Professional Documents

Culture Documents

AB Limited Provides You The Following Data

AB Limited Provides You The Following Data

Uploaded by

Rajarshi DaharwalOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

AB Limited Provides You The Following Data

AB Limited Provides You The Following Data

Uploaded by

Rajarshi DaharwalCopyright:

Available Formats

1.

AB limited provides you the following data –

EBIT Rs.3,00,000

Less Interest@ 12% Rs.60,000

Profit before Tax Rs.2,40,000

Tax rate is 50%, company has 40,000 equity shares of 10 each. Current Market price per

equity share is 30. Company has undistributed reserves of Rs. 6,00,000. Company needs Rs.

20,00,000 for expansion, which would yield same rate of return as of now. You are informed

that the debt equity ratio (Debt / (debt + equity)) higher than 35% will push PE ratio down by

20% and also rate of interest on debt raise to 14% on the additional amount of debt if any.

You are required to estimate Market price after expansion by considering following options-

a. Additional funds raised by debt

b. Additional funds raised by issue of equity shares at current market price

Working Notes:

Capital Employed:

Current Debt = Rs. 500000.00 Lacs (i.e. Interest @12% Rs.60000*100/12)

Equity = Rs. 400000.00 Lacs (I.e. 40000 share of 10 Rs. Each)

Reserve = Rs. 600000.00 Lacs (Given)

Total Capital Employed: 500000.00 + 400000.00 + 600000.00 = Rs. 1500000.00

Return on Investment:

𝑬𝑩𝑰𝑻 𝟑𝟎𝟎𝟎𝟎𝟎

ROI = =

𝑻𝑶𝑻𝑨𝑳 𝑪𝑨𝑷𝑰𝑻𝑨𝑳 𝑬𝑴𝑷𝑳𝑶𝒀𝑬𝑫 𝟏𝟓𝟎𝟎𝟎𝟎𝟎

= 20%

Earnings Per share:

𝑷𝑨𝑻 𝟏𝟐𝟎𝟎𝟎𝟎

EPS=

𝑵𝑶.𝑶𝑭 𝑺𝑯𝑨𝑹𝑬𝑺

= 𝟒𝟎𝟎𝟎𝟎

=3

PAT = PBT – TAX (240000.00 – 50% of 240000.00 = Rs. 120000.00)

PE Ratio:

𝑴𝑨𝑹𝑲𝑬𝑻 𝑷𝑹𝑰𝑪𝑬 𝟑𝟎

PE Ratio = = = 10

𝑬𝑷𝑺 𝟑

Debt Equity Ratio under Debt Equity Option:

𝑫𝑬𝑩𝑻 𝟓𝟎𝟎𝟎𝟎𝟎+𝟐𝟎𝟎𝟎𝟎𝟎𝟎

Debt Equity Ratio = 𝑫𝑬𝑩𝑻+𝑬𝑸𝑼𝑰𝑻𝒀

= 𝟓𝟎𝟎𝟎𝟎𝟎+𝟐𝟎𝟎𝟎𝟎𝟎𝟎+𝟏𝟎𝟎𝟎𝟎𝟎𝟎 = 71% (Approx.)

Which is 35% higher and PE is 20% down i.e. (10 - 20 % of 10 = Rs. 8)

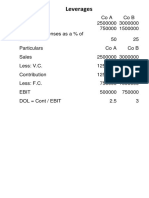

100% Debt 100% Equity

Particular Option A Option B

Existing Capital 15,00,000 15,00,000

Funds raised by equity - 20,00,000

Funds raised by Debt @ 14% 20,00,000

Total Capital 35,00,000 35,00,000

EBIT @20% 7,00,000 7,00,000

Interest @ 12% 60,000 60,000

Interest @ 14% 2,80,000 -

Profit Before Tax 3,60,000 6,40,000

Tax @ 50% 1,80,000 3,20,000

Profit After Tax 1,80,000 3,20,000

No. Of Equity Share 40,000 1,06,667

EPS 4.50 3.00

PE 8.00 10.00

Market Price 36.00 30.00

You might also like

- Inheritance Law IIDocument11 pagesInheritance Law IImacodz766392% (12)

- Monopolistic Comp FRQs AnswersDocument4 pagesMonopolistic Comp FRQs AnswersHeizlyn Amyneina100% (1)

- Numericals On Financial ManagementDocument4 pagesNumericals On Financial ManagementDhruv100% (1)

- FM Assignment 7 - Group 4Document7 pagesFM Assignment 7 - Group 4Puspita RamadhaniaNo ratings yet

- FM Assignment-2Document8 pagesFM Assignment-2Rajarshi DaharwalNo ratings yet

- Cost Volume Profit AnalysisDocument14 pagesCost Volume Profit AnalysisVanityHughNo ratings yet

