Professional Documents

Culture Documents

Press Release Clarification On Applicability of TDS On Cash Withdrawals Dated 30-08-2019

Press Release Clarification On Applicability of TDS On Cash Withdrawals Dated 30-08-2019

Uploaded by

Sudarshan BhangdiyaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Press Release Clarification On Applicability of TDS On Cash Withdrawals Dated 30-08-2019

Press Release Clarification On Applicability of TDS On Cash Withdrawals Dated 30-08-2019

Uploaded by

Sudarshan BhangdiyaCopyright:

Available Formats

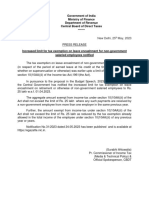

Government of India

Ministry of Finance

Department of Revenue

Central Board of Direct Taxes

New Delhi, 30th August, 2019

PRESS RELEASE

Clarification on applicability of Tax Deduction at Source on cash

withdrawals

In order to discourage cash transactions and move towards less cash

economy, the Finance (No. 2) Act, 2019 has inserted a new section 194N in the

Income-tax Act, 1961 (the ‘Act’), to provide for levy of tax deduction at source (TDS)

@2% on cash payments in excess of one crore rupees in aggregate made during the

year, by a banking company or cooperative bank or post office, to any person from

one or more accounts maintained with it by the recipient. The above section shall

come into effect from 1st September, 2019.

Since the section provided that the person responsible for paying any sum, or,

as the case may be, aggregate of sums, in cash, in excess of one crore rupees

during the previous year to deduct income tax @2% on cash payment in excess of

rupees one crore, queries were received from the general public through social

media on the applicability of this section on withdrawal of cash from 01.04.2019 to

31.08.2019.

The CBDT, having considered the concerns of the people, hereby clarifies

that section 194N inserted in the Act, is to come into effect from 1st September,

2019. Hence, any cash withdrawal prior to 1st September, 2019 will not be subjected

to the TDS under section 194N of the Act. However, since the threshold of Rs. 1

crore is with respect to the previous year, calculation of amount of cash withdrawal

for triggering deduction under section 194N of the Act shall be counted from 1st

April, 2019. Hence, if a person has already withdrawn Rs. 1 crore or more in cash

upto 31st August, 2019 from one or more accounts maintained with a banking

company or a cooperative bank or a post office, the two per cent TDS shall apply on

all subsequent cash withdrawals.

(Surabhi Ahluwalia)

Commissioner of Income Tax

(Media & Technical Policy)

Official Spokesperson, CBDT.

You might also like

- Income-Taxation Edt 2023 Solman-2Document35 pagesIncome-Taxation Edt 2023 Solman-2bth chee100% (2)

- Cos Jo Annex A1 Sample-TemplateDocument1 pageCos Jo Annex A1 Sample-TemplateGamy Glazyle100% (1)

- How to Handle Goods and Service Tax (GST)From EverandHow to Handle Goods and Service Tax (GST)Rating: 4.5 out of 5 stars4.5/5 (4)

- Tutorial 2e Residence StatusDocument2 pagesTutorial 2e Residence StatusnatlyhNo ratings yet

- Income Tax Notifiation - For Extension of Issuance of Form No. 16 For FY 2018-19Document1 pageIncome Tax Notifiation - For Extension of Issuance of Form No. 16 For FY 2018-19Subhash VishwakarmaNo ratings yet

- Government of India Ministry of Finance Department of Revenue Central Board of Direct TaxesDocument1 pageGovernment of India Ministry of Finance Department of Revenue Central Board of Direct TaxesJai ModiNo ratings yet

- Press Release Advance Tax e Campaign For FY 2023 24 Dated 10 03 2024Document2 pagesPress Release Advance Tax e Campaign For FY 2023 24 Dated 10 03 2024jodhpurfilmcityNo ratings yet

- Government of India Ministry of Finance Department of Revenue Central Board of Direct TaxesDocument2 pagesGovernment of India Ministry of Finance Department of Revenue Central Board of Direct TaxesJai ModiNo ratings yet

