Professional Documents

Culture Documents

I. Working Capital Management

I. Working Capital Management

Uploaded by

Jewel Jade RellosaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

I. Working Capital Management

I. Working Capital Management

Uploaded by

Jewel Jade RellosaCopyright:

Available Formats

SH1663

Working Capital Management

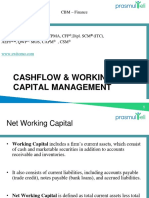

I. Working Capital Management

A. Holding on to cash

• Why People Hold on to Cash

o Speculation – Firms hold on to cash in case there are special opportunities for the firm

that must be acted on quickly.

o Precaution – Holding cash can serve as an emergency fund for the firm. If expected

cash inflows are not received, the cash held on as a precautionary basis could be used

to satisfy short-term obligations.

o Transaction – Firms exist to produce goods and services. This activity results to the

need for cash to buy raw materials and pay off debts.

• Liquidity

o Liquidity is the ability of the company to satisfy its short-term obligations using assets

that are readily converted to cash. Liquidity management is the ability of the company

to generate cash when and where needed.

o Liquidity management requires addressing the drags and pulls on liquidity.

Drags on liquidity are the forces that delay the collection of cash, such as slow

payments from customers or obsolete inventory.

Pulls on liquidity are decisions that result in paying cash too soon, such as paying

cash credit or a bank reducing its line of credit.

o Primary sources of liquidity

Cash and cash equivalents

• Cash received from sales

• Accounts payables

Short-term funds

• Trade credit from suppliers

• Working capital loans from banks

Cash flow management

• The firm can also generate working capital by effectively managing its cash.

II. Managing Cash, Receivables, and Inventory

A. The Operating Cycle

• A business purchases raw materials to manufacture the products they sell. Sometimes, those

raw materials are bought on credit. Once the products are sold, the business can choose to

pay immediately or at a later date.

• Ideally, businesses want to receive payment for sales right away and then use the payment

to clear the debts. However, in reality, there is often a mismatch in the timing of cash

receipts and the cash payment for the raw materials. Therefore, it is necessary to know how

long, on the average, it takes for the business to pay its suppliers and collect its sales.

• The operating period refers to the time period between the sale of the product and receiving

the cash payment. The cycle is composed of two (2) periods: the inventory period and the

accounts receivable period. The inventory period is the time it takes for the business to sell

its product after it has purchased the raw materials, while the accounts receivable period is

the time it takes for the business to collect the sale of the finished product. A shorter

operating period is preferable for business.

