Professional Documents

Culture Documents

GPR Accounting & Auditing Firm Chart of Accounts: Instructions

GPR Accounting & Auditing Firm Chart of Accounts: Instructions

Uploaded by

Krizza Sajonia TaboclaonCopyright:

Available Formats

You might also like

- Cash To Accrual Single Entry With AnswersDocument9 pagesCash To Accrual Single Entry With AnswersHazel PachecoNo ratings yet

- Financial WorksheetDocument6 pagesFinancial WorksheetCelyn DeañoNo ratings yet

- Accounting Assignments Week 1Document12 pagesAccounting Assignments Week 1Taufan Putra100% (1)

- Journalizing, Posting and Trial Balance: For Non-WiredDocument8 pagesJournalizing, Posting and Trial Balance: For Non-WiredCj ArquisolaNo ratings yet

- Assignment 2465 - 02 PDFDocument2 pagesAssignment 2465 - 02 PDFAhsan KamranNo ratings yet

- Main 3 - Claveria, Jenny PDFDocument18 pagesMain 3 - Claveria, Jenny PDFSheena marie ClaveriaNo ratings yet

- AP 01 - Cash To Accrual BasisDocument11 pagesAP 01 - Cash To Accrual BasisGabriel OrolfoNo ratings yet

- Assignment 1 AnswersDocument9 pagesAssignment 1 Answersimandimahawatte2008No ratings yet

- CH 12 Study Guide AnsDocument3 pagesCH 12 Study Guide AnsLo Ka ChunNo ratings yet

- Adjusting The AccountsDocument6 pagesAdjusting The AccountsKena Montes Dela PeñaNo ratings yet

- Exercises P Class2-2022Document9 pagesExercises P Class2-2022Angel MéndezNo ratings yet

- 1st AccDocument6 pages1st AccChristine PerezNo ratings yet

- Shs Fabm2 q3 Weeks 1 2 2ndreading Egs EditedfinalDocument20 pagesShs Fabm2 q3 Weeks 1 2 2ndreading Egs EditedfinalKrize Colene dela CruzNo ratings yet

- ACCT 490 Assignment 1Document7 pagesACCT 490 Assignment 1Saad FahadNo ratings yet

- Acctg201 - Prelim Part 1Document9 pagesAcctg201 - Prelim Part 1Rowena GayasNo ratings yet

- ALDEN FS-update 2019Document57 pagesALDEN FS-update 2019cris gerard trinidadNo ratings yet

- FundamentalsofABM2 Q1 M5Revised.-1Document12 pagesFundamentalsofABM2 Q1 M5Revised.-1Jomein Aubrey Belmonte60% (5)

- Father Saturnino Urios University Accountancy Program Acc111 - Conceptual Framework & Accounting StandardsDocument2 pagesFather Saturnino Urios University Accountancy Program Acc111 - Conceptual Framework & Accounting StandardsErika BucaoNo ratings yet

- PT Qu-Be Berseri: Cash Flow StatementDocument1 pagePT Qu-Be Berseri: Cash Flow StatementOrlando29No ratings yet

- Basic Accounting ReviewDocument9 pagesBasic Accounting ReviewAether SkywardNo ratings yet

- Analyzing, Recording, Posting and Trial Balance: Normal Balance of AccountsDocument6 pagesAnalyzing, Recording, Posting and Trial Balance: Normal Balance of AccountsMich Binayug100% (1)

- Fumar and Remulte - Worksheet 1Document15 pagesFumar and Remulte - Worksheet 1arrmfarmeggcellentNo ratings yet

- BES Q3 Week 7Document3 pagesBES Q3 Week 7Ashley Nicole LazoNo ratings yet

- Bài tập C4Document4 pagesBài tập C4Khanh LêNo ratings yet

- CASH TO ACCRUAL SINGLE ENTRY With ANSWERSDocument8 pagesCASH TO ACCRUAL SINGLE ENTRY With ANSWERSRaven SiaNo ratings yet

- Book 3Document10 pagesBook 3Marron FranciaNo ratings yet

- Entrepreneurship Q2 Week 8Document10 pagesEntrepreneurship Q2 Week 8Nizel Sherlyn NarsicoNo ratings yet

- Local Media8011400976913649007Document16 pagesLocal Media8011400976913649007Ivan dela CruzNo ratings yet

- Financial & Managerial AccountingDocument21 pagesFinancial & Managerial AccountingRifath AhmedNo ratings yet

- Fundamentals of ABM1 - Q4 - LAS1 DRAFTDocument17 pagesFundamentals of ABM1 - Q4 - LAS1 DRAFTSitti Halima Amilbahar AdgesNo ratings yet

- Sole Proprietorship Accounting TransactionsDocument17 pagesSole Proprietorship Accounting TransactionsErica Mae GuzmanNo ratings yet

