Professional Documents

Culture Documents

Cost Acctng

Cost Acctng

Uploaded by

airaguevarraCopyright:

Available Formats

You might also like

- Opwd Code Vol-IDocument111 pagesOpwd Code Vol-IJoyce Dungdung100% (1)

- Adjustments Quiz 2Document6 pagesAdjustments Quiz 2Loey ParkNo ratings yet

- Rig Inspections: Lloyd's Register Energy - DrillingDocument2 pagesRig Inspections: Lloyd's Register Energy - DrillingShraddhanand MoreNo ratings yet

- Chapter 5Document12 pagesChapter 5?????0% (1)

- Procurement PolicyDocument58 pagesProcurement PolicyBejace NyachhyonNo ratings yet

- Treasurers Affidavit - TemplateDocument1 pageTreasurers Affidavit - TemplateStephen Quiambao100% (1)

- Capital FinanceDocument61 pagesCapital FinanceJan ryanNo ratings yet

- PART I: True or False: Management Accounting Quiz 1 BsmaDocument4 pagesPART I: True or False: Management Accounting Quiz 1 BsmaAngelyn SamandeNo ratings yet

- 2017 Vol 2 CH 3 AnsDocument17 pages2017 Vol 2 CH 3 AnsJohn Lloyd YastoNo ratings yet

- Reflection and Oblicon AssDocument2 pagesReflection and Oblicon AssnimnimNo ratings yet

- Fabm 2 PDFDocument3 pagesFabm 2 PDFgk concepcionNo ratings yet

- Chapter 4 - Partnership LiquidationDocument4 pagesChapter 4 - Partnership LiquidationMikaella BengcoNo ratings yet

- CFAS-MC Ques - Review of The Acctg. ProcessDocument5 pagesCFAS-MC Ques - Review of The Acctg. ProcessKristine Elaine RocoNo ratings yet

- Cost-Volume-Profit Analysis - Sample ProblemsDocument1 pageCost-Volume-Profit Analysis - Sample ProblemsViviene Seth Alvarez LigonNo ratings yet

- AdjustmentDocument5 pagesAdjustmentBeta TesterNo ratings yet

- Midterm Exam ACTG22Document2 pagesMidterm Exam ACTG22Jj Abad BoieNo ratings yet

- REVIEWer Take Home QuizDocument3 pagesREVIEWer Take Home QuizNeirish fainsan0% (1)

- Project C Manual For Counters ReviewedDocument30 pagesProject C Manual For Counters ReviewedDarlynSilvanoNo ratings yet

- Coblaw Chap 3Document15 pagesCoblaw Chap 3Charlene TiaNo ratings yet

- Quizzes - Chapter 6 - Business Transactions & Their AnalysisDocument6 pagesQuizzes - Chapter 6 - Business Transactions & Their AnalysisClint Abenoja100% (1)

- Trial BalanceDocument4 pagesTrial BalanceRonnie Lloyd JavierNo ratings yet

- Quiz-Inventory TheoryDocument4 pagesQuiz-Inventory TheoryCaila Nicole ReyesNo ratings yet

- JPIA CA5101 MerchxManuf Reviewer PDFDocument7 pagesJPIA CA5101 MerchxManuf Reviewer PDFmei angelaNo ratings yet

- Bernice Joana Oblicon ReviewerDocument40 pagesBernice Joana Oblicon ReviewerJulPadayaoNo ratings yet

- Managerial Accounting and Cost ConceptDocument20 pagesManagerial Accounting and Cost ConceptNavidEhsanNo ratings yet

- Final Exam Enhanced 1 1Document8 pagesFinal Exam Enhanced 1 1Villanueva Rosemarie100% (1)

- Accounting For Special Transactions Midterm Examination: Use The Following Information For The Next Two QuestionsDocument13 pagesAccounting For Special Transactions Midterm Examination: Use The Following Information For The Next Two QuestionsAndrew wigginNo ratings yet

- Pluralism Towards Authentic CommunionDocument7 pagesPluralism Towards Authentic CommunionHeather De la VegaNo ratings yet