06 Handout 1 *Property of STI

Page 1 of 2

SH1663

Accounts Receivable Period

Receivables Turnover 𝑁𝑁𝑁𝑁𝑁𝑁 𝐶𝐶𝐶𝐶𝐶𝐶𝐶𝐶𝐶𝐶𝐶𝐶 𝑆𝑆𝑆𝑆𝑆𝑆𝑆𝑆𝑆𝑆

Ratio: (𝐵𝐵𝐵𝐵𝐵𝐵𝐵𝐵𝐵𝐵𝐵𝐵𝐵𝐵𝐵𝐵𝐵𝐵 𝑅𝑅𝑅𝑅𝑅𝑅𝑅𝑅𝑅𝑅𝑅𝑅𝑅𝑅𝑅𝑅𝑅𝑅𝑅𝑅𝑅𝑅 + 𝐸𝐸𝐸𝐸𝐸𝐸𝐸𝐸𝐸𝐸𝐸𝐸 𝑅𝑅𝑅𝑅𝑅𝑅𝑅𝑅𝑅𝑅𝑅𝑅𝑅𝑅𝑅𝑅𝑅𝑅𝑅𝑅𝑅𝑅)⁄2

Age of Receivables 365

𝑅𝑅𝑅𝑅𝑅𝑅𝑅𝑅𝑅𝑅𝑅𝑅𝑅𝑅𝑅𝑅𝑅𝑅𝑅𝑅𝑅𝑅 𝑇𝑇𝑇𝑇𝑇𝑇𝑇𝑇𝑇𝑇𝑇𝑇𝑇𝑇𝑇𝑇

Inventory Period

Inventory Turnover Ratio 𝐶𝐶𝐶𝐶𝐶𝐶𝐶𝐶 𝑜𝑜𝑜𝑜 𝐺𝐺𝐺𝐺𝐺𝐺𝐺𝐺𝐺𝐺 𝑆𝑆𝑆𝑆𝑆𝑆𝑆𝑆

(𝐵𝐵𝐵𝐵𝐵𝐵𝐵𝐵𝐵𝐵𝐵𝐵𝐵𝐵𝐵𝐵𝐵𝐵 𝐼𝐼𝐼𝐼𝐼𝐼𝐼𝐼𝐼𝐼𝐼𝐼𝐼𝐼𝐼𝐼𝐼𝐼 + 𝐸𝐸𝐸𝐸𝐸𝐸𝐸𝐸𝐸𝐸𝐸𝐸 𝐼𝐼𝐼𝐼𝐼𝐼𝐼𝐼𝐼𝐼𝐼𝐼𝐼𝐼𝐼𝐼𝐼𝐼)⁄2

Age of Inventory 365

𝐼𝐼𝐼𝐼𝐼𝐼𝐼𝐼𝐼𝐼𝐼𝐼𝐼𝐼𝐼𝐼𝐼𝐼 𝑇𝑇𝑇𝑇𝑇𝑇𝑇𝑇𝑇𝑇𝑇𝑇𝑇𝑇𝑇𝑇

Operating Cycle

𝐴𝐴𝐴𝐴𝐴𝐴 𝑜𝑜𝑜𝑜 𝑅𝑅𝑅𝑅𝑅𝑅𝑅𝑅𝑅𝑅𝑅𝑅𝑅𝑅𝑅𝑅𝑅𝑅𝑅𝑅𝑅𝑅 + 𝐴𝐴𝐴𝐴𝐴𝐴 𝑜𝑜𝑜𝑜 𝐼𝐼𝐼𝐼𝐼𝐼𝐼𝐼𝐼𝐼𝐼𝐼𝐼𝐼𝐼𝐼𝐼𝐼

B. The Cash Conversion Cycle

• The cash conversion cycle, also known as the cash cycle, is the time it takes for the

business to collect its account receivables after it has paid for its raw materials. It is

calculated by subtracting the accounts payable period from the operating cycle.

• The cash conversion period may be obtained by first computing the accounts payable

period turnover. It is the time it takes for the business to pay for its raw materials from the

time they are acquired. Just like the operating cycle, a shorter cycle is preferred.

Accounts Payable Turnover 𝐶𝐶𝐶𝐶𝐶𝐶𝐶𝐶 𝑜𝑜𝑜𝑜 𝐺𝐺𝐺𝐺𝐺𝐺𝐺𝐺𝐺𝐺 𝑆𝑆𝑆𝑆𝑆𝑆𝑆𝑆

𝐵𝐵𝐵𝐵𝐵𝐵𝐵𝐵𝐵𝐵𝐵𝐵𝐵𝐵𝐵𝐵𝐵𝐵 𝑃𝑃𝑃𝑃𝑃𝑃𝑃𝑃𝑃𝑃𝑃𝑃𝑃𝑃𝑃𝑃 + 𝐸𝐸𝐸𝐸𝐸𝐸𝐸𝐸𝐸𝐸𝐸𝐸 𝑃𝑃𝑃𝑃𝑃𝑃𝑃𝑃𝑃𝑃𝑃𝑃𝑃𝑃𝑃𝑃

� �

2

Accounts Payable Period 365

𝐴𝐴𝐴𝐴𝐴𝐴𝐴𝐴𝐴𝐴𝐴𝐴𝐴𝐴𝐴𝐴 𝑃𝑃𝑃𝑃𝑃𝑃𝑃𝑃𝑃𝑃𝑃𝑃𝑃𝑃 𝑇𝑇𝑇𝑇𝑇𝑇𝑇𝑇𝑇𝑇𝑇𝑇𝑇𝑇𝑇𝑇

Cash Conversion Cycle 𝑂𝑂𝑂𝑂𝑂𝑂𝑂𝑂𝑂𝑂𝑂𝑂𝑂𝑂𝑂𝑂𝑂𝑂 𝑐𝑐𝑐𝑐𝑐𝑐𝑐𝑐𝑐𝑐 − 𝐴𝐴𝐴𝐴𝐴𝐴𝐴𝐴𝐴𝐴𝐴𝐴𝐴𝐴𝐴𝐴 𝑃𝑃𝑃𝑃𝑃𝑃𝑃𝑃𝑃𝑃𝑃𝑃𝑃𝑃 𝑃𝑃𝑃𝑃𝑃𝑃𝑃𝑃𝑃𝑃𝑃𝑃

References:

Benito, P. P., Chan Pao, T. P., & Yumang, K. (2016). Exploring small business and personal finance

in senior high. Quezon City: Phoenix Publishing House.

Lopez-Mariano, N. D. (2014). Elements of finance. Quezon City: Rex Book Store.

