Professional Documents

Culture Documents

Participating in Return Tables 212 No Direct Implication in Return Tables 0

Participating in Return Tables 212 No Direct Implication in Return Tables 0

Uploaded by

Dharmendra RoutOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Participating in Return Tables 212 No Direct Implication in Return Tables 0

Participating in Return Tables 212 No Direct Implication in Return Tables 0

Uploaded by

Dharmendra RoutCopyright:

Available Formats

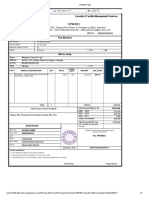

NAB BHARAT ENTERPRISES

AUTHORISED SALES & SERVICE

DEALER FOR M/S KIRLOSKAR OIL ENGINE LTD,

22/A,FALCON HOUSE,CUTTACK ROAD,

BHUBANESWAR

Ph.-9776009935/7381046444

Odisha - 751006, India

GST Computation

1-Mar-2019 to 31-Mar-2019

Page 1

GSTIN/UIN : 21AZMPP5794P1ZF 1-Mar-2019 to 31-Mar-2019

Returns Summary

Total number of vouchers for the period 473

Included in returns 212

Participating in return tables 212

No direct implication in return tables 0

Not relevant for returns 261

Incomplete/Mismatch in information (to be resolved) 0

Ta- P a r t i c u l a r s Taxable Integra- Central State Tax Cess Tax

ble Value ted Tax Tax Amount Amount Amount

No. Amount Amount

3.1 Outward supplies and inward supplies liable to reverse 13,47,436.49 1,10,292.87 1,10,292.87 2,20,585.74

charge

3.2 Of the supplies shown in 3.1 (a) above, details of inter

-state supplies made to unregistered persons,

composition taxable persons and UIN holders

4 Eligible ITC 30,704.60 74,638.15 74,638.15 1,79,980.90

5 Value of exempt, nil rated and non-GST inward supplies 9,738.00

5.1 Interest and Late fee Payable

Reverse Charge Liability and Input Credit to be booked

Reverse Charge Inward Supplies 0.00

Import of Service 0.00

Input Credit to be Booked

Advance Payments

Amount Unadjusted Against Purchases 0.00

Purchase Against Advance from Previous Periods

Note: Amount is not shown for Input Credit to be Booked. Drill down for values.

You might also like

- PayslipDocument1 pagePayslipRow Dizon0% (3)

- TDS Certificate - Form 16A - Q 1 - 23Document3 pagesTDS Certificate - Form 16A - Q 1 - 23ADBHUT CHARAN DAS IskconNo ratings yet

- PDF Document TD 2023Document2 pagesPDF Document TD 2023EDWARD MCMILLIAN100% (1)

- Participating in Return Tables 58 No Direct Implication in Return Tables 0Document1 pageParticipating in Return Tables 58 No Direct Implication in Return Tables 0Mallikarjun KambadNo ratings yet

- Participating in Return Tables 512 No Direct Implication in Return Tables 0Document2 pagesParticipating in Return Tables 512 No Direct Implication in Return Tables 0ROHIT SHARMA DEHRADUNNo ratings yet

- GST3BDocument1 pageGST3BParshad SankheNo ratings yet

- GST 3 BDocument1 pageGST 3 BSwetha KarthickNo ratings yet

- GSTR 3BDocument2 pagesGSTR 3BShruti RastogiNo ratings yet

- 23bch021 (Dilkhush Kumar) GSTR-3BDocument2 pages23bch021 (Dilkhush Kumar) GSTR-3Bpr91127810No ratings yet

- Combinepdf 2Document4 pagesCombinepdf 2Kisan LendeNo ratings yet

- SRO0677689 BHAVANI PRIYA .V CHN ICITSS IT 03-21-130 GST ComputationDocument2 pagesSRO0677689 BHAVANI PRIYA .V CHN ICITSS IT 03-21-130 GST ComputationKarthick KartyNo ratings yet

