Professional Documents

Culture Documents

Taxxxx

Taxxxx

Uploaded by

faye gCopyright:

Available Formats

You might also like

- Dyson - Presentation About Company and Case StudyDocument17 pagesDyson - Presentation About Company and Case StudyPiotr Bartenbach67% (6)

- International Construction Market Survey 2017Document100 pagesInternational Construction Market Survey 2017crainsnewyorkNo ratings yet

- Multiple Choice-Problems: Total 225,000Document13 pagesMultiple Choice-Problems: Total 225,000IT GAMING50% (2)

- Company's AddressDocument59 pagesCompany's AddressCarlNo ratings yet

- CH 15 Mini CaseDocument16 pagesCH 15 Mini CaseMahmud Mostakim TakrimNo ratings yet

- Bir Ruling Da 086 08Document5 pagesBir Ruling Da 086 08Orlando O. CalundanNo ratings yet

- 4 CIR Vs Reyes GR 159694-GR 163581 Jan 27 2006Document10 pages4 CIR Vs Reyes GR 159694-GR 163581 Jan 27 2006FredamoraNo ratings yet

- Yabes V FlojoDocument5 pagesYabes V FlojoanailabucaNo ratings yet

- Deed of DonationDocument3 pagesDeed of DonationMenard Dasing KilitoNo ratings yet

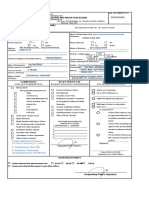

- Annex A - 1701A Jan 2018 - RMC 17-2019Document2 pagesAnnex A - 1701A Jan 2018 - RMC 17-2019Joe75% (4)

- DENR Memorandum Circular 2011-01Document9 pagesDENR Memorandum Circular 2011-01alex_borjaNo ratings yet

- Expropriation in EuropeDocument31 pagesExpropriation in EuropeCentar za ustavne i upravne studije100% (1)

- Kindred Torts Digests (Set 6)Document15 pagesKindred Torts Digests (Set 6)jetzon2022No ratings yet

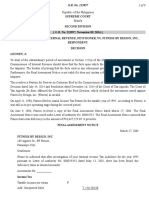

- Republic of The Philippines Court of Tax Appeals Quezon: Petitioner, ChairpersonDocument30 pagesRepublic of The Philippines Court of Tax Appeals Quezon: Petitioner, ChairpersonjohnnayelNo ratings yet

- I. Abandonment: Customs Administrative Order (CAO) No. 17-2019Document5 pagesI. Abandonment: Customs Administrative Order (CAO) No. 17-2019Arya Padrino100% (1)

- RR 13-01Document5 pagesRR 13-01Peggy SalazarNo ratings yet

- DrainandPurgeCert PDFDocument1 pageDrainandPurgeCert PDFAlaa saidNo ratings yet

- CIR v. Asalus Corporation, GR 221590, Feb. 22, 2017Document14 pagesCIR v. Asalus Corporation, GR 221590, Feb. 22, 2017jeandpmdNo ratings yet

- Coral Vs CirDocument13 pagesCoral Vs CirJAMNo ratings yet

- Accounting For LgusDocument47 pagesAccounting For LgusPatricia Reyes100% (1)

- BIR Ruling No. 242-18 (Gift Certs.)Document7 pagesBIR Ruling No. 242-18 (Gift Certs.)LizNo ratings yet

- Transfer TaxDocument6 pagesTransfer TaxMark Rainer Yongis LozaresNo ratings yet

- Affidavit of Loss - ForMDocument1 pageAffidavit of Loss - ForMLiDdy Cebrero BelenNo ratings yet

- RMC No. 108-2020 Annex ADocument3 pagesRMC No. 108-2020 Annex AJoel SyNo ratings yet

- Pagong BagalDocument1 pagePagong Bagaljuliet_emelinotmaestroNo ratings yet

- Bustos vs. Millians Shoe, Inc.Document12 pagesBustos vs. Millians Shoe, Inc.Krystal Grace D. PaduraNo ratings yet

- 304-CIR v. Fitness by Design, Inc. G.R. No. 215957 November 9, 2016Document9 pages304-CIR v. Fitness by Design, Inc. G.R. No. 215957 November 9, 2016Jopan SJ100% (1)