Maneval, E. (n.d.). Working capital management. Retrieved from Study Finance website:

http://www.studyfinance.com/lessons/workcap/?page=03

Sources of liquidity and factors affecting firm's liquidity. (2016). Retrieved from Finance Train:

http://financetrain.com/sources-of-liquidity-and-factors-affecting-firms-liquidity/

06 Handout 1 *Property of STI

Page 2 of 2

You might also like

- Credit RepairDocument2 pagesCredit RepairMill Bey67% (3)

- Dicionario Juridico Ingles Portugues Pinheiro Neto Law DictionaryDocument169 pagesDicionario Juridico Ingles Portugues Pinheiro Neto Law DictionaryJade Dalfior100% (1)

- GM Vs Ford Financial AnalysisDocument33 pagesGM Vs Ford Financial Analysissagar100% (2)

- Hernandez Cristina - Student Activity Packet Investing UnitDocument23 pagesHernandez Cristina - Student Activity Packet Investing Unitapi-51266945050% (2)

- Activity in IT202Document3 pagesActivity in IT202Tine Robiso100% (1)

- Study On The Factors Affecting Investors Decision in Investing in Equity Shares in IndiaDocument104 pagesStudy On The Factors Affecting Investors Decision in Investing in Equity Shares in IndiaHridayanshu RastogiNo ratings yet

- Working Capital ManagementDocument8 pagesWorking Capital ManagementMariell PenaroyoNo ratings yet

- Working Capital ManagementDocument44 pagesWorking Capital ManagementsamaNo ratings yet

- Working Capital ManagementDocument21 pagesWorking Capital ManagementAbhishek Mishra0% (1)

- CBM Fin Working Capital 2021 SwiDocument22 pagesCBM Fin Working Capital 2021 SwiKhrisna Aditya YudhaNo ratings yet

- Cash ManagementDocument42 pagesCash ManagementJay-ar Castillo Watin Jr.No ratings yet

- WC Final PPT 1 AprilDocument23 pagesWC Final PPT 1 AprilSachin NagargojeNo ratings yet

- Ch10 Credit AnalysisDocument44 pagesCh10 Credit AnalysisRiki Tia100% (1)

- Working Capital ManagementDocument34 pagesWorking Capital ManagementNirmal ShresthaNo ratings yet

- Working CapitalDocument3 pagesWorking Capitalmengjun0987654311No ratings yet

- WC MGMTDocument34 pagesWC MGMTVikas GargNo ratings yet

- Working Capital ManagementDocument52 pagesWorking Capital ManagementSuraj KumarNo ratings yet

- Cash Management Problrms SolvedDocument42 pagesCash Management Problrms SolvedKarthikNo ratings yet

- Working Capital ManagementDocument62 pagesWorking Capital ManagementANISH KUMARNo ratings yet

- HandoutDocument7 pagesHandoutSalma AbdullahNo ratings yet

- Mac2 - Current Asset ManagementDocument42 pagesMac2 - Current Asset ManagementAbigail Faye RoxasNo ratings yet

- Working Capital Management: A PerspectiveDocument21 pagesWorking Capital Management: A PerspectiveSanthosh Philip GeorgeNo ratings yet

- Working Capital ManagementDocument64 pagesWorking Capital ManagementPrerna SinhaNo ratings yet

- Cash & Marketable SecuritiesDocument40 pagesCash & Marketable SecuritiesadekramlanNo ratings yet

- Working Capital MGT - Chapter8Document22 pagesWorking Capital MGT - Chapter8shenaNo ratings yet

- Working Capital Management.Document3 pagesWorking Capital Management.Christine MalayoNo ratings yet

- Session 6 FINANCIAL PLANNING Working Capital ManagementDocument44 pagesSession 6 FINANCIAL PLANNING Working Capital ManagementXia AlliaNo ratings yet

- Working Capital ManagementDocument27 pagesWorking Capital ManagementNamir RafiqNo ratings yet

- Ilide - Info Working Capital Management p1 and 2 PRDocument23 pagesIlide - Info Working Capital Management p1 and 2 PRRayzie MatulinNo ratings yet

- Working CapitalDocument17 pagesWorking CapitalHanuman PrasadNo ratings yet

- Working CapitalDocument17 pagesWorking CapitalSnehal ShahNo ratings yet

- Working Capital ManagementDocument15 pagesWorking Capital ManagementfoodNo ratings yet

- 8) Cash - Flow - Week 11Document24 pages8) Cash - Flow - Week 11Rydom SHNo ratings yet

