Professional Documents

Culture Documents

Global - IT Services, February 2019

Global - IT Services, February 2019

Uploaded by

ashvarybabulCopyright:

Available Formats

You might also like

- The Forrester Wave™ Workforce Optimization Platforms, Q4 2021Document15 pagesThe Forrester Wave™ Workforce Optimization Platforms, Q4 2021Ashish NagarNo ratings yet

- Market Guide For Digital Commerce Payment VendorsDocument37 pagesMarket Guide For Digital Commerce Payment Vendorsmkache5No ratings yet

- TAX - Final Pre-Board With Answer Key Batch Exodus - EncryptedDocument16 pagesTAX - Final Pre-Board With Answer Key Batch Exodus - EncryptedSophia Perez100% (1)

- Gartner IT GlossaryDocument396 pagesGartner IT GlossaryshivenderNo ratings yet

- Chapter 1 Managing The Digital FirmDocument50 pagesChapter 1 Managing The Digital FirmSaufiNo ratings yet

- Broadcasting Value ChainDocument4 pagesBroadcasting Value Chainashvarybabul100% (2)

- Indonesia Sustainability Summit (Premailer) John LKDMDocument5 pagesIndonesia Sustainability Summit (Premailer) John LKDMKhaidil Prayuda KhaliqNo ratings yet

- Gartner Market Share Analysis - Security Consulting, Worldwide, 2012Document9 pagesGartner Market Share Analysis - Security Consulting, Worldwide, 2012Othon CabreraNo ratings yet

- Healthcare Report Q1 2021Document75 pagesHealthcare Report Q1 2021Venkatraman KrishnamoorthyNo ratings yet

- DL Presentation Deutsche TelekomDocument49 pagesDL Presentation Deutsche Telekomimam arifuddinNo ratings yet

- Forrester Report - Predictions 2021 - AutomationDocument3 pagesForrester Report - Predictions 2021 - Automationzio_nano0% (1)

- ICT Investments Report GCCDocument31 pagesICT Investments Report GCCMohammed Jabir AhmedNo ratings yet

- Quantitative Economics With Python PDFDocument945 pagesQuantitative Economics With Python PDFcarlos ortizNo ratings yet

- Ericsson Case Study - QXDDocument10 pagesEricsson Case Study - QXDTanvir SinghNo ratings yet

- KPMG IT SpendingDocument36 pagesKPMG IT Spendingankit191188No ratings yet

- Digital Government Strategic DirectionsDocument20 pagesDigital Government Strategic DirectionsZee NapNo ratings yet

- 04 - MC Kinsey - (Chris Ip) PPT Part 1 - IoT - Capturing The Opportunity VF - 21 June 2016.1pptxDocument23 pages04 - MC Kinsey - (Chris Ip) PPT Part 1 - IoT - Capturing The Opportunity VF - 21 June 2016.1pptxeverpereiraNo ratings yet

- On MobileDocument136 pagesOn Mobiletejaiipm9809No ratings yet

- 5440 - 1 - NASSCOM Perspective 2025 - Shaping The Digital RevolutionDocument13 pages5440 - 1 - NASSCOM Perspective 2025 - Shaping The Digital RevolutionBinduPrakashBhattNo ratings yet

- Data MonetizationDocument3 pagesData MonetizationmohnishNo ratings yet

- Analyse This, P Analyse This, Predict That - Final Report - Singles LR - Redict That - Final Report - Singles LRDocument60 pagesAnalyse This, P Analyse This, Predict That - Final Report - Singles LR - Redict That - Final Report - Singles LRNitish JalaliNo ratings yet

- Insurance Sector in IndiaDocument4 pagesInsurance Sector in IndiaYadav412No ratings yet

- Strategyand Becoming A Digital TelecomDocument16 pagesStrategyand Becoming A Digital TelecomMohammadNo ratings yet

- Accenture Top10 Challenges 2011Document120 pagesAccenture Top10 Challenges 2011남상욱No ratings yet

- Biotech-In-A-Box How To ACE' Geographical Expansion in EuropeDocument16 pagesBiotech-In-A-Box How To ACE' Geographical Expansion in Europesaurav_eduNo ratings yet

- Gartner Critical Capabilities For Network Services Global March 2021Document37 pagesGartner Critical Capabilities For Network Services Global March 2021ta pei100% (1)

- 2021-Cisco Networking-ReportDocument18 pages2021-Cisco Networking-ReportFredy Abel Huanca TorresNo ratings yet

- Capability Maturity FrameworkDocument12 pagesCapability Maturity FrameworkClaudio VélizNo ratings yet

- OneSpan AnalystReport ISMG The State of Digital Account Opening TransformationDocument28 pagesOneSpan AnalystReport ISMG The State of Digital Account Opening TransformationJhordan ZelayaNo ratings yet

- Session 7-1: Fintech and Financial Literacy in Viet Nam by Peter J. MorganDocument30 pagesSession 7-1: Fintech and Financial Literacy in Viet Nam by Peter J. MorganADBI Events100% (1)

- Resource Orchestration in Business Ecosystem - RezaDocument24 pagesResource Orchestration in Business Ecosystem - RezaAsyrafinafilah HasanawiNo ratings yet

- CEB - IT Budget Key FindingsDocument3 pagesCEB - IT Budget Key FindingsAnuragBoraNo ratings yet

- Future Trends in Insurance - Trevor RorbyeDocument23 pagesFuture Trends in Insurance - Trevor Rorbyekwtam338No ratings yet

- External Factor Evaluation ANalysisDocument42 pagesExternal Factor Evaluation ANalysisSetyo Ferry WibowoNo ratings yet

- Fixed Mobile Integration - Opportunity or Challenge? (Detecon Executive Briefing)Document6 pagesFixed Mobile Integration - Opportunity or Challenge? (Detecon Executive Briefing)Detecon InternationalNo ratings yet

- Multi SourcingDocument32 pagesMulti SourcingpantmukulNo ratings yet

- MicrosoftDocument20 pagesMicrosoftSagar PatelNo ratings yet

- Accenture IT Cost Reduction Using New TechnologyDocument6 pagesAccenture IT Cost Reduction Using New TechnologyAlexanderNo ratings yet

- 3i Infotech-Developing A Hybrid StrategyDocument20 pages3i Infotech-Developing A Hybrid StrategyVinod JoshiNo ratings yet

- Gartner Supply Chain Top 25 For 2024 1Document12 pagesGartner Supply Chain Top 25 For 2024 13atefaklNo ratings yet

- Magic Quadrant For Data Center Backup and Recovery SolutionsDocument27 pagesMagic Quadrant For Data Center Backup and Recovery SolutionsCumhurNo ratings yet

- Framing A Winning Data Monetization StrategyDocument16 pagesFraming A Winning Data Monetization StrategypragsyNo ratings yet

- A Level - Business Studies AiDocument3 pagesA Level - Business Studies AiMariaNo ratings yet

- Use Adaptive Sourcing To Drive Double Digit Cost Optimization of It and Business ProcessesDocument14 pagesUse Adaptive Sourcing To Drive Double Digit Cost Optimization of It and Business ProcessesmwhaliNo ratings yet

- The Top Security Technology Trends To Watch, 2020Document12 pagesThe Top Security Technology Trends To Watch, 2020Karan OjhaNo ratings yet

- Gartner Security Na Brochure 2020Document8 pagesGartner Security Na Brochure 2020ramstein86No ratings yet

- Managed Services Healthcare PDFDocument4 pagesManaged Services Healthcare PDFShivangi RathiNo ratings yet

- Intel Information Risk Analyzer: Hackpions GDS ES HackathonDocument26 pagesIntel Information Risk Analyzer: Hackpions GDS ES HackathonKashish BhagatNo ratings yet

- Icici Bank Final Management Strategy Final Report 1Document14 pagesIcici Bank Final Management Strategy Final Report 1alkanm750No ratings yet

- Gartner - The Nexus of ForcesDocument38 pagesGartner - The Nexus of ForcesAdriely Nara BarbosaNo ratings yet

- Nec GteDocument63 pagesNec GteSunil PandeyNo ratings yet

- Tackling Insurtech Poll Results FinalDocument1 pageTackling Insurtech Poll Results FinalBernewsAdminNo ratings yet

- For UPSDocument16 pagesFor UPSkeyur0% (1)

- Accenture Banking Technology Vision 2019Document30 pagesAccenture Banking Technology Vision 2019Nguyen NhanNo ratings yet

