Professional Documents

Culture Documents

Accounting Assumptions, Principles, and Constraints

Accounting Assumptions, Principles, and Constraints

Uploaded by

Paco ActsCopyright:

Available Formats

You might also like

- Generally Accepted Accounting PrinciplesDocument5 pagesGenerally Accepted Accounting PrinciplesJessNo ratings yet

- Water Drive Oil ReservoirDocument2 pagesWater Drive Oil ReservoirJoseph YepezNo ratings yet

- Code For Segmentation Into 277x277 MatrixDocument9 pagesCode For Segmentation Into 277x277 MatrixAvinash BaldiNo ratings yet

- Joyce Travelbee (1926 Human Relationship ModelDocument4 pagesJoyce Travelbee (1926 Human Relationship ModelHugMoco Moco Locah ÜNo ratings yet

- The Count of Monte CristoDocument12 pagesThe Count of Monte CristoElla AustriaNo ratings yet

- Generally Accepted Accounting Principles (GAAP) Is A Term Used To Refer To The StandardDocument6 pagesGenerally Accepted Accounting Principles (GAAP) Is A Term Used To Refer To The StandardRahul JainNo ratings yet

- Inbound 3522308407029868205Document18 pagesInbound 3522308407029868205KupalNo ratings yet

- Accountings AssignmentDocument12 pagesAccountings AssignmentDivisha AgarwalNo ratings yet

- Branches of AccountingDocument6 pagesBranches of AccountingTrisha RagonotNo ratings yet

- Chapter 6 - Accounting Concepts and PrinciplesDocument19 pagesChapter 6 - Accounting Concepts and PrinciplesRyah Louisse E. ParabolesNo ratings yet

- Unit 6 - Accounting Concepts Standards-1Document20 pagesUnit 6 - Accounting Concepts Standards-1evalynmoyo5No ratings yet

- Corporate FinanceDocument51 pagesCorporate FinanceAnna FossiNo ratings yet

- 4.accounting StandardsDocument3 pages4.accounting StandardsbouhaddihayetNo ratings yet

- GAAP - Craige Coutinho VU2120031Document2 pagesGAAP - Craige Coutinho VU2120031hvhvmNo ratings yet

- Accounting Principles-Chp 02Document12 pagesAccounting Principles-Chp 02Md. RuHul A.No ratings yet

- Fabm 1 - Week 2Document2 pagesFabm 1 - Week 2FERNANDO TAMZ2003No ratings yet

- KTTC lý thuyếtDocument22 pagesKTTC lý thuyếtAnh Tùng VũNo ratings yet

- Assingnment On AccountingDocument5 pagesAssingnment On AccountingAbdul LatifNo ratings yet

- Accounting PrinciplesDocument7 pagesAccounting Principlesshubham singhNo ratings yet

- A Framework For Financial Statement AnalysisDocument27 pagesA Framework For Financial Statement AnalysisAndrea Prado CondeNo ratings yet

- Accounting PrinciplesDocument6 pagesAccounting PrinciplesGabeno issachNo ratings yet

- Accounting PrinciplesDocument12 pagesAccounting PrinciplesBalti MusicNo ratings yet

- Cpa Review PPT 4Document18 pagesCpa Review PPT 4JINKY TOLENTINONo ratings yet

- Basic Features of Financial AccountingDocument3 pagesBasic Features of Financial AccountingmaggievscaNo ratings yet

- Course: Financial Accounting & AnalysisDocument16 pagesCourse: Financial Accounting & Analysiskarunakar vNo ratings yet

- "The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"From Everand"The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"No ratings yet

- Accounting Concepts and Recording of Financial TransactionsDocument8 pagesAccounting Concepts and Recording of Financial Transactionsjunita bwaliNo ratings yet

- Accounting Business and Management ABMDocument42 pagesAccounting Business and Management ABMJacky SereñoNo ratings yet

- Accounting PrinciplesDocument2 pagesAccounting Principlesayson.wynaaNo ratings yet

- Accounting Concepts and PrinciplesDocument18 pagesAccounting Concepts and PrinciplesCharissa Jamis ChingwaNo ratings yet

- Assignment of Financial Accounting: Submitted ToDocument5 pagesAssignment of Financial Accounting: Submitted ToCh Ali TariqNo ratings yet

- Lecture#2: Prepared & Delivered By:: Financial Accounting - Conceptual Framework Babar AkhtarDocument17 pagesLecture#2: Prepared & Delivered By:: Financial Accounting - Conceptual Framework Babar AkhtarBabarAkhtarNo ratings yet

