Professional Documents

Culture Documents

Intermediate Accounting I - Cash and Cash Equivalents

Intermediate Accounting I - Cash and Cash Equivalents

Uploaded by

Joovs JoovhoOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Intermediate Accounting I - Cash and Cash Equivalents

Intermediate Accounting I - Cash and Cash Equivalents

Uploaded by

Joovs JoovhoCopyright:

Available Formats

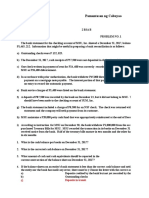

Intermediate Accounting I

Cash and cash equivalents

Problems:

1. Consider the following: Cash in Bank – checking account of P18,500, Cash on hand of P500, Post-dated

checks received totaling P3,500, and Certificates of deposit totaling P124,000. How much should be

reported as cash in the balance sheet?

2. Meliodas Company has cash in bank of P15,000, restricted cash in a separate account of P3,000, and a

bank overdraft in an account at another bank of P1,000. Meliodas should report cash of?

3. Casper Company has the following items at year-end:

Cash in bank P30,000

Petty cash 300

Short-term paper with maturity of 2 months 5,500

Postdated checks 1,400

Casper should report cash and cash equivalents of

4. Harlequin Company month-end bank statement shows a balance of P72,000, outstanding checks are

P24,000, a deposit of P8,000 was in transit at month end, and a check for P1,000 was erroneously

charged by the bank against the account, the correct balance in the bank account of Harlequin Company

at month end is?

5. Finley, Inc.’s checkbook balance on December 31, 2018 was P42,400. In addition, Finley held the

following items in its safe on December 31.

(1) A check for P900 from Peters, Inc. received December 30, 2018, which was not included in

the checkbook balance.

(2) An NSF check from Garner Company in the amount of P1,800 that had been deposited at the

bank, but was returned for lack of sufficient funds on December 29. The check was to be

redeposited on January 3, 2019. The original deposit has been included in the December 31

checkbook balance.

(3) Coin and currency on hand amounted to P2,900.

The proper amount to be reported on Finley's balance sheet for cash at December 31, 2018 is?

6. The cash account shows a balance of P90,000 before reconciliation. The bank statement does not

include a deposit of P4,600 made on the last day of the month. The bank statement shows a collection by

the bank of P1,880 and a customer's check for P640 was returned because it was NSF. A customer's

check for P900 was recorded on the books as P1,080, and a check written for P158 was recorded as

P94. The correct balance in the cash account was?

JHA 2019 Exclusive Copy

7. Escanor Plastics Company deposits all receipts and makes all payments by check. The following

information is available from the cash records:

MARCH 31, 2019 BANK RECONCILIATION

Balance per bank P26,746

Add: Deposits in transit 2,100

Deduct: Outstanding checks (3,800)

Balance per books P25,046

Month of April Results

Per Bank Per Books

Balance April 30, 2019 P27,995 P27,355

April deposits 11,784 13,889

April checks 11,100 10,080

April note collected (not included in April deposits) 3,000 -0-

April bank service charge 35 -0-

April NSF check of a customer returned by the bank

(recorded by bank as a charge) 900 -0-

Instructions

(a) Calculate the amount of the April 30, 2019:

1. Deposits in transit

2. Outstanding checks

(b) What is the April 30, 2019 adjusted cash balance?

8. Estarossa Corp.’s checkbook balance on December 31, year 2, was P5,000. In addition, Estarossa held

the following items in its safe on that date:

P2,000 Check payable to Estarossa Corp., dated January 2, year 3, in payment of a sale made in

December year 2, not included in December 31 checkbook balance

P500 Check payable to Estarossa Corp., deposited December 15 and included in December 31

checkbook balance, but re turned by bank on December 30 stamped “NSF.” The check was

redeposited on January 2, year 3, and cleared on January 9

P300 Check drawn on Estarossa Corp.’s account, payable to a vendor, dated and recorded in

Ral’s books on December 31 but not mailed until January 10, year 3

The proper amount to be shown as Cash on Estarossa’s balance sheet at December 31, year 2, is_____.

