Professional Documents

Culture Documents

1pb - Afar

1pb - Afar

Uploaded by

Paula Villarubia0 ratings0% found this document useful (0 votes)

177 views12 pagesHshshahauuh

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentHshshahauuh

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

0 ratings0% found this document useful (0 votes)

177 views12 pages1pb - Afar

1pb - Afar

Uploaded by

Paula VillarubiaHshshahauuh

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

You are on page 1of 12

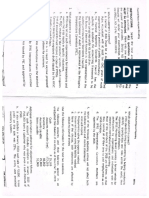

‘Advanced Financial Accounting and Reporting SETA

Erasures will render your examination answer sheet INVALID,

Use PENCIL NO. 2 only. GOODLUCKI@ .

1. State the proper order of partnership liquidation.

I. Outside creditors

TI. Owners’ interests

IIL. Insice creditors

a. I, Mand Il c¢. I, land ur

b. Il, land It a d. 1,1, 1

2. When the old partners receive a bonus upon admission of a

new partner into a partnership, the bonus is allocated to:

1, all the partners in their profit and loss sharing ratio.

Il, the existing partners in their profit and loss sharing ratio.

2. Lonly c. Either 1 or II

b. Monly 4. Neither I nor 11

3. A partner's maximum loss absorption is calculated by

2. aividing the partner's capital balance by his or her profit-

and loss-sharing percentage.

b. multiplying the partner's capital balance by his or her

profit-and-loss-sharing percentage.

© multiplying distributable assets by the partner's profit-

sharing percentage

& dividing the partner's capital balance by ‘his or her

percentage interest in capit

4. The interest of the withdrawing, retiring, or deceased partner

shall be adjusted for which of the following?

1 nis share of any profit or loss up to the date of his

withdrawal, retirement or death, if he withdraws, retires

or dies during the year

fis share of any revaluation gains or losses as at the date

of his withdrawal, retirement, or death

a. Tonly ¢. Tori

b. Ionly d. Land I

som pa Aran, openFreio 19

wero

Advanced Financial Accounting and Reporting SETA

In a statement of affairs, assets pledged for parti

creditors are

securea

Included with assets pledged for fully secured creditors

Offset against partially secured creditors

Included with free assets

Disregarded

eogse

On a statement of financial affairs, a company's assets should

be valued at

net realizable value, if lower than historical cost.

net realizable value, if higher than historical cost.

net realizable value, whether higher or lower than

historical cost.

aose

In a statement of financial affairs, assets are classified

8. accarding to whether they ere pledged with particular

creditors.

b. as current or noncurrent.

as monetary or nonmonetary

6. a8 operating or nonoperating,

Determine the true statement under PFRS 11

& Joint arrengement is either joint venture or joint

operation. :

b. Joint operation is either joint arrangement or joint

venture

¢. Jomt venture is either joint arrangement or jo

operation.

d. Joint arrangement, joint venture and yornt operation are

one’and the same

Aayanced Ferancial Accounting and Reporting

9.

10.

uN

SETA

Ik ss the joint arrangement that involves the establishment of

2 corporation in which each party has an equity interest in the

net assets of the corporation.

a. Jount venture

b. Joint operation |

< Either joint venture or joint operation

4. Neither joint venture nor joint operation

Which of the following statements is(are) true regarding sales

agency and branch?

1A branch is not a self-contained business but rather acts

only on behalf of the home office.

Il. A sales agency is a self-contained business which acts

independently, but within the bounds of the company

policy and subject to the control af the home office.

@ Toniy c. Land 0

b. Ionly d. Neither I nor 11

For external reporting, the individual financial statements of

the home office and the branch are combined

2. by using complex consolidation procedures

B. by recognizing the home office's own assets,

mcome and expenses plus its share in the

assets, liabilities, income and expenses

by adding together similar items of assets,

e and expenses

\g together similar items of assets,

nd expenses and eliminating reciprocal accounts.

cP 2 partner retires and receives cash less than his capital

ne difference be treated?

the partners in

balance, how should

Gifference sh

wid be credited to

OF 1968 ratio

vld be debited to a

oF loss ratio

the partners in

anne Anenkbn10 19

‘Advanced Financial Accounting and Reporting can

¢. The difference should be credited We the remaining

Partners in their remaining profit or loss ratio

d. The difference should be debited to the rema

partners in their remaining profit or loss ratio

ing

13. In the cash distribution plan, which partner gets the first cash

distribution?

a. The partner with the largest loan balance

b. The partner with the largest loss absorption potential

c. The partner with the largest capital balance

d. The partner with the largest profit or loss ratio,

14, When as asset is transferred to a branch from its head office,

which of the following occurs?

a. Only a memo entry is made

b. A credit to Home Office account

cc. A debit to Home Office account

d. A credit to Investment in Branch account

15, On a statement of financial affairs, a company's assets should

be vatued at

a. historical cost

b. able value, if lower than historical cost.

c izable value, it higher than historical cost.

whether higher or lower than

d. net realizable value,

historical cost

Trial balances for the Home Office and the branch of FIELD

ENTFRPRISES show the following accounts, before adjustments,

‘on December 31, 2019, Part of the branch’s merchandise come

from the Home Office, billed at 125% of acquisition cost.

Advanced Francia Accounting and Reporting

SETA

Home Office Branch

Allowance for overvaluation of Office

branch inventory P 14,000

shipments to Branch 480,000

Purenases (from other suppliers) a

Shipments from Home Office on

Merchandise Inventory, Jan. 1 Biaeoe

the branch inventory on~December 31, 2019 of 100,000

includes purchases from outsiders of P20,000. "

16. Calculate the total goods available for sale in the branch from

the standpoint of the Home Office.

