Professional Documents

Culture Documents

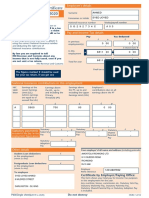

Payslip Template

Payslip Template

Uploaded by

Maiel Siu0 ratings0% found this document useful (0 votes)

31 views4 pagesThis document contains payroll information for an employee, including allowances, basic pay, overtime, tax deductions, and net pay. It lists taxable income amounts, applicable tax rates, and total tax withheld. The net pay amount is shown as 1666.67 pesos after accounting for all earnings, deductions, and tax withholdings.

Original Description:

Payslip computation guideline

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document contains payroll information for an employee, including allowances, basic pay, overtime, tax deductions, and net pay. It lists taxable income amounts, applicable tax rates, and total tax withheld. The net pay amount is shown as 1666.67 pesos after accounting for all earnings, deductions, and tax withholdings.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

0 ratings0% found this document useful (0 votes)

31 views4 pagesPayslip Template

Payslip Template

Uploaded by

Maiel SiuThis document contains payroll information for an employee, including allowances, basic pay, overtime, tax deductions, and net pay. It lists taxable income amounts, applicable tax rates, and total tax withheld. The net pay amount is shown as 1666.67 pesos after accounting for all earnings, deductions, and tax withholdings.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

You are on page 1of 4

Salary Computation in peso

Allowance non taxable. DEMINIMIS input data here

Basic pay input data here

Reg OT input data here

Night dif input data here

Legal holiday/ input data here

Special holiday on a restday nd input data here

Special holiday input data here

Withholding tax input data here just for comparison

Phil health input data here

SSS input data here

HDMF input data here

BIR bracket-single(FIX) 12500

BIR bracket % for single(FIX) 30%

BIR tax table(FIX) 2083.33

Sum of total taxable 0

Total taxable less of phil health, SSS,

hdmf 0

Taxable net less BIR bracket -12500

Multiply by bracket percentage -3750

TOTAL WITHHOLDING TAX -1666.67 if match with payslip 0

Deductions and tax -1666.67 Total deduction including company advances -1666.67

Gross earning 0 SSS LOAN

NET PAY 1666.67

1666.67

from BIR tax table

https://lh3.googleusercontent.com/-LURq0JXcuFU/WKXwxfzNijI/AAAAAAAAA5Q/v1hZHGN528M7ZNyJz9iOGcpxnnf

just for comparison

advance due to holiday not paid advance

528M7ZNyJz9iOGcpxnnfokpsTwCL0B/h3508/2017-02-16.png

You might also like

- Australian Payslip Generator TemplateDocument1 pageAustralian Payslip Generator TemplateFarzinNo ratings yet

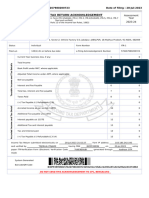

- ITR 1 Excel Sheet To Download OnlyDocument6 pagesITR 1 Excel Sheet To Download OnlyRahul Kumar100% (1)

- Amontola Richmond LTD - Form P60 - SYED JOYED AHMED - 19-20Document1 pageAmontola Richmond LTD - Form P60 - SYED JOYED AHMED - 19-20shamiaNo ratings yet

- Chapter 14-Regular Income Taxation: IndividualsDocument28 pagesChapter 14-Regular Income Taxation: Individualsarjay matanguihan100% (3)

- Sana MabagoDocument1 pageSana MabagojoystambaNo ratings yet

- SGV and Co Presentation On TRAIN LawDocument48 pagesSGV and Co Presentation On TRAIN LawPortCalls100% (8)

- P60 For Year 2021/22Document1 pageP60 For Year 2021/22gd9pnygr27No ratings yet

- Procedure BIR Form To Submit: Fill in Both Forms For (A) & (B)Document21 pagesProcedure BIR Form To Submit: Fill in Both Forms For (A) & (B)TenNo ratings yet

- Pre Salary Revision:: For Current FY Apr '05 To Mar '06Document4 pagesPre Salary Revision:: For Current FY Apr '05 To Mar '06Vij Vaibhav VermaNo ratings yet