9. Star Labs Company had the following account balances at December 31, year 2:

Cash in banks P2,250,000

Cash on hand 125,000

Cash legally restricted for additions to

plant (expected to be disbursed in year 3) 1,600,000

Cash in banks includes P600,000 of compensating balances against short-term borrowing arrangements.

The compensating balances are not legally restricted as to withdrawal by Burr. In the current assets

section of Burr’s December 31, year 2 balance sheet, total cash should be reported at

a. P1,775,000

b. P2,250,000

c. P2,375,000

d. P3,975,000

JHA 2019 Exclusive Copy

10. Stark Industries cash account as of December 31, 20x1:

Outstanding checks, 11/30/20x1 P 16,250

Outstanding checks, 12/31/20x1 12,500

Deposit in transit, 11/30/20x1 12,500

Cash balance per general ledger, 12/31/20x1 37,500

Actual company collections from its customers during

December 152,500

Company checks paid by bank in December 130,000

Bank service charges recorded on the company books

in December 2,500

Bank service charges per December bank statement 3,250

Deposits credited by bank during December 145,000

November bank service charges recorded on company

books in December 1,500

The cash receipts book of December is underfooted by P 2,500.

The bank erroneously charged the company's account for a P3,750 check of another depositor. This bank

error was corrected in January 20x2.

Questions:

a. How much is the deposit in transit on December 31, 20x1?

b. What is the total unrecorded bank service charges as of December 31, 20x1?

c. What is the total book receipts in December?

d. What is the total amount of company checks issued in December?

e. What is the total book disbursements in December?

f. What is the book balance on November 30, 20x1?

g. What is the bank balance on November 30, 20x1?

h. What is the total bank receipts in December?

i. What is the total bank disbursements in December?

j. What is the bank balance on December 31, 20x1?

JHA 2019 Exclusive Copy

11. S.H.I.E.L.D Company

General and Petty Cash Count

Bills and Coins

Denomination Pieces

P 500 218

100 454

50 610

20 1,008

10 20

5 608

1 1,040

0.25 4,032

Checks

Maker Payee Date Amount

Tissot - Customer Bonjour Company 12/30/20x1 P 23,840

Castro - Customer Bonjour Company 12/26/20x1 25,010

Allez - Customer Bonjour Company 1/2/20x2 11,414

Petra - Customer Bonjour Company 12/21/20x1 26,700

Bonjour Company Bonne Chance Corp. 12/27/20x1 29,000

Salut - Officer Bearer 1/5/20x2 620

Bueno* Cash 12/29/20x1 520

*Amount is for a return of travel advance made to the employee in an earlier period.

Vouchers and IOUS

Paid to Date Amount

BWD 1/2/20x2 P 70

BENECO 12/20/20x1 300

Eurotel - Christmas Party 12/23/20x1 12,580

Vina - IOU 12/27/20x1 600

Additional Notes:

1. Cash sales invoice (all currencies, No. 17903 to 18112), P 201,000.

2. Official Receipts

Number Amount Form of Collection

31250 P 1,120 Cash

31251 25,010 Check

31252 2,404 Cash

31253 23,840 Check

31254 26,700 Check

3. Stamps of various denomination amounted to P 160.

4. A notation on an envelope is "Proceeds from employee contribution for Christmas Party, P 19,000".

5. Petty cash per ledger, P 30,000.

Questions:

1. How much is the petty cash shortage as of January 5, 20x2?

2. What is the credit adjustment to correct the petty cash fund?

3. What is the adjusted petty cash fund as of December 31, 20x1?

JHA 2019 Exclusive Copy

You might also like

- Accounting10 (Reviewer)Document5 pagesAccounting10 (Reviewer)Erika Panit ReyesNo ratings yet