- ACJC Prelim H2 (Essays)Document26 pagesACJC Prelim H2 (Essays)lammofjvl0% (1)

- FM Eco Important 1620388826Document126 pagesFM Eco Important 1620388826Naresh SomvanshiNo ratings yet

- Ebit EpsDocument19 pagesEbit EpsPrashant SharmaNo ratings yet

- FM Questions RevisedDocument15 pagesFM Questions RevisedRajarshi DaharwalNo ratings yet

- Traditional Theory Approach: Illustrations 1Document7 pagesTraditional Theory Approach: Illustrations 1PRAMOD VNo ratings yet

- 1705383722Ch 5 Financial Decisions Capital Structure CA Inter CTSanswerDocument6 pages1705383722Ch 5 Financial Decisions Capital Structure CA Inter CTSanswerPratyushNo ratings yet

- CAPITAL STRUCTURE Sums OnlinePGDMDocument6 pagesCAPITAL STRUCTURE Sums OnlinePGDMSoumendra RoyNo ratings yet

- End-Term Paper Financial Management - 2 Set - A: SolutionDocument7 pagesEnd-Term Paper Financial Management - 2 Set - A: SolutionLakshmi NairNo ratings yet

- Case 1 - Tutor GuideDocument3 pagesCase 1 - Tutor GuideKAR ENG QUAHNo ratings yet

- Financial Leverage Excel Template: Visit: EmailDocument4 pagesFinancial Leverage Excel Template: Visit: EmailAsad MuhammadNo ratings yet

- Final CasesDocument22 pagesFinal CaseshadeerahmedNo ratings yet

- CA Intermediate - Financial Management Solve Any 3 Questions From The Following 4 Questions Total Marks - 48 Q1)Document12 pagesCA Intermediate - Financial Management Solve Any 3 Questions From The Following 4 Questions Total Marks - 48 Q1)Sohail Ahmed KhiljiNo ratings yet

- Capital Structure Debt Equity - ProblemsDocument5 pagesCapital Structure Debt Equity - ProblemsSaumya SinghNo ratings yet

- Chapter 5 LectureDocument6 pagesChapter 5 LectureSaadNo ratings yet

- ST-1 (Analysis of Recessionary Cash Flows) ADocument4 pagesST-1 (Analysis of Recessionary Cash Flows) AGA ZinNo ratings yet

- Financial Management: Capital StructureDocument18 pagesFinancial Management: Capital StructureSamiul AzamNo ratings yet

- Fim Model SolutionDocument7 pagesFim Model Solutionhyp siinNo ratings yet

- MBA Advance Financial Management - ASYNCHRONUS ACTIVITYDocument9 pagesMBA Advance Financial Management - ASYNCHRONUS ACTIVITYDaniella LampteyNo ratings yet

- 2nd Assignment of Financial ManagementDocument6 pages2nd Assignment of Financial Managementpratiksha24No ratings yet

- Accounting and Financial Management - Problems For RevisionDocument12 pagesAccounting and Financial Management - Problems For RevisionshameemanwarNo ratings yet

- Final Exam CorporateDocument4 pagesFinal Exam CorporateCiptawan CenNo ratings yet

- AFM IBSB Leverages WordDocument16 pagesAFM IBSB Leverages WordSangeetha K SNo ratings yet

- Capital StructureDocument7 pagesCapital StructureShripradha AcharyaNo ratings yet

- FINANCIAL MANAGEMENT CAT ClintonDocument6 pagesFINANCIAL MANAGEMENT CAT ClintonClinton MugendiNo ratings yet

- 3A. Capital Structure Leverages Numerical MarkedDocument3 pages3A. Capital Structure Leverages Numerical MarkedSundeep MogantiNo ratings yet

- Ebit Eps AnalysisDocument15 pagesEbit Eps AnalysisGunjan GargNo ratings yet

- Problems On Capital SturctureDocument6 pagesProblems On Capital SturctureShripradha AcharyaNo ratings yet

- MaDocument6 pagesMaAashayNo ratings yet

- Financial Planning 2Document7 pagesFinancial Planning 2atentoangiaNo ratings yet

- C09 +chap+16 +Capital+Structure+-+Basic+ConceptsDocument24 pagesC09 +chap+16 +Capital+Structure+-+Basic+Conceptsstanley tsangNo ratings yet

- Solution Manual For Cfin 5Th Edition by Besley and Brigham Isbn 1305661656 9781305661653 Full Chapter PDFDocument36 pagesSolution Manual For Cfin 5Th Edition by Besley and Brigham Isbn 1305661656 9781305661653 Full Chapter PDFtiffany.kunst387100% (14)