- Merchandising Bus Prub Periodic MethodDocument2 pagesMerchandising Bus Prub Periodic MethodChristopher Keith BernidoNo ratings yet

- Orca Share Media1600756371985 6714058854046129160Document11 pagesOrca Share Media1600756371985 6714058854046129160Jireh RiveraNo ratings yet

- Chapter 4 Accounting For Partnership AnswerDocument17 pagesChapter 4 Accounting For Partnership AnswerTan Yilin0% (1)

- Multiple ChoiceDocument2 pagesMultiple ChoicesppNo ratings yet

- Cash and Cash EquivalentsDocument52 pagesCash and Cash EquivalentsDeryl GalveNo ratings yet

- Corporation QuizDocument13 pagesCorporation Quizjano_art21No ratings yet

- Cash, Cash Equivalent and Bank ReconDocument7 pagesCash, Cash Equivalent and Bank ReconPrincess ReyesNo ratings yet

- PRACTICE SET-Inventories (Problems)Document8 pagesPRACTICE SET-Inventories (Problems)polxrixNo ratings yet

- Multiple Choices - Quiz - Chapter 1-To-3Document21 pagesMultiple Choices - Quiz - Chapter 1-To-3Ella SingcaNo ratings yet

- Problem 3 Accounts ReceivableDocument11 pagesProblem 3 Accounts ReceivableAngelie Bocala CatalanNo ratings yet

- ParcOR ReveiwerDocument23 pagesParcOR ReveiwerMon Christian VasquezNo ratings yet

- First Exam Review WithSolutionDocument6 pagesFirst Exam Review WithSolutionLexter Dave C EstoqueNo ratings yet

- Chapter 2 Cost Concepts and ClassificationDocument40 pagesChapter 2 Cost Concepts and ClassificationJean Rae RemiasNo ratings yet

- Management Advisory Services by Agamata Answer KeyDocument11 pagesManagement Advisory Services by Agamata Answer KeyLeon Genaro Naraga0% (1)

- Gtlr7lak1 - ACTIVITY - CHAPTER 12 - PARTNERSHIP OPERATIONSDocument2 pagesGtlr7lak1 - ACTIVITY - CHAPTER 12 - PARTNERSHIP OPERATIONSLyra Mae De BotonNo ratings yet

- Diagnostic in Basic AccountingDocument5 pagesDiagnostic in Basic Accountingjapvivi cece100% (2)

- Merchandising AccountingDocument4 pagesMerchandising AccountingJuby BelandresNo ratings yet

- Ac101 ch3Document21 pagesAc101 ch3Alex ChewNo ratings yet

- Aud. Prob.Document16 pagesAud. Prob.Ria Alanis CastilloNo ratings yet

- Completing Accounting CycleDocument11 pagesCompleting Accounting CycleiamjnschrstnNo ratings yet

- Exam Financial ManagementDocument5 pagesExam Financial ManagementMaha MansoorNo ratings yet

- GENERAL INSTRUCTION. Multiple Choice. Select The Letter of The Best Answer by Marking Properly The ScannableDocument7 pagesGENERAL INSTRUCTION. Multiple Choice. Select The Letter of The Best Answer by Marking Properly The ScannableEdison San JuanNo ratings yet

- GuidelinesDocument3 pagesGuidelines123r12f1No ratings yet

- Partnership FormationDocument3 pagesPartnership Formationmiss independent100% (1)

- Part II Partnerhsip CorporationDocument101 pagesPart II Partnerhsip CorporationKhrestine ElejidoNo ratings yet

- TOA MockBoardDocument16 pagesTOA MockBoardHansard Labisig100% (1)

- Formation of Partnership BusinessDocument17 pagesFormation of Partnership BusinessSabrina SamantaNo ratings yet

- 9201 - Partnership FormationDocument4 pages9201 - Partnership FormationBrian Dave OrtizNo ratings yet

- Millan Conceptual Framework and Accounting StandardsDocument11 pagesMillan Conceptual Framework and Accounting StandardsMichael Angelo Guillermo AlemanNo ratings yet

