Professional Documents

Culture Documents

Australian Private Equity Weekly Deal News - 20190812 - Edition 35 - NEW

Australian Private Equity Weekly Deal News - 20190812 - Edition 35 - NEW

Uploaded by

LCC Asia Pacific Corporate FinanceOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Australian Private Equity Weekly Deal News - 20190812 - Edition 35 - NEW

Australian Private Equity Weekly Deal News - 20190812 - Edition 35 - NEW

Uploaded by

LCC Asia Pacific Corporate FinanceCopyright:

Available Formats

PRIVATEEQUITYAUSTRALIA.

COM

Private Equity News Australia

Australia Private Equity News Weekly Report Date

Edition 35 12 August 2019

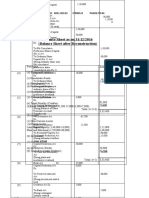

ASX200 INDEX

Key Highlights From Various Media Sources

7,000

Royal Wolf Holdings is said to be for sale

6,500

ICG considering exit options for Everlight Radiology

6,000

InfoTrack said to be in discussions to acquire SAI Global’s

5,500

property services division

5,000

Airline operator Airnorth is reportedly for sale

4,500

SKM Recycling undergoing an immediate review

4,000

'15 '16 '17 '18 '19

Royal Wolf. It was reported that GFN Asia Pacific-owned portable

buildings and storage container business Royal Wolf Holdings is for

EQUITY INDICES (WEEKLY % CHANGE)

sale, with a speculated price tag of more than $300 million. 1

0.0%

Everlight Radiology. It was reported that Intermediate Capital Group- (1.0%)

(0.7%)

(0.5%)

backed radiology company Everlight Radiology is considering exit (2.0%)

options. The company is said to be generating circa $30 million in

(1.9%)

(2.1%)

(3.0%)

earnings and is speculated to be worth 15x earnings. 1

(2.7%)

(2.8%)

(3.1%)

(4.0%)

(3.6%)

(5.0%)

Arnott’s. It was reported that KKR & Co is seeking to arrange an initial

(6.0%)

debt package of more than US$1 billion for its acquisition of Arnott’s

(7.0%)

(at more than 6x earnings). 1

SAI Global’s property services division. It was reported that InfoTrack is

set to acquire Baring Private Equity-backed SAI Global’s property

services division for about $100 million. 2

Mader Group. It was reported that privately-owned mining services

contractor Mader Group is seeking to list on the ASX. 1

For more information

Enwave Australia. It was reported that mid-market infrastructure

investor Infrastructure Capital Group is eyeing Brookfield’s up-for-sale

David Gacic

Director – Corporate Finance

gas network Enwave Australia. 1 E: ddg@lccapac.com

Lendlease’s engineering business. It was reported that Lendlease may Duncan Ross

be looking to divest its engineering and services business in two parts Director – Corporate Finance

to make it more attractive to potential acquirers. 1 E: sdr@lccapac.com

Airnorth. It was reported that regional airline operator Airnorth (owned Nicholas Assef

by US-based Bristow Group) is for sale. 1 Founder & Principal

E: naa@lccapac.com

SKM Recycling. It was reported that CBA (owed c.$60 million) has

appointed a receiver for SKM Recycling to perform an immediate Phone : + 61 2 9262 2121

review. 1

LCC Asia Pacific – an award winning

corporate finance and strategic advice

boutique & independent firm

PRIVATEEQUITYAUSTRALIA.COM

Bango Wind Farm. It was reported that Partners Group has acquired a DAILY PERFORMANCE OF ASX200

stake in the $500 million 222MW Bango Wind Farm project. 1

0.7%

Hobart Airport. It was reported that VINCI is one of the shortlisted parties

0.6%

1.0%

0.2%

in the sale process for the up-for-sale 51% stake in Hobart Airport. 1

Perth Energy. It was reported that AGL Energy is set to acquire Infratil’s 0.0%

80% stake in electricity retailer and power plant owner Perth Energy for

c.$100 million. 1 (1.0%)

