Professional Documents

Culture Documents

Winaxx Impex Order

Winaxx Impex Order

Uploaded by

Sachin0 ratings0% found this document useful (0 votes)

87 views27 pageswinaxx impex nclt order

Original Title

winaxx impex order

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentwinaxx impex nclt order

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

0 ratings0% found this document useful (0 votes)

87 views27 pagesWinaxx Impex Order

Winaxx Impex Order

Uploaded by

Sachinwinaxx impex nclt order

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

You are on page 1of 27

IN THE NATIONAL COMPANY LAW TRIBUNAL, NEW DELHI

PRINCIPAL BENCH

C.P. NO. IB-271(PB)/2017

IN THE MATTER O}

Srei Equipment Finance Limites

Wianxx Impex Private Limited .....Corporate Debtor/Respondent

Financial Creditor/Petitioner

SECTION: UNDER SECTION 7 OF THE INSOLVENCY AND

BANKRUPTCY CODE, 2016

JUDGMENT DELIVERED ON 23.08.2019

CORAM:

CHIEF JUSTICE (RTD.) M.M, KUMAR

HON’BLE PRESIDENT

SH. S. K. MOHAPATRA

HON’BLE MEMBER (TECHNICAL)

PRESENT:

For the Petitioner: Mr. Arijit Mazumdar & Mr. Akshay

Chandna, Advocates

For the Respondent: Mr. Muneesh Malhotra, Mr. Rajat

Bhardwaj, Ms. Manpreet Kaur & Ms.

Vanya Khanna, Advocates

(UMAR, PRESIDENT

JUDGMENT

‘The ‘Financial Creditor’Srei Equipment Finance Limited

has filed the instant petition under Section 7 of the Insolvency

and Bankruptey Code, 2016 (for brevity ‘the Code) with a prayer

to trigger the Corporate Insolvency Resolution Process in the

matter of Wiansxx Impex Private Limited.

ae

P.nea)27408/2017,

Sel Egupmen nonce. ¥, WianImpex Private. boge 127

2. The Corporate Debtor-Wianxx Impex Private Limited is a

company registered under the provisions of the Companies Act,

1956 and was incorporated on 27.07.1995, The identification

number of the Corporate Debtor is U74899DL1995?TC071191

and its registered office is situated at 1010-1011, 10% Floor,

Devika Tower-6, Nehru Place, New Delhi-110019,

3. The Financial Creditor had initially proposed the name of

Resolution Professional, Mr. Vinod Kumar Kothari to act as

Interim Resolution Professional (for brevity TRP). On account of

his inability to act as IRP, the Financial Creditor filed an

application being C.A. No. 990(PB)/2019 and proposed the name

of Mr. Gopal Lal Baser with the address House No. M-356, First

Floor, Orchid Island, Sector 51, Gurgaon, Haryana-122001 to act

as IRP. His registration number is IBBI/IPA-002/IP-

No0553/2017-2018/11677.He has filed his written

communication which satisfies the requirement of Rule 9(1) of

the Insolvency and Bankruptcy (Application to Adjudicating

Authority) Rules, 2016 along with the certificate of registration.

4. It is pertinent to mention that it is a second round of

litigation between the parties as on previous occasion petition

FP canemanarion

Srl Eeipment nonce Ld, Wien mpen Private ope 2 j27

under 7 of the Code being C.P. (IB) No. 54(PB}/2017 was filed by

the petitioner. In the said petition the assertion of the petitioner

was that initially in 2008 the Corporate Debtor approached the

petitioner for availing financial facility for asset finance. On

26.03.2008 the petitioner sanctioned a loan of Rs. 25 Crores vide

agreement dated 29.05.2008. However, later at the request of the

Corporate Debtor the said loan was divided into four parts and

four separate contracts were entered into between the parties

being Contract No. HL0022255 for Rs.10 Crores dated

04.08.2008, Contract No. HL0028132 for Rs. 5 Crores dated

18.06.2009, Contract No. HL0028334 for Rs. 70,177,687/- and

Contract No. HL0031754 for Rs. 29,800,000/-. Subsequently,

again in 2010 the loan amount under the said four contracts

were restructured by way of executing fresh nine contracts for

aggregate loan of Rs. 26,50,06,533/-. Later on, once again on

29.03.2012 the said nine contracts were restructured by way of

executing three contracts for aggregate loan of Rs.