- The Petty Cash FundDocument10 pagesThe Petty Cash FundLilian TaiNo ratings yet

- DG8C3UQW6Document16 pagesDG8C3UQW6gumbanaleahfateNo ratings yet

- Answer Key Chapter 3Document5 pagesAnswer Key Chapter 3Donna Zandueta-TumalaNo ratings yet

- Assignment in Costacc: Group 2Document16 pagesAssignment in Costacc: Group 2Love FreddyNo ratings yet

- CostDocument3 pagesCostKyle Vincent SaballaNo ratings yet

- Ca 4Document4 pagesCa 4lerabadolNo ratings yet

- Handout - CADocument10 pagesHandout - CAArfeen ArifNo ratings yet

- Ethical Behaviour and Implications For AccountantsDocument24 pagesEthical Behaviour and Implications For AccountantsKeoikantseNo ratings yet

- Government Functional Standard: Govs 002: Project Delivery - Portfolio, Programme and Project ManagementDocument31 pagesGovernment Functional Standard: Govs 002: Project Delivery - Portfolio, Programme and Project ManagementJavier Andrés Acevedo GarcíaNo ratings yet

- Caltex Philippines, Inc. vs. Commission On AuditDocument45 pagesCaltex Philippines, Inc. vs. Commission On AuditJAMNo ratings yet

- 2012 IIA Standards UpdateDocument34 pages2012 IIA Standards UpdateAlexandru VasileNo ratings yet

- Compliance VerificationDocument11 pagesCompliance VerificationDon CabasiNo ratings yet

- The Stages of An Audit - Appointment: 1. OverviewDocument4 pagesThe Stages of An Audit - Appointment: 1. OverviewRavin BoodhanNo ratings yet

- Anandapuram - Anekapalle 681-732Document96 pagesAnandapuram - Anekapalle 681-732Arun kumar SethiNo ratings yet

- Topic 6 - Bank ReconciliationRev (Students)Document32 pagesTopic 6 - Bank ReconciliationRev (Students)Novian Dwi RamadanaNo ratings yet

- GPS Process Stakeholder Interfaces 202211 1Document19 pagesGPS Process Stakeholder Interfaces 202211 1SeidlNo ratings yet

- 1100-P-001 Rev. 0 Quality Manual ValarbiDocument20 pages1100-P-001 Rev. 0 Quality Manual ValarbiRahmad DesmanNo ratings yet

- Ch. 2 - Homework SolutionsDocument23 pagesCh. 2 - Homework SolutionsJessieNo ratings yet

- Standard Costing and Flexible Budget 10Document5 pagesStandard Costing and Flexible Budget 10Lhorene Hope DueñasNo ratings yet

- CPA - Quizbowl 2008Document10 pagesCPA - Quizbowl 2008frankreedh100% (3)

- ADVANCED AUDITING Revision QNS, Check CoverageDocument21 pagesADVANCED AUDITING Revision QNS, Check CoverageRewardMaturure100% (2)

- Profl ResponsibilitiesDocument11 pagesProfl ResponsibilitiesRNo ratings yet

- Sol Man - Chap13 - Partnership Dissolution - PDFDocument8 pagesSol Man - Chap13 - Partnership Dissolution - PDFsabyNo ratings yet

- Basic BookkeepingDocument61 pagesBasic BookkeepingJayson Reyes50% (4)

- Acct 474 Fall15 SUA - RonDocument129 pagesAcct 474 Fall15 SUA - Rontarawneh92No ratings yet

- ScadalDocument23 pagesScadalLeah MgangaNo ratings yet

- L (.Il Julylg,: or For The in To ofDocument7 pagesL (.Il Julylg,: or For The in To ofCliff DaquioagNo ratings yet

- Advanced AuditingDocument733 pagesAdvanced Auditingwarda rashid100% (3)

- Sample EB5 Business Plan (Unlocked by WWW - Freemypdf.com)Document116 pagesSample EB5 Business Plan (Unlocked by WWW - Freemypdf.com)mtbroadbentNo ratings yet

- Decision,+ERC+Case+No +2013-137+RCDocument35 pagesDecision,+ERC+Case+No +2013-137+RCAnonymous RMJ8QANo ratings yet

