Professional Documents

Culture Documents

AKL 2 - Tugas 5 Marselinus A H T (A31113316)

AKL 2 - Tugas 5 Marselinus A H T (A31113316)

Uploaded by

Marselinus Aditya Hartanto TjungadiOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

AKL 2 - Tugas 5 Marselinus A H T (A31113316)

AKL 2 - Tugas 5 Marselinus A H T (A31113316)

Uploaded by

Marselinus Aditya Hartanto TjungadiCopyright:

Available Formats

Nama : Marselinus Aditya Hartanto Tjungadi

NIM : A31113316

Advanced Accounting 2 (Akuntansi Keuangan Lanjutan 2)

Problem 8-6

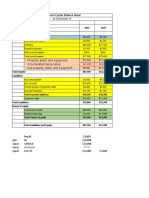

1 Investment in Sod December 31, 2012

Investment in Sod January 2, 2011 $ 98,000

Increase for 2011 ($30,000 retained earnings increase 70%) 21,000

Purchase of additional 20% interest June 30, 2012 37,000

Increase for income for 2012:

($30,000 1/2 year 70%) + ($30,000 1/2 year 90%) 24,000

Dividends 2012: ($10,000 90%) (9,000)

Investment in Sod December 31, 2012 $171,000

2 Goodwill December 31, 2012

January 2, 2011 purchase:

Cost of 70% interest $ 98,000

Implied fair value of Sod ($98,000 / 70%) $140,000

Less: Book value of Sod 120,000

Goodwill $ 20,000

June 30, 2012 purchase:

Cost of 20% interest $ 37,000

Implied fair value of Sod ($37,000 / 20%) $185,000

Less: Book value of Sod 165,000

Goodwill - December 31, 2012 $ 20,000

3 Consolidated net income

Sales $600,000

Cost of sales (400,000)

Expenses (70,000)

Consolidated net income 130,000

Noncontrolling interest share * 6,000

Controlling share of net income $124,000

* Noncontrolling share is 10% for full year plus

20% for ½ year.

Alternative:

Pot’s reported income = Controlling share of net income $124,000

4 Consolidated retained earnings December 31, 2012

Beginning retained earnings $200,000

Add: Controlling share of Consolidated net income — 2012 124,000 Less:

Dividends (64,000)

Consolidated retained earnings — ending $260,000

Alternative solution:

Pot’s reported ending retained earnings = Consolidated

retained earnings — ending $260,000

5 Noncontrolling interest December 31, 2012

Equity of Sod December 31, 2012 $170,000

Goodwill 20,000

Fair value of Sod $190,000

Noncontrolling interest percentage 10%

Noncontrolling interest December 31, 2012 $ 19,000

Problem 8-7

Pod Corporation and Subsidiary

Consolidated Income Statement for the year

ended December 31, 2012 (in thousands)

Sales $3,200

Cost of sales (1,900)

Gross profit 1,300

Depreciation expense (700)

Other expenses (150)

Consolidated net income 450

Noncontrolling interest share (($150,000 20%) (33.75)

($150,000 1/4 year 10%)

Controlling share of Consolidated net income $ 416.25

Note:

Should also add Gain on revaluation of investment of $66,750 to Consolidated

income statement.

Calculation:

Implied fair value of Subsidiary $95,000/0.1 = $950,000 Fair

value of original investment $950,000 x 70% = $665,000 Less:

Carrying value of original investment 598,250

Gain on revaluation of investment $66,750

Carrying value of original investment= $600,000 + ($150,000 x 3/12 x 70%) –

($40,000 x 70%) = $598,250

Schedule to allocate Saw’s income and dividends

Saw’s income: Controlling

share:

($150,000 x 70% x 3/12) + ($150,000 x 80% x 9/12) = 116,250

Noncontrolling share:

($150,000 x 30% x 3/12) + ($150,000 x 20% x 9/12) = 33,750

Saw’s dividends:

Controlling share:

