Professional Documents

Culture Documents

Motor Tax Renewal Form: Do Not Use This Form To Register Changes of Ownership (See Note B)

Motor Tax Renewal Form: Do Not Use This Form To Register Changes of Ownership (See Note B)

Uploaded by

Agatha BustamanteCopyright:

Available Formats

You might also like

- Apollo Smart Health Insurance GuideDocument2 pagesApollo Smart Health Insurance GuideFarhanNo ratings yet

- TPTL234 PDFDocument93 pagesTPTL234 PDFcody punNo ratings yet

- AnnexureDocument7 pagesAnnexureshaantnuNo ratings yet

- UEFA Champions League 2015 2018 RegulationsDocument100 pagesUEFA Champions League 2015 2018 RegulationsTifoso BilanciatoNo ratings yet

- D-Contractor Letter ExamplesDocument6 pagesD-Contractor Letter Examplestfc80No ratings yet

- Final - JKR-203A-Rev-1-2010Document60 pagesFinal - JKR-203A-Rev-1-2010Amar Muqri Ramlan100% (1)

- US Internal Revenue Service: f1098c - 2005Document7 pagesUS Internal Revenue Service: f1098c - 2005IRSNo ratings yet

- FORM-24 Detail Article RtoDocument3 pagesFORM-24 Detail Article RtoSUNNY MANOJ RAJPUTNo ratings yet

- US Internal Revenue Service: f8404 - 2004Document2 pagesUS Internal Revenue Service: f8404 - 2004IRSNo ratings yet

- Securities and Exchange Commission Sec Form - Acpr Annual Commercial Paper Issuance ReportDocument2 pagesSecurities and Exchange Commission Sec Form - Acpr Annual Commercial Paper Issuance ReportAdrian ToisaNo ratings yet

- US Internal Revenue Service: f1098c06 AccessibleDocument7 pagesUS Internal Revenue Service: f1098c06 AccessibleIRSNo ratings yet

- Suzuki Marine Claim Form 2008Document1 pageSuzuki Marine Claim Form 2008AmanNo ratings yet

- Application For Texas Cerificate of TitleDocument2 pagesApplication For Texas Cerificate of TitleRobert CookNo ratings yet

- US Internal Revenue Service: f8804 - 1991Document1 pageUS Internal Revenue Service: f8804 - 1991IRSNo ratings yet

- Application For Drivers Licence Transactions 25-01-2021Document1 pageApplication For Drivers Licence Transactions 25-01-2021Shevanese FagonNo ratings yet

- FORM A 1-For Import Payments OnlyDocument6 pagesFORM A 1-For Import Payments OnlyAnonymous rPwwJGksANo ratings yet

- BUN DE MANCATDocument2 pagesBUN DE MANCATkoronagozalesNo ratings yet

- Application For Provisional Driver'S Licence: Form H3ADocument1 pageApplication For Provisional Driver'S Licence: Form H3AAngel KryptonNo ratings yet

- Dgii Motor Vehicle FormDocument3 pagesDgii Motor Vehicle FormScribdTranslationsNo ratings yet

- US Internal Revenue Service: f8404 - 2000Document2 pagesUS Internal Revenue Service: f8404 - 2000IRSNo ratings yet

- TITULO-DE-CALIFORNIADocument2 pagesTITULO-DE-CALIFORNIAkoronagozalesNo ratings yet

- US Internal Revenue Service: f8404 - 2001Document2 pagesUS Internal Revenue Service: f8404 - 2001IRSNo ratings yet

- Application For Registration, Renewal, Replacement or Transfer of Plates And/or StickersDocument4 pagesApplication For Registration, Renewal, Replacement or Transfer of Plates And/or Stickersdccab33No ratings yet

- Claim Form II B Departmental ExecutionDocument1 pageClaim Form II B Departmental ExecutionChimakurthy NagarapanchayatNo ratings yet

- Form AJDocument2 pagesForm AJhongmean2002No ratings yet

- MI 273 SIRB SQC ApplicationDocument2 pagesMI 273 SIRB SQC ApplicationSaro ShyamNo ratings yet

- Inf1123 Request For Vehicle-Vessel Automated Record InformationDocument1 pageInf1123 Request For Vehicle-Vessel Automated Record InformationSteve SmithNo ratings yet

- Title CalifDocument2 pagesTitle CalifkoronagozalesNo ratings yet

- Adm 399 R6 2020 As WWWDocument3 pagesAdm 399 R6 2020 As WWWshawntaeadams04No ratings yet

- Wealthtax Return FormDocument7 pagesWealthtax Return FormsugasenthilNo ratings yet

- 130-U Title ApplicationDocument2 pages130-U Title Applicationjoshua_perry_4No ratings yet

- Form A1 For Import Payment (By Surendra)Document4 pagesForm A1 For Import Payment (By Surendra)surenksinghal100% (5)

- Common Transaction SlipDocument3 pagesCommon Transaction Slipabdriver2000No ratings yet

- Rf100 VehicleDocument2 pagesRf100 VehicleMaria KellyNo ratings yet

- Attention:: WWW - Irs.gov/form1099Document6 pagesAttention:: WWW - Irs.gov/form1099jengNo ratings yet

- Bid Taxi 0 Ahbo@bis - Gov.inDocument13 pagesBid Taxi 0 Ahbo@bis - Gov.inChehar EnterprisesNo ratings yet

