Professional Documents

Culture Documents

Digest RR 8-2019

Digest RR 8-2019

Uploaded by

Nikki Garcia0 ratings0% found this document useful (0 votes)

34 views2 pagesThis document summarizes amendments made to Revenue Regulations No. 12-2018 regarding estate and donor's tax provisions incorporating changes from the TRAIN Law. Key changes include:

1) Allowing estate taxes to be paid in cash installments over two years from filing instead of one year.

2) Requiring banks to withhold 6% final tax on withdrawals from deposit accounts of deceased persons within one year of death.

3) Specifying bank reporting procedures for remitting withheld taxes through monthly or quarterly returns depending on timing of withholding. Withheld taxes cannot be refunded but may be credited against estate taxes due.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document summarizes amendments made to Revenue Regulations No. 12-2018 regarding estate and donor's tax provisions incorporating changes from the TRAIN Law. Key changes include:

1) Allowing estate taxes to be paid in cash installments over two years from filing instead of one year.

2) Requiring banks to withhold 6% final tax on withdrawals from deposit accounts of deceased persons within one year of death.

3) Specifying bank reporting procedures for remitting withheld taxes through monthly or quarterly returns depending on timing of withholding. Withheld taxes cannot be refunded but may be credited against estate taxes due.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

34 views2 pagesDigest RR 8-2019

Digest RR 8-2019

Uploaded by

Nikki GarciaThis document summarizes amendments made to Revenue Regulations No. 12-2018 regarding estate and donor's tax provisions incorporating changes from the TRAIN Law. Key changes include:

1) Allowing estate taxes to be paid in cash installments over two years from filing instead of one year.

2) Requiring banks to withhold 6% final tax on withdrawals from deposit accounts of deceased persons within one year of death.

3) Specifying bank reporting procedures for remitting withheld taxes through monthly or quarterly returns depending on timing of withholding. Withheld taxes cannot be refunded but may be credited against estate taxes due.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 2

REVENUE REGULATIONS NO.

8-2019 issued on June 25, 2019 amends pertinent

provisions of Sections 9 and 10 of Revenue Regulations (RR) No. 12-2018 regarding

the Consolidated RRs on Estate Tax and Donor’s Tax incorporating the amendments

introduced by Republic Act No. 10963 (TRAIN Law), to read as follows:

“SECTION 9. TIME AND PLACE OF FILING ESTATE TAX RETURN AND

PAYMENT OF ESTATE TAX DUE.-

1. Estate Tax Return. – xxx

xxx

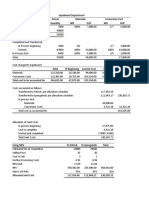

6. Payment of the Estate Tax by installment and partial disposition of estate. –

xxx

6.1. Cash Installment

i. The cash installments shall be made within two (2) years from the

date of filing of the estate tax return, using the Payment Form (BIR

Form No. 0605), or a payment form dedicated for this transaction, for

succeeding installment payments after the filing/first (1 st) payment

through the estate tax return.

ii. xxx

xxx”

“SEC. 10. PAYMENT OF TAX ANTECEDENT TO THE TRANSFER OF

SHARES, BONDS OR RIGHTS AND BANK DEPOSITS WITHDRAWAL. - xxx

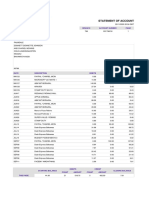

If a bank has knowledge of the death of a person, who maintained a bank

deposit account alone, or jointly with another, it shall allow the withdrawal from the said

deposit account, subject to a Final Withholding Tax of six percent (6%) of the amount

to be withdrawn, provided that the withdrawal shall be made within one year from the

date of death of the decedent. The bank shall remit to the BIR the withholding tax

prescribed under this Section by filing a duly accomplished Monthly Remittance Form

of Taxes Withheld on the Amount Withdrawn from the Decedent’s Deposit Account

(BIR Form No. 0620) and remit the tax withheld on or before the tenth (10th) day

following the month when the withholding was made. However, if the tax was withheld

on the third month of the quarter, instead of using BIR Form No. 0620 in the remittance

of tax withheld, a quarterly remittance return (BIR Form No. 1621) shall be filed and the

corresponding final withholding tax paid on or before the last day of the month following

the close of the quarter during which the withholding was made. The herein prescribed

quarterly return shall indicate, among others, the name of the estate of the decedent,

Taxpayer Identification Number (TIN), date of decedent’s death, taxable base, amount

withheld and date withheld.