- Auditing Quiz Audit of CashDocument4 pagesAuditing Quiz Audit of CashLoveli Breindaelyn Rivera0% (2)

- Cash and Cash Equivalents - ProblemsDocument47 pagesCash and Cash Equivalents - Problemscommissioned homeworkNo ratings yet

- Assignment No. 1 Audit of CashDocument5 pagesAssignment No. 1 Audit of CashMa Tiffany Gura RobleNo ratings yet

- Total Cash 8,050,000: Additional InformationDocument10 pagesTotal Cash 8,050,000: Additional Informationeia aieNo ratings yet

- Audit of CashDocument4 pagesAudit of CashandreamrieNo ratings yet

- 100% Key Answers For The 2 First Quizzes - ACT1104Document34 pages100% Key Answers For The 2 First Quizzes - ACT1104moncarla lagonNo ratings yet

- BANKRECONPROBLEMSDocument3 pagesBANKRECONPROBLEMSPaulAnthonyNo ratings yet

- Bulacan State University: College of Business AdministrationDocument13 pagesBulacan State University: College of Business AdministrationLiana100% (1)

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Final Exams April 2, 2019Document4 pagesFinal Exams April 2, 2019Joovs JoovhoNo ratings yet

- UCU Audit ProblemsDocument9 pagesUCU Audit ProblemsTCC FreezeNo ratings yet

- Cash For SeatworkDocument3 pagesCash For SeatworkMika MolinaNo ratings yet

- Intermediate Accounting I - Cash and Cash EquivalentsDocument2 pagesIntermediate Accounting I - Cash and Cash EquivalentsJoovs Joovho0% (1)

- Assignment No. 2 PCF and BANK RECONCILIATION1Document4 pagesAssignment No. 2 PCF and BANK RECONCILIATION1Elaine Antonio100% (1)

- Cash and Cash EquivalentsDocument50 pagesCash and Cash EquivalentsAnne EstrellaNo ratings yet

- Audit of Cash and Cash EquivalentsDocument6 pagesAudit of Cash and Cash Equivalentsphoebelyn acdogNo ratings yet

- Problem SolvingDocument4 pagesProblem SolvingsunflowerNo ratings yet

- Handout - Cash and Cash EquivalentsDocument5 pagesHandout - Cash and Cash Equivalentsandrea arapocNo ratings yet

- 1 Review CceDocument10 pages1 Review CceJobelle Candace Flores AbreraNo ratings yet

- RM - Cash and Cash EquivalentsDocument3 pagesRM - Cash and Cash Equivalentsncaacademics.nfjpia2324No ratings yet

- Cash & Cash Equivalent TheoryDocument17 pagesCash & Cash Equivalent Theoryjoneth.duenasNo ratings yet

- Accounting For Cash-receivables-InventoriesDocument12 pagesAccounting For Cash-receivables-InventoriesPaupau100% (1)

- Prelim-Pr 2a14fb4488c3b5b235Document11 pagesPrelim-Pr 2a14fb4488c3b5b235Romina LopezNo ratings yet

- Mocule1 Quiz 202Document4 pagesMocule1 Quiz 202yowatdafrickNo ratings yet

- RDocument2 pagesRjhevesNo ratings yet

- CCE Quiz Batasan SetDocument3 pagesCCE Quiz Batasan SetJoovs JoovhoNo ratings yet

- Assignment - Cash and CEDocument4 pagesAssignment - Cash and CEAleah Jehan AbuatNo ratings yet

- ReSA B43 FAR First PB Exam Questions Answers SolutionsDocument14 pagesReSA B43 FAR First PB Exam Questions Answers Solutionsrtenaja100% (1)

- Quiz Module 1 FINALDocument4 pagesQuiz Module 1 FINALeia aieNo ratings yet

- Cabigon Problem 1 AuditDocument2 pagesCabigon Problem 1 AuditGianrie Gwyneth CabigonNo ratings yet

