Professional Documents

Culture Documents

Standrad Costing 2.1

Standrad Costing 2.1

Uploaded by

Lhorene Hope DueñasCopyright:

Available Formats

You might also like

- InstructionsDocument36 pagesInstructionsjhouvan50% (6)

- Chap 4 - CVP AnalysisDocument47 pagesChap 4 - CVP Analysiszyra liam styles93% (14)

- Introduction To Managerial Accounting 7th Edition Test Bank BrewerDocument155 pagesIntroduction To Managerial Accounting 7th Edition Test Bank BrewerJefferson SarmientoNo ratings yet

- AIA D200 1995 Free Sample PreviewDocument22 pagesAIA D200 1995 Free Sample PreviewShely NovitaNo ratings yet

- Cost Acctg ReviewerDocument106 pagesCost Acctg ReviewerGregory Chase83% (6)

- Manufacturing Cycle EfficiencyDocument1 pageManufacturing Cycle EfficiencyLhorene Hope DueñasNo ratings yet

- Chapter 3 - MethodologyDocument3 pagesChapter 3 - MethodologyLhorene Hope Dueñas67% (3)

- Should The Tax Laws Be Reformed To Encourage Saving ?Document13 pagesShould The Tax Laws Be Reformed To Encourage Saving ?Tripti RaiNo ratings yet

- Chapter 13 - Progress & Performance Measurement & EvaluationDocument40 pagesChapter 13 - Progress & Performance Measurement & EvaluationRatan Gohel100% (2)

- Jensen 2003 PDFDocument28 pagesJensen 2003 PDFwahyu artikaNo ratings yet

- Midterm Exam Government Accounting and Npo Dfcamclp Ay 2020 2021 For Online StudentsDocument12 pagesMidterm Exam Government Accounting and Npo Dfcamclp Ay 2020 2021 For Online StudentsLeny Joy Dupo33% (3)

- Standard Costing 1.1Document3 pagesStandard Costing 1.1Lhorene Hope DueñasNo ratings yet

- ASSESSMENT - PROC-WPS OfficeDocument3 pagesASSESSMENT - PROC-WPS OfficeJoana Mae DaguioNo ratings yet

- Standard Costs and Variance Analysis MCQs by Hilario TanDocument17 pagesStandard Costs and Variance Analysis MCQs by Hilario TanJoovs Joovho100% (1)

- Stratcost Sample Problems ReviewerDocument7 pagesStratcost Sample Problems ReviewerAngela Nicole CalimbasNo ratings yet

- Theory Standard Costing and Variance AnalysisDocument6 pagesTheory Standard Costing and Variance AnalysisFranklin Galope100% (1)

- Management Advisory ServicesDocument18 pagesManagement Advisory ServicesNanya BisnestNo ratings yet

- Ch03 Predetermined Overhead RatesDocument48 pagesCh03 Predetermined Overhead Ratesバツ きNo ratings yet

- Part I. Theories A. Multiple Choice: Standard Costing and Variance AnalysisDocument29 pagesPart I. Theories A. Multiple Choice: Standard Costing and Variance AnalysisChristian Blanza Lleva100% (2)

- Cost Accounting ExamDocument29 pagesCost Accounting ExamErina AusriaNo ratings yet

- Overhead Costs Have Been Increasing Due To All of The Following EXCEPTDocument13 pagesOverhead Costs Have Been Increasing Due To All of The Following EXCEPTElla Mae TuratoNo ratings yet

- Chapter 6-Cost Concepts and Measurement: Multiple ChoiceDocument29 pagesChapter 6-Cost Concepts and Measurement: Multiple Choiceakash deepNo ratings yet

- CELADocument66 pagesCELAXha100% (1)

- DocxDocument138 pagesDocxTrixie HicaldeNo ratings yet

- Multiple ChoiceDocument2 pagesMultiple ChoiceCarlo ParasNo ratings yet

- MAS - Variance AnalysisDocument13 pagesMAS - Variance AnalysisGhaill CruzNo ratings yet

- Standard Costs and Variance AnalysisDocument14 pagesStandard Costs and Variance AnalysisfretziegaronNo ratings yet

- FA Answer KeyDocument9 pagesFA Answer Keyimsana minatozakiNo ratings yet

- MSQ-01 - Standard Costs and Variance AnalysisDocument14 pagesMSQ-01 - Standard Costs and Variance Analysismimi supasNo ratings yet

- 10 - Standard Costing and Variance AnalysisDocument26 pages10 - Standard Costing and Variance AnalysisKonodio DarudeNo ratings yet

- Chapter 11 Testbank Solution Manual Management AccountingDocument74 pagesChapter 11 Testbank Solution Manual Management AccountingTrinh LêNo ratings yet