- Digital Value Creation Accross The Deal CycleDocument13 pagesDigital Value Creation Accross The Deal CycleTrần Phương Thuý100% (1)

- PSEB Profile For EXPO PAKISTAN 2012Document1 pagePSEB Profile For EXPO PAKISTAN 2012muxxammilNo ratings yet

- SM Project TCSDocument32 pagesSM Project TCSShivam SenNo ratings yet

- Business Ecosystem and Platform Businesses Ebs FinalDocument10 pagesBusiness Ecosystem and Platform Businesses Ebs FinalOilid El AttariNo ratings yet

- Four - Scenarios - For - How - Cios Can Clarify or Deduce Their Business StrategiesDocument11 pagesFour - Scenarios - For - How - Cios Can Clarify or Deduce Their Business StrategiesJOSENo ratings yet

- Global - Construction, December 2019Document33 pagesGlobal - Construction, December 2019Wafa' AtsabitaNo ratings yet

- 1 SystemDocument15 pages1 SystemAminul IslamNo ratings yet

- Forecast Analysis E 717149 NDXDocument15 pagesForecast Analysis E 717149 NDX徐得胜No ratings yet

- IT-BPM Industry UpdateDocument8 pagesIT-BPM Industry UpdateGovinda SomaniNo ratings yet

- ROI Calculator For IT Service ManagementDocument10 pagesROI Calculator For IT Service ManagementashvarybabulNo ratings yet

- When Cultures Collide: Prof Papiya deDocument23 pagesWhen Cultures Collide: Prof Papiya deashvarybabulNo ratings yet

- Database Trends and Applications Magazine Dec 2018 Jan 2019 IssueDocument60 pagesDatabase Trends and Applications Magazine Dec 2018 Jan 2019 IssueashvarybabulNo ratings yet

- Module 2 The Concept of Time MTVWbDtcLeDocument2 pagesModule 2 The Concept of Time MTVWbDtcLeashvarybabulNo ratings yet

- Amul Case StudyDocument8 pagesAmul Case StudyashvarybabulNo ratings yet

- BBA Syllabus Sem-6 (Finance)Document10 pagesBBA Syllabus Sem-6 (Finance)Mukesh GiriNo ratings yet

- What Makes A Good Business Model, AnywayDocument2 pagesWhat Makes A Good Business Model, AnywayadillawaNo ratings yet

- PSCP San M Ariano FinalDocument77 pagesPSCP San M Ariano FinalMdrrmo AngadananNo ratings yet

- Macroeconomics 6th Edition Williamson Solutions ManualDocument36 pagesMacroeconomics 6th Edition Williamson Solutions Manualstirrupsillon.d8yxo100% (42)

- GST Issues For Works Contract CA Yashwant Kasar - 31st July 2021Document73 pagesGST Issues For Works Contract CA Yashwant Kasar - 31st July 2021fintech ConsultancyNo ratings yet

- Waste Management in IndiaDocument26 pagesWaste Management in IndiaAndre SuitoNo ratings yet

- Unemployment in India UnemploymentDocument5 pagesUnemployment in India UnemploymentRaj GuptaNo ratings yet

- New OpenDocument TextDocument24 pagesNew OpenDocument TextSonia GabaNo ratings yet

- EMAILDocument1 pageEMAILSmdryfruits IranianNo ratings yet

- WB - Paper-17 CMA FINALDocument131 pagesWB - Paper-17 CMA FINALvijaykumartaxNo ratings yet

- TPDM Assignment 2 by Avi Thakur (19BMSR0279)Document6 pagesTPDM Assignment 2 by Avi Thakur (19BMSR0279)Avi ThakurNo ratings yet

- International Contracts and E-Commerce - Course Hand OutDocument3 pagesInternational Contracts and E-Commerce - Course Hand Outpravinsankalp100% (2)

- Ci 040109Document40 pagesCi 040109AymanFXNo ratings yet

- Community Risk Reduction Taskforce 2018 - 2020 Strategic PlanDocument1 pageCommunity Risk Reduction Taskforce 2018 - 2020 Strategic PlanAnonymous VtK7R8eRNo ratings yet

- MBA-AFM Theory QBDocument18 pagesMBA-AFM Theory QBkanikaNo ratings yet

- Aggregate Planning Example SolvedDocument16 pagesAggregate Planning Example SolvedAbdullah ShahidNo ratings yet

- 08 AggPlanDocument27 pages08 AggPlanMahmutNo ratings yet

- Modern Auditing and Assurance Services 6th Edition Leung Solutions ManualDocument6 pagesModern Auditing and Assurance Services 6th Edition Leung Solutions ManualSonam ChophelNo ratings yet

- Central, New York, NY April 20XX: Sample Monthly Congregation Accounts Report-Cash VersionDocument2 pagesCentral, New York, NY April 20XX: Sample Monthly Congregation Accounts Report-Cash VersionAbel ServinNo ratings yet

- Globalization Visual Sources CH 23Document6 pagesGlobalization Visual Sources CH 23api-230184052No ratings yet

- Form 26QBDocument1 pageForm 26QBYashu GoelNo ratings yet

- Malling DemallingDocument25 pagesMalling DemallingalizhNo ratings yet

- Bus 2101 - Chapter 2Document24 pagesBus 2101 - Chapter 2HarshaBorresAlamoNo ratings yet

- Building A Flexible Supply Chain in Low Volume High Mix IndustrialsDocument9 pagesBuilding A Flexible Supply Chain in Low Volume High Mix IndustrialsThanhquy NguyenNo ratings yet

- RDocument671 pagesRlinhtruong.31221024012No ratings yet

- Practical Problems: Lustration 1 After 8Document4 pagesPractical Problems: Lustration 1 After 8Kiran Kumar KBNo ratings yet

- One Shot Revision - Cash Flow StatementsDocument39 pagesOne Shot Revision - Cash Flow Statementssoumithansda286No ratings yet

- Ysr Cheyutha 2022-23 Wea WWDS Field Verification Form 1.0Document1 pageYsr Cheyutha 2022-23 Wea WWDS Field Verification Form 1.0vijeyacumarrdNo ratings yet

Global - IT Services, February 2019

Global - IT Services, February 2019

Uploaded by

ashvarybabulCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Global - IT Services, February 2019

Global - IT Services, February 2019

Uploaded by

ashvarybabulCopyright:

Available Formats

Global - IT Services

REFERENCE CODE: MLIP2881-0009

PUBLICATION DATE: Feb 2019

WWW.MARKETLINEINFO.COM

© MARKETLINE. THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED

Global - IT Services Page 1

MLIP2881-0009

© MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED

EMISPDF in-nmims001 from 122.170.126.143 on 2019-08-26 07:46:18 BST. DownloadPDF.

Downloaded by in-nmims001 from 122.170.126.143 at 2019-08-26 07:46:18 BST. EMIS. Unauthorized Distribution Prohibited.

Executive Summary

Executive Summary

Market value

The global IT services industry grew by 9.2% in 2018 to reach a value of $1,002.1 billion.

Market value forecast

In 2023, the global IT services industry is forecast to have a value of $1,912.3 billion, an increase of 90.8%

since 2018.

Category segmentation

Infrastructure services is the largest segment of the global IT services industry, accounting for 59.9% of the

industry's total value.

Geography segmentation

The United States accounts for 39.9% of the global IT services industry value.

Market rivalry

The IT services industry is evolving from offering services such as outsourcing, which improve productivity

and efficiency, to providing value-added services such as analytics consulting. This has increased rivalry as

players seek to capture a share of these higher margin sectors.

Global - IT Services Page 2

MLIP2881-0009

© MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED

EMISPDF in-nmims001 from 122.170.126.143 on 2019-08-26 07:46:18 BST. DownloadPDF.

Downloaded by in-nmims001 from 122.170.126.143 at 2019-08-26 07:46:18 BST. EMIS. Unauthorized Distribution Prohibited.

Market Overview

Market Overview

Market definition

The IT services industry is valued as the combination of the business process outsourcing (BPO) services

market, the application services market and the infrastructure services market. Values include revenues

generated from (a) signed deals that remain under contract and (b) new contracts signed within that

particular calendar year.

The BPO services market is defined as the reveues from services related to the following segments:

customer relationship management (CRM), finance and accounting, human resources, knowledge process

outsourcing, and procurement and supply-chain.

The application services market is defined as the revenues from services related to the following segments:

application development, application management and application performance monitoring.