- Tally Erp 9 Sop 2 Part 3Document1 pageTally Erp 9 Sop 2 Part 3srehaan891No ratings yet

- Tax Invoice: Plot No. 837, Udyog Vihar Phase - 5, Gurgaon-122016, HaryanaDocument1 pageTax Invoice: Plot No. 837, Udyog Vihar Phase - 5, Gurgaon-122016, HaryanaMazhar KhanNo ratings yet

- 15-Mar-2019 CL PDFDocument3 pages15-Mar-2019 CL PDFDarshanNo ratings yet

- HTMLReports 1Document1 pageHTMLReports 1kuldeeptawar250No ratings yet

- Statement of Accounts: Account SummaryDocument1 pageStatement of Accounts: Account Summarypadma padmaNo ratings yet

- Bill-1 240419 165356Document9 pagesBill-1 240419 165356kavish.1628No ratings yet

- MAC Jan-2022 Pending InvDocument1 pageMAC Jan-2022 Pending InvSree ganapathy Facilitation servicesNo ratings yet

- Draf T: Form GSTR-3BDocument3 pagesDraf T: Form GSTR-3BAnamikaNo ratings yet

- Anand Steel GSTR1 AugustDocument1 pageAnand Steel GSTR1 AugustNikita VarshneyNo ratings yet

- Cetp ChargesDocument1 pageCetp ChargesBharat SharmaNo ratings yet

- Bhagwati Traders - (From 1-Apr-2011) : Participating in Return Tables 161 No Direct Implication in Return Tables 0Document4 pagesBhagwati Traders - (From 1-Apr-2011) : Participating in Return Tables 161 No Direct Implication in Return Tables 0mukesh singhal537No ratings yet

- Broadband Apr 2019 To Sep 2019Document1 pageBroadband Apr 2019 To Sep 2019Yatharth SahuNo ratings yet

- VP 06DBJ4LK InvoicesDocument2 pagesVP 06DBJ4LK Invoicesjalpa daveNo ratings yet

- Downloadbillsinumber 06252450631&invoicenumber HT2510I000567391&lob FIXED LINE&billingAccountNumber 20013748746Document4 pagesDownloadbillsinumber 06252450631&invoicenumber HT2510I000567391&lob FIXED LINE&billingAccountNumber 20013748746anurag97719No ratings yet

- 1-3740814354921 Bm2419i001277859Document4 pages1-3740814354921 Bm2419i001277859subhradip.durbintechNo ratings yet

- TALLYDocument1 pageTALLYNikita VarshneyNo ratings yet

- Airw 3Document1 pageAirw 3Bhupendra SinghNo ratings yet

- EtisalatDocument15 pagesEtisalatStena NadishaniNo ratings yet

- DL ReportDocument1 pageDL ReportAkshay SakharkarNo ratings yet

- L00368bi 20231227 85232 0001094215Document1 pageL00368bi 20231227 85232 0001094215Vikas NimbranaNo ratings yet

- GST AcDocument1 pageGST AcParshad SankheNo ratings yet

- Sample InvoiceDocument2 pagesSample Invoicemladdict001No ratings yet

- Gopal Ji Steel GSTR3B April To June 2022Document1 pageGopal Ji Steel GSTR3B April To June 2022Nikita VarshneyNo ratings yet

- Taco 0215148050700005Document1 pageTaco 0215148050700005hariprasathnishik5293No ratings yet

- PDF Document TD 2-2Document2 pagesPDF Document TD 2-2tygablinkzNo ratings yet

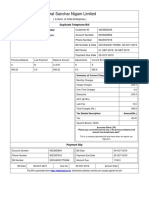

- Bharat Sanchar Nigam Limited: Duplicate Telephone Bill Name and Address of The CustomerDocument1 pageBharat Sanchar Nigam Limited: Duplicate Telephone Bill Name and Address of The CustomerMerlin HawkNo ratings yet

