Professional Documents

Culture Documents

Income Tax Declaration

Income Tax Declaration

Uploaded by

Parwinder Singh0 ratings0% found this document useful (0 votes)

39 views1 pageThis document is a declaration by a transport company to CLAAS Agricultural Machinery Private Limited stating that the transport company owns fewer than 10 goods carriages and therefore qualifies for non-deduction of tax at source from payments received. The declaration specifies the transport company name and PAN, confirms ownership of fewer than 10 goods carriages currently and a commitment to notify if that exceeds 10, and is signed and dated by the declarant.

Original Description:

Income tax declartion

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document is a declaration by a transport company to CLAAS Agricultural Machinery Private Limited stating that the transport company owns fewer than 10 goods carriages and therefore qualifies for non-deduction of tax at source from payments received. The declaration specifies the transport company name and PAN, confirms ownership of fewer than 10 goods carriages currently and a commitment to notify if that exceeds 10, and is signed and dated by the declarant.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

39 views1 pageIncome Tax Declaration

Income Tax Declaration

Uploaded by

Parwinder SinghThis document is a declaration by a transport company to CLAAS Agricultural Machinery Private Limited stating that the transport company owns fewer than 10 goods carriages and therefore qualifies for non-deduction of tax at source from payments received. The declaration specifies the transport company name and PAN, confirms ownership of fewer than 10 goods carriages currently and a commitment to notify if that exceeds 10, and is signed and dated by the declarant.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 1

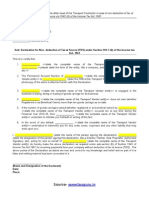

Declaration under Section 194C(6) for Non-deduction of Tax at Source

To

CLAAS Agricultural Machinery Private Limited

15/3, Mathura Road,

Faridabad-121003

Declaration

I, Mr. ___________________, Proprietor/Partner/Director of M/s ____________Transport Company,

________________, New Delhi (hereinafter “the contractor”) do hereby make the following declaration

as required by sub section (6) of Section 194C of the Income Tax Act, 1961 for receiving payments

from the payer without deduction of tax at source,:

1. That I/We, ____________am/are authorized to make this declaration in the capacity

as Proprietor/Partner/Director of M/s __________________. .

2. That M/s _____________ is being engaged by the payer for playing, hiring or leasing of goods

carriage for its business.

3. That M/s _____________ does not own more than ten goods carriage as on date.

4. That if the number of goods carriages owned by the contractor exceeds ten at any time during the

previous year 2019-20 (01-04-2019 to 31-03-2020) , the contractor shall forthwith, in writing intimate

the payer of this fact.

5. That the Income Tax Permanent Account Number (PAN) of the contractor is ____________ . A

photocopy of the same is furnished to the payer along with this declaration.

Place:

Dated:

Declarant

VERIFICATION

I the above named declarant do hereby verify that the contents of paragraphs one to five above are

true to my own knowledge and belief and no part of it is false and nothing material has been concealed

in it.

Place:

Dated:

You might also like

- Vehicle Plan Agreement INC.Document5 pagesVehicle Plan Agreement INC.Atty. dj TanNo ratings yet

- Declaration Under Section 194CDocument1 pageDeclaration Under Section 194CAloha Kinderworld100% (1)

- Declaration Under Section 194CDocument1 pageDeclaration Under Section 194Cwasim bari75% (4)

- Declaration 194C NoTDSTransporterDocument1 pageDeclaration 194C NoTDSTransporternitinnawar100% (4)

- LEGAL NOTICE-Recovery of DuesDocument5 pagesLEGAL NOTICE-Recovery of DuesAnandi Sengunthar100% (2)

- Car Rental AgreementDocument1 pageCar Rental Agreementgideon tinio100% (4)

- Thumbs up Trucking llc E-book: Step by step e-book on how to start a trucking companyFrom EverandThumbs up Trucking llc E-book: Step by step e-book on how to start a trucking companyNo ratings yet

- Franchise ContractDocument3 pagesFranchise Contractedward tablazon100% (2)

- Declaration For NonDocument1 pageDeclaration For NonVipool Ghetia100% (1)

- Petition Under IBC For Recovery of Salary DuesDocument10 pagesPetition Under IBC For Recovery of Salary DuesAmrita JoshiNo ratings yet

- CONTRACT OF SERVICES - HaulingDocument2 pagesCONTRACT OF SERVICES - HaulingBernadette Luces Beldad0% (1)

- Meghmani Pigmets,: 11 Floor, JMC House, Opp:-Parimal Garden, Ahmedabad - 380006Document3 pagesMeghmani Pigmets,: 11 Floor, JMC House, Opp:-Parimal Garden, Ahmedabad - 380006JIGNESH SHAHNo ratings yet

- Declaration Under Section 194C (6) For Non-Deduction of Tax at SourceDocument1 pageDeclaration Under Section 194C (6) For Non-Deduction of Tax at Sourcesai sabari accounting solutionsNo ratings yet

- Declaration For Non Deduction of Tax FormatDocument2 pagesDeclaration For Non Deduction of Tax FormatD.k. PathakNo ratings yet

- 1627964171Document1 page1627964171sajahan aliNo ratings yet

- 194C - Non Deduction of TDS For TransporterDocument1 page194C - Non Deduction of TDS For TransporterDINESH MEHTANo ratings yet

- Declaration Under Section 194CDocument1 pageDeclaration Under Section 194Cwasim bari50% (2)

- TDS Declaration From Transporter For 194CDocument1 pageTDS Declaration From Transporter For 194Csurat-bkgNo ratings yet