The infrastructure services market is defined as the revenues from services related to the following

segments: cloud computing, data center & hosting services, IT management, security and storage.

All currency conversions are at constant 2018 annual average exchange rates.

For the purposes of this report, the global market consists of North America, South America, Europe, Asia-

Pacific, Middle East, South Africa and Nigeria.

North America consists of Canada, Mexico, and the United States.

South America comprises Argentina, Brazil, Chile, Colombia, and Peru.

Europe comprises Austria, Belgium, the Czech Republic, Denmark, Finland, France, Germany, Greece,

Ireland, Italy, Netherlands, Norway, Poland, Portugal, Russia, Spain, Sweden, Switzerland, Turkey, and the

United Kingdom.

Scandinavia comprises Denmark, Finland, Norway, and Sweden.

Asia-Pacific comprises Australia, China, Hong Kong, India, Indonesia, Kazakhstan, Japan, Malaysia, New

Zealand, Pakistan, Philippines, Singapore, South Korea, Taiwan, Thailand, and Vietnam.

Middle East comprises Egypt, Israel, Saudi Arabia, and United Arab Emirates.

Market analysis

The Global IT services industry experienced strong growth over the past five years. The industry is set to

grow at a similar rate over the forecast period.

The IT services industry is highly correlated with the gross domestic product (GDP) of a country. This

means that the IT services industry will move according to GDP growth, due to their positive correlation.

This has been the case globally, where high GDP growth in the US and China has driven industry growth

for IT services to a new level-high.

The global IT services industry had total revenues of $1,002.1bn in 2018, representing a compound annual

growth rate (CAGR) of 13.8% between 2014 and 2018. In comparison, the Asia-Pacific and US industries

grew with CAGRs of 11.2% and 16.4% respectively, over the same period, to reach respective values of

$244.7bn and $399.7bn in 2018.

Due to a number of high-level cybersecurity threats and the interconnected nature of network technologies,

cybersecurity has become critical for many businesses. This has driven growth in the service industry and

Global - IT Services Page 3

MLIP2881-0009

© MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED

EMISPDF in-nmims001 from 122.170.126.143 on 2019-08-26 07:46:18 BST. DownloadPDF.

Downloaded by in-nmims001 from 122.170.126.143 at 2019-08-26 07:46:18 BST. EMIS. Unauthorized Distribution Prohibited.

encouraged innovation and development within the field. As a response to the increased threat of

cyberattacks, many governments have strived to implement regulations and offer support, encouraging

demand for services of this nature.

The infrastructure services segment was the industry's most lucrative in 2018, with total revenues of

$600.8bn, equivalent to 59.9% of the industry's overall value. The application services segment contributed

revenues of $226.8bn in 2018, equating to 22.6% of the industry's aggregate value.

Leading players have helped to encourage growth by diversifying service offerings and investing in

innovative ideas such as artificial intelligence (AI) and blockchain to attract new clients and compete more

effectively in the global industry.

The performance of the industry is forecast to follow a similar pattern with an anticipated CAGR of 13.8%

for the five-year period 2018 - 2023, which is expected to drive the industry to a value of $1,912.3bn by the

end of 2023. Comparatively, the Asia-Pacific and US industries will grow with CAGRs of 11.8% and 15.1%

respectively, over the same period, to reach respective values of $427.3bn and $808.8bn in 2023.

Growth in the global cloud computing industry is expected to record a forecast-period CAGR of 35.8%,

which will help to fuel growth in the IT services industry. Cloud computing systems, as well as quantum

computing, are expected to achieve dynamic growth as buyers expand the use of data centers and

advanced analytics in order to manage the vast amounts of data being produced in the connected world.

The positive impact of this transition on the IT services industry could be outbalanced by a decline in

outsourcing and processing services, as many more tasks become automated through the use of artificial

intelligence-based algorithms.

The presence of digital giants such as Google, Amazon, Baidu and Alibaba will drive growth as firms will

increasingly rely on the technology and expertise of service providers to implement and develop emerging

technologies such as big data, e-commerce and the internet of things (IoT). This trend is likely to spread

across other national industries as IT services are implemented more widely.

Global - IT Services Page 4

MLIP2881-0009

© MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED

EMISPDF in-nmims001 from 122.170.126.143 on 2019-08-26 07:46:18 BST. DownloadPDF.

Downloaded by in-nmims001 from 122.170.126.143 at 2019-08-26 07:46:18 BST. EMIS. Unauthorized Distribution Prohibited.

Market Data

Market Data

Market Value

The global IT services industry grew by 9.2% in 2018 to reach a value of $1,002.1 billion.

The compound annual growth rate of the industry in the period 2014-18 was 13.8%.

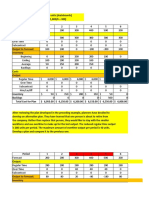

Table 1: Global IT services industry value: $ billion, 2014–18

Year $ billion € billion % Growth

2014 596.6 505.1

2015 700.0 592.7 17.3%

2016 794.7 672.9 13.5%

2017 917.3 776.7 15.4%

2018 1,002.1 848.6 9.2%

CAGR: 2014–18 13.8%

Source: MARKETLINE

Figure 1: Global IT services industry value: $ billion, 2014–18

Source: MARKETLINE

Global - IT Services Page 5

MLIP2881-0009

© MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED

EMISPDF in-nmims001 from 122.170.126.143 on 2019-08-26 07:46:18 BST. DownloadPDF.

Downloaded by in-nmims001 from 122.170.126.143 at 2019-08-26 07:46:18 BST. EMIS. Unauthorized Distribution Prohibited.

Market Segmentation

Market Segmentation

Category Segmentation

Infrastructure services is the largest segment of the global IT services industry, accounting for 59.9% of the

industry's total value.

The Application services segment accounts for a further 22.6% of the industry.

Table 2: Global IT services industry category segmentation: $ billion, 2018

Category 2018 %

Infrastructure Services 600.8 59.9

Application Services 226.8 22.6

BPO Services 174.5 17.4

Total 1,002.1 100%

Source: MARKETLINE

Figure 2: Global IT services industry category segmentation: % share, by value, 2018

Source: MARKETLINE

Geography Segmentation

The United States accounts for 39.9% of the global IT services industry value.

Global - IT Services Page 6

MLIP2881-0009

© MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED

EMISPDF in-nmims001 from 122.170.126.143 on 2019-08-26 07:46:18 BST. DownloadPDF.

Downloaded by in-nmims001 from 122.170.126.143 at 2019-08-26 07:46:18 BST. EMIS. Unauthorized Distribution Prohibited.

Europe accounts for a further 28.6% of the global industry.

Table 3: Global IT services industry geography segmentation: $ billion, 2018

Geography 2018 %

United States 399.7 39.9

Europe 286.2 28.6

Asia-Pacific 244.7 24.4

Middle East 2.5 0.3

Rest of the World 69.0 6.9

Total 1,002.1 100%

Source: MARKETLINE

Figure 3: Global IT services industry geography segmentation: % share, by value, 2018

Source: MARKETLINE

Global - IT Services Page 7

MLIP2881-0009

© MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED

EMISPDF in-nmims001 from 122.170.126.143 on 2019-08-26 07:46:18 BST. DownloadPDF.

Downloaded by in-nmims001 from 122.170.126.143 at 2019-08-26 07:46:18 BST. EMIS. Unauthorized Distribution Prohibited.

Market Outlook

Market Outlook

Market Value Forecast

In 2023, the global IT services industry is forecast to have a value of $1,912.3 billion, an increase of 90.8%

since 2018.

The compound annual growth rate of the industry in the period 2018-23 is predicted to be 13.8%.

Table 4: Global IT services industry value forecast: $ billion, 2018–23

Year $ billion € billion % Growth

2018 1,002.1 848.6 9.2%

2019 1,109.2 939.2 10.7%

2020 1,247.6 1,056.4 12.5%

2021 1,424.3 1,206.0 14.2%

2022 1,652.5 1,399.2 16.0%

2023 1,912.3 1,619.2 15.7%

CAGR: 2018–23 13.8%

Source: MARKETLINE

Figure 4: Global IT services industry value forecast: $ billion, 2018–23

Source: MARKETLINE

Global - IT Services Page 8

MLIP2881-0009

© MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED

EMISPDF in-nmims001 from 122.170.126.143 on 2019-08-26 07:46:18 BST. DownloadPDF.

Downloaded by in-nmims001 from 122.170.126.143 at 2019-08-26 07:46:18 BST. EMIS. Unauthorized Distribution Prohibited.