- Drivers License FormDocument1 pageDrivers License FormNehal GaurNo ratings yet

- Request Letter For FI For OPENING FIDocument20 pagesRequest Letter For FI For OPENING FISYED ZOHAIB HAIDARNo ratings yet

- Advance Payment Requisition Form: Customer Vendor OthersDocument1 pageAdvance Payment Requisition Form: Customer Vendor OthersSMTT WORK OFFICIALNo ratings yet

- Certificate of Automobile Insurance (For Ridesharing-Ontario)Document4 pagesCertificate of Automobile Insurance (For Ridesharing-Ontario)Mostwanted 77No ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument4 pagesItr-V: Indian Income Tax Return Verification FormVaishu SoniNo ratings yet

- US Internal Revenue Service: f8404 - 2003Document2 pagesUS Internal Revenue Service: f8404 - 2003IRSNo ratings yet

- Claim For Deficiency Dividends Deductions by A Personal Holding Company, Regulated Investment Company, or Real Estate Investment TrustDocument2 pagesClaim For Deficiency Dividends Deductions by A Personal Holding Company, Regulated Investment Company, or Real Estate Investment TrustIRSNo ratings yet

- Authorised Release Certificate: Casa Form 1Document18 pagesAuthorised Release Certificate: Casa Form 1Adalberto Sánchez SolórzanoNo ratings yet

- UTILIZATIONDocument2 pagesUTILIZATIONMike BasalNo ratings yet

- US Internal Revenue Service: f990pf - 2004Document12 pagesUS Internal Revenue Service: f990pf - 2004IRSNo ratings yet

- F3529 CFDDocument1 pageF3529 CFDjmvuletichNo ratings yet

- a-YVR RAIC Extension - CGDocument1 pagea-YVR RAIC Extension - CGRobin NgNo ratings yet

- F3529 CFDDocument2 pagesF3529 CFDinfo.brisbanea1trailersNo ratings yet

- Form 4: Peker Lev Faraday Future Intelligent Electric IncDocument1 pageForm 4: Peker Lev Faraday Future Intelligent Electric InccphlegoNo ratings yet

- New Mexico Bill of Sale Form For Motor Vehicle Trailer or BoatDocument2 pagesNew Mexico Bill of Sale Form For Motor Vehicle Trailer or BoatMocks CetNo ratings yet

- F7216D02Document1 pageF7216D02robertlyons740No ratings yet

- Interest Charge On DISC-Related Deferred Tax Liability: Sign HereDocument2 pagesInterest Charge On DISC-Related Deferred Tax Liability: Sign HereIRSNo ratings yet

- Application For Registration, Renewal, Replacement or Transfer of Plates And/or StickersDocument4 pagesApplication For Registration, Renewal, Replacement or Transfer of Plates And/or StickersToddUlrichNo ratings yet

- Pa UtvDocument2 pagesPa Utvfysgvrrj4qNo ratings yet

- MVD 10002Document2 pagesMVD 10002idnac moralesNo ratings yet

- Department of State Growth: Application For RegistrationDocument1 pageDepartment of State Growth: Application For Registrationdibesh dhakalNo ratings yet

- Mutual Fund Restatementization Request FormDocument1 pageMutual Fund Restatementization Request FormRaj KumarNo ratings yet

- Statement of Assets and Liabilities As On - (This Form Should Be Obtained From Borrower / Co-Borrower/guarantors)Document4 pagesStatement of Assets and Liabilities As On - (This Form Should Be Obtained From Borrower / Co-Borrower/guarantors)Raghu Veer100% (1)

- Enhanced WeAccess Enrollment Forms - v2.27.18Document38 pagesEnhanced WeAccess Enrollment Forms - v2.27.18CharmaineDabuNo ratings yet

- Welcome!: Updated To Work With NSDL FVU 3.1 (From FY 2010 Onwards)Document9 pagesWelcome!: Updated To Work With NSDL FVU 3.1 (From FY 2010 Onwards)SagarDaveNo ratings yet

- Louisiana DuplicateDocument2 pagesLouisiana Duplicateperezhola287No ratings yet

- DriverDocument1 pageDriverfindingfelicityNo ratings yet

- How to Do a 1031 Exchange of Real Estate: Using a 1031 Qualified Intermediary (Qi) 2Nd EditionFrom EverandHow to Do a 1031 Exchange of Real Estate: Using a 1031 Qualified Intermediary (Qi) 2Nd EditionNo ratings yet

- Share 'Qbix PDFDocument5 pagesShare 'Qbix PDFAgatha BustamanteNo ratings yet

- Pon Pon ProjectDocument3 pagesPon Pon ProjectAgatha BustamanteNo ratings yet

- Motorcycle Ownership Transfer 1Document2 pagesMotorcycle Ownership Transfer 1Agatha BustamanteNo ratings yet

- Frontline Service: Documentation of Workers-On-Leave: Office/Location: Clients/Customers: Documentary RequirementsDocument4 pagesFrontline Service: Documentation of Workers-On-Leave: Office/Location: Clients/Customers: Documentary RequirementsAgatha BustamanteNo ratings yet

- Epayment Services: Department of Foreign AffairsDocument1 pageEpayment Services: Department of Foreign AffairsAgatha BustamanteNo ratings yet