- Oplan KandadoDocument1 pageOplan KandadoHerzl HermosaNo ratings yet

- VALUE ADDED TAX Notes From BIRDocument30 pagesVALUE ADDED TAX Notes From BIREmil BautistaNo ratings yet

- Pag Ibig Spa Pro FormaDocument2 pagesPag Ibig Spa Pro FormaCloudette BaguiwenNo ratings yet

- TaxationBarQ26A TaxRemediesDocument32 pagesTaxationBarQ26A TaxRemediesjuneson agustinNo ratings yet

- Corporate Rehabilitation - CasesDocument3 pagesCorporate Rehabilitation - CasesJustice PajarilloNo ratings yet

- Contract of Loan and Promissory NoteDocument2 pagesContract of Loan and Promissory NoteZor Ro100% (1)

- To Tax Church PropertyDocument2 pagesTo Tax Church PropertyKino MarinayNo ratings yet

- Rule 10 AmendmentsDocument11 pagesRule 10 AmendmentsMarichelNo ratings yet

- Tax Bulletin by SGV As of Oct 2014Document18 pagesTax Bulletin by SGV As of Oct 2014adobopinikpikanNo ratings yet

- City of Taylor, TIFA Lawsuit Against Wayne CountyDocument132 pagesCity of Taylor, TIFA Lawsuit Against Wayne CountyDavid KomerNo ratings yet

- Summary of Significant CTA Decisions (February 2011)Document2 pagesSummary of Significant CTA Decisions (February 2011)ShaneBeriñaImperialNo ratings yet

- Value Added Tax2Document28 pagesValue Added Tax2biburaNo ratings yet

- Execution PanopioDocument3 pagesExecution PanopioAnonymous iBVKp5Yl9A100% (1)

- Single-Entry Approach (Sena) : National Conciliation and Mediation BoardDocument7 pagesSingle-Entry Approach (Sena) : National Conciliation and Mediation BoardUNEXPECTEDNo ratings yet

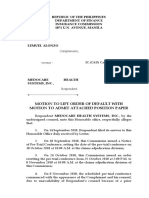

- Motion To Lift Order of Default With Position PaperDocument3 pagesMotion To Lift Order of Default With Position PaperAtty. Dahn UyNo ratings yet

- 33-CIR v. Wander Philippines, Inc. G.R. No. L-68375 April 15, 1988Document4 pages33-CIR v. Wander Philippines, Inc. G.R. No. L-68375 April 15, 1988Jopan SJNo ratings yet

- 209890-2017-Opulent Landowners Inc. v. Commissioner of PDFDocument29 pages209890-2017-Opulent Landowners Inc. v. Commissioner of PDFJobar BuenaguaNo ratings yet

- Top Business and It Solutions: Scope of WorkDocument4 pagesTop Business and It Solutions: Scope of WorkJonathan PradasNo ratings yet

- DepedDocument2 pagesDepedGlaiza Mae MasaoyNo ratings yet

- 169774-2014-BPI v. Commissioner of Internal RevenueDocument7 pages169774-2014-BPI v. Commissioner of Internal RevenueAnonymous U7Az3W8IANo ratings yet

- LifeBlood - Assessment Process Tax 2Document17 pagesLifeBlood - Assessment Process Tax 2Monjid AbpiNo ratings yet

- 1 BIR - TRAIN - TOT - Briefing - Introduction To TRAIN2Document24 pages1 BIR - TRAIN - TOT - Briefing - Introduction To TRAIN2Jordan Tagao ColcolNo ratings yet

- Rmo 26-2016Document4 pagesRmo 26-2016Raniel MirandaNo ratings yet

- Deed of AssignmentDocument2 pagesDeed of AssignmentPanda MimiNo ratings yet

- RMC No. 77-2021Document38 pagesRMC No. 77-2021Mike Ferdinand SantosNo ratings yet

- 2001 Bir RulingsDocument12 pages2001 Bir RulingsSarah Jeane CardonaNo ratings yet

- GSIS Benefits & PrivilegesDocument37 pagesGSIS Benefits & PrivilegesJerald LunaNo ratings yet

- LSP Externship Agreement For PRINTINGDocument3 pagesLSP Externship Agreement For PRINTINGzzzzzNo ratings yet