- FM Unit 1-5Document260 pagesFM Unit 1-5VINAY BETHANo ratings yet

- Tugas 2 MK IIDocument6 pagesTugas 2 MK IIKirana Maharani - SagasitasNo ratings yet

- 6 - Dividend - DividendPolicy - FM - Mahesh MeenaDocument9 pages6 - Dividend - DividendPolicy - FM - Mahesh MeenaIshvinder SinghNo ratings yet

- Capital StructureDocument9 pagesCapital StructureDEVNo ratings yet

- Set ADocument3 pagesSet AManish KumarNo ratings yet

- Finance 8174787Document2 pagesFinance 8174787erikyryangNo ratings yet

- Unit 2 LeveragesDocument4 pagesUnit 2 Leveragesbhargavayg1915No ratings yet

- FM NumericalDocument3 pagesFM NumericalNitin KumarNo ratings yet

- My Brigham CH 3Document33 pagesMy Brigham CH 3sabapshafaghNo ratings yet

- Topic 7 Capital Structure & Dividend ImputationDocument53 pagesTopic 7 Capital Structure & Dividend Imputationsir bookkeeperNo ratings yet

- FM Assignment1Document6 pagesFM Assignment1Rishi Kumar SainiNo ratings yet

- Tutorial 8 AnswerDocument3 pagesTutorial 8 AnswerHaidahNo ratings yet

- Chapter 1 Eis & Eps AnalysisDocument5 pagesChapter 1 Eis & Eps AnalysisAbhishek TiwariNo ratings yet

- Dividend Policy Gorden, Walter & MM Model Practice QuestionsDocument1 pageDividend Policy Gorden, Walter & MM Model Practice QuestionsAmjad AliNo ratings yet

- Dividend Policy Gorden, Walter & MM Model Practice QuestionsDocument1 pageDividend Policy Gorden, Walter & MM Model Practice QuestionsAmjad AliNo ratings yet

- Dewa Satria Rachman Lubis - 11 - 4-17Document15 pagesDewa Satria Rachman Lubis - 11 - 4-17DewaSatriaNo ratings yet

- Bài tập chương 13Document10 pagesBài tập chương 132021agl12.phamhoangdieumyNo ratings yet

- Fitriyanto - Financial Management Asignment - CH 14 15Document6 pagesFitriyanto - Financial Management Asignment - CH 14 15iyanNo ratings yet

- Market Value (No Leverage) $60,000/0.10 $600,000Document1 pageMarket Value (No Leverage) $60,000/0.10 $600,000Kyla Ramos DiamsayNo ratings yet

- Intermediate Accounting Chapter 17 and 18Document9 pagesIntermediate Accounting Chapter 17 and 18avilastephjaneNo ratings yet

- Capital Structure ProblemsDocument6 pagesCapital Structure Problemschandel08No ratings yet

- CH.6 Financial Structure & The Uses of LeverageDocument16 pagesCH.6 Financial Structure & The Uses of LeverageMark KaiserNo ratings yet

- 10 Financial Leverage and Capital Structure Policy (Session 22, 23)Document22 pages10 Financial Leverage and Capital Structure Policy (Session 22, 23)creamellzNo ratings yet

- Assignment 1Document2 pagesAssignment 1Mitch wongNo ratings yet

- Capital Structure Self Correction ProblemsDocument53 pagesCapital Structure Self Correction ProblemsTamoor BaigNo ratings yet

- Solution-Dissolution and LiquidationDocument8 pagesSolution-Dissolution and LiquidationRejay VillamorNo ratings yet

- Capital Structure - Balance Sheet ProblemsDocument5 pagesCapital Structure - Balance Sheet ProblemsShripradha AcharyaNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- The 6 Market Model Britannia: 18020448091 Rajrishi Daharwal 18020448125 Dulal Nandy 18020448062 Ravi PandhareDocument12 pagesThe 6 Market Model Britannia: 18020448091 Rajrishi Daharwal 18020448125 Dulal Nandy 18020448062 Ravi PandhareRajarshi DaharwalNo ratings yet

- FcpaDocument4 pagesFcpaRajarshi DaharwalNo ratings yet

- Stock Analysis 2Document62 pagesStock Analysis 2Rajarshi DaharwalNo ratings yet

- SAPMDocument4 pagesSAPMRajarshi DaharwalNo ratings yet

- FM Questions RevisedDocument15 pagesFM Questions RevisedRajarshi DaharwalNo ratings yet

- If You Would Have Invested Rs.10,00,000 What Would Have Been Weightage To Both The Categories?Document4 pagesIf You Would Have Invested Rs.10,00,000 What Would Have Been Weightage To Both The Categories?Rajarshi DaharwalNo ratings yet