DC Power Co. It was reported that renewable energy startup DC Power Co

has raised $1.63 million in a crowdfunding campaign. 3 (2.0%)

(1.9%)

(2.4%)

WithYouWithMe. It was reported that HR and recruitment startup (3.0%)

WithYouWithMe has raised $5 million as it ramps up development of its

SaaS platform. 3

Fluent Commerce. It was reported that retail startup Fluent Commerce has

raised $33 million in a Series B funding, led by US growth equity firm

Arrowroot Capital. 3

The ASX200 closed 2.7%

Five V Capital. It was reported that Five V Capital has secured $250 million lower for the week to end

in commitments for its third buyout fund. 1

at 6584 points as the US-

China trade war

continues to escalate (the

Chinese Yuan breached

the seven-per-US-dollar

mark, increasing

concerns that a currency

war may be on the cards).

Sources:

(1) The Australian Financial Review

(2) The Australian

(3) SmartCompany

(4) ASX / Company Announcement

(5) Australian Mining

(6) Mining Journal

LCC Asia Pacific Insights: Australian Private Equity News Page 2

PRIVATEEQUITYAUSTRALIA.COM

About LCC Asia Pacific

Founded in 2004, LCC Asia Pacific is an award-winning boutique investment banking & strategic advisory

firm. We assist our private equity clients with both investment banking & strategic consulting engagements

in areas of work including:

capitalising on key industry trends,

positioning for eventual exit and identifying key strategies (e.g. buy-

executing successful strategies and-build, orphan assets, etc.) and

to maximise exit valuation enhancing proprietary deal flows

Exit Deal

Generation

ongoing strategic reviews (including

global benchmarking) that delivers Strategic Due strategic due diligence on

deep & valuable insight for senior Review Diligence acquisition opportunities,

management to pursue growth and including financial modelling,

cost reduction strategies, adopt market analysis, risk analysis,

“future proofing” technology and Post- and entry/exit valuation

optimise business operations Acquisition

deriving maximum value from acquisitions

through rapid organisation transformation,

implementing initiatives that “move the needle”

and ‘business coaching’ for C-Suite

LCC also works closely with family- and privately-owned businesses that are either considering exit options

or are seeking to raise external capital to accelerate their growth strategies.

lccasiapacific.com.au SYDNEY | BRISBANE | NEW YORK

privateequityaustralia.com

LCC Asia Pacific is a boutique investment banking practice, providing independent

corporate finance & strategy advice to clients in Australia and across Asia Pacific

markets. We have acted for ambitious clients ranging from “emerging” companies,

up to Fortune 100 & “Mega” Asian listed entities.

LCC Asia Pacific provides clear, unbiased counsel to CEOs and Boards of Directors

considering growth strategies, business transformation and challenging corporate

decisions. We understand that to service such clients requires a high performance

approach, and a tenacity to deliver results.

For more information, visit www.lccasiapacific.com.au.

© 2019 LCC Asia Pacific

AFSL 278054

Disclaimer

This general information has been prepared by LCC Asia Pacific Pty. Limited ("LCC"). The research is based on public information obtained from sources

believed to be accurate and reliable. LCC does not guarantee the accuracy, reliability, completeness or suitability of any such information and makes no

warranty, guarantee or representation, expressly or impliedly about this research. LCC accepts no obligation to correct or update the information. No

opinion or recommendation is made within this research. This report is not intended to be, nor should it be relied on, as a substitute for professional

advice. This report should not be relied upon as the sole basis for any investment decision or planning, and LCC does not accept any responsibility on

this basis for actions made.