Five Forces Analysis

Five Forces Analysis

The IT services market will be analyzed taking providers of it outsourcing & processing, it consulting &

support and cloud computing services as players. The key buyers will be taken as businesses and

government agencies, and providers of hardware devices and software tools, as well as skilled employees

as the key suppliers.

Summary

Figure 5: Forces driving competition in the global IT services industry, 2018

Source: MARKETLINE

The IT services industry is evolving from offering services such as outsourcing, which improve productivity

and efficiency, to providing value-added services such as analytics consulting. This has increased rivalry as

players seek to capture a share of these higher margin sectors.

The IT services industry is fragmented, with small players competing alongside large multinationals.

Services have become increasingly globalized and are likely to become gradually automated, particularly

due to the adoption of cloud computing services. Buyers range in size; larger buyers, with greater financial

muscle, exert more buyer power.

Brand recognition is of significant importance to customers and many look to reputable companies for

services. This is particularly the case for players involved in IT outsourcing and data processing, where

consistent quality and security are key factors in winning contracts.

Skilled employees, as suppliers of technical knowledge and expertise, are an important input. Other inputs

include hardware components, which tend to be purchased from a sole supplier, increasing their power. In

contrast, some companies engage in backwards integration with their own hardware and software

capabilities, which reduces their reliance on external suppliers.

Global - IT Services Page 9

MLIP2881-0009

© MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED

EMISPDF in-nmims001 from 122.170.126.143 on 2019-08-26 07:46:18 BST. DownloadPDF.

Downloaded by in-nmims001 from 122.170.126.143 at 2019-08-26 07:46:18 BST. EMIS. Unauthorized Distribution Prohibited.

A substitute is to employ and train in-house staff to provide IT services. In times of economic difficulty,

some companies may rely on existing staff rather than third-party service providers. However, the services

offered by industry players do provide several key advantages. As such, the threat from substitutes remains

moderate.

Buyer Power

Figure 6: Drivers of buyer power in the global IT services industry, 2018

Source: MARKETLINE

Buyers range in size from small businesses to multinational companies and government agencies. Larger

buyers, with greater financial muscle, exert more buyer power. Contracts between industry players and

buyers vary according to the service provided. Some IT service contracts can last for several years, which

can translate into substantial switching costs for buyers should they wish to terminate the agreement early.

However, consulting contracts tend to be shorter and there is a growing trend towards shorter duration

contracts. Contracts with large customers are often secured after a bidding process. Consequently, such

customers enjoy greater buyer power.

There are small and big players in the market offering slightly differentiated products, giving buyers the

upper hand, as they are able to choose from a variety of market players. However, brand recognition is

likely to be of significant importance to customers, particularly when it comes to electronic data processing.

Buyers will often look to a reputable company for such services; this is especially the case regarding

government contracts, which have heightened media scrutiny in terms of IT failures. Services offered are

often critical to the successful operation of a business, which reduces buyer power considerably. Full

backwards integration by buyers is unlikely, even in cases where in-house IT services have been

developed; however, those IT services cannot match the quality of products the market players can provide

due to years of experience, decreasing buyer power overall. Although this could decrease buyer power, it is

mitigated by the fact that players are reluctant to integrate forwards into buyers' areas of operation,

industries in which players may not necessarily have any experience.

Services are relatively undifferentiated, which has given rise to strong price competition, driven by a

reduction in labor costs, and has encouraged multinational providers to relocate to low-cost locations. This

shows the power that buyers have in influencing player practices. Large-scale players seek to differentiate

themselves in terms of customer relations and are likely to become more successful as they develop more

complex offerings; IBM, for instance, has developed ‘System One’, a quantum computer which is 1,000

times faster than a normal computing system, which can offer its services to all institutions around the world

via cloud access, which will serve to weaken buyer power. While some smaller companies may seek to

drive down the cost of services by seeking the best prices from players, for many buyers, the quality of the

services offered is of the utmost importance as the quality of the buyer's product is greatly affected by this.

Global - IT Services Page 10

MLIP2881-0009

© MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED

EMISPDF in-nmims001 from 122.170.126.143 on 2019-08-26 07:46:18 BST. DownloadPDF.

Downloaded by in-nmims001 from 122.170.126.143 at 2019-08-26 07:46:18 BST. EMIS. Unauthorized Distribution Prohibited.

It is particularly important for multinational corporations and government agencies to ensure they obtain a

high-quality product as failures could be extremely costly. However, due to the fact that government

agencies and big corporations often employ market players through auctions, or price competitions, they

force market players to complete with each other for the same kind of services, giving buyers the power to

choose the best price. Therefore, in this industry, there is a mix of buyers willing to pay less for services

and willing to pay more for high quality services.

Overall, buyer power is assessed as moderate.

Supplier Power

Figure 7: Drivers of supplier power in the global IT services industry, 2018

Source: MARKETLINE

A critical industry input is staff with appropriate technical knowledge and expertise. Industry players rely on

the continued service of qualified employees, and high rates of staff turnover can be detrimental. This can

be regarded as a high switching cost, with employees viewed as suppliers of such expertise. Competition

for talented developers is strong among large-scale players. The US, Europe and Japan are considered to

be the 'triad' of knowledge economies and are at the forefront of many technological developments. As

such there is a large pool of skilled labor in these economies, which reduces supplier power to an extent.

Equally, global IT outsourcing has played a key role in developing Bangalore and Hyderabad as technology

hubs, which has increased the availability of qualified workers for the domestic Indian market.

Taking into consideration that suppliers in this industry are mainly highly paid and skillful employees, it

makes the industry a crucial component of suppliers' livelihoods, due to their specialised expertise providing

services based on this specific industry. Its highly likely for suppliers to move into the industry themselves,

due to the experience they could acquire over the years, making them willing and confident to start their

own companies and organizations. The amount of alternative raw materials is relatively low, as raw

materials in this industry are hardware components and software; this increases supplier power.

Inputs such as hardware components are often purchased from sole suppliers. Suppliers are normally large

companies offering high-quality differentiated products, resulting in significant supplier power. The software

market is dominated by large international companies; leading suppliers include Microsoft Corporation,

Oracle Corporation and SAP AG. In contrast, companies such as IBM engage in backwards integration –

the company has its own hardware and software capabilities – reducing its reliance on external suppliers.

Alternative solutions exist for most software and network suppliers.

Software suppliers may begin to forward integrate once more complex software is required to provide IT

services linked to powerful computers, offering parallel processing and advanced analytical techniques,

which will increase supplier power. Microsoft, for example, runs a predictive analytics service based around

Global - IT Services Page 11

MLIP2881-0009

© MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED

EMISPDF in-nmims001 from 122.170.126.143 on 2019-08-26 07:46:18 BST. DownloadPDF.

Downloaded by in-nmims001 from 122.170.126.143 at 2019-08-26 07:46:18 BST. EMIS. Unauthorized Distribution Prohibited.

its Azure cloud platform, while IBM gives access to their new quantum computer System One to institutions

around the world through the cloud.

Supplier power in this industry is assessed as strong overall.

New Entrants

Figure 8: Factors influencing the likelihood of new entrants in the global IT services industry, 2018

Source: MARKETLINE

Entry on a small scale is achievable in the IT services industry; some smaller players have grown as both

government and commercial institutions increasingly turn to third-parties to provide specialized IT support.

Similarly, buyers seek to cut costs wherever possible and data processing and other business processes

have increasingly been outsourced to specialists; allowing clients to focus on core activities. Newly

developing niche markets will offer opportunities for smaller players in areas such as green IT and the IoT.

Equally, industry specialists operating in the key markets of healthcare and finance have notable

opportunities.

Large companies in this industry have significant economies of scale in processing and can offer more

services; smaller companies can compete by specializing in particular verticals, and offering customized

services. However, prominent companies, relying on an established image, may be unwilling to trust

smaller, less established companies, giving larger industry players an advantage. While there is a relatively

large number of expert staff in this industry, many will be attracted to firms such as IBM and Accenture as

they are often able to offer greater incentives, such as development opportunities and higher pay. This may

deter new entrants as they may lack the reputation and ability to attract the most experienced staff.