- Bcom QbankDocument13 pagesBcom QbankIshaNo ratings yet

- Financial Reporting in Specialized Industry Reporting Issues and Financial AnalysisDocument14 pagesFinancial Reporting in Specialized Industry Reporting Issues and Financial AnalysisjheL garciaNo ratings yet

- Fundamentals of AccountingDocument39 pagesFundamentals of Accountingchaitra kiranNo ratings yet

- Assignment On GAAP, AccountingDocument7 pagesAssignment On GAAP, AccountingAsma Hameed67% (3)

- Accounting For Non AccountantsDocument25 pagesAccounting For Non Accountantsamer_wahNo ratings yet

- Accounting PrinciplesDocument22 pagesAccounting PrinciplesAshiq HossainNo ratings yet

- Fundamentals of AccountingDocument3 pagesFundamentals of AccountingJelo sunidoNo ratings yet

- Financial StatementDocument15 pagesFinancial StatementDarshit AhirNo ratings yet

- Accounting Standard-1: Disclosure of Accounting PoliciesDocument8 pagesAccounting Standard-1: Disclosure of Accounting Policieskeshvika singlaNo ratings yet

- MBA-AFM Theory QBDocument18 pagesMBA-AFM Theory QBkanikaNo ratings yet

- BNU Question Paper QuestionsDocument9 pagesBNU Question Paper QuestionsAdith MNo ratings yet

- Unit 7Document45 pagesUnit 7mandavillinagavenkatasriNo ratings yet

- Fa - Session 3Document18 pagesFa - Session 3Haroon RasheedNo ratings yet

- Financial AccountingDocument9 pagesFinancial Accountinghvr.harshvardhanraohvrNo ratings yet

- MB41 Ans IDocument14 pagesMB41 Ans IAloke SharmaNo ratings yet

- Meaning of Financial StatementsDocument44 pagesMeaning of Financial Statementsparth100% (1)

- Chapter 5 Principls and ConceptsDocument10 pagesChapter 5 Principls and ConceptsawlachewNo ratings yet

- What Is Accounting PrinciplesDocument17 pagesWhat Is Accounting PrinciplesvicenteferrerNo ratings yet

- Accounting Principles and Concepts LectureDocument9 pagesAccounting Principles and Concepts LectureMary De JesusNo ratings yet

- SomethingDocument6 pagesSomethingGanya BishnoiNo ratings yet

- Fun Acc - Chapter 2Document6 pagesFun Acc - Chapter 2Mizpah Montevirgen - PachecoNo ratings yet

- Adv. Accountancy Paper-1Document5 pagesAdv. Accountancy Paper-1Avadhut PaymalleNo ratings yet

- Accounting Concepts AssingmentDocument13 pagesAccounting Concepts AssingmentKapilNo ratings yet

- Final Accounts LessonDocument8 pagesFinal Accounts LessonSiham KhayetNo ratings yet

- Unit - 10 Financial Statements and Ratio AnalysisDocument18 pagesUnit - 10 Financial Statements and Ratio AnalysisAayushi Kothari100% (1)

- Financial ManagementDocument26 pagesFinancial ManagementHILLARY SHINGIRAI MAPIRANo ratings yet

- Accounting Concepts-GAAPDocument5 pagesAccounting Concepts-GAAPArsalan KhalidNo ratings yet

- Generally Accepted Accounting Principles - GAAP: Concept DefinitionDocument8 pagesGenerally Accepted Accounting Principles - GAAP: Concept DefinitiontasyriqNo ratings yet

- Week 1 AccDocument24 pagesWeek 1 AccLawrence MosizaNo ratings yet

- 1SM - Introduction To AccountingDocument14 pages1SM - Introduction To AccountinghaizeemeNo ratings yet

- Principles of Accoutning Edb 100 NotesDocument67 pagesPrinciples of Accoutning Edb 100 NotesFidel Flavin100% (3)

- ENGLISH Teacher - S Guide-GRADE 3 (2nd Quarter)Document112 pagesENGLISH Teacher - S Guide-GRADE 3 (2nd Quarter)dyancris2567% (3)

- Unit 3. Mixtures and Pure SubstancesDocument36 pagesUnit 3. Mixtures and Pure SubstancesArman VillagraciaNo ratings yet

- People vs. Umali, 193 SCRA 493, G.R. No. 84450 February 4, 1991Document12 pagesPeople vs. Umali, 193 SCRA 493, G.R. No. 84450 February 4, 1991Trea CheryNo ratings yet