25,73,96,034/-. Again in 2016 in view of difficulty in repaying the

loans, the loan amount under the said three con:racts were

restructured by way of executing two contracts firstly being

Agreement bearing No. 105996 dated 01.04.2016 for facility of

Ewe} 271(0)2017

‘Srl Egupment Financ td Won impex Private Lt age 3/27

Rs. 18,86,00,000/- and secondly being Agreement bearing No.

111305 dated 24.06.2016 for facility of Rs. 19,53,00,000/-.

5. After service of notice the Corporate Debtor had filed its

reply on 12.05.2017 and in para 3 of the reply had candidly

admitted as under:

“The total amount due of Rs, 95,66,61,986/- on 31.03.2016 was again

rescheduled by the Applicant into loan accounts with the

understanding that for a period of one year Respondent is not liable to

pay the instalment. Accordingly, it was agreed between the parties

that first six months there would be moratorium of interest and

balance six months" interest shall be added to the loan mount. After

adding the interest portion of one year (inclusive of moratorium of six

‘months) in Joan amount of Rs. $5,66,61,986/-, the total outstanding

amount became Rs, 38,39,00,000/-. The total amount of Rs.

38,39,00,000/- was financed in the present two loan cccounts and

the instalment for the 1% loan account was due to be paid on

22.03.2017 and for the 2% loan account was due to be paid on

22.06.2017. It is worthwhile to mention here that on the date of fling

of the petition, there was no default as contemplated in Section 7 of

the Insolvency and Bankruptey Code, 2016. The present petition is

pre-mature, and bundle of concealment of facts, The alleged amount,

due as on filing of petition was not due. The details of which is an

under;

(P.no(is}27106/2017

Sol EgulpmentFinene Lv, Wien Impex Prvte Page [27

RESTRUCTURING OF RS. 35,66,61,986/.

PARTICULARS | AMOUNT Rs.

1. |= RESTRUGTURED LOAN ACCOUNT | 18,86,00,000/-

(CONTRACT Wo. 105996)

2, | Balance Amount After Restructuring | 16,80,61,986/-

(35,66,61,986 ~ 18,86,00,000/-)

‘Six Month Interest (7-12 months) on the | 1,44,04,750/-

1 Joan account (Contract No. 105996)

‘Six Month Interest (7-12 months) on the |1,28,56,113/- |

24 loan account (Contract No. 111305]

‘Total amount of the 2°4 Loan Account | 19,53,02,863/-

{Contract No. 111305) Round off:

116,80,61,986+1,44,04,760+1,28,36,115] 19,53,00,000/-

Subsequently, vide order dated 30.05.2017 passed by this

Tribunal the said petition was dismissed as withdrawn with

liberty to file fresh one, if such necessity arises and the said order

reads as under:

“This is an application with a prayer to grant permission for

withdrawal of the Company Application No. (1B}-54(PB)/2017 with

CP. Notshz71(r8/2017

Se Egulpmen Finance Lt, Wien Impex Poe Ld. Page s 127

liberty to file fresh one as the cause of action in some respect appears

to be pre-mature.

Notice of the application was given and we have heard

arguments. The application has been opposed by the learned counsel

for the non-applicant-respondent.

Having heard the arguments, we are of the considered view that

once @ financial creditor applies for withdrawal of the application,

then the examination on facts should be avoided so that interest of

either of the parties are not prejudiced. Keeping in view the aforesaid

principle, we are not opining on the merit of the controversy either

way and are inclined to allow the application

In view of the above, the application is allowed and Company

Application No, (1B}-S4(PB)/2017 is dismissed as withdrawn with

liberty to file fresh one, if such necessity arises.

Application stands disposed of.”

7. The present proceeding has been initiated on account of the

default committed by the Respondent in repayment of its dues

under the Loan Agreement dated 01.04.2016 bearing Contract

No. 105996 (Pg, No. 212-245 of Vol. Il). As per the petitioner the

repayment under the Loan Agreement was to commence from

September 2016 (Annexure II to Schedule VII @ Pg. 243 of Vol.

I), The Petitioner has realized the instalments for the months of

cP. nats} 274p6)/2007

“Stelfgupmen France ed. Wane mpexPvate Ud. Poge [27

September 2016 till February 2017. However, the instalments for

the months of March 2017 to July 2017 amounting to Rs.

5,13,47,660/- has not been paid by the Respondent.