2. 848,000 c. P656,000

b. P646,667 d. P806,000

17 What is the balance of the allowance for overvaluation

account, after eliminations, on the books of the Home Office

on December 31, 2019?

2 P 16,667 cc, P104,000

b. P 112,667 d. P 28,000

LLS CORPORATION issues 390,000 shares of its own P10 par

ordinary shares for the net assets of BROS COMPANY in a merger

cesummated on August 30, 2019. On this cate, the HILLS stock

< quoted at P12 per share. Balance sheets far the combining

es at August 30, 3019 just befcre combination, are 3s

HILLS. BROS

Cousrent assets: p14,400,000 P 1,200,000

Plant and Property 17,600,000 5,200,000

32,000,000 P 6,400, 000

7 P 6,600,000 P 1,600,000

ary shares, 16,000,000 2,400,000

2,400,000 800,000

2,000,000 1,600,000

P32,000,000 P 6,400,000

wee sccom un agan, OpentPBIOI9

‘Advanced Financial Accounting and Reporing 4

ETA

HILLS also paid finder’s fees of PSK 3

sasssces of 30,000, The east of reysterng and sun ec

stocks is P150,000 issuing the

48. The amount of Retained Earnings on the balance sheet to be

presented by HILLS CORPORATION at August 30, 2019 will be

a. P5,600,000 ¢. P4,950,000

b. P5,070,000 d, P4,040,000

Claudia, Petra, Mona, and Hilda are partners who share profits

ad losses at 40%, 30%, 20%, and 10%, respectively. Since two

of them have given intention to withdraw, they have decided to

iquidate the partnership instead, At this point, the capital

balances of the partners are as Follows:

Claudia 48,000

Petra 21,600

Mona 34,400

Hilda 16,000

19. Which of the following statements is true?

a. The first available P1,600 will go to Hilda.

b. Claudia will be the last partner to receive any available

cash.

c. The first available P2,400 wil go to Mona,

d. Claudia will collect @ portion of any 2v

Hilda receives anything

ible cash before

GREEN BERET, INC. 1S very financially distressed and tne

and. Exchange Commission ordered its prompt

Securities

Iquidation. The company has the following assets at this pOwt

Fair Value

Current assets 28,000

Lane 72,000

Buildings. 56,000 (61,600

Equipment 24,00 26,400

ee “pram DpenFPB10 19

Rgeroe ne como

‘Advanced Financial Accounting and Reporting

SETA

The company’s liabiliti

ies at

pele the same date are as follows:

Notes payable, secured by | cae

Accounts payable tone son

Salanes payable een

Bonds payable pee

Administrative expenses for liquidation 6-000

20. Calculate the estimar

of non-priority claims

2. P 88,800 cP 86,

: 400

b.. P 100,000 d. P108,600

ed net amount available for the payment

21. Calculate the amount of estimated payment to holders of note

payable in the event of liquidation.

2. P 88,800

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5823)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- ArefbitiDocument7 pagesArefbitiPaula Villarubia100% (1)

- Assignment No. 4Document3 pagesAssignment No. 4Paula VillarubiaNo ratings yet

- Far First Set ADocument8 pagesFar First Set APaula Villarubia100% (1)

- ScholarshipsponsorDocument1 pageScholarshipsponsorPaula VillarubiaNo ratings yet

- NakakaxDocument3 pagesNakakaxPaula Villarubia100% (1)

- ApaDocument2 pagesApaPaula Villarubia100% (1)

- At 2503Document43 pagesAt 2503Paula VillarubiaNo ratings yet

- NOLOLDocument11 pagesNOLOLPaula VillarubiaNo ratings yet

- JV ZZZZDocument32 pagesJV ZZZZPaula VillarubiaNo ratings yet

- AFAR Preweek PDFDocument8 pagesAFAR Preweek PDFPaula VillarubiaNo ratings yet

- AT L. R. Cabarles/J.M. D. Maglinao Quiz 3 SET A OCTOBER 2019Document2 pagesAT L. R. Cabarles/J.M. D. Maglinao Quiz 3 SET A OCTOBER 2019Paula VillarubiaNo ratings yet

- EmeyesDocument6 pagesEmeyesPaula Villarubia100% (2)

- HshshjaaDocument6 pagesHshshjaaPaula Villarubia0% (1)

- Ap Set ADocument2 pagesAp Set APaula VillarubiaNo ratings yet

- Far First Set ADocument8 pagesFar First Set APaula Villarubia100% (1)

- TAX Tabag First Preboard Set A October 2019: Page 1 of 4Document4 pagesTAX Tabag First Preboard Set A October 2019: Page 1 of 4Paula VillarubiaNo ratings yet

- TAX Tabag First Preboard Set A October 2019: Page 1 of 4Document4 pagesTAX Tabag First Preboard Set A October 2019: Page 1 of 4Paula VillarubiaNo ratings yet

- EmeyesDocument6 pagesEmeyesPaula Villarubia100% (2)

- V MG AnalysisDocument2 pagesV MG AnalysisPaula VillarubiaNo ratings yet

- First Pb-FarDocument16 pagesFirst Pb-FarPaula VillarubiaNo ratings yet

- P S P C: Ilipinas Hell Etroleum OrporationDocument16 pagesP S P C: Ilipinas Hell Etroleum OrporationPaula VillarubiaNo ratings yet

- 01 - Time Value of Money AKDocument1 page01 - Time Value of Money AKPaula VillarubiaNo ratings yet

- SUBWAYDocument1 pageSUBWAYPaula VillarubiaNo ratings yet