- Voluntary DealingsDocument17 pagesVoluntary DealingsdaryllNo ratings yet

- Increase in RentDocument1 pageIncrease in Rentroland deschainNo ratings yet

- ComplaintDocument4 pagesComplaintAmado Vallejo IIINo ratings yet

- Regional Trial Court of Cebu BranchDocument3 pagesRegional Trial Court of Cebu BranchNika RojasNo ratings yet

- Tools Accountability Form To Return SAMPLEDocument1 pageTools Accountability Form To Return SAMPLEGau Callanga JrNo ratings yet

- Motor Sidecar Deed of SaleDocument1 pageMotor Sidecar Deed of SaleIyan DgNo ratings yet

- Different Kinds of Taxes in The PhilippinesDocument5 pagesDifferent Kinds of Taxes in The PhilippinesJosephine Berces100% (2)

- Types of Taxes in The PhilippinesDocument4 pagesTypes of Taxes in The PhilippinesJustin Laraño RabagoNo ratings yet

- Taxes: Orduna Santos Dumalag PinesDocument56 pagesTaxes: Orduna Santos Dumalag PinesJosh DumalagNo ratings yet

- RsiDocument2 pagesRsivenkatesh9966No ratings yet

- Assignment 1 Sol 2020Document8 pagesAssignment 1 Sol 2020Wissal RiyaniNo ratings yet

- Macroeconomic Determinants of Stock Market Development: Evidence From Borsa IstanbulDocument21 pagesMacroeconomic Determinants of Stock Market Development: Evidence From Borsa IstanbulMaria KulawikNo ratings yet

- UntitledDocument43 pagesUntitledShirley YipNo ratings yet

- Unit Plan On Consumer Arithmetic For Form 4Document16 pagesUnit Plan On Consumer Arithmetic For Form 4api-537308426No ratings yet

- Topic 3: Foreign Investment and Financing DecisionsDocument17 pagesTopic 3: Foreign Investment and Financing DecisionsCenith CheeNo ratings yet

- Chapter 8 MonopolyDocument23 pagesChapter 8 MonopolyFebNo ratings yet

- Opportunity BrochureDocument2 pagesOpportunity BrochureCherry San DiegoNo ratings yet

- AB Back Tester BasicsDocument27 pagesAB Back Tester BasicstungkanguruNo ratings yet

- Fictitious Product ProjectDocument23 pagesFictitious Product Projectmneha100% (1)

- Handout On Piecewise Functions PDFDocument2 pagesHandout On Piecewise Functions PDFryle34100% (1)

- Extended Warranty (Claim Form) - AutoTranny - ForumDocument2 pagesExtended Warranty (Claim Form) - AutoTranny - ForumvwshayNo ratings yet

- Development of A Competitive Air-Transport Market in Vietnam: Issues and Experience For Countries in TransitionDocument13 pagesDevelopment of A Competitive Air-Transport Market in Vietnam: Issues and Experience For Countries in TransitionNgọc QuỳnhNo ratings yet

- Oxy Marketing PlanDocument8 pagesOxy Marketing PlanFlora NguyễnNo ratings yet

- Strategic Cost MidtermDocument15 pagesStrategic Cost MidtermhsjhsNo ratings yet

- Comparative AdvertisingDocument3 pagesComparative Advertisingdnrwn0% (1)

- 20140811Document28 pages20140811កំពូលបុរសឯកាNo ratings yet

- 1.bank ConfirmationDocument5 pages1.bank ConfirmationPranay78No ratings yet

- RR 02-40Document27 pagesRR 02-40JDR JDRNo ratings yet

- CML TheoryDocument34 pagesCML TheoryVaidyanathan RavichandranNo ratings yet

- Asignación 4Document6 pagesAsignación 4Ricardo Andres Caballero CalderonNo ratings yet

- Salad or Wrap & Full TANK Classic Smoothie: Recipient: Redeemable FromDocument1 pageSalad or Wrap & Full TANK Classic Smoothie: Recipient: Redeemable FromlakeNo ratings yet

- Delhi Metro RailDocument24 pagesDelhi Metro RailTYAGI PROJECTSNo ratings yet

- Management Des CoutsDocument58 pagesManagement Des CoutsFarid Farid100% (2)

- Crispy MashroomDocument9 pagesCrispy MashroomDivia PriscillaNo ratings yet

- 15Document16 pages15Mayank AroraNo ratings yet

Taxxxx

Taxxxx

Uploaded by

faye gOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Taxxxx

Taxxxx

Uploaded by

faye gCopyright:

Available Formats

TAX

What is tax?