- AccountingPrinciples Group08Document12 pagesAccountingPrinciples Group08Truong Ngoc Tho B2206548No ratings yet

- A. MODULE 1a BASIC ACCOUNTING BOOKKEEPINGDocument9 pagesA. MODULE 1a BASIC ACCOUNTING BOOKKEEPINGMer CyNo ratings yet

- Week 3 Illustrative Lecture SolutionsDocument7 pagesWeek 3 Illustrative Lecture SolutionsKristel AndreaNo ratings yet

- Entrepreneurship - Quarter 2 Week 9Document8 pagesEntrepreneurship - Quarter 2 Week 9SHEEN ALUBANo ratings yet

- The Accounting Cycle - Part1Document12 pagesThe Accounting Cycle - Part1RaaiinaNo ratings yet

- Requirements: Application Assignment-Coaching Session 5 The Following Are His Activities For The Month of December 2019Document29 pagesRequirements: Application Assignment-Coaching Session 5 The Following Are His Activities For The Month of December 2019Edrianne Dela RamaNo ratings yet

- SUBJECT: Accounting 20 NC Descriptive Title: Operation AuditingDocument5 pagesSUBJECT: Accounting 20 NC Descriptive Title: Operation AuditingandreaNo ratings yet

- The Zuni Co Has The Following Accounts in Its LedgerDocument1 pageThe Zuni Co Has The Following Accounts in Its LedgerM Bilal SaleemNo ratings yet

- Bookkeeping Video Training: (Handout)Document22 pagesBookkeeping Video Training: (Handout)Yusuf RaharjaNo ratings yet

- Department: Banking & Finance Course Title: Business Finance Chapter 3: Financial StatementsDocument14 pagesDepartment: Banking & Finance Course Title: Business Finance Chapter 3: Financial StatementsMhmdNo ratings yet

- Fundamentals of Accounting Business and Management - II 2Document4 pagesFundamentals of Accounting Business and Management - II 2Kathlene JaoNo ratings yet

- Adjusting Entries: Anne Angelie C. Gomez San Isidro College School of AccountancyDocument36 pagesAdjusting Entries: Anne Angelie C. Gomez San Isidro College School of AccountancyPamela SantosNo ratings yet

- Chapter 4Document17 pagesChapter 4RBNo ratings yet

- Case 8-1 Group Report Norman PDFDocument6 pagesCase 8-1 Group Report Norman PDFNavodi RathnasingheNo ratings yet

- LJK Sak Etap Tahap 2 Ud. BuanaDocument14 pagesLJK Sak Etap Tahap 2 Ud. Buanaazzah aqilahNo ratings yet

- Entrepreneurship Q2 Week 9Document9 pagesEntrepreneurship Q2 Week 9Nizel Sherlyn NarsicoNo ratings yet

- Business Plan Work SheetDocument17 pagesBusiness Plan Work SheetRey OñateNo ratings yet

- Adjusting EntriesDocument7 pagesAdjusting EntriesMichael MagdaogNo ratings yet

- Solution 103-Basic Accounting Problem 103 - Recording - Business - TransactionsDocument15 pagesSolution 103-Basic Accounting Problem 103 - Recording - Business - TransactionsmeepxxxNo ratings yet

- (In Philippine Peso) : Human Essence Beauty Parlor (Jennie F. Espiritu)Document12 pages(In Philippine Peso) : Human Essence Beauty Parlor (Jennie F. Espiritu)Michelle Ann S. FerriolNo ratings yet

- Unit 4Document33 pagesUnit 4b21ai008No ratings yet

- Quarter 2 Lesson 1Document11 pagesQuarter 2 Lesson 1Gilbert NarvasNo ratings yet

- Mihret and Elsabet FS 2021Document374 pagesMihret and Elsabet FS 2021melakuNo ratings yet

- Wahlen Int3e PR03-11Document4 pagesWahlen Int3e PR03-11林義哲No ratings yet

- FA FOR BADM Unit 3Document10 pagesFA FOR BADM Unit 3GUDATA ABARANo ratings yet

- AccountingDocument6 pagesAccountingaya walidNo ratings yet

- 21St Century Computer Solutions: A Manual Accounting SimulationFrom Everand21St Century Computer Solutions: A Manual Accounting SimulationNo ratings yet

- Financial Accounting - Want to Become Financial Accountant in 30 Days?From EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Rating: 3.5 out of 5 stars3.5/5 (2)

- Activate: Answer Sheet PE4 Lesson 3 Name: Krizza Mae S. Taboclaon Date: March 12,2021 Section Code: B510Document2 pagesActivate: Answer Sheet PE4 Lesson 3 Name: Krizza Mae S. Taboclaon Date: March 12,2021 Section Code: B510Krizza Sajonia TaboclaonNo ratings yet

