Professional Documents

Culture Documents

Important

Important

Uploaded by

HdkakaksjsbOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Important

Important

Uploaded by

HdkakaksjsbCopyright:

Available Formats

Questions

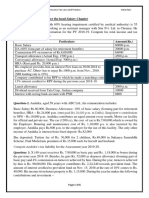

Q1. Mr. X, Indian Citizen, employed by the Govt. of India, was sent to Hong Kong on

1.06.2018 (he went outside India for the first time) on a project where he was earning a

salary of Rs. 4,00,000 per annum. He also had a property in Hong Kong where he has

loss from house property of amount Rs. 60,000 during the financial year 19-20. Mr. X,

wishes to visit his family members in India in PY 19-20. Advise Mr. X, on the basis of

residential status, for how long he should stay in India so that his tax liability is minimum

for PY 17-18.

Q2. Mrs. Y, (25 years), currently has total Income of Rs. 4,50,000 accruing in India.

Advise her on being Resident or Non-Resident, considering her tax liability for PY 19-

20. Also compute her tax liability for the year.

Q3. Mr. Z, (62 yrs), has a plant in china, US and India. He is having loss from business in

china (controlled from India) amounting Rs. 4,00,000. He also has business gain in US (controlled

from US) worth Rs. 6,00,000. He is having profits from business in India Rs. 12,00,000. Advise Z

on his Residential status for financial year 19-20. Also compute his tax liability for AY

20-21 assuming that he claims deduction to the limit specified in 80C.

You might also like

- Problems On Tax ManagementDocument44 pagesProblems On Tax ManagementBalaji Elangovan25% (4)

- Tax - M-1 ProblemsDocument14 pagesTax - M-1 ProblemsChikke GowdaNo ratings yet

- Residential Status: - Impact On Tax Liability 060820Document37 pagesResidential Status: - Impact On Tax Liability 060820Abhay GroverNo ratings yet

- Unit - 2 Important Questions: BBA 3 Year 5 Semester Subject: Income Tax Law & Accounting Subject Code: BBA N 503Document3 pagesUnit - 2 Important Questions: BBA 3 Year 5 Semester Subject: Income Tax Law & Accounting Subject Code: BBA N 503jyoti.singhNo ratings yet

- Income Tax Cap 2Document30 pagesIncome Tax Cap 2MEGHENDRA DEV SHARMANo ratings yet

- L15 MCQs Residential Status No Anno (1) (1) (Recovered)Document8 pagesL15 MCQs Residential Status No Anno (1) (1) (Recovered)Gaurav JainNo ratings yet

- Worksheet Unit1Document8 pagesWorksheet Unit1Kaushal pateriyaNo ratings yet

- 15UPA515 - Direct TaxDocument26 pages15UPA515 - Direct TaxPrincy MonicaNo ratings yet

- DT (Q&a)Document186 pagesDT (Q&a)mktg.seagullshippingNo ratings yet

- Assignment DTDocument2 pagesAssignment DTJayashree SahaNo ratings yet

- Assignment For Residential StatusDocument4 pagesAssignment For Residential StatusRaj HanumanteNo ratings yet

- Residential StatusDocument24 pagesResidential StatusGaurav BeniwalNo ratings yet

- Income Tax Law PracticeDocument16 pagesIncome Tax Law PracticeTholai Nokku [ தொலை நோக்கு ]No ratings yet

- Residential Status Scope of Total IncomeDocument4 pagesResidential Status Scope of Total IncomedeepakadhanaNo ratings yet

- Inter CA Direct Tax Homework SolutionsDocument67 pagesInter CA Direct Tax Homework SolutionsAbhijit HoroNo ratings yet

- RESIDENCE AND TAX LIABILITY of PersonDocument6 pagesRESIDENCE AND TAX LIABILITY of PersonRuksana ChikodeNo ratings yet

- Residential Status Pratical QuestionsDocument9 pagesResidential Status Pratical QuestionsGaurav MalikNo ratings yet

- Unit 1, Part 2Document10 pagesUnit 1, Part 2Sandip Kumar BhartiNo ratings yet

- 3.residential Status of The AssesseeDocument5 pages3.residential Status of The Assesseetoton33No ratings yet

- Incidence of Tax - IllustrationDocument16 pagesIncidence of Tax - IllustrationAnirban ThakurNo ratings yet

- 4 Heads - RemovedDocument59 pages4 Heads - Removedantiquehindustani0% (1)

- 1328866787Chp 2 - Residence and Scope of Total IncomeDocument5 pages1328866787Chp 2 - Residence and Scope of Total IncomeMohiNo ratings yet

- Residential Status: Vaibhav BanjanDocument14 pagesResidential Status: Vaibhav Banjandeepika gawasNo ratings yet

- Introduction To Income TaxDocument36 pagesIntroduction To Income TaxDeep ShahNo ratings yet

- 3rd Sem Taxation Ppt-3.Pdf328Document34 pages3rd Sem Taxation Ppt-3.Pdf328Harpreet SinghNo ratings yet

- PTP SolutionsDocument5 pagesPTP SolutionsSanah SahniNo ratings yet

- Tax Management-Module 1 Problems On Residential Status and Incidence On TaxDocument2 pagesTax Management-Module 1 Problems On Residential Status and Incidence On TaxdiviprabhuNo ratings yet

- Residential Status: Vaibhav BanjanDocument14 pagesResidential Status: Vaibhav BanjanAnmolNo ratings yet