- HDFC Bank MitcDocument37 pagesHDFC Bank MitcJayakrishnaraj AJDNo ratings yet

- Progressive InnovationDocument20 pagesProgressive InnovationArpit DarakNo ratings yet

- (Group 5) Engineering ManagementDocument31 pages(Group 5) Engineering ManagementairaNo ratings yet

- Complete Digest Compilation - Law 154 Local Government (Loanzon)Document511 pagesComplete Digest Compilation - Law 154 Local Government (Loanzon)Renz RuizNo ratings yet

- Schedule KDocument2 pagesSchedule Kapi-457375876No ratings yet

- Kshitija Final ProjectDocument26 pagesKshitija Final ProjectBhushan BajpeyiNo ratings yet

- Berkshire Hathaway Inc.: United States Securities and Exchange CommissionDocument48 pagesBerkshire Hathaway Inc.: United States Securities and Exchange CommissionTu Zhan LuoNo ratings yet

- HDFC Life GUARANTEED WEALTH PLUS BROCHUREDocument19 pagesHDFC Life GUARANTEED WEALTH PLUS BROCHUREpankaj_97100% (1)

- Business Analyst Project Manager in Atlanta GA Farmington MI Resume Denise DonnellyDocument3 pagesBusiness Analyst Project Manager in Atlanta GA Farmington MI Resume Denise DonnellyDeniseDonnellyNo ratings yet

- Kancharla Srinivasa RaoDocument2 pagesKancharla Srinivasa Raonayeem4444No ratings yet

- Whitepaper On Prioritising Fleet Risk Management - ClementsDocument12 pagesWhitepaper On Prioritising Fleet Risk Management - Clementsjadwa consultingNo ratings yet

- Declaration of Good Health Form PDFDocument3 pagesDeclaration of Good Health Form PDFvemula shekar100% (1)

- China Aircraft Lease IndustryDocument26 pagesChina Aircraft Lease IndustryblueraincapitalNo ratings yet

- Dental InsuranceDocument3 pagesDental InsurancemcrblxbxiaeqdyzxjoNo ratings yet

- PT - DOCU Tender NPCIL PDFDocument28 pagesPT - DOCU Tender NPCIL PDFKarikalan UNo ratings yet

- Smart Early Payout Criticalcare BrochureDocument8 pagesSmart Early Payout Criticalcare BrochureAIA Sunnie YapNo ratings yet

- UCPB General Insurance Co. Inc. vs. Masagana Telemart, Inc.Document4 pagesUCPB General Insurance Co. Inc. vs. Masagana Telemart, Inc.Carla DomingoNo ratings yet

- Insurance Job DescriptionDocument2 pagesInsurance Job Descriptionد عبدالجليل نادر محمد عبدالجليلNo ratings yet

- ECGCDocument63 pagesECGCRobin Singh AroraNo ratings yet

- Insurance Application Form: To Be Completed by SanitasDocument6 pagesInsurance Application Form: To Be Completed by SanitasAndy OrtizNo ratings yet

- Bale Ramu RemovedDocument7 pagesBale Ramu Removedsarath potnuriNo ratings yet

- Business Finance Reviewer For Summative TestDocument8 pagesBusiness Finance Reviewer For Summative TestMia Abegail ChuaNo ratings yet

- Paris Gs 2018 Outlines 6 Decem-1516475103Document17 pagesParis Gs 2018 Outlines 6 Decem-1516475103api-66404100No ratings yet

- Business Pre-Loss Planning GuideDocument27 pagesBusiness Pre-Loss Planning GuideCraig MillerNo ratings yet

Motor Tax Renewal Form: Do Not Use This Form To Register Changes of Ownership (See Note B)

Motor Tax Renewal Form: Do Not Use This Form To Register Changes of Ownership (See Note B)

Uploaded by

Agatha BustamanteOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Motor Tax Renewal Form: Do Not Use This Form To Register Changes of Ownership (See Note B)

Motor Tax Renewal Form: Do Not Use This Form To Register Changes of Ownership (See Note B)

Uploaded by

Agatha BustamanteCopyright:

Available Formats

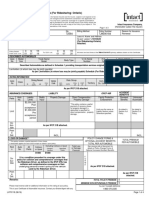

MOTOR TAX RENEWAL FORM RF100A

DO NOT USE THIS FORM TO REGISTER CHANGES OF OWNERSHIP (See Note B)

1. REGISTRATION NUMBER Make/Model

Colour(s) Chassis No.

APPLICANT

Mr, Ms, etc. First Name (s)

Address at which vehicle ordinarily

kept (Enter “as across” if vehicle is

Surname OR kept at Address across)

Company Name

Address

Town/City

County Phone NO.

Has your name/address changed (e.g. on marriage) since the vehicle was last taxed? YES NO

2. TAX CLASS (See Note C2) Private P Goods G Agricultural Tractor A Motor Cycle C

Other - please specify

3. INSURANCE DETAILS (See Note C3)

Insurance Company Name (NOT Broker)

Insurance Policy no.