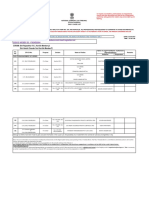

8. The total amount claimed to be in default and the details of

default have been given in sub para 2 of Part-IV and the same

reads as under:

[2. AMOUNT a

cuaimen | [Contract Amount —]Date on | Daysaf Default

to BE in| [No |claimed to| which

| | perauur. be in | default

are Default (in | occurred

DATE ON Rs)

water 105096 | 9,595,901 [20-08-3017 | 139

perauit | |

cccunen | | 95586 | 863633052017 |——120

105096 | 9,595,991 | 22-04-3017 35

| 108896 | 367,236 [30-04-2017 0

| | Hoss6 [oses sar [aa-05-3017 we

105096 | 695,373] 30-05-3017 oo

108096 | 9,595,921 | 22-06-2017 37

T0596 | 3.325] 30-06-2017 %

105096 | 974,869 | 29-07-2017 2

105096 | 9,595,901 | 29-07-2017 7

| 105996 | 1,241,890 | 22-03-2017 T

Be —ereaninnrar

“rceeloment ance Manager rte voce 127

Total [51,347,660

Total Default

Particulars ‘Amount Claimed t be in

Default fin Rs.)

‘Overdue & — Other | 51,347,660

Charges

Balance Principal | 162,820,763

Outstanding

| Total Defautt 214, 168,423

Days of Default has been calculated upto 29-67-2017

L}/__HeeeSaEHJOrHOnrHEar—v—JvVHrXS—VKaXKX—X—K—R—R————e—

‘Thus, the case of the petitioner is that on 29.07.2017 a sum

of Rs, 214,168,423/- is outstanding and the petition has been

filed on 04.08.2017.

9, The details of the securities held by, or charge created for

the benefit of ‘financial creditor-Srei Equipment Finance Limited

which fulfils the requirements of Section 77 & 78 of Companies

Act, 2013have been given in Part V of the application.

10. The Financial Creditor has also placed on record a list of all

the financial facilities granted by the Financial Crecitor to the

¢—

CP. no6}27105)/2007

‘Srl gupment Ponce. Wions Impex Piet. pages 127

Corporate Debtor along with the copies of the said Financial

Contracts.

11. Learned counsel for the Corporate Debtor has opposed the

admission of the petition by asserting as under:

() An amount of Rs. 50,31,41,663/- have been paid to

the Petitioner on various dates starting from March

2008.

(i) In addition to above the Respondent is in the process

of getting details of payment for an amount of Rs.

4,30,00,000/- made to the Petitioner.

(ii) An adjustment of Rs. 10,99,54,880/- to be made on

account of some advance against property.

(iv) The total payment received and the amount adjusted

against the property has been intentionally not

brought to the knowledge of this Tribunal with

mischievous intention.

(*) The initial agreement dated 29.05.2008 by which loan

was granted to the Respondent has arbitration clause

which specifically reflects that the dispute is to be

resolved through arbitration.

~e—

(CP. Note}271/99)/2017

‘Se éeipment Fnonee Lv Wane pe Prat Page 9127

(vi) As per the understanding, it was agreed that in case of

default on the part of the Respondent, the Petitioner

would take over the possession of the property, which

Petitioner

has been allotted as collateral security to t

and are of a very high value and in such premises the

Petitioner does not have the option to initiate the

present proceedings.

(vii) As per its own version of the petitioner, it has provided

the facility of ‘equipment finance’ to run the operations

of the Respondent and thus there was no amount that

was credited to the account of the Respondent.

(viii) The applicant had no authority to work as NBFC on

the day of Agreement, whereas, the alleged loan has

been granted prior to registration (raised vice diary No.

576 dated 05.02.2018)

12. A rejoinder to the reply has been filed by the Financial

Creditor reiterating the submissions made in the petition and

controver

ig the assertions in the reply.

13. Vide diary No. 1691 dated 27.03.2018 petitioner has filed an

affidavit along with certificate of Registration dated 15.05.2007

‘ic Egupment Fnanee Ld Winx pe rive Lt Page 20/27

(Annexure A-1), showing that it is registered as a Non-Banking

Finance Company (NBFC). The certificate issued by Reserve Bank

of India in favour of SREI Infrastructure Finance Limited. Two

other certificates dated 12.06.2007 & 03.09.2008 (Annexure A-2

& A-3) of similar nature have also been filed with the said

affidavit. It has been highlighted that originally in the year 2008,

the loan was sanctioned and granted by SREI Infrastructure

Finance Limited which is having certificate of Registration dated

15.05.2007 (Annexure A-1), as Non-Banking Finance Company

(NBFC) issued by Reserve Bank of India in its favour (Annexure

A-1) before the date of loan agreement dated 29.05.2008.

