Professional Documents

Culture Documents

Commercial Flow Chart Rev2

Commercial Flow Chart Rev2

Uploaded by

H126 IN5Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Commercial Flow Chart Rev2

Commercial Flow Chart Rev2

Uploaded by

H126 IN5Copyright:

Available Formats

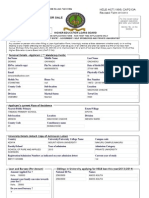

OUR Commercial Flow Chart

You need the following in place FIRST and on filed with the IRS, they do not see the UCC document:

Form 2848 Power of Attorney and Form 56 - Fiduciary Contract (between you and your “Birth Certificate”

Private Foundation Trust/Corporation).

To Pay Bills/Court Cases Pay-off Mortgage or P.N. To Banks (for control of Accounts)

1st Presentment: 1st Presentment: 1st Presentment:

Part 1 * Part 1 * Part 1 *

1. Cover Letter * 1. Cover Letter * 1. Cover Letter *

2. 1099-A for their Bill 2. A4V – for their Bill ** 2. A4V – for their Bill **

3. A4V/R4V – for Pay-off 3. 1099-A for their Bill ** 3. 1099-A for their Bill **

Presentment 4. 1040V’s (for Account Set-off) 4. 1040V’s (for Account Set-off)

4. 1040V’s 5. 1099-B (give them the B copy)

Need to do both of the following: Part 2 - for out of pocket payments:

Part 2 - for out of pocket payments 1. 1099-A - for out of pocket

1. 1099-A for out of pocket 6. A4V - Initial Contract

7. A4V - Pay-off Presentment deposits (give them the B copy)

payments (give them the B copy) 2. 1099-OID (requested from them)

2. 1099-OID (requested from them) Part 2 - for out of pocket payments: 3. 1099-INT (requested from them)

3. 1099-INT (requested from them) 1. 1099-A for out of pocket

payments (give them the B copy) 2nd Presentment: (IF they returned or

2nd Presentment: (IF they returned or 2. 1099-OID (requested from them) rejected your offer)

rejected your offer to pay and settle)

3. 1099-INT (requested from them)

1. New Cover Letter (this is

1. New Cover Letter (this is Part 3 – for extra Escrow: second Request)

second Payment offer) 1. 1099-A for ESCROW (give 2. Everything from before plus

2. Everything from before plus them the B copy) 3. Add the sf28 and op91 (tied

3. Add the sf28 and op91 (tied together word wise)

together word wise) 2nd Presentment: (IF they returned or

rejected your offer to pay and settle)

To the IRS:

To the IRS: 1. New Cover Letter (this is

second Payment offer) 1096 and 1099-A (copy A)

1096 and 1099-A (copy A)

2. Everything from before plus

3. Add the sf28, op90 and op91 To the Federal Reserve Bank

(tied together word wise) Complaint and Investigative Department

To the IRS/CID – For CLOSURE:

To the IRS: 1. Cover Letter to them

1. Cover Letter to IRS 2. Complete package of what you

2. 3949A 1096 and 1099-A (should be 3/4 –A copies) sent to the bank

3. Complete package of what you And

1096 and 1099-B (A copy)

sent to the Company

To the IRS/CID:

To the IRS/CID – For CLOSURE: 1. Cover Letter

1. Cover Letter to IRS 2. 3949A

2. 3949A

3. Complete package of what you

sent to the Mortgage company.

* - The Cover Letter and a copy of our Form 56 and 2848, will address the fact to them who is who.

** - The required IRS forms will be supplied to them by our Corporation, when the Corporation receives a Valid Bill and the Corporation makes

the settlement.

Special Notes:

• Only after they refuse to supply the 1099-OID’s and/or the 1099-INT’s, THEN can your Corporation file them per IRS Pub. 1212.

• STOP Thinking that you know everything, you Don’t;

• We are NOT the Corporation “Taxpayer” person, we are a Third Party representative.

• Our Corporation has to pay and settle its accounts and YOU are there to HELP the Corporation stay in Honor, you let the IRS do the rest.