You might also like

- International Certificate in Wealth and Investment Management Ed3Document685 pagesInternational Certificate in Wealth and Investment Management Ed3Sivaprasad Thekke Parayil79% (14)

- The Analyst DilemmaDocument4 pagesThe Analyst Dilemmalubiyue2000No ratings yet

- Navigating Oil and Gas Securitization TransactionsDocument21 pagesNavigating Oil and Gas Securitization TransactionsEliecer PalaciosNo ratings yet

- Viper Drones Business PlanDocument21 pagesViper Drones Business Plannoel gonsalves100% (3)

- AJC CaseDocument18 pagesAJC CaseAbhinava Chanda100% (1)

- Cairn ReportDocument37 pagesCairn ReportRaghav AryaNo ratings yet

- Tut 2 Questions - Dominic Robinson 3476Document4 pagesTut 2 Questions - Dominic Robinson 3476Dominic RobinsonNo ratings yet

- Australian Private Equity Weekly Deal News - 20190805 - Edition 34 - NEWDocument3 pagesAustralian Private Equity Weekly Deal News - 20190805 - Edition 34 - NEWLCC Asia Pacific Corporate FinanceNo ratings yet

- Fish PresentationDocument13 pagesFish Presentationtayyabsmeer511No ratings yet

- Australian Engineering, Contractors & Service ProvidersDocument5 pagesAustralian Engineering, Contractors & Service ProvidersLCC Asia Pacific Corporate FinanceNo ratings yet

- Australian Engineering, Infrastructure Services & Mining Services Research - Edition355 - 24042020Document5 pagesAustralian Engineering, Infrastructure Services & Mining Services Research - Edition355 - 24042020LCC Asia Pacific Corporate FinanceNo ratings yet

- Australian Engineering, Contractors & Service ProvidersDocument2 pagesAustralian Engineering, Contractors & Service ProvidersLCC Asia Pacific Corporate FinanceNo ratings yet

- Project Report UrjaDocument16 pagesProject Report Urjashubham jagtapNo ratings yet

- Asian Electronics LimitedDocument14 pagesAsian Electronics Limiteddownloadman1973No ratings yet

- Far Quiz 13Document3 pagesFar Quiz 13Juliana Reign RuedaNo ratings yet

- Balance Sheet As On 31/12/2016 (Balance Sheet After Reconstruction)Document8 pagesBalance Sheet As On 31/12/2016 (Balance Sheet After Reconstruction)GauravNo ratings yet

- Building North America'S Largest Constellation of Standardized DronesDocument27 pagesBuilding North America'S Largest Constellation of Standardized DronesCarlos HuamanNo ratings yet

- Dialog Axiata PLC Capital TRUST Securities 14-03-2016 PDFDocument16 pagesDialog Axiata PLC Capital TRUST Securities 14-03-2016 PDFerandi.pereraNo ratings yet

- 2022 11 01 November PresentationDocument47 pages2022 11 01 November Presentationcarlosmarco87No ratings yet

- Kuis - Financial Lab ModelingDocument2 pagesKuis - Financial Lab Modelingalexandersur9No ratings yet

- Internal Reconstruction - HomeworkDocument25 pagesInternal Reconstruction - HomeworkYash ShewaleNo ratings yet

- Galaxy - Sal de Vida - Revised DFS Confirms Low Cost, Long Life and Economically Robust OperationDocument21 pagesGalaxy - Sal de Vida - Revised DFS Confirms Low Cost, Long Life and Economically Robust OperationGuillaume De SouzaNo ratings yet

- KrisAssets 1H10 - Retain HoldDocument4 pagesKrisAssets 1H10 - Retain Holdlimml63No ratings yet

- Motilal Oswal Results Review 14-Aug-23Document74 pagesMotilal Oswal Results Review 14-Aug-23Diganta GuptaNo ratings yet

- Caso Glen Mount Furniture CompanyDocument56 pagesCaso Glen Mount Furniture CompanyJanetCruces100% (2)

- Green Infra Wind Energy - R - 23052018Document8 pagesGreen Infra Wind Energy - R - 23052018Soham DasguptaNo ratings yet

- STARK Corporation PCL Investment Roadshow: June 2020Document61 pagesSTARK Corporation PCL Investment Roadshow: June 2020ekkawatNo ratings yet

- Feature Finance PlanDocument1 pageFeature Finance PlanJad ZoghaibNo ratings yet

