Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

146 viewsUnderstanding FICO Scores

Understanding FICO Scores

Uploaded by

Francisco NeumanFICO scores are credit scores calculated using data from credit reports that predict the likelihood of repaying debts. The five main factors that determine a FICO score are: (1) payment history, (2) amounts owed, (3) length of credit history, (4) new credit applications, and (5) credit mix. FICO scores fluctuate as credit reports change due to payments made, debts incurred, and other financial activities. Checking a free annual credit report is recommended to ensure credit reports are accurate as FICO scores are based on that data.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- Precise DIY Metro2 Credit Ebook (DC17 - )Document16 pagesPrecise DIY Metro2 Credit Ebook (DC17 - )Tbonds80% (10)

- 7 Ways To Improve Your Credit E-BookDocument17 pages7 Ways To Improve Your Credit E-Bookjordan.gowinsNo ratings yet

- DIY Credit Repair GuideDocument21 pagesDIY Credit Repair GuideAnthony VinsonNo ratings yet

- Chapter 1 Accounting For Business Combinations SolmanDocument10 pagesChapter 1 Accounting For Business Combinations SolmanKhen FajardoNo ratings yet

- Credit Card Letter 121 PDFDocument1 pageCredit Card Letter 121 PDFsushant100% (1)

- Question and Answer - 3Document31 pagesQuestion and Answer - 3acc-expertNo ratings yet

- Final Selected Banking New TermsDocument17 pagesFinal Selected Banking New Termsgoku spade100% (2)

- Checklist For Due Diligence Report For BanksDocument16 pagesChecklist For Due Diligence Report For BanksAddisu Mengist ZNo ratings yet

- Broker Business PlanDocument18 pagesBroker Business PlanJulie Flanagan100% (1)

- myFICO Understanding Your Credit ScoreDocument20 pagesmyFICO Understanding Your Credit Scorecolonelcash100% (1)

- Fico ScoreDocument3 pagesFico ScoreBill BobbittNo ratings yet

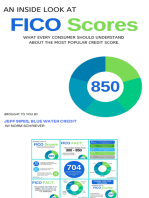

- An Inside Look at FICO Scores: What every consumer should understand about the most popular credit score.From EverandAn Inside Look at FICO Scores: What every consumer should understand about the most popular credit score.No ratings yet

- Foreclosure Damage - A Longlasting HitDocument6 pagesForeclosure Damage - A Longlasting Hit83jjmackNo ratings yet

- YourcreditscoreDocument6 pagesYourcreditscoreapi-309082881No ratings yet

- Free Credit Score: How to get your REAL FICO Credit Score for FreeFrom EverandFree Credit Score: How to get your REAL FICO Credit Score for FreeRating: 4.5 out of 5 stars4.5/5 (3)

- WCG - CRDT RPT 3 11-28-08Document2 pagesWCG - CRDT RPT 3 11-28-08Bill TaylorNo ratings yet

- Credit TipsDocument13 pagesCredit TipsMatthew Cody SnyderNo ratings yet

- Contoh PowerpointDocument29 pagesContoh PowerpointNamanyaNo ratings yet

- Erf Newsletter 11.05Document4 pagesErf Newsletter 11.05Bill TaylorNo ratings yet

- FICO Scores: Statistical AnalysisDocument1 pageFICO Scores: Statistical AnalysisraqibappNo ratings yet

- Chapter 2 1 Intl CLEARDocument8 pagesChapter 2 1 Intl CLEARChris FloresNo ratings yet

- Payday LendingDocument3 pagesPayday LendingDany Dzakwan LikardoNo ratings yet

- What Affects Your Credit ScoreDocument7 pagesWhat Affects Your Credit ScoreAlpa DwivediNo ratings yet

- Kevin Lee - Understanding How Credit Scores WorkDocument3 pagesKevin Lee - Understanding How Credit Scores WorkKevin LeeNo ratings yet

- Credit Score Research PapersDocument7 pagesCredit Score Research Papershxmchprhf100% (1)

