Professional Documents

Culture Documents

Association of Custom Brokers vs. Manila

Association of Custom Brokers vs. Manila

Uploaded by

lexxOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Association of Custom Brokers vs. Manila

Association of Custom Brokers vs. Manila

Uploaded by

lexxCopyright:

Available Formats

Association of Custom Brokers vs.

Manila

GR L-4376, 22 May 1953

En Banc, Bautista-Angelo (J): 3 concur, 4 concur in result

FACTS:

The Association of Customs Brokers, which is composed of all brokers and public service

operators of motor vehicles in the City of Manila, challenges the validity of Ordinance 3379 on the

grounds (1) that while it levies a so-called property tax, it is in reality a license tax which is beyond the

power of the Manila Municipal Board; (2) that said ordinance offends against the rule on uniformity of

taxes; and (3) that it constitutes double taxation.

ISSUE: Whether the ordinance infringes on the rule on uniformity of taxes as ordained by the

Constitution.

HELD:

While the tax in the Ordinance refers to property tax and it is fixed ad valorem, it is merely

levied on all motor vehicles operating within Manila with the main purpose of raising funds to be

expended exclusively for the repair, maintenance and improvement of the streets and bridges in said

city. The ordinance imposes a license fee although under the cloak of an ad valorem tax to circumvent

the prohibition in the Motor Vehicle Law.

Further, it does not distinguish between a motor vehicle for hire and one which is purely for

private use. Neither does it distinguish between a motor vehicle registered in Manila and one registered

in another place but occasionally comes to Manila and uses its streets and public highways. The

distinction is necessary if his ordinance intends to burden with tax only those registered in Manila as

may be inferred from the word “operating” used therein. There is an inequality in the ordinance which

renders it offensive to the Constitution.

You might also like

- Association of Customs Brokers vs. Municipal Board of ManilaDocument5 pagesAssociation of Customs Brokers vs. Municipal Board of ManilaRaquel DoqueniaNo ratings yet

- 064&076-Association of Customs Brokers, Inc. v. The Municipal Board, 93 Phil. 103Document3 pages064&076-Association of Customs Brokers, Inc. v. The Municipal Board, 93 Phil. 103Jopan SJNo ratings yet

- City of Manila DigestDocument12 pagesCity of Manila DigestArthur John GarratonNo ratings yet

- CITY OF MANILA Vs INTER-ISLAND GAS SERVICE INCDocument1 pageCITY OF MANILA Vs INTER-ISLAND GAS SERVICE INCJustine DagdagNo ratings yet

- Commissioner of Internal Revenue vs. Seagate Technology (Philippines), 451 SCRA 132, February 11, 2005Document2 pagesCommissioner of Internal Revenue vs. Seagate Technology (Philippines), 451 SCRA 132, February 11, 2005idolbondocNo ratings yet

- Republic v. Rural Bank of Kabacan, Inc.Document2 pagesRepublic v. Rural Bank of Kabacan, Inc.Yuri NishimiyaNo ratings yet

- Department of Education Vs Mariano TuliaoDocument6 pagesDepartment of Education Vs Mariano TuliaoLyceum LawlibraryNo ratings yet

- Bill of RightsDocument75 pagesBill of RightsJsim100% (1)

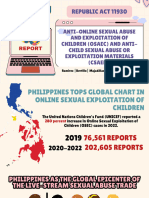

- Presentation On Ra 11930Document40 pagesPresentation On Ra 11930Stella BertilloNo ratings yet

- Acquisition of PossessionDocument18 pagesAcquisition of PossessionFroilan Villafuerte FaurilloNo ratings yet

- Taxation LawDocument199 pagesTaxation LawRufino Gerard MorenoNo ratings yet

- Philippine Society For The Prevention of Cruelty To Animals VsDocument34 pagesPhilippine Society For The Prevention of Cruelty To Animals VsKrisven Mae R. ObedoNo ratings yet

- GEMINIANO vs. CADocument7 pagesGEMINIANO vs. CACyrusNo ratings yet

- List of Financing Companies With Certificate of Authority December 31, 2017Document17 pagesList of Financing Companies With Certificate of Authority December 31, 2017mylene latorreNo ratings yet

