocument4 pagesAWESOME ATTACK OUTLINE Securities Regulation - Haft 2005-Previewscottshear1No ratings yet

- Business Associations OutlineDocument34 pagesBusiness Associations OutlineIsabella L100% (1)

- Securities Regulation-E&E (6th Ed.)Document24 pagesSecurities Regulation-E&E (6th Ed.)Larry Rogers100% (1)

- Secreg - Gun Jumping Exam SheetDocument5 pagesSecreg - Gun Jumping Exam SheetRaj VashiNo ratings yet

- Momotaro Roles Play ScriptDocument3 pagesMomotaro Roles Play Scriptmommymusab100% (1)

- Possessory Estates & Future InterestsDocument1 pagePossessory Estates & Future InterestsAnnaNo ratings yet

- Mini Outline Securities RegulationDocument11 pagesMini Outline Securities RegulationGang GaoNo ratings yet

- BusAss OutlineDocument75 pagesBusAss OutlinejryanandersonNo ratings yet

- Business Associations - ChartDocument9 pagesBusiness Associations - Chartmkelly2109100% (1)

- PRINTED - Sec. Reg. Outline - GW Prof. Gabaldon 2012 - Text Soderquist & GabaldonDocument33 pagesPRINTED - Sec. Reg. Outline - GW Prof. Gabaldon 2012 - Text Soderquist & GabaldonErin Jackson100% (3)

- ST OutlineDocument103 pagesST Outlineam3ze100% (4)

- Gift and Estate Tax OutlineDocument15 pagesGift and Estate Tax OutlineChad DeCoursey100% (1)

- Secured Transactions OutlineDocument148 pagesSecured Transactions Outlineinsane7100% (3)

- Contract Law OutlineDocument8 pagesContract Law OutlineJ0221No ratings yet

- Secured Transactions OutlineDocument27 pagesSecured Transactions OutlineJ M100% (1)

- SERVITUDESDocument5 pagesSERVITUDESmfarooqi21100% (1)

- Secured Transactions, Governing Law: Law Essentials for Law School and Bar Exam PrepFrom EverandSecured Transactions, Governing Law: Law Essentials for Law School and Bar Exam PrepRating: 3 out of 5 stars3/5 (1)

- Keto Mojo Kickstart GuideDocument105 pagesKeto Mojo Kickstart GuideJulie GonzalezNo ratings yet

- Securities Regulation OutlineDocument50 pagesSecurities Regulation OutlineTruth Press Media100% (1)

- Sec Reg ChartDocument17 pagesSec Reg ChartMelissa GoldbergNo ratings yet

- Securities OutlineDocument58 pagesSecurities OutlineJonDoeNo ratings yet

- 2 207 FlowchartDocument1 page2 207 FlowchartMatthew Alan PierceNo ratings yet

- Secured Trans (Good Explanations)Document42 pagesSecured Trans (Good Explanations)JasonGershensonNo ratings yet

- Checklist PrintDocument22 pagesChecklist PrintIkram AliNo ratings yet

- Fiscal Carillo Full Transcript - Crim Law 1Document161 pagesFiscal Carillo Full Transcript - Crim Law 1Ryu Mendoza100% (1)

- Attack Sec. RegDocument5 pagesAttack Sec. RegTroyNo ratings yet

- Securities Regulation Outline - PKDocument119 pagesSecurities Regulation Outline - PKErin Jackson100% (2)

- Securities Outline FinalDocument22 pagesSecurities Outline FinalDaniel Novick100% (1)

- Securities RegulationDocument127 pagesSecurities RegulationErin Jackson100% (1)

- Securities Regulation OutlineDocument67 pagesSecurities Regulation OutlineSean Balkan100% (1)

- Contracts OutlineDocument31 pagesContracts OutlineVasu Goyal100% (12)

- Sec Reg Attack 2021 - NEWDocument28 pagesSec Reg Attack 2021 - NEWmattytang100% (1)

- Securities Regulations Law OutlineDocument32 pagesSecurities Regulations Law Outlinetwbrown1220100% (2)

- Securities Regulation OutlineDocument55 pagesSecurities Regulation OutlineJosh SawyerNo ratings yet

- Acing BA OutlineDocument64 pagesAcing BA OutlineStephanie PayanoNo ratings yet

- Securities Regulation Short Outline: I. BackgroundDocument14 pagesSecurities Regulation Short Outline: I. BackgroundzklvkfdNo ratings yet