- Standard Costing Multiple ChoiceDocument11 pagesStandard Costing Multiple ChoiceRuiz, CherryjaneNo ratings yet

- MSQ-01 - Standard Costs and Variance AnalysisDocument13 pagesMSQ-01 - Standard Costs and Variance AnalysisacyNo ratings yet

- Cost Accounting (1) AnswersDocument5 pagesCost Accounting (1) AnswersMelissa Kayla ManiulitNo ratings yet

- Multiple ChoiceDocument15 pagesMultiple ChoiceChristian Kim MedranoNo ratings yet

- Multiple ChoiceDocument15 pagesMultiple ChoiceChristian Kim MedranoNo ratings yet

- Multiple Choice Questions Variable vs. Absorption CostingDocument106 pagesMultiple Choice Questions Variable vs. Absorption CostingNicole CapundanNo ratings yet

- Toaz - Info Quiz1 Set A PR PDFDocument8 pagesToaz - Info Quiz1 Set A PR PDFNah HamzaNo ratings yet

- Standard Costing Quiz Highlighted AnswersDocument9 pagesStandard Costing Quiz Highlighted AnswersPatrick SalvadorNo ratings yet

- Flexible Budgets and Overhead Analysis: True/FalseDocument69 pagesFlexible Budgets and Overhead Analysis: True/FalseRv CabarleNo ratings yet

- Standard Costs and Variance AnalysisDocument13 pagesStandard Costs and Variance AnalysisJanicaNoiraC.ZunigaNo ratings yet

- God of AllDocument9 pagesGod of AllRaphael Dean Vitug DesturaNo ratings yet

- Standard Costing Multiple ChoiceDocument8 pagesStandard Costing Multiple ChoiceMae Ann AvenidoNo ratings yet

- Std. Cost & Var 2014Document10 pagesStd. Cost & Var 2014Aj de CastroNo ratings yet

- Managerial Economics QuestionnairesDocument26 pagesManagerial Economics QuestionnairesClyde SaladagaNo ratings yet

- TB ch11Document15 pagesTB ch11Pola PolzNo ratings yet

- Chapter 18tstanDocument21 pagesChapter 18tstanGhaill CruzNo ratings yet

- HO5 - Absorption and Variable Costing PDFDocument4 pagesHO5 - Absorption and Variable Costing PDFPATRICIA PEREZNo ratings yet

- CVP Oct 2018 Multiple Choice AnswersDocument5 pagesCVP Oct 2018 Multiple Choice AnswersDufuxwerr WerrNo ratings yet

- Cost ReviewerDocument130 pagesCost ReviewerMarjorie Nepomuceno100% (1)

- Absorption CostingDocument22 pagesAbsorption CostingLeanFlor SegundinoNo ratings yet

- Chapter 3Document49 pagesChapter 3Laijanie Claire Gonzales AlvarezNo ratings yet

- Chap 4 CVP AnalysisDocument45 pagesChap 4 CVP AnalysisJessaNo ratings yet

- Annual Insurance PremiumDocument3 pagesAnnual Insurance PremiumJoyce TenorioNo ratings yet

- Standard Costs and Variance AnalysisDocument14 pagesStandard Costs and Variance Analysisboen jayme0% (1)

- Assessment No. 3 MAS-03 Absorption and Variable Costing Part 1. Multiple Choice Theory: Choose The Letter of The Best AnswerDocument10 pagesAssessment No. 3 MAS-03 Absorption and Variable Costing Part 1. Multiple Choice Theory: Choose The Letter of The Best AnswerPaupauNo ratings yet

- TBApp 08 ADocument161 pagesTBApp 08 Aomar altamimiNo ratings yet

- 5 6235268602178568335Document45 pages5 6235268602178568335Maristella Gaton100% (1)

- MSQ 03 Standard Costs and Variance Analysis BrylDocument13 pagesMSQ 03 Standard Costs and Variance Analysis BrylDavid DavidNo ratings yet

- Ca 5107 - Cost Accounting & Control Quizzer - Standard CostingDocument13 pagesCa 5107 - Cost Accounting & Control Quizzer - Standard CostingAlexandra CruzNo ratings yet

- Management Accounting Strategy Study Resource for CIMA Students: CIMA Study ResourcesFrom EverandManagement Accounting Strategy Study Resource for CIMA Students: CIMA Study ResourcesNo ratings yet

- Management Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageFrom EverandManagement Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageRating: 5 out of 5 stars5/5 (1)

- Finance for Non-Financiers 2: Professional FinancesFrom EverandFinance for Non-Financiers 2: Professional FinancesNo ratings yet