Regulation is varied and largely dependent on the service offered and the buyers involved. For example,

data processing services for financial institutions are often stringently regulated. In the US, they are subject

to examination by the Federal Financial Institutions Examination Council, an interagency body comprising

the federal bank, thrift regulators, and the National Credit Union Association. Restrictions on data flows

between different countries may restrict the expansion capabilities of new entrants. Some countries have

introduced a variety of incentives in a bid to encourage new entrants, these include competitive tax rates,

funding for start-ups and R&D programs. In Singapore, the government has introduced a range of policies

and regulations to encourage innovation and support the Smart Nation initiative; this includes encouraging

technology start-ups by doing business with them rather than making them rely on grants. Regions which

implement favorable policies are likely to attract new entrants.

Blockchain technology has increased the number of new entrants in the market as it is not regulated, so

companies have a certain amount of freedom when using this particular technology. However, companies

Global - IT Services Page 12

MLIP2881-0009

© MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED

EMISPDF in-nmims001 from 122.170.126.143 on 2019-08-26 07:46:18 BST. DownloadPDF.

Downloaded by in-nmims001 from 122.170.126.143 at 2019-08-26 07:46:18 BST. EMIS. Unauthorized Distribution Prohibited.

using blockchain technology have to be particularly careful and, most of the time, have to publish their

financials, due to fear of persecution from the government, based on fraud allegations.

Fixed costs for the market are relatively high, due to the energy and electricity consumption server rooms

require. In order to provide their services, even via cloud, IT companies require a large amount of space for

their server rooms, consuming high levels of electricity. To provide high-end services and keep them up to

date, server rooms require constant maintenance from high expertise personnel, increasing fixed costs.

In addition, new entrants require highly skilled employees in order to be able to compete with already

established market players, which are well-known in the industry through their brand image, rendering entry

even more difficult.

The markets in which the companies in this industry operate are subject to technological advances,

developing industry standards, and changing customer needs and preferences. The success of a company

is dependent on its ability to anticipate and adapt to changes. Large companies are therefore becoming

increasingly concerned with procuring other companies as they seek to obtain the technological advances

of small and innovative firms. IBM for example, as stated in its 2015 annual report, spent over $15bn

between 2010 and 2015 on more than 20 acquisitions relating to big data and analytics.

Increasing demand for the technology and expertise to implement emerging technologies such as big data,

e-commerce and the IoT will continue to attract new entrants into the industry.

Distribution is often limited by technological infrastructure, meaning new entrants to developing markets will

find it difficult to expand. The World Economic Forum's latest Global Information Technology report ranks

the US fifth, Brazil 72nd, Germany 15th, China 59th, and India 91st out of 139 countries in terms of network

readiness, suggesting that the global industry has very varied levels of development in terms of IT

infrastructure. Intellectual property is likely to become increasingly important as the industry shifts to more

complex service offerings; IBM, for example, has obtained over 97,000 patents since 1993. This will

weaken opportunities for new entrants.

The likelihood of new entrants to this industry is assessed as strong.

Threat of substitutes

Figure 9: Factors influencing the threat of substitutes in the global IT services industry, 2018

Source: MARKETLINE

An alternative to a number of services offered in this industry is to employ and train in-house staff to provide

such services. In times of economic difficulty, some companies may rely on existing staff rather than third-

party service providers. However, the services offered by industry players do provide several key

Global - IT Services Page 13

MLIP2881-0009

© MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED

EMISPDF in-nmims001 from 122.170.126.143 on 2019-08-26 07:46:18 BST. DownloadPDF.

Downloaded by in-nmims001 from 122.170.126.143 at 2019-08-26 07:46:18 BST. EMIS. Unauthorized Distribution Prohibited.

advantages. Key employees may be released from performing non-core or administrative processes,

allowing a company to concentrate wholly on its core activities.

The increasing automation of IT services will pose difficulties for many players as buyers seek to bring

more services in-house. This will also allow the service arms of hardware and software suppliers to act as

substitutes for traditional IT services players. Equally, professional services firms such as KPMG are

increasingly offering IT services due to the relative ease of replicating service models.

Business can be more flexible by not investing in assets and reducing response times to environmental

changes. However, using outsourcing or consulting companies can result in a loss of internal business

process know-how, and consequently result in a dependency on service providers.

Overall, there is a moderate threat from substitutes in this industry.

Degree of rivalry

Figure 10: Drivers of degree of rivalry in the global IT services industry, 2018

Source: MARKETLINE

Despite the presence of large, international incumbents such as IBM, HP, Fujitsu and Accenture, the

industry is fragmented. There is some evidence of consolidation, with M&A activity common. For example,

IBM acquired the enterprise Linux business Red Hat for $33.4bn in order to assert and strengthen its cloud

dominance, a significantly larger amount than what many of its rivals plan to spend. This has helped IBM to

spread its expertise into new technological fields, such as quantum computing and cloud computing, which

has proven lucrative due to the increasing popularity of infrastructure services.

The number of competitors varies between countries. The US has more than 100,000 software and IT

services companies, over 99% of which are SMEs – which increases rivalry in comparison to Brazil, which

has closer to 3,000 IT services companies. The Chinese industry is more fragmented than other countries,

with competition in this industry being dominated by small firms with less than 50 employees. A key factor

in the Chinese industry is that there are almost no IT services inputs or imports from foreign economies,

which highlights that most international service providers already have a presence in China.

Large players attempt to differentiate themselves through a number of initiatives in an effort to boost their

competitive edge. Companies such as IBM offer a variety of services and products including hardware and

software, which serves to ease rivalry as they are not solely reliant on the revenues generated from this

industry. In addition, developments in social network, mobile, analytic and cloud technologies have begun

to allow players to offer more value-added services, increasing rivalry in terms of intellectual property and

the need for perpetual innovation. Due to a number of high-level cybersecurity threats and the

interconnected nature of network technologies, cybersecurity has become crucial for many businesses. IBM

Global - IT Services Page 14

MLIP2881-0009

© MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED

EMISPDF in-nmims001 from 122.170.126.143 on 2019-08-26 07:46:18 BST. DownloadPDF.

Downloaded by in-nmims001 from 122.170.126.143 at 2019-08-26 07:46:18 BST. EMIS. Unauthorized Distribution Prohibited.

securities has established itself as a leading player in this field; the company partnered with Cisco in 2017,

and has since shared intelligence between internal research groups when investigating hacks. Partnerships

of this nature can help players gain a competitive edge, reducing the degree of rivalry.

While switching costs for small businesses in this industry can be relatively low, for large corporations and

government agencies, switching providers for certain services, such as infrastructure, can incur high costs

and damage reputations if services are down for a long period of time. High switching costs for some will

reduce the degree of rivalry, as players may become locked into using a certain supplier. In the UK, Fujitsu

and Capgemini have provided government agency HMRC with IT services since 2008 and have received

£12.9bn throughout the years, highlighting the importance of attracting buyers.

The globalized nature of the industry increases rivalry with regard to cost reductions, which has driven the

rapid expansion of export services in countries such as India, where competitive contractual terms are key

success factors. This has historically been linked to labor costs, but may develop into storage costs as

restrictions on data flows mean that data centers will proliferate.

Security and secrecy are also key factors in terms of data storage, which is perhaps why traditional tax

havens top the list of countries with the most secure internet servers per million people – Liechtenstein,

Bermuda, Monaco, Switzerland, Luxembourg and the Isle of Man are all in the top 10. However, services

offered by most industry players are essentially similar and companies are highly reliant on revenues from

the industry.

Following a contraction in 2015, the industry has returned to growth, which has alleviated the degree of

rivalry between players and reduced the likelihood of a zero-sum game.

Overall, the degree of rivalry is assessed as moderate.

Global - IT Services Page 15

MLIP2881-0009

© MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED

EMISPDF in-nmims001 from 122.170.126.143 on 2019-08-26 07:46:18 BST. DownloadPDF.

Downloaded by in-nmims001 from 122.170.126.143 at 2019-08-26 07:46:18 BST. EMIS. Unauthorized Distribution Prohibited.

Leading Companies

Leading Companies

Accenture plc

Table 5: Accenture plc: key facts

DetailType Detail

Head office: 1 Grand Canal Square, Grand Canal Harbour,

Dublin, IRL

Telephone: 353 1 6462000

Fax: 353 1 6462020

Website: www.accenture.comie-en

Financial year-end: August

Ticker: ACN

Stock exchange: New York

Source: COMPANY WEBSITE

Accenture plc (Accenture) is a global management consulting, technology services and outsourcing

company. It operates across 200 cities in 55 countries in the Americas, Europe, Middle East and Africa

(EMEA), and Asia-Pacific. Accenture provides services through a global network of over 50 delivery

centers.