- Chapter 5 Cash Management - STDDocument40 pagesChapter 5 Cash Management - STDNgọc Anh VũNo ratings yet

- Chapter 5 Cash Management - STDDocument40 pagesChapter 5 Cash Management - STDNgọc Anh VũNo ratings yet

- Unit 1 Principles OF Working Capital Management: Financial Management II - DFA 4102Document11 pagesUnit 1 Principles OF Working Capital Management: Financial Management II - DFA 4102mis gunNo ratings yet

- Chapter 2 Cash Management EditedDocument14 pagesChapter 2 Cash Management Editedmiadjafar463No ratings yet

- Working Capital Management-1Document32 pagesWorking Capital Management-1Tapabrata sarkerNo ratings yet

- Week 1-Growth of Accounting Practice of AccountingDocument9 pagesWeek 1-Growth of Accounting Practice of AccountingMark Anthony Llovit BabaoNo ratings yet

- Manila Cavite Laguna Cebu Cagayan de Oro DavaoDocument5 pagesManila Cavite Laguna Cebu Cagayan de Oro DavaoMonica GarciaNo ratings yet

- PDF Ch10 Credit AnalysisDocument44 pagesPDF Ch10 Credit AnalysisdwiyaniNo ratings yet

- 06 CBM Fin Working Capital 22 May'18Document52 pages06 CBM Fin Working Capital 22 May'18AM FMNo ratings yet

- Chapter-3 Managing Cash and Marketable SecuritiesDocument9 pagesChapter-3 Managing Cash and Marketable SecuritiesSintu TalefeNo ratings yet

- Lecture 5 - Finance and The FutureDocument31 pagesLecture 5 - Finance and The Futureyongzi2002No ratings yet

- Types of Accounting AccountsDocument44 pagesTypes of Accounting AccountsAzhar Hussain100% (2)

- Finance - 20231014 - 215030 - 0000Document17 pagesFinance - 20231014 - 215030 - 00000314-Rayhanul KabirNo ratings yet

- Accounting As Level NoteDocument38 pagesAccounting As Level NotedakshinNo ratings yet

- Session 19Document58 pagesSession 19pgdmib23ritwikaNo ratings yet

- Working Capital, Credit and Accounts Receivable Management: Reference: ETM Chapter 6 & 7 STFM Chapter 5 & 6Document31 pagesWorking Capital, Credit and Accounts Receivable Management: Reference: ETM Chapter 6 & 7 STFM Chapter 5 & 6sandeep949No ratings yet

- Financial Statement Analysis: K.R. SubramanyamDocument40 pagesFinancial Statement Analysis: K.R. SubramanyamMishal sohailNo ratings yet

- S Working CapitalDocument23 pagesS Working CapitalTapas TiwariNo ratings yet

- Handout. WCM - Cash ManagementDocument26 pagesHandout. WCM - Cash ManagementNaia SNo ratings yet

- Course: FINC6001 Effective Period: September2019: Managing Cash Flow, Sales Collection, Credit CollectionDocument27 pagesCourse: FINC6001 Effective Period: September2019: Managing Cash Flow, Sales Collection, Credit Collectionsalsabilla rpNo ratings yet

- Working Capital ManagementDocument36 pagesWorking Capital ManagementVeeresh Madival VmNo ratings yet

- Presentation On Working Capital: by M.P. DeivikaranDocument31 pagesPresentation On Working Capital: by M.P. DeivikaranmajidNo ratings yet

- Management of CashDocument27 pagesManagement of Cashmastermind10No ratings yet

- Working Capital ManagementDocument34 pagesWorking Capital ManagementPavas SinghalNo ratings yet

- Master in Business Administration Mba 308 - Financial ManagementDocument7 pagesMaster in Business Administration Mba 308 - Financial ManagementJhaydiel JacutanNo ratings yet

- ACY4008 - Topic 3 - Analyzing Financing ActivitiesDocument44 pagesACY4008 - Topic 3 - Analyzing Financing Activitiesjason leeNo ratings yet

- Operating and Cash Conversion CyclesDocument4 pagesOperating and Cash Conversion CyclesChristoper SalvinoNo ratings yet

- CH 07Document61 pagesCH 07nasie.kazemiNo ratings yet

- Chapter-3 - Working Capital MGTDocument57 pagesChapter-3 - Working Capital MGTRaunak YadavNo ratings yet

- Acc 301 Corporate Finance - Lectures Two - ThreeDocument17 pagesAcc 301 Corporate Finance - Lectures Two - ThreeFolarin EmmanuelNo ratings yet