- Score 4.39.90Document4 pagesScore 4.39.90Aravindh MassNo ratings yet

- Credit History, Credit Score & Credit RatingDocument68 pagesCredit History, Credit Score & Credit RatingVishnu PujariNo ratings yet

- CR RatingDocument7 pagesCR RatingCynthia DelaneyNo ratings yet

- Credit FundamentalsDocument15 pagesCredit FundamentalsCody Long100% (3)

- Guide To Understanding Credit GuideDocument11 pagesGuide To Understanding Credit GuideRobert Glen Murrell JrNo ratings yet

- A Literature Review of Concepts of Credit Ratings and Corporate ValuationDocument26 pagesA Literature Review of Concepts of Credit Ratings and Corporate ValuationHarsh Vyas100% (1)

- Five Cs of Credit: CreditworthinessDocument3 pagesFive Cs of Credit: CreditworthinessSakshi Singh YaduvanshiNo ratings yet

- Credit Rating AgenciesDocument11 pagesCredit Rating AgenciesmanyasinghNo ratings yet

- DIY Credit Repair And Building Guide: Financial Free VictoryFrom EverandDIY Credit Repair And Building Guide: Financial Free VictoryNo ratings yet

- Credit ReportDocument36 pagesCredit Reportleo namNo ratings yet

- Repair Your Credit Score: The Ultimate Personal Finance Guide. Learn Effective Credit Repair Strategies, Fix Bad Debt and Improve Your Score.From EverandRepair Your Credit Score: The Ultimate Personal Finance Guide. Learn Effective Credit Repair Strategies, Fix Bad Debt and Improve Your Score.No ratings yet

- BankingDocument110 pagesBankingNarcity UzumakiNo ratings yet

- Capital: Owner About Their Stake Hence More Safeguard Will Be The Borrowed FundsDocument28 pagesCapital: Owner About Their Stake Hence More Safeguard Will Be The Borrowed FundsMdramjanaliNo ratings yet

- Credit Information BureauDocument15 pagesCredit Information BureaurishiomkumarNo ratings yet

- Credit Worthiness: What Is A Corporate Credit RatingDocument23 pagesCredit Worthiness: What Is A Corporate Credit RatingSudarshan ChitlangiaNo ratings yet

- Banking Services 29011Document14 pagesBanking Services 29011anky54321No ratings yet

- CCC NotesDocument8 pagesCCC NotesElla MendresNo ratings yet

- Bank BazaarDocument2 pagesBank BazaaradityashettyNo ratings yet

- CCC NotesDocument8 pagesCCC NotesElla MendresNo ratings yet

- Credit AppraisalDocument4 pagesCredit AppraisalAbhishek RanjanNo ratings yet

- Credit Scoring Literature ReviewDocument5 pagesCredit Scoring Literature Reviewafdtovmhb100% (2)

- Experian Credit Report Customer ServiceDocument9 pagesExperian Credit Report Customer Serviceewbs1766100% (1)

- Credit Rating: CreditworthinessDocument5 pagesCredit Rating: CreditworthinessRekha SoniNo ratings yet

- Bank of America 1Document19 pagesBank of America 1Vinayak JayanathNo ratings yet

- Credit Rating Is The Opinion of The Rating Agency On The Relative Ability and Willingness of The Issuer of A Debt Instrument To Meet The Debt Service Obligations As and When They AriseDocument5 pagesCredit Rating Is The Opinion of The Rating Agency On The Relative Ability and Willingness of The Issuer of A Debt Instrument To Meet The Debt Service Obligations As and When They ArisePrince VargheseNo ratings yet

- Credit Scoreand ReportDocument10 pagesCredit Scoreand ReportMortgage ResourcesNo ratings yet

- Credit Analyst Q&ADocument6 pagesCredit Analyst Q&ASudhir PowerNo ratings yet

- Chapter 16Document12 pagesChapter 16Nicholas GiaquintoNo ratings yet

- (Gurgaon) (Mumbai) : US Mortgage Process OriginationDocument9 pages(Gurgaon) (Mumbai) : US Mortgage Process OriginationAshish RupaniNo ratings yet