The company's business is structured into five divisions, which together comprise 13 industry groups that

serve more than 40 industries. The firm’s five divisions include: products; financial services;

communications, media and technology; resources; and health and public service.

The products division serves a set of increasingly interconnected consumer-relevant industries. The

consumer goods, retail and travel services industry group serves food and beverage, household goods,

personal care, tobacco, fashion, agribusiness and consumer health companies; supermarkets, hardline

retailers, mass-merchandise discounters, department stores and specialty retailers; as well as airlines, and

hospitality and travel services companies. The industrial industry group works with automotive

manufacturers and suppliers; freight and logistics companies; industrial and electrical equipment; consumer

durable and heavy equipment companies; and construction and infrastructure management firms. The life

sciences industry group serves pharmaceutical, medical technology and biotechnology companies.

The financial services division serves the banking, capital markets and insurance industries. Professionals

in this division work with clients to address growth, cost and profitability pressures, industry consolidation,

regulatory changes, and address the need to adapt to new digital technologies. The division comprises the

banking and capital markets industry group which serves retail and commercial banks, mortgage lenders,

investment banks, wealth and asset management firms, brokers/dealers, depositories, exchanges, clearing

and settlement organizations, and other diversified financial enterprises. The insurance industry group

serves property and casualty insurers, life insurers, reinsurance firms and insurance brokers.

The communications, media and technology division serves the communications, electronics, high

technology, media and entertainment industries. It comprises the communications industry group, which

serves wireline, wireless, cable, and satellite communication and service providers. The electronics and

high-tech industry group serves the information and communication technology, software, semiconductor,

consumer electronics, aerospace and defense, and medical equipment industries. While the media and

Global - IT Services Page 16

MLIP2881-0009

© MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED

EMISPDF in-nmims001 from 122.170.126.143 on 2019-08-26 07:46:18 BST. DownloadPDF.

Downloaded by in-nmims001 from 122.170.126.143 at 2019-08-26 07:46:18 BST. EMIS. Unauthorized Distribution Prohibited.

entertainment industry group serves the broadcast, entertainment, print, publishing and internet/social

media industries.

The resources division serves the chemicals, energy, forest products, metals and mining, and utilities

industries. It comprises the chemicals and natural resources industry group, which works with the

petrochemicals, specialty chemicals, polymers and plastics, gases, agricultural chemicals, metals, mining,

forest products and building materials industries. The energy industry group serves a range of companies in

the oil and gas industry, including upstream, downstream, oil services and new energy companies, while

the utilities industry group works with electric, gas and water utilities firms.

The health and public service division serves healthcare payers and providers, as well as government

departments and agencies, public service organizations, educational institutions and non-profit

organizations. It comprises the health industry group which works with healthcare providers, such as

hospitals, public health systems, policy-making authorities, health insurers (payers), and industry

organizations and associations. The public service industry group primarily works with defense departments

and military forces, public safety authorities such as police forces and border management agencies,

justice departments, human services agencies, and educational institutions.

In addition, the company offers services across five growth platforms: Accenture strategy, Accenture

consulting, Accenture digital, Accenture technology, and Accenture operations.

Accenture strategy offers a range of services focused on areas such as digital technologies; enterprise

architecture and applications, finance and enterprise performance, IT, mergers and acquisitions,

operations, sales and customer service, sustainability, and talent and organization.

Accenture consulting provides insight, management and technology consulting services. Its consulting

capabilities enable clients to design and implement transformational change programs, either for one or

more functions or business units, or across their entire organization. It provides industry-specific consulting

services, as well as functional and technology consulting services. The functional and technology

consulting services include finance and enterprise performance; supply chain and operations; talent and

organization; customers and channels; applications and architecture advisory; and technology advisory.

Accenture digital combines capabilities in digital marketing, mobility and analytics to help clients provide a

better experience to the customers they serve, create new products and business models, and enhance

their digital enterprise capabilities and connections. It provides digital services across three key areas:

Accenture interactive, an end-to-end marketing solutions that help clients deliver multi-channel customer

experiences and enhance their marketing performance. The services span customer experience design,

digital marketing, personalization and commerce, as well as digital content production and operations.

Accenture mobility provide clients with practical innovations in connectivity and the Internet of Things (IoT)

to transform business processes and enable new operating models. Its mobility capabilities include

collecting and exchanging data through connected devices, mobile applications, embedded software and

sensor technology. Accenture analytics delivers insight-driven outcomes at scale to help clients improve

their performance. Its capabilities range from implementing analytics technologies such as big data to

advanced mathematical modeling and statistical analysis.

Accenture technology comprises technology delivery, innovation and ecosystem solutions. Technology

delivery includes the company's application services, spanning systems integration and application

outsourcing, a portfolio of software solutions, and global delivery capabilities. The technology innovation

and ecosystem side focuses on innovation through the firm’s R&D activities. The company also manages

technology platforms and alliance relationships across a range of providers, including SAP, Oracle,

Microsoft, salesforce.com, Workday, and Pegasystems.

Accenture operations provides business process, infrastructure, security and cloud services, including the

Accenture Cloud Platform. The company offers services for specific business functions, such as finance

and accounting, procurement, marketing, human resources and learning, as well as industry-specific

services, such as credit and health platforms. Accenture's infrastructure and cloud services provide

infrastructure and security design, implementation and operation services to help organizations take

advantage of innovative technologies and improve the efficiency and effectiveness of their existing

technology.

Global - IT Services Page 17

MLIP2881-0009

© MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED

EMISPDF in-nmims001 from 122.170.126.143 on 2019-08-26 07:46:18 BST. DownloadPDF.

Downloaded by in-nmims001 from 122.170.126.143 at 2019-08-26 07:46:18 BST. EMIS. Unauthorized Distribution Prohibited.

Key Metrics

The company recorded revenues of $41,603 million in the fiscal year ending August 2018, an increase of

13.2% compared to fiscal 2017. Its net income was $4,060 million in fiscal 2018, compared to a net income

of $3,445 million in the preceding year.

Table 6: Accenture plc: key financials ($)

$ million 2014 2015 2016 2017 2018

Revenues 31,875.0 32,914.0 34,797.7 36,765.5 41,603.4

Net income 2,941.5 3,054.0 4,111.9 3,445.2 4,059.9

(loss)

Total assets 17,930.5 18,266.0 20,609.0 22,689.9 13,585.6

Total liabilities 11,645.1 12,132.0 13,053.7 13,740.4 14,084.3

Employees 319,000.0 358,000.0 384,000.0 384,000.0 459,000.0

Source: COMPANY FILINGS

Table 7: Accenture plc: key financial ratios

Ratio 2014 2015 2016 2017 2018

Profit margin 9.2% 9.3% 11.8% 9.4% 9.8%

Revenue growth 11.6% 3.3% 5.7% 5.7% 13.2%

Asset growth 6.3% 1.9% 12.8% 10.1% (40.1%)

Liabilities growth 1.8% 4.2% 7.6% 5.3% 2.5%

Debt/asset ratio 64.9% 66.4% 63.3% 60.6% 103.7%

Return on 16.9% 16.9% 21.2% 15.9% 22.4%

assets

Revenue per $99,922 $91,939 $90,619 $95,743 $90,639

employee

Profit per $9,221 $8,531 $10,708 $8,972 $8,845

employee

Source: COMPANY FILINGS

Global - IT Services Page 18

MLIP2881-0009

© MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED

EMISPDF in-nmims001 from 122.170.126.143 on 2019-08-26 07:46:18 BST. DownloadPDF.

Downloaded by in-nmims001 from 122.170.126.143 at 2019-08-26 07:46:18 BST. EMIS. Unauthorized Distribution Prohibited.

Figure 11: Accenture plc: revenues & profitability

Source: COMPANY FILINGS

Figure 12: Accenture plc: assets & liabilities

Source: COMPANY FILINGS

Fujitsu Limited

Table 8: Fujitsu Limited: key facts

DetailType Detail

Head office: Shiodome City Center, 1-5-2, Higashi-Shimbashi,

Minato-Ku, Tokyo, JPN

Telephone: 81 3 62522220

Website: www.fujitsu.comglobal

Financial year-end: March

Global - IT Services Page 19

MLIP2881-0009

© MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED

EMISPDF in-nmims001 from 122.170.126.143 on 2019-08-26 07:46:18 BST. DownloadPDF.

Downloaded by in-nmims001 from 122.170.126.143 at 2019-08-26 07:46:18 BST. EMIS. Unauthorized Distribution Prohibited.

