Professional Documents

Culture Documents

How To Export Goods From Canada

How To Export Goods From Canada

Uploaded by

Mehdi SoltaniOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

How To Export Goods From Canada

How To Export Goods From Canada

Uploaded by

Mehdi SoltaniCopyright:

Available Formats

STAGE 1: BEFORE EXPORTING

1. WRITE YOUR EXPORT PLAN An export plan is a business plan that focuses on international

markets. It identifies your target market(s), export goals, necessary

A roadmap to success and a tool to

measure your business’ progress. resources and anticipated results.

For tips on writing a business plan, visit sbbc.co/howtobizplan

See our Business Plan Review Service sbbc.co/bizplanreview and

business plan seminars sbbc.co/SBBCeduCal) for help.

2. MARKET RESEARCH AND

MARKET ANALYSIS

Before investing in the export of goods, make sure there is a demand

for your product in the targeted country.

Market research is a vital part of your Department of Foreign Affairs and International Trade Canada

business plan, including creating a

viability report.

(www.international.gc.ca)

Export Development Canada (www.edc.ca)

Trade Map (www.trademap.org)

Centre for Intercultural Learning (www.intercultures.gc.ca)

3. FIND POTENTIAL CLIENTS Ensure you have potential clients interesting in buying your items and

develop relationship with them.

Trade Facilitation Office Canada (www.tfocanada.ca)

Department of Foreign Affairs and International Trade Canada

(www.international.gc.ca)

Visit Small Business BC to access Kompass and Hoovers

(www.kompass.com and www.hoovers.com)

Duns and Bradstreet (www.dnb.com)

4. REGULATIONS AND

PERMITS

Visit the Foreign Affairs and International Trade to find out if your

goods require an export permit: www.international.gc.ca

Find out if your goods are regulated by a government department and

agency: sbbc.co/regulatedgoods

5. PRODUCT AND LABELLING

REQUIREMENTS

Different government departments will have different labeling

standards depending on industry of your product. Contact the relevant

government of the foreign country or ask your buyer to give you

information about the labeling requirement.

6. TARIFF CLASSIFICATION

(HS CODE)

Find the Tariff classification (HS code), Tariff Treatment, duties, taxes

of your goods.

Determine the 8 digit tariff classification number (HS code) for each

item exported. Call Statistics Canada 1-800-257-2434 to obtain

codes.Your buyer or international Freight Forwarder can provide you,

for a fee, with the HS code.

Small Business BC | Tel: 604-775-5525 | 1-800-667-2272 | Email: askus@smallbusinessbc.ca | Web: smallbusinessbc.ca

03/2017

7. OBTAIN A CERTIFICATE

OF ORIGIN

Under the free trade agreements:

Value shipment less than CAD$2500: a formal certificate of origin is

not required, only a letter stating the origin of the goods

Value shipment greater than CAD$2500: a formal certificate of origin

required: sbbc.co/certorigin

Under GPT and LDCT: sbbc.co/gptldct

8. REGISTER YOUR

BUSINESS

Apply for a business name and register a sole proprietorship,

partnership or a corporation: sbbc.co/registerbusiness

See our Registration Services for help: sbbc.co/registeryourbiz

9. OBTAIN IMPORT/EXPORT

ACCOUNT

Obtain an import/export account, from Canada Revenue Agency at

1-800-959-5525 or www.cra-arc.gc.ca.

Small Business BC offers registration service, including opening your

trade account: sbbc.co/importexportservices

10. FIND POTENTIAL CLIENTS Find clients and develop relationship:

Trade Facilitation Office Canada (www.tfocanada.ca)

Department of Foreign Affairs and International Trade Canada

(www.international.gc.ca)

STAGE 2: AT THE BORDER

11. EXPORT DECLARATION

B13A

Use the Canadian Automated Export Declaration to file the B13A form

at least 48 hours prior to export. Visit sbbc.co/exportdeclaration to

Not required for shipments to US download the free software, or call 1-800-257-2434.

or shipments valued under $2000.

12. ACCOUNTING PACKAGE

DOCUMENTS

Customs require 3 copies of your completed B13A (if applicable),

certificate of origin (if applicable), commercial invoice, and all required

permits certificates or licenses for the destination.

DON’T KNOW WHERE TO START? READY FOR THE NEXT STEP?

EXPORT REGISTRATION PACKAGE ARE YOU THINKING OF EXPORTING?

One-on-one trade consulting including export Learn the basics of international trade,

$89

processes and requirements

Export account setup and number

$59 understand the use of Incoterms, means of

payment, regulations

PLUS TAXES Harmonized System Code PLUS TAXES Acquire the knowledge to be ready to

export

Certificate of origin and paperwork for export

Receive the tools to develop an export plan

And more!