- Region X: Audio and Visual Presentation and Composing EquiDocument4 pagesRegion X: Audio and Visual Presentation and Composing EquiKrizza Sajonia TaboclaonNo ratings yet

- Familiarize The Various Dance Terminologies Used in Dancing Execute The Basic Dance Steps AccuratelyDocument2 pagesFamiliarize The Various Dance Terminologies Used in Dancing Execute The Basic Dance Steps AccuratelyKrizza Sajonia TaboclaonNo ratings yet

- Bukidnon State University: Physical Education DepartmentDocument1 pageBukidnon State University: Physical Education DepartmentKrizza Sajonia TaboclaonNo ratings yet

- Lecture Notes - MNGTDocument6 pagesLecture Notes - MNGTKrizza Sajonia TaboclaonNo ratings yet

- Strategic Cost Management PDFDocument20 pagesStrategic Cost Management PDFKrizza Sajonia TaboclaonNo ratings yet

- Reinforcement Activity - Ae 21Document6 pagesReinforcement Activity - Ae 21Krizza Sajonia TaboclaonNo ratings yet

- LECTURE NOTES Word Shortcut KeysDocument4 pagesLECTURE NOTES Word Shortcut KeysKrizza Sajonia TaboclaonNo ratings yet

- Strategic Cost Management PDFDocument20 pagesStrategic Cost Management PDFKrizza Sajonia TaboclaonNo ratings yet

- Movie Hub: Socio-Economic FeasibilityDocument2 pagesMovie Hub: Socio-Economic FeasibilityKrizza Sajonia TaboclaonNo ratings yet

- Understanding The Self Chu2Document4 pagesUnderstanding The Self Chu2Krizza Sajonia Taboclaon100% (1)

- Work Immersion Experience at The Abm Canteen of The Bukidnon National High School, Malaybalay CityDocument7 pagesWork Immersion Experience at The Abm Canteen of The Bukidnon National High School, Malaybalay CityKrizza Sajonia TaboclaonNo ratings yet

- File 7595477826281120346Document13 pagesFile 7595477826281120346sunshineNo ratings yet

- Accounting Entries P-PDocument14 pagesAccounting Entries P-PSudhir PatilNo ratings yet

- CCMPP Accounting Firm QuickBooks Desktop US Version Training Manual Philippine Based Setup TaxationDocument53 pagesCCMPP Accounting Firm QuickBooks Desktop US Version Training Manual Philippine Based Setup TaxationMarco Louis Duval UyNo ratings yet

- Principal of Accounting: Topic: Cash BookDocument6 pagesPrincipal of Accounting: Topic: Cash BooksajidNo ratings yet

- Detailstatement - 11 12 2023@20 26 11Document12 pagesDetailstatement - 11 12 2023@20 26 11KAJAL GUPTANo ratings yet

- Accounting PhaseDocument3 pagesAccounting PhaseFaithful FighterNo ratings yet

- Bbaw2103 - Financial AccountingDocument13 pagesBbaw2103 - Financial AccountingSimon RajNo ratings yet

- Chapter 5Document51 pagesChapter 5duy blaNo ratings yet

- Accounting Equation - DPP 05 - (Aarambh 2.0 2024)Document4 pagesAccounting Equation - DPP 05 - (Aarambh 2.0 2024)Kanishk SawaliyaNo ratings yet

- Payment SystemDocument24 pagesPayment SystemiramanwarNo ratings yet

- FC TransactionDocument40 pagesFC TransactionShihab Hasan ChowdhuryNo ratings yet

- Aud 2019Document9 pagesAud 2019Marjorie AmpongNo ratings yet

- Chapter 2 Bank FundDocument31 pagesChapter 2 Bank FundNiloy AhmedNo ratings yet

- AIS & E-CommerceDocument9 pagesAIS & E-CommerceSyed Asim AliNo ratings yet

- Chapter 6 NotesDocument8 pagesChapter 6 NotesCunanan, Malakhai JeuNo ratings yet

- Far Compiled ReviewerDocument33 pagesFar Compiled ReviewerjinyangsuelNo ratings yet

- Tutorial 3 Merchandising-1Document5 pagesTutorial 3 Merchandising-1minzheNo ratings yet

- Advacc 3 Question Set A 150 CopiesDocument6 pagesAdvacc 3 Question Set A 150 CopiesPearl Mae De VeasNo ratings yet

- Checklist For Statutory Audit of BankDocument9 pagesChecklist For Statutory Audit of BankAayush BansalNo ratings yet

- MBBsavings - 112241 144291 - 2023 09 30Document6 pagesMBBsavings - 112241 144291 - 2023 09 30KaiserAngSeongLengNo ratings yet