DetailType Detail

Ticker: 6702

Stock exchange: Tokyo

Source: COMPANY WEBSITE

Fujitsu Limited (Fujitsu) offers ICT solutions. The company's business encompasses the development,

manufacture, sale and maintenance of electronic devices that make these services possible. Its key

products include software, networks, electronics devices, IT products and systems, and other products.

Fujitsu’s portfolio includes the management of infrastructure, business and application, hybrid IT and cloud,

and product support services. It also supplies infrastructure, industry and business and technology

solutions. The company has a presence in more than 100 countries globally.

The company operates through four business segments: technology solutions, ubiquitous solutions, device

solutions, and other operations.

The technology solutions segment provides solutions/system integration services for IT system consulting

and construction, and infrastructure services centered on outsourcing services, such as complete

information system operations and the management of such systems. The company also offers platforms

such as servers and storage systems, which form the backbone of information systems, along with network

products such as mobile phone base stations, optical transmission systems, and other communication

infrastructure. Its system products comprise mainframes, UNIX, mission-critical IA and x86 servers; storage

systems; and middleware on which information systems are built. Network products include mobile phone

base stations, optical transmission systems, network management systems and other equipment used to

build communications infrastructure.

Fujitsu's ubiquitous solutions segment is engaged in the manufacturing of PCs, mobile phones, and mobile

wear. PCs include desktops, laptops, water- and dust-resistant tablets, and customization options. Fujitsu

offers smartphones with advanced central processing units (CPUs) as well as the Raku-Raku Phone series.

Through mobile wear, the company offers connectivity products such as car navigation systems, mobile

communication equipment and automotive electronics.

The device solutions segment includes LSI devices and electronic components. Electronic components

include semiconductor packages, batteries, structural components such as relays, connectors, optical

transceiver modules, and printed circuit boards. Fujitsu Semiconductor Limited manufactures and designs

semiconductors and provides solutions and support to meet the various needs of its customers. Its products

and services include ASICs/COT, ASSPs, and Ferroelectric RAM (FRAM), with wide-ranging expertise

focusing on imaging, wireless, automotive and security applications. The segment also looks at power

efficiency and environmental initiatives.

The other operations segment includes an expansion in strategic investments, primarily in next-generation

cloud platforms as a platform for using the IoT.

Key Metrics

The company recorded revenues of $36,565 million in the fiscal year ending March 2018, a decrease of

.8% compared to fiscal 2017. Its net income was $1,511 million in fiscal 2018, compared to a net income of

$789 million in the preceding year.

Table 9: Fujitsu Limited: key financials ($)

$ million 2014 2015 2016 2017 2018

Revenues 42,489.2 42,406.8 42,282.7 36,873.2 36,564.6

Net income 1,010.1 1,249.3 774.1 789.5 1,510.8

(loss)

Total assets 27,474.7 29,184.0 28,784.2 28,473.7 27,849.4

Total liabilities 21,207.7 20,847.6 21,800.4 20,611.0 18,144.3

Global - IT Services Page 20

MLIP2881-0009

© MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED

EMISPDF in-nmims001 from 122.170.126.143 on 2019-08-26 07:46:18 BST. DownloadPDF.

Downloaded by in-nmims001 from 122.170.126.143 at 2019-08-26 07:46:18 BST. EMIS. Unauthorized Distribution Prohibited.

$ million 2014 2015 2016 2017 2018

Employees 163,374.0 162,393.0 159,000.0 155,000.0 155,000.0

Source: COMPANY FILINGS

Table 10: Fujitsu Limited: key financials (¥)

¥ million 2014 2015 2016 2017 2018

Revenues 4,762,445.0 4,753,210.0 4,739,294.0 4,132,972.0 4,098,379.0

Net income 113,215.0 140,024.0 86,763.0 88,489.0 169,340.0

(loss)

Total assets 3,079,534.0 3,271,121.0 3,226,303.0 3,191,498.0 3,121,522.0

Total liabilities 2,377,085.0 2,336,724.0 2,443,521.0 2,310,206.0 2,033,725.0

Source: COMPANY FILINGS

Table 11: Fujitsu Limited: key financial ratios

Ratio 2014 2015 2016 2017 2018

Profit margin 2.4% 2.9% 1.8% 2.1% 4.1%

Revenue growth 8.7% (0.2%) (0.3%) (12.8%) (0.8%)

Asset growth 1.0% 6.2% (1.4%) (1.1%) (2.2%)

Liabilities growth 11.1% (1.7%) 4.6% (5.5%) (12.0%)

Debt/asset ratio 77.2% 71.4% 75.7% 72.4% 65.2%

Return on 3.7% 4.4% 2.7% 2.8% 5.4%

assets

Revenue per $260,073 $261,137 $265,929 $237,892 $235,901

employee

Profit per $6,183 $7,693 $4,868 $5,093 $9,747

employee

Source: COMPANY FILINGS

Global - IT Services Page 21

MLIP2881-0009

© MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED

EMISPDF in-nmims001 from 122.170.126.143 on 2019-08-26 07:46:18 BST. DownloadPDF.

Downloaded by in-nmims001 from 122.170.126.143 at 2019-08-26 07:46:18 BST. EMIS. Unauthorized Distribution Prohibited.

Figure 13: Fujitsu Limited: revenues & profitability

Source: COMPANY FILINGS

Figure 14: Fujitsu Limited: assets & liabilities

Source: COMPANY FILINGS

Hewlett Packard Enterprise Company

Table 12: Hewlett Packard Enterprise Company: key facts

DetailType Detail

Head office: 3000 Hanover St, California 94304 1112, Palo Alto,

California, USA

Telephone: 1 650 6875817

Fax: 1 302 6555049

Website: investors.hpe.com

Global - IT Services Page 22

MLIP2881-0009

© MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED

EMISPDF in-nmims001 from 122.170.126.143 on 2019-08-26 07:46:18 BST. DownloadPDF.

Downloaded by in-nmims001 from 122.170.126.143 at 2019-08-26 07:46:18 BST. EMIS. Unauthorized Distribution Prohibited.

DetailType Detail

Financial year-end: October

Ticker: HPE

Stock exchange: New York

Source: COMPANY WEBSITE

Hewlett Packard Enterprise Company (HPE) provides technology solutions to optimize traditional IT

systems. The company's portfolio of offerings includes enterprise IT solutions – servers, storage,

networking, converged systems, and software – and customized financial solutions. HPE operates in Africa,

the Americas, the Asia-Pacific, Europe and the Middle East.

The company operates through five segments: Enterprise Group (EG), Enterprise services, financial

services, software, and corporate investments.

HPE’s EG segment offers a range of enterprise technology solutions for next-generation applications, web

services and user experiences. It offers servers, storage, networking, and technology services. In addition,

it offers HPE OneView, unified display software-defined infrastructure management solutions and the HPE

Helion cloud portfolio, a portfolio of hybrid cloud solutions, services and software.

HPE servers offer both industry standard servers (ISSs) and business critical systems (BCSs). ISSs

provide a range of products, including entry level, HPE ProLiant, and workload-specific servers for high-

performance computing, big data, and hyperscale workloads. In addition, the company offers Integrity

servers based on the Intel Itanium processor, HPE Integrity NonStop solutions and mission critical x86 HPE

ProLiant servers.

The company's storage solutions include platforms for enterprises and small- and medium-size business

(SMB) environments. Its flagship product, 3PAR StoreServ Storage Platform, is designed for virtualization,

the cloud, and IT-as-a-service (ITaaS). Traditional storage solutions include tape, storage networking and

legacy external disk products such as EVA and XP. Converged storage solutions include the 3PAR

StoreServ, StoreOnce and StoreVirtual products.

HPE's network offerings include switches, routers, wireless local area network (WLAN) and network

management products that deliver consistent solutions that span the data center, campus and branch

environments and deliver software-defined networking (SDN) and unified communications capabilities. The

company's unified wired and wireless networking offerings include WLAN access points, controllers, and

switches. Networking solutions are based on FlexNetwork architecture, designed to enable server

virtualization, unified communications, and business application delivery for the enterprises.

The company's technology services provide support and consulting services. Support service offerings

span various levels of customer support needs and include: HPE Foundation Care, a portfolio of reactive

hardware and software support services; HPE Proactive Care, which combines remote support technology

for real-time monitoring with rapid access for technical experts; HPE Datacenter Care, end-to-end support

that enables customers to build, operate or consume IT in private or hybrid cloud environments; and

Lifecycle Event services, which are event-based services. Consulting services are focused on cloud

mobility and big data and provide IT organizations with advice, design, implementation, migration and the

optimization of EG's platforms, such as servers, storage, networking and converged infrastructure.