CLIENT SERVICES

CONTACT

604-775-5525 | 1-800-667-2272 | askus@smallbusinessbc.ca

All clients are advised to reconfirm information from the official departments from the necessary government agencies both in Canada and abroad. Small Business BC accepts

no liability or responsibility for any acts or errors, omissions, misuse, and/or misinterpretation resulting from reliance, in whole or in part, on information provided.

Small Business BC | Tel: 604-775-5525 | 1-800-667-2272 | Email: askus@smallbusinessbc.ca | Web: smallbusinessbc.ca

03/2017

You might also like

- Brazilian Footwear CompanyDocument5 pagesBrazilian Footwear CompanyIfra AkhlaqNo ratings yet

- Azure SynapseDocument609 pagesAzure SynapseShubham SarafNo ratings yet

- 1.the Masala MarketDocument17 pages1.the Masala MarketShubham DeshmukhNo ratings yet

- Alejandro Gómez. QuizDocument2 pagesAlejandro Gómez. Quizoswaldo gutierrez100% (2)

- INTL 729 Importing To Canada 2Document3 pagesINTL 729 Importing To Canada 2philipNo ratings yet

- Export Certificate of Origin PDFDocument2 pagesExport Certificate of Origin PDFRachel100% (2)

- NOV Spherical BOP ManualDocument122 pagesNOV Spherical BOP ManualSarah Bartley91% (11)

- Styrene Pressure Drop Tutorial ASPEN PDFDocument10 pagesStyrene Pressure Drop Tutorial ASPEN PDFTomNo ratings yet

- Sentro8 - Modbus - Registers #1 10Document24 pagesSentro8 - Modbus - Registers #1 10Rodrigo RestrepoNo ratings yet

- Stage 1: Before Importing: 1. Business PlanDocument2 pagesStage 1: Before Importing: 1. Business Planleyfer9No ratings yet

- "Documentación de La Operación de Comercio".Document25 pages"Documentación de La Operación de Comercio".Luiza Fernanda VelaNo ratings yet

- Building Your Business in B.C. Guide: BC PNP Entrepreneur ImmigrationDocument1 pageBuilding Your Business in B.C. Guide: BC PNP Entrepreneur Immigrationsimiyu cciNo ratings yet

- Iconnect Business Private Limited: Export Prime - TimelineDocument6 pagesIconnect Business Private Limited: Export Prime - TimelineazharuzinNo ratings yet

- USMCASmallBusinessExportChecklis PDFDocument16 pagesUSMCASmallBusinessExportChecklis PDFAtif MahmoodNo ratings yet

- Canada Business VISAS Complete GuideDocument6 pagesCanada Business VISAS Complete Guidewaqas arshadNo ratings yet

- Step-By-Step Guide To Importing Commercial Goods Into CanadaDocument7 pagesStep-By-Step Guide To Importing Commercial Goods Into CanadaRicardo J FloresNo ratings yet

- Actividad de Aprendizaje 15 Evidencia 8 Steps To Xport MALORIS VILLADIEGO TraducirDocument12 pagesActividad de Aprendizaje 15 Evidencia 8 Steps To Xport MALORIS VILLADIEGO Traducirluis carlos hernandez diazNo ratings yet

- Export Process FlowDocument32 pagesExport Process Flowstats.tuticorincustomsNo ratings yet

- Evidencia 8 - Presentation Steps To ExportDocument10 pagesEvidencia 8 - Presentation Steps To ExportLiliana Diaz ANo ratings yet

- Usmca Customs & Trade Facilitation: Deep Sengupta, LL.M Ceo, DSG Global, LLC Mobile: 415-741-7256Document17 pagesUsmca Customs & Trade Facilitation: Deep Sengupta, LL.M Ceo, DSG Global, LLC Mobile: 415-741-7256Deep SenGuptaNo ratings yet

- Importing GuideDocument3 pagesImporting GuideAnonymous I03Wesk92No ratings yet

- Export GuideDocument29 pagesExport GuidemultilinkaddisNo ratings yet

- Competition Merger Toolkit June 2021Document40 pagesCompetition Merger Toolkit June 2021ricdick33No ratings yet

- Gkingdom Moonligt Enterprises LTD Export Acceleration Program 2021/2021Document4 pagesGkingdom Moonligt Enterprises LTD Export Acceleration Program 2021/2021SCHAEFFER CAPITAL ADVISORSNo ratings yet