- Assertions On The Financial StatementsDocument1 pageAssertions On The Financial StatementsRenato AlferesNo ratings yet

- 12-Roles Responsibilities and Authorities ExampleDocument2 pages12-Roles Responsibilities and Authorities Examplecarmine evangelistaNo ratings yet

- Sagaya CandyDocument1 pageSagaya CandyimranpashausNo ratings yet

- BK Imp ObjectivesDocument21 pagesBK Imp Objectivespanchalyash266No ratings yet

- Virtual Wallet Fine PrintDocument34 pagesVirtual Wallet Fine PrintDeanthony WilliamsNo ratings yet

- None 9aa455b5Document10 pagesNone 9aa455b5ANISNo ratings yet

- A Stockbroker Is A Regulated Professional IndividualDocument2 pagesA Stockbroker Is A Regulated Professional Individualmldc2006No ratings yet

- Intermediate Accounting IFRS Edition: Kieso, Weygandt, WarfieldDocument16 pagesIntermediate Accounting IFRS Edition: Kieso, Weygandt, Warfielddystopian au.100% (1)

- Review Questions On Financial Planning and ForecastingDocument5 pagesReview Questions On Financial Planning and ForecastingGadafi FuadNo ratings yet

- Chapter #1 Tutorial Class: Faculty of Economics and Administration Accounting Department ACCT 117Document47 pagesChapter #1 Tutorial Class: Faculty of Economics and Administration Accounting Department ACCT 117hazem 00No ratings yet

- Module 2 - Completing The Accounting CycleDocument45 pagesModule 2 - Completing The Accounting CycleShane TorrieNo ratings yet

- Penyimpanan Barang Ke GudangDocument10 pagesPenyimpanan Barang Ke Gudangajeng.saraswatiNo ratings yet

- Accounting Process by NavkarDocument44 pagesAccounting Process by NavkarShlok JainNo ratings yet

- Module 1.1 Orientation & PFRS 15Document22 pagesModule 1.1 Orientation & PFRS 15NCTNo ratings yet

- Nestle Finance International LTD Fullyear Financial Report 2021 enDocument37 pagesNestle Finance International LTD Fullyear Financial Report 2021 enT.k.e.dNo ratings yet

- Wealth Management For NRIsDocument4 pagesWealth Management For NRIsVishal SoniNo ratings yet

- Chapter 6 CashDocument15 pagesChapter 6 CashTesfamlak MulatuNo ratings yet

- Cash Advance - Travel, Payroll, PCF, & Operational ExpensesDocument1 pageCash Advance - Travel, Payroll, PCF, & Operational ExpensesPgas PaccoNo ratings yet

- Palepu 3e ch4Document21 pagesPalepu 3e ch4Nadine SantosNo ratings yet

- Answer Key - Employee Benefits PDFDocument3 pagesAnswer Key - Employee Benefits PDFglobeth berbanoNo ratings yet

- Tutorial Set 2 - Key SolutionsDocument4 pagesTutorial Set 2 - Key SolutionsgregNo ratings yet

- Safari 1Document1 pageSafari 1SATNAM SINGH LAMBANo ratings yet

- Activity On AbcDocument3 pagesActivity On AbcAvox EverdeenNo ratings yet

- Public Sector Accounting Developments and Conceptual FrameworkDocument24 pagesPublic Sector Accounting Developments and Conceptual FrameworkREJAY89No ratings yet

- By: Ashish SharmaDocument26 pagesBy: Ashish Sharmashukhi89No ratings yet

- Bond Consultants Inc: PH 215 766 1990 FAX 215 766 1225Document2 pagesBond Consultants Inc: PH 215 766 1990 FAX 215 766 1225trustkonanNo ratings yet

- Hull OFOD9e MultipleChoice Questions and Answers Ch07 PDFDocument7 pagesHull OFOD9e MultipleChoice Questions and Answers Ch07 PDFfawefwaeNo ratings yet