- Resource Mobilisation of LSGBsDocument31 pagesResource Mobilisation of LSGBsShaimon Joseph0% (1)

- Auditing Assurance ServicesDocument24 pagesAuditing Assurance ServicesMicaela Marimla100% (1)

- Auditing ReserchDocument64 pagesAuditing ReserchNetsanet ShikurNo ratings yet

Cost Acctng

Cost Acctng

Uploaded by

airaguevarraOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cost Acctng

Cost Acctng

Uploaded by

airaguevarraCopyright:

Available Formats

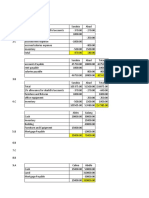

PROBLEM #1

1. Direct materials used 205,000

Materials – end 90,000

Materials – beg. ( 95,000)

Direct materials purchased 200,000

2. Total manufacturing costs 675,000

Factory overhead ( 175,000)

Materials used ( 205,000)

Direct labor costs 295,000

3. Cost of goods available for sale 775,000

Finished goods, end (110,000)

Cost of goods sold 665,000

4. Sales 900,000

Cost of goods sold (665,000)

Gross profit 235,000

PROBLEM #2 (start with No.. 3 then No. 2)

1) Cost of goods manufactured 168,000

WP, January 31 95,000

WP, January 1 ( 80,000)

Total manufacturing cost 183,000

Direct labor (63,000 / 75%) ( 84,000)

Factory overhead ( 63,000)

Direct materials used 36,000

Materials January 31 50,000

Indirect materials used 1,000

Purchases ( 46,000)

Materials, January 1 41,000

2) Cost of goods sold – normal 150,000

Finished goods, January 31 78,000

Finished goods, January 1 ( 60,000)

Cost of goods manufactured 168,000

3) Sales ( 25,000 / 12.5%) 200,000

Selling and administrative expenses ( 25,000)

Net income (25,200)

Cost of goods sold, actual 149,800

Overapplied FO

Actual 62,800

Less: Applied 63,000 200

Cost of goods sold, normal 150,000

PROBLEM #3

Journal entries

1. Materials 28,000

Accounts payable 28,000

2. Work in process 22,000

Factory overhead control 3.000

Materials 25,000

3. Materials 800

Work in process 500

FO Control 300

4. Accounts payable 1,000

Materials 1,000

5. Payroll 39,000

Withholding taxes payable 3,025

SSS Premiums payable 1,600

Phil Health contributions payable 375

Pag-ibig funds contributions payable 1,200

Accrued payroll 32,800

Accrued payroll 32,800

Cash 32,800

6. Work in process 33,400

Factory overhead control 5,600

Payroll 39,000

7. Factory Overhead Control 3,575

SSS Premiums payable 2,000

Phil Health cont. payable 375

Pag-ibig cont. payable 1,200

8 FO Control 15,000

Accum Depr. 3,000

Prepaid ins. 950

Accounts payable 11,050

9. Work in process 26,720

FO Applied 26,720

10. Finished goods 72,220

WP 72,220

Job 401 31,720

Job 402 40,500

11. Accounts receivable 44,408

Sales (31,720 x 140%) 44,408

Cost of goods sold 31,720

FG 31,720

12. Cash 35,000

Accounts receivable 35,000

Cost of goods sold statement

Direct materials used

Materials, August 1 22,000

Purchases 28,000

Less. Purchase returns 1,000 27,000

Total available for use 49,000

Less: Materials, Aug. 31 24,800

Ind. Materials 2,700 27,500 21,500

Direct labor 33,400

Factory overhead 26.720

Total manufacturing costs 81,620

Work in process, Aug. 1 18,500

Cost of goods put into process 100.120

Less: Work in process, Aug. 31 27,900

Cost of goods manufactured 72,220

Finished goods, Aug. 1 25,000

Total goods available for sale 97,220

Less: Finished goods, Aug. 31 65,500

Cost of goods sold - normal 31,720

Add. Under applied factory overhead 155

Cost of goods sold 31,875

You might also like

- Opwd Code Vol-IDocument111 pagesOpwd Code Vol-IJoyce Dungdung100% (1)