- Ep60 2016-17 PDFDocument1 pageEp60 2016-17 PDFAnonymous ZoN0SOKzVNo ratings yet

- P60 End of Year Certificate: Tax Year To 5 AprilDocument1 pageP60 End of Year Certificate: Tax Year To 5 April林陵No ratings yet

- Miller P60Document1 pageMiller P60alexanderpatrickfarrellNo ratings yet

- Regular Income Taxation: Individuals: Chapter Overview and ObjectivesDocument27 pagesRegular Income Taxation: Individuals: Chapter Overview and ObjectivesJane Handumon100% (1)

- P60 Single Sheet 2022 To 2023Document1 pageP60 Single Sheet 2022 To 2023Manuel Brites FerreiraNo ratings yet

- Income Tax Calculator For FY 2022-23 & 2023-24 AY 2023-24 & 2024-25Document134 pagesIncome Tax Calculator For FY 2022-23 & 2023-24 AY 2023-24 & 2024-25Vipul SharmaNo ratings yet

- x6cWiJTtNswqquGU1iymdf2w NGURPv8eI9mmdBTx1gxAUB1ddV7CtLbXVshNVSJhOKZAZ0l7-k-maA2DqNc66ObsoxWTOzDJ5CL OapJjqfDocument1 pagex6cWiJTtNswqquGU1iymdf2w NGURPv8eI9mmdBTx1gxAUB1ddV7CtLbXVshNVSJhOKZAZ0l7-k-maA2DqNc66ObsoxWTOzDJ5CL OapJjqfAdemuyiwa OlaniyiNo ratings yet

- Heads of Income - Income From SalaryDocument10 pagesHeads of Income - Income From SalaryBhavesh KhillareNo ratings yet

- Enter Necessary Data For Income Tax CalculationDocument12 pagesEnter Necessary Data For Income Tax CalculationAnzi25No ratings yet

- Income Tax of IndividualsDocument4 pagesIncome Tax of IndividualsBhabhing EnriquezNo ratings yet

- Tax Year To 5 April: P60 End of Year Certificate 2024Document1 pageTax Year To 5 April: P60 End of Year Certificate 2024wjrwzmt22wNo ratings yet

- P60single 2Document1 pageP60single 2Claira JervisNo ratings yet

- Written Report Week 8 Income TaxDocument16 pagesWritten Report Week 8 Income Taxdevy mar topiaNo ratings yet

- Chapter 9 Other Percentage TaxesDocument56 pagesChapter 9 Other Percentage TaxesKarylle BartolayNo ratings yet

- Itr2 2018 PR1.1Document98 pagesItr2 2018 PR1.1HarshaNo ratings yet

- Itr2 2018 PR1.2Document104 pagesItr2 2018 PR1.2pingbadriNo ratings yet

- Excise Taxes On Alcohol ProductsDocument18 pagesExcise Taxes On Alcohol ProductsChristine ChuaNo ratings yet

- Book1 PsDocument2 pagesBook1 PsVincent IgnacioNo ratings yet

- Downloads My Downloads 673Document1 pageDownloads My Downloads 673Katalin GemesNo ratings yet

- Taxation: DATE: November 10,2018 Presented By: Mr. Florante P. de Leon, Mba, CBDocument35 pagesTaxation: DATE: November 10,2018 Presented By: Mr. Florante P. de Leon, Mba, CBFlorante De LeonNo ratings yet

- NicolaiCommunicationView 2Document1 pageNicolaiCommunicationView 2dmorari93No ratings yet

- Sucha Singh ITR3 - PR6Document129 pagesSucha Singh ITR3 - PR6Varinder AnandNo ratings yet

- Individual Tax Payer - Part 2Document18 pagesIndividual Tax Payer - Part 2Ems TeopeNo ratings yet

- 2021-2022 Tax ReturnDocument3 pages2021-2022 Tax ReturnMmmmmmmNo ratings yet

- Income Tax Calculator FY 2014 15Document2 pagesIncome Tax Calculator FY 2014 15atul bansalNo ratings yet