- Faculty EvaluationDocument2 pagesFaculty EvaluationSakibul Islam AlveNo ratings yet

- Darwin Melendez - Ledger AccountsDocument4 pagesDarwin Melendez - Ledger AccountsDarwin MelendezNo ratings yet

- DATEV Account Chart: Standard Chart of Accounts (SKR 03) Valid For 2018Document35 pagesDATEV Account Chart: Standard Chart of Accounts (SKR 03) Valid For 2018Elizabeth Sánchez LeónNo ratings yet

- C7A Cash & Cash EquivalentsDocument6 pagesC7A Cash & Cash EquivalentsSteeeeeeeephNo ratings yet

- Cipfawb15 - wb3 Format 19Document45 pagesCipfawb15 - wb3 Format 19Sayed RahmanNo ratings yet

- Tutorial 3 Due DateDocument6 pagesTutorial 3 Due DateFatin Nur Aina Mohd Radzi0% (1)

- Introduction To Partnership AccountingDocument16 pagesIntroduction To Partnership Accountingmachelle franciscoNo ratings yet

- Order in The Matter of M/s Century Finvest Private Ltd.Document35 pagesOrder in The Matter of M/s Century Finvest Private Ltd.Shyam SunderNo ratings yet

- Cost Accounting Cycle 2019Document6 pagesCost Accounting Cycle 2019Luming0% (1)

- 2014-2015 (L-2, T-1) - MeDocument27 pages2014-2015 (L-2, T-1) - MeactstyloNo ratings yet

GPR Accounting & Auditing Firm Chart of Accounts: Instructions

GPR Accounting & Auditing Firm Chart of Accounts: Instructions

Uploaded by

Krizza Sajonia TaboclaonOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

GPR Accounting & Auditing Firm Chart of Accounts: Instructions

GPR Accounting & Auditing Firm Chart of Accounts: Instructions

Uploaded by

Krizza Sajonia TaboclaonCopyright:

Available Formats

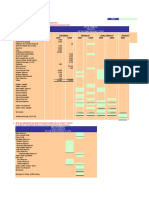

GPR Accounting & Auditing Firm

Chart of Accounts

BALANCE SHEET ACCOUNTS INCOME STATEMENT ACCOUNTS

Acct. No. ASSETS

110 Cash Acct. No. REVENUE

120 Accounts Receivable 410 Service Fees

125 Allowance for Bad Debts

130 Prepaid Rent Expense

140 Prepaid Office Supplies EXPENSES

150 Property, Plant, Equipment 510 Bad Debts Expense

155 Accumulated Depreciation 520 Rent Expense

LIABILITIES 530 Salaries Expense

210 Accounts Payable 540 Supplies Expense

220 Salaries Payable 550 Depreciation Expense

230 Unearned Service Fees

OWNER’S EQUITY

310 Girlie, Capital

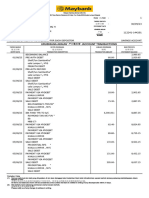

The opening balances of GPR Accounting & Auditing Firm as of January 1, 2019 are as follows:

Cash in bank P 1,217,691

Accounts receivable 101,400

Prepaid rent expense 70,000

Prepaid office supplies 8,980

Property, plant, equipment 1,750,000

Allowance for bad debts P 2,028

Accumulated depreciation 218,750

Accounts payable 130,014

Salaries payable 62,756

Unearned Service Fees 656,763

Girlie, Capital 2,077,760

INSTRUCTIONS:

Analyze the business transactions. Write journal entries if doing so helps in the analysis.

Plot the account title affected by the following business transactions in the T-accounts on

the last page.

For the adjusting entries, write them down on the box provided. Plot the adjustments on their

respective T-accounts on the last page as well.

Read each transaction CAREFULLY. Analyze.

Prepared by: Jobelle Candace F. Abrera, CPA, CTT

9/10/2019

During the year, the following events and transactions occurred:

1) Total cash collections for the year totaled P 476,615, and total cash payments made amounted to

P 227,565.

2) Services rendered during the year: Services not yet rendered but paid for in advance by

- On account, P 87,247 clients during the year (The income method is used):

- For cash, P 136,043 -For cash, P 340,572

3) Aside from rendering service on account (as shown above, P 87,247), no other transactions affected the

Accounts Receivable account.

4) On August 1, 2019, paid cash for 8 months of advance rent for the office space, P 80,000.

The expense method is used for recording rental transactions. (The cash payment here of P80,000 is

already included in the total cash payments in number 1) which is P 227,565)

5) Paid cash in exchange for P 19,802 worth of supplies.