The bank shall issue the corresponding BIR Form No. 2306 certifying such

withholding, with the original and duplicate copies issued to the executor, administrator

or any of the legal heirs of the decedent while the third copy retained by the bank as its

reference file. The duplicate copy shall be submitted by the executor, administrator or

the authorized legal heir to the RDO having jurisdiction over the place where the

decedent was domiciled at the time of his or her death, within five (5) days from its

receipt.

In all cases, the final tax withheld shall not be refunded, however, may be

credited from the tax due in instances where the bank deposit account subjected to the

final withholding tax has been actually included in the gross estate declared in the

estate tax return of the decedent.

xxx”

You might also like

- Adp Pay Stub TemplateDocument1 pageAdp Pay Stub Templateluis gonzalez0% (1)

- 709 Form 2005 SampleDocument4 pages709 Form 2005 Sample123pratus92% (13)

- EXAMPLE - 83 (B) Letter To IRS Individual)Document1 pageEXAMPLE - 83 (B) Letter To IRS Individual)Joe WallinNo ratings yet

- Taxrev Final Exam-InovictusDocument16 pagesTaxrev Final Exam-InovictusNikki GarciaNo ratings yet

- Gaston Vs Republic Planters BankDocument5 pagesGaston Vs Republic Planters BankRyan SuaverdezNo ratings yet

- Solution in Partnership Liquidation LumpsumDocument4 pagesSolution in Partnership Liquidation LumpsumNikki GarciaNo ratings yet

- MQ2 Process CostingDocument1 pageMQ2 Process CostingNikki Garcia67% (3)

- Partnership Liquidation LumpsumDocument1 pagePartnership Liquidation LumpsumNikki GarciaNo ratings yet

- Payroll AccountingDocument7 pagesPayroll Accountingmobinil1No ratings yet

- First Division: JED Cta Case CorporationDocument15 pagesFirst Division: JED Cta Case CorporationLady Paul SyNo ratings yet

- First Division: Ourt of Tax AppealsDocument31 pagesFirst Division: Ourt of Tax AppealsdoookaNo ratings yet

- Garcia vs. Executive SecretaryDocument8 pagesGarcia vs. Executive SecretarySharmen Dizon GalleneroNo ratings yet

- 54 City of Ozamis Vs LumapasDocument3 pages54 City of Ozamis Vs Lumapasiamlucy88No ratings yet

- Special Commercial Laws (Trust Receipt Cases)Document21 pagesSpecial Commercial Laws (Trust Receipt Cases)Jacq LinNo ratings yet

- Rule 37 New Trial or ReconsiderationDocument15 pagesRule 37 New Trial or ReconsiderationDiana Rose ConstantinoNo ratings yet

- 01 Tolentino vs. Secretary of Finance, 235 SCRA 630, G.R. No. 115455, Oct 30, 1995Document212 pages01 Tolentino vs. Secretary of Finance, 235 SCRA 630, G.R. No. 115455, Oct 30, 1995Galilee RomasantaNo ratings yet

- MEMORANDUMDocument3 pagesMEMORANDUMTugonon M Leo RoswaldNo ratings yet

- Case On Lack of Verification of PleadingsDocument11 pagesCase On Lack of Verification of PleadingsFulgue JoelNo ratings yet

- Affidavit - Complaint: Republic of The Philippines) City of Dipolog - . - . - .) S.SDocument3 pagesAffidavit - Complaint: Republic of The Philippines) City of Dipolog - . - . - .) S.SArnel LadagNo ratings yet

- POSITION PAPER - Limsuan Vs PortDocument3 pagesPOSITION PAPER - Limsuan Vs PortIan QuisadoNo ratings yet

- CTA 8703 (Hoya) - DividendsDocument33 pagesCTA 8703 (Hoya) - DividendsJerwin DaveNo ratings yet

- Atlas Consolidated Mining and Development Corporation vs. CIRDocument54 pagesAtlas Consolidated Mining and Development Corporation vs. CIRChristian Adrian CepilloNo ratings yet

- CSC Memo Cir No. 2-2005Document35 pagesCSC Memo Cir No. 2-2005daniel besina jrNo ratings yet

- Questions and Answers On Significant Supreme Court Taxation Law Jurisprudence From January 2013 To June 2018Document36 pagesQuestions and Answers On Significant Supreme Court Taxation Law Jurisprudence From January 2013 To June 2018mcris101No ratings yet

- Tax - Kepco Phil Vs CIRDocument15 pagesTax - Kepco Phil Vs CIRPebs DrlieNo ratings yet

- First E-Bank Tower Condominium Corp v. BIRDocument35 pagesFirst E-Bank Tower Condominium Corp v. BIRAdi SalvadorNo ratings yet