- Adjustments Quiz 2Document6 pagesAdjustments Quiz 2Loey ParkNo ratings yet

- Rig Inspections: Lloyd's Register Energy - DrillingDocument2 pagesRig Inspections: Lloyd's Register Energy - DrillingShraddhanand MoreNo ratings yet

- Chapter 5Document12 pagesChapter 5?????0% (1)

- Procurement PolicyDocument58 pagesProcurement PolicyBejace NyachhyonNo ratings yet

- Treasurers Affidavit - TemplateDocument1 pageTreasurers Affidavit - TemplateStephen Quiambao100% (1)

- Capital FinanceDocument61 pagesCapital FinanceJan ryanNo ratings yet

- PART I: True or False: Management Accounting Quiz 1 BsmaDocument4 pagesPART I: True or False: Management Accounting Quiz 1 BsmaAngelyn SamandeNo ratings yet

- 2017 Vol 2 CH 3 AnsDocument17 pages2017 Vol 2 CH 3 AnsJohn Lloyd YastoNo ratings yet

- Reflection and Oblicon AssDocument2 pagesReflection and Oblicon AssnimnimNo ratings yet

- Fabm 2 PDFDocument3 pagesFabm 2 PDFgk concepcionNo ratings yet

- Chapter 4 - Partnership LiquidationDocument4 pagesChapter 4 - Partnership LiquidationMikaella BengcoNo ratings yet

- CFAS-MC Ques - Review of The Acctg. ProcessDocument5 pagesCFAS-MC Ques - Review of The Acctg. ProcessKristine Elaine RocoNo ratings yet

- Cost-Volume-Profit Analysis - Sample ProblemsDocument1 pageCost-Volume-Profit Analysis - Sample ProblemsViviene Seth Alvarez LigonNo ratings yet

- AdjustmentDocument5 pagesAdjustmentBeta TesterNo ratings yet

- Midterm Exam ACTG22Document2 pagesMidterm Exam ACTG22Jj Abad BoieNo ratings yet

- REVIEWer Take Home QuizDocument3 pagesREVIEWer Take Home QuizNeirish fainsan0% (1)

- Project C Manual For Counters ReviewedDocument30 pagesProject C Manual For Counters ReviewedDarlynSilvanoNo ratings yet

- Coblaw Chap 3Document15 pagesCoblaw Chap 3Charlene TiaNo ratings yet

- Quizzes - Chapter 6 - Business Transactions & Their AnalysisDocument6 pagesQuizzes - Chapter 6 - Business Transactions & Their AnalysisClint Abenoja100% (1)

- Trial BalanceDocument4 pagesTrial BalanceRonnie Lloyd JavierNo ratings yet

- Quiz-Inventory TheoryDocument4 pagesQuiz-Inventory TheoryCaila Nicole ReyesNo ratings yet

- JPIA CA5101 MerchxManuf Reviewer PDFDocument7 pagesJPIA CA5101 MerchxManuf Reviewer PDFmei angelaNo ratings yet

- Bernice Joana Oblicon ReviewerDocument40 pagesBernice Joana Oblicon ReviewerJulPadayaoNo ratings yet

- Managerial Accounting and Cost ConceptDocument20 pagesManagerial Accounting and Cost ConceptNavidEhsanNo ratings yet

- Final Exam Enhanced 1 1Document8 pagesFinal Exam Enhanced 1 1Villanueva Rosemarie100% (1)

- Accounting For Special Transactions Midterm Examination: Use The Following Information For The Next Two QuestionsDocument13 pagesAccounting For Special Transactions Midterm Examination: Use The Following Information For The Next Two QuestionsAndrew wigginNo ratings yet

- Pluralism Towards Authentic CommunionDocument7 pagesPluralism Towards Authentic CommunionHeather De la VegaNo ratings yet

- Merchandising Bus Prub Periodic MethodDocument2 pagesMerchandising Bus Prub Periodic MethodChristopher Keith BernidoNo ratings yet

- Orca Share Media1600756371985 6714058854046129160Document11 pagesOrca Share Media1600756371985 6714058854046129160Jireh RiveraNo ratings yet