The asset method is used for supplies. (The cash payment here of P 19,802 is already included in the

total cash payments in number 1) which is P 227,565)

6) Paid off half of the Accounts Payable during the year. (The cash payment here is already included in

the total cash payments in number 1) which is P 227,565)

7) Paid off all Salaries Payable at the beginning of the year. (The cash payment here is already included in

the total cash payments in number 1) which is P 227,565)

8) No additions or withdrawals affected Girlie, Capital during the year

CHECKPOINT: Before you proceed with adjusting entries, plot the affected

accounts from above on the T-accounts. Don’t forget that the beginning balances

are placed first on T-accounts.

Check the equality of Total Debits and Total Credits. If balanced, proceed:

Year-end adjustments on December 31, 2019 are to be made:

1) Details in the rental contract revealed that monthly rent was P 10,000. Record the adjusting entry to

recognize the remaining prepaid rent expense, and to derecognize the used up rent expense for 12

months.

2) 2/3 of the total office supplies paid in advance were used up during the year. Recognize the

expense.

3) Of the ending balance of the receivables, 2% is estimated to be uncollectible.

4) Property, Plant, Equipment has a useful life of 16 years, with no salvage value. Recognize

depreciation.

5) Of the P 340,572 services not yet rendered but paid for in advance by clients during the year

(income method is used), 3/4 was actually rendered and earned by the end of the year. Record the

adjusting entry to recognize the unearned portion, and lessen the recorded income to reflect its true

balance.

Prepared by: Jobelle Candace F. Abrera, CPA, CTT

9/10/2019

Cash Accounts Receivable Allowance for Bad Debts

Prepaid Rent Expense Prepaid Office Supplies Property, Plant, Equipment

Accumulated Depreciation Accounts Payable Salaries Payable

Unearned Service Fees Girlie, Capital Service Fees

Bad Debts Expense Rent Expense Salaries Expense

Supplies Expense Depreciation Expense

Prepared by: Jobelle Candace F. Abrera, CPA, CTT

9/10/2019

PREPARATION AND PRESENTATION OF BASIC FINANCIAL STATEMENTS

ASSETS

Current Assets with related Contra-asset

Noncurrent Assets with related Contra-asset

TOTAL ASSETS

LIABILITIES

OWNER’S EQUITY

TOTAL LIABILITIES AND OWNER’S EQUITY

INCOME

EXPENSES

NET PROFIT/LOSS

GPR ACCOUNTING AND AUDITING FIRM

STATEMENT OF CHANGES IN OWNER’S EQUITY

FOR THE YEAR ENDED, DECEMBER 31, 2019

Girlie, Capital- January 1, 2019

Add: Additional Investments

Profit

Less: Withdrawals

Loss

Girlie, Capital- December 31, 2019

Prepared by: Jobelle Candace F. Abrera, CPA, CTT

9/10/2019

GPR ACCOUNTING AND AUDITING FIRM

STATEMENT OF CASH FLOWS

FOR THE YEAR ENDED, DECEMBER 31, 2019

Cash Flows from Operating Activities

Cash inflows

-

-

Cash outflows

-

-

-

-

-

NET CASH USED IN OPERATING ACTIVITIES

Cash Flows from Investing Activities

Cash inflows

-

-

Cash outflows

-

-

Cash Flows from Financing Activities

Cash inflows

-

-

Cash outflows

-

-

Net Increase(Decrease) in Cash

Add: Beginning Cash Balance

Cash Balance at the End of the Period

Prepared by: Jobelle Candace F. Abrera, CPA, CTT

9/10/2019

You might also like

- Cash To Accrual Single Entry With AnswersDocument9 pagesCash To Accrual Single Entry With AnswersHazel PachecoNo ratings yet

- Financial WorksheetDocument6 pagesFinancial WorksheetCelyn DeañoNo ratings yet

- Accounting Assignments Week 1Document12 pagesAccounting Assignments Week 1Taufan Putra100% (1)

- Journalizing, Posting and Trial Balance: For Non-WiredDocument8 pagesJournalizing, Posting and Trial Balance: For Non-WiredCj ArquisolaNo ratings yet

- Assignment 2465 - 02 PDFDocument2 pagesAssignment 2465 - 02 PDFAhsan KamranNo ratings yet

- Main 3 - Claveria, Jenny PDFDocument18 pagesMain 3 - Claveria, Jenny PDFSheena marie ClaveriaNo ratings yet

- AP 01 - Cash To Accrual BasisDocument11 pagesAP 01 - Cash To Accrual BasisGabriel OrolfoNo ratings yet

- Assignment 1 AnswersDocument9 pagesAssignment 1 Answersimandimahawatte2008No ratings yet

- CH 12 Study Guide AnsDocument3 pagesCH 12 Study Guide AnsLo Ka ChunNo ratings yet