- Decision: Second DivisionDocument13 pagesDecision: Second DivisionGilbert John LacorteNo ratings yet

- 2 CIR vs. Sony Phils, Inc. G.R. No. 178697, November 17, 2010Document17 pages2 CIR vs. Sony Phils, Inc. G.R. No. 178697, November 17, 2010Alfred GarciaNo ratings yet

- CIR vs. CA and Commonwealth 125355Document1 pageCIR vs. CA and Commonwealth 125355magenNo ratings yet

- Churchill and Tait vs. ConcepcionDocument5 pagesChurchill and Tait vs. ConcepcionGee GuevarraNo ratings yet

- Taxation Law 2010 Bar Exam QuestionsDocument8 pagesTaxation Law 2010 Bar Exam QuestionsCherrie Mae J. Bongcawil-DawamiNo ratings yet

- Demurrer To Evidence Eden Del Rosario GEANNDocument6 pagesDemurrer To Evidence Eden Del Rosario GEANNJoseph John Madrid AguasNo ratings yet

- Cta 08264Document30 pagesCta 08264Dyrene Rosario UngsodNo ratings yet

- Republic of The Philippines Regional Trial Court: Temporary Restraining Order and Preliminary InjunctionDocument8 pagesRepublic of The Philippines Regional Trial Court: Temporary Restraining Order and Preliminary InjunctionJayson AzuraNo ratings yet

- Maceda V. Macaraig Summary: The Petition Seeks To Nullify Certain Decisions, Orders, Rulings, and ResolutionsDocument3 pagesMaceda V. Macaraig Summary: The Petition Seeks To Nullify Certain Decisions, Orders, Rulings, and ResolutionsTrixie PeraltaNo ratings yet

- 25 CIR Vs CTA and PetronDocument11 pages25 CIR Vs CTA and PetronKing ForondaNo ratings yet

- Caltex Philippines, Inc. vs. Commission On AuditDocument45 pagesCaltex Philippines, Inc. vs. Commission On AuditJAMNo ratings yet

- 4.tax Suggested Answers (1994-2006), WordDocument72 pages4.tax Suggested Answers (1994-2006), Wordjojitus0% (1)

- PBCOM vs. CIRDocument19 pagesPBCOM vs. CIRColeen Navarro-RasmussenNo ratings yet

- Maceda v. Macaraeg, G.R. No. 88291, May 31, 1991Document35 pagesMaceda v. Macaraeg, G.R. No. 88291, May 31, 1991Ryuzaki HidekiNo ratings yet

- Guide Notes On Local Government TaxationDocument27 pagesGuide Notes On Local Government TaxationNayadNo ratings yet

- CIR v. AcesiteDocument4 pagesCIR v. AcesiteTheresa BuaquenNo ratings yet

- Motion To Lift Order of Default With Position PaperDocument3 pagesMotion To Lift Order of Default With Position PaperAtty. Dahn UyNo ratings yet

- CIR V Fortune TobaccoDocument16 pagesCIR V Fortune TobaccoOlivia JaneNo ratings yet

- 33-CIR v. Wander Philippines, Inc. G.R. No. L-68375 April 15, 1988Document4 pages33-CIR v. Wander Philippines, Inc. G.R. No. L-68375 April 15, 1988Jopan SJNo ratings yet

- People Vs SantosDocument2 pagesPeople Vs SantosQuoleteNo ratings yet

- Judicial Admissions CasesDocument93 pagesJudicial Admissions CasesAlexis Anne P. ArejolaNo ratings yet

- CIR Vs Raul Gonzales DigestDocument4 pagesCIR Vs Raul Gonzales DigestFroilan Villafuerte Faurillo100% (2)

- CIR vs. American Express InternationalDocument30 pagesCIR vs. American Express InternationalMonikkaNo ratings yet

- Gaston v. RepublicDocument10 pagesGaston v. RepublicBliz100% (1)

- Philippine Health Care Providers, Inc., v. CIR, G.R. No. 167330, September 18, 2009Document24 pagesPhilippine Health Care Providers, Inc., v. CIR, G.R. No. 167330, September 18, 2009Gfor FirefoxonlyNo ratings yet

- Provisional Remedies DoctrinesDocument5 pagesProvisional Remedies DoctrinesMakoy MolinaNo ratings yet

- Gains and Losses From Dealings in PropertiesDocument29 pagesGains and Losses From Dealings in PropertiesCj Garcia100% (1)

- MEMO RTC BRANCH 4 (Final)Document11 pagesMEMO RTC BRANCH 4 (Final)danilo m.sampagaNo ratings yet

