Professional Documents

Culture Documents

Cost Sheet: Solutions To Assignment Problems

Cost Sheet: Solutions To Assignment Problems

Uploaded by

NidaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cost Sheet: Solutions To Assignment Problems

Cost Sheet: Solutions To Assignment Problems

Uploaded by

NidaCopyright:

Available Formats

No.

1 for CA/CWA & MEC/CEC MASTER MINDS

1. COST SHEET

SOLUTIONS TO ASSIGNMENT PROBLEMS

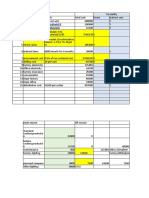

Problem No. 1

Cost Sheet

Particulars Rs. Rs.

Direct materials (consumed) (W.N - 1) 97,000

Direct labour (manufacturing wages) 50,000

Direct expenses (Royalty) 10,000

Prime cost 1,57,000

Add: Factory Overhead (W.N - 2) 37,000

Gross Factory Cost / Gross Works Cost 1,94,000

Add: Opening Work-In-Progress -

Less: Closing Work-In-Progress - 0

Net Factory Cost / Net Works Cost 1,94,000

Add: Administration Overhead (W.N - 3) 43,000

Cost of Goods Produced 2,37,000

Add: Opening finished goods 20,000

2,37,000

Less: Closing finished goods 1,000

5,000 (47,400) (27,400)

Cost of Goods Sold 2,09,600

Add: Selling & Distribution Overhead (W.N - 4) 30,000

Cost of Sales 2,39,600

Profit (b/f) 1,54,400

Sales 3,94,000

Note: Since the entire opening stock has been sold, the closing stock represents current month production.

W.N - 1: Calculation of Direct Materials Consumed:

Particulars Amount

Opening stock 20,000

Purchase of Raw Material 82,000

Less: Closing stock 10,000

Less: Scrap sales (A1) 2,000

Less: Abnormal loss 3,000

Customs duty (A2) 10,000

Direct Materials Consumed 97,000

W.N - 2: Calculation of Factory Overhead:

Particulars Amount

Depreciation on plant 15,000

Factory rent, taxes 12,000

Excise duty 10,000

Factory Overhead 37,000

W.N - 3: Calculation of Administration Overhead:

Particulars Amount

General Charges 15,000

IPCC_34.5e_Costing _ Cost Sheet_ Assignment Solutions ______________________1

Ph: 98851 25025/26 www.mastermindsindia.com

Data processing cost 5,000

Salaries 20,000

Stock insurance Premium 3,000

Administration Overhead 43,000

W.N - 4: Calculation of Selling & Distribution Overhead:

Particulars Amount

Sales tax 10,000

Marketing expenses 15,000

Branch office expenses for after sales service 5,000

Selling & Distribution Overhead 30,000

W.N - 5: Items to be ignored:

Particulars Amount

Loss on sale of plant – (Non Cost Related Item) 8,000

Discount on sales – (Items of Pure Finance) 10,000

Advance Income tax – (Items of Pure Finance) 20,000

Donations – (Non Cost Related Item) 5,000

Interest on loan received – (Items of Pure Finance) 5,000

Normal loss – (already included in Direct Material) 5,000

Returnable packing – (not included in cost of material) 4,000

Transfer to debenture Redemption reserve. (Non Cost Related Item) 5,000

Purchase of computers (Capital Expenditure) 50,000

Assumptions:

Scrap sales relates to Raw Materials.

Customs duty is incurred for importing of Raw Material.