- Residential StatusDocument11 pagesResidential StatusSaurav MedhiNo ratings yet

- Residential Status and Incidence of Tax On Income Under Income Tax ActDocument6 pagesResidential Status and Incidence of Tax On Income Under Income Tax ActhaseefaNo ratings yet

- Kishan Kumar Income Tax Amendments May2021Document6 pagesKishan Kumar Income Tax Amendments May2021ileshrathod0No ratings yet

- Residential Status and Incidence of Tax - Study MaterialDocument6 pagesResidential Status and Incidence of Tax - Study MaterialEmeline SoroNo ratings yet

- Residential Status Mock Test 1 IGP-CS CA Vivek GabaDocument11 pagesResidential Status Mock Test 1 IGP-CS CA Vivek GabaRahul R SinghNo ratings yet

- Residential Status MCQDocument6 pagesResidential Status MCQSarvar PathanNo ratings yet

- Chapter 1: Residential Status of An AssesseeDocument4 pagesChapter 1: Residential Status of An AssesseeHahNo ratings yet

- Bos 58983Document20 pagesBos 58983NitzNo ratings yet

- Residential Status PDFDocument14 pagesResidential Status PDFPaiNo ratings yet

- e Book PDF PDFDocument91 pagese Book PDF PDFGiri SukumarNo ratings yet

- 4 HeadsDocument133 pages4 HeadsantiquehindustaniNo ratings yet

- 1) Residential Status of An INDIVIDUAL Ans: Residential Status For Each Previous Year - Residential Status of An Assessee IsDocument14 pages1) Residential Status of An INDIVIDUAL Ans: Residential Status For Each Previous Year - Residential Status of An Assessee Isdhananjay7No ratings yet

- Bos 58983Document20 pagesBos 58983Kartik0% (1)

- Residential Status and Tax LiabilityDocument2 pagesResidential Status and Tax LiabilityPrachi AlungNo ratings yet

- Write A Note On Previous Year and Assessment YearDocument2 pagesWrite A Note On Previous Year and Assessment YearBhaskar BhaskiNo ratings yet

- Residential Status and Scope of Total IncomeDocument19 pagesResidential Status and Scope of Total IncomeSamyak JainNo ratings yet

- Chapter 26 MCQs On International TaxationDocument26 pagesChapter 26 MCQs On International TaxationSuranjali Tiwari100% (1)

- DIRECT TAX I Bharathiar University B.com PADocument78 pagesDIRECT TAX I Bharathiar University B.com PAkalpanaNo ratings yet

- Rules For Deciding Residential Status of An Individual: Knowing Your Residential Status and Income Tax ImplicationsDocument6 pagesRules For Deciding Residential Status of An Individual: Knowing Your Residential Status and Income Tax ImplicationsmamtakariraNo ratings yet

- Residence Status and Tax LiabilityDocument14 pagesResidence Status and Tax LiabilityDrafts StorageNo ratings yet

- UNIT 1 B Residental StatusDocument26 pagesUNIT 1 B Residental StatusPrayag DasNo ratings yet

- RESIDENCE RELATED - 3rd SemDocument33 pagesRESIDENCE RELATED - 3rd Semyokip59536No ratings yet

- Question BankDocument146 pagesQuestion BankSanskriti JainNo ratings yet

- MOCK TEST of INCOME TAX WITHOUT SOLUTIONDocument19 pagesMOCK TEST of INCOME TAX WITHOUT SOLUTIONRajender SinghNo ratings yet

- Prepared By: Sikha Sadani Assistant Professor, IITMDocument39 pagesPrepared By: Sikha Sadani Assistant Professor, IITMTANYANo ratings yet

- Residential StatusDocument27 pagesResidential Statusparinita raviNo ratings yet

- Income Tax Residential Status PDFDocument16 pagesIncome Tax Residential Status PDFNagesha CSNo ratings yet

- Direct Tax Summary NotesDocument88 pagesDirect Tax Summary NotesAlisha LukeNo ratings yet

- Direct Taxes Sem-Iii-20Document22 pagesDirect Taxes Sem-Iii-20Pranita MandlekarNo ratings yet

- Classification of Taxes PPT DomsDocument37 pagesClassification of Taxes PPT DomsBabasab Patil (Karrisatte)No ratings yet

- Will COVID19 Globalisation?: Y NirudhDocument19 pagesWill COVID19 Globalisation?: Y NirudhHdkakaksjsbNo ratings yet

- Full Name: Educational QualifiationsDocument1 pageFull Name: Educational QualifiationsHdkakaksjsbNo ratings yet

- Shri Ram College of Commerce: MondayDocument25 pagesShri Ram College of Commerce: MondayHdkakaksjsbNo ratings yet

- OverviewDocument2 pagesOverviewHdkakaksjsbNo ratings yet

- Shri Ram College of Commerce: MondayDocument25 pagesShri Ram College of Commerce: MondayHdkakaksjsbNo ratings yet

- PGBP QuestionsDocument6 pagesPGBP QuestionsHdkakaksjsb100% (2)

- IFS QuestionDocument6 pagesIFS QuestionHdkakaksjsbNo ratings yet

- Class Discussion Questions For Capital Gains ChapterDocument3 pagesClass Discussion Questions For Capital Gains ChapterHdkakaksjsbNo ratings yet

- Essay of CemeteryDocument3 pagesEssay of CemeteryHdkakaksjsbNo ratings yet