- Five Canadian Government Supports For Small Medium Sized Enterprises (SME) ExportingDocument35 pagesFive Canadian Government Supports For Small Medium Sized Enterprises (SME) ExportingUlusyar TareenNo ratings yet

- Selling To The Government-FinalDocument12 pagesSelling To The Government-FinalJustin Hansen100% (2)

- Ibm554 16 DocumentsDocument12 pagesIbm554 16 Documentsfazillah.asNo ratings yet

- EXPORT PLAN - KeyDocument18 pagesEXPORT PLAN - KeySaurabhNo ratings yet

- Ricardo - Adrián - GMB380 - Entregable 1Document11 pagesRicardo - Adrián - GMB380 - Entregable 1romeoNo ratings yet

- Step by Step Guide For New Exporters Export ProceduresDocument20 pagesStep by Step Guide For New Exporters Export ProceduresOsama RathoreNo ratings yet

- Export Fruits & Vegetables-19-29Document11 pagesExport Fruits & Vegetables-19-29manutdudaNo ratings yet

- Canada StartUp VisaDocument3 pagesCanada StartUp Visawaqas arshadNo ratings yet

- Pricing - SCA-PARTNERDocument2 pagesPricing - SCA-PARTNERSCHAEFFER CAPITAL ADVISORSNo ratings yet

- Import RegulationsDocument3 pagesImport RegulationsNehal SarhanNo ratings yet

- Step by Step Guide For New Exporters Export ProceduresDocument20 pagesStep by Step Guide For New Exporters Export Proceduresعلی خانNo ratings yet

- Guidelines To Export & Import: As Per Foreign Trade Policy 2015-2020Document109 pagesGuidelines To Export & Import: As Per Foreign Trade Policy 2015-2020manoj chNo ratings yet

- Writing An Export Plan - Compress PDFDocument12 pagesWriting An Export Plan - Compress PDFshin sharifiNo ratings yet

- Ankit Majmudar - Module - 1 - Introduction To International TradeDocument20 pagesAnkit Majmudar - Module - 1 - Introduction To International TradehimanshuNo ratings yet

- Actividad Aprendizaje 10 Evidencia 6Document13 pagesActividad Aprendizaje 10 Evidencia 6Gloria CastilloNo ratings yet

- The Beginners Guide To Export Forms - Shipping SolutionsDocument43 pagesThe Beginners Guide To Export Forms - Shipping SolutionsssgdppNo ratings yet

- ADLC Program User Guideline Unifed ICVDocument28 pagesADLC Program User Guideline Unifed ICVShinoj ShamsuddinNo ratings yet

- Your 5-Step Plan For Breaking Into Exports Get The Latest From SME Toolkit South AfricaDocument3 pagesYour 5-Step Plan For Breaking Into Exports Get The Latest From SME Toolkit South AfricaDonovaNo ratings yet

- Sitpro: Roadmap To Exporting SuccessDocument6 pagesSitpro: Roadmap To Exporting SuccessSiddharth Shri Shri MalNo ratings yet

- Exim Procedure of Cargosol CompanyDocument91 pagesExim Procedure of Cargosol CompanyShantam JaiswalNo ratings yet

- Export-Basics Ghana v5Document58 pagesExport-Basics Ghana v5Diana TandohNo ratings yet

- Villaroman, KDM - Harley-Davidson WITH COMMENTSDocument9 pagesVillaroman, KDM - Harley-Davidson WITH COMMENTSKD MVNo ratings yet

- Actividad de Aprendizaje 13 Aa 2Document6 pagesActividad de Aprendizaje 13 Aa 2ferneyNo ratings yet

- BELTRAIDE - Belize Exporter's Manual 2007Document72 pagesBELTRAIDE - Belize Exporter's Manual 2007Office of Trade Negotiations (OTN), CARICOM SecretariatNo ratings yet

- 1 Step by Step Guide For Exporters Export ProceduresDocument20 pages1 Step by Step Guide For Exporters Export ProceduressauviragccNo ratings yet

- Real Estate Analyst - Job Description - HCCPDocument2 pagesReal Estate Analyst - Job Description - HCCPMatthew JohnNo ratings yet

- Alberta 'S Trade Certification Process: Through This ProgramDocument2 pagesAlberta 'S Trade Certification Process: Through This ProgramAbdeslam SerkouhNo ratings yet

- Retail Ecommerce Tax Update TIEADocument3 pagesRetail Ecommerce Tax Update TIEAgarybNo ratings yet

- Fully Baked - Business Plan PresentationDocument40 pagesFully Baked - Business Plan PresentationcdourmashkinNo ratings yet