Tax is a compulsory contribution to state revenue, levied by the government on workers’ income

and business profits, or added to the cost of some goods, services, and transactions.

Direct Tax

Direct tax is a tax which is levied on the income or profits of the person who pays it, rather than

on goods or services.

Indirect tax is levied on goods and services rather than on income or profits.

National Taxes in the Philippines

Capital Gains Tax – is a tax imposed on the gains presumed to have been realized by the seller

from the sale, exchange, or other disposition of capital assets located in the Philippines, including

pacto de retro sales and other forms of conditional sale.

Documentary Stamp Tax – is a tax on documents, instruments, loan agreements and papers

evidencing the acceptance, assignment, sale or transfer of an obligation, rights, or property

incident thereto. Examples of documentary stamp tax are those that are charged on bank

promissory notes, deed of sale, and deed of assignment on transfer of shares of corporate stock

ownership.

Donor’s Tax – is a tax on a donation or gift, and is imposed on the gratuitous transfer of property

between two or more persons who are living at the time of the transfer. Donor’s tax is based on a

graduated schedule of tax rate.

Estate Tax – is a tax on the right of the deceased person to transmit his/her estate to his/her

lawful heirs and beneficiaries at the time of death and on certain transfers which are made by law

as equivalent to testamentary disposition. Estate tax is also based on a graduated schedule of tax

rate.

Income Tax – is a tax on all yearly profits arising from property, profession, trades or offices or as

a tax on a person’s income, emoluments, profits and the like. Self-employed individuals and

corporate taxpayers pay quarterly income taxes from 1st quarter to 3rd quarter. And instead of

filing quarterly income tax on the fourth quarter, they file and pay their annual income tax return

for the taxable year. Individual income tax is based on graduated schedule of tax rate, while

corporate income tax in based on a fixed rate prescribe by the tax law or special law.

Percentage Tax – is a business tax imposed on persons or entities who sell or lease goods,

properties or services in the course of trade or business whose gross annual sales or receipts do

not exceed the amount required to register as VAT-registered taxpayers. Percentage taxes are

usually based on a fixed rate. They are usually paid monthly by businesses or professionals.

However, some special industries and transactions pay percentage tax on a quarterly basis.

Value Added Tax – is a business tax imposed and collected from the seller in the course of trade

or business on every sale of properties (real or personal) lease of goods or properties (real or

personal) or vendors of services. It is an indirect tax, thus, it can be passed on to the buyer,

causing this to increase the prices of most goods and services bought and paid by consumers.

VAT returns are usually filed and paid monthly and quarterly.

Excise Tax – is a tax imposed on goods manufactured or produced in the Philippines for

domestic sale or consumption or any other disposition. It is also imposed on things that are

imported.

Withholding Tax on Compensation – is the tax withheld from individuals receiving purely

compensation income. This tax is what employers withheld in their employees’ compensation

income and remit to the government through the BIR or authorized accrediting agent.

Expanded Withholding Tax – is a kind of withholding tax which is prescribed only for certain

payors and is creditable against the income tax due of the payee for the taxable quarter year.

Examples of the expanded withholding taxes are those that are withheld on rental income and

professional income.

Final Withholding Tax – is a kind of withholding tax which is prescribed only for certain payors

and is not creditable against the income tax due of the payee for the taxable year. Income Tax

withheld constitutes the full and final payment of the Income Tax due from the payee on the said

income. An example of final withholding tax is the tax withheld by banks on the interest income

earned on bank deposits.

Withholding Tax on Government Money Payments – is the withholding tax withheld by

government offices and instrumentalities, including government-owned or -controlled corporations

and local government units, before making any payments to private individuals, corporations,

partnerships and/or associations.

Local Taxes in the Philippines

Tax on Transfer of Real Property Ownership – tax imposed on the sale, donation, barter, or on

any other mode of transferring ownership or title of real property.