- Chapter 1 Cash and Cash Equivalent-01 PDFDocument7 pagesChapter 1 Cash and Cash Equivalent-01 PDFleng g50% (2)

- S Announcement 19717Document3 pagesS Announcement 19717Amy RillorazaNo ratings yet

- Ap9208 Cash 1Document4 pagesAp9208 Cash 1Onids AbayaNo ratings yet

- Cpa Review School of The PhilippinesDocument12 pagesCpa Review School of The PhilippinesMike SerafinoNo ratings yet

- Auditing ProblemsDocument39 pagesAuditing ProblemstinNo ratings yet

- Reviewees IntaccDocument6 pagesReviewees IntaccMarvic Cabangunay0% (2)

- Cash Problem 1Document3 pagesCash Problem 1Dawson Dela CruzNo ratings yet

- IntAcct Cash CashEquivalents 1Document3 pagesIntAcct Cash CashEquivalents 1Arkhie DavocolNo ratings yet

- AP Preweek B94 - QuestionnaireDocument7 pagesAP Preweek B94 - QuestionnaireSilver LilyNo ratings yet

- 3.3 - Bank Reconciliation and Proof of CashDocument5 pages3.3 - Bank Reconciliation and Proof of CashxxxNo ratings yet

- Ap-5907 CashDocument11 pagesAp-5907 CashSaoxalo ONo ratings yet

- PAULA GOZUN - Activity 2 Accounting For Cash-receivables-InventoriesDocument9 pagesPAULA GOZUN - Activity 2 Accounting For Cash-receivables-InventoriesPaupauNo ratings yet

- A) B) C) D) E) A) B) C) D) E) A) B) C) D) E) A) B) C) D) E)Document3 pagesA) B) C) D) E) A) B) C) D) E) A) B) C) D) E) A) B) C) D) E)Mharvie LorayaNo ratings yet

- 02audit of CashDocument12 pages02audit of CashJeanette FormenteraNo ratings yet

- Finals Pom HandoutDocument7 pagesFinals Pom HandoutFlorenz AmbasNo ratings yet

- Cash-And-Cash-Equivalent - Answers On HandoutDocument6 pagesCash-And-Cash-Equivalent - Answers On HandoutElaine AntonioNo ratings yet

- Practice Porblems CashDocument8 pagesPractice Porblems CashDonna Zandueta-TumalaNo ratings yet

- Problems CCEDocument10 pagesProblems CCERafael Renz DayaoNo ratings yet

- Cash and Cash Equivalents QuizDocument2 pagesCash and Cash Equivalents QuizMarkJoven Bergantin100% (1)

- Cce Prob DiscussionDocument6 pagesCce Prob DiscussionTrazy Jam BagsicNo ratings yet

- Securities: Date Acquired Maturity Date AmountDocument5 pagesSecurities: Date Acquired Maturity Date AmountThe Chuffed Shop PHNo ratings yet

- Questions - Level 1Document2 pagesQuestions - Level 1didiaenNo ratings yet

- 1 Cash and Cash EquivalentsDocument3 pages1 Cash and Cash EquivalentsJohn Aries Reyes100% (1)

- Ar QDocument2 pagesAr QAyaNo ratings yet

- Practical Auditing Empleo Sol Man Chapter 3Document6 pagesPractical Auditing Empleo Sol Man Chapter 3Elaine AntonioNo ratings yet

- Long Examination Cash Set ADocument3 pagesLong Examination Cash Set AprechuteNo ratings yet

- AUD02 - 05 Audit of Cash and Cash EquivalentsDocument3 pagesAUD02 - 05 Audit of Cash and Cash EquivalentsMark BajacanNo ratings yet

- Audit of Cash - SW8Document7 pagesAudit of Cash - SW8d.pagkatoytoyNo ratings yet