- TDS Declaration From Transporter For 194CDocument1 pageTDS Declaration From Transporter For 194Cmdimrankhan5245No ratings yet

- TDS Declaration From Transporter For 194CDocument1 pageTDS Declaration From Transporter For 194CASHISH KUMARNo ratings yet

- TDS DeclaraDocument1 pageTDS Declararudrarajenterprise111No ratings yet

- TDS Declaration From Transporter For 194CDocument1 pageTDS Declaration From Transporter For 194Ckksinghp1987No ratings yet

- TDS DeductionDocument1 pageTDS Deductionvishnupatel3672No ratings yet

- Form No. 15-I: VerificationDocument1 pageForm No. 15-I: Verificationtabassumansari0750No ratings yet

- S. 194C (6) For Non-Deduction of TDS by Transporter - Taxguru - inDocument2 pagesS. 194C (6) For Non-Deduction of TDS by Transporter - Taxguru - indudstataskyNo ratings yet

- Vendors TDS Declaration Under Section 194CDocument2 pagesVendors TDS Declaration Under Section 194Caakash thakkarNo ratings yet

- Template-Of-TDS-Declaration For Transporter Wef 1.6.15Document1 pageTemplate-Of-TDS-Declaration For Transporter Wef 1.6.15Dhananjay KulkarniNo ratings yet

- TDS On Payments Made To TransportersDocument4 pagesTDS On Payments Made To TransportersAmar ChouguleNo ratings yet

- Declaration TDS - GOKULRAJDocument2 pagesDeclaration TDS - GOKULRAJShivaranjhani PalanisamyNo ratings yet

- FSI GST Wavier Undertaking Cum Indeminity 24.08.2021Document2 pagesFSI GST Wavier Undertaking Cum Indeminity 24.08.2021sai nair100% (1)

- Declaration 194c6Document3 pagesDeclaration 194c6sajahan aliNo ratings yet

- 352801995-Declaration-us-194C-doc FOR BHANDARE TRANSPORTDocument1 page352801995-Declaration-us-194C-doc FOR BHANDARE TRANSPORTsuraj salunkeNo ratings yet

- Commercial Declaration Cum Indemnity CommercialDocument2 pagesCommercial Declaration Cum Indemnity CommercialbandiinfraprojectNo ratings yet

- Agreement For Sale of Motor VehicleDocument2 pagesAgreement For Sale of Motor Vehiclescarlett AthenaNo ratings yet

- N. Nagamani Transport-Tds Non-Deduction DeclarationDocument1 pageN. Nagamani Transport-Tds Non-Deduction Declarationjayey37935No ratings yet

- Contrato Civil de Prestación de Servicios Profesionales en InglesDocument3 pagesContrato Civil de Prestación de Servicios Profesionales en InglesDom DomNo ratings yet

- Letter Head BindiawisiniDocument1 pageLetter Head BindiawisiniChetan TiwariNo ratings yet

- Certificate of Authority To Use GarageDocument1 pageCertificate of Authority To Use GarageonelaenusNo ratings yet

- Road Transport Envolep No.1Document11 pagesRoad Transport Envolep No.1Tonoj DasNo ratings yet

- Declaration Under Section 194CDocument1 pageDeclaration Under Section 194CsuratNo ratings yet

- No Objection CertificateDocument3 pagesNo Objection CertificaterameswarNo ratings yet

- TFS - Affidavit of UndertakingDocument1 pageTFS - Affidavit of UndertakingMary Rose LealNo ratings yet

- Form 28 For NOCDocument3 pagesForm 28 For NOCAnonymous Fhs3ufkCNo ratings yet

- Affidavit of Warranty/ Undertaking: Picon DitablanDocument1 pageAffidavit of Warranty/ Undertaking: Picon Ditablandaisy mae mendozaNo ratings yet

- Affidit Cum UndertakingDocument1 pageAffidit Cum UndertakingAaju KausikNo ratings yet

- Declaration Us 194C Format2Document1 pageDeclaration Us 194C Format2CA SHOBHIT GoelNo ratings yet

- Declaration Us 194CDocument1 pageDeclaration Us 194CSushant Ghadi0% (1)

- Form No 30Document2 pagesForm No 30mithun7No ratings yet

- RGRM141015 File2of6.Tech SpecificationDocument5 pagesRGRM141015 File2of6.Tech SpecificationKedar ChoksiNo ratings yet

- Undertaking RilDocument2 pagesUndertaking RilvikramreddyNo ratings yet

- Government MOA On Contract of Fuel SupplyDocument5 pagesGovernment MOA On Contract of Fuel SupplyAtty. Cca MagallanesNo ratings yet

- Ajay KR DeyDocument8 pagesAjay KR Dey858aNo ratings yet

- Application For Insurance Broker'S LicenseDocument4 pagesApplication For Insurance Broker'S LicenseRealino PradoNo ratings yet

- KoraDocument1 pageKorasunil kr vermaNo ratings yet

- ASD FormDocument1 pageASD FormDeepak ChughNo ratings yet

- Declaration Under Section 194CDocument2 pagesDeclaration Under Section 194Cnaveen pointNo ratings yet

- Application Form - Paras SquareDocument14 pagesApplication Form - Paras SquareSehgal EstatesNo ratings yet

- Memoramdum of Loan AgreementDocument6 pagesMemoramdum of Loan AgreementMICHELLE GATSONNo ratings yet

- The Book of the Morris Minor and the Morris Eight - A Complete Guide for Owners and Prospective Purchasers of All Morris Minors and Morris EightsFrom EverandThe Book of the Morris Minor and the Morris Eight - A Complete Guide for Owners and Prospective Purchasers of All Morris Minors and Morris EightsNo ratings yet