- Securities Regulation Outline Bancroft Fall 2011Document33 pagesSecurities Regulation Outline Bancroft Fall 2011Erin JacksonNo ratings yet

- SecReg Outline 1 - Stern DetailedDocument127 pagesSecReg Outline 1 - Stern Detailedsachin_desai_9No ratings yet

- Choi (1) SecuritiesRegulation Spring2006Document124 pagesChoi (1) SecuritiesRegulation Spring2006himanshuNo ratings yet

- Chart OutlineDocument29 pagesChart OutlineKasem AhmedNo ratings yet

- I. Was It Implied in Fact?: 33 SaterialeDocument9 pagesI. Was It Implied in Fact?: 33 SaterialeJFNo ratings yet

- M and ADocument52 pagesM and Aoaijf100% (3)

- Corporations OutlineDocument42 pagesCorporations OutlineElNo ratings yet

- Trust OutlineDocument21 pagesTrust Outlineprentice brown100% (1)

- Sec Reg 2016 OutlineDocument101 pagesSec Reg 2016 OutlineRyan MaloleyNo ratings yet

- The Rule Against PerpetuitiesDocument2 pagesThe Rule Against Perpetuitieselleeklein100% (1)

- UCC OutlineDocument5 pagesUCC Outlinesielynikam50% (2)

- Decedent's Estates and Trusts OutlineDocument29 pagesDecedent's Estates and Trusts OutlineKylee Colwell100% (1)

- Corps Secret WeaponDocument4 pagesCorps Secret WeaponKeith DyerNo ratings yet

- Secured TransactionsDocument28 pagesSecured Transactionspatrick88% (8)

- Contracts UCC SalesDocument89 pagesContracts UCC Salesalbtros100% (7)

- Secured TransactionsDocument3 pagesSecured TransactionsJon Leins100% (2)

- Sales Outline: "The Good Guy Always Wins"Document15 pagesSales Outline: "The Good Guy Always Wins"zachroyusiNo ratings yet

- Secured Transactions OutlineDocument59 pagesSecured Transactions OutlineGabby ViolaNo ratings yet

- Contracts OutlineDocument26 pagesContracts OutlineNader100% (6)

- Estates and Trust OutlineDocument34 pagesEstates and Trust OutlinestaceyNo ratings yet

- Business Associations OutlineDocument59 pagesBusiness Associations OutlineCfurlan02100% (1)

- Covenants, Equitable Servitudes and RestrictionsDocument23 pagesCovenants, Equitable Servitudes and RestrictionsPhillip DoughtieNo ratings yet

- Remedie and Restitution NotesDocument128 pagesRemedie and Restitution NotesShelby MathewsNo ratings yet

- Full Outline - Bar Exam DoctorDocument19 pagesFull Outline - Bar Exam DoctorJulie Gonzalez100% (1)

- The Mariology of Maximillian KolbeDocument18 pagesThe Mariology of Maximillian KolbeJulie GonzalezNo ratings yet

- List N Disinfectant Results Table - ExploreDocument135 pagesList N Disinfectant Results Table - ExploreJulie GonzalezNo ratings yet

- Lemon Herb VinaigretteDocument8 pagesLemon Herb VinaigretteJulie GonzalezNo ratings yet

- Dom Prosper GuérangerDocument22 pagesDom Prosper GuérangerJulie GonzalezNo ratings yet

- The Athanasian CreedDocument3 pagesThe Athanasian CreedJulie GonzalezNo ratings yet

- The Epistles of ST Ignatius Bishop of AntiochDocument139 pagesThe Epistles of ST Ignatius Bishop of AntiochJulie GonzalezNo ratings yet

- Real Property Future Interests PDFDocument1 pageReal Property Future Interests PDFJulie GonzalezNo ratings yet

- Guide To Reading The BibleDocument53 pagesGuide To Reading The BibleJulie GonzalezNo ratings yet

- Real Property: Easements: STEP TWO: What Will The Effect Be? Three QuestionsDocument1 pageReal Property: Easements: STEP TWO: What Will The Effect Be? Three QuestionsJulie GonzalezNo ratings yet

- PSALMSDocument175 pagesPSALMSJulie GonzalezNo ratings yet

- Real Property Future Interests PDFDocument1 pageReal Property Future Interests PDFJulie GonzalezNo ratings yet