14. Afterwards vide diary No. 3737 dated 06.06.2018 petitioner

has filed a supplementary affidavit along with bank transfer

receipt (Annexure-A) showing disbursement of _Rs.

18,86,00,000/- on 01.04.2016 to the Respondent and a

certificate under Section 2-A of the Bankers Books Evidence Act,

1891 (Annexure-B). The petitioner has asserted that the

Respondent has made payment of Rs, 18,86,00,000/- on 13"

April, 2016 and 16% April, 2016 and thereafter of Rs.

16,80,62,000/- from 5 July, 2016 and 19% July, 2016 as would

be evident from pgs. 11 & 12 of the counter affidavit filed on

cP. noa}27400)/2017

Se Eaipment Fnence Ld, Winx Impex Private ts Page 18127

ef

behalf of the Respondent. Thus, the sum of Rs. 35,66,62,000/-

which has been paid by the Respondent to the Petitioner is on

account of its previous outstanding of Rs. 35,66,61,986/- which

was outstanding on the part of the Respondent as on 31+ March,

2016 as was unconditionally and unequivocally admitted by the

Respondent in page 24 of its counter affidavit filed by it in the

prior proceeding (LB. No. 54(PB)/2017). A sum of Rs

18,86,00,000/- was once again disbursed to the Respondent by

the petitioner on 1* April, 2016 which is still due and payable to

it,

15. Another supplementary affidavit has also been filed by the

petitioner vide diary No. 5265 dated 03.08.2018 along with a

copy of confirmation of transaction (Annexure-B) from petitioner's,

account to the Respondent’s account for a sum of Rs.

18,86,00,000/- on 13.04.2016 issued by ICICI Bank. The

petitioner has claimed that it is an independent transaction and

having no relevancy with the previous one

16. Objection regarding authorisation in favour of Mr. Shiv

Shankar Chowdhury has been raised by the Respondent by filing

replies vide diary No. 4470 dated 10.07.2018 & thereafter vide

Th erretmariyacer

‘Srl eupment nance ed. Wane Impex Pivot age 12/27

diary No. 5777 dated 20.08.2018. It is asserted thet Mr. Shiv

Shankar Chowdhury is not authorized by the Petitioner to file the

supplementary affidavit as the power of attorney authorising him

has expired on 31.03.2018 and subsequently he has been

changed without the permission of this Tribunal. A table showing,

different versions and contrary stands taken by the petitioner on

various occasions has been prepared by the Respondent and the

same reads as under:

[S-_[As per the I= Application

Present

Application

Supplementary

Affidavit

T. [The applicant granted fresh

financial facility to the

corporate debtor under two

Joan agreements dated

01.04.2016 and 24.06.2016

totalling to an amount of Rs.

38.39 crores for acquiring

assets for the project

The applicant

sanctioned the

oan of Rs. 25

crores vide

agreement dated

29.05.2008

which was

restructured

‘The applicant

executed a loan

agreement dated

01.04.2006 and

made a

disbursement of

the amount of

Rs, 18.86 crores

to the corporate

debtor.

[in 2016 the corporate debtor

has approached the applicant,

for availing financial facility

Ta 3008 the

corporate debtor

has approached

the applicant for

availing the loan

facility

Disbursed @ sum

of Rs. 18.86

3 [Fresh disbursement of Re.

Toan of Rs. 25

Toan of Rs. 18.86

(cP. 2730)72017

‘sci uipment Finance Lv Winns hex Private

ee

age n3/27

38.39 crores Grores: disbursed

in 2008

4._| Date of defaultis 28.06.2016 | Date of default is

22.09.2017

5. [Application relates to an Application ‘Application

amount of Rs. 98.39 crores [relates to an|relates to an

amount of Rs. 25| amount of Rs. 35

Crores Crores

[6 [Total default value of Re. [Total default | Total defaule

1,98,81,596/- value of Rs.|value of Rs.

21,41,68,423/- | 18,85,000,00/-

17, Subsequently vide diary dated 28.03.2019 Respondent has

filed an affidavit along with letter issued by YES Bank dated

10.08.2018 (Annexure R-1] to substantiate the fact that the

amount of Rs, 18.86 crores under the loan agreement dated

01.04.2016 was credited

its account and it immediately paid

back the entire amount to the petitioner in two tranches firstly on

13.04.2016 for a sum of Rs. 17 crores and secondly on

16.04.2016 for a sum of Rs. 1.86 crores. It has also asserted that

the said amount has not been paid towards any previous

outstanding.