- Cost & Managerial Accounting II EssentialsFrom EverandCost & Managerial Accounting II EssentialsRating: 4 out of 5 stars4/5 (1)

- Flexible BudgetDocument2 pagesFlexible BudgetLhorene Hope DueñasNo ratings yet

- Price Variance: W CompanyDocument2 pagesPrice Variance: W CompanyLhorene Hope DueñasNo ratings yet

- Variance Costing and Activity Based Cotsing Test PrepDocument3 pagesVariance Costing and Activity Based Cotsing Test PrepLhorene Hope DueñasNo ratings yet

- Standard CostingDocument1 pageStandard CostingLhorene Hope DueñasNo ratings yet

- Variance 1Document2 pagesVariance 1Lhorene Hope DueñasNo ratings yet

- Activity Based Costing TestbankDocument7 pagesActivity Based Costing TestbankLhorene Hope DueñasNo ratings yet

- Standard Costing QuizDocument2 pagesStandard Costing QuizLhorene Hope Dueñas100% (1)

- Standard Costing and Flexible Budget 10Document5 pagesStandard Costing and Flexible Budget 10Lhorene Hope DueñasNo ratings yet

- Flexible BudgetDocument4 pagesFlexible BudgetLhorene Hope Dueñas100% (1)

- Flexible Budget and VarianceDocument8 pagesFlexible Budget and VarianceLhorene Hope DueñasNo ratings yet

- Activity Based Costing Test PrepationDocument5 pagesActivity Based Costing Test PrepationLhorene Hope DueñasNo ratings yet

- Standard Costing 1.1Document3 pagesStandard Costing 1.1Lhorene Hope DueñasNo ratings yet

- Abc 3Document13 pagesAbc 3Lhorene Hope DueñasNo ratings yet

- English Grammar and Correct Usage Part 3Document3 pagesEnglish Grammar and Correct Usage Part 3Lhorene Hope DueñasNo ratings yet

- Flexible Budgetand Activity Based CostingDocument13 pagesFlexible Budgetand Activity Based CostingLhorene Hope DueñasNo ratings yet

- Flexible Budget and Activity Based Costing Test BankDocument2 pagesFlexible Budget and Activity Based Costing Test BankLhorene Hope DueñasNo ratings yet

- Standard Costing Ang Variance AnalysisDocument3 pagesStandard Costing Ang Variance AnalysisLhorene Hope DueñasNo ratings yet

- ABC and Flexible BudgetDocument6 pagesABC and Flexible BudgetLhorene Hope DueñasNo ratings yet

- English Grammar and Correct Usage Part 2 2 PDFDocument3 pagesEnglish Grammar and Correct Usage Part 2 2 PDFLhorene Hope DueñasNo ratings yet

- Cash Advances For TravelDocument10 pagesCash Advances For TravelLhorene Hope DueñasNo ratings yet

- This Part Shows The Step-By-Step-Process Followed by The Business in Connection With Its Sales and DisbursementDocument11 pagesThis Part Shows The Step-By-Step-Process Followed by The Business in Connection With Its Sales and DisbursementLhorene Hope DueñasNo ratings yet

- Chapter 3Document5 pagesChapter 3Lhorene Hope DueñasNo ratings yet

- Chapter 3 IPDocument5 pagesChapter 3 IPLhorene Hope DueñasNo ratings yet

- Analysis of Variance - PPTX Generyn ReportDocument6 pagesAnalysis of Variance - PPTX Generyn ReportLhorene Hope DueñasNo ratings yet

- Psychosocial Behavior of Students With Incarcerated ParentsDocument5 pagesPsychosocial Behavior of Students With Incarcerated ParentsLhorene Hope DueñasNo ratings yet

- Binsooiiii Tax 7 PangitDocument1 pageBinsooiiii Tax 7 PangitLhorene Hope DueñasNo ratings yet

- Constitution: Name: Charlynn Joy T. ChavezDocument1 pageConstitution: Name: Charlynn Joy T. ChavezLhorene Hope DueñasNo ratings yet

- 361 Chapter 9 MC SolutionsDocument24 pages361 Chapter 9 MC SolutionsLouie De La TorreNo ratings yet

- Draft Bangladesh IPoA Implementation Report Oct 13 2019Document96 pagesDraft Bangladesh IPoA Implementation Report Oct 13 2019Mahbub AlamNo ratings yet

- (A) Explain The Concept of Cost Management.Document7 pages(A) Explain The Concept of Cost Management.rutendo budaiNo ratings yet

- Principles of Sound Tax SystemDocument3 pagesPrinciples of Sound Tax Systemkate trishaNo ratings yet

