Professional Documents

Culture Documents

Performance - Trade Nivesh

Performance - Trade Nivesh

Uploaded by

TradeNivesh AdviseryOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Performance - Trade Nivesh

Performance - Trade Nivesh

Uploaded by

TradeNivesh AdviseryCopyright:

Available Formats

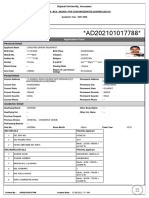

Daily Report

THURSDAY SEPT 19 2019

URL: www.tradenivesh.com Call Us On : + 91-9039261444 Page: 1

Daily Report

THURSDAY SEPT 19 2019

MARKETS AT A GLANCE

INDIAN MARKETS

INDICES VALUE CHANGE % CHANGE

NIFTY 10840.70 23.10 0.21

SENSEX 36563.88 82.79 0.23

BANKNIFTY 27172.70 40.95 0.15

GLOBAL MARKETS INDIAN SECTORIAL INDICES

INDICES VALUE % change INDICES % change

DJIA 27,110.80 0.13 NIFTY AUTO -0.12

NIFTY FIN SERVICE 0.04

S&P 500 3,005.70 0.26

NIFTY FMCG 0.27

NASDAQ 8,186.02 0.40

NIFTY IT 0.49

FTSE 100 7,327.36 0.10 NIFTY MEDIA -0.44

DAX 12,390.78 0.15 NIFTY METAL 1.13

NIFTY PHARMA -0.13

CAC 40 5,623.97 0.15

NIFTY PSU BANK 1.04

NIKKEI 21,960.71 -0.18

NIFTY PVT BANK -0.07

HANGSENG 26,754.12 -0.13

NIFTY REALTY 1.47

MARKETS’ SUMMARY

At close, the Sensex was up 82.79 points at 36,563.88, while Nifty was up 23.10 points at

10,840.70. About 1236 shares have advanced, 1227 shares declined, and 156 shares are un-

changed

Tata Steel, BPCL, Vedanta, JSW Steel and IOC were among major gainers, while losers were

Britannia Industries, Coal India, ONGC, Eicher Motors and Yes Bank.

URL: www.tradenivesh.com Call Us On : + 91-9039261444 Page: 2

Daily Report

THURSDAY SEPT 19 2019

DAILY NEWS

After a horrifying day on September 17, the Indian benchmark indices are trading on a positive

note this Wednesday morning with Sensex up 62 points at 36,543 mark while the Nif-

ty added 13 points and is trading at 10,830 level.

Nifty Metal added a percent led by gains from Tata Steel, JSW Steel, NMDC, Jindal Steel &

Power, Hindustan Zinc and Vedanta.

Realty stocks are also buzzing with gains from Prestige Estates which spiked over 7 percent fol-

lowed by Oberoi Realty, Sobha and Sunteck Realty.

The Auto index is trading flat with Tata Motors and Mahindra & Mahindra adding a percent

each while Ashok Leyland, Maruti Suzuki and Eicher Motors are trading in the red.

Global research firm CLSA is of the view that dealer survey shows continued demand weak-

ness and high inventories. It remains cautious on the sector on weak demand and regulatory

pressures.

Among the Nifty50 names, 29 stocks advanced while 21 declined.

58 stocks hit new 52- week low on BSE including Indiabulls Real Estate, Dalmia Bharat and

LIC Housing Finance among others.