- Government of India Ministry of Finance Department of Revenue Central Board of Direct TaxesDocument2 pagesGovernment of India Ministry of Finance Department of Revenue Central Board of Direct TaxesShivalNo ratings yet

- Press-Release-Cbdt-Extends-Due-Date-For-Filing-Tax Audit Reports-01-11-2017Document1 pagePress-Release-Cbdt-Extends-Due-Date-For-Filing-Tax Audit Reports-01-11-2017Nithin KumarNo ratings yet

- PressRelease Last Date For Linking of PAN Aadhaar Extended 28 3 23Document1 pagePressRelease Last Date For Linking of PAN Aadhaar Extended 28 3 23Faisal SaeedNo ratings yet

- Press Release DTC For The FY 2022 23 Exceed The Union Budget Estimates by 2.41 Lakh Crore I.E. by 16.97 Dated 03 04 2023Document1 pagePress Release DTC For The FY 2022 23 Exceed The Union Budget Estimates by 2.41 Lakh Crore I.E. by 16.97 Dated 03 04 2023Mindplys FundaNo ratings yet

- Press Release CBDT Issues Clarification On The Applicability of TDS Provisions Dated 4 02 2020Document1 pagePress Release CBDT Issues Clarification On The Applicability of TDS Provisions Dated 4 02 2020ajitNo ratings yet

- Validate UDIN Generated From ICAI Portal 26 11 20Document1 pageValidate UDIN Generated From ICAI Portal 26 11 20Ravindra PoojaryNo ratings yet

- Press Release Inclusion of Interst Income 23 03 2016Document1 pagePress Release Inclusion of Interst Income 23 03 2016Nayab PathanNo ratings yet

- Government of India Ministry of Finance Department of Revenue Central Board of Direct TaxesDocument2 pagesGovernment of India Ministry of Finance Department of Revenue Central Board of Direct TaxesAslamNo ratings yet

- 269st pdf-1Document1 page269st pdf-1ajinkya.kadamandassociatesNo ratings yet

- PressRelease Increased Limit For Tax Exemption On Leave Encashment For Non Government Salaried Employees Notified 25 5 23Document1 pagePressRelease Increased Limit For Tax Exemption On Leave Encashment For Non Government Salaried Employees Notified 25 5 23Agrim BehlNo ratings yet

- Government of India Ministry of Finance Department of Revenue Central Board of Direct TaxesDocument2 pagesGovernment of India Ministry of Finance Department of Revenue Central Board of Direct TaxesBhan WatiNo ratings yet

- Circular No.: Government India Department Revenue Board Direct Division)Document2 pagesCircular No.: Government India Department Revenue Board Direct Division)ashim1No ratings yet

- Government of India: Press Information BureauDocument3 pagesGovernment of India: Press Information BureausummiNo ratings yet

- Tax Laws Ns Ep June 2020Document29 pagesTax Laws Ns Ep June 2020sarvaniNo ratings yet

- PressRelease Extension of Due Date of Furnishing of IITR and Audit Reports 24 10 20 PDFDocument2 pagesPressRelease Extension of Due Date of Furnishing of IITR and Audit Reports 24 10 20 PDFSaBoNo ratings yet

- June 2020 SP 2Document27 pagesJune 2020 SP 2Avinash ShettyNo ratings yet

- Professional Programme (New Syllabus) Supplement FOR Advanced Tax LawDocument5 pagesProfessional Programme (New Syllabus) Supplement FOR Advanced Tax Lawmanjunath rNo ratings yet

- Changes in GSTDocument4 pagesChanges in GSTRanjodh KaurNo ratings yet

- Amity Global Business School, PuneDocument15 pagesAmity Global Business School, PuneChand KalraNo ratings yet

- Notice To The Taxpayers: Change of Value Added Tax Rate Income TaxDocument1 pageNotice To The Taxpayers: Change of Value Added Tax Rate Income Taxamicoindustries984No ratings yet

- Income Tax Circular No. 17/2014 Dated 10.12.14Document70 pagesIncome Tax Circular No. 17/2014 Dated 10.12.14Elisabeth MuellerNo ratings yet

- Income Tax Law and PracticesDocument148 pagesIncome Tax Law and PracticesUjjwal KandhaweNo ratings yet