18. We have heard learned counsel for the parties and have also

perused the record,

cP. no(ny27yray/2017

Sel Egupment Finance Ltd, Wien Impex Plate Ld page a6 [27

yo

19. Having heard learned counsel for the parties we are of the

considered view that the Financial Creditor has succeeded in

establishing a case for triggering the Corporate Insolvency

Resolution Process.

20. The Financial Creditor has placed on record numerous proof

of amount disbursed as loan to the Respondent Company. The

material on record and the documents clearly depict that the loan

was sanctioned and disbursed. Respondent company utilized and

enjoyed the loan facility.

21, The Corporate Debtor in previous round of litigation had

candidly admitted the restructuring of total loan amount of Rs.

35,66,61,986 by way of executing two contracts firstly being

Agreement bearing No. 105996 dated 01.04.2016 fo- facility of

Rs. 18,86,00,000/- and secondly being Agreement bearing No.

111305 dated 24.06.2016 for facility of Rs. 19,53,00,000/- as

detailed in preceding para 5 of the order. It is also evident from a

perusal of supplementary affidavit dated 03.08.2018 read with a

copy of confirmation of transaction (Annexure-B) that a sum of

Rs. 18,86,00,000/- was further disbursed by the petitioner on

13.04.2016 to the Respondent after aforesaid candid admission

cP. no.i6-27195)/2017

Se Equipment Finance Lv. amex Impex Prot age 25127

ae

by it and the said amount is an independent transaction and

having no relevancy with the previous one. It does not lie in the

mouth of the Corporate Debtor to take a contrary stand and

principles in the nature of estoppel would come in play.

22. It is pertinent to mention that the resolution process is an

attempt to rescue a fund starving body corporate from the

financial challenging conditions and to restore it back to a

sustainable financial ease. It may involve financial restructuring,

any other arrangement by involving another fund infusing

‘company or even by compromise with its creditors. The object of

the ‘Code’ is to resolve the insolvency which could not be

achieved unless the petition is admitted. The resolution as

against liquidation would only be possible if the Corporate

Insolvency Resolution Process is triggered and efforts in that

direction are made. Even this petition could be withdrawn after

admission if requirement of Section 12A of the Code are fulfilled.

Even before constitution of CoC the CIR Process could be

withdrawn by filing an application under Rule 11 of NCLT Rules,

2016. In that regard the parties have to fulfil the requirements of

law as laid down by Hon'ble the Supreme Court in Sw'ss Ribbons

cP. no(b}27)/2017

‘Se Ealpment nonce Ld, Winx impo Prvote Page 26 [27

——

Pvt, Ltd, & Anr. v. Union of India & Ors. (Writ Petition (Civil) No.

99 of 2018 decided on 25.01.2019.

23. The objection raised by the Respondent that the initial

agreement dated 29.05.2008 as executed between the parties,

clearly provides for dispute resolution through Arbitration,

‘The presence of an arbitration clause in the loan agreement

would not cause any impediment with regard to initiation of

Corporate Insolvency Resolution Process because under Section 7

of the Code the presence of an arbitration agreement is no bar to

the admission of the petition and initiation of Corporate

Insolvency Resolution Process unlike the provisions of Section 8

& 9 of the Code. There is however no such provision in Section 7

of the Code. Accordingly, this argument completely lacks

statutory content and therefore, is hereby rejected as unfounded.

24, In view of filing the certificate of Registration dated

15.05.2007 (Annexure A-1), as Non-Banking Finance Company

(NBFC} issued by Reserve Bank of India in favour of SREL

Infrastructure Finance Limited vide diary No. 1691 dated

27.03.2018 the argument advanced by learned counsel for the

Respondent that the petitioner had no authority to worl as NBFC

cP. woa}271/99}72017

‘Srl auiment once ef, Wane px Pivot. age? 127

CT

on the day of Agreement would also not require eny further

consideration.