URL: www.tradenivesh.com Call Us On : + 91-9039261444 Page: 4

Daily Report

THURSDAY SEPT 19 2019

MOVERS & SHAKERS

Gainers of the Day Losers of the Day

Symbol CMP % change Symbol CMP % change

TATASTEEL 357.70 3.70 BRITANNIA 2,614.90 -2.88

IBULHSGFIN 417.20 -2.78

BPCL 382.00 3.59

VEDL 150.00 3.16 COALINDIA 192.45 -2.61

GAIL 135.55 2.77 ONGC 127.15 -1.97

SBIN 280.40 2.35 EICHERMOT 16,043.00 -1.49

52 Weeks’ High 52 Weeks’ Low

Symbol LTP Change % change Symbol LTP Change % change

IBREALEST 60.30 -2.00 -3.21

CAREERP 99.85 3.65 3.7

FORCEMOT 1,158.00 -21.20 -1.80

CINEVISTA 8.45 0.40 4.97

FIEMIND 327.60 -15.30 -4.46

GRSE 159.00 15.90 11.11

DALBHARAT 800.00 -3.19

INDIAMART 1,750.00 58.10 3.43 -26.40

WHIRLPOOL 1,685.00 44.95 2.74 BHARATWIRE 29.00 0.90 3.20

Volume Shockers OI Spurts

Symbol Volume % Change in

Symbol Change in OI

PLASTIBLEN 8,73,294 OI

KABRAEXTRU 15,64,207 MINDTREE 699 21.96

GET&D 13,49,833 PIDILITIND 1,085 17.94

ABSLNN50ET 5,025

NIITTECH 265 17.11

ADVANIHOTR 1,27,724

KAJARIACER 140 15.82

ICICI500 57,814

BANKNIFTY 1,26,012 14.35

MUKTAARTS 3,40,849

URL: www.tradenivesh.com Call Us On : + 91-9039261444 Page: 3

Daily Report

THURSDAY SEPT 19 2019

RBI REFERENCE RATE

INR / 1 USD 71.81

INR / 1 EURO 78.96

INR / 100 Jap. YEN 66.36

INR / 1 POUND Sterling 89.12

FII DERIVATIVES STATISTICS

OPEN INTEREST AT THE END OF THE

BUY SELL

DAY

No. of con- No. of con-

Amt in Crores Amt in Crores No. of contracts Amt in Crores

tracts tracts

INDEX FUTURES 70970 4755.32 58164 4163.14 241536 18457.72

INDEX OPTIONS 3907646 251813.76 3916493 252714.61 872026 65174.86

STOCK FUTURES 232685 13070.10 229467 12705.34 1533121 89567.33

STOCK OPTIONS 109673 6365.67 110855 6422.10 76379 4101.93

-0.34

URL: www.tradenivesh.com Call Us On : + 91-9039261444 Page: 5

Daily Report

THURSDAY SEPT 19 2019

TECHNICAL RECOMMENDATIONS

1. BRITANNIA FUTURE : (BUY )

PIVOT LEVELS

R2 R1 PIVOT S1 S2

2,698.17 2,653.33 2,615.17 2,570.33 2,532.17

BRITANNIA FUTURE :AFTER

DOWNSIDE BREAKOUT, THIS SCRIPT IS

FORMING DEAD CAT BOUNCE KIND OF

PATTERN SHORT RALLY CAN BE SEEN

FROM LOWS, RSI IS ALSO GIVING BUY SIG-

NAL .

SO WE ADVISE TO BUY IT ABOVE 2620 TGT

2650-2680 SL BELOW 2585.

1. REC FUTURE (BUY)

PIVOT LEVELS

R2 R1 PIVOT S1 S2

140.95 136.70 134.10 129.85 127.25

REC FUTURE : THIS SCRIPT IS IN

DOWNTREND FROM FEW DAYS, AFTER

BREAKOUT FROM MAJOR SUPPORT , RSI IS

ASLO GIVING BUY SIGNAL, SHOWING SIGNS

OF BULLISH REVERSAL.

SO WE ADVISE TO BUY IT ABOVE 134 TGT

137-140 SL BELOW 131

URL: www.tradenivesh.com Call Us On : + 91-9039261444 Page: 6

Daily Report

THURSDAY SEPT 19 2019

TECHNICAL RECOMMENDATIONS

TECHNICAL VIEW : BRITANNIA LTD(BUY)

PIVOT LEVELS

R2 R1 PIVOT S1 S2

2,704.43 2,659.67 2,623.93 2,579.17 2,543.43

BRITANNIA LTD :AFTER DOWNSIDE

BREAKOUT, THIS SCRIPT IS FORMING DEAD

CAT BOUNCE KIND OF PATTERN SHORT RAL-

LY CAN BE SEEN FROM LOWS, RSI IS ALSO

GIVING BUY SIGNAL .