You might also like

- Car Dealer LTR Sample 1099aDocument3 pagesCar Dealer LTR Sample 1099aBrooks94% (64)

- How To File 1096 1099a 1099oid To Pay Utility BillsDocument7 pagesHow To File 1096 1099a 1099oid To Pay Utility BillsNotarys To Go99% (67)

- Information On Pure Common Law TrustsDocument27 pagesInformation On Pure Common Law TrustsBrenda87% (61)

- Fitl /: How Out Form FnstructionsDocument7 pagesFitl /: How Out Form Fnstructionslauren5maria100% (17)

- Cashflow 101 Game SheetsDocument4 pagesCashflow 101 Game SheetsJohn Mohr86% (7)

- Trustee Process For The 1099-A ProcessDocument26 pagesTrustee Process For The 1099-A ProcessJusta96% (54)

- Sample 1099-OidDocument1 pageSample 1099-OidNikki Cofield74% (27)

- 1-1099A Checklist To Purchase of Payyoff DebtDocument7 pages1-1099A Checklist To Purchase of Payyoff DebtJusta100% (16)

- 1099 AD Anna Von Reitz Discheging DebtDocument6 pages1099 AD Anna Von Reitz Discheging Debtlerosenoir96% (27)

- Irs Form 1099 OidDocument43 pagesIrs Form 1099 Oidblcksource98% (50)

- Money Order Keating Style ExampleDocument2 pagesMoney Order Keating Style Examplekbarn389100% (84)

- 709 Form 2005 SampleDocument4 pages709 Form 2005 Sample123pratus92% (13)

- Memorandum of Law in Support of 1099oidDocument19 pagesMemorandum of Law in Support of 1099oidkingtbrown50100% (3)

- 1099IODDocument10 pages1099IODpreston_402003100% (30)

- Fiduciary Appointment and Authorization: Respondent / Fiduciary Trustee Principal / BeneficiaryDocument6 pagesFiduciary Appointment and Authorization: Respondent / Fiduciary Trustee Principal / Beneficiarytony100% (23)

- 2 - Oid MethodDocument2 pages2 - Oid MethodSovereign62996% (49)

- 1099 OidDocument40 pages1099 OidTheeMerovingian98% (53)

- Admiralty Special Maritime ExposedDocument46 pagesAdmiralty Special Maritime ExposedGOD SAVES AMERICA100% (5)

- To Pay Bills - Court CasesDocument6 pagesTo Pay Bills - Court Casesliz knight93% (14)

- 1099-Oid Interview SanitizedDocument24 pages1099-Oid Interview Sanitizedcamwills2100% (7)

- Commercial Flow Chart Rev2Document1 pageCommercial Flow Chart Rev2H126 IN5100% (6)

- Commercial Flow Chart Rev2Document1 pageCommercial Flow Chart Rev2H126 IN5100% (6)

- Learn The ABCs and Get Your CAP Rev 3Document9 pagesLearn The ABCs and Get Your CAP Rev 3sc100% (27)

- 1099+O I D +classDocument8 pages1099+O I D +classBoyd Kyle100% (19)

- 1099 Oid in DepthDocument29 pages1099 Oid in Depthpauldawalll78% (9)

- Our Commercial Flow Chart Rev2Document1 pageOur Commercial Flow Chart Rev2Dark Heineken100% (1)

- Do Not Send Anything To Austin TX 73301-0215 - This Is A Sorting OfficeDocument11 pagesDo Not Send Anything To Austin TX 73301-0215 - This Is A Sorting Officenaturalvibes94% (17)

- 1040-V Template 10-03-08Document1 page1040-V Template 10-03-08Justin Vance100% (6)

- InstructionsDocument6 pagesInstructionslyocco191% (11)

- My AFV SuccessDocument5 pagesMy AFV SuccessNat Williams100% (2)

- Case 2:09-cv-07017-GHK-RC Document 36 Filed 03/08/10 1 of 8Document5 pagesCase 2:09-cv-07017-GHK-RC Document 36 Filed 03/08/10 1 of 8Nat WilliamsNo ratings yet

- Banking Trust Flow Chart OverviewDocument1 pageBanking Trust Flow Chart OverviewRoger Ross67% (3)