25. The other objections raised on behalf of the Corporate

Debtor also do not warrant any serious consideration. It is

already observed that the object of the Corporate Insolvency

Resolution Process is to rescue a fund starving body corporate

from the financial stress as is discussed in para 22 of the order

and it is not understood as to how the Corporate Insolvency

Resolution Process could be deferred merely because it was

agreed between the parties that in case of default on the part of

the Respondent, the Petitioner would take over the possession of

the property, which has been allotted as collateral security to the

Petitioner and are of a very high value. It is not the property

which is at the base of the Code, 2016. It is cash liquidity which

is the basis for triggering the Corporate Insolvency Resolution

Process, Such like factors have no bearing on the admission of

the petition,

26. Learned Counsel for the petitioner has then argued that all

requirements of Section 7 of the Code for initiation of Corporate

Insolvency Resolution Process by a Financial Creditor stand

CP. not6}27195)/2017

Ste Equipment Finnce ev. Women mex Peet tt age 8127

p—~

fulfilled and other conditions prescribed by Rule 4 (1) of the

Insolvency and Bankruptcy (Application to Adjudicating

Authority) Rules, 2016. It is further submitted that the details of

default along with its dates have been clearly stated in part IV

along with all the minute details. There is overwhelming evidence

to prove default. The name of the resolution professional has also

been specified.

27. We may now examine the provisions of Section 7 (2) and

Section 7 (5) of IBC which read as under:~

“Initiation of corporate insolvency resolution process by

financial creditor.

7()

7 (2) The financial creditor shall make an application

under sub-section (1) in such form and manner

and accompanied with such fee as may be

prescribed.

7(3)

7A)

P.Na}-2718/2017

Se Eauipment Finance Lv, Wianximpox vote i Page 29/27

ww

7S) Where the Adjudicating Authority is satisfied

that—

(a) @ default has occurred and the application

under sub-section (2) is complete, and there

is no disciplinary proceedings pending

against the proposed resolution professional,

it may, by order, admit such application; or

(B)aesecceseeee”

28. A conjoint reading of the aforesaid provision would show

that form and manner of the application has to be the one as

prescribed. It is evident from the record that the application has

been filed on the proforma prescribed under Rule 4 (2) of the

Insolvency and Bankruptcy (Application to Adjudicating

Authority) Rules, 2016 read with Section 7 of the Code. We are

satisfied that a default amounting to lacs of rupees has occurred.

As per requirement of Section 4 of the Code if default amount is

one lac or more then the CIR Process would be issued. The

application under sub section 2 of Section 7 is complete; and no

cP. nosis) 27409)/2017

Sel Egipment Finance Ud. Wiamaimpex Private Ld. one 20127

rn

disciplinary proceedings are pending against the proposed

Interim Resolution Professional.

29. Asa sequel to the above discussion, this petition is admitted

and Mr, Gopal Lal Baser is appointed as an Interim Resolution

Professional.

30. In pursuance of Section 13 (2) of the Code, we direct that

Interim Insolvency Resolution Professional to make public

announcement immediately with regard to admission of this

application under Section 7 of the Code. The expression

immediately’ means within three days as clarified by Explanation

to Regulation 6 (1) of the IBBI (Insolvency Resolution Process for

Corporate Persons) Regulations, 2016.

31, We also declare moratorium in terms of Section 14 of the

Code. A necessary consequence of the moratorium flows from the

provisions of Section 14 (1) (a), (b), (c) & (d) and thus the

following prohibitions are imposed which must be followed by all

and sundry:

“(a)_ the institution of suits or continuation of pending suits

or proceedings against the corporate debtor including

execution of any judgment, decree or order in any

cP. noyi-27ur8\/2017

‘Equipment Pinan Led , Wien pen rivte td Paget [27

court of law, tribunal, arbitration panel or other

authority;

(b) transferring, encumbering, alienating or disposing of

by the corporate debtor any of its assets cr any legal

right or beneficial interest therein;

(c) any action to foreclose, recover or enforce any security

interest created by the corporate debtor in respect of

its property including any action under the

Securitisation and Reconstruction of Finarcial Assets

and Enforcement of Security Interest Act, 2002;

(a) the recovery of any property by an owner or lessor

where such property is occupied by or in the

possession of the corporate debtor.”

32, It is made clear that the provisions of moratoriun shall not

apply to (a) such transactions which might be notified by the

Central Government in consultation with any financial regulator;

(b) a surety in a contract of guarantor to a Corporate Debtor.

Additionally, the supply of essential goods or services to the

Corporate Debtor as may be specified is not to be terminated or

suspended or interrupted during the moratorium period. These

cP Nots}2719e}/2017

Se Eeipmen Finance Lv, Wien Impex rate Page 22127

ee

would include supply of water, electricity and similar other

services or supplies as provided by Regulation 22 of IBBI

(Insolvency Resolution Process for Corporate _ Persons)

Regulations, 2016.