($40,000 x 70%) + ($40,000 x 80%) = $60,000

Noncontrolling share:

($40,000 x 30%) + ($40,000 x 20%) = $20,000

Problem 8-8

Preliminary computations

Cost October 1, 2011 $ 82,400

Implied fair value of Sat ($82,400 / 80%) $103,000

Book value on October 1 acquisition date:

Book value on January 1, 2011 $70,000

Add: Income January 1 to October 1

($24,000 3/4 year) 18,000

Deduct: Dividends March 15 (5,000)

Book value October 1 83,000

Goodwill $ 20,000

Income from Sat for 2011

Share of Sat’s net income ($24,000 1/4 year 80%) $ 4,800

Less: Unrealized profit in Sat’s ending inventory (1,000)

Income from Sat $ 3,800

* Preacquisition income ($24,000 3/4 year 100%) $18,000

* Preacquisition dividends ($5,000 80%) $ 4,000

* Noncontrolling interest share ($6,000 20%) $ 1,200

* Under GAAP, preacquisition earnings are not shown as a

reduction of consolidated net income. Rather, we only

include earnings and dividends subsequent to the acquisition

date. Preacquistion amounts are disclosed in required pro-

forma disclosures for acquisitions. The worksheet on the

following page reflects these adjustments.

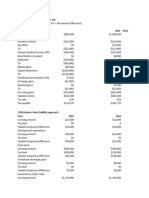

Pop Corporation and Subsidiary

Consolidation Working Papers for

the year ended December 31, 2011

Adjustments and Consolidated

Pop Sat 80% Eliminations Statements

Income Statement

Sales $ 112,000 $ 50,000 a 12,000 $ 112,500

c 37,500

Income from Sat 3,800 b 3,800

Cost of sales 60,000* 20,000* d 1,000 a 12,000 54,000*

c 15,000

Operating expenses 25,100* 6,000* c 4,500 26,600*

Consolidated net income 31,900

Noncontrolling int. share f 1,200 1,200*

Controlling share of NI $ 30,700 $ 24,000 $ 30,700

Retained Earnings

Retained earnings — Pop $ 30,000 $ 30,000

Retained earnings — Sat $ 20,000 e 20,000

Net income 30,700 24,000 30,700

Dividends 20,000* 10,000* b 4,000

c 5,000

f 1,000 20,000*

Retained earnings

December 31 $ 40,700 $ 34,000 $ 40,700

Balance Sheet

Cash $ 5,100 $ 7,000 $ 12,100

Accounts receivable 10,400 17,000 g 6,000 21,400

Note receivable 5,000 10,000 15,000

Inventories 30,000 16,000 d 1,000 45,000

Plant assets — net 88,000 60,000 148,000

Investment in Sat 82,200 b 200

e 82,400

Goodwill e 20,000 20,000

$ 220,700 $ 110,000 $ 261,500

Accounts payable $ 15,000 $ 16,000 g 6,000 $ 25,000

Notes payable 25,000 10,000 35,000

Capital stock 140,000 50,000 e 50,000 140,000

Retained earnings 40,700 34,000 40,700

$ 220,700 $ 110,000

Noncontrolling interest — beginning c 13,000

e 7,600

Noncontrolling interest December 31 f 200 20,800

$ 261,500

* Deduct

Working paper entries:

a Sales 12,000

Cost of sales 12,000

b Income from Sat 3,800

Investment in Sat 200

Dividends 4,000

c Sales 37,500

Cost of sales 15,000

Operating expenses 4,500

Dividends 5,000

Noncontrolling interest 13,000

d Cost of sales 1,000

Inventories 1,000

e Retained earnings — Sat 20,000

Goodwill 20,000

Capital stock 50,000

Investment in Sat 82,400

Noncontrolling interest 7,600

f Noncontrolling interest share 1,200

Dividends 1,000

Noncontrolling interest 200

g Accounts payable 6,000

Accounts receivable 6,000

You might also like

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)From EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Rating: 3.5 out of 5 stars3.5/5 (17)