- Adjusting The AccountsDocument6 pagesAdjusting The AccountsKena Montes Dela PeñaNo ratings yet

- Exercises P Class2-2022Document9 pagesExercises P Class2-2022Angel MéndezNo ratings yet

- 1st AccDocument6 pages1st AccChristine PerezNo ratings yet

- Shs Fabm2 q3 Weeks 1 2 2ndreading Egs EditedfinalDocument20 pagesShs Fabm2 q3 Weeks 1 2 2ndreading Egs EditedfinalKrize Colene dela CruzNo ratings yet

- ACCT 490 Assignment 1Document7 pagesACCT 490 Assignment 1Saad FahadNo ratings yet

- Acctg201 - Prelim Part 1Document9 pagesAcctg201 - Prelim Part 1Rowena GayasNo ratings yet

- ALDEN FS-update 2019Document57 pagesALDEN FS-update 2019cris gerard trinidadNo ratings yet

- FundamentalsofABM2 Q1 M5Revised.-1Document12 pagesFundamentalsofABM2 Q1 M5Revised.-1Jomein Aubrey Belmonte60% (5)

- Father Saturnino Urios University Accountancy Program Acc111 - Conceptual Framework & Accounting StandardsDocument2 pagesFather Saturnino Urios University Accountancy Program Acc111 - Conceptual Framework & Accounting StandardsErika BucaoNo ratings yet

- PT Qu-Be Berseri: Cash Flow StatementDocument1 pagePT Qu-Be Berseri: Cash Flow StatementOrlando29No ratings yet

- Basic Accounting ReviewDocument9 pagesBasic Accounting ReviewAether SkywardNo ratings yet

- Analyzing, Recording, Posting and Trial Balance: Normal Balance of AccountsDocument6 pagesAnalyzing, Recording, Posting and Trial Balance: Normal Balance of AccountsMich Binayug100% (1)

- Fumar and Remulte - Worksheet 1Document15 pagesFumar and Remulte - Worksheet 1arrmfarmeggcellentNo ratings yet

- BES Q3 Week 7Document3 pagesBES Q3 Week 7Ashley Nicole LazoNo ratings yet

- Bài tập C4Document4 pagesBài tập C4Khanh LêNo ratings yet

- CASH TO ACCRUAL SINGLE ENTRY With ANSWERSDocument8 pagesCASH TO ACCRUAL SINGLE ENTRY With ANSWERSRaven SiaNo ratings yet

- Book 3Document10 pagesBook 3Marron FranciaNo ratings yet

- Entrepreneurship Q2 Week 8Document10 pagesEntrepreneurship Q2 Week 8Nizel Sherlyn NarsicoNo ratings yet

- Local Media8011400976913649007Document16 pagesLocal Media8011400976913649007Ivan dela CruzNo ratings yet

- Financial & Managerial AccountingDocument21 pagesFinancial & Managerial AccountingRifath AhmedNo ratings yet

- Fundamentals of ABM1 - Q4 - LAS1 DRAFTDocument17 pagesFundamentals of ABM1 - Q4 - LAS1 DRAFTSitti Halima Amilbahar AdgesNo ratings yet

- Sole Proprietorship Accounting TransactionsDocument17 pagesSole Proprietorship Accounting TransactionsErica Mae GuzmanNo ratings yet

- AccountingPrinciples Group08Document12 pagesAccountingPrinciples Group08Truong Ngoc Tho B2206548No ratings yet

- A. MODULE 1a BASIC ACCOUNTING BOOKKEEPINGDocument9 pagesA. MODULE 1a BASIC ACCOUNTING BOOKKEEPINGMer CyNo ratings yet

- Week 3 Illustrative Lecture SolutionsDocument7 pagesWeek 3 Illustrative Lecture SolutionsKristel AndreaNo ratings yet

- Entrepreneurship - Quarter 2 Week 9Document8 pagesEntrepreneurship - Quarter 2 Week 9SHEEN ALUBANo ratings yet

- The Accounting Cycle - Part1Document12 pagesThe Accounting Cycle - Part1RaaiinaNo ratings yet

- Requirements: Application Assignment-Coaching Session 5 The Following Are His Activities For The Month of December 2019Document29 pagesRequirements: Application Assignment-Coaching Session 5 The Following Are His Activities For The Month of December 2019Edrianne Dela RamaNo ratings yet

- SUBJECT: Accounting 20 NC Descriptive Title: Operation AuditingDocument5 pagesSUBJECT: Accounting 20 NC Descriptive Title: Operation AuditingandreaNo ratings yet

- The Zuni Co Has The Following Accounts in Its LedgerDocument1 pageThe Zuni Co Has The Following Accounts in Its LedgerM Bilal SaleemNo ratings yet