- Tanjong PLC: Major Shareholder Privatising Tanjong at RM21.80/Share - 02/08/2010Document3 pagesTanjong PLC: Major Shareholder Privatising Tanjong at RM21.80/Share - 02/08/2010Rhb InvestNo ratings yet

- Industry Standards Activity OverviewDocument7 pagesIndustry Standards Activity OverviewHugo Soruco SolizNo ratings yet

- Mukerjee, K., 2020Document17 pagesMukerjee, K., 2020Eduardo CastañedaNo ratings yet

- Hassett Et Al. (Monkey Toy Preferences) NotesDocument33 pagesHassett Et Al. (Monkey Toy Preferences) NotesKarthiNo ratings yet

- Diass QTR2Document26 pagesDiass QTR2Jamil SalibioNo ratings yet

- Lonnie Melvin Murray v. United States, 419 U.S. 942 (1974)Document3 pagesLonnie Melvin Murray v. United States, 419 U.S. 942 (1974)Scribd Government DocsNo ratings yet

- Mapeh 10 Exam 4th QuarterDocument2 pagesMapeh 10 Exam 4th QuarterMaybelyn de los ReyesNo ratings yet

- Playground Design: Bridges in Mathematics Grade 4 Unit 8Document2 pagesPlayground Design: Bridges in Mathematics Grade 4 Unit 8api-289120259No ratings yet

- Amazon Summary PDFDocument3 pagesAmazon Summary PDFShafat AhmedNo ratings yet

- Lesson Plan 4Document3 pagesLesson Plan 4api-481212444No ratings yet

- What Got You Here, Won't Get You ThereDocument19 pagesWhat Got You Here, Won't Get You Thereyannis7100% (1)

- Micro Part 3Document180 pagesMicro Part 3Perlie CNo ratings yet

- Module 3 - Topic 5 (Retail Inventory Method)Document4 pagesModule 3 - Topic 5 (Retail Inventory Method)Ann BergonioNo ratings yet

- Attraction Reiki Two-2Document16 pagesAttraction Reiki Two-2Secure High Returns100% (1)

- A Transcription of Jean Françaix'S L'Horloge de Flore For Solo Oboe and Organ (Four Hands)Document67 pagesA Transcription of Jean Françaix'S L'Horloge de Flore For Solo Oboe and Organ (Four Hands)Juan MendozaNo ratings yet

- Ghana Maketing PlanDocument11 pagesGhana Maketing PlanchiranrgNo ratings yet

- Assignment (Case Analysis)Document4 pagesAssignment (Case Analysis)Anupom Hossain SoumikNo ratings yet

- MHRM 2016 PDFDocument16 pagesMHRM 2016 PDFבעילום שם משתמשNo ratings yet

- General Clauses Act 1897Document20 pagesGeneral Clauses Act 1897Jay KothariNo ratings yet

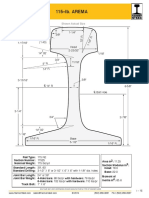

- Arema 115REDocument1 pageArema 115REAntonioNo ratings yet

- Ineffective Breathing PatternDocument2 pagesIneffective Breathing PatternKimberly T. CaballeroNo ratings yet

- Social PhilosophyDocument20 pagesSocial PhilosophyPrincess Diane Gravides100% (1)

- Volume I The Mandragora SectorDocument7 pagesVolume I The Mandragora SectorBede RogersonNo ratings yet

Accounting Assumptions, Principles, and Constraints

Accounting Assumptions, Principles, and Constraints

Uploaded by

Paco ActsOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accounting Assumptions, Principles, and Constraints

Accounting Assumptions, Principles, and Constraints

Uploaded by

Paco ActsCopyright:

Available Formats

The four basic assumptions of accounting are separate entity assumption, going concern assumption,

stable monetary unit assumption, and fixed time period assumption.

Accounting Entity - A corporation is considered a “living, fictional” being.

Going Concern - A corporation is assumed to remain in existence indefinitely.

Units of Measure of a company - Measurement and Financial statements show only measurable

activities. Financial statements must be reported in the national monetary unit (i.e., U.S. dollars for U.S.

companies).

Periodicity – A company’s continuous life can be divided into measured periods of time for which

financial statements are prepared. U.S. companies are required to file quarterly and annual reports.