Tax on Business of Printing and Publication – tax on the business of persons engaged in the

printing and/or publication of books, cards, posters, leaflets, handbills, certificates, receipts,

pamphlets, and others of similar nature.

Franchise Tax – tax on businesses enjoying a franchise, at the rate not exceeding fifty percent

(50%) of one percent (1%) of the gross annual receipts for the preceding calendar year based on

the incoming receipt, or realized, within its territorial jurisdiction.

Tax on Sand, Gravel and Other Quarry Resources – tax imposed on ordinary stones, sand,

gravel, earth, and other quarry resources, as defined under the National Internal Revenue Code,

as amended, extracted from public lands or from the beds of seas, lakes, rivers, streams, creeks,

and other public waters within its territorial jurisdiction.

Professional Tax – an annual professional tax on each person engaged in the exercise or

practice of his profession requiring government examination.

Amusement Tax– tax collected from the proprietors, lessees, or operators of theaters, cinemas,

concert halls, circuses, boxing stadia, and other places of amusement.

Service Fees or Charges – fees or charges that may be collected by the barangays for services

rendered in connection with the regulations or the use of barangay-owned properties or service

facilities, such as palay, copra, or tobacco dryers.

Barangay Clearance – a reasonable fee collected by barangays upon issuance of barangay

clearance – a document required for many government transactions, such as when applying for

business permit with the city or municipality.

What is a tax adviser?

Tax advisers/consultants are the experts in providing commercially-focused tax advice and tax

services to a wide range of clients who operate in all sectors of the economy. This involves devising

tax-efficient strategies for multinational and domestic based clients in diverse business situations,

including mergers, takeovers and corporate reconstructions. Tax consultants work continually to help

ensure that their clients make the best business decisions in the light of fiscal change and

development. They monitor and anticipate changes to tax legislation and respond quickly with advice

specific to their clients’ particular commercial requirements.

Why pay taxes?

Taxes are the lifeblood of the country. Without tax, the country will collapse and paralyze.

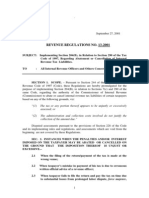

PENALTIES FOR LATE FILING OF TAX RETURNS

A. For late filing of Tax Returns with Tax Due to be paid, the following penalties will be imposed upon

filing, in addition to the tax due:

1. Surcharge

NIRC SEC. 248. - Civil Penalties.

(A) There shall be imposed, in addition to the tax required to be paid, a penalty equivalent to

twenty-five percent (25%) of the amount due, in the following cases:

1. (1) Failure to file any return and pay the tax due thereon as required under the provisions of this

Code or rules and regulations on the date prescribed; or

2. (2) Unless otherwise authorized by the Commissioner, filing a return with an internal revenue

officer other than those with whom the return is required to be filed; or

3. (3) Failure to pay the deficiency tax within the time prescribed for its payment in the notice of

assessment; or

4. (4) Failure to pay the full or part of the amount of tax shown on any return required to be filed

under the provisions of this Code or rules and regulations, or the full amount of tax due for which

no return is required to be filed, on or before the date prescribed for its payment.

2.Interest

NIRC SEC. 249. Interest. -

(A) In General. - There shall be assessed and collected on any unpaid amount of tax, interest at the rate

of twenty percent (20%) per annum, or such higher rate as may be prescribed by rules and regulations,

from the date prescribed for payment until the amount is fully paid.

3.Compromise

NIRC SEC. 255. Failure to File Return, Supply Correct and Accurate Information, Pay Tax Withhold

and Remit Tax and Refund Excess Taxes Withheld on Compensation. - Any person required under

this Code or by rules and regulations promulgated thereunder to pay any tax make a return, keep any

record, or supply correct the accurate information, who willfully fails to pay such tax, make such return,

keep such record, or supply correct and accurate information, or withhold or remit taxes withheld, or

refund excess taxes withheld on compensation, at the time or times required by law or rules and

regulations shall, in addition to other penalties provided by law, upon conviction thereof, be punished by a

fine of not less than Ten Thousand Pesos (P 10,000) and suffer imprisonment of not less than one (1)

year but not more than ten (10) years.