SO WE ADVISE TO BUY IT ABOVE 2620 TGT

2650-2680 SL BELOW 2585.

TECHNICAL VIEW: REC LTD CASH (BUY)

PIVOT LEVELS

R2 R1 PIVOT S1 S2

140.68 136.27 133.58 129.17 126.48

REC LTD : THIS SCRIPT IS IN DOWN-

TREND FROM FEW DAYS, AFTER BREAKOUT

FROM MAJOR SUPPORT , RSI IS ASLO GIVING

BUY SIGNAL, SHOWING SIGNS OF BULLISH

REVERSAL.

SO WE ADVISE TO BUY IT ABOVE 134 TGT

137-140 SL BELOW 131

URL: www.tradenivesh.com Call Us On : + 91-9039261444 Page: 7

Daily Report

THURSDAY SEPT 19 2019

TECHNICAL RECOMMENDATIONS

3. NIFTY FUTURE (BUY)

PIVOT LEVELS

R2 R1 PIVOT S1 S2

10,937.87 10,901.93 10,864.02 10,828.08 10,790.17

NIFTY FUTURE: SHOWING SIGNS OF WEAK-

NESS ON DAILY AN D HOURLY CHART ,DOJI

KIND OF PATTERN IS FORMING ON CHART,

RSI IS ALSO GIVING BUY SIGNAL,

SO WE ADVISE TO BUY IT ABOVE 10880 TGT

10930-10980 SL BELOW 10830

4. BANK NIFTY FUTURE (SELL)

PIVOT LEVELS

R2 R1 PIVOT S1 S2

27,601.65 27,390.45 27,258.80 27,047.60 26,915.95

BANK NIFTY FUTURE: SHOWING SIGNS OF

WEAKNESS ON DAILY AN D HOURLY

CHART ,DOJI KIND OF PATTERN IS FORMING

ON CHART, RSI IS ALSO GIVING SELL SIGNAL,

SO WE ADVISE TO SELL IT BELOW 27150 TGT

27100-27050 SLL BELOW 27200.

URL: www.tradenivesh.com Call Us On : + 91-9039261444 Page: 8

Daily Report

THURSDAY SEPT 19 2019

PREVIOUS DAY’S PERFORMANCE

SEG-

CALL ADVISE ENTRY TGT SL STATUS

MENT

NIFTY INDEX SELL 10800 10720-10620 10910 NOT EXECUTED

BANKNIFTY INDEX SELL 27000 26900-26750 27150 NOT EXECUTED

AXISBANK CASH SELL 640 634-625 648 NOT EXECUTED

LTD

TATASTEEL

CASH SELL 344 340-335 350.20 NOT EXECUTED

LTD

TATASTEEL FUTURE SELL 344 340-335 350.20 NOT EXECUTED

AXISBANK FUTURE SELL 640 634-625 648 NOT EXECUTED

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any

investment decision. Nothing in this document should be construed as investment or financial advice. Each recipient of

this document should make such investigations as they deem necessary to arrive at an independent evaluation of an in-

vestment in the securities of the companies referred to in this document including the merits and risks involved, and

should consult their own advisors to determine the merits and risks of such an investment. Reports based on technical

and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading vol-

ume. The information in this document has been printed on the basis of publicly available information, internal data and

other reliable sources believed to be true, but we do not represent that it is accurate or complete and it should not be

relied on as such, as this document is for general guidance only. Trade Nivesh shall not be in any way responsible for

any loss or damage that may arise.