- 02 Antero Sison Jr. Vs Acting BIR Commissioner Ruben AnchetaDocument2 pages02 Antero Sison Jr. Vs Acting BIR Commissioner Ruben Anchetasunsetsailor85No ratings yet

- Case DigestsDocument9 pagesCase DigestsMithi Villarmea100% (1)

- Tax I DigestsDocument172 pagesTax I DigestsSara Dela Cruz AvillonNo ratings yet

- Northern Luzon Island vs. GraciaDocument3 pagesNorthern Luzon Island vs. GraciaJessica AbadillaNo ratings yet

- CIR vs. Algue, IncDocument1 pageCIR vs. Algue, IncimXinYNo ratings yet

- Corp, Set 1, DigestDocument22 pagesCorp, Set 1, DigestApureelRoseNo ratings yet

- Shipside Inc. Vs Court of Appeals 352 SCRA 334 (2001)Document13 pagesShipside Inc. Vs Court of Appeals 352 SCRA 334 (2001)KarlNo ratings yet

- Governed by Chapter 5 of The Public Land ActDocument12 pagesGoverned by Chapter 5 of The Public Land ActIrang GandiaNo ratings yet

- Manila Electric Vs Province of LagunaDocument5 pagesManila Electric Vs Province of LagunaKenmar NoganNo ratings yet

- de La Salle Montessori Int'l of Malolos, Inc. v. de La Sale Brothers, Inc., 855 SCRA 38 (2018)Document15 pagesde La Salle Montessori Int'l of Malolos, Inc. v. de La Sale Brothers, Inc., 855 SCRA 38 (2018)bentley CobyNo ratings yet

- Ramon V. Sison For Petitioner. Public Attorney's Office For Private RespondentDocument2 pagesRamon V. Sison For Petitioner. Public Attorney's Office For Private RespondentYodh Jamin OngNo ratings yet

- An Act Providing For The Revised Corporation Code of The PhilippinesDocument1 pageAn Act Providing For The Revised Corporation Code of The PhilippinesMIKE OGADNo ratings yet

- Sps. Baysa vs. Sps PlantillaDocument13 pagesSps. Baysa vs. Sps PlantillaEunice NavarroNo ratings yet

- Cases For Digesting in CivproDocument17 pagesCases For Digesting in CivproKuthe Ig Toots0% (1)

- 4 Manresa Labor TranscriptionDocument30 pages4 Manresa Labor TranscriptionattycertfiedpublicaccountantNo ratings yet

- SP Sport I Cvs CristobalDocument1 pageSP Sport I Cvs CristobalEm Asiddao-DeonaNo ratings yet

- G.R. No. 170912Document12 pagesG.R. No. 170912Rene Valentos100% (1)

- 06 Pascual vs. Commissioner of Internal RevenueDocument12 pages06 Pascual vs. Commissioner of Internal RevenueRaiya AngelaNo ratings yet

- Cagayan Vs Sandiko - DigestDocument2 pagesCagayan Vs Sandiko - DigestNegou Xian TeNo ratings yet

- VAT CasesDocument57 pagesVAT CasesGerald RoxasNo ratings yet

- Review Notes Admin LawDocument3 pagesReview Notes Admin LawCalagui Tejano Glenda JaygeeNo ratings yet

- Missioner of Internal Revenue vs. Court of Appeals, 242 SCRA 289, March 10, 1995Document30 pagesMissioner of Internal Revenue vs. Court of Appeals, 242 SCRA 289, March 10, 1995specialsection100% (1)

- Zuellig Freight and Cargo V NLRCDocument1 pageZuellig Freight and Cargo V NLRCJeunaj LardizabalNo ratings yet

- Court Personnel Vs LlamasDocument6 pagesCourt Personnel Vs LlamasCentSering100% (1)

- General Principles of TaxationDocument40 pagesGeneral Principles of TaxationXhin CagatinNo ratings yet

- Blue CarbonDocument30 pagesBlue CarbonmeathraNo ratings yet

- Progressive Development Corporation vs. Quezon City GR 36081, 24 April 1989Document1 pageProgressive Development Corporation vs. Quezon City GR 36081, 24 April 1989Gela Bea BarriosNo ratings yet

- 05 Eastern Shipping Lines vs. POEADocument8 pages05 Eastern Shipping Lines vs. POEACarlota Nicolas VillaromanNo ratings yet