- Cypark Resources Berhad: Public Issue of 30.0m New Shares, and Offer For Sale of 20.0m Shares - 13/10/2010Document6 pagesCypark Resources Berhad: Public Issue of 30.0m New Shares, and Offer For Sale of 20.0m Shares - 13/10/2010Rhb Invest100% (1)

- Project Report On Dairy Farm: Shri. Taichat Biham (Pan-Ccspb0082R)Document10 pagesProject Report On Dairy Farm: Shri. Taichat Biham (Pan-Ccspb0082R)CA Devangaraj GogoiNo ratings yet

- Chirag Daultani 01 Kushal Agarwal 02 Akshay Cotha 03Document11 pagesChirag Daultani 01 Kushal Agarwal 02 Akshay Cotha 03Chirag Daultani100% (1)

- Atc Investor Relations American Tower Financial Operational Update q3 2Document33 pagesAtc Investor Relations American Tower Financial Operational Update q3 2Nicolas GomezNo ratings yet

- Tata Chemicals: CMP: INR650 Acquires Residual Stake in North American Soda Ash BizDocument8 pagesTata Chemicals: CMP: INR650 Acquires Residual Stake in North American Soda Ash BizTayyaba AnsariNo ratings yet

- Pe2 Acc Nov05Document19 pagesPe2 Acc Nov05api-3825774No ratings yet

- Buana Lintas Lautan: Equity ResearchDocument7 pagesBuana Lintas Lautan: Equity ResearchSuma DyantariNo ratings yet

- 2021 ReportDocument18 pages2021 ReportMunkhbaatar SanjaasurenNo ratings yet

- CBSE Accountancy 12th Term 2 CH 3Document5 pagesCBSE Accountancy 12th Term 2 CH 3AadasNo ratings yet

- Ca Inter New Course (May 2021) Advanced Accounting Test-1 (Chapters-5, 6) SolutionDocument17 pagesCa Inter New Course (May 2021) Advanced Accounting Test-1 (Chapters-5, 6) Solutionmonudeep aggarwalNo ratings yet

- CH 05Document19 pagesCH 05ahmad.hhddaabbNo ratings yet

- Opinion: CrisilDocument12 pagesOpinion: CrisilarvindNo ratings yet

- RHB Equity 360° - 20 May 2010 (Notion Vtec, Kencana, Media Prima, Amway Technical: IOI, FBM KLCI)Document4 pagesRHB Equity 360° - 20 May 2010 (Notion Vtec, Kencana, Media Prima, Amway Technical: IOI, FBM KLCI)Rhb InvestNo ratings yet

- Sprott Conference 2016 - Corporate Presentation PDFDocument42 pagesSprott Conference 2016 - Corporate Presentation PDFkaiselkNo ratings yet

- Sprott Conference 2016 Corporate PresentationDocument42 pagesSprott Conference 2016 Corporate PresentationkaiselkNo ratings yet

- ATRO Dougherty Conference Presentation FINALDocument30 pagesATRO Dougherty Conference Presentation FINALPOPNo ratings yet

- Latin American MRO Industry Trends & Market Forecast: Panama City, Panama February 14, 2018Document27 pagesLatin American MRO Industry Trends & Market Forecast: Panama City, Panama February 14, 2018Juan Manuel RoncoNo ratings yet

- New Format Exam Q Maf620 - Oct 2009Document5 pagesNew Format Exam Q Maf620 - Oct 2009kkNo ratings yet

- Exemplo Do Mercado de Carbono AustralianoDocument23 pagesExemplo Do Mercado de Carbono AustralianoGalloNo ratings yet

- AVT McCormick-R-26032018Document7 pagesAVT McCormick-R-26032018Siddharth DamaniNo ratings yet

- Advanced Materials - Tracxn Feed Report - 04 Jul 2022Document82 pagesAdvanced Materials - Tracxn Feed Report - 04 Jul 2022Rucha MaheshwariNo ratings yet