Any person who attempts to make it appear for any reason that he or another has in fact filed a return or

statement, or actually files a return or statement and subsequently withdraws the same return or

statement after securing the official receiving seal or stamp of receipt of internal revenue office wherein

the same was actually filed shall, upon conviction therefor, be punished by a fine of not less than Ten

Thousand Pesos (P10,000) but not more than Twenty Thousand Pesos (P 20,000) and suffer

imprisonment of not less than one (1) year but not more than three (3) years.

You might also like

- Dyson - Presentation About Company and Case StudyDocument17 pagesDyson - Presentation About Company and Case StudyPiotr Bartenbach67% (6)

- International Construction Market Survey 2017Document100 pagesInternational Construction Market Survey 2017crainsnewyorkNo ratings yet

- Multiple Choice-Problems: Total 225,000Document13 pagesMultiple Choice-Problems: Total 225,000IT GAMING50% (2)

- Company's AddressDocument59 pagesCompany's AddressCarlNo ratings yet

- CH 15 Mini CaseDocument16 pagesCH 15 Mini CaseMahmud Mostakim TakrimNo ratings yet

- Bir Ruling Da 086 08Document5 pagesBir Ruling Da 086 08Orlando O. CalundanNo ratings yet

- 4 CIR Vs Reyes GR 159694-GR 163581 Jan 27 2006Document10 pages4 CIR Vs Reyes GR 159694-GR 163581 Jan 27 2006FredamoraNo ratings yet

- Yabes V FlojoDocument5 pagesYabes V FlojoanailabucaNo ratings yet

- Deed of DonationDocument3 pagesDeed of DonationMenard Dasing KilitoNo ratings yet

- Annex A - 1701A Jan 2018 - RMC 17-2019Document2 pagesAnnex A - 1701A Jan 2018 - RMC 17-2019Joe75% (4)

- DENR Memorandum Circular 2011-01Document9 pagesDENR Memorandum Circular 2011-01alex_borjaNo ratings yet

- Expropriation in EuropeDocument31 pagesExpropriation in EuropeCentar za ustavne i upravne studije100% (1)

- Kindred Torts Digests (Set 6)Document15 pagesKindred Torts Digests (Set 6)jetzon2022No ratings yet

- Republic of The Philippines Court of Tax Appeals Quezon: Petitioner, ChairpersonDocument30 pagesRepublic of The Philippines Court of Tax Appeals Quezon: Petitioner, ChairpersonjohnnayelNo ratings yet

- I. Abandonment: Customs Administrative Order (CAO) No. 17-2019Document5 pagesI. Abandonment: Customs Administrative Order (CAO) No. 17-2019Arya Padrino100% (1)

- RR 13-01Document5 pagesRR 13-01Peggy SalazarNo ratings yet

- DrainandPurgeCert PDFDocument1 pageDrainandPurgeCert PDFAlaa saidNo ratings yet

- CIR v. Asalus Corporation, GR 221590, Feb. 22, 2017Document14 pagesCIR v. Asalus Corporation, GR 221590, Feb. 22, 2017jeandpmdNo ratings yet

- Coral Vs CirDocument13 pagesCoral Vs CirJAMNo ratings yet

- Accounting For LgusDocument47 pagesAccounting For LgusPatricia Reyes100% (1)

- BIR Ruling No. 242-18 (Gift Certs.)Document7 pagesBIR Ruling No. 242-18 (Gift Certs.)LizNo ratings yet

- Transfer TaxDocument6 pagesTransfer TaxMark Rainer Yongis LozaresNo ratings yet

- Affidavit of Loss - ForMDocument1 pageAffidavit of Loss - ForMLiDdy Cebrero BelenNo ratings yet

- RMC No. 108-2020 Annex ADocument3 pagesRMC No. 108-2020 Annex AJoel SyNo ratings yet

- Pagong BagalDocument1 pagePagong Bagaljuliet_emelinotmaestroNo ratings yet

- Bustos vs. Millians Shoe, Inc.Document12 pagesBustos vs. Millians Shoe, Inc.Krystal Grace D. PaduraNo ratings yet

- 304-CIR v. Fitness by Design, Inc. G.R. No. 215957 November 9, 2016Document9 pages304-CIR v. Fitness by Design, Inc. G.R. No. 215957 November 9, 2016Jopan SJ100% (1)