- Part I: Statutory Update: © The Institute of Chartered Accountants of IndiaDocument4 pagesPart I: Statutory Update: © The Institute of Chartered Accountants of IndiaRamanNo ratings yet

- Madam,: of CentralDocument4 pagesMadam,: of CentralMohammad MehdiNo ratings yet

- Tax HDocument15 pagesTax HDeepesh SinghNo ratings yet

- Income Tax All Particulars 2013-14Document72 pagesIncome Tax All Particulars 2013-14kvsgssNo ratings yet

- Nov 2019Document39 pagesNov 2019amitha g.sNo ratings yet

- Press Release Clarification On Doubts Arising On Account of New TCS Provisions Dated 30 09 2020Document2 pagesPress Release Clarification On Doubts Arising On Account of New TCS Provisions Dated 30 09 2020Gulrana AlamNo ratings yet

- India: Budget 2015-16 - For The Corporates: Corporate Tax RateDocument4 pagesIndia: Budget 2015-16 - For The Corporates: Corporate Tax RateraghuNo ratings yet

- Tds SALARY FOR A.Y. 2011-12Document59 pagesTds SALARY FOR A.Y. 2011-12Pragnesh ShahNo ratings yet

- No.402/92/2006-MC (04 of 2010) Government of IndiaDocument1 pageNo.402/92/2006-MC (04 of 2010) Government of Indiaapi-25886395No ratings yet

- Budget Public FinanceDocument11 pagesBudget Public FinanceMRS.NAMRATA KISHNANI BSSSNo ratings yet

- Taxation of Salaried EmployeesDocument39 pagesTaxation of Salaried Employeessailolla30100% (1)

- Income Tax CircularDocument67 pagesIncome Tax CirculartaxscribdNo ratings yet

- TLP Supplement DT June 2019 Old SyllabusDocument60 pagesTLP Supplement DT June 2019 Old Syllabusjanardhan CA,CSNo ratings yet

- Supplement Executive Programme: For June, 2021 ExaminationDocument10 pagesSupplement Executive Programme: For June, 2021 ExaminationSP CONTRACTORNo ratings yet

- Union Budget HighlightsDocument9 pagesUnion Budget HighlightsJojy SebastianNo ratings yet

- Income Tax Circular For FY 2015-16 PDFDocument77 pagesIncome Tax Circular For FY 2015-16 PDFvaibhinavNo ratings yet

- GST Circular PDFDocument11 pagesGST Circular PDFNavnera divisionNo ratings yet

- 30.07.2020 - CGST Rules, 2017 - (Part-A - Rules)Document164 pages30.07.2020 - CGST Rules, 2017 - (Part-A - Rules)Dost BhawanaNo ratings yet

- Executive Programme: Supplement FOR Tax Laws and Practice (Old Syllabus)Document37 pagesExecutive Programme: Supplement FOR Tax Laws and Practice (Old Syllabus)Zamr GNo ratings yet

- TLP Supplement DT Dec, 2019 - Old SyllabusDocument94 pagesTLP Supplement DT Dec, 2019 - Old Syllabusjanardhan CA,CSNo ratings yet

- Income Tax Deduction From SalariesDocument112 pagesIncome Tax Deduction From SalarieskumarNo ratings yet

- By Shoba Kanakraj: Mstu, ChennaiDocument20 pagesBy Shoba Kanakraj: Mstu, ChennaiVasanthNo ratings yet

- 9C Extended To 30.11.2019 - Taxguru - inDocument3 pages9C Extended To 30.11.2019 - Taxguru - inIshan SharmaNo ratings yet

- Malaysian BudgetDocument12 pagesMalaysian Budgetbmcss_nowNo ratings yet

- 01.07.2020 - CGST Rules, 2017 - (Part-A - Rules)Document163 pages01.07.2020 - CGST Rules, 2017 - (Part-A - Rules)rdabliNo ratings yet

- Applied Direct TaxationDocument548 pagesApplied Direct TaxationVarun SinghNo ratings yet

- FP&TM - Unit Iii - Tax NotesDocument77 pagesFP&TM - Unit Iii - Tax NotesMansi sharmaNo ratings yet