- Rule: Disabilities Rating Schedule: Current Diagnostic CodesDocument34 pagesRule: Disabilities Rating Schedule: Current Diagnostic CodesJustia.comNo ratings yet

- Jurnal Capital BudgetingDocument8 pagesJurnal Capital BudgetingNely SofwaNo ratings yet

- "Chashma Sugar Mills (Expansion) Ramak, D.I.Khan".Document3 pages"Chashma Sugar Mills (Expansion) Ramak, D.I.Khan".siddiq ul HassanNo ratings yet

- Circular Letter: Boncodin Hall, Gen - Solano ST., San Miguel, ManilaDocument2 pagesCircular Letter: Boncodin Hall, Gen - Solano ST., San Miguel, ManilaRaine Buenaventura-EleazarNo ratings yet

- Cost Ch2Document22 pagesCost Ch2gizish belay100% (2)

- Financial Accounting and Reporting: Consolidated FundDocument42 pagesFinancial Accounting and Reporting: Consolidated FundHAFIZAH BINTI MAT NAWINo ratings yet

- Sen. Coburn Report: Parked!Document208 pagesSen. Coburn Report: Parked!kballuck1No ratings yet

- Management Accounting Made EasyDocument60 pagesManagement Accounting Made Easykaran Sharma100% (1)

- Managing RestructuringDocument140 pagesManaging RestructuringCollinson GrantNo ratings yet

- CTEVT Institutions ListsDocument30 pagesCTEVT Institutions ListsSubash Shahi ChandNo ratings yet

- GME Botswana ReportDocument15 pagesGME Botswana ReportSunil SurendranathNo ratings yet

- CBS News Poll: Pessimism About Economy, Low Marks For President Obama (July 9-12, 2010)Document20 pagesCBS News Poll: Pessimism About Economy, Low Marks For President Obama (July 9-12, 2010)CBS NewsNo ratings yet

- Glossary of Economic Terms PDFDocument8 pagesGlossary of Economic Terms PDFuzairNo ratings yet

- En Planner Reviewer: A. LDC & LFCDocument22 pagesEn Planner Reviewer: A. LDC & LFCAeron Paul AntonioNo ratings yet

- Local Media8372041483726452441Document4 pagesLocal Media8372041483726452441Richie PrejulaNo ratings yet

- Feasibility of Implementation of Right To Education Act - Pankaj Jain, Ravindra DholakiaDocument6 pagesFeasibility of Implementation of Right To Education Act - Pankaj Jain, Ravindra Dholakiachittaranjan.kaul6122No ratings yet

- WHO013 UHC2030-Capacity-building-Toolkit Ch2 Mod2 b5Document3 pagesWHO013 UHC2030-Capacity-building-Toolkit Ch2 Mod2 b5Superintendent CHC ChikitiNo ratings yet

- Marginal Costing With Decision MakingDocument38 pagesMarginal Costing With Decision MakingHaresh Sahitya0% (1)

- Capital BudgetingDocument9 pagesCapital BudgetingSEKEETHA DE NOBREGANo ratings yet

- Exim Policy 2002-2007 & Foreign Trade Policy 2004-2009Document18 pagesExim Policy 2002-2007 & Foreign Trade Policy 2004-2009Anubandh Patil0% (1)

- Budget: The New York State Unified Court SystemDocument183 pagesBudget: The New York State Unified Court SystemjspectorNo ratings yet

Standrad Costing 2.1

Standrad Costing 2.1

Uploaded by

Lhorene Hope DueñasOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Standrad Costing 2.1

Standrad Costing 2.1

Uploaded by

Lhorene Hope DueñasCopyright:

Available Formats

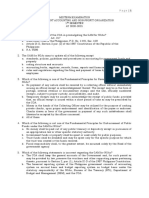

1.

Actual fixed overhead minus budgeted fixed overhead equals the

a. fixed overhead volume variance.

b. fixed overhead spending variance.

c. noncontrollable variance.

ANS: B

2. Total actual overhead minus total budgeted overhead at the actual input production level equals the

a. variable overhead spending variance.

b. total overhead efficiency variance.

c. total overhead spending variance.

ANS: C

3. A favorable fixed overhead spending variance indicates that

a. budgeted fixed overhead is less than actual fixed overhead.

b. budgeted fixed overhead is greater than applied fixed overhead.

c. actual fixed overhead is less than budgeted fixed overhead.

ANS: C

4. An unfavorable fixed overhead volume variance is most often caused by

a. actual fixed overhead incurred exceeding budgeted fixed overhead.

b. an over-application of fixed overhead to production.

c. normal capacity exceeding actual production levels.