- Archean Chemical Industries LTD - Initiating Coverage - 19122023 - FinalDocument30 pagesArchean Chemical Industries LTD - Initiating Coverage - 19122023 - FinalaccountsNo ratings yet

- AirAsia 120524 - AMDocument5 pagesAirAsia 120524 - AMJing GokNo ratings yet

- Whirlwind Exploration Company: Case 54Document4 pagesWhirlwind Exploration Company: Case 54Jorge RomeroNo ratings yet

- Assignment A17Document4 pagesAssignment A17Emmanuel AtokoNo ratings yet

- 1 - PCBL Company Update - 01 Dec 2023Document7 pages1 - PCBL Company Update - 01 Dec 2023Abhinav KumarNo ratings yet

- Airfinance Journal Roundtable Summit: The Future of Engine TechnologyDocument37 pagesAirfinance Journal Roundtable Summit: The Future of Engine TechnologyliuhkNo ratings yet

- Ranbaxy Labs: Multiple Triggers Ahead Upgrade To HoldDocument6 pagesRanbaxy Labs: Multiple Triggers Ahead Upgrade To HoldImaya ElavarasanNo ratings yet

- Oberoi Realty Limited: Ipo NoteDocument12 pagesOberoi Realty Limited: Ipo NoteabNo ratings yet

- Cash Flow Real Life Company AnalysisDocument20 pagesCash Flow Real Life Company AnalysisKedar MangrolaNo ratings yet

- Aditya Birla Fashion and Retail Ltd. - EdelweissDocument8 pagesAditya Birla Fashion and Retail Ltd. - EdelweissrahulNo ratings yet

- Business Plan Blue PrintDocument17 pagesBusiness Plan Blue PrintEmmanuel OmondiNo ratings yet

- AIA Guided Portfolio Pro Optimiser FactsheetDocument2 pagesAIA Guided Portfolio Pro Optimiser FactsheetChua Shao XiangNo ratings yet

- Apple Adoption of ChatGPT - Implications for Data & Energy Consumption-nicholas assefDocument10 pagesApple Adoption of ChatGPT - Implications for Data & Energy Consumption-nicholas assefLCC Asia Pacific Corporate FinanceNo ratings yet

- Australian Engineering & Industrial Services Research Report_edition 534Document3 pagesAustralian Engineering & Industrial Services Research Report_edition 534LCC Asia Pacific Corporate FinanceNo ratings yet

- Private Company Valuation OverviewDocument13 pagesPrivate Company Valuation OverviewLCC Asia Pacific Corporate FinanceNo ratings yet

- Mergers & Acquisitions, Machine Learning and Mining TechnologyDocument10 pagesMergers & Acquisitions, Machine Learning and Mining TechnologyLCC Asia Pacific Corporate FinanceNo ratings yet

- Australian Engineering, Infrastructure Services & Mining Services Research - Edition355 - 24042020Document5 pagesAustralian Engineering, Infrastructure Services & Mining Services Research - Edition355 - 24042020LCC Asia Pacific Corporate FinanceNo ratings yet

- Opportunities in Environmental Engineering & Services Sector As A Result of COVID 19Document7 pagesOpportunities in Environmental Engineering & Services Sector As A Result of COVID 19LCC Asia Pacific Corporate FinanceNo ratings yet

- Australian Private Equity Weekly Deal News - 20190805 - Edition 34 - NEWDocument3 pagesAustralian Private Equity Weekly Deal News - 20190805 - Edition 34 - NEWLCC Asia Pacific Corporate FinanceNo ratings yet

- Australian Engineering, Contractors & Service ProvidersDocument5 pagesAustralian Engineering, Contractors & Service ProvidersLCC Asia Pacific Corporate FinanceNo ratings yet

- Australian Engineering, Contractors & Service ProvidersDocument2 pagesAustralian Engineering, Contractors & Service ProvidersLCC Asia Pacific Corporate FinanceNo ratings yet