- RA 8436 As Amended by RA 9369 - Election Modernization ActDocument8 pagesRA 8436 As Amended by RA 9369 - Election Modernization ActWeng CuevillasNo ratings yet

- Diaz v. Sec of Finance and CIRDocument1 pageDiaz v. Sec of Finance and CIRCaroline A. LegaspinoNo ratings yet

- Burbe vs. MagultaDocument2 pagesBurbe vs. MagultaRD AntolinNo ratings yet

- ESSO Standard Eastern Inc Vs CIRDocument6 pagesESSO Standard Eastern Inc Vs CIRToya MochizukieNo ratings yet

- GR No. 180771Document34 pagesGR No. 180771MarizPatanaoNo ratings yet

- Tax SyllabusDocument7 pagesTax Syllabuscrizzia fanugaNo ratings yet

- Ra 7055Document1 pageRa 7055AfricaEdnaNo ratings yet

- 15 Fressel v. Marianno Uy Chaco CoDocument4 pages15 Fressel v. Marianno Uy Chaco CoFarhan JumdainNo ratings yet

- 140-French Oil Mills Machinery Co., Inc. vs. CA 295 Scra 462 (1998)Document3 pages140-French Oil Mills Machinery Co., Inc. vs. CA 295 Scra 462 (1998)Jopan SJNo ratings yet

- 01 Ching Kian Chuan V CADocument12 pages01 Ching Kian Chuan V CAWeesam EscoberNo ratings yet

- A Padua V RanadaDocument20 pagesA Padua V RanadaLester AgoncilloNo ratings yet

- Piercing of Corporate VeilDocument4 pagesPiercing of Corporate VeilRhic Ryanlhee Vergara FabsNo ratings yet

- Primelink vs. LazatinDocument21 pagesPrimelink vs. LazatinBenjamin Hernandez Jr.No ratings yet

- National Internal Revenue Code of 1997Document160 pagesNational Internal Revenue Code of 1997abbdeloNo ratings yet

- Be It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledDocument21 pagesBe It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledSolleil AnnNo ratings yet

- Association of Custom Brokers, Inc. vs. Municipal Board G.R. No. L-4376 May 22, 1953 FactsDocument1 pageAssociation of Custom Brokers, Inc. vs. Municipal Board G.R. No. L-4376 May 22, 1953 FactsJhailey Delima VillacuraNo ratings yet

- Association of Customs Brokers Inc Vs The Municipality Board City of ManilaDocument2 pagesAssociation of Customs Brokers Inc Vs The Municipality Board City of ManilaYvon Baguio67% (3)

- Association of Customs Brokers vs. Municipal Board of Manila (95 Phil 107Document2 pagesAssociation of Customs Brokers vs. Municipal Board of Manila (95 Phil 107ROSASENIA “ROSASENIA, Sweet Angela” Sweet AngelaNo ratings yet

- Rules Preventing The Holding of A Certification ElectionDocument4 pagesRules Preventing The Holding of A Certification ElectionlexxNo ratings yet

- LIWALUG AMEROL, Et Al, vs. MOLOK BAGUMBARAN, Respondent. G.R. No. L-33261 September 30, 1987Document3 pagesLIWALUG AMEROL, Et Al, vs. MOLOK BAGUMBARAN, Respondent. G.R. No. L-33261 September 30, 1987lexxNo ratings yet

- (NACUSIP) - TUCP, Petitioner, vs. DIR. CRESENCIANO B. TRAJANODocument1 page(NACUSIP) - TUCP, Petitioner, vs. DIR. CRESENCIANO B. TRAJANOlexxNo ratings yet

- GOVERNMENT SERVICE INSURANCE SYSTEM, Petitioner, vs. EDUARDO M. SANTIAGO, Substituted by His Widow ROSARIO ENRIQUEZ VDA. DE SANTIAGO, Respondent. G.R. No. 155206, October 28, 2003Document2 pagesGOVERNMENT SERVICE INSURANCE SYSTEM, Petitioner, vs. EDUARDO M. SANTIAGO, Substituted by His Widow ROSARIO ENRIQUEZ VDA. DE SANTIAGO, Respondent. G.R. No. 155206, October 28, 2003lexxNo ratings yet