ANS: C

5. In a standard cost system, when production is greater than the estimated unit or denominator level of activity, there

will be a(n)

a. unfavorable capacity variance.

b. favorable material and labor usage variance.

c. favorable volume variance.

ANS: C

6. In analyzing manufacturing overhead variances, the volume variance is the difference between the

a. amount shown in the flexible budget and the amount shown in the debit side of the overhead control

account.

b. predetermined overhead application rate and the flexible budget application rate times actual hours

worked.

c. budget allowance based on standard hours allowed for actual production for the period and the

amount budgeted to be applied during the period.

ANS: C

7. Variance analysis for overhead normally focuses on

a. efficiency variances for machinery and indirect production costs.

b. volume variances for fixed overhead costs.

c. the controllable variance as a lump-sum amount.

ANS: A

8. The efficiency variance computed on a three-variance approach is

a. equal to the efficiency variance computed on the four-variance approach.

b. equal to the variable overhead spending variance plus the efficiency variance computed on the four-

variance approach.

c. computed as the difference between applied variable overhead and actual variable overhead.

ANS: A

9. The use of separate variable and fixed overhead rates is better than a combined rate because such a system

a. is less expensive to operate and maintain.

b. does not result in underapplied or overapplied overhead.

c. is more effective in assigning overhead costs to products.

ANS: C

10. The fixed overhead application rate is a function of a predetermined activity level. If standard hours allowed for good

output equal the predetermined activity level for a given period, the volume variance will be

a. zero.

b. favorable.

c. unfavorable.

ANS: A

You might also like

- InstructionsDocument36 pagesInstructionsjhouvan50% (6)

- Chap 4 - CVP AnalysisDocument47 pagesChap 4 - CVP Analysiszyra liam styles93% (14)

- Introduction To Managerial Accounting 7th Edition Test Bank BrewerDocument155 pagesIntroduction To Managerial Accounting 7th Edition Test Bank BrewerJefferson SarmientoNo ratings yet

- AIA D200 1995 Free Sample PreviewDocument22 pagesAIA D200 1995 Free Sample PreviewShely NovitaNo ratings yet

- Cost Acctg ReviewerDocument106 pagesCost Acctg ReviewerGregory Chase83% (6)

- Manufacturing Cycle EfficiencyDocument1 pageManufacturing Cycle EfficiencyLhorene Hope DueñasNo ratings yet

- Chapter 3 - MethodologyDocument3 pagesChapter 3 - MethodologyLhorene Hope Dueñas67% (3)

- Should The Tax Laws Be Reformed To Encourage Saving ?Document13 pagesShould The Tax Laws Be Reformed To Encourage Saving ?Tripti RaiNo ratings yet

- Chapter 13 - Progress & Performance Measurement & EvaluationDocument40 pagesChapter 13 - Progress & Performance Measurement & EvaluationRatan Gohel100% (2)

- Jensen 2003 PDFDocument28 pagesJensen 2003 PDFwahyu artikaNo ratings yet

- Midterm Exam Government Accounting and Npo Dfcamclp Ay 2020 2021 For Online StudentsDocument12 pagesMidterm Exam Government Accounting and Npo Dfcamclp Ay 2020 2021 For Online StudentsLeny Joy Dupo33% (3)

- Standard Costing 1.1Document3 pagesStandard Costing 1.1Lhorene Hope DueñasNo ratings yet

- ASSESSMENT - PROC-WPS OfficeDocument3 pagesASSESSMENT - PROC-WPS OfficeJoana Mae DaguioNo ratings yet

- Standard Costs and Variance Analysis MCQs by Hilario TanDocument17 pagesStandard Costs and Variance Analysis MCQs by Hilario TanJoovs Joovho100% (1)

- Stratcost Sample Problems ReviewerDocument7 pagesStratcost Sample Problems ReviewerAngela Nicole CalimbasNo ratings yet

- Theory Standard Costing and Variance AnalysisDocument6 pagesTheory Standard Costing and Variance AnalysisFranklin Galope100% (1)

- Management Advisory ServicesDocument18 pagesManagement Advisory ServicesNanya BisnestNo ratings yet

- Ch03 Predetermined Overhead RatesDocument48 pagesCh03 Predetermined Overhead Ratesバツ きNo ratings yet

- Part I. Theories A. Multiple Choice: Standard Costing and Variance AnalysisDocument29 pagesPart I. Theories A. Multiple Choice: Standard Costing and Variance AnalysisChristian Blanza Lleva100% (2)

- Cost Accounting ExamDocument29 pagesCost Accounting ExamErina AusriaNo ratings yet

- Overhead Costs Have Been Increasing Due To All of The Following EXCEPTDocument13 pagesOverhead Costs Have Been Increasing Due To All of The Following EXCEPTElla Mae TuratoNo ratings yet