URL: www.tradenivesh.com Call Us On : + 91-9039261444 Page: 9

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5820)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Entrepreneurial MindDocument70 pagesThe Entrepreneurial MindJavan Domanico100% (2)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Parents Interview SummaryDocument2 pagesParents Interview Summaryapi-385317557No ratings yet

- Always Clarify Clearance Via Voice If There Is ConfusionDocument2 pagesAlways Clarify Clearance Via Voice If There Is Confusionn kNo ratings yet

- Human Resource ManagementDocument13 pagesHuman Resource ManagementJerom EmmnualNo ratings yet

- Assess The Role of National Horticulture Mission (NHM) in Boosting The ProductionDocument1 pageAssess The Role of National Horticulture Mission (NHM) in Boosting The ProductionGogoi RaktimNo ratings yet

- Saiteja T.S ReportDocument4 pagesSaiteja T.S ReportSaiNo ratings yet

- Science Has Made Life Better But Not Easier.' Discuss.Document2 pagesScience Has Made Life Better But Not Easier.' Discuss.Yvette LimNo ratings yet

- Even Semester 2023-24 Student Attendance Report Less Than 75% As On 19.02.2024Document449 pagesEven Semester 2023-24 Student Attendance Report Less Than 75% As On 19.02.2024Prithvi RastogiNo ratings yet

- B767 ATA 24 Student BookDocument73 pagesB767 ATA 24 Student BookElijah Paul Merto100% (6)

- Forms: WWMS (Waste Water Management SystemDocument3 pagesForms: WWMS (Waste Water Management SystemAkram KhanNo ratings yet

- Chavez v. Bonto-PerezDocument4 pagesChavez v. Bonto-PerezRyan Jhay YangNo ratings yet

- 5Q0765RTDocument10 pages5Q0765RTFuadNo ratings yet

- NHM Acknowledgment of A CSR Activity by Oil India LTDDocument2 pagesNHM Acknowledgment of A CSR Activity by Oil India LTDThe WireNo ratings yet

- Early Ships and BoatsDocument99 pagesEarly Ships and BoatsWessex Archaeology100% (2)

- Final IipcDocument109 pagesFinal IipcPandiya RajaNo ratings yet

- Kinetic Energy of Rigid Bodies PDFDocument7 pagesKinetic Energy of Rigid Bodies PDFGooftilaaAniJiraachuunkooYesusiinNo ratings yet

- Application SummaryDocument5 pagesApplication SummaryVishal RathodNo ratings yet

- Curreclem BAP Level 1Document105 pagesCurreclem BAP Level 1sisay mamoNo ratings yet

- Hypow 12 ScreenDocument28 pagesHypow 12 ScreenDragan TrajkovicNo ratings yet

- 28 DavidAsarnowDocument24 pages28 DavidAsarnowRolindoSantosNo ratings yet

- Brain ChildDocument8 pagesBrain ChildGabriel PiticasNo ratings yet

- Online Recruitment in Telenor PakistanDocument38 pagesOnline Recruitment in Telenor Pakistanapi-27544491100% (1)

- IJAIR Volume 9 Issue 2 (IX) April - June 2022Document289 pagesIJAIR Volume 9 Issue 2 (IX) April - June 2022Rupali BhardwajNo ratings yet

- Business Logistics/Supply Chain-A Vital SubjectDocument13 pagesBusiness Logistics/Supply Chain-A Vital SubjectAhmed MaherNo ratings yet

- Dutch Standards For Hydrographic Surveys - 1st Edition - July 2009 - tcm174-302218Document32 pagesDutch Standards For Hydrographic Surveys - 1st Edition - July 2009 - tcm174-302218grondi2013No ratings yet

- CE 323 - Engineering Management Case Study No. 6: Submitted By: Roger F. Villaruel, JRDocument4 pagesCE 323 - Engineering Management Case Study No. 6: Submitted By: Roger F. Villaruel, JRGEr JrvillaruElNo ratings yet

- Steering SYSTEM Diagnostic 'Blink' CodesDocument1 pageSteering SYSTEM Diagnostic 'Blink' CodesAugusto EugênioNo ratings yet

- Duotone GuideDocument1 pageDuotone Guideapi-648378651No ratings yet

- BRMDocument6 pagesBRMGagan Kumar RaoNo ratings yet

- Rosacea FulminansDocument8 pagesRosacea FulminansberkerNo ratings yet