- Chapter 4 Accounting For Partnership AnswerDocument17 pagesChapter 4 Accounting For Partnership AnswerTan Yilin0% (1)

- Multiple ChoiceDocument2 pagesMultiple ChoicesppNo ratings yet

- Cash and Cash EquivalentsDocument52 pagesCash and Cash EquivalentsDeryl GalveNo ratings yet

- Corporation QuizDocument13 pagesCorporation Quizjano_art21No ratings yet

- Cash, Cash Equivalent and Bank ReconDocument7 pagesCash, Cash Equivalent and Bank ReconPrincess ReyesNo ratings yet

- PRACTICE SET-Inventories (Problems)Document8 pagesPRACTICE SET-Inventories (Problems)polxrixNo ratings yet

- Multiple Choices - Quiz - Chapter 1-To-3Document21 pagesMultiple Choices - Quiz - Chapter 1-To-3Ella SingcaNo ratings yet

- Problem 3 Accounts ReceivableDocument11 pagesProblem 3 Accounts ReceivableAngelie Bocala CatalanNo ratings yet

- ParcOR ReveiwerDocument23 pagesParcOR ReveiwerMon Christian VasquezNo ratings yet

- First Exam Review WithSolutionDocument6 pagesFirst Exam Review WithSolutionLexter Dave C EstoqueNo ratings yet

- Chapter 2 Cost Concepts and ClassificationDocument40 pagesChapter 2 Cost Concepts and ClassificationJean Rae RemiasNo ratings yet

- Management Advisory Services by Agamata Answer KeyDocument11 pagesManagement Advisory Services by Agamata Answer KeyLeon Genaro Naraga0% (1)

- Gtlr7lak1 - ACTIVITY - CHAPTER 12 - PARTNERSHIP OPERATIONSDocument2 pagesGtlr7lak1 - ACTIVITY - CHAPTER 12 - PARTNERSHIP OPERATIONSLyra Mae De BotonNo ratings yet

- Diagnostic in Basic AccountingDocument5 pagesDiagnostic in Basic Accountingjapvivi cece100% (2)

- Merchandising AccountingDocument4 pagesMerchandising AccountingJuby BelandresNo ratings yet

- Ac101 ch3Document21 pagesAc101 ch3Alex ChewNo ratings yet

- Aud. Prob.Document16 pagesAud. Prob.Ria Alanis CastilloNo ratings yet

- Completing Accounting CycleDocument11 pagesCompleting Accounting CycleiamjnschrstnNo ratings yet

- Exam Financial ManagementDocument5 pagesExam Financial ManagementMaha MansoorNo ratings yet

- GENERAL INSTRUCTION. Multiple Choice. Select The Letter of The Best Answer by Marking Properly The ScannableDocument7 pagesGENERAL INSTRUCTION. Multiple Choice. Select The Letter of The Best Answer by Marking Properly The ScannableEdison San JuanNo ratings yet

- GuidelinesDocument3 pagesGuidelines123r12f1No ratings yet

- Partnership FormationDocument3 pagesPartnership Formationmiss independent100% (1)

- Part II Partnerhsip CorporationDocument101 pagesPart II Partnerhsip CorporationKhrestine ElejidoNo ratings yet

- TOA MockBoardDocument16 pagesTOA MockBoardHansard Labisig100% (1)

- Formation of Partnership BusinessDocument17 pagesFormation of Partnership BusinessSabrina SamantaNo ratings yet

- 9201 - Partnership FormationDocument4 pages9201 - Partnership FormationBrian Dave OrtizNo ratings yet

- Millan Conceptual Framework and Accounting StandardsDocument11 pagesMillan Conceptual Framework and Accounting StandardsMichael Angelo Guillermo AlemanNo ratings yet

- The Petty Cash FundDocument10 pagesThe Petty Cash FundLilian TaiNo ratings yet

- DG8C3UQW6Document16 pagesDG8C3UQW6gumbanaleahfateNo ratings yet

- Answer Key Chapter 3Document5 pagesAnswer Key Chapter 3Donna Zandueta-TumalaNo ratings yet

- Assignment in Costacc: Group 2Document16 pagesAssignment in Costacc: Group 2Love FreddyNo ratings yet