- WSET L4Wines D2 Wine Business en LowRes Aug2023Document117 pagesWSET L4Wines D2 Wine Business en LowRes Aug2023Cecilia ChansiinNo ratings yet

- Chapter 9. CH 09-10 Build A Model: Growth SalesDocument6 pagesChapter 9. CH 09-10 Build A Model: Growth SalesMatt SlowickNo ratings yet

- Week 4Document7 pagesWeek 4Marki Mendina100% (1)

- Principles of Economics Chapter 22Document30 pagesPrinciples of Economics Chapter 22Lu CheNo ratings yet

- Gitman IM Ch03Document15 pagesGitman IM Ch03tarekffNo ratings yet

- CFIN 4 4th Edition Besley Solutions Manual PDFDocument9 pagesCFIN 4 4th Edition Besley Solutions Manual PDFbill334No ratings yet

- Difficulties in Using A Cost Leadership Strategy in Emerging MarketsDocument16 pagesDifficulties in Using A Cost Leadership Strategy in Emerging MarketsMarselinus Aditya Hartanto TjungadiNo ratings yet

- Tugas IndividuDocument6 pagesTugas IndividuMuhammad Fauzan H FauzanNo ratings yet

- Tugas AlimDocument3 pagesTugas AlimHappy MichaelNo ratings yet

- ACCT 203 (Assignment 3)Document4 pagesACCT 203 (Assignment 3)koftaNo ratings yet

- P6Document3 pagesP6Jessica HutabaratNo ratings yet

- Assignment 2Document5 pagesAssignment 2Ahmad SaleemNo ratings yet

- Homework Session 1 Caroline Oktaviani - 01619190059 Exercise 1.1Document3 pagesHomework Session 1 Caroline Oktaviani - 01619190059 Exercise 1.1Caroline OktavianiNo ratings yet

- CH - 04 SolutionDocument3 pagesCH - 04 SolutionSaifur R. SabbirNo ratings yet

- David A Carrucini Assignment Chapter 22Document8 pagesDavid A Carrucini Assignment Chapter 22dcarruciniNo ratings yet

- Chapter 8Document3 pagesChapter 8Yasmeen YoussefNo ratings yet

- Bài tập chương 13Document10 pagesBài tập chương 132021agl12.phamhoangdieumyNo ratings yet

- Febbinia Dwigna P - Week7 AKL 1Document5 pagesFebbinia Dwigna P - Week7 AKL 1febbiniaNo ratings yet

- FSA-Tutorial 3-Fall 2023 With SolutionsDocument4 pagesFSA-Tutorial 3-Fall 2023 With SolutionschtiouirayyenNo ratings yet

- 8657948Document4 pages8657948Pulkit MahajanNo ratings yet

- Chapter 6 WorksheetsDocument8 pagesChapter 6 Worksheetsreza gunawanNo ratings yet

- 1130 - 89 - Tugas Pribadi Akl Pertemuan 9 Dan 11Document9 pages1130 - 89 - Tugas Pribadi Akl Pertemuan 9 Dan 11Maulana AmriNo ratings yet

- Name: Avishchal Shivneel Chand Student ID: S11171687Document3 pagesName: Avishchal Shivneel Chand Student ID: S11171687Avishchal ChandNo ratings yet

- Property, Plant, and Equipment Accumulated Depreciation Net Property, Plant, and EquipmentDocument6 pagesProperty, Plant, and Equipment Accumulated Depreciation Net Property, Plant, and EquipmentEman KhalilNo ratings yet

- 5-Year Financial Plan - Manufacturing 1Document8 pages5-Year Financial Plan - Manufacturing 1tulalit008No ratings yet

- Assignment Akl Bab 4 (Kel. 7)Document5 pagesAssignment Akl Bab 4 (Kel. 7)Nadiyah ShofwahNo ratings yet