- Chapter 6-Cost Concepts and Measurement: Multiple ChoiceDocument29 pagesChapter 6-Cost Concepts and Measurement: Multiple Choiceakash deepNo ratings yet

- CELADocument66 pagesCELAXha100% (1)

- DocxDocument138 pagesDocxTrixie HicaldeNo ratings yet

- Multiple ChoiceDocument2 pagesMultiple ChoiceCarlo ParasNo ratings yet

- MAS - Variance AnalysisDocument13 pagesMAS - Variance AnalysisGhaill CruzNo ratings yet

- Standard Costs and Variance AnalysisDocument14 pagesStandard Costs and Variance AnalysisfretziegaronNo ratings yet

- FA Answer KeyDocument9 pagesFA Answer Keyimsana minatozakiNo ratings yet

- MSQ-01 - Standard Costs and Variance AnalysisDocument14 pagesMSQ-01 - Standard Costs and Variance Analysismimi supasNo ratings yet

- 10 - Standard Costing and Variance AnalysisDocument26 pages10 - Standard Costing and Variance AnalysisKonodio DarudeNo ratings yet

- Chapter 11 Testbank Solution Manual Management AccountingDocument74 pagesChapter 11 Testbank Solution Manual Management AccountingTrinh LêNo ratings yet

- Standard Costing Multiple ChoiceDocument11 pagesStandard Costing Multiple ChoiceRuiz, CherryjaneNo ratings yet

- MSQ-01 - Standard Costs and Variance AnalysisDocument13 pagesMSQ-01 - Standard Costs and Variance AnalysisacyNo ratings yet

- Cost Accounting (1) AnswersDocument5 pagesCost Accounting (1) AnswersMelissa Kayla ManiulitNo ratings yet

- Multiple ChoiceDocument15 pagesMultiple ChoiceChristian Kim MedranoNo ratings yet

- Multiple ChoiceDocument15 pagesMultiple ChoiceChristian Kim MedranoNo ratings yet

- Multiple Choice Questions Variable vs. Absorption CostingDocument106 pagesMultiple Choice Questions Variable vs. Absorption CostingNicole CapundanNo ratings yet

- Toaz - Info Quiz1 Set A PR PDFDocument8 pagesToaz - Info Quiz1 Set A PR PDFNah HamzaNo ratings yet

- Standard Costing Quiz Highlighted AnswersDocument9 pagesStandard Costing Quiz Highlighted AnswersPatrick SalvadorNo ratings yet

- Flexible Budgets and Overhead Analysis: True/FalseDocument69 pagesFlexible Budgets and Overhead Analysis: True/FalseRv CabarleNo ratings yet

- Standard Costs and Variance AnalysisDocument13 pagesStandard Costs and Variance AnalysisJanicaNoiraC.ZunigaNo ratings yet

- God of AllDocument9 pagesGod of AllRaphael Dean Vitug DesturaNo ratings yet

- Standard Costing Multiple ChoiceDocument8 pagesStandard Costing Multiple ChoiceMae Ann AvenidoNo ratings yet

- Std. Cost & Var 2014Document10 pagesStd. Cost & Var 2014Aj de CastroNo ratings yet

- Managerial Economics QuestionnairesDocument26 pagesManagerial Economics QuestionnairesClyde SaladagaNo ratings yet

- TB ch11Document15 pagesTB ch11Pola PolzNo ratings yet

- Chapter 18tstanDocument21 pagesChapter 18tstanGhaill CruzNo ratings yet

- HO5 - Absorption and Variable Costing PDFDocument4 pagesHO5 - Absorption and Variable Costing PDFPATRICIA PEREZNo ratings yet

- CVP Oct 2018 Multiple Choice AnswersDocument5 pagesCVP Oct 2018 Multiple Choice AnswersDufuxwerr WerrNo ratings yet

- Cost ReviewerDocument130 pagesCost ReviewerMarjorie Nepomuceno100% (1)

- Absorption CostingDocument22 pagesAbsorption CostingLeanFlor SegundinoNo ratings yet

- Chapter 3Document49 pagesChapter 3Laijanie Claire Gonzales AlvarezNo ratings yet

- Chap 4 CVP AnalysisDocument45 pagesChap 4 CVP AnalysisJessaNo ratings yet

- Annual Insurance PremiumDocument3 pagesAnnual Insurance PremiumJoyce TenorioNo ratings yet

- Standard Costs and Variance AnalysisDocument14 pagesStandard Costs and Variance Analysisboen jayme0% (1)