- Transfer Advice ةلاوح راعشإ: JO09 UBSI 1010 0000 1020 7720 9151 01Document2 pagesTransfer Advice ةلاوح راعشإ: JO09 UBSI 1010 0000 1020 7720 9151 01Rasha AbdullahNo ratings yet

Understanding FICO Scores

Understanding FICO Scores

Uploaded by

Francisco Neuman0 ratings0% found this document useful (0 votes)

146 views1 pageFICO scores are credit scores calculated using data from credit reports that predict the likelihood of repaying debts. The five main factors that determine a FICO score are: (1) payment history, (2) amounts owed, (3) length of credit history, (4) new credit applications, and (5) credit mix. FICO scores fluctuate as credit reports change due to payments made, debts incurred, and other financial activities. Checking a free annual credit report is recommended to ensure credit reports are accurate as FICO scores are based on that data.

Original Description:

Understanding FICO Scores

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentFICO scores are credit scores calculated using data from credit reports that predict the likelihood of repaying debts. The five main factors that determine a FICO score are: (1) payment history, (2) amounts owed, (3) length of credit history, (4) new credit applications, and (5) credit mix. FICO scores fluctuate as credit reports change due to payments made, debts incurred, and other financial activities. Checking a free annual credit report is recommended to ensure credit reports are accurate as FICO scores are based on that data.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

146 views1 pageUnderstanding FICO Scores

Understanding FICO Scores

Uploaded by

Francisco NeumanFICO scores are credit scores calculated using data from credit reports that predict the likelihood of repaying debts. The five main factors that determine a FICO score are: (1) payment history, (2) amounts owed, (3) length of credit history, (4) new credit applications, and (5) credit mix. FICO scores fluctuate as credit reports change due to payments made, debts incurred, and other financial activities. Checking a free annual credit report is recommended to ensure credit reports are accurate as FICO scores are based on that data.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

Understanding FICO® Scores

What are FICO® Scores?

FICO® Scores are the most widely used credit scores. Each FICO® Score is a three-digit number calculated from the

data on your credit reports at the three major consumer reporting agencies—Experian, TransUnion and Equifax. Your

FICO® Scores predict how likely you are to pay back a credit obligation as agreed. Lenders use FICO® Scores to help

them quickly, consistently and objectively evaluate potential borrowers’ credit risk.

What goes into FICO® Scores?

FICO® Scores are calculated from the credit data in your credit report. This data is grouped into five categories; the

chart below shows the relative importance of each category.

1. 35% - Payment history:

Whether you've paid past credit accounts on time

2. 30% - Amounts owed:

The amount of credit and loans you are using

3. 15% - Length of credit history:

How long you've had credit

4. 10% - New credit:

Frequency of credit inquires and new account openings

5. 10% - Credit mix:

The mix of your credit, retail accounts, installment loans, finance company accounts and mortgage loans

What are score factors?

Score factors are delivered with a consumer’s FICO® Score, these are the top areas that affected that consumer’s

FICO® Scores. The order in which the score factors are listed is important. The first factor indicates the area that

most affected the score and the second factor is the next most significant influence. Addressing these factors can

benefit the score.

Why is my FICO® Score different than other scores I’ve seen?

There are many different credit scores available to consumers and lenders. FICO® Scores are the credit scores used

by most lenders, and different lenders may use different versions of FICO® Scores. In addition, FICO® Scores are

based on credit file data from a consumer reporting agency, so differences in your credit files may create differences

in your FICO® Scores.

Why do FICO® Scores fluctuate/change?

There are many reasons why a score may change. FICO® Scores are calculated each time they are requested, taking

into consideration the information that is in your credit file from a consumer reporting agency at that time. So, as the

information in your credit file at that CRA changes, FICO® Scores can also change. Review your key score factors,

which explain what factors from your credit report most affected a score. Comparing key score factors from the two

different time periods can help identify causes for a change in a FICO® Score. Keep in mind that certain events such

as late payments or bankruptcy can lower FICO® Scores quickly.

How do I check my credit report for free?

You may get a free copy of your credit report from each of the three major consumer reporting agencies annually.