The principles of accounting are the historical cost principle, the matching principle, the revenue

recognition principle, and the full disclosure principle

Historical Cost - Financial statements report companies’ resources and obligations at an initial

historical cost. This conservative measure precludes constant appraisal and revaluation.

Revenue Recognition - Revenues must be recorded when earned and measurable.

Matching Principle - Costs of a product must be recorded during the same period as revenue

from selling it.

Disclosure - Companies must reveal all relevant economic information determined to make a

difference to their users.

. The constraints of accounting are estimates and judgements, materiality, consistency, and conservatism.

Estimates and Judgements: Certain measurements cannot be performed completely accurately, and must

therefore utilize conservative estimates and judgments.

Materiality: Inclusion and disclosure of financial transactions in financial statements hinge on their size

and effect on the company performing them.

Consistency: For each company, the preparation of financial statements must utilize measurement

techniques and assumptions that are consistent from one period to another.

Conservatism: Financial statements should be prepared with a downward measurement bias.

GAAP are imposed on companies so that investors have a minimum level of consistency in the financial

statements they use when analyzing companies for investment purposes. GAAP cover such things as

revenue recognition, balance sheet item classification and outstanding share measurements. Companies

are expected to follow GAAP rules when reporting their financial data via financial statements.

http://accounting-financial-tax.com/2009/08/basic-accounting-assumptions-principles-constraints/

http://www.investopedia.com/terms/g/gaap.asp

You might also like

- Generally Accepted Accounting PrinciplesDocument5 pagesGenerally Accepted Accounting PrinciplesJessNo ratings yet

- Water Drive Oil ReservoirDocument2 pagesWater Drive Oil ReservoirJoseph YepezNo ratings yet

- Code For Segmentation Into 277x277 MatrixDocument9 pagesCode For Segmentation Into 277x277 MatrixAvinash BaldiNo ratings yet

- Joyce Travelbee (1926 Human Relationship ModelDocument4 pagesJoyce Travelbee (1926 Human Relationship ModelHugMoco Moco Locah ÜNo ratings yet

- The Count of Monte CristoDocument12 pagesThe Count of Monte CristoElla AustriaNo ratings yet

- Generally Accepted Accounting Principles (GAAP) Is A Term Used To Refer To The StandardDocument6 pagesGenerally Accepted Accounting Principles (GAAP) Is A Term Used To Refer To The StandardRahul JainNo ratings yet

- Inbound 3522308407029868205Document18 pagesInbound 3522308407029868205KupalNo ratings yet

- Accountings AssignmentDocument12 pagesAccountings AssignmentDivisha AgarwalNo ratings yet

- Branches of AccountingDocument6 pagesBranches of AccountingTrisha RagonotNo ratings yet

- Chapter 6 - Accounting Concepts and PrinciplesDocument19 pagesChapter 6 - Accounting Concepts and PrinciplesRyah Louisse E. ParabolesNo ratings yet

- Unit 6 - Accounting Concepts Standards-1Document20 pagesUnit 6 - Accounting Concepts Standards-1evalynmoyo5No ratings yet

- Corporate FinanceDocument51 pagesCorporate FinanceAnna FossiNo ratings yet

- 4.accounting StandardsDocument3 pages4.accounting StandardsbouhaddihayetNo ratings yet

- GAAP - Craige Coutinho VU2120031Document2 pagesGAAP - Craige Coutinho VU2120031hvhvmNo ratings yet

- Accounting Principles-Chp 02Document12 pagesAccounting Principles-Chp 02Md. RuHul A.No ratings yet

- Fabm 1 - Week 2Document2 pagesFabm 1 - Week 2FERNANDO TAMZ2003No ratings yet

- KTTC lý thuyếtDocument22 pagesKTTC lý thuyếtAnh Tùng VũNo ratings yet

- Assingnment On AccountingDocument5 pagesAssingnment On AccountingAbdul LatifNo ratings yet

- Accounting PrinciplesDocument7 pagesAccounting Principlesshubham singhNo ratings yet

- A Framework For Financial Statement AnalysisDocument27 pagesA Framework For Financial Statement AnalysisAndrea Prado CondeNo ratings yet

- Accounting PrinciplesDocument6 pagesAccounting PrinciplesGabeno issachNo ratings yet

- Accounting PrinciplesDocument12 pagesAccounting PrinciplesBalti MusicNo ratings yet

- Cpa Review PPT 4Document18 pagesCpa Review PPT 4JINKY TOLENTINONo ratings yet

- Basic Features of Financial AccountingDocument3 pagesBasic Features of Financial AccountingmaggievscaNo ratings yet