- Case - International Expansion - Why Target's Localization Strategy Failed in Canada - Brand2Global PDFDocument7 pagesCase - International Expansion - Why Target's Localization Strategy Failed in Canada - Brand2Global PDFTushar MarwahaNo ratings yet

- Guidelines To The Procurement Obligations of 1 Guidelines To The ProcurementDocument33 pagesGuidelines To The Procurement Obligations of 1 Guidelines To The ProcurementEm FernandezNo ratings yet

- Program in Import & Export Management: Start UpDocument2 pagesProgram in Import & Export Management: Start UpRitesh ChauhanNo ratings yet

- KRE #R 31 Marking SchemeDocument5 pagesKRE #R 31 Marking Schemetharindu.dediyagalaNo ratings yet

- Evidencia 8 Presentation Setps To ExportDocument8 pagesEvidencia 8 Presentation Setps To ExportCesar MerchanNo ratings yet

- Actividad de Aprendizaje 10 Evidencia 6: Video "Steps To Export"Document4 pagesActividad de Aprendizaje 10 Evidencia 6: Video "Steps To Export"jeimmy ruedaNo ratings yet

- Export GuideDocument28 pagesExport Guidebirhanu100% (1)

- Banking For New Comers To Canada: (Source For Entire Document:)Document1 pageBanking For New Comers To Canada: (Source For Entire Document:)Harsh DaveNo ratings yet

- The Private Equity Toolkit: A Step-by-Step Guide to Getting Deals Done from Sourcing to ExitFrom EverandThe Private Equity Toolkit: A Step-by-Step Guide to Getting Deals Done from Sourcing to ExitNo ratings yet

- Cash Is King: Maintain Liquidity, Build Capital, and Prepare Your Business for Every OpportunityFrom EverandCash Is King: Maintain Liquidity, Build Capital, and Prepare Your Business for Every OpportunityNo ratings yet

- Pressure Inverting Pedestal: Product DescriptionDocument1 pagePressure Inverting Pedestal: Product DescriptionMehdi SoltaniNo ratings yet

- WipersDocument19 pagesWipersMehdi SoltaniNo ratings yet

- Wear Rings: Product DescriptionDocument11 pagesWear Rings: Product DescriptionMehdi SoltaniNo ratings yet

- Recommended WPCE Service and Certification ScheduleDocument3 pagesRecommended WPCE Service and Certification ScheduleMehdi SoltaniNo ratings yet

- Vee Packing PDFDocument10 pagesVee Packing PDFMehdi SoltaniNo ratings yet

- Oil SealsDocument42 pagesOil SealsMehdi SoltaniNo ratings yet

- Rebuild KitDocument3 pagesRebuild KitMehdi SoltaniNo ratings yet

- Top Drive 750 Product SheetDocument2 pagesTop Drive 750 Product SheetMehdi SoltaniNo ratings yet

- Cameron Ram BopDocument2 pagesCameron Ram BopMehdi SoltaniNo ratings yet

- Guide To Import & Export, Customs Formalities: Iran InvestDocument2 pagesGuide To Import & Export, Customs Formalities: Iran InvestMehdi SoltaniNo ratings yet

- Inconel 625 - BOP Body BlockDocument3 pagesInconel 625 - BOP Body BlockMehdi SoltaniNo ratings yet

- For Goods Exported To or From Canada - Not For Use Under NAFTADocument2 pagesFor Goods Exported To or From Canada - Not For Use Under NAFTAMehdi SoltaniNo ratings yet

- Capped T SealsDocument6 pagesCapped T SealsMehdi SoltaniNo ratings yet

- Top Drive 750 Product SheetDocument2 pagesTop Drive 750 Product SheetMehdi SoltaniNo ratings yet

- Fluid Seals: Product DescriptionDocument11 pagesFluid Seals: Product DescriptionMehdi SoltaniNo ratings yet

- Washers: Product DescriptionDocument4 pagesWashers: Product DescriptionMehdi SoltaniNo ratings yet

- Flexpacker NR Product SheetDocument1 pageFlexpacker NR Product SheetMehdi SoltaniNo ratings yet

- 21 1/4 - 2,000 Ram Blowout Preventer Operation Manual Hydraulic Wedge Lock 2FZ54-14 FZ54-14Document28 pages21 1/4 - 2,000 Ram Blowout Preventer Operation Manual Hydraulic Wedge Lock 2FZ54-14 FZ54-14Mehdi SoltaniNo ratings yet

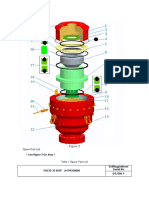

- Spare Part List: See Figure 3 For ItemDocument2 pagesSpare Part List: See Figure 3 For ItemMehdi SoltaniNo ratings yet