Excise Duty relates to Factory Overhead (Indirect expense).

a. Changes that occur in cost sheet when 200 units of entire opening stock remained unsold:

Particulars Units Amount Amount

Cost of Production 5,000 - 2,37,000

Add: Opening finished goods 1,000 20,000

Less: Closing finished goods (W.N – 6) 1,000 41,920 21,920

Cost of Goods Sold 2,15,080

Add: Selling & Distribution Overhead 30,000

Cost of Sales 2,45,080

Add: Profit 1,48,920

Sales 3,94,000

W.N – 6: Calculation of Value of Closing Finished Goods:

Particulars Amount

Opening Stock included in Closing Stock (200 units @ Rs. 20 each) 4,000

Closing Stock of 800 units @ Rs. 47.4 each (47,400 / 1,000) x 800 37,920

Value of Closing Finished Goods 41,920

Therefore, Profit will decrease by Rs.5,480 (47,400 - 41,920)

b. Changes that occur in cost sheet when closing stock included units of opening stock but the units

were not known:

Particulars Units Amount Amount

Cost of Production 5,000 - 2,37,000

Add: Opening finished goods 1,000 20,000

Less: Closing finished goods (W.N – 7) 1,000 42,833 22,833

IPCC_34.5e_Costing _ Cost Sheet_ Assignment Solutions_______________________2

No.1 for CA/CWA & MEC/CEC MASTER MINDS

Cost of Goods Sold 2,14,167

Add: Selling & Distribution Overhead 30,000

Cost of Sales 2,44,167

Add: Profit 1,49,833

Sales 3,94,000

W.N – 7: Calculation of Value of Closing Finished Goods:

Particulars Amount

Cost of Production (5,000 units @ Rs. 47.4 each) 2,37,000

Opening Finished Goods (1,000 units @ Rs. 20 each) 20,000

Cost of Goods Sold (6,000 units @ Rs. 42.83 each) 2,57,000

Closing Finished Goods (1,000 units @ Rs. 42.83 each) 42,833

Therefore, Profit will decrease by Rs.4,567 (47,400 - 42,833).

THE END

IPCC_34.5e_Costing _ Cost Sheet_ Assignment Solutions ______________________3

You might also like

- Financial Markets and InvestmentsDocument500 pagesFinancial Markets and InvestmentsPrathmesh KadamNo ratings yet

- Zkhokhar - 1336 - 3711 - 1 - CHAPTER 04 - JOB-ORDER COSTING - PROBLEMSDocument34 pagesZkhokhar - 1336 - 3711 - 1 - CHAPTER 04 - JOB-ORDER COSTING - PROBLEMSnabeel nabiNo ratings yet

- Netscapes Work CultureDocument10 pagesNetscapes Work CultureNidaNo ratings yet

- HOTEL AccountingDocument8 pagesHOTEL AccountingNidaNo ratings yet

- HOTEL AccountingDocument8 pagesHOTEL AccountingNidaNo ratings yet

- Vault Guide To The Top Insurance EmployersDocument192 pagesVault Guide To The Top Insurance EmployersPatrick AdamsNo ratings yet

- Bradley CurveDocument21 pagesBradley Curveajm7No ratings yet

- Business Environment Assignment Titan IndustriesDocument8 pagesBusiness Environment Assignment Titan IndustriesAnuj Singh50% (2)

- Manufacturing SolutionsDocument8 pagesManufacturing SolutionsMothusi M NtsholeNo ratings yet

- Cost SheetDocument20 pagesCost SheetKeshviNo ratings yet

- Cost Sheet PDFDocument17 pagesCost Sheet PDFRajuSharmiNo ratings yet

- Cost Accounting Notes Fall 19-1Document11 pagesCost Accounting Notes Fall 19-1AnoshiaNo ratings yet

- Conceptual Frame Work of AccountingDocument7 pagesConceptual Frame Work of AccountingashiqNo ratings yet

- Chapter 5 NotesDocument6 pagesChapter 5 NotesXenia MusteataNo ratings yet

- Absorption and Marginal CostingDocument4 pagesAbsorption and Marginal CostingJonathan Smoko100% (1)

- 0568-Cost and Management AccountingDocument7 pages0568-Cost and Management AccountingWaqar AhmadNo ratings yet

- CAPE Accounting 2007 U1 P1Document12 pagesCAPE Accounting 2007 U1 P1rajkumkarsinglalaNo ratings yet