- Akl Soal 3 Kelompok 2Document9 pagesAkl Soal 3 Kelompok 2dikaNo ratings yet

- Akl Soal 3 - Kelompok 2Document9 pagesAkl Soal 3 - Kelompok 2M KhairiNo ratings yet

- Home Depot Balance SheetDocument4 pagesHome Depot Balance SheetNicolas ErnestoNo ratings yet

- Chapter 2: Accounting Statements and Cash FlowDocument4 pagesChapter 2: Accounting Statements and Cash FlowBarbara H.CNo ratings yet

- Akl1 Week 6Document2 pagesAkl1 Week 6tolha ramadhaniNo ratings yet

- For The Period Ended 31/03/2011: Income StatementDocument7 pagesFor The Period Ended 31/03/2011: Income StatementMuostapha FikryNo ratings yet

- Nama: Aliea Yenemia Putri NPM: 120110210003 P4-19 A. Randy & Wiskers Enterprises Pro Forma Balance Sheet December 31, 2019 Assets Liabilities and Stockholders' EquityDocument10 pagesNama: Aliea Yenemia Putri NPM: 120110210003 P4-19 A. Randy & Wiskers Enterprises Pro Forma Balance Sheet December 31, 2019 Assets Liabilities and Stockholders' EquityAliea YenemiaNo ratings yet

- Chapter 2: Accounting Statements and Cash FlowDocument4 pagesChapter 2: Accounting Statements and Cash FlowTang De MelanciaNo ratings yet

- Worksheets For The Financial Rosetta StoneDocument4 pagesWorksheets For The Financial Rosetta StonemeNo ratings yet

- Project HardDocument12 pagesProject HardTalha Khan SherwaniNo ratings yet

- Intermediate Accounting Exam 2 SolutionsDocument5 pagesIntermediate Accounting Exam 2 SolutionsAlex Schuldiner100% (1)

- Acca110 Adorable Ac21 As03Document6 pagesAcca110 Adorable Ac21 As03Shaneen AdorableNo ratings yet

- Lagrimas, Sarah Nicole S. - PC&OL PART 2Document3 pagesLagrimas, Sarah Nicole S. - PC&OL PART 2Sarah Nicole S. LagrimasNo ratings yet

- Solutions To Chapter 8 Using Discounted Cash-Flow Analysis To Make Investment DecisionsDocument12 pagesSolutions To Chapter 8 Using Discounted Cash-Flow Analysis To Make Investment Decisionshung TranNo ratings yet

- Assignment 1 Fall 2017Document3 pagesAssignment 1 Fall 2017YaseenTamerNo ratings yet

- Statement of Cash Flows 4Document6 pagesStatement of Cash Flows 4Rashid W QureshiNo ratings yet

- Session 11,12&13 AssignmentDocument3 pagesSession 11,12&13 AssignmentMardi SutiosoNo ratings yet

- Dian Sari (A031171703) Tugas Akl IiDocument3 pagesDian Sari (A031171703) Tugas Akl Iidian sariNo ratings yet

- Analisis Rasio P14-2Document4 pagesAnalisis Rasio P14-2Yoga Arif PratamaNo ratings yet

- Cases 3 - Berlin Novanolo G (29123112)Document4 pagesCases 3 - Berlin Novanolo G (29123112)catatankotakkuningNo ratings yet

- Practice Exam Chapters 1-5 (2) Solutions: Problem IDocument4 pagesPractice Exam Chapters 1-5 (2) Solutions: Problem IAtif RehmanNo ratings yet

- Solutions To End-Of-Chapter ProblemsDocument14 pagesSolutions To End-Of-Chapter ProblemsTushar MalhotraNo ratings yet

- Mid Year AcqusitionDocument4 pagesMid Year AcqusitionOmolaja IbukunNo ratings yet

- QuestionsDocument13 pagesQuestionsAriaNo ratings yet

- T1 - IAS 12 - BT1 - KeyDocument3 pagesT1 - IAS 12 - BT1 - KeyKotoru HanoelNo ratings yet