HPE's Enterprise services segment offers technology consulting, outsourcing and support services across

infrastructure, applications and business process domains in traditional and strategic enterprise service

offerings. These include analytics and data management, security and cloud services.

Infrastructure technology outsourcing encompasses the management of data centers, IT security, cloud

computing, workplace technology, networks, unified communications and enterprise service management.

The company provides a range of managed services that provide a cross-section of broader infrastructure

offerings for smaller, discrete engagements. Application and business services include application

development, testing, modernization, system integration, the maintenance and management of both

packaged and custom-built applications, and cloud offerings. It also offers intellectual property-based

industry solutions, alongside technologies and related services for customer relationship management,

finance and administration, human resources, payroll and document processing.

Global - IT Services Page 23

MLIP2881-0009

© MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED

EMISPDF in-nmims001 from 122.170.126.143 on 2019-08-26 07:46:18 BST. DownloadPDF.

Downloaded by in-nmims001 from 122.170.126.143 at 2019-08-26 07:46:18 BST. EMIS. Unauthorized Distribution Prohibited.

HPE’s financial services segment offers flexible investment solutions, including leasing, financing, IT

consumption, utility programs, asset management services that facilitate unique technology deployment

models, and the acquisition of complete IT solutions. In addition, the segment offers a range of investment

solution capabilities for large enterprise customers and channel partners, alongside an array of financial

options to SMBs and educational and governmental entities.

The company's software segment provides big data analytics and applications, application testing and

delivery management, security and information governance, and IT operations management solutions for

businesses and enterprises. Its offerings include licenses, support, professional services and software-as-

a-service (SaaS).

HPE's big data analytics and applications suite includes HPE Vertica, an analytics database technology for

machine, structured and semi-structured data; HPE IDOL, an analytics tool for human information; as well

as solutions for archiving, data protection, eDiscovery, information governance and enterprise content

management. These solutions are delivered via on-premise, and SaaS and hybrid delivery models. The

application testing and delivery management group provides software that enables organizations to deliver

high-performance applications, accelerate the application delivery life cycle and automate the testing

processes to ensure the quality and scalability of desktop, web, mobile and cloud-based applications.

HPE's security and information governance is designed to disrupt fraud, hackers and cyber criminals by

testing and scanning software and websites for security vulnerabilities, improving network defenses and

security, implementing security controls, safeguarding data at rest, in motion and in use, and providing

security intelligent, analytics, and information management to identify threats and manage risks. In addition,

the firm’s IT operations management solutions group provides the software required to automate routine IT

tasks and to identify problems.

The company's corporate investments include Hewlett Packard Labs and certain cloud-related business

incubation projects.

Geographically, the company classifies its operations into three segments: the US, the UK and other

countries.

Key Metrics

The company recorded revenues of $30,852 million in the fiscal year ending October 2018, an increase of

6.9% compared to fiscal 2017. Its net income was $1,908 million in fiscal 2018, compared to a net income

of $344 million in the preceding year.

Table 13: Hewlett Packard Enterprise Company: key financials ($)

$ million 2014 2015 2016 2017 2018

Revenues 55,123.0 31,077.0 30,280.0 28,871.0 30,852.0

Net income 1,648.0 2,461.0 3,161.0 344.0 1,908.0

(loss)

Total assets 65,071.0 79,916.0 79,629.0 61,406.0 17,272.0

Total liabilities 28,295.0 46,381.0 48,181.0 37,940.0 34,254.0

Source: COMPANY FILINGS

Table 14: Hewlett Packard Enterprise Company: key financial ratios

Ratio 2014 2015 2016 2017 2018

Profit margin 3.0% 7.9% 10.4% 1.2% 6.2%

Revenue growth (3.9%) (43.6%) (2.6%) (4.7%) 6.9%

Asset growth (5.4%) 22.8% (0.4%) (22.9%) (71.9%)

Liabilities growth (8.1%) 63.9% 3.9% (21.3%) (9.7%)

Global - IT Services Page 24

MLIP2881-0009

© MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED

EMISPDF in-nmims001 from 122.170.126.143 on 2019-08-26 07:46:18 BST. DownloadPDF.

Downloaded by in-nmims001 from 122.170.126.143 at 2019-08-26 07:46:18 BST. EMIS. Unauthorized Distribution Prohibited.

Ratio 2014 2015 2016 2017 2018

Debt/asset ratio 43.5% 58.0% 60.5% 61.8% 198.3%

Return on 2.5% 3.4% 4.0% 0.5% 4.9%

assets

Source: COMPANY FILINGS

Figure 15: Hewlett Packard Enterprise Company: revenues & profitability

Source: COMPANY FILINGS

Figure 16: Hewlett Packard Enterprise Company: assets & liabilities

Source: COMPANY FILINGS

Global - IT Services Page 25

MLIP2881-0009

© MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED

EMISPDF in-nmims001 from 122.170.126.143 on 2019-08-26 07:46:18 BST. DownloadPDF.

Downloaded by in-nmims001 from 122.170.126.143 at 2019-08-26 07:46:18 BST. EMIS. Unauthorized Distribution Prohibited.

International Business Machines Corporation

Table 15: International Business Machines Corporation: key facts

DetailType Detail

Head office: 1 New Orchard Rd, New York, Armonk, USA

Telephone: 1 914 4991900

Website: www.ibm.com

Financial year-end: December

Ticker: IBM

Stock exchange: New York

Source: COMPANY WEBSITE

International Business Machines Corporation (IBM) is a global IT company which provides a range of

services, software, systems and research services. The company also offers related financing services.

The company has a global presence, operating across the Americas, Europe, the Middle East, Africa and

Asia-Pacific.

The company's operations span five segments: technology services and cloud platforms, cognitive

solutions, global business services, systems and global financing.

Technology services and cloud platforms provide IT infrastructure services that incorporate intellectual

property within a global delivery model. Its capabilities include infrastructure services, technical support

services and integration software. Infrastructure services delivers a portfolio of cloud, project-based,

outsourcing and other managed services focused on clients’ enterprise IT infrastructure environments. The

portfolio includes a set of hybrid cloud services and solutions to assist clients in building and running

enterprise IT environments that utilize public and private clouds and traditional IT. The IBM Cloud Platform

offers services to developers and IBM’s cloud infrastructure-as-a-service covers a variety of workloads.

Technical support services deliver a line of support platforms to maintain and improve the availability of

clients’ IT infrastructures. These offerings include maintenance for IBM products and other technology

platforms, as well as software and solution support. Integration Software delivers hybrid cloud solutions to

achieve innovation, hybrid integration, and process transformation with choice and consistency across

public, dedicated and local cloud environments, leveraging IBM’s Bluemix platform-as-a-service solution.

Integration software offerings and capabilities help clients address digital imperatives to create, connect

and optimize their applications, data and infrastructure on their journey to become cognitive businesses.

Cognitive solutions comprise a portfolio of capabilities that help IBM’s clients to identify actionable insights

and informed decision-making to attain a competitive advantage. Using IBM’s research, technology and

industry expertise, this business delivers a full spectrum of capabilities, from descriptive, predictive and

prescriptive analytics to cognitive systems. Cognitive solutions include Watson, the commercially available

cognitive computing platform that has the ability to interact in natural language, process vast amounts of big

data, and learn from interactions with people and computers. These solutions are provided through the

contemporary delivery methods. including cloud environments and as-a-service models. The firm’s

cognitive solutions comprise solutions and transaction processing software. Solutions software provides the

basis for many of the company’s strategic areas including analytics, security and social media. The Watson

Platform, Watson Health and Watson Internet of Things capabilities are included under this banner. IBM’s

security platform delivers integrated security intelligence across a client’s entire operations, including their

cloud, applications, networks and data, helping them to prevent, detect and remediate potential threats.

Transaction processing software includes software that primarily runs mission-critical systems in industries

such as banking, airlines and retail. Most of this software is on premise and annuity in nature.

Global business services (GBS) provides clients with consulting, application management and global

process services. These professional services deliver business value and innovation to clients through

solutions that leverage industry, technology and business process expertise. GBS is the digital reinvention

partner for IBM clients, combining industry knowledge, functional expertise, and applications with the power