- 2018 Albano Doctrine On INCOME Taxation For The 2018 Bar ExamDocument14 pages2018 Albano Doctrine On INCOME Taxation For The 2018 Bar ExamNissi JonnaNo ratings yet

- PAGCOR v. BIRDocument26 pagesPAGCOR v. BIRAronJamesNo ratings yet

- CIR v. Aichi Forging Company of Asia, IncDocument22 pagesCIR v. Aichi Forging Company of Asia, IncAronJamesNo ratings yet

- Department of Legal Management College of Arts and Sciences San Beda University Tax1 Course Syllabus First Semester, AY 2021-2022Document15 pagesDepartment of Legal Management College of Arts and Sciences San Beda University Tax1 Course Syllabus First Semester, AY 2021-2022nayhrbNo ratings yet

- Tax Reviewer - CallantaDocument52 pagesTax Reviewer - CallantaAnonymous 8SUSyvGc3dNo ratings yet

- Bir Ruling No. 108-93Document2 pagesBir Ruling No. 108-93saintkarriNo ratings yet

- Gadon QuashDocument9 pagesGadon QuashYNNA DERAYNo ratings yet

- Nullity - GRN 247985 de SilvaDocument59 pagesNullity - GRN 247985 de SilvaJoAnneGallowayNo ratings yet

- Post Nuptial and Prenuptual Agreement EnforceabilityDocument1 pagePost Nuptial and Prenuptual Agreement Enforceabilitysuperxl2009No ratings yet

- CIR v. MarubeniDocument31 pagesCIR v. Marubenimceline19No ratings yet

- RP vs. Gallo - Correction in The Civil Registry - LeonenDocument26 pagesRP vs. Gallo - Correction in The Civil Registry - LeonenhlcameroNo ratings yet

- BIR Ruling No. 453-2018 Interest Income On Individual Loans Obtained From Banks That Are Not Securitized, Assigned or Participated OutDocument4 pagesBIR Ruling No. 453-2018 Interest Income On Individual Loans Obtained From Banks That Are Not Securitized, Assigned or Participated Outliz kawiNo ratings yet

- REVENUE MEMORANDUM CIRCULAR NO. 62-2018 Issued On July 10, 2018 ClarifiesDocument1 pageREVENUE MEMORANDUM CIRCULAR NO. 62-2018 Issued On July 10, 2018 ClarifiesRamon EldonoNo ratings yet

- Taxation - Leonen - 2021 Pre-Week MaterialsDocument57 pagesTaxation - Leonen - 2021 Pre-Week MaterialsJonahNo ratings yet

- Cpar Far Must ReviewDocument23 pagesCpar Far Must ReviewNikki GarciaNo ratings yet

- 2019PressRelease Hold Departure Order Issued Against KAPA Scam Operators 07042019Document2 pages2019PressRelease Hold Departure Order Issued Against KAPA Scam Operators 07042019Nikki GarciaNo ratings yet

- RR 9-2019Document3 pagesRR 9-2019Nikki GarciaNo ratings yet

- Solution To Bikini Bottom - Accounting For JC and BPDocument6 pagesSolution To Bikini Bottom - Accounting For JC and BPNikki GarciaNo ratings yet

- Solution in Partnership Liquidation InstallmentDocument20 pagesSolution in Partnership Liquidation InstallmentNikki GarciaNo ratings yet

- HAVA Powerpoint Presentation: Imperial Resources, IncDocument4 pagesHAVA Powerpoint Presentation: Imperial Resources, IncNikki GarciaNo ratings yet

- Solution in Partnership Liquidation InstallmentDocument20 pagesSolution in Partnership Liquidation InstallmentNikki GarciaNo ratings yet

- Seatwork - A334-A331 - Lala MalalaDocument8 pagesSeatwork - A334-A331 - Lala MalalaNikki GarciaNo ratings yet

- Solution To Final QuizzesDocument8 pagesSolution To Final QuizzesNikki GarciaNo ratings yet

- Process Costing - Loss UnitsDocument7 pagesProcess Costing - Loss UnitsNikki GarciaNo ratings yet

- Process Costing Standard CostingDocument4 pagesProcess Costing Standard CostingNikki GarciaNo ratings yet

- Process Costing - Max CorporationDocument7 pagesProcess Costing - Max CorporationNikki GarciaNo ratings yet

- Quiz 2 - A331-321-334Document1 pageQuiz 2 - A331-321-334Nikki Garcia100% (1)

- Process Costing - Max CorporationDocument7 pagesProcess Costing - Max CorporationNikki GarciaNo ratings yet