Day Month Year

Expiry date of Insurance Certificate under Road Traffic Act 1961 , as amended

READ NOTE C4 BEFORE COMPLETING

4. MOTOR TAX RENEWAL DETAILS

All months between expiry of the last Motor Tax Disc Assessment

FROM FIRST DAY OF To LAST DAY OF

and start of new disc must be covered by a Past Owner,

Non-Use or Arrears Period. Month Year Month Year

4.1 Expiry date of Last Motor Tax Disc Arrears 15/4

4.2 Past Owner Period (if applicable) To Checked

4.3 Non-Use Period (if applicable) To

4.4 Arrears Period 1 (if applicable) To €

4.5 Arrears Period 2 (if applicable) To €

4.6 TAX DISC NOW REQUIRED: To €

OFFICE USE ONLY

5. DECLARATION (See Note C5)

CASH € PO € €

I declare that the particulars given on this form are correct.

CHQ € MO € TOTAL €

CR CARD €

VLC Disc Letter

Signature RBK

Date Rec’d

INS

Date Date Issued

YOU MUST SIGN FORM Day Month Year

6. CARD PAYMENT OPTION (See Note C6)

Vehicle Registration No. Card type: Master Card Visa Credit Visa Debit Laser

Card Account No. Card Expiry Date

Cardholder’s Name

Cardholders Address

Cardholder Signature Contact phone number

orNew

or Newowner

ownerdetails

detailson

onthe

theVehicle

VehicleRegistration

RegistrationCertificate

Certificateand

and

send to Vehicle Registration Unit, Department of the Environment, Heritage and Local Government, Shannon Town Centre, Co.

send to Vehicle Registration Unit, Department of the Environment, Heritage and Local Government, Shannon Town Centre, Co. Clare.Clare.

//Registration

Registration

Certificateto

Certificate tothe

theMotor

MotorDealer.

Dealer.

YouMUST

You MUSTcomplete

completeSectionSection1. 1.Section

Section11CANNOT

CANNOTbe beused

usedto toregister

registeraachange

changeof ofownership

ownershipof ofany

anykind

kind--seeseeNote

NoteBBabove.

above.Enter

Enterthe

thename

name

and If sold

address of PRIVATELY,

the person in complete

whose namePart B vehicle

the of the Vehicle

is to be Licensing

licensed. Certificate

If the or

orNew

or

vehicle

New

New

is Owner

not

owner

owner

being Details

details

licensed on

details on

on in the

the

the

the Vehicle

Vehicle

Vehicle

name Registration

Registration

Registration

of a person Certificate

Certificate

Certificate

but rather and send

and

and

and address to of

send the

Driver

to person

and in whose

Vehicle name

Computer the vehicle

Services is toofbe

Division, licensed.

Department If the vehicle

of Transport,is and

not being

Tourism licensed

and Sport, inShannon

theShannon

name of Town

Town a Centre,

person but rather

Co. Clare. a trader //

a trader

registered send

companyto Vehicle

Vehicle

special

Registration

Registration

attention is

Unit,

Unit, Department

Department

required to ensure

the

ofthat

the Environment,

Environment,

the company

Heritage

Heritage

name and and

not

Local

Local

the

Government,

Government,

trading name is Shannon

used. The Town Centre,

Centre,

company

Co. Clare.

Co.must

name Clare.bethe

the

registered company

If sold to aspecial

MOTOR attention

DEALER,is required

complete to ensure

Form that the

RF105 company

(form is will namefrom

available and notMotortheDealer)

trading and

name is used. The andcompany name must be

sameas

same asthat

that stated

stated on

on thecompany’s

the company’s Certification

Certification ofIncorporation

of Incorporation and

and will inmost

in mostcases

cases have

have “Limited”ininsend

“Limited” the

to Driver

thename.

name. Ifthe

If

Vehicle

thetrader

trader Computer

isnot

is not an

an

Services

Division,

Incorporated Department

company, formof

theform Transport,

must Tourismand

becompleted

completed andsigned

Sport,inShannon nameTown

thename Centre, Co. Clare and give the Vehicle Licensing Certificate// Registration

ofaaperson.

person. to the

Registration

Incorporated company,

Certificate

Motor tothe

to

Dealer.

Certificate the

the Motor

Motormust be

Dealer.

Dealer. and signed in the of

You

You MUST

MUST complete

complete Section

Section 1. 1. Section

Section 11 CANNOT

CANNOT be be used

used to to register

register aa change

change of of ownership

ownership of of any

any kind

kind -- see

see Note

Note B B above.

above. Enter

Enter the

the name

name

and

and address

address ofof the

the person

person inin whose

whose name

name thethe vehicle

vehicle isis to

to be

be licensed.

licensed. IfIf the

the vehicle

vehicle is

is not

not being

being licensed

licensed in

in the

the name

name of of aa person

person butbut rather

rather aa trader

trader //

registered

registered company

company special

special attention

attention is

is required

required to

to ensure

ensure that that the

the company

company name name andand not

not the

the trading

trading name

name is is used.

used.The

The company

company name name must

must be be the

the

same

same asas that

that stated

stated on

on the

the company’s

company’s Certification

Certification of

of Incorporation

Incorporation and and will

will in

in most

most cases

cases have

have “Limited”

“Limited” in

in the

the name.

name. IfIf the

the trader

trader is

is not

not an

an

Incorporated

Incorporated company,

company, thethe form

form must

must be be completed

completed and

and signed

signed in in the

the name

name of of aa person.

person.