- Chapter 8 Solutions - Inclass ExercisesDocument8 pagesChapter 8 Solutions - Inclass ExercisesSummerNo ratings yet

- Managerial Accounting: Tools For Business Decision-MakingDocument56 pagesManagerial Accounting: Tools For Business Decision-MakingdavidNo ratings yet

- Answers Homework # 15 Cost MGMT 4Document7 pagesAnswers Homework # 15 Cost MGMT 4Raman ANo ratings yet

- Sanders CompanyDocument6 pagesSanders CompanyculadiNo ratings yet

- Add or Drop Product DecisionsDocument6 pagesAdd or Drop Product DecisionsksnsatishNo ratings yet

- M1. Introduction To Cost and Management AccountingDocument11 pagesM1. Introduction To Cost and Management AccountingLara Camille CelestialNo ratings yet

- MGMT 027 Connect 04 HWDocument7 pagesMGMT 027 Connect 04 HWSidra Khan100% (1)

- Gbagada General HospitalDocument1 pageGbagada General HospitalChijioke PaschalNo ratings yet

- Assignment 1111Document8 pagesAssignment 1111SAAD HUSSAINNo ratings yet

- Manufacturing-Accounts Teaching GuideDocument26 pagesManufacturing-Accounts Teaching GuidekimringineNo ratings yet

- Overheads Revision PDFDocument9 pagesOverheads Revision PDFSurajNo ratings yet

- Cost Accounting AssignmentDocument3 pagesCost Accounting AssignmentMkaeDizonNo ratings yet

- Practice Que 7 9 21 07092021 112106amDocument2 pagesPractice Que 7 9 21 07092021 112106amAsif KhanNo ratings yet

- Steps in Job CostingDocument8 pagesSteps in Job CostingBhagaban DasNo ratings yet

- Joint Products and By-ProductsDocument16 pagesJoint Products and By-ProductsAnmol AgalNo ratings yet

- Chapter 6 Practice QuestionsDocument9 pagesChapter 6 Practice QuestionsAbdul Wajid Nazeer CheemaNo ratings yet

- A. Williams Module 2Document16 pagesA. Williams Module 2awilliams2641No ratings yet

- Job Order Costing SystemDocument10 pagesJob Order Costing SystemfitsumNo ratings yet

- Chapter 7: Applying ExcelDocument8 pagesChapter 7: Applying ExcelMan Tran Y NhiNo ratings yet

- 7cost Sheet 7Document4 pages7cost Sheet 7Jyoti GuptaNo ratings yet

- Cost Units, Cost Classification and Profit Reporting: Lesson 3Document41 pagesCost Units, Cost Classification and Profit Reporting: Lesson 3Kj NayeeNo ratings yet

- All Intermediate ChapterDocument278 pagesAll Intermediate ChapterNigus AyeleNo ratings yet

- 4-28. Job Costing Actual, Normal, and Variation From Normal CostingDocument2 pages4-28. Job Costing Actual, Normal, and Variation From Normal CostingFadilah Kamilah100% (1)

- Chapter 3 Notes - Part 3Document2 pagesChapter 3 Notes - Part 3SummerNo ratings yet

- Tutorial 4 - Activity-Based CostingDocument3 pagesTutorial 4 - Activity-Based Costingsouayeh wejdenNo ratings yet

- QA Activity Based Costing1Document12 pagesQA Activity Based Costing1umar44150% (2)

- JOB, BATCH AND SERVICE COSTING-lesson 11Document22 pagesJOB, BATCH AND SERVICE COSTING-lesson 11Kj NayeeNo ratings yet

- 610 Exam 2 Spring 11 PracticeDocument8 pages610 Exam 2 Spring 11 PracticeSummerNo ratings yet

- Manufacturing Account-Ref - Material: SyllabusDocument5 pagesManufacturing Account-Ref - Material: SyllabusMohamed MuizNo ratings yet

- Management Accounting Chapter 4Document53 pagesManagement Accounting Chapter 4yimer100% (1)