- Oplan KandadoDocument1 pageOplan KandadoHerzl HermosaNo ratings yet

- VALUE ADDED TAX Notes From BIRDocument30 pagesVALUE ADDED TAX Notes From BIREmil BautistaNo ratings yet

- Pag Ibig Spa Pro FormaDocument2 pagesPag Ibig Spa Pro FormaCloudette BaguiwenNo ratings yet

- TaxationBarQ26A TaxRemediesDocument32 pagesTaxationBarQ26A TaxRemediesjuneson agustinNo ratings yet

- Corporate Rehabilitation - CasesDocument3 pagesCorporate Rehabilitation - CasesJustice PajarilloNo ratings yet

- Contract of Loan and Promissory NoteDocument2 pagesContract of Loan and Promissory NoteZor Ro100% (1)

- To Tax Church PropertyDocument2 pagesTo Tax Church PropertyKino MarinayNo ratings yet

- Rule 10 AmendmentsDocument11 pagesRule 10 AmendmentsMarichelNo ratings yet

- Tax Bulletin by SGV As of Oct 2014Document18 pagesTax Bulletin by SGV As of Oct 2014adobopinikpikanNo ratings yet

- City of Taylor, TIFA Lawsuit Against Wayne CountyDocument132 pagesCity of Taylor, TIFA Lawsuit Against Wayne CountyDavid KomerNo ratings yet

- Summary of Significant CTA Decisions (February 2011)Document2 pagesSummary of Significant CTA Decisions (February 2011)ShaneBeriñaImperialNo ratings yet

- Value Added Tax2Document28 pagesValue Added Tax2biburaNo ratings yet

- Execution PanopioDocument3 pagesExecution PanopioAnonymous iBVKp5Yl9A100% (1)

- Single-Entry Approach (Sena) : National Conciliation and Mediation BoardDocument7 pagesSingle-Entry Approach (Sena) : National Conciliation and Mediation BoardUNEXPECTEDNo ratings yet

- Motion To Lift Order of Default With Position PaperDocument3 pagesMotion To Lift Order of Default With Position PaperAtty. Dahn UyNo ratings yet

- 33-CIR v. Wander Philippines, Inc. G.R. No. L-68375 April 15, 1988Document4 pages33-CIR v. Wander Philippines, Inc. G.R. No. L-68375 April 15, 1988Jopan SJNo ratings yet

- 209890-2017-Opulent Landowners Inc. v. Commissioner of PDFDocument29 pages209890-2017-Opulent Landowners Inc. v. Commissioner of PDFJobar BuenaguaNo ratings yet

- Top Business and It Solutions: Scope of WorkDocument4 pagesTop Business and It Solutions: Scope of WorkJonathan PradasNo ratings yet

- DepedDocument2 pagesDepedGlaiza Mae MasaoyNo ratings yet

- 169774-2014-BPI v. Commissioner of Internal RevenueDocument7 pages169774-2014-BPI v. Commissioner of Internal RevenueAnonymous U7Az3W8IANo ratings yet

- LifeBlood - Assessment Process Tax 2Document17 pagesLifeBlood - Assessment Process Tax 2Monjid AbpiNo ratings yet

- 1 BIR - TRAIN - TOT - Briefing - Introduction To TRAIN2Document24 pages1 BIR - TRAIN - TOT - Briefing - Introduction To TRAIN2Jordan Tagao ColcolNo ratings yet

- Rmo 26-2016Document4 pagesRmo 26-2016Raniel MirandaNo ratings yet

- Deed of AssignmentDocument2 pagesDeed of AssignmentPanda MimiNo ratings yet

- RMC No. 77-2021Document38 pagesRMC No. 77-2021Mike Ferdinand SantosNo ratings yet

- 2001 Bir RulingsDocument12 pages2001 Bir RulingsSarah Jeane CardonaNo ratings yet

- GSIS Benefits & PrivilegesDocument37 pagesGSIS Benefits & PrivilegesJerald LunaNo ratings yet

- LSP Externship Agreement For PRINTINGDocument3 pagesLSP Externship Agreement For PRINTINGzzzzzNo ratings yet