- Cpar 2Document11 pagesCpar 2Ana MarieNo ratings yet

- Economic & Budget Forecast Workbook: Economic workbook with worksheetFrom EverandEconomic & Budget Forecast Workbook: Economic workbook with worksheetNo ratings yet

- 21St Century Computer Solutions: A Manual Accounting SimulationFrom Everand21St Century Computer Solutions: A Manual Accounting SimulationNo ratings yet

- Filipinas Port V GoDocument2 pagesFilipinas Port V GoJoovs JoovhoNo ratings yet

- Valle Verde Country Club Vs AfricaDocument2 pagesValle Verde Country Club Vs AfricaJoovs JoovhoNo ratings yet

- G.R. No. 117847Document10 pagesG.R. No. 117847Joovs JoovhoNo ratings yet

- G.R. No. 188307Document14 pagesG.R. No. 188307Joovs JoovhoNo ratings yet

- G.R. No. 154291Document13 pagesG.R. No. 154291Joovs JoovhoNo ratings yet

- G.R. No. L-15092Document3 pagesG.R. No. L-15092Joovs JoovhoNo ratings yet

- Ramirez Vs Orientalist Co.Document2 pagesRamirez Vs Orientalist Co.Joovs Joovho67% (3)

- People of The Philippines Vs BelloDocument1 pagePeople of The Philippines Vs BelloJoovs Joovho100% (2)

- G.R. No. 224825Document8 pagesG.R. No. 224825Joovs JoovhoNo ratings yet

- G.R. No. 199669Document17 pagesG.R. No. 199669Joovs JoovhoNo ratings yet

- B3-C G.R. No. 135808 SEC-vs-Interport-Resources-CorpDocument2 pagesB3-C G.R. No. 135808 SEC-vs-Interport-Resources-CorpJoovs Joovho100% (1)

- People Vs Marie Teresa Pangilinan GR 152662Document13 pagesPeople Vs Marie Teresa Pangilinan GR 152662Verbosee VVendettaNo ratings yet

- A17 G.R. No. 180010 Cariaga vs. PeopleDocument3 pagesA17 G.R. No. 180010 Cariaga vs. PeopleJoovs JoovhoNo ratings yet

- B3-B G.R. No. 167571 Panaguiton, Jr. vs. DOJ. G.R. No. 167571Document4 pagesB3-B G.R. No. 167571 Panaguiton, Jr. vs. DOJ. G.R. No. 167571Joovs JoovhoNo ratings yet

- B1-B G.R. No. 183623 Leticia B. Agbayani vs. Court of AppealsDocument7 pagesB1-B G.R. No. 183623 Leticia B. Agbayani vs. Court of AppealsJoovs JoovhoNo ratings yet

- A11-5 G.R. No. 175457 & G.R. No. 175482 Ambil v. SandiganbayanDocument9 pagesA11-5 G.R. No. 175457 & G.R. No. 175482 Ambil v. SandiganbayanJoovs JoovhoNo ratings yet

- B3-A G.R. No. 168662 Sanrio Company Ltd. vs. Lim PDFDocument4 pagesB3-A G.R. No. 168662 Sanrio Company Ltd. vs. Lim PDFJoovs JoovhoNo ratings yet

- A16 G.R. No. 171175 People v. DucaDocument5 pagesA16 G.R. No. 171175 People v. DucaJoovs JoovhoNo ratings yet

- A12-2 G.R. No. 147097 Lazatin v. DesiertoDocument5 pagesA12-2 G.R. No. 147097 Lazatin v. DesiertoJoovs JoovhoNo ratings yet

- A101 Financial Accounting and Reporting XFARDocument61 pagesA101 Financial Accounting and Reporting XFARCristina TayagNo ratings yet

- Corporate Accounting I - Unit 1 EditedDocument39 pagesCorporate Accounting I - Unit 1 EditedAngelin TherusNo ratings yet