- Joinder & Impleader & JurisdictionDocument2 pagesJoinder & Impleader & JurisdictionJulie GonzalezNo ratings yet

- Balunueco Vs CADocument2 pagesBalunueco Vs CAJoshua OuanoNo ratings yet

- Family Report 2019 BDocument13 pagesFamily Report 2019 BalannainsanityNo ratings yet

- Eclipse-Lautapelin Viimeinen Osa, Shadow of The RiftDocument5 pagesEclipse-Lautapelin Viimeinen Osa, Shadow of The RiftPetteri KlenholmNo ratings yet

- Parliamentary ProceduresDocument59 pagesParliamentary ProceduresmarievalencNo ratings yet

- 2017 Puerto Rican Status ReferendumDocument5 pages2017 Puerto Rican Status ReferendumarroyojcNo ratings yet

- Guy FawkesDocument10 pagesGuy FawkesChristopher ServantNo ratings yet

- Pakistan Affairs PPSC 2022Document34 pagesPakistan Affairs PPSC 2022Malik TAHIRNo ratings yet

- APT Case Digest (RMP)Document3 pagesAPT Case Digest (RMP)boorijan0% (1)

- Barfield, MedallionDocument8 pagesBarfield, MedallionTR119No ratings yet

- We Signed A Binding Contract Last Year and It Is Still ValidDocument2 pagesWe Signed A Binding Contract Last Year and It Is Still ValidJosé ArmandoNo ratings yet

- CIR V Ayala Securities CorporationDocument1 pageCIR V Ayala Securities CorporationEmil Bautista100% (1)

- Today's Fallen Heroes Sunday 20 October 1918 (1732)Document35 pagesToday's Fallen Heroes Sunday 20 October 1918 (1732)MickTierneyNo ratings yet

- Cebu Shipyard and Engineering Works, Inc. v. William Lines - IBP Zamboanga Del Norte ChapterDocument4 pagesCebu Shipyard and Engineering Works, Inc. v. William Lines - IBP Zamboanga Del Norte ChapterZainne Sarip BandingNo ratings yet

- True Ghosts Spooky IncidentsDocument136 pagesTrue Ghosts Spooky IncidentsAliosha BazaesNo ratings yet

- The Coca-Cola Bottling Company of New York, Inc. v. Soft Drink and Brewery Workers Union Local 812, International Brotherhood of Teamsters, 242 F.3d 52, 2d Cir. (2001)Document9 pagesThe Coca-Cola Bottling Company of New York, Inc. v. Soft Drink and Brewery Workers Union Local 812, International Brotherhood of Teamsters, 242 F.3d 52, 2d Cir. (2001)Scribd Government DocsNo ratings yet

- PLDT Vs CADocument2 pagesPLDT Vs CAAissa VelayoNo ratings yet

- Individual Daily Log Accomplishement ReportDocument11 pagesIndividual Daily Log Accomplishement ReportSilvester CardinesNo ratings yet

- NCLEX Study GuideDocument26 pagesNCLEX Study GuideLinda KellyNo ratings yet

- Appendix Notice 138Document2 pagesAppendix Notice 138Mrīgendra Narayan UpadhyayNo ratings yet

- Fake News Essay Outline PDFDocument2 pagesFake News Essay Outline PDFGarry ChiuNo ratings yet

- Phil Pharmawealth V PfizerDocument1 pagePhil Pharmawealth V PfizerKristina B DiamanteNo ratings yet

- Revision For Unit 1,2,3Document9 pagesRevision For Unit 1,2,3Pham ThuhienNo ratings yet

- 'The Woman in The House Across The Street From The Girl in The Window' Ending, ExplainedDocument1 page'The Woman in The House Across The Street From The Girl in The Window' Ending, ExplainedBecca WhoNo ratings yet

- Differential Diagnosis of Genital Ulcer Differential Diagnosis of Genital UlcersDocument3 pagesDifferential Diagnosis of Genital Ulcer Differential Diagnosis of Genital UlcersNurhayati HasanahNo ratings yet

- Kaaba PresentationDocument15 pagesKaaba PresentationmimiNo ratings yet

- Rubi vs. Provincial Board of MindoroDocument2 pagesRubi vs. Provincial Board of MindoroMichaelNo ratings yet

- People vs. BulosDocument1 pagePeople vs. BulosEllaine VirayoNo ratings yet

- Evid ProjectDocument74 pagesEvid ProjectVince Albert TanteNo ratings yet