- 1099-b Whfit FormDocument6 pages1099-b Whfit FormYarod EL100% (5)

- f1099 OID 1096 TemplateDocument3 pagesf1099 OID 1096 Templatethenjhomebuyer100% (27)

- 1099 Form InstructionsDocument106 pages1099 Form InstructionsLor-ron Wade100% (1)

- 1099-C PDFDocument6 pages1099-C PDFZyren Del Mundo50% (6)

- Contract Act 1872Document26 pagesContract Act 1872akash100% (1)

- Time Value of MechanicsDocument6 pagesTime Value of MechanicsFyaj RohanNo ratings yet

- Challenges and Performance of Adopting REIT Structure in Financing Real Estate in NigeriaDocument60 pagesChallenges and Performance of Adopting REIT Structure in Financing Real Estate in NigeriaTayo Odunsi100% (4)

- 1099A Ach PMO Method UnleashedDocument3 pages1099A Ach PMO Method UnleashedPeter Moulden86% (7)

- 1199 A 1 PDFDocument4 pages1199 A 1 PDFGerry Ruff100% (1)

- 2+ +Oid+MethodDocument2 pages2+ +Oid+Methodsnaps78100% (5)

- 2 Oid Method 1Document2 pages2 Oid Method 1sc100% (6)

- 33 - NOTICE of 1099A - Gov - Uscourts.ord.124749.33.0, NOTICE OF 1099ADocument3 pages33 - NOTICE of 1099A - Gov - Uscourts.ord.124749.33.0, NOTICE OF 1099AFreeman Lawyer86% (7)

- 1099 BDocument22 pages1099 Bbharat80% (5)

- Remedies Tax Recovery Letters PDFDocument92 pagesRemedies Tax Recovery Letters PDFmo100% (10)

- A Paper: Including 1099-A On 1040: 1099-A: Acquisition or Abandonment of Secured PropertyDocument3 pagesA Paper: Including 1099-A On 1040: 1099-A: Acquisition or Abandonment of Secured PropertyDarrell Wilson100% (3)

- 1099 Payoff Mortgage Process - Redacted V 9-10-22Document14 pages1099 Payoff Mortgage Process - Redacted V 9-10-22Joshua Sygnal Gutierrez100% (42)

- Tax Recovery 10 20 - 13Document61 pagesTax Recovery 10 20 - 13Kurozato Candy100% (1)

- Seth Sundberg 1099 OID Indictment, Complaint, Motion To DismissDocument43 pagesSeth Sundberg 1099 OID Indictment, Complaint, Motion To DismissBob Hurt90% (30)

- Instructions For Completing The SF 1199A (Direct Deposit Form)Document1 pageInstructions For Completing The SF 1199A (Direct Deposit Form)donald trumpNo ratings yet

- 1099 Oid'sDocument8 pages1099 Oid'sNikki Cofield82% (17)

- Report 1099Document9 pagesReport 1099William Smith100% (3)

- 1041 Tax Return Walk-ThroughDocument66 pages1041 Tax Return Walk-Throughdsfewr100% (5)

- 1099 ExplDocument17 pages1099 Expldcsshit100% (11)

- Payment Voucher Form 1040v WEBDocument1 pagePayment Voucher Form 1040v WEBWil100% (5)

- 1099 File SpecsDocument162 pages1099 File SpecsVipan kumar100% (1)

- Latest A4VDocument10 pagesLatest A4VStephen L. SmithNo ratings yet

- Updated Letter To Escrow Holder 1aDocument3 pagesUpdated Letter To Escrow Holder 1aapi-19731109100% (7)

- F 1099 CDocument6 pagesF 1099 Cmoritzjohn50% (2)

- How To File Your Own Bankruptcy: The Step-by-Step Handbook to Filing Your Own Bankruptcy PetitionFrom EverandHow To File Your Own Bankruptcy: The Step-by-Step Handbook to Filing Your Own Bankruptcy PetitionNo ratings yet

- The Constitutional Case for Religious Exemptions from Federal Vaccine MandatesFrom EverandThe Constitutional Case for Religious Exemptions from Federal Vaccine MandatesNo ratings yet