To request a copy of your credit report, please visit: www.annualcreditreport.com. Please note that your free credit

report will not include your FICO® Score. Because your FICO® Score is based on the information in your credit report,

it is important to make sure that the credit report information is accurate.

Will receiving my FICO® Score impact my credit?

No. The FICO® Score we provide to you will not impact your credit.

© 2018 Fair Isaac Corporation. All rights reserved.

You might also like

- Precise DIY Metro2 Credit Ebook (DC17 - )Document16 pagesPrecise DIY Metro2 Credit Ebook (DC17 - )Tbonds80% (10)

- 7 Ways To Improve Your Credit E-BookDocument17 pages7 Ways To Improve Your Credit E-Bookjordan.gowinsNo ratings yet

- DIY Credit Repair GuideDocument21 pagesDIY Credit Repair GuideAnthony VinsonNo ratings yet

- Chapter 1 Accounting For Business Combinations SolmanDocument10 pagesChapter 1 Accounting For Business Combinations SolmanKhen FajardoNo ratings yet

- Credit Card Letter 121 PDFDocument1 pageCredit Card Letter 121 PDFsushant100% (1)

- Question and Answer - 3Document31 pagesQuestion and Answer - 3acc-expertNo ratings yet

- Final Selected Banking New TermsDocument17 pagesFinal Selected Banking New Termsgoku spade100% (2)

- Checklist For Due Diligence Report For BanksDocument16 pagesChecklist For Due Diligence Report For BanksAddisu Mengist ZNo ratings yet

- Broker Business PlanDocument18 pagesBroker Business PlanJulie Flanagan100% (1)

- myFICO Understanding Your Credit ScoreDocument20 pagesmyFICO Understanding Your Credit Scorecolonelcash100% (1)

- Fico ScoreDocument3 pagesFico ScoreBill BobbittNo ratings yet

- An Inside Look at FICO Scores: What every consumer should understand about the most popular credit score.From EverandAn Inside Look at FICO Scores: What every consumer should understand about the most popular credit score.No ratings yet

- Foreclosure Damage - A Longlasting HitDocument6 pagesForeclosure Damage - A Longlasting Hit83jjmackNo ratings yet

- YourcreditscoreDocument6 pagesYourcreditscoreapi-309082881No ratings yet

- Free Credit Score: How to get your REAL FICO Credit Score for FreeFrom EverandFree Credit Score: How to get your REAL FICO Credit Score for FreeRating: 4.5 out of 5 stars4.5/5 (3)

- WCG - CRDT RPT 3 11-28-08Document2 pagesWCG - CRDT RPT 3 11-28-08Bill TaylorNo ratings yet

- Credit TipsDocument13 pagesCredit TipsMatthew Cody SnyderNo ratings yet

- Contoh PowerpointDocument29 pagesContoh PowerpointNamanyaNo ratings yet

- Erf Newsletter 11.05Document4 pagesErf Newsletter 11.05Bill TaylorNo ratings yet

- FICO Scores: Statistical AnalysisDocument1 pageFICO Scores: Statistical AnalysisraqibappNo ratings yet

- Chapter 2 1 Intl CLEARDocument8 pagesChapter 2 1 Intl CLEARChris FloresNo ratings yet

- Payday LendingDocument3 pagesPayday LendingDany Dzakwan LikardoNo ratings yet

- What Affects Your Credit ScoreDocument7 pagesWhat Affects Your Credit ScoreAlpa DwivediNo ratings yet

- Kevin Lee - Understanding How Credit Scores WorkDocument3 pagesKevin Lee - Understanding How Credit Scores WorkKevin LeeNo ratings yet

- Credit Score Research PapersDocument7 pagesCredit Score Research Papershxmchprhf100% (1)

- Score 4.39.90Document4 pagesScore 4.39.90Aravindh MassNo ratings yet

- Credit History, Credit Score & Credit RatingDocument68 pagesCredit History, Credit Score & Credit RatingVishnu PujariNo ratings yet