- Bill-1 240419 165356Document5 pagesBill-1 240419 165356kavish.1628No ratings yet

- Employee Processed RecordDocument129 pagesEmployee Processed RecordMANU RAJNo ratings yet

- Detailed Computation BDJPS7350C 1870960 Old Regime 20230730161927Document4 pagesDetailed Computation BDJPS7350C 1870960 Old Regime 20230730161927suman.singh08031992No ratings yet

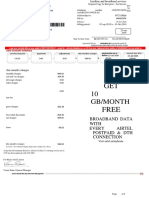

- 10 Gb/Month: Broadband Data With Every Airtel Postpaid & DTH ConnectionDocument7 pages10 Gb/Month: Broadband Data With Every Airtel Postpaid & DTH ConnectionSuresh ShpNo ratings yet

- INNOVITI Airtel BillDocument2 pagesINNOVITI Airtel BillSyed HussainNo ratings yet

- INNOVITI Airtel BillDocument2 pagesINNOVITI Airtel BillSyed HussainNo ratings yet

- Screenshot 2023-04-04 at 6.54.43 PMDocument20 pagesScreenshot 2023-04-04 at 6.54.43 PMJeffy SimonNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Satyajit GarewalNo ratings yet

- INV1844199792Document18 pagesINV1844199792MohdDanishNo ratings yet

- Vidvatam Est. Fy 22-23Document6 pagesVidvatam Est. Fy 22-23Kunal SinghNo ratings yet

- Goods & Service Tax (GST) - User DashboardDocument1 pageGoods & Service Tax (GST) - User Dashboardpratyushkushwaha064No ratings yet

- Upgrad PayslipDocument1 pageUpgrad PayslipSantanu SauNo ratings yet

- Tax Invoice: Raga Coffee CPSDocument1 pageTax Invoice: Raga Coffee CPSAbhijit SarkarNo ratings yet

- Comp 22 23Document2 pagesComp 22 23mexop31426No ratings yet

- IGL B2003 June 2022Document2 pagesIGL B2003 June 2022shivam_2607No ratings yet

- Government of Andhra Pradesh: (APTC Form-47)Document2 pagesGovernment of Andhra Pradesh: (APTC Form-47)Y.rajuNo ratings yet

- Rajesh Bora Itr PLBS 2022Document5 pagesRajesh Bora Itr PLBS 2022ABDUL KHALIKNo ratings yet

- Computation 2019Document16 pagesComputation 2019Giri SukumarNo ratings yet

- Form 16 (2022-23) Assessment Year 2023-24Document6 pagesForm 16 (2022-23) Assessment Year 2023-24Hidden future techNo ratings yet

- EMI Cash Outflow - 1,799,952 Tax Benefit On Lease Rental - 539,986 Cash Flow Post Tax Benefit - 1,259,966Document1 pageEMI Cash Outflow - 1,799,952 Tax Benefit On Lease Rental - 539,986 Cash Flow Post Tax Benefit - 1,259,966KmmNo ratings yet

- Tax Invoice: Bharat Auto Agency Hero Insurance Broking India Private LimitedDocument1 pageTax Invoice: Bharat Auto Agency Hero Insurance Broking India Private Limitedbharauthero barautNo ratings yet

- WS51H883AS0716 - 01-Apr-2019TO30-Apr-2019Document1 pageWS51H883AS0716 - 01-Apr-2019TO30-Apr-2019Avineet SadaniNo ratings yet

- Right to Work?: Assessing India's Employment Guarantee Scheme in BiharFrom EverandRight to Work?: Assessing India's Employment Guarantee Scheme in BiharNo ratings yet

- Income Taxation Taxation of CorporationsDocument52 pagesIncome Taxation Taxation of CorporationsBianca Denise AbadNo ratings yet