- Assessment No. 3 MAS-03 Absorption and Variable Costing Part 1. Multiple Choice Theory: Choose The Letter of The Best AnswerDocument10 pagesAssessment No. 3 MAS-03 Absorption and Variable Costing Part 1. Multiple Choice Theory: Choose The Letter of The Best AnswerPaupauNo ratings yet

- TBApp 08 ADocument161 pagesTBApp 08 Aomar altamimiNo ratings yet

- 5 6235268602178568335Document45 pages5 6235268602178568335Maristella Gaton100% (1)

- MSQ 03 Standard Costs and Variance Analysis BrylDocument13 pagesMSQ 03 Standard Costs and Variance Analysis BrylDavid DavidNo ratings yet

- Ca 5107 - Cost Accounting & Control Quizzer - Standard CostingDocument13 pagesCa 5107 - Cost Accounting & Control Quizzer - Standard CostingAlexandra CruzNo ratings yet

- Management Accounting Strategy Study Resource for CIMA Students: CIMA Study ResourcesFrom EverandManagement Accounting Strategy Study Resource for CIMA Students: CIMA Study ResourcesNo ratings yet

- Management Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageFrom EverandManagement Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageRating: 5 out of 5 stars5/5 (1)

- Finance for Non-Financiers 2: Professional FinancesFrom EverandFinance for Non-Financiers 2: Professional FinancesNo ratings yet

- Cost & Managerial Accounting II EssentialsFrom EverandCost & Managerial Accounting II EssentialsRating: 4 out of 5 stars4/5 (1)

- Flexible BudgetDocument2 pagesFlexible BudgetLhorene Hope DueñasNo ratings yet

- Price Variance: W CompanyDocument2 pagesPrice Variance: W CompanyLhorene Hope DueñasNo ratings yet

- Variance Costing and Activity Based Cotsing Test PrepDocument3 pagesVariance Costing and Activity Based Cotsing Test PrepLhorene Hope DueñasNo ratings yet

- Standard CostingDocument1 pageStandard CostingLhorene Hope DueñasNo ratings yet

- Variance 1Document2 pagesVariance 1Lhorene Hope DueñasNo ratings yet

- Activity Based Costing TestbankDocument7 pagesActivity Based Costing TestbankLhorene Hope DueñasNo ratings yet

- Standard Costing QuizDocument2 pagesStandard Costing QuizLhorene Hope Dueñas100% (1)

- Standard Costing and Flexible Budget 10Document5 pagesStandard Costing and Flexible Budget 10Lhorene Hope DueñasNo ratings yet

- Flexible BudgetDocument4 pagesFlexible BudgetLhorene Hope Dueñas100% (1)

- Flexible Budget and VarianceDocument8 pagesFlexible Budget and VarianceLhorene Hope DueñasNo ratings yet

- Activity Based Costing Test PrepationDocument5 pagesActivity Based Costing Test PrepationLhorene Hope DueñasNo ratings yet

- Standard Costing 1.1Document3 pagesStandard Costing 1.1Lhorene Hope DueñasNo ratings yet

- Abc 3Document13 pagesAbc 3Lhorene Hope DueñasNo ratings yet

- English Grammar and Correct Usage Part 3Document3 pagesEnglish Grammar and Correct Usage Part 3Lhorene Hope DueñasNo ratings yet

- Flexible Budgetand Activity Based CostingDocument13 pagesFlexible Budgetand Activity Based CostingLhorene Hope DueñasNo ratings yet

- Flexible Budget and Activity Based Costing Test BankDocument2 pagesFlexible Budget and Activity Based Costing Test BankLhorene Hope DueñasNo ratings yet

- Standard Costing Ang Variance AnalysisDocument3 pagesStandard Costing Ang Variance AnalysisLhorene Hope DueñasNo ratings yet

- ABC and Flexible BudgetDocument6 pagesABC and Flexible BudgetLhorene Hope DueñasNo ratings yet

- English Grammar and Correct Usage Part 2 2 PDFDocument3 pagesEnglish Grammar and Correct Usage Part 2 2 PDFLhorene Hope DueñasNo ratings yet

- Cash Advances For TravelDocument10 pagesCash Advances For TravelLhorene Hope DueñasNo ratings yet

- This Part Shows The Step-By-Step-Process Followed by The Business in Connection With Its Sales and DisbursementDocument11 pagesThis Part Shows The Step-By-Step-Process Followed by The Business in Connection With Its Sales and DisbursementLhorene Hope DueñasNo ratings yet

- Chapter 3Document5 pagesChapter 3Lhorene Hope DueñasNo ratings yet

- Chapter 3 IPDocument5 pagesChapter 3 IPLhorene Hope DueñasNo ratings yet

- Analysis of Variance - PPTX Generyn ReportDocument6 pagesAnalysis of Variance - PPTX Generyn ReportLhorene Hope DueñasNo ratings yet