- CR RatingDocument7 pagesCR RatingCynthia DelaneyNo ratings yet

- Credit FundamentalsDocument15 pagesCredit FundamentalsCody Long100% (3)

- Guide To Understanding Credit GuideDocument11 pagesGuide To Understanding Credit GuideRobert Glen Murrell JrNo ratings yet

- A Literature Review of Concepts of Credit Ratings and Corporate ValuationDocument26 pagesA Literature Review of Concepts of Credit Ratings and Corporate ValuationHarsh Vyas100% (1)

- Five Cs of Credit: CreditworthinessDocument3 pagesFive Cs of Credit: CreditworthinessSakshi Singh YaduvanshiNo ratings yet

- Credit Rating AgenciesDocument11 pagesCredit Rating AgenciesmanyasinghNo ratings yet

- DIY Credit Repair And Building Guide: Financial Free VictoryFrom EverandDIY Credit Repair And Building Guide: Financial Free VictoryNo ratings yet

- Credit ReportDocument36 pagesCredit Reportleo namNo ratings yet

- Repair Your Credit Score: The Ultimate Personal Finance Guide. Learn Effective Credit Repair Strategies, Fix Bad Debt and Improve Your Score.From EverandRepair Your Credit Score: The Ultimate Personal Finance Guide. Learn Effective Credit Repair Strategies, Fix Bad Debt and Improve Your Score.No ratings yet

- BankingDocument110 pagesBankingNarcity UzumakiNo ratings yet

- Capital: Owner About Their Stake Hence More Safeguard Will Be The Borrowed FundsDocument28 pagesCapital: Owner About Their Stake Hence More Safeguard Will Be The Borrowed FundsMdramjanaliNo ratings yet

- Credit Information BureauDocument15 pagesCredit Information BureaurishiomkumarNo ratings yet

- Credit Worthiness: What Is A Corporate Credit RatingDocument23 pagesCredit Worthiness: What Is A Corporate Credit RatingSudarshan ChitlangiaNo ratings yet

- Banking Services 29011Document14 pagesBanking Services 29011anky54321No ratings yet

- CCC NotesDocument8 pagesCCC NotesElla MendresNo ratings yet

- Bank BazaarDocument2 pagesBank BazaaradityashettyNo ratings yet

- CCC NotesDocument8 pagesCCC NotesElla MendresNo ratings yet

- Credit AppraisalDocument4 pagesCredit AppraisalAbhishek RanjanNo ratings yet

- Credit Scoring Literature ReviewDocument5 pagesCredit Scoring Literature Reviewafdtovmhb100% (2)

- Experian Credit Report Customer ServiceDocument9 pagesExperian Credit Report Customer Serviceewbs1766100% (1)

- Credit Rating: CreditworthinessDocument5 pagesCredit Rating: CreditworthinessRekha SoniNo ratings yet

- Bank of America 1Document19 pagesBank of America 1Vinayak JayanathNo ratings yet

- Credit Rating Is The Opinion of The Rating Agency On The Relative Ability and Willingness of The Issuer of A Debt Instrument To Meet The Debt Service Obligations As and When They AriseDocument5 pagesCredit Rating Is The Opinion of The Rating Agency On The Relative Ability and Willingness of The Issuer of A Debt Instrument To Meet The Debt Service Obligations As and When They ArisePrince VargheseNo ratings yet

- Credit Scoreand ReportDocument10 pagesCredit Scoreand ReportMortgage ResourcesNo ratings yet

- Credit Analyst Q&ADocument6 pagesCredit Analyst Q&ASudhir PowerNo ratings yet

- Chapter 16Document12 pagesChapter 16Nicholas GiaquintoNo ratings yet

- (Gurgaon) (Mumbai) : US Mortgage Process OriginationDocument9 pages(Gurgaon) (Mumbai) : US Mortgage Process OriginationAshish RupaniNo ratings yet

- Assertions On The Financial StatementsDocument1 pageAssertions On The Financial StatementsRenato AlferesNo ratings yet