- AS-3 Cash Flow StatementDocument5 pagesAS-3 Cash Flow StatementJitendra UdawantNo ratings yet

- Unit 3: Indian Accounting Standard 7: Statement of Cash FlowsDocument37 pagesUnit 3: Indian Accounting Standard 7: Statement of Cash Flowspulkitddude_24114888No ratings yet

- #10 Cash and Cash EquivalentsDocument2 pages#10 Cash and Cash Equivalentsmilan100% (3)

- Cash and Cash EquivalentsDocument5 pagesCash and Cash Equivalentsforuse insitesNo ratings yet

- 2014 Vol 1 CH 2 AnswersDocument10 pages2014 Vol 1 CH 2 Answerskim wonpilNo ratings yet

- FAR NotesDocument30 pagesFAR NotesMary Grace Peralta ParagasNo ratings yet

- On January 1Document6 pagesOn January 1Warren Nahial ValerioNo ratings yet

- 1.3.2 Practice ProblemsDocument5 pages1.3.2 Practice ProblemsBea FalnicanNo ratings yet

- Ipsas 2 Cash Flow StatementsDocument18 pagesIpsas 2 Cash Flow StatementsNassib SongoroNo ratings yet

- Error Correction Problem 1: Lord Gen A. Rilloraza, CPADocument5 pagesError Correction Problem 1: Lord Gen A. Rilloraza, CPAMae-shane SagayoNo ratings yet

- Allianz Life Fund Performance Report 2013 PDFDocument346 pagesAllianz Life Fund Performance Report 2013 PDFChong Vun KinNo ratings yet

- IntAcc Quiz 1 PDFDocument9 pagesIntAcc Quiz 1 PDFMyles Ninon LazoNo ratings yet

- C7A Cash & Cash EquivalentsDocument6 pagesC7A Cash & Cash EquivalentsSteeeeeeeephNo ratings yet

- Cash Flow Statements: Deepti Gurvinder Jitender Niraj PalakDocument29 pagesCash Flow Statements: Deepti Gurvinder Jitender Niraj PalakPalak GoelNo ratings yet

- Lecture 1 - Cash and Cash EquivalentsDocument18 pagesLecture 1 - Cash and Cash EquivalentsJim Carlo ChiongNo ratings yet

- Netflix, Inc. Consolidated Balance SheetsDocument4 pagesNetflix, Inc. Consolidated Balance Sheetsjain.ruchir4281No ratings yet

- Financial - Statement Reporting-IIDocument29 pagesFinancial - Statement Reporting-IIAshwini KhareNo ratings yet

- Chapter 10Document3 pagesChapter 10Jao FloresNo ratings yet

- Zendesk, Inc.: United States Securities and Exchange Commission FORM 10-KDocument16 pagesZendesk, Inc.: United States Securities and Exchange Commission FORM 10-KKumar SinghNo ratings yet

- Financial Statement Analysis of Target and TescoDocument15 pagesFinancial Statement Analysis of Target and TesconormaltyNo ratings yet

- Chapter 7Document24 pagesChapter 7akram oukNo ratings yet

- Peoject Synopsis Format PTUDocument15 pagesPeoject Synopsis Format PTUਲਵਲੀਸ਼ ਕੁਮਾਰNo ratings yet

- Unit 4 Cash Flow StatementDocument36 pagesUnit 4 Cash Flow StatementDrShailesh Singh ThakurNo ratings yet

- Cash and Cash EquivalentsDocument2 pagesCash and Cash EquivalentsAngelo Christian B. OreñadaNo ratings yet

- Cash Flow Statements PDFDocument101 pagesCash Flow Statements PDFSubbu ..100% (1)

- 01-IlocosNorteProvince2020 Audit ReportDocument89 pages01-IlocosNorteProvince2020 Audit ReportRuffus TooqueroNo ratings yet

- Cash and Cash EquivalentsDocument17 pagesCash and Cash EquivalentsNobu NobuNo ratings yet