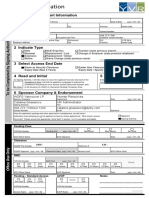

C3 Section 3

C4 Section 4 4.1 to 4.6

4.4

4.2, 4.3

4.1 4.1 September 2013, enter

this as 0 9 2 0 1 3

If the ownership of the vehicle has changed

4.2 If the ownership of the vehicle has changed since sinceititwas

waslast

lasttaxed,

taxed,youyouare

areNOT

NOTliable

liablefor

forthe

thearrears

arrearsperiod

periodfrom

fromthetheexpiry

expiryof

ofthe

thelast

lasttax

tax

disc to the end of the month immediately preceding the date of sale. If you are a new owner since the vehicle was last taxed and the renewal isisinin

disc to the end of the month immediately preceding the date of sale. If you are a new owner since the vehicle was last taxed and the renewal

respectof

respect ofaagoods

goodsvehicle

vehicleyou

youmust

mustproduce WeightDocket

produceaaWeight Docketand andififthe

therenewal

renewalisisininrespect

respectof of(i)

(i)aagoods

goodsvehicle

vehiclewhose

whoseunladen

unladenweight

weightdoes

does

notexceed

not exceed3,500kg

3,500kg(DGVW)

(DGVW)or or(ii)

(ii)aarecovery

recoveryvehicle,

vehicle,ititisisnecessary

necessaryto tocomplete

completeform

form(i) (i)RF111A

RF111Aor or(ii)

(ii)RF111B

RF111Bavailable

availablefrom

fromthe

theMotor

MotorTax

TaxOffice.

Office.

4.3 If the vehicle is currently declared off the road enter the period of non-use in the boxes provided.

4.4, If4.5 If there are elapsed months since the expiry ofit the last Motor Tax disc or off the road declaration, which was not covered by a Past Owner Period,

If the

the ownership

ownership of of the

the vehicle

vehicle has

has changed

changed since

since it waswas last

last taxed,

taxed, youyou are

are NOT

NOT liable

liable for

for the

the arrears

arrears period

period from

from the

the expiry

expiry ofof the

the last

last tax

tax

arrearsthe

disc are due. Entermonth

a continuous period of arrears indate the boxes providedare at 4.4 on owner

the form. If the arrears period is broken, enter the details using the

disc to to the end

end of

of the

the month immediately

immediately preceding

preceding the

the date of of sale.

sale. IfIf you

you are aa new

new owner sincesince the

the vehicle

vehicle was

was last

last taxed

taxed and

and the

the renewal

renewal is is in

in

boxes 4.4

respect of aand 4.5 on

goods the form.

vehicle you Enterproduce

must relevantaamount

Weight of arrears.

Docket and if the renewal is in respect of (i) a goods vehicle whose unladen weight does

respect of a goods vehicle you must produce a Weight Docket and if the renewal is in respect of (i) a goods vehicle whose unladen weight does

4.6exceed

not

not Enter the

exceed 3,500kg

renewal

3,500kg (DGVW)

periodor

(DGVW) you

or (ii) aa recovery

(ii)require and vehicle,

recovery the itit is

relevant

vehicle, is necessary

fee to

in the boxes

necessary to complete form

provided.

complete form (i)

(i) RF111A

RenewalRF111A or

or (ii)

options ofRF111B

(ii) 3 months,

RF111B available

6 months

available fromor the

from oneMotor

the Tax

year are

Motor Office.

Taxavailable

Office.

unless the annual fee is less than €119 in which case, only a renewal period of one year is available.

C5 Section 5- The signature on the application must be that of the owner of the vehicle (defined in Section 130 of the Finance Act, 1992 as the Keeper of

the vehicle). In the case of companies registered under the Companies Act 1963, the signature must be that of the Managing Director or Secretary. Where a

private firm is concerned, one of the partners’ signatures must be inserted.

C6 Section 6 - Complete this section if payment is being made by Credit Card or Debit Card. Card type: Please note Laser cards are not acceptable for

postal applications. Cardholder’s name – enter as it appears on the card.

D. What should accompany this form

You MUST County

include

County Council //City

CityCouncil

the following

Council Council andcrossed

crossed“Motor

with application:

and “MotorTaxTaxAccount”.

Account”.DO DONOT

NOTSEND

SENDCASHCASHTHROUGH

THROUGHTHE THEPOST.

POST.Contact

Contactyouryourlocal

localMotor

MotorTax

Tax

Office

• FeeOffice forclarification

- You for

mustclarification

include a ofofthe

theappropriate

cheque appropriate Motor

or postal order Tax

for therates or

correct other

fee payment

(including methods.

arrears Payments

where can also

appropriate), be

mademade by

payable credit

to the / debit card.

appropriate

Motor Tax rates or other payment methods. Payments can also be made by credit / debit card. (Motor (Motor

County

TaxRates

Ratesare

Council/Borough

Tax areCouncils

availableand

available onAertel

on AertelPage

crossedPage 454Tax

“Motor

454 (RTE

(RTE 2)or

orat

Account”.

2) atDO

www.motortax.ie,

NOT SEND CASH

www.motortax.ie, andselect

and select

THROUGH MotorTHE

Motor TaxRates.)

Tax Rates.)

POST. Contact your local Motor Tax Office for

clarification of the appropriate Motor Tax rates or other payment methods.

• Goods or Recovery Declaration, if applicable (see Note 4.2) and,,and aand

WeightWeight

aaWeight Docket

Docket ififownership

ownership

if ownership

Docket haschanged

has changed

has changed since

it wasititlast

sincesince wastaxed.

was lasttaxed.

last taxed.