- 20 Traders Royal Bank V Radio Phil NetworkDocument2 pages20 Traders Royal Bank V Radio Phil NetworkMichelle BernardoNo ratings yet

- CIR v. Mirant, G.R. No. 172129, 2008 4.31.41 PMDocument18 pagesCIR v. Mirant, G.R. No. 172129, 2008 4.31.41 PMTorrecampo YvetteNo ratings yet

- Estmt - 2019 08 26Document8 pagesEstmt - 2019 08 26Sandra RíosNo ratings yet

- Chemalite AnswersDocument2 pagesChemalite AnswersMine SayracNo ratings yet

- In Come Tax Return Form 2019Document48 pagesIn Come Tax Return Form 2019Mirza Naseer AbbasNo ratings yet

- TNG Statement Bengkel MP QRDocument2 pagesTNG Statement Bengkel MP QRfadhlina.alinNo ratings yet

- Government and NFP Accounting Assignment IIDocument3 pagesGovernment and NFP Accounting Assignment IIeferemNo ratings yet

- Truong Phat Invoice Receipt 27147Document1 pageTruong Phat Invoice Receipt 27147Phuong Trang TranNo ratings yet

- Proposal Espay Updated Aug 2020Document7 pagesProposal Espay Updated Aug 2020yogi halobelanjaNo ratings yet

- Kuwait IncomeTax Decree PDFDocument8 pagesKuwait IncomeTax Decree PDFChristian D. Orbe100% (1)

- MahalakmiDocument1 pageMahalakmiJeyaselan JeyaseelanNo ratings yet

- Acctng Manufacturing BusinessDocument1 pageAcctng Manufacturing BusinessLilyNo ratings yet

- 8657948Document4 pages8657948Pulkit MahajanNo ratings yet

- Amazon July Seller InvoiceDocument4 pagesAmazon July Seller InvoiceShoyab ZeonNo ratings yet

- 01.29.2017 02.13.2017Document1 page01.29.2017 02.13.2017vineethNo ratings yet

- Manduleli Victor Bikitsha M0zwmqy8 ArchivedDocument6 pagesManduleli Victor Bikitsha M0zwmqy8 ArchivedManduleli BikitshaNo ratings yet

- 11 PaperDocument2 pages11 PaperSomesh DhingraNo ratings yet

- Ibex Training - J.C. Miranda - 122451Document17 pagesIbex Training - J.C. Miranda - 122451Esmeralda CuadraNo ratings yet

- John F. Jackson, JR., and Shirley Jackson v. Commissioner of Internal Revenue, 966 F.2d 598, 10th Cir. (1992)Document6 pagesJohn F. Jackson, JR., and Shirley Jackson v. Commissioner of Internal Revenue, 966 F.2d 598, 10th Cir. (1992)Scribd Government DocsNo ratings yet

- Bus Bar Trunking System: Product Name Brand Capacity HS CodeDocument3 pagesBus Bar Trunking System: Product Name Brand Capacity HS CodeEast West Medical College & HospitalNo ratings yet

- Official Gift CertificateDocument2 pagesOfficial Gift Certificatepradeep dixitNo ratings yet

- DownloadDocument4 pagesDownloadAMR ERFANNo ratings yet

- 80 G - Income Tax ActDocument11 pages80 G - Income Tax ActGajendran Venkata Perumal RajuNo ratings yet

- Tally PDFDocument1 pageTally PDFVipin Kumar ChandelNo ratings yet

- ZerodhaDocument46 pagesZerodhaanicket kabeerNo ratings yet

- Excitel - Procare A DecDocument2 pagesExcitel - Procare A Decmdumar0164No ratings yet

- A Judge Denied A 94 Year Old Woman S Attempt ToDocument1 pageA Judge Denied A 94 Year Old Woman S Attempt ToFreelance WorkerNo ratings yet

- Ddpo Issuance Indus FormDocument1 pageDdpo Issuance Indus FormDesikanNo ratings yet