- Bookkeeping Video Training: (Handout)Document22 pagesBookkeeping Video Training: (Handout)Yusuf RaharjaNo ratings yet

- Department: Banking & Finance Course Title: Business Finance Chapter 3: Financial StatementsDocument14 pagesDepartment: Banking & Finance Course Title: Business Finance Chapter 3: Financial StatementsMhmdNo ratings yet

- Fundamentals of Accounting Business and Management - II 2Document4 pagesFundamentals of Accounting Business and Management - II 2Kathlene JaoNo ratings yet

- Adjusting Entries: Anne Angelie C. Gomez San Isidro College School of AccountancyDocument36 pagesAdjusting Entries: Anne Angelie C. Gomez San Isidro College School of AccountancyPamela SantosNo ratings yet

- Chapter 4Document17 pagesChapter 4RBNo ratings yet

- Case 8-1 Group Report Norman PDFDocument6 pagesCase 8-1 Group Report Norman PDFNavodi RathnasingheNo ratings yet

- LJK Sak Etap Tahap 2 Ud. BuanaDocument14 pagesLJK Sak Etap Tahap 2 Ud. Buanaazzah aqilahNo ratings yet

- Entrepreneurship Q2 Week 9Document9 pagesEntrepreneurship Q2 Week 9Nizel Sherlyn NarsicoNo ratings yet

- Business Plan Work SheetDocument17 pagesBusiness Plan Work SheetRey OñateNo ratings yet

- Adjusting EntriesDocument7 pagesAdjusting EntriesMichael MagdaogNo ratings yet

- Solution 103-Basic Accounting Problem 103 - Recording - Business - TransactionsDocument15 pagesSolution 103-Basic Accounting Problem 103 - Recording - Business - TransactionsmeepxxxNo ratings yet

- (In Philippine Peso) : Human Essence Beauty Parlor (Jennie F. Espiritu)Document12 pages(In Philippine Peso) : Human Essence Beauty Parlor (Jennie F. Espiritu)Michelle Ann S. FerriolNo ratings yet

- Unit 4Document33 pagesUnit 4b21ai008No ratings yet

- Quarter 2 Lesson 1Document11 pagesQuarter 2 Lesson 1Gilbert NarvasNo ratings yet

- Mihret and Elsabet FS 2021Document374 pagesMihret and Elsabet FS 2021melakuNo ratings yet

- Wahlen Int3e PR03-11Document4 pagesWahlen Int3e PR03-11林義哲No ratings yet

- FA FOR BADM Unit 3Document10 pagesFA FOR BADM Unit 3GUDATA ABARANo ratings yet

- AccountingDocument6 pagesAccountingaya walidNo ratings yet

- 21St Century Computer Solutions: A Manual Accounting SimulationFrom Everand21St Century Computer Solutions: A Manual Accounting SimulationNo ratings yet

- Financial Accounting - Want to Become Financial Accountant in 30 Days?From EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Rating: 3.5 out of 5 stars3.5/5 (2)

- Activate: Answer Sheet PE4 Lesson 3 Name: Krizza Mae S. Taboclaon Date: March 12,2021 Section Code: B510Document2 pagesActivate: Answer Sheet PE4 Lesson 3 Name: Krizza Mae S. Taboclaon Date: March 12,2021 Section Code: B510Krizza Sajonia TaboclaonNo ratings yet

- Region X: Audio and Visual Presentation and Composing EquiDocument4 pagesRegion X: Audio and Visual Presentation and Composing EquiKrizza Sajonia TaboclaonNo ratings yet

- Familiarize The Various Dance Terminologies Used in Dancing Execute The Basic Dance Steps AccuratelyDocument2 pagesFamiliarize The Various Dance Terminologies Used in Dancing Execute The Basic Dance Steps AccuratelyKrizza Sajonia TaboclaonNo ratings yet

- Bukidnon State University: Physical Education DepartmentDocument1 pageBukidnon State University: Physical Education DepartmentKrizza Sajonia TaboclaonNo ratings yet

- Lecture Notes - MNGTDocument6 pagesLecture Notes - MNGTKrizza Sajonia TaboclaonNo ratings yet

- Strategic Cost Management PDFDocument20 pagesStrategic Cost Management PDFKrizza Sajonia TaboclaonNo ratings yet

- Reinforcement Activity - Ae 21Document6 pagesReinforcement Activity - Ae 21Krizza Sajonia TaboclaonNo ratings yet

- LECTURE NOTES Word Shortcut KeysDocument4 pagesLECTURE NOTES Word Shortcut KeysKrizza Sajonia TaboclaonNo ratings yet

- Strategic Cost Management PDFDocument20 pagesStrategic Cost Management PDFKrizza Sajonia TaboclaonNo ratings yet