• PSV (plate) Licence - Public Service Vehicles only.

• Article 60 Licence

County

County Council- /School

Council / City Busesand

City Council

Council only.crossed

and crossed “Motor

“Motor Tax

Tax Account”.

Account”. DO

DO NOT

NOT SEND

SEND CASH

CASH THROUGH

THROUGH THE THE POST.

POST. Contact

Contact your

your local

local Motor

Motor Tax

Tax

ADDITIONALOffice for

for clarification

clarification of

OfficeREQUIREMENTS of the

the appropriate

appropriate Motor

Motor Tax

Tax rates

rates or

or other

other payment

payment methods.

methods. Payments

Payments cancan also

also be

be made

made by

by credit

credit // debit

debit card.

card. (Motor

(Motor

Tax

Tax Rates

Rates are

are available

available on

on Aertel Page

Aertelmust

Pagebe454

454 (RTE 2) or at

at www.motortax.ie, and

and select Motor

Motor Tax Rates.)

A Certificate of Roadworthiness (CRW) in(RTE

force2)inororder

www.motortax.ie, selectTrailers,

to tax Goods Vehicles, Tax Rates.)

Buses and Ambulances over one year old.

DISCLOSURE OF DATA and aa Weight

,, and Weight Docket

Docket ifif ownership

ownership has

has changed

changed since

since itit was

was last

last taxed.

taxed.

Computer data based on this document may be subject to disclosure under Section 60 of the Finance Act, 1993 (No. 13 of 1993) as amended by Section

86 of the Finance Act, 1994 (No. 13 of 1994) and regulations made thereunder. List of disclosees is registered with the Data Protection Commissioner -

REF 721/A

WARNING - FALSE DECLARATIONS

Any person making a false declaration, or who subsequently fails to notify any changes in the licensing particulars now furnished, including disposal of the

vehicle is liable to heavy penalties. A licensing authority may require appropriate evidence as to the accuracy of particulars declared.

NOTE: AN IRISH VERSION OF THIS FORM IS ALSO AVAILABLE AT MOTOR TAX OFFICES AND GARDA STATIONS.

You might also like

- Apollo Smart Health Insurance GuideDocument2 pagesApollo Smart Health Insurance GuideFarhanNo ratings yet

- TPTL234 PDFDocument93 pagesTPTL234 PDFcody punNo ratings yet

- AnnexureDocument7 pagesAnnexureshaantnuNo ratings yet

- UEFA Champions League 2015 2018 RegulationsDocument100 pagesUEFA Champions League 2015 2018 RegulationsTifoso BilanciatoNo ratings yet

- D-Contractor Letter ExamplesDocument6 pagesD-Contractor Letter Examplestfc80No ratings yet

- Final - JKR-203A-Rev-1-2010Document60 pagesFinal - JKR-203A-Rev-1-2010Amar Muqri Ramlan100% (1)

- US Internal Revenue Service: f1098c - 2005Document7 pagesUS Internal Revenue Service: f1098c - 2005IRSNo ratings yet

- FORM-24 Detail Article RtoDocument3 pagesFORM-24 Detail Article RtoSUNNY MANOJ RAJPUTNo ratings yet

- US Internal Revenue Service: f8404 - 2004Document2 pagesUS Internal Revenue Service: f8404 - 2004IRSNo ratings yet

- Securities and Exchange Commission Sec Form - Acpr Annual Commercial Paper Issuance ReportDocument2 pagesSecurities and Exchange Commission Sec Form - Acpr Annual Commercial Paper Issuance ReportAdrian ToisaNo ratings yet

- US Internal Revenue Service: f1098c06 AccessibleDocument7 pagesUS Internal Revenue Service: f1098c06 AccessibleIRSNo ratings yet

- Suzuki Marine Claim Form 2008Document1 pageSuzuki Marine Claim Form 2008AmanNo ratings yet

- Application For Texas Cerificate of TitleDocument2 pagesApplication For Texas Cerificate of TitleRobert CookNo ratings yet

- US Internal Revenue Service: f8804 - 1991Document1 pageUS Internal Revenue Service: f8804 - 1991IRSNo ratings yet

- Application For Drivers Licence Transactions 25-01-2021Document1 pageApplication For Drivers Licence Transactions 25-01-2021Shevanese FagonNo ratings yet

- FORM A 1-For Import Payments OnlyDocument6 pagesFORM A 1-For Import Payments OnlyAnonymous rPwwJGksANo ratings yet

- BUN DE MANCATDocument2 pagesBUN DE MANCATkoronagozalesNo ratings yet

- Application For Provisional Driver'S Licence: Form H3ADocument1 pageApplication For Provisional Driver'S Licence: Form H3AAngel KryptonNo ratings yet

- Dgii Motor Vehicle FormDocument3 pagesDgii Motor Vehicle FormScribdTranslationsNo ratings yet

- US Internal Revenue Service: f8404 - 2000Document2 pagesUS Internal Revenue Service: f8404 - 2000IRSNo ratings yet

- TITULO-DE-CALIFORNIADocument2 pagesTITULO-DE-CALIFORNIAkoronagozalesNo ratings yet

- US Internal Revenue Service: f8404 - 2001Document2 pagesUS Internal Revenue Service: f8404 - 2001IRSNo ratings yet