- Voluntary DealingsDocument17 pagesVoluntary DealingsdaryllNo ratings yet

- Increase in RentDocument1 pageIncrease in Rentroland deschainNo ratings yet

- ComplaintDocument4 pagesComplaintAmado Vallejo IIINo ratings yet

- Regional Trial Court of Cebu BranchDocument3 pagesRegional Trial Court of Cebu BranchNika RojasNo ratings yet

- Tools Accountability Form To Return SAMPLEDocument1 pageTools Accountability Form To Return SAMPLEGau Callanga JrNo ratings yet

- Motor Sidecar Deed of SaleDocument1 pageMotor Sidecar Deed of SaleIyan DgNo ratings yet

- Different Kinds of Taxes in The PhilippinesDocument5 pagesDifferent Kinds of Taxes in The PhilippinesJosephine Berces100% (2)

- Types of Taxes in The PhilippinesDocument4 pagesTypes of Taxes in The PhilippinesJustin Laraño RabagoNo ratings yet

- Taxes: Orduna Santos Dumalag PinesDocument56 pagesTaxes: Orduna Santos Dumalag PinesJosh DumalagNo ratings yet

- RsiDocument2 pagesRsivenkatesh9966No ratings yet

- Assignment 1 Sol 2020Document8 pagesAssignment 1 Sol 2020Wissal RiyaniNo ratings yet

- Macroeconomic Determinants of Stock Market Development: Evidence From Borsa IstanbulDocument21 pagesMacroeconomic Determinants of Stock Market Development: Evidence From Borsa IstanbulMaria KulawikNo ratings yet

- UntitledDocument43 pagesUntitledShirley YipNo ratings yet

- Unit Plan On Consumer Arithmetic For Form 4Document16 pagesUnit Plan On Consumer Arithmetic For Form 4api-537308426No ratings yet

- Topic 3: Foreign Investment and Financing DecisionsDocument17 pagesTopic 3: Foreign Investment and Financing DecisionsCenith CheeNo ratings yet

- Chapter 8 MonopolyDocument23 pagesChapter 8 MonopolyFebNo ratings yet

- Opportunity BrochureDocument2 pagesOpportunity BrochureCherry San DiegoNo ratings yet

- AB Back Tester BasicsDocument27 pagesAB Back Tester BasicstungkanguruNo ratings yet

- Fictitious Product ProjectDocument23 pagesFictitious Product Projectmneha100% (1)

- Handout On Piecewise Functions PDFDocument2 pagesHandout On Piecewise Functions PDFryle34100% (1)

- Extended Warranty (Claim Form) - AutoTranny - ForumDocument2 pagesExtended Warranty (Claim Form) - AutoTranny - ForumvwshayNo ratings yet

- Development of A Competitive Air-Transport Market in Vietnam: Issues and Experience For Countries in TransitionDocument13 pagesDevelopment of A Competitive Air-Transport Market in Vietnam: Issues and Experience For Countries in TransitionNgọc QuỳnhNo ratings yet

- Oxy Marketing PlanDocument8 pagesOxy Marketing PlanFlora NguyễnNo ratings yet

- Strategic Cost MidtermDocument15 pagesStrategic Cost MidtermhsjhsNo ratings yet

- Comparative AdvertisingDocument3 pagesComparative Advertisingdnrwn0% (1)

- 20140811Document28 pages20140811កំពូលបុរសឯកាNo ratings yet

- 1.bank ConfirmationDocument5 pages1.bank ConfirmationPranay78No ratings yet

- RR 02-40Document27 pagesRR 02-40JDR JDRNo ratings yet

- CML TheoryDocument34 pagesCML TheoryVaidyanathan RavichandranNo ratings yet

- Asignación 4Document6 pagesAsignación 4Ricardo Andres Caballero CalderonNo ratings yet

- Salad or Wrap & Full TANK Classic Smoothie: Recipient: Redeemable FromDocument1 pageSalad or Wrap & Full TANK Classic Smoothie: Recipient: Redeemable FromlakeNo ratings yet

- Delhi Metro RailDocument24 pagesDelhi Metro RailTYAGI PROJECTSNo ratings yet

- Management Des CoutsDocument58 pagesManagement Des CoutsFarid Farid100% (2)

- Crispy MashroomDocument9 pagesCrispy MashroomDivia PriscillaNo ratings yet

- 15Document16 pages15Mayank AroraNo ratings yet