- Lala MalalaDocument1 pageLala MalalaNikki GarciaNo ratings yet

- Partnership Accounting Comprehensive ProblemDocument10 pagesPartnership Accounting Comprehensive ProblemNikki GarciaNo ratings yet

- Qty Schedule - 1-10-17Document14 pagesQty Schedule - 1-10-17Akira Marantal ValdezNo ratings yet

- PPP Mfg. Co. Unit Cost Data REVIEWDocument58 pagesPPP Mfg. Co. Unit Cost Data REVIEWNikki GarciaNo ratings yet

- Labor and Overhead ExerciseDocument3 pagesLabor and Overhead ExerciseNikki GarciaNo ratings yet

- Kala WangDocument2 pagesKala WangNikki GarciaNo ratings yet

- CPA Exam REG - S-Corporation Taxation.Document2 pagesCPA Exam REG - S-Corporation Taxation.Manny MarroquinNo ratings yet

- 1-4e Income Taxes: Formula For Federal Income Tax On IndividualsDocument3 pages1-4e Income Taxes: Formula For Federal Income Tax On IndividualsMeriton KrivcaNo ratings yet

- Largest Banks and Thrifts in The US by Total AssetsDocument4 pagesLargest Banks and Thrifts in The US by Total Assetsht5116No ratings yet

- G30 2023 Why Does Latin America Underperform SELECCDocument20 pagesG30 2023 Why Does Latin America Underperform SELECCporota loverNo ratings yet

- Description: Tags: FFELLendersNov2007Document50 pagesDescription: Tags: FFELLendersNov2007anon-405484No ratings yet

- W2 Matthew RussellDocument2 pagesW2 Matthew Russellmatthewrussell661No ratings yet

- Form 6744Document6 pagesForm 6744api-495108136No ratings yet

- SMChap 004Document57 pagesSMChap 004testbank100% (2)

- Form 1099 MISC David Kovach-1Document1 pageForm 1099 MISC David Kovach-1dolapo BalogunNo ratings yet

- HOUSING Eviction PreventionDocument2 pagesHOUSING Eviction Preventionjgstorandt44No ratings yet

- Homes SOLD On Lake Michigan in Wisconsin 2014Document9 pagesHomes SOLD On Lake Michigan in Wisconsin 2014Lori KoschnickNo ratings yet

- Https:/onlinebanking Firstcaribbeanbank Com/api/public/ibs/v1/statemDocument2 pagesHttps:/onlinebanking Firstcaribbeanbank Com/api/public/ibs/v1/statemMcInnis Enterprises.No ratings yet

- KPQooo 001266420000 R 07112758 C846621Document1 pageKPQooo 001266420000 R 07112758 C846621Jonathan GutierrezNo ratings yet

- PhonePe Statement May2023 May2024Document53 pagesPhonePe Statement May2023 May2024billamassguru14No ratings yet

- Sponsors of National Merit ScholarshipsDocument4 pagesSponsors of National Merit ScholarshipsSamarth KNo ratings yet

- 2018-120 PHLDocument3 pages2018-120 PHLJAGUAR GAMINGNo ratings yet

- Payroll ReconciliationDocument3 pagesPayroll ReconciliationGreg CastroNo ratings yet

- Teil - 17 - Foreclosure FraudDocument151 pagesTeil - 17 - Foreclosure FraudNathan BeamNo ratings yet

- US Internal Revenue Service: p519 - 1999Document52 pagesUS Internal Revenue Service: p519 - 1999IRSNo ratings yet

- EIN IRS MicroInformationTechnologiesDocument2 pagesEIN IRS MicroInformationTechnologiesmariefe.wvillacoraNo ratings yet

- Date Region Retailer Type Customer Quantity RevenueDocument36 pagesDate Region Retailer Type Customer Quantity RevenueSk Intekhaf AlamNo ratings yet

- 2020 W2 Forms CaseyDocument9 pages2020 W2 Forms CaseyjuliusomotayooluwagbemiNo ratings yet

- Ginnie Mae Summit AttendeesDocument13 pagesGinnie Mae Summit AttendeesGinnie Mae100% (1)

- U.S. Individual Income Tax Return: Staples 219-19-7094 Jaimar HDocument4 pagesU.S. Individual Income Tax Return: Staples 219-19-7094 Jaimar HJayam Jai Maharaj100% (1)

- Robo-Galore!! Lynn's List of Top Mortgage Signers For First Half of 2011Document5 pagesRobo-Galore!! Lynn's List of Top Mortgage Signers For First Half of 201183jjmack86% (14)

- David RockefellerDocument4 pagesDavid RockefellerRonaldNo ratings yet