- 12-Roles Responsibilities and Authorities ExampleDocument2 pages12-Roles Responsibilities and Authorities Examplecarmine evangelistaNo ratings yet

- Sagaya CandyDocument1 pageSagaya CandyimranpashausNo ratings yet

- BK Imp ObjectivesDocument21 pagesBK Imp Objectivespanchalyash266No ratings yet

- Virtual Wallet Fine PrintDocument34 pagesVirtual Wallet Fine PrintDeanthony WilliamsNo ratings yet

- None 9aa455b5Document10 pagesNone 9aa455b5ANISNo ratings yet

- A Stockbroker Is A Regulated Professional IndividualDocument2 pagesA Stockbroker Is A Regulated Professional Individualmldc2006No ratings yet

- Intermediate Accounting IFRS Edition: Kieso, Weygandt, WarfieldDocument16 pagesIntermediate Accounting IFRS Edition: Kieso, Weygandt, Warfielddystopian au.100% (1)

- Review Questions On Financial Planning and ForecastingDocument5 pagesReview Questions On Financial Planning and ForecastingGadafi FuadNo ratings yet

- Chapter #1 Tutorial Class: Faculty of Economics and Administration Accounting Department ACCT 117Document47 pagesChapter #1 Tutorial Class: Faculty of Economics and Administration Accounting Department ACCT 117hazem 00No ratings yet

- Module 2 - Completing The Accounting CycleDocument45 pagesModule 2 - Completing The Accounting CycleShane TorrieNo ratings yet

- Penyimpanan Barang Ke GudangDocument10 pagesPenyimpanan Barang Ke Gudangajeng.saraswatiNo ratings yet

- Accounting Process by NavkarDocument44 pagesAccounting Process by NavkarShlok JainNo ratings yet

- Module 1.1 Orientation & PFRS 15Document22 pagesModule 1.1 Orientation & PFRS 15NCTNo ratings yet

- Nestle Finance International LTD Fullyear Financial Report 2021 enDocument37 pagesNestle Finance International LTD Fullyear Financial Report 2021 enT.k.e.dNo ratings yet

- Wealth Management For NRIsDocument4 pagesWealth Management For NRIsVishal SoniNo ratings yet

- Chapter 6 CashDocument15 pagesChapter 6 CashTesfamlak MulatuNo ratings yet

- Cash Advance - Travel, Payroll, PCF, & Operational ExpensesDocument1 pageCash Advance - Travel, Payroll, PCF, & Operational ExpensesPgas PaccoNo ratings yet

- Palepu 3e ch4Document21 pagesPalepu 3e ch4Nadine SantosNo ratings yet

- Answer Key - Employee Benefits PDFDocument3 pagesAnswer Key - Employee Benefits PDFglobeth berbanoNo ratings yet

- Tutorial Set 2 - Key SolutionsDocument4 pagesTutorial Set 2 - Key SolutionsgregNo ratings yet

- Safari 1Document1 pageSafari 1SATNAM SINGH LAMBANo ratings yet

- Activity On AbcDocument3 pagesActivity On AbcAvox EverdeenNo ratings yet

- Public Sector Accounting Developments and Conceptual FrameworkDocument24 pagesPublic Sector Accounting Developments and Conceptual FrameworkREJAY89No ratings yet

- By: Ashish SharmaDocument26 pagesBy: Ashish Sharmashukhi89No ratings yet

- Bond Consultants Inc: PH 215 766 1990 FAX 215 766 1225Document2 pagesBond Consultants Inc: PH 215 766 1990 FAX 215 766 1225trustkonanNo ratings yet

- Hull OFOD9e MultipleChoice Questions and Answers Ch07 PDFDocument7 pagesHull OFOD9e MultipleChoice Questions and Answers Ch07 PDFfawefwaeNo ratings yet

- Transfer Advice ةلاوح راعشإ: JO09 UBSI 1010 0000 1020 7720 9151 01Document2 pagesTransfer Advice ةلاوح راعشإ: JO09 UBSI 1010 0000 1020 7720 9151 01Rasha AbdullahNo ratings yet