- Pajak Penghasilan Orang Pribadi: by Tri Puji Astuti Ismi Kurnia HayatiDocument17 pagesPajak Penghasilan Orang Pribadi: by Tri Puji Astuti Ismi Kurnia HayatiKenny AndikaNo ratings yet

- NZ Resident Tax Refund CalculatorDocument3 pagesNZ Resident Tax Refund CalculatorkwqczxrdwnNo ratings yet

- Note On Budget Proposals-2020Document7 pagesNote On Budget Proposals-2020Mayur VartakNo ratings yet

- US Internal Revenue Service: p533 - 1995Document10 pagesUS Internal Revenue Service: p533 - 1995IRSNo ratings yet

- How To Calculate PAYE Tax in Nigeria - Guide To Taxation of EmplDocument22 pagesHow To Calculate PAYE Tax in Nigeria - Guide To Taxation of Empledos izedonmwenNo ratings yet

- Emailing Inter Full Book DT - Youtube - Prof - Aagam Dalal-3Document126 pagesEmailing Inter Full Book DT - Youtube - Prof - Aagam Dalal-3chalu account100% (2)

- Ten Tax Mistakes - Part 1Document17 pagesTen Tax Mistakes - Part 1bomseriesNo ratings yet

- Income Tax Calculator FY 2015-16 (AY 2016-17) : Particulars Details TypeDocument4 pagesIncome Tax Calculator FY 2015-16 (AY 2016-17) : Particulars Details TypeKamlesh ChauhanNo ratings yet

- Case Analysis Tempo Manufacturing Inc.Document2 pagesCase Analysis Tempo Manufacturing Inc.Mihaela MendozaNo ratings yet

- Finacc 2 8Document65 pagesFinacc 2 8Marielle De LeonNo ratings yet

- It 23-24Document5 pagesIt 23-24Alok G ShindeNo ratings yet

- MBA 308 Compensation ManagementDocument18 pagesMBA 308 Compensation ManagementFaiz KhanNo ratings yet

- Intro RIT - Exclusion in GIDocument23 pagesIntro RIT - Exclusion in GIdelacruzrojohn600No ratings yet

- Itr3 2018 PR1Document148 pagesItr3 2018 PR1Harish Kumar MahavarNo ratings yet

- US Internal Revenue Service: p533 - 1999Document18 pagesUS Internal Revenue Service: p533 - 1999IRSNo ratings yet

- Taxation On Partnership FirmDocument11 pagesTaxation On Partnership FirmnarendraNo ratings yet

- Individual Taxation 2013 Pratt 7th Edition Test BankDocument19 pagesIndividual Taxation 2013 Pratt 7th Edition Test Bankbrianbradyogztekbndm100% (47)

- Salary Break-Up Cost To CompanyDocument2 pagesSalary Break-Up Cost To Companyshanmukha2007No ratings yet

- COMPUTATIONDocument2 pagesCOMPUTATIONjaredford913No ratings yet

- Goods and Services Tax: 4A, 4B, 6B, 6C - B2B, SEZ, DE Invoices - View DetailsDocument4 pagesGoods and Services Tax: 4A, 4B, 6B, 6C - B2B, SEZ, DE Invoices - View DetailsPallavi PandeyNo ratings yet

- Solution Manual For College Accounting 22nd EditionDocument23 pagesSolution Manual For College Accounting 22nd EditionMissKellyWilliamsondawe100% (46)

- Tax Return: Wealth and Income Tax 2021Document6 pagesTax Return: Wealth and Income Tax 2021evelinaburagaite2001No ratings yet

- Tejilal VDocument1 pageTejilal VNatraj IyerNo ratings yet

- Process Flow To Submit Tax Regime4102023Document12 pagesProcess Flow To Submit Tax Regime4102023Gokul KrishNo ratings yet

- College Accounting Chapters 1-15-22nd Edition Heintz Solutions ManualDocument23 pagesCollege Accounting Chapters 1-15-22nd Edition Heintz Solutions Manualotisphoebeajn100% (35)

- Make Taxes Great Again: The Good, the Bad and the Ugly About Tax ReformFrom EverandMake Taxes Great Again: The Good, the Bad and the Ugly About Tax ReformNo ratings yet