- Double V Shear Rams Product SheetDocument1 pageDouble V Shear Rams Product SheetMehdi Soltani100% (1)

- Cameron International Corporation: FORM 10-KDocument31 pagesCameron International Corporation: FORM 10-KMehdi SoltaniNo ratings yet

- 21 1/4 - 2,000 Ram Blowout Preventer Operation Manual Hydraulic Wedge Lock 2FZ54-14 FZ54-14Document28 pages21 1/4 - 2,000 Ram Blowout Preventer Operation Manual Hydraulic Wedge Lock 2FZ54-14 FZ54-14Mehdi SoltaniNo ratings yet

- Live Face Tracking Robot ArmDocument6 pagesLive Face Tracking Robot ArmIJRASETPublicationsNo ratings yet

- Respondus Monitor GuideDocument4 pagesRespondus Monitor GuideMeegan WilliNo ratings yet

- Java (Full Course)Document57 pagesJava (Full Course)tayzarlwintunNo ratings yet

- Ch6-The Kanban SystemDocument23 pagesCh6-The Kanban SystemSaadAminNo ratings yet

- Modern Wireless Attacks PDFDocument50 pagesModern Wireless Attacks PDFbehlole aqilNo ratings yet

- Tale Blazer Tutorial 2Document6 pagesTale Blazer Tutorial 2kak.isNo ratings yet

- It Policy Oxford UniversityDocument27 pagesIt Policy Oxford UniversitysamdaliNo ratings yet

- Final Recap With SyllabusDocument7 pagesFinal Recap With SyllabusLittle GardenNo ratings yet

- C3 EX TYPE CV en ANGLAISDocument2 pagesC3 EX TYPE CV en ANGLAISThuthur freerideNo ratings yet

- Python 3 Cheat Sheet v3Document13 pagesPython 3 Cheat Sheet v3Nilay Chauhan100% (3)

- Nutanix and HPE Partner To Deliver Hyperconverged Systems: The End of An EraDocument7 pagesNutanix and HPE Partner To Deliver Hyperconverged Systems: The End of An EraAdi YusupNo ratings yet

- Rajavardhan UTMIDocument69 pagesRajavardhan UTMIRajavardhan_Re_6459No ratings yet

- Naukri SunilKumar (6y 0m)Document3 pagesNaukri SunilKumar (6y 0m)dodla.naiduNo ratings yet

- Gccint PDFDocument722 pagesGccint PDFMaxim ShelestofNo ratings yet

- OpenScape Business V3 Security Checklist Issue 5Document167 pagesOpenScape Business V3 Security Checklist Issue 5slamet riyadiNo ratings yet

- Human Machine InterfacesDocument34 pagesHuman Machine InterfacesAlvaro Villalba TorresNo ratings yet

- Data Collector Guide PDFDocument9 pagesData Collector Guide PDFchimbwaNo ratings yet

- Introduction To Computer ArchitectureDocument17 pagesIntroduction To Computer ArchitectureSURYA SUMEETNo ratings yet

- 2010-03-02 054850 Java QuestionsDocument15 pages2010-03-02 054850 Java QuestionsJason ShaoNo ratings yet

- License Plate Recognition For Security ApplicationDocument9 pagesLicense Plate Recognition For Security ApplicationTAgore Ravi TejaNo ratings yet

- Mendelson - Second Thoughts About Church's Thesis and Mathematical Proofs - The Journal of Philosophy Volume 87 Issue 5 1990 (Doi 10.2307/2026831)Document10 pagesMendelson - Second Thoughts About Church's Thesis and Mathematical Proofs - The Journal of Philosophy Volume 87 Issue 5 1990 (Doi 10.2307/2026831)losoloresNo ratings yet

- Tripp Lite 3-Phase UPS BrochureDocument24 pagesTripp Lite 3-Phase UPS Brochurearyan_iustNo ratings yet

- Assignment - 1 - Embedded SystemsDocument2 pagesAssignment - 1 - Embedded SystemsHasan AhmedNo ratings yet

- Datasheet - Ewon Cosy 131Document3 pagesDatasheet - Ewon Cosy 131Omar AzzainNo ratings yet

- Pivot Table Formulas Before PowerpivotDocument6 pagesPivot Table Formulas Before PowerpivotAziz Khan LodhiNo ratings yet

- OpenVox A400/800/1200 Series Analog Card DatasheetDocument1 pageOpenVox A400/800/1200 Series Analog Card Datasheetmaple4VOIPNo ratings yet