- Course: Financial Accounting & AnalysisDocument16 pagesCourse: Financial Accounting & Analysiskarunakar vNo ratings yet

- "The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"From Everand"The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"No ratings yet

- Accounting Concepts and Recording of Financial TransactionsDocument8 pagesAccounting Concepts and Recording of Financial Transactionsjunita bwaliNo ratings yet

- Accounting Business and Management ABMDocument42 pagesAccounting Business and Management ABMJacky SereñoNo ratings yet

- Accounting PrinciplesDocument2 pagesAccounting Principlesayson.wynaaNo ratings yet

- Accounting Concepts and PrinciplesDocument18 pagesAccounting Concepts and PrinciplesCharissa Jamis ChingwaNo ratings yet

- Assignment of Financial Accounting: Submitted ToDocument5 pagesAssignment of Financial Accounting: Submitted ToCh Ali TariqNo ratings yet

- Lecture#2: Prepared & Delivered By:: Financial Accounting - Conceptual Framework Babar AkhtarDocument17 pagesLecture#2: Prepared & Delivered By:: Financial Accounting - Conceptual Framework Babar AkhtarBabarAkhtarNo ratings yet

- Bcom QbankDocument13 pagesBcom QbankIshaNo ratings yet

- Financial Reporting in Specialized Industry Reporting Issues and Financial AnalysisDocument14 pagesFinancial Reporting in Specialized Industry Reporting Issues and Financial AnalysisjheL garciaNo ratings yet

- Fundamentals of AccountingDocument39 pagesFundamentals of Accountingchaitra kiranNo ratings yet

- Assignment On GAAP, AccountingDocument7 pagesAssignment On GAAP, AccountingAsma Hameed67% (3)

- Accounting For Non AccountantsDocument25 pagesAccounting For Non Accountantsamer_wahNo ratings yet

- Accounting PrinciplesDocument22 pagesAccounting PrinciplesAshiq HossainNo ratings yet

- Fundamentals of AccountingDocument3 pagesFundamentals of AccountingJelo sunidoNo ratings yet

- Financial StatementDocument15 pagesFinancial StatementDarshit AhirNo ratings yet

- Accounting Standard-1: Disclosure of Accounting PoliciesDocument8 pagesAccounting Standard-1: Disclosure of Accounting Policieskeshvika singlaNo ratings yet

- MBA-AFM Theory QBDocument18 pagesMBA-AFM Theory QBkanikaNo ratings yet

- BNU Question Paper QuestionsDocument9 pagesBNU Question Paper QuestionsAdith MNo ratings yet

- Unit 7Document45 pagesUnit 7mandavillinagavenkatasriNo ratings yet

- Fa - Session 3Document18 pagesFa - Session 3Haroon RasheedNo ratings yet

- Financial AccountingDocument9 pagesFinancial Accountinghvr.harshvardhanraohvrNo ratings yet

- MB41 Ans IDocument14 pagesMB41 Ans IAloke SharmaNo ratings yet

- Meaning of Financial StatementsDocument44 pagesMeaning of Financial Statementsparth100% (1)

- Chapter 5 Principls and ConceptsDocument10 pagesChapter 5 Principls and ConceptsawlachewNo ratings yet

- What Is Accounting PrinciplesDocument17 pagesWhat Is Accounting PrinciplesvicenteferrerNo ratings yet

- Accounting Principles and Concepts LectureDocument9 pagesAccounting Principles and Concepts LectureMary De JesusNo ratings yet

- SomethingDocument6 pagesSomethingGanya BishnoiNo ratings yet

- Fun Acc - Chapter 2Document6 pagesFun Acc - Chapter 2Mizpah Montevirgen - PachecoNo ratings yet

- Adv. Accountancy Paper-1Document5 pagesAdv. Accountancy Paper-1Avadhut PaymalleNo ratings yet

- Accounting Concepts AssingmentDocument13 pagesAccounting Concepts AssingmentKapilNo ratings yet

- Final Accounts LessonDocument8 pagesFinal Accounts LessonSiham KhayetNo ratings yet

- Unit - 10 Financial Statements and Ratio AnalysisDocument18 pagesUnit - 10 Financial Statements and Ratio AnalysisAayushi Kothari100% (1)

- Financial ManagementDocument26 pagesFinancial ManagementHILLARY SHINGIRAI MAPIRANo ratings yet

- Accounting Concepts-GAAPDocument5 pagesAccounting Concepts-GAAPArsalan KhalidNo ratings yet