- Statistics Assignment 3 Q1Document1 pageStatistics Assignment 3 Q1Rajarshi DaharwalNo ratings yet

- Q1 Liabilities Amount Assests Amount Balance Sheet: CA 225000 CL CA-135000 90000Document2 pagesQ1 Liabilities Amount Assests Amount Balance Sheet: CA 225000 CL CA-135000 90000Rajarshi DaharwalNo ratings yet

- 2 Way AnnovaDocument1 page2 Way AnnovaRajarshi DaharwalNo ratings yet

- Efficient Frontier: Month HDFC TCS % Return TCS % Return HDFC HDFC TCS RP S.D Portfolio Mix (W)Document1 pageEfficient Frontier: Month HDFC TCS % Return TCS % Return HDFC HDFC TCS RP S.D Portfolio Mix (W)Rajarshi DaharwalNo ratings yet

- CTC Structure: 7% Component A Component B Component C Component D Component E Component FDocument1 pageCTC Structure: 7% Component A Component B Component C Component D Component E Component FRajarshi DaharwalNo ratings yet

- DRM CH 2 - Futures Markets and Central Counterparties PDFDocument35 pagesDRM CH 2 - Futures Markets and Central Counterparties PDFNeha SinghNo ratings yet

- Demand and Supply AssignmentDocument2 pagesDemand and Supply Assignmentmoon musicNo ratings yet

- Nifty B ES: Do It Yourself - SIPDocument18 pagesNifty B ES: Do It Yourself - SIPzeeviNo ratings yet

- 1.options Trading OI DetailsDocument4 pages1.options Trading OI DetailsGp GpNo ratings yet

- Schirding H. - Stochastic Oscillator (1984)Document5 pagesSchirding H. - Stochastic Oscillator (1984)puran1234567890No ratings yet

- FIN 516 Week 8 Final ExamDocument2 pagesFIN 516 Week 8 Final ExamCherylR0% (1)

- Acc105 Accounting ConceptDocument48 pagesAcc105 Accounting Conceptparivesh GoyalNo ratings yet

- ExerDocument4 pagesExerdianne ballonNo ratings yet

- ECO402 Formative AssesmentDocument20 pagesECO402 Formative AssesmentAsif AliNo ratings yet

- Chapter 2 - Analyzing Urban Spatial StructureDocument6 pagesChapter 2 - Analyzing Urban Spatial StructureMd. Shiharan Afridi NiloyNo ratings yet

- CarlsbergDocument104 pagesCarlsbergVajirapanie BandaranayakeNo ratings yet

- Can One Size Fit All?Document21 pagesCan One Size Fit All?Abhimanyu ChoudharyNo ratings yet

- IRENA Innovative Ancillary Services 2019Document24 pagesIRENA Innovative Ancillary Services 2019DanniVivanNo ratings yet

- World in Ruin SHTFPlan ComDocument11 pagesWorld in Ruin SHTFPlan ComRuss TaylorNo ratings yet

- Black BookDocument54 pagesBlack BookAnurag YadavNo ratings yet

- Walmart Ethical Problems (Assignment)Document12 pagesWalmart Ethical Problems (Assignment)iamKOB100% (7)

- IFRS 15 - Revenue From ContractsDocument5 pagesIFRS 15 - Revenue From ContractsRedNo ratings yet

- Why People Really Buy Hybrids: Jonathan KleinDocument9 pagesWhy People Really Buy Hybrids: Jonathan KleinfkkfoxNo ratings yet

- 50 KVA Ricardo For MARSDocument6 pages50 KVA Ricardo For MARSrr engineering managing directorNo ratings yet

- Logistics and Competitive AdvantageDocument63 pagesLogistics and Competitive AdvantageSUNDAR1967No ratings yet

- 25444sm SFM Finalnewvol2 Cp12 Chapter 12Document54 pages25444sm SFM Finalnewvol2 Cp12 Chapter 12Prin PrinksNo ratings yet

- 21st Century Cures Act LetterDocument2 pages21st Century Cures Act LetterPeter SullivanNo ratings yet

- Lecture 1Document83 pagesLecture 1Алтынгуль ЕрежеповаNo ratings yet

- 2021 Retake Solutions Exam in Corporate FinanceDocument6 pages2021 Retake Solutions Exam in Corporate FinanceNikolai PriessNo ratings yet

- Heineken Case StudyDocument8 pagesHeineken Case StudyParnamoy DuttaNo ratings yet

- Convexity Maven - A Guide For The PerplexedDocument11 pagesConvexity Maven - A Guide For The Perplexedbuckybad2No ratings yet