- Assignment SalmanDocument9 pagesAssignment SalmanSalman AtherNo ratings yet

- Financial Management (Problems)Document12 pagesFinancial Management (Problems)Prasad GowdNo ratings yet

- Assignment#01Document8 pagesAssignment#01Aaisha AnsariNo ratings yet

- Wac 1 (Final)Document12 pagesWac 1 (Final)lynloy24No ratings yet

- CFIN 4th Edition Besley by Besley and Brigham ISBN Solution ManualDocument9 pagesCFIN 4th Edition Besley by Besley and Brigham ISBN Solution Manualrussell100% (33)

- Solution Manual For Cfin 4 4Th Edition Besley by Besley and Brigham Isbn 1285434544 9781285434544 Full Chapter PDFDocument30 pagesSolution Manual For Cfin 4 4Th Edition Besley by Besley and Brigham Isbn 1285434544 9781285434544 Full Chapter PDFtiffany.kunst387100% (19)

- Kelompok 5 - Cash Flow - ALKDocument16 pagesKelompok 5 - Cash Flow - ALKSiti Ruhmana SiregarNo ratings yet

- Financial Accounting: Tools For Business Decision Making: Ninth EditionDocument70 pagesFinancial Accounting: Tools For Business Decision Making: Ninth EditionJesussNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- Acc2521 TVMDocument186 pagesAcc2521 TVMNahar Sabirah100% (1)

- Risk and Return Theories (Financial Management - Manajemen Keuangan)Document24 pagesRisk and Return Theories (Financial Management - Manajemen Keuangan)Marselinus Aditya Hartanto TjungadiNo ratings yet

- Capital Budgeting Decision Criteria: 2002, Prentice Hall, IncDocument59 pagesCapital Budgeting Decision Criteria: 2002, Prentice Hall, IncMarselinus Aditya Hartanto TjungadiNo ratings yet

- Piutang & Persediaan (Financial Management - Manajemen Keuangan)Document22 pagesPiutang & Persediaan (Financial Management - Manajemen Keuangan)Marselinus Aditya Hartanto TjungadiNo ratings yet

- Kebijakan Dividen - Manajemen KeuanganDocument41 pagesKebijakan Dividen - Manajemen KeuanganMarselinus Aditya Hartanto TjungadiNo ratings yet

- Fund Management - Financial ManagementDocument18 pagesFund Management - Financial ManagementMarselinus Aditya Hartanto TjungadiNo ratings yet

- Akuntansi Keuangan Lanjutan 2Document6 pagesAkuntansi Keuangan Lanjutan 2Marselinus Aditya Hartanto TjungadiNo ratings yet

- AKL 2 - Tugas 4 Marselinus A H T (A31113316)Document5 pagesAKL 2 - Tugas 4 Marselinus A H T (A31113316)Marselinus Aditya Hartanto TjungadiNo ratings yet

- AKL 2 - Tugas 3 Marselinus A H T (A31113316)Document3 pagesAKL 2 - Tugas 3 Marselinus A H T (A31113316)Marselinus Aditya Hartanto TjungadiNo ratings yet

- Akuntansi Keuangan Lanjutan 2Document6 pagesAkuntansi Keuangan Lanjutan 2Marselinus Aditya Hartanto TjungadiNo ratings yet

- AKL 2 - Tugas 1Document14 pagesAKL 2 - Tugas 1Marselinus Aditya Hartanto TjungadiNo ratings yet

- Vitality in BusinessDocument10 pagesVitality in BusinessMarselinus Aditya Hartanto TjungadiNo ratings yet

- Ilovepdf MergedDocument14 pagesIlovepdf MergedSaiyam ShahNo ratings yet

- Income Tax by Sachin RevekarDocument5 pagesIncome Tax by Sachin RevekarSACHIN REVEKARNo ratings yet