- Application For Registration, Renewal, Replacement or Transfer of Plates And/or StickersDocument4 pagesApplication For Registration, Renewal, Replacement or Transfer of Plates And/or Stickersdccab33No ratings yet

- Claim Form II B Departmental ExecutionDocument1 pageClaim Form II B Departmental ExecutionChimakurthy NagarapanchayatNo ratings yet

- Form AJDocument2 pagesForm AJhongmean2002No ratings yet

- MI 273 SIRB SQC ApplicationDocument2 pagesMI 273 SIRB SQC ApplicationSaro ShyamNo ratings yet

- Inf1123 Request For Vehicle-Vessel Automated Record InformationDocument1 pageInf1123 Request For Vehicle-Vessel Automated Record InformationSteve SmithNo ratings yet

- Title CalifDocument2 pagesTitle CalifkoronagozalesNo ratings yet

- Adm 399 R6 2020 As WWWDocument3 pagesAdm 399 R6 2020 As WWWshawntaeadams04No ratings yet

- Wealthtax Return FormDocument7 pagesWealthtax Return FormsugasenthilNo ratings yet

- 130-U Title ApplicationDocument2 pages130-U Title Applicationjoshua_perry_4No ratings yet

- Form A1 For Import Payment (By Surendra)Document4 pagesForm A1 For Import Payment (By Surendra)surenksinghal100% (5)

- Common Transaction SlipDocument3 pagesCommon Transaction Slipabdriver2000No ratings yet

- Rf100 VehicleDocument2 pagesRf100 VehicleMaria KellyNo ratings yet

- Attention:: WWW - Irs.gov/form1099Document6 pagesAttention:: WWW - Irs.gov/form1099jengNo ratings yet

- Bid Taxi 0 Ahbo@bis - Gov.inDocument13 pagesBid Taxi 0 Ahbo@bis - Gov.inChehar EnterprisesNo ratings yet

- Drivers License FormDocument1 pageDrivers License FormNehal GaurNo ratings yet

- Request Letter For FI For OPENING FIDocument20 pagesRequest Letter For FI For OPENING FISYED ZOHAIB HAIDARNo ratings yet

- Advance Payment Requisition Form: Customer Vendor OthersDocument1 pageAdvance Payment Requisition Form: Customer Vendor OthersSMTT WORK OFFICIALNo ratings yet

- Certificate of Automobile Insurance (For Ridesharing-Ontario)Document4 pagesCertificate of Automobile Insurance (For Ridesharing-Ontario)Mostwanted 77No ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument4 pagesItr-V: Indian Income Tax Return Verification FormVaishu SoniNo ratings yet

- US Internal Revenue Service: f8404 - 2003Document2 pagesUS Internal Revenue Service: f8404 - 2003IRSNo ratings yet

- Claim For Deficiency Dividends Deductions by A Personal Holding Company, Regulated Investment Company, or Real Estate Investment TrustDocument2 pagesClaim For Deficiency Dividends Deductions by A Personal Holding Company, Regulated Investment Company, or Real Estate Investment TrustIRSNo ratings yet

- Authorised Release Certificate: Casa Form 1Document18 pagesAuthorised Release Certificate: Casa Form 1Adalberto Sánchez SolórzanoNo ratings yet

- UTILIZATIONDocument2 pagesUTILIZATIONMike BasalNo ratings yet

- US Internal Revenue Service: f990pf - 2004Document12 pagesUS Internal Revenue Service: f990pf - 2004IRSNo ratings yet

- F3529 CFDDocument1 pageF3529 CFDjmvuletichNo ratings yet

- a-YVR RAIC Extension - CGDocument1 pagea-YVR RAIC Extension - CGRobin NgNo ratings yet

- F3529 CFDDocument2 pagesF3529 CFDinfo.brisbanea1trailersNo ratings yet

- Form 4: Peker Lev Faraday Future Intelligent Electric IncDocument1 pageForm 4: Peker Lev Faraday Future Intelligent Electric InccphlegoNo ratings yet

- New Mexico Bill of Sale Form For Motor Vehicle Trailer or BoatDocument2 pagesNew Mexico Bill of Sale Form For Motor Vehicle Trailer or BoatMocks CetNo ratings yet

- F7216D02Document1 pageF7216D02robertlyons740No ratings yet

- Interest Charge On DISC-Related Deferred Tax Liability: Sign HereDocument2 pagesInterest Charge On DISC-Related Deferred Tax Liability: Sign HereIRSNo ratings yet

- Application For Registration, Renewal, Replacement or Transfer of Plates And/or StickersDocument4 pagesApplication For Registration, Renewal, Replacement or Transfer of Plates And/or StickersToddUlrichNo ratings yet

- Pa UtvDocument2 pagesPa Utvfysgvrrj4qNo ratings yet

- MVD 10002Document2 pagesMVD 10002idnac moralesNo ratings yet

- Department of State Growth: Application For RegistrationDocument1 pageDepartment of State Growth: Application For Registrationdibesh dhakalNo ratings yet

- Mutual Fund Restatementization Request FormDocument1 pageMutual Fund Restatementization Request FormRaj KumarNo ratings yet

- Statement of Assets and Liabilities As On - (This Form Should Be Obtained From Borrower / Co-Borrower/guarantors)Document4 pagesStatement of Assets and Liabilities As On - (This Form Should Be Obtained From Borrower / Co-Borrower/guarantors)Raghu Veer100% (1)