- Lawfully Yours: The Realm of Business, Government and LawFrom EverandLawfully Yours: The Realm of Business, Government and LawNo ratings yet

- I941 INSTRUCTIONS 2019 PDFDocument12 pagesI941 INSTRUCTIONS 2019 PDFH126 IN5No ratings yet

- Ch-4-2019 - 09-MAR-RRTFB-3-29-19 ATTORNEYDocument166 pagesCh-4-2019 - 09-MAR-RRTFB-3-29-19 ATTORNEYH126 IN5No ratings yet

- Constructive NoticeDocument3 pagesConstructive NoticeH126 IN5100% (3)

- Test Question For Math 12Document5 pagesTest Question For Math 12Ernie Lahaylahay100% (1)

- Fire InsuranceDocument9 pagesFire InsuranceNisarg KhamarNo ratings yet

- Barreto V VillanuevaDocument1 pageBarreto V VillanuevaSalma GurarNo ratings yet

- Idiomatic American EnglishDocument122 pagesIdiomatic American EnglishNguyenquang Hoa100% (2)

- Ubi Process Note of Shourya Virat Trading CompanyDocument11 pagesUbi Process Note of Shourya Virat Trading CompanyTripurari KumarNo ratings yet

- Montecillo Vs Reyes (GR No. 138018)Document16 pagesMontecillo Vs Reyes (GR No. 138018)Rose MadrigalNo ratings yet

- Dissertation On Export FinanceDocument38 pagesDissertation On Export FinancerrkbNo ratings yet

- Luzon Development Bank: Published Balance SheetDocument2 pagesLuzon Development Bank: Published Balance SheetThinkingPinoyNo ratings yet

- Bharti AxaDocument65 pagesBharti Axatriptiud100% (1)

- DM Assignment - Thena BankDocument39 pagesDM Assignment - Thena BankSanthosh SadasivamNo ratings yet

- Swabhimaan - Transforming Rural India Through Financial InclusionDocument2 pagesSwabhimaan - Transforming Rural India Through Financial Inclusionjohnyy2kNo ratings yet

- Scope of Financial ServicesDocument23 pagesScope of Financial ServicessuchethatiaNo ratings yet

- RMK Banking Accounting and LPDDocument24 pagesRMK Banking Accounting and LPDNadiani NanaNo ratings yet

- Managing Change in Organizations: Submitted byDocument7 pagesManaging Change in Organizations: Submitted bya_biyaniNo ratings yet

- Bank of India E Auction Sale Notice For Uploading09.02.2024Document1 pageBank of India E Auction Sale Notice For Uploading09.02.2024Ranbir GoyalNo ratings yet

- Understanding Your Cibil Transunion ScoreDocument3 pagesUnderstanding Your Cibil Transunion Scorechirag1658108No ratings yet

- State Investment House Inc. Vs Citibank - FulltextDocument4 pagesState Investment House Inc. Vs Citibank - Fulltextscartoneros_1No ratings yet

- Guaranty ReviewerDocument3 pagesGuaranty ReviewerPduys16No ratings yet

- Interview Question and AnswersDocument7 pagesInterview Question and AnswersDvd NitinNo ratings yet

- Logarithms and Car PaymentsDocument8 pagesLogarithms and Car Paymentsapi-264152935No ratings yet

- Mayor Annise Parker Inaugural Address January 3, 2012: I Love This City!Document4 pagesMayor Annise Parker Inaugural Address January 3, 2012: I Love This City!Houston ChronicleNo ratings yet

- Hud-Property Conveyances 4330.4Document75 pagesHud-Property Conveyances 4330.4Wonderland ExplorerNo ratings yet

- Helb DennisDocument6 pagesHelb DennisDennis Onchieku OnyandoNo ratings yet

- What Is The World Bank?Document8 pagesWhat Is The World Bank?Nahidul IslamNo ratings yet

- Alexis Dawes - Desperate Buyers OnlyDocument99 pagesAlexis Dawes - Desperate Buyers Onlylyllacycus100% (1)

- Flores Vs LindoDocument1 pageFlores Vs LindoRR FNo ratings yet