- Movie Hub: Socio-Economic FeasibilityDocument2 pagesMovie Hub: Socio-Economic FeasibilityKrizza Sajonia TaboclaonNo ratings yet

- Understanding The Self Chu2Document4 pagesUnderstanding The Self Chu2Krizza Sajonia Taboclaon100% (1)

- Work Immersion Experience at The Abm Canteen of The Bukidnon National High School, Malaybalay CityDocument7 pagesWork Immersion Experience at The Abm Canteen of The Bukidnon National High School, Malaybalay CityKrizza Sajonia TaboclaonNo ratings yet

- File 7595477826281120346Document13 pagesFile 7595477826281120346sunshineNo ratings yet

- Accounting Entries P-PDocument14 pagesAccounting Entries P-PSudhir PatilNo ratings yet

- CCMPP Accounting Firm QuickBooks Desktop US Version Training Manual Philippine Based Setup TaxationDocument53 pagesCCMPP Accounting Firm QuickBooks Desktop US Version Training Manual Philippine Based Setup TaxationMarco Louis Duval UyNo ratings yet

- Principal of Accounting: Topic: Cash BookDocument6 pagesPrincipal of Accounting: Topic: Cash BooksajidNo ratings yet

- Detailstatement - 11 12 2023@20 26 11Document12 pagesDetailstatement - 11 12 2023@20 26 11KAJAL GUPTANo ratings yet

- Accounting PhaseDocument3 pagesAccounting PhaseFaithful FighterNo ratings yet

- Bbaw2103 - Financial AccountingDocument13 pagesBbaw2103 - Financial AccountingSimon RajNo ratings yet

- Chapter 5Document51 pagesChapter 5duy blaNo ratings yet

- Accounting Equation - DPP 05 - (Aarambh 2.0 2024)Document4 pagesAccounting Equation - DPP 05 - (Aarambh 2.0 2024)Kanishk SawaliyaNo ratings yet

- Payment SystemDocument24 pagesPayment SystemiramanwarNo ratings yet

- FC TransactionDocument40 pagesFC TransactionShihab Hasan ChowdhuryNo ratings yet

- Aud 2019Document9 pagesAud 2019Marjorie AmpongNo ratings yet

- Chapter 2 Bank FundDocument31 pagesChapter 2 Bank FundNiloy AhmedNo ratings yet

- AIS & E-CommerceDocument9 pagesAIS & E-CommerceSyed Asim AliNo ratings yet

- Chapter 6 NotesDocument8 pagesChapter 6 NotesCunanan, Malakhai JeuNo ratings yet

- Far Compiled ReviewerDocument33 pagesFar Compiled ReviewerjinyangsuelNo ratings yet

- Tutorial 3 Merchandising-1Document5 pagesTutorial 3 Merchandising-1minzheNo ratings yet

- Advacc 3 Question Set A 150 CopiesDocument6 pagesAdvacc 3 Question Set A 150 CopiesPearl Mae De VeasNo ratings yet

- Checklist For Statutory Audit of BankDocument9 pagesChecklist For Statutory Audit of BankAayush BansalNo ratings yet

- MBBsavings - 112241 144291 - 2023 09 30Document6 pagesMBBsavings - 112241 144291 - 2023 09 30KaiserAngSeongLengNo ratings yet

- Faculty EvaluationDocument2 pagesFaculty EvaluationSakibul Islam AlveNo ratings yet

- Darwin Melendez - Ledger AccountsDocument4 pagesDarwin Melendez - Ledger AccountsDarwin MelendezNo ratings yet

- DATEV Account Chart: Standard Chart of Accounts (SKR 03) Valid For 2018Document35 pagesDATEV Account Chart: Standard Chart of Accounts (SKR 03) Valid For 2018Elizabeth Sánchez LeónNo ratings yet

- C7A Cash & Cash EquivalentsDocument6 pagesC7A Cash & Cash EquivalentsSteeeeeeeephNo ratings yet

- Cipfawb15 - wb3 Format 19Document45 pagesCipfawb15 - wb3 Format 19Sayed RahmanNo ratings yet

- Tutorial 3 Due DateDocument6 pagesTutorial 3 Due DateFatin Nur Aina Mohd Radzi0% (1)

- Introduction To Partnership AccountingDocument16 pagesIntroduction To Partnership Accountingmachelle franciscoNo ratings yet

- Order in The Matter of M/s Century Finvest Private Ltd.Document35 pagesOrder in The Matter of M/s Century Finvest Private Ltd.Shyam SunderNo ratings yet

- Cost Accounting Cycle 2019Document6 pagesCost Accounting Cycle 2019Luming0% (1)

- 2014-2015 (L-2, T-1) - MeDocument27 pages2014-2015 (L-2, T-1) - MeactstyloNo ratings yet