- Parties in This CaseDocument1 pageParties in This CaselexxNo ratings yet

- COASTAL PACIFIC TRADING, INC., vs. SOUTHERN ROLLING MILLS, CO., INC. (Now Known As Visayan Integrated Steel Corporation), Et - AlDocument3 pagesCOASTAL PACIFIC TRADING, INC., vs. SOUTHERN ROLLING MILLS, CO., INC. (Now Known As Visayan Integrated Steel Corporation), Et - AllexxNo ratings yet

- Province of Abra Vs Judge Hernando, The Roman Catholic Bishop of Bangued, Inc. 107 SCRA 104Document1 pageProvince of Abra Vs Judge Hernando, The Roman Catholic Bishop of Bangued, Inc. 107 SCRA 104lexxNo ratings yet

- VICTORIA BRINGAS PEREIRA, Petitioner, vs. THE HONORABLE COURT OF APPEALS and RITA PEREIRA NAGAC, Respondents. G.R. No. L-81147 June 20, 1989Document2 pagesVICTORIA BRINGAS PEREIRA, Petitioner, vs. THE HONORABLE COURT OF APPEALS and RITA PEREIRA NAGAC, Respondents. G.R. No. L-81147 June 20, 1989lexxNo ratings yet

- CORNELIA BALADAD (Represented by Heinrich M. Angeles and Rex Aaron A. Baladad), Petitioner, vs. SERGIO A. RUBLICO and SPOUSES LAUREANO F. YUPANO, Respondents. G.R. No. 160743, August 4, 2009Document1 pageCORNELIA BALADAD (Represented by Heinrich M. Angeles and Rex Aaron A. Baladad), Petitioner, vs. SERGIO A. RUBLICO and SPOUSES LAUREANO F. YUPANO, Respondents. G.R. No. 160743, August 4, 2009lexxNo ratings yet

- MARCELINO MACOCO, Complainant, Vs - ESTEBAN B. DIAZ, RespondentDocument1 pageMARCELINO MACOCO, Complainant, Vs - ESTEBAN B. DIAZ, RespondentlexxNo ratings yet

- Labor Dispute Case 1&2Document13 pagesLabor Dispute Case 1&2lexxNo ratings yet

- WALTER LUTZ, As Judicial Administrator of the Intestate Estate of the Deceased Antonio Jayme Ledesma, Plaintiff-Appellant, Vs. J. ANTONIO ARANETA, As the Collector of Internal Revenue, Defendant-Appellee.Document4 pagesWALTER LUTZ, As Judicial Administrator of the Intestate Estate of the Deceased Antonio Jayme Ledesma, Plaintiff-Appellant, Vs. J. ANTONIO ARANETA, As the Collector of Internal Revenue, Defendant-Appellee.lexxNo ratings yet

- LOADSTAR SHIPPING CO., INC., Petitioner, vs. COURT OF APPEALS and THE MANILA INSURANCE CO., INC., Respondents.Document4 pagesLOADSTAR SHIPPING CO., INC., Petitioner, vs. COURT OF APPEALS and THE MANILA INSURANCE CO., INC., Respondents.lexxNo ratings yet

- Abra Valley College, Inc., Represented by Pedro v. Borgonia, Petitioner, vs. AquinoDocument1 pageAbra Valley College, Inc., Represented by Pedro v. Borgonia, Petitioner, vs. AquinolexxNo ratings yet

- G.R. No. 121833Document6 pagesG.R. No. 121833lexxNo ratings yet

- Art. 262. Duty To Bargain Collectively in The Absence of CbaDocument1 pageArt. 262. Duty To Bargain Collectively in The Absence of CbalexxNo ratings yet

- 9 Bulletin Publishing Corporation vs. Sanchez G.R. No. 74425 October 71986Document2 pages9 Bulletin Publishing Corporation vs. Sanchez G.R. No. 74425 October 71986lexx100% (1)

- Cir v. CA, City Trust Banking Corp.Document1 pageCir v. CA, City Trust Banking Corp.lexxNo ratings yet

- Malayan Insurance Case and Manila Bankers Life Insurance CaseDocument3 pagesMalayan Insurance Case and Manila Bankers Life Insurance CaselexxNo ratings yet