- Generally Accepted Accounting Principles - GAAP: Concept DefinitionDocument8 pagesGenerally Accepted Accounting Principles - GAAP: Concept DefinitiontasyriqNo ratings yet

- Week 1 AccDocument24 pagesWeek 1 AccLawrence MosizaNo ratings yet

- 1SM - Introduction To AccountingDocument14 pages1SM - Introduction To AccountinghaizeemeNo ratings yet

- Principles of Accoutning Edb 100 NotesDocument67 pagesPrinciples of Accoutning Edb 100 NotesFidel Flavin100% (3)

- ENGLISH Teacher - S Guide-GRADE 3 (2nd Quarter)Document112 pagesENGLISH Teacher - S Guide-GRADE 3 (2nd Quarter)dyancris2567% (3)

- Unit 3. Mixtures and Pure SubstancesDocument36 pagesUnit 3. Mixtures and Pure SubstancesArman VillagraciaNo ratings yet

- People vs. Umali, 193 SCRA 493, G.R. No. 84450 February 4, 1991Document12 pagesPeople vs. Umali, 193 SCRA 493, G.R. No. 84450 February 4, 1991Trea CheryNo ratings yet

- Tanjong PLC: Major Shareholder Privatising Tanjong at RM21.80/Share - 02/08/2010Document3 pagesTanjong PLC: Major Shareholder Privatising Tanjong at RM21.80/Share - 02/08/2010Rhb InvestNo ratings yet

- Industry Standards Activity OverviewDocument7 pagesIndustry Standards Activity OverviewHugo Soruco SolizNo ratings yet

- Mukerjee, K., 2020Document17 pagesMukerjee, K., 2020Eduardo CastañedaNo ratings yet

- Hassett Et Al. (Monkey Toy Preferences) NotesDocument33 pagesHassett Et Al. (Monkey Toy Preferences) NotesKarthiNo ratings yet

- Diass QTR2Document26 pagesDiass QTR2Jamil SalibioNo ratings yet

- Lonnie Melvin Murray v. United States, 419 U.S. 942 (1974)Document3 pagesLonnie Melvin Murray v. United States, 419 U.S. 942 (1974)Scribd Government DocsNo ratings yet

- Mapeh 10 Exam 4th QuarterDocument2 pagesMapeh 10 Exam 4th QuarterMaybelyn de los ReyesNo ratings yet

- Playground Design: Bridges in Mathematics Grade 4 Unit 8Document2 pagesPlayground Design: Bridges in Mathematics Grade 4 Unit 8api-289120259No ratings yet

- Amazon Summary PDFDocument3 pagesAmazon Summary PDFShafat AhmedNo ratings yet

- Lesson Plan 4Document3 pagesLesson Plan 4api-481212444No ratings yet

- What Got You Here, Won't Get You ThereDocument19 pagesWhat Got You Here, Won't Get You Thereyannis7100% (1)

- Micro Part 3Document180 pagesMicro Part 3Perlie CNo ratings yet

- Module 3 - Topic 5 (Retail Inventory Method)Document4 pagesModule 3 - Topic 5 (Retail Inventory Method)Ann BergonioNo ratings yet

- Attraction Reiki Two-2Document16 pagesAttraction Reiki Two-2Secure High Returns100% (1)

- A Transcription of Jean Françaix'S L'Horloge de Flore For Solo Oboe and Organ (Four Hands)Document67 pagesA Transcription of Jean Françaix'S L'Horloge de Flore For Solo Oboe and Organ (Four Hands)Juan MendozaNo ratings yet

- Ghana Maketing PlanDocument11 pagesGhana Maketing PlanchiranrgNo ratings yet

- Assignment (Case Analysis)Document4 pagesAssignment (Case Analysis)Anupom Hossain SoumikNo ratings yet

- MHRM 2016 PDFDocument16 pagesMHRM 2016 PDFבעילום שם משתמשNo ratings yet

- General Clauses Act 1897Document20 pagesGeneral Clauses Act 1897Jay KothariNo ratings yet

- Arema 115REDocument1 pageArema 115REAntonioNo ratings yet

- Ineffective Breathing PatternDocument2 pagesIneffective Breathing PatternKimberly T. CaballeroNo ratings yet

- Social PhilosophyDocument20 pagesSocial PhilosophyPrincess Diane Gravides100% (1)

- Volume I The Mandragora SectorDocument7 pagesVolume I The Mandragora SectorBede RogersonNo ratings yet