- Enhanced WeAccess Enrollment Forms - v2.27.18Document38 pagesEnhanced WeAccess Enrollment Forms - v2.27.18CharmaineDabuNo ratings yet

- Welcome!: Updated To Work With NSDL FVU 3.1 (From FY 2010 Onwards)Document9 pagesWelcome!: Updated To Work With NSDL FVU 3.1 (From FY 2010 Onwards)SagarDaveNo ratings yet

- Louisiana DuplicateDocument2 pagesLouisiana Duplicateperezhola287No ratings yet

- DriverDocument1 pageDriverfindingfelicityNo ratings yet

- How to Do a 1031 Exchange of Real Estate: Using a 1031 Qualified Intermediary (Qi) 2Nd EditionFrom EverandHow to Do a 1031 Exchange of Real Estate: Using a 1031 Qualified Intermediary (Qi) 2Nd EditionNo ratings yet

- Share 'Qbix PDFDocument5 pagesShare 'Qbix PDFAgatha BustamanteNo ratings yet

- Pon Pon ProjectDocument3 pagesPon Pon ProjectAgatha BustamanteNo ratings yet

- Motorcycle Ownership Transfer 1Document2 pagesMotorcycle Ownership Transfer 1Agatha BustamanteNo ratings yet

- Frontline Service: Documentation of Workers-On-Leave: Office/Location: Clients/Customers: Documentary RequirementsDocument4 pagesFrontline Service: Documentation of Workers-On-Leave: Office/Location: Clients/Customers: Documentary RequirementsAgatha BustamanteNo ratings yet

- Epayment Services: Department of Foreign AffairsDocument1 pageEpayment Services: Department of Foreign AffairsAgatha BustamanteNo ratings yet

- HDFC Bank MitcDocument37 pagesHDFC Bank MitcJayakrishnaraj AJDNo ratings yet

- Progressive InnovationDocument20 pagesProgressive InnovationArpit DarakNo ratings yet

- (Group 5) Engineering ManagementDocument31 pages(Group 5) Engineering ManagementairaNo ratings yet

- Complete Digest Compilation - Law 154 Local Government (Loanzon)Document511 pagesComplete Digest Compilation - Law 154 Local Government (Loanzon)Renz RuizNo ratings yet

- Schedule KDocument2 pagesSchedule Kapi-457375876No ratings yet

- Kshitija Final ProjectDocument26 pagesKshitija Final ProjectBhushan BajpeyiNo ratings yet

- Berkshire Hathaway Inc.: United States Securities and Exchange CommissionDocument48 pagesBerkshire Hathaway Inc.: United States Securities and Exchange CommissionTu Zhan LuoNo ratings yet

- HDFC Life GUARANTEED WEALTH PLUS BROCHUREDocument19 pagesHDFC Life GUARANTEED WEALTH PLUS BROCHUREpankaj_97100% (1)

- Business Analyst Project Manager in Atlanta GA Farmington MI Resume Denise DonnellyDocument3 pagesBusiness Analyst Project Manager in Atlanta GA Farmington MI Resume Denise DonnellyDeniseDonnellyNo ratings yet

- Kancharla Srinivasa RaoDocument2 pagesKancharla Srinivasa Raonayeem4444No ratings yet

- Whitepaper On Prioritising Fleet Risk Management - ClementsDocument12 pagesWhitepaper On Prioritising Fleet Risk Management - Clementsjadwa consultingNo ratings yet

- Declaration of Good Health Form PDFDocument3 pagesDeclaration of Good Health Form PDFvemula shekar100% (1)

- China Aircraft Lease IndustryDocument26 pagesChina Aircraft Lease IndustryblueraincapitalNo ratings yet

- Dental InsuranceDocument3 pagesDental InsurancemcrblxbxiaeqdyzxjoNo ratings yet

- PT - DOCU Tender NPCIL PDFDocument28 pagesPT - DOCU Tender NPCIL PDFKarikalan UNo ratings yet

- Smart Early Payout Criticalcare BrochureDocument8 pagesSmart Early Payout Criticalcare BrochureAIA Sunnie YapNo ratings yet

- UCPB General Insurance Co. Inc. vs. Masagana Telemart, Inc.Document4 pagesUCPB General Insurance Co. Inc. vs. Masagana Telemart, Inc.Carla DomingoNo ratings yet

- Insurance Job DescriptionDocument2 pagesInsurance Job Descriptionد عبدالجليل نادر محمد عبدالجليلNo ratings yet

- ECGCDocument63 pagesECGCRobin Singh AroraNo ratings yet

- Insurance Application Form: To Be Completed by SanitasDocument6 pagesInsurance Application Form: To Be Completed by SanitasAndy OrtizNo ratings yet

- Bale Ramu RemovedDocument7 pagesBale Ramu Removedsarath potnuriNo ratings yet

- Business Finance Reviewer For Summative TestDocument8 pagesBusiness Finance Reviewer For Summative TestMia Abegail ChuaNo ratings yet

- Paris Gs 2018 Outlines 6 Decem-1516475103Document17 pagesParis Gs 2018 Outlines 6 Decem-1516475103api-66404100No ratings yet

- Business Pre-Loss Planning GuideDocument27 pagesBusiness Pre-Loss Planning GuideCraig MillerNo ratings yet