- Putting Home Economics Into Macroeconomics: Replication of Greenward, Rogerson and Wright's Work (1993)Document19 pagesPutting Home Economics Into Macroeconomics: Replication of Greenward, Rogerson and Wright's Work (1993)Dynamix SolverNo ratings yet

- Braudel - Production Away From Home - Wheels of CommereDocument79 pagesBraudel - Production Away From Home - Wheels of CommerefrankmandellNo ratings yet

- Agri Sample Csec Ag Sci Sba Crop Livestock Investigative Projects - 05.06.2017 3Document53 pagesAgri Sample Csec Ag Sci Sba Crop Livestock Investigative Projects - 05.06.2017 3Shakwan Waterman100% (1)

- IFRS Edition-2nd: Conceptual Framework For Financial ReportingDocument30 pagesIFRS Edition-2nd: Conceptual Framework For Financial ReportingAhmed SroorNo ratings yet

- 0306220035case Studies of Fpos in India 2019 21Document391 pages0306220035case Studies of Fpos in India 2019 21Saikrishna VaidyaNo ratings yet

- NSDL Conso File FVU Error Code ListDocument22 pagesNSDL Conso File FVU Error Code Listlekireddy33% (9)

- Consolidated FSDocument5 pagesConsolidated FSNicah AcojonNo ratings yet

- TAXATIONDocument31 pagesTAXATIONRocel DomingoNo ratings yet

- Chapter 2Document25 pagesChapter 2Tricia Mae FernandezNo ratings yet

- TaxDocument10 pagesTaxAna leah Orbeta-mamburamNo ratings yet

- NVIDIA Template - FS Analysis - Fall 2023Document7 pagesNVIDIA Template - FS Analysis - Fall 2023Faisal ShahbazNo ratings yet

- Activity 13 May 2023 Key To CorrectionDocument1 pageActivity 13 May 2023 Key To CorrectionJohn Paul MagbitangNo ratings yet

- SoalDocument54 pagesSoalNur Fajri AjieNo ratings yet

- CT CLSA - Hayleys Fabric (MGT) 3Q21 Results Update - 22 February 2021Document11 pagesCT CLSA - Hayleys Fabric (MGT) 3Q21 Results Update - 22 February 2021Imran ansariNo ratings yet

- Accounts (NEW DRAFT) 24 SeptDocument45 pagesAccounts (NEW DRAFT) 24 Septsaria.ossama.95No ratings yet

- CH 1 - TemplatesDocument7 pagesCH 1 - TemplatesadibbahNo ratings yet

- MODULE Midterm FAR 3 EmpBenefitsDocument15 pagesMODULE Midterm FAR 3 EmpBenefitsKezNo ratings yet

- Chapter 2 Business Management and Accounting Basics - 2Document88 pagesChapter 2 Business Management and Accounting Basics - 2Kirththi PriyaNo ratings yet

- Bus 5110 Managerial Accounting Written Assignment Unit 71 PDFDocument10 pagesBus 5110 Managerial Accounting Written Assignment Unit 71 PDFEmmanuel Gift Bernard100% (1)

- Moi University: School of Business and EconomicsDocument5 pagesMoi University: School of Business and EconomicsMARION KERUBONo ratings yet

- Metro Rizal Doctors Hospital Nucum, Carlo BenedictDocument5 pagesMetro Rizal Doctors Hospital Nucum, Carlo BenedictColeen IrisNo ratings yet

- ACC 311 Sample Problem General Instructions:: ST ND RD THDocument1 pageACC 311 Sample Problem General Instructions:: ST ND RD THexquisiteNo ratings yet

- Literature Review On International Trade and Economic GrowthDocument7 pagesLiterature Review On International Trade and Economic GrowthafmzsbnbobbgkeNo ratings yet

- Individuals: Income TAXDocument40 pagesIndividuals: Income TAXBSA 1-CChelsee Rosemae MoraldeNo ratings yet

- Tax & Taxation of BangladeshDocument31 pagesTax & Taxation of BangladeshAl JamiNo ratings yet