- Session 10-14 PGDM 2020-21Document44 pagesSession 10-14 PGDM 2020-21Krishnapriya NairNo ratings yet

- Assignment No.2 206Document5 pagesAssignment No.2 206Halimah SheikhNo ratings yet

- Absorption and Marginal Costing With Answers 2Document6 pagesAbsorption and Marginal Costing With Answers 2Hassaan ImranNo ratings yet

- SDocument59 pagesSmoniquettnNo ratings yet

- Unit 2 Cost Concepts and Classifications (BBA)Document25 pagesUnit 2 Cost Concepts and Classifications (BBA)Aayushi KothariNo ratings yet

- Harsh ElectricalsDocument7 pagesHarsh ElectricalsR GNo ratings yet

- Assignment 3 Managerial Accounting: Submitted By-Ghayoor Zafar Submitted To - DR MohsinDocument11 pagesAssignment 3 Managerial Accounting: Submitted By-Ghayoor Zafar Submitted To - DR Mohsinjgfjhf arwtr100% (1)

- 02 CAS-4-FormatDocument1 page02 CAS-4-FormatMOORTHY.KENo ratings yet

- Process Costing and Hybrid Product-Costing SystemsDocument17 pagesProcess Costing and Hybrid Product-Costing SystemsWailNo ratings yet

- Kings Inc - Cost AcctgDocument2 pagesKings Inc - Cost AcctgShinjiNo ratings yet

- CMA Vol IDocument218 pagesCMA Vol Isyed saqib AliNo ratings yet

- Costing Solutions To C.d.problemsDocument214 pagesCosting Solutions To C.d.problemsparithinilavan07No ratings yet

- Q3 SolutionDocument1 pageQ3 SolutionSuhani JainNo ratings yet

- Cost Accounting: Rs. Rs. Rs. Rs. Rs. RsDocument8 pagesCost Accounting: Rs. Rs. Rs. Rs. Rs. RsShehrozSTNo ratings yet

- Cost Acc CHP1 COCDocument8 pagesCost Acc CHP1 COCpurvi doshiNo ratings yet

- Statement of Comprehensive Income - PROBLEMSDocument20 pagesStatement of Comprehensive Income - PROBLEMSSarah GNo ratings yet

- Ready To Go QB - Cost Vol 1Document319 pagesReady To Go QB - Cost Vol 1nnj247896No ratings yet

- Practice 1: Text Book: Managerial Accounting - Garrison and NoreenDocument4 pagesPractice 1: Text Book: Managerial Accounting - Garrison and NoreenMoin khanNo ratings yet

- P10 CMA RTP Dec2013 Syl2012Document44 pagesP10 CMA RTP Dec2013 Syl2012Ziad MohammedNo ratings yet

- Chapter 4 - Ia3Document10 pagesChapter 4 - Ia3Xynith Nicole RamosNo ratings yet

- Introduction To Service IndustryDocument64 pagesIntroduction To Service IndustryNidaNo ratings yet

- Income From HPDocument8 pagesIncome From HPNidaNo ratings yet

- The Indian Call Center Journey: Call Centers Fare BadlyDocument7 pagesThe Indian Call Center Journey: Call Centers Fare BadlyNidaNo ratings yet

- Document - Acc AssignmentDocument19 pagesDocument - Acc AssignmentNidaNo ratings yet

- Training and DevelopmentDocument12 pagesTraining and DevelopmentNidaNo ratings yet

- Unit 3 (Dividend Policy)Document23 pagesUnit 3 (Dividend Policy)NidaNo ratings yet

- The Driving ForceDocument7 pagesThe Driving ForceNidaNo ratings yet

- Job Offers of Multi-National Accounting Firms: The Effects of Emotional Intelligence, Extra-Curricular Activities, and Academic PerformanceDocument20 pagesJob Offers of Multi-National Accounting Firms: The Effects of Emotional Intelligence, Extra-Curricular Activities, and Academic PerformanceNidaNo ratings yet