- CostDocument3 pagesCostKyle Vincent SaballaNo ratings yet

- Ca 4Document4 pagesCa 4lerabadolNo ratings yet

- Handout - CADocument10 pagesHandout - CAArfeen ArifNo ratings yet

- Ethical Behaviour and Implications For AccountantsDocument24 pagesEthical Behaviour and Implications For AccountantsKeoikantseNo ratings yet

- Government Functional Standard: Govs 002: Project Delivery - Portfolio, Programme and Project ManagementDocument31 pagesGovernment Functional Standard: Govs 002: Project Delivery - Portfolio, Programme and Project ManagementJavier Andrés Acevedo GarcíaNo ratings yet

- Caltex Philippines, Inc. vs. Commission On AuditDocument45 pagesCaltex Philippines, Inc. vs. Commission On AuditJAMNo ratings yet

- 2012 IIA Standards UpdateDocument34 pages2012 IIA Standards UpdateAlexandru VasileNo ratings yet

- Compliance VerificationDocument11 pagesCompliance VerificationDon CabasiNo ratings yet

- The Stages of An Audit - Appointment: 1. OverviewDocument4 pagesThe Stages of An Audit - Appointment: 1. OverviewRavin BoodhanNo ratings yet

- Anandapuram - Anekapalle 681-732Document96 pagesAnandapuram - Anekapalle 681-732Arun kumar SethiNo ratings yet

- Topic 6 - Bank ReconciliationRev (Students)Document32 pagesTopic 6 - Bank ReconciliationRev (Students)Novian Dwi RamadanaNo ratings yet

- GPS Process Stakeholder Interfaces 202211 1Document19 pagesGPS Process Stakeholder Interfaces 202211 1SeidlNo ratings yet

- 1100-P-001 Rev. 0 Quality Manual ValarbiDocument20 pages1100-P-001 Rev. 0 Quality Manual ValarbiRahmad DesmanNo ratings yet

- Ch. 2 - Homework SolutionsDocument23 pagesCh. 2 - Homework SolutionsJessieNo ratings yet

- Standard Costing and Flexible Budget 10Document5 pagesStandard Costing and Flexible Budget 10Lhorene Hope DueñasNo ratings yet

- CPA - Quizbowl 2008Document10 pagesCPA - Quizbowl 2008frankreedh100% (3)

- ADVANCED AUDITING Revision QNS, Check CoverageDocument21 pagesADVANCED AUDITING Revision QNS, Check CoverageRewardMaturure100% (2)

- Profl ResponsibilitiesDocument11 pagesProfl ResponsibilitiesRNo ratings yet

- Sol Man - Chap13 - Partnership Dissolution - PDFDocument8 pagesSol Man - Chap13 - Partnership Dissolution - PDFsabyNo ratings yet

- Basic BookkeepingDocument61 pagesBasic BookkeepingJayson Reyes50% (4)

- Acct 474 Fall15 SUA - RonDocument129 pagesAcct 474 Fall15 SUA - Rontarawneh92No ratings yet

- ScadalDocument23 pagesScadalLeah MgangaNo ratings yet

- L (.Il Julylg,: or For The in To ofDocument7 pagesL (.Il Julylg,: or For The in To ofCliff DaquioagNo ratings yet

- Advanced AuditingDocument733 pagesAdvanced Auditingwarda rashid100% (3)

- Sample EB5 Business Plan (Unlocked by WWW - Freemypdf.com)Document116 pagesSample EB5 Business Plan (Unlocked by WWW - Freemypdf.com)mtbroadbentNo ratings yet

- Decision,+ERC+Case+No +2013-137+RCDocument35 pagesDecision,+ERC+Case+No +2013-137+RCAnonymous RMJ8QANo ratings yet

- Resource Mobilisation of LSGBsDocument31 pagesResource Mobilisation of LSGBsShaimon Joseph0% (1)

- Auditing Assurance ServicesDocument24 pagesAuditing Assurance ServicesMicaela Marimla100% (1)

- Auditing ReserchDocument64 pagesAuditing ReserchNetsanet ShikurNo ratings yet