33. The Interim Resolution Professional shall perform all his

functions religiously and strictly which are contemplated,

interatia, by Sections 15, 17, 18, 19, 20 & 21 of the Code. He

must follow best practices and principles of fairness which are to

apply at various stages of Corporate Insolvency Resolution

Process. His conduct should be above board é independent; and

he should work with utmost integrity and honesty. It is further

made clear that all the personnel connected with the Corporate

Debtor, erstwhile directors, promoters or any other person

associated with the Management of the Corporate Debtor are

under legal obligation under Section 19 of the Code to extend

every assistance and cooperation to the Interim Resolution

Professional as may be required by him in managing the affairs of

the Corporate Debtor. In case there is any violation committed by

the ex-management or any tainted/illegel transaction by ex-

directors or anyone else the Interim —_Resolution

cP. noga} 2730/2007

Sci eglpment Fenced v Wines inp rat age 23/27

oe

Professional/Resolution Professional would be at liberty to make

appropriate application to this Tribunal with a prayer for passing

an appropriate order. The_—Interim —_—Resolution

Professional/Resolution Professional shall be under a duty to

protect and preserve the value of the property of the ‘Corporate

Debtor’ as a part of its obligation imposed by Section 20 of the

Code and perform all his functions strictly in accordance with the

provisions of the Code.

34, Directions are also issued to the Ex-Management/Auditors

etc, to provide all the documents in their possession and furnish

every information in their knowledge as required under Section

19 of the Code to the Interim Resolution Professional within a

period of one week from today otherwise coercive steps to follow.

5. We direct the Financial Creditor to deposit a sum of Rs. 2

lacs with the Interim Resolution Professional to meet out the

expenses to perform the functions assigned to him in accordance

with Regulation 6 of Insolvency and Bankruptcy Boerd of India

{Insolvency Resolution Process for Corporate Person) Regulations,

2016. The needful shall be done within three days from the date

of receipt of this order by the Financial Creditor. The amount

0. nay-27(r/2017

Sci equpment Pace Ud, Winx pe rive i Page 28127

ea

however be subject to adjustment by the Committee of Creditors.

The amount must be accounted for by Interim Resolution

Professional and shall be paid back to the Financial Creditor.

36. Before parting we must notice the complaint made against

Financial Creditor in the form of discrepancies in the statement

of account. We cannot in summary proceedings determine the

amount due. This function is required to be performed by the

Information Utility which is not yet fully functional. Therefore,

Resolution Professional may ask the ex-promoter/director of the

Corporate Debtor for any such correction if need be and act

accordingly by placing it before the Financial Creditor as it is only

fair to do so,

37. The judgment in this matter could not be pronounced

earlier as the issue concerning Constitutional validity of

explanation to sub section 8 (| of Section 5 of the Code, 2016

was subject matter of challenge before Hon'ble the Supreme

Court in a bunch of petitions. In the lead case titled as Pioneer

Urban Land and Infrastructure Limited and Another v. Union of

India & Ors. (Writ Petition (Civil) No. 43 of 2019) the order has

now been pronounced on 09.08.2019. We have gone through the

9. Ne(s}271(8/2017

‘Se Eeipment Fnence Lv, Winx impo Private ts Page 25/27

Ge

order and find that the directions issued by Hon'ble the Supreme

Court do not in any manner advance the case of the Corporate

Debtor and the petition deserves to be admitted. It may also be

noticed that at no stage possession has been offered and the

denial of possession does not arise.

38. Mr. K, Datta, learned counsel for the petitioner ir. connected

petition namely (1B)-1666(PB}/2018, has pointed out that stay

order was passed by Hon’ble the Supreme Court namely Wianxx

Impex Pvt. Ltd. in Writ Petition (civil) No. 438 of 2019 which has

been dismissed ted*y +, 23.08.2019. The aforesaid submission

would show that there is no impediment left in the

pronouncement of order which was reserved in reszect of the

corporate debtor in CP No, (IB)-271(PB)/2017 and other

connected matters namely (1B)-1401(PB)/2018, (IB)

1153(PB)/2018 and (1B)-695(PB)/2018. Accordingly, orders have

been pronounced.

‘No. 302{PB)/2018

39. The prayer made in this application is to permit intervention

in the pending proceeding on the ground that the applicants have

huge claim in respect of the Corporate Debtor. As the petition has

(Poa) 271(0)72017

Se equipment Finance Lv Wines pe rate ed age 26127

been admitted the necessity of intervention by the applicants is,

obviated. Accordingly, all the applicants would be well within

their rights to file their claims before the Interim Resolution

Professional namely Mr. Gopal Lal Baser which shall be

considered in accordance with law.