- Horizontal and Vertical Ratio AnalysisDocument21 pagesHorizontal and Vertical Ratio AnalysismrnttdpnchngNo ratings yet

- InvestmentDocument25 pagesInvestmentCris Joy Biabas100% (3)

- Effects of Cost Management On The Financial Performance of Profit Making Organizations in NigeriaDocument26 pagesEffects of Cost Management On The Financial Performance of Profit Making Organizations in NigeriaOgechukwu JulianaNo ratings yet

- Selena Gomez's Rare Beauty Exploring An IPO or Sale As Net Sales Cross $400 Million - BoFDocument4 pagesSelena Gomez's Rare Beauty Exploring An IPO or Sale As Net Sales Cross $400 Million - BoFChâu Anh Phan NguyễnNo ratings yet

- Finacc1 FS1Document5 pagesFinacc1 FS1Denise MarambaNo ratings yet

- Chapter 3: Forward and Futures Prices: Continuous CompoundingDocument7 pagesChapter 3: Forward and Futures Prices: Continuous Compoundingsunilp14No ratings yet

- Riginal Ronouncements: Statement of Financial Accounting Standards No. 141Document73 pagesRiginal Ronouncements: Statement of Financial Accounting Standards No. 141ctaggart878No ratings yet

- CFA RC Final Report. UFE Team Meraki 1Document31 pagesCFA RC Final Report. UFE Team Meraki 1oyunnominNo ratings yet

- Accelerating Capital Markets Development in Emerging EconomiesDocument26 pagesAccelerating Capital Markets Development in Emerging EconomiesIchbin BinNo ratings yet

- KT - Eng-1-4 - Lectura Trabajo 1Document4 pagesKT - Eng-1-4 - Lectura Trabajo 1Julio Cesar Guio ArdilaNo ratings yet

- Dangote Flour Mills Financials 2012Document1 pageDangote Flour Mills Financials 2012Simileoluwa Cullen AdebajoNo ratings yet

- A16Z PortfolioDocument2 pagesA16Z PortfolioAnuraag GirdharNo ratings yet

- Development and Learning in Organizations: An International JournalDocument4 pagesDevelopment and Learning in Organizations: An International JournalDonatoNo ratings yet

- 2011-12-19 Rothstein Scott AMDocument178 pages2011-12-19 Rothstein Scott AMmatthendleyNo ratings yet

- Ratio Analysis: 1. Gross Profit PercentageDocument3 pagesRatio Analysis: 1. Gross Profit PercentageNatalieNo ratings yet

- Math in Our World: Section 8.6Document18 pagesMath in Our World: Section 8.6Kaycee Cabrillos DolleteNo ratings yet

- Chief Compliance Officer Investments in Denver CO Resume Dexter BuckDocument2 pagesChief Compliance Officer Investments in Denver CO Resume Dexter BuckDexterBuckNo ratings yet

- Set B Quiz 2 Final Basic Earning and Diluted Earning Per ShareDocument1 pageSet B Quiz 2 Final Basic Earning and Diluted Earning Per ShareMega MindNo ratings yet

- Balance of Payment of India For StudentsDocument4 pagesBalance of Payment of India For StudentskhushiYNo ratings yet

- Net Present ValueDocument21 pagesNet Present ValueMatthew LgkaroNo ratings yet

- Arbitrage TaiwanDocument6 pagesArbitrage Taiwanwegerg123343No ratings yet

- TestDocument3 pagesTestMehak AliNo ratings yet

- James Tisch Keynote CIMADocument24 pagesJames Tisch Keynote CIMAgenid.ssNo ratings yet

- 2011.06.30 ASX Annual ReportDocument80 pages2011.06.30 ASX Annual ReportKevin LinNo ratings yet

- Dissertation Synopsis Project Report OnDocument5 pagesDissertation Synopsis Project Report OnBerkshire Hathway coldNo ratings yet

- Chapter 17 Notes INVESTMENTSDocument14 pagesChapter 17 Notes INVESTMENTSBusiness Administration DepartmentNo ratings yet