- Summary CH 18 - Siti Nadya Sefrily - 2006534902Document5 pagesSummary CH 18 - Siti Nadya Sefrily - 2006534902SitiNadyaSefrilyNo ratings yet

- ReviewerDocument2 pagesReviewerlacsamjuriz64No ratings yet

- New Balance CR$46.79 Amount Due $0.00 Payment Not Required: American Express® Gold CardDocument10 pagesNew Balance CR$46.79 Amount Due $0.00 Payment Not Required: American Express® Gold CardJohn RoyNo ratings yet

- Financial Markets and Institutions 10th Edition Madura Solutions ManualDocument25 pagesFinancial Markets and Institutions 10th Edition Madura Solutions ManualMrTaylorPowellaidq100% (58)

- 2021 Tax Rates SwitzerlandDocument4 pages2021 Tax Rates SwitzerlandKamil JanasNo ratings yet

- Powered & Maintained by NSDL E-Governance Infrastructure LTD.© 2015 NSDL E-GovDocument3 pagesPowered & Maintained by NSDL E-Governance Infrastructure LTD.© 2015 NSDL E-GovRajeev TomarNo ratings yet

- Australian Hospital Patient Costing Standards - Version 4.0 - Part 2 - Business RulesDocument76 pagesAustralian Hospital Patient Costing Standards - Version 4.0 - Part 2 - Business RulesHonors GroupNo ratings yet

- Innovation in Indian Banking SectorDocument20 pagesInnovation in Indian Banking SectorSanket S ChavanNo ratings yet

- Corporate Restructuring Under Insolvency and Bankruptcy Code 2016Document21 pagesCorporate Restructuring Under Insolvency and Bankruptcy Code 2016Manish SinghNo ratings yet

- ALMA 1 Manajemen Aktiva-PasivaDocument31 pagesALMA 1 Manajemen Aktiva-PasivaNining KholifahNo ratings yet

- Accountancy Project: StorylineDocument2 pagesAccountancy Project: StorylineYatish AgrawalNo ratings yet

- Summer Internship Project Report ON "A Study On Customer Retention Strategies of Idbi Federal Life Insurance Company LTD."Document58 pagesSummer Internship Project Report ON "A Study On Customer Retention Strategies of Idbi Federal Life Insurance Company LTD."rohanNo ratings yet

- As A Preliminary To Requesting Budget Estimates of SalesDocument4 pagesAs A Preliminary To Requesting Budget Estimates of SalesChiodos OliverNo ratings yet

- 8 Key Reasons Why You Should Prefer Sharjah and Dubai For Real Estate InvestmentDocument2 pages8 Key Reasons Why You Should Prefer Sharjah and Dubai For Real Estate InvestmentHasan MahmoodNo ratings yet

- Fintech and Finance Transformation: The Rise of Ant Financial ServicesDocument14 pagesFintech and Finance Transformation: The Rise of Ant Financial ServicesSyed MuneerNo ratings yet

- Negotiable Instruement ActDocument3 pagesNegotiable Instruement ActNethaji MudaliyarNo ratings yet

- Chapter 8 Income StatementDocument2 pagesChapter 8 Income Statementmarianne raelNo ratings yet

- Residential StatusDocument17 pagesResidential Statussaif aliNo ratings yet

- Receivable Management Llustration 1: A Company Has Prepared The Following Projections For A YearDocument6 pagesReceivable Management Llustration 1: A Company Has Prepared The Following Projections For A YearJC Del MundoNo ratings yet

- 0 0 0 0 0 0 SGST (0006)Document2 pages0 0 0 0 0 0 SGST (0006)sufyan006No ratings yet

- Practice-Assignment - Afs - 31-Augsut-2019Document10 pagesPractice-Assignment - Afs - 31-Augsut-2019Waqar AhmadNo ratings yet

- Ucl Financial Assistance Fund: Step 1Document8 pagesUcl Financial Assistance Fund: Step 1FelipeNo ratings yet

- Istilah Akuntansi DLM Bhs. InggrisDocument6 pagesIstilah Akuntansi DLM Bhs. InggrisBugawatiNo ratings yet

- Reflection On 'Chapter 3 - Business Plan'Document6 pagesReflection On 'Chapter 3 - Business Plan'Mahdiya Baktyer Ahmed (191011097)No ratings yet

- 1st Pre-Board - P2 October 2011 BatchDocument8 pages1st Pre-Board - P2 October 2011 BatchKim Cristian MaañoNo ratings yet

- Receivable Financing Part 2Document2 pagesReceivable Financing Part 2lcNo ratings yet