- Income Not Part of Total Income Full NotesDocument93 pagesIncome Not Part of Total Income Full NotesCA Rishabh DaiyaNo ratings yet

- Memo No 1304Document8 pagesMemo No 1304chandra shekharNo ratings yet

- Indonesian Taxation: for Academics and Foreign Business Practitioners Doing Business in IndonesiaFrom EverandIndonesian Taxation: for Academics and Foreign Business Practitioners Doing Business in IndonesiaNo ratings yet

- Profile t1 InstructionsDocument4 pagesProfile t1 Instructionsapi-306226330No ratings yet

- Capital Gain & IFOS - PaperDocument3 pagesCapital Gain & IFOS - Papermshivam617No ratings yet

- Earnings Rate QTY Amount Deductions: Mailum, Angelyn BDocument12 pagesEarnings Rate QTY Amount Deductions: Mailum, Angelyn BAndrea Banayat MailumNo ratings yet

- The Pace Makers-4Document38 pagesThe Pace Makers-4TULI MODAKNo ratings yet

- 4f1b0a895e O-3Document1 page4f1b0a895e O-3CreativNo ratings yet

- Bajaj Capital LimitedDocument2 pagesBajaj Capital LimitedCharles StoneNo ratings yet

- Overview of Vietnam Tax SystemDocument13 pagesOverview of Vietnam Tax SystemNhung HồngNo ratings yet

- Residential Status of An AssesseeDocument9 pagesResidential Status of An Assesseetanisha negiNo ratings yet

- Goods and Service TaxDocument14 pagesGoods and Service TaxkejkarNo ratings yet

- BIR Form 1702-RTDocument4 pagesBIR Form 1702-RTAljohn Sechico BacolodNo ratings yet

- CPAR Tax On Partnerships (Batch 90) - HandoutDocument4 pagesCPAR Tax On Partnerships (Batch 90) - HandoutAljur SalamedaNo ratings yet

- Payment of Bonus Rules (Pt.-4)Document9 pagesPayment of Bonus Rules (Pt.-4)Anonymous QyYvWj1No ratings yet

- Cir Vs PalDocument1 pageCir Vs Palann laguardiaNo ratings yet

- Clubbing of IncomeDocument14 pagesClubbing of IncomethemeditatorNo ratings yet

- Chapter 4 EXERCISES - Estates and TrustsDocument9 pagesChapter 4 EXERCISES - Estates and TrustscathyydumpNo ratings yet

- Period When Returns Are Filed: BIR Form 1801Document4 pagesPeriod When Returns Are Filed: BIR Form 1801I Am Not DeterredNo ratings yet

- Tax Computations SampleDocument5 pagesTax Computations Samplelcsme tubodaccountsNo ratings yet

- P6 3Document5 pagesP6 3Neil RyanNo ratings yet

- Activity-Partnerships-METRILLO, JOHN KENNETH R.Document4 pagesActivity-Partnerships-METRILLO, JOHN KENNETH R.LordCelene C MagyayaNo ratings yet

- MemoDocument3 pagesMemoAnonymous mO72yqNcNo ratings yet

- Nature and Form of Business OrganizationDocument2 pagesNature and Form of Business OrganizationJash Raven BoraboNo ratings yet

- Brief of Dtls of Direct Selling and PlanDocument2 pagesBrief of Dtls of Direct Selling and PlanKangen WaterNo ratings yet

- Employees Declaration For IncomeDocument1 pageEmployees Declaration For Incomehareesh13hNo ratings yet

- Module 11 - Dealings in PropertiesDocument17 pagesModule 11 - Dealings in PropertiesRuth Nouelle Sta. CruzNo ratings yet

- Taxation - Individual - QuizzerDocument12 pagesTaxation - Individual - QuizzerKenneth Bryan Tegerero TegioNo ratings yet

- 18e Key Question Answers CH 4Document2 pages18e Key Question Answers CH 4Andrea RobinsonNo ratings yet

- Badlani Classes (Taation)Document6 pagesBadlani Classes (Taation)RahulBhagatNo ratings yet