- Four-S Monthly Cleantech Track February 2012Document9 pagesFour-S Monthly Cleantech Track February 2012seema1707No ratings yet

- Financial Analyst Program: Training & InternshipDocument11 pagesFinancial Analyst Program: Training & InternshipSabbiruddin KhanNo ratings yet

- Chapter 6.valuation of SDocument48 pagesChapter 6.valuation of SPark CảiNo ratings yet

- Monte Carlo MethodologyDocument2 pagesMonte Carlo MethodologygauravroongtaNo ratings yet

- DB Realty Limited: Another Mumbai-Based PlayerDocument8 pagesDB Realty Limited: Another Mumbai-Based PlayerVahni SinghNo ratings yet

- CB Insights Disruption Investment BankingDocument45 pagesCB Insights Disruption Investment BankingbandarumanasaNo ratings yet

- Financial InstitutionsDocument19 pagesFinancial InstitutionsSunako NakaharaNo ratings yet

- Vault - A Day in The Life - Analyst, Goldman SachsDocument2 pagesVault - A Day in The Life - Analyst, Goldman SachsTing-Yu HuNo ratings yet

- Irma - Nip Dan TMTDocument169 pagesIrma - Nip Dan TMTumeno umeniNo ratings yet

- SI & CI (Gagan Pratap)Document62 pagesSI & CI (Gagan Pratap)THE GMAILNo ratings yet

- Loan SyndicationDocument7 pagesLoan SyndicationAnshika PanchuriNo ratings yet

- Investments An Introduction 12Th Edition Mayo Test Bank Full Chapter PDFDocument31 pagesInvestments An Introduction 12Th Edition Mayo Test Bank Full Chapter PDFninhletitiaqt3100% (13)

- Corporate Finance - Notes ?Document21 pagesCorporate Finance - Notes ?XinNo ratings yet

- Brief Analysis of Some Merchant Banks in IndiaDocument6 pagesBrief Analysis of Some Merchant Banks in IndiaParul PrasadNo ratings yet

- EMI Calculator - Prepayment OptionDocument15 pagesEMI Calculator - Prepayment OptionPrateekSorteNo ratings yet

- Selby Jennings - Year in Review and 2022 Outlook With Salary Guide (North Asia)Document19 pagesSelby Jennings - Year in Review and 2022 Outlook With Salary Guide (North Asia)Edmund ThamNo ratings yet

- Banking Profitability DeterminantsDocument22 pagesBanking Profitability DeterminantsHussain Mohammed SaqifNo ratings yet

- BM2102 Lecture 7Document48 pagesBM2102 Lecture 7shahnaz chNo ratings yet

- Global MA Financial ReviewDocument24 pagesGlobal MA Financial ReviewSteven HunterNo ratings yet

- Key From Unit 6 To Unit 10 Esp PDF FreeDocument20 pagesKey From Unit 6 To Unit 10 Esp PDF FreeTrần Đức TàiNo ratings yet

- Interview QuestionsDocument7 pagesInterview Questionssantoshk165No ratings yet

- FM3 Lesson 1 Banking and Financial InstitutionDocument8 pagesFM3 Lesson 1 Banking and Financial InstitutionBeatriz Caladiao MatituNo ratings yet

- SAC From Gst4u.inDocument42 pagesSAC From Gst4u.inkumar45caNo ratings yet

- Investments Background and IssuesDocument9 pagesInvestments Background and Issuespiepkuiken-knipper0jNo ratings yet

- Barclays PLC Strategic Report 2022Document71 pagesBarclays PLC Strategic Report 2022PiyushNo ratings yet

- Fidelity Bank 2015 Annual ReportDocument100 pagesFidelity Bank 2015 Annual ReportFuaad DodooNo ratings yet

- Strategic Management: Jpmorgan Chase & CoDocument16 pagesStrategic Management: Jpmorgan Chase & CoBea Garcia100% (1)

- FIN203 Tutorial 1 QDocument4 pagesFIN203 Tutorial 1 Q黄于绮100% (1)