- Psychosocial Behavior of Students With Incarcerated ParentsDocument5 pagesPsychosocial Behavior of Students With Incarcerated ParentsLhorene Hope DueñasNo ratings yet

- Binsooiiii Tax 7 PangitDocument1 pageBinsooiiii Tax 7 PangitLhorene Hope DueñasNo ratings yet

- Constitution: Name: Charlynn Joy T. ChavezDocument1 pageConstitution: Name: Charlynn Joy T. ChavezLhorene Hope DueñasNo ratings yet

- 361 Chapter 9 MC SolutionsDocument24 pages361 Chapter 9 MC SolutionsLouie De La TorreNo ratings yet

- Draft Bangladesh IPoA Implementation Report Oct 13 2019Document96 pagesDraft Bangladesh IPoA Implementation Report Oct 13 2019Mahbub AlamNo ratings yet

- (A) Explain The Concept of Cost Management.Document7 pages(A) Explain The Concept of Cost Management.rutendo budaiNo ratings yet

- Principles of Sound Tax SystemDocument3 pagesPrinciples of Sound Tax Systemkate trishaNo ratings yet

- Rule: Disabilities Rating Schedule: Current Diagnostic CodesDocument34 pagesRule: Disabilities Rating Schedule: Current Diagnostic CodesJustia.comNo ratings yet

- Jurnal Capital BudgetingDocument8 pagesJurnal Capital BudgetingNely SofwaNo ratings yet

- "Chashma Sugar Mills (Expansion) Ramak, D.I.Khan".Document3 pages"Chashma Sugar Mills (Expansion) Ramak, D.I.Khan".siddiq ul HassanNo ratings yet

- Circular Letter: Boncodin Hall, Gen - Solano ST., San Miguel, ManilaDocument2 pagesCircular Letter: Boncodin Hall, Gen - Solano ST., San Miguel, ManilaRaine Buenaventura-EleazarNo ratings yet

- Cost Ch2Document22 pagesCost Ch2gizish belay100% (2)

- Financial Accounting and Reporting: Consolidated FundDocument42 pagesFinancial Accounting and Reporting: Consolidated FundHAFIZAH BINTI MAT NAWINo ratings yet

- Sen. Coburn Report: Parked!Document208 pagesSen. Coburn Report: Parked!kballuck1No ratings yet

- Management Accounting Made EasyDocument60 pagesManagement Accounting Made Easykaran Sharma100% (1)

- Managing RestructuringDocument140 pagesManaging RestructuringCollinson GrantNo ratings yet

- CTEVT Institutions ListsDocument30 pagesCTEVT Institutions ListsSubash Shahi ChandNo ratings yet

- GME Botswana ReportDocument15 pagesGME Botswana ReportSunil SurendranathNo ratings yet

- CBS News Poll: Pessimism About Economy, Low Marks For President Obama (July 9-12, 2010)Document20 pagesCBS News Poll: Pessimism About Economy, Low Marks For President Obama (July 9-12, 2010)CBS NewsNo ratings yet

- Glossary of Economic Terms PDFDocument8 pagesGlossary of Economic Terms PDFuzairNo ratings yet

- En Planner Reviewer: A. LDC & LFCDocument22 pagesEn Planner Reviewer: A. LDC & LFCAeron Paul AntonioNo ratings yet

- Local Media8372041483726452441Document4 pagesLocal Media8372041483726452441Richie PrejulaNo ratings yet

- Feasibility of Implementation of Right To Education Act - Pankaj Jain, Ravindra DholakiaDocument6 pagesFeasibility of Implementation of Right To Education Act - Pankaj Jain, Ravindra Dholakiachittaranjan.kaul6122No ratings yet

- WHO013 UHC2030-Capacity-building-Toolkit Ch2 Mod2 b5Document3 pagesWHO013 UHC2030-Capacity-building-Toolkit Ch2 Mod2 b5Superintendent CHC ChikitiNo ratings yet

- Marginal Costing With Decision MakingDocument38 pagesMarginal Costing With Decision MakingHaresh Sahitya0% (1)

- Capital BudgetingDocument9 pagesCapital BudgetingSEKEETHA DE NOBREGANo ratings yet

- Exim Policy 2002-2007 & Foreign Trade Policy 2004-2009Document18 pagesExim Policy 2002-2007 & Foreign Trade Policy 2004-2009Anubandh Patil0% (1)

- Budget: The New York State Unified Court SystemDocument183 pagesBudget: The New York State Unified Court SystemjspectorNo ratings yet