40. Application being C.A. No. 302(PB)/2018 stands disposed

of,

41. The office is directed to communicate a copy of the order to

the Financial Creditor, the Corporate Debtor, the Interim

Resolution Professional and the Registrar of Companies, NCR,

New Dethi at the earliest but not later than seven days from

today. The Registrar of Companies shall update its website by

updating the status of ‘Corporate Debtor’ and specific mention

regarding admission of this petition must be notified.

(MM. KUMAR)?

PRESIDENT

(8.K. MOHAPATRA)

MEMBER|TECHNICAL)

23.08.2019

VINEET

P.note}2799)/2017

Sel equipment Fiend, Wiema Impex Pvt Ld. 27127

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5834)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (350)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (824)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- (Tev) Study On Entity Build Tech LTDDocument72 pages(Tev) Study On Entity Build Tech LTDSachinNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Supreme Court Ruling On IBC 1Document26 pagesSupreme Court Ruling On IBC 1SachinNo ratings yet

- Blank IM DraftDocument37 pagesBlank IM DraftSachinNo ratings yet

- Wearit Global LimitedDocument1 pageWearit Global LimitedSachinNo ratings yet

- Ibc - A Case Law Compendium - PDFDocument6 pagesIbc - A Case Law Compendium - PDFSachinNo ratings yet

- Claim NclatDocument113 pagesClaim NclatSachinNo ratings yet

- DR - Navrang Saini-IBC CASE LAWSDocument10 pagesDR - Navrang Saini-IBC CASE LAWSSachinNo ratings yet

- Rajat WiresDocument1 pageRajat WiresSachinNo ratings yet

- Maneesh Pharmaceuticals LTDDocument1 pageManeesh Pharmaceuticals LTDSachinNo ratings yet

- (Through Web-Based Video Conferencing Platform) : The National Company Law Tribunal Chandigarh Bench, ChandigarhDocument2 pages(Through Web-Based Video Conferencing Platform) : The National Company Law Tribunal Chandigarh Bench, ChandigarhSachinNo ratings yet

- Vikram Financial Services LimitedDocument1 pageVikram Financial Services LimitedSachinNo ratings yet

- Kosas Industries Pvt. Ltd. 1Document1 pageKosas Industries Pvt. Ltd. 1SachinNo ratings yet

- Madhucon Granites LTD 1Document1 pageMadhucon Granites LTD 1SachinNo ratings yet

- Final Cause List Dated 23.09.2021Document10 pagesFinal Cause List Dated 23.09.2021SachinNo ratings yet

- 20.07.2020 - Caues ListDocument2 pages20.07.2020 - Caues ListSachinNo ratings yet

- Reliance Industries - Sebi Bans Reliance Industries, 12 Others From Equity Derivative Market For 1 Year - The Economic TimesDocument9 pagesReliance Industries - Sebi Bans Reliance Industries, 12 Others From Equity Derivative Market For 1 Year - The Economic TimesSachinNo ratings yet

- Bank of Baroda vs. Ms. Rathi Super Steels LTD - 2Document20 pagesBank of Baroda vs. Ms. Rathi Super Steels LTD - 2SachinNo ratings yet

- India Water Markets January2019Document49 pagesIndia Water Markets January2019SachinNo ratings yet

- SEBI Slaps Rs 50 Lakh Fine On 6 Entities For Fraudulent Trade in Polar Pharma Shares - The New Indian ExpressDocument10 pagesSEBI Slaps Rs 50 Lakh Fine On 6 Entities For Fraudulent Trade in Polar Pharma Shares - The New Indian ExpressSachinNo ratings yet

- How A Retail Investor Can Find Out Stock Manipulation To Avoid LossDocument3 pagesHow A Retail Investor Can Find Out Stock Manipulation To Avoid LossSachinNo ratings yet

- BS Hindi 14.07.2020 GopalsansDocument1 pageBS Hindi 14.07.2020 GopalsansSachinNo ratings yet

- Bank of Baroda vs. Ms. Rathi Super Steels LTD - 2 PDFDocument20 pagesBank of Baroda vs. Ms. Rathi Super Steels LTD - 2 PDFSachinNo ratings yet

- Summarized Facts TEV StudyDocument3